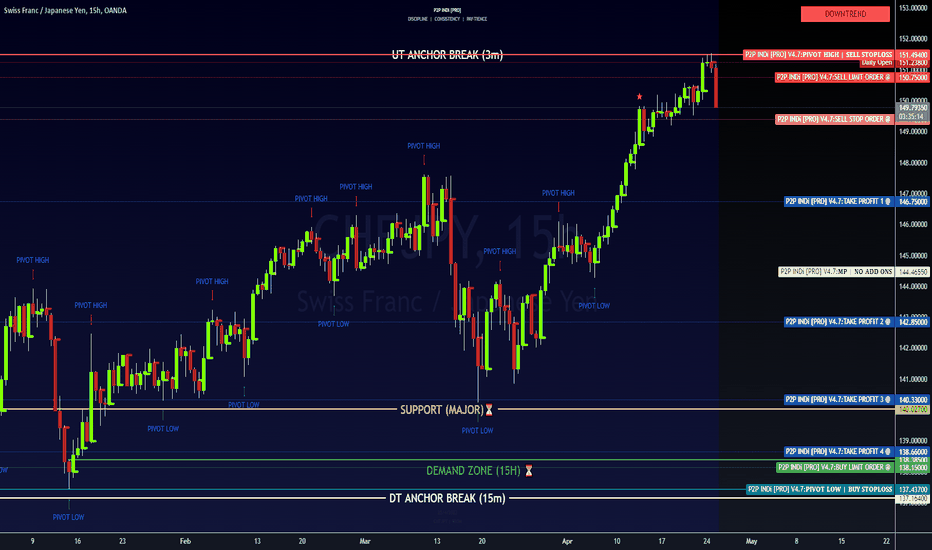

NEW TRADE 🔥 CHFJPY ✨ COUNTER-TREND TRADE 🔥-SL @ 151.49 🚫

SLO @ 150.75 ⏳

SSO @ 149.40 ⏳

TP1 @ 146.75

TP2 @ 142.85

TP3 @ 140.33

TP4 @ 138.66

BLO @ 138.15

ADDITIONAL INFO:

00:00 Shout Out to @oktane

00:42 Curve Analysis is DT

01:00 Sell Orders

01:20 Position Sizing @ ~2-3%

01:50 Shaving 25% @ each TP

02:23 Add-On Sell Opportunities

02:54 Demand Zone

03:04 @oktane may not agree with me 😏

04:40 Boost, Follow, Comment, Join

Yen

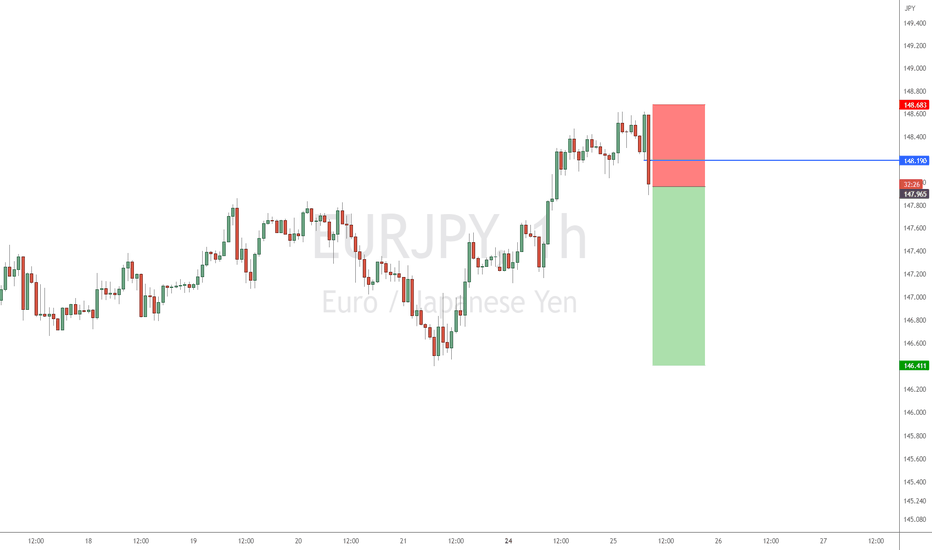

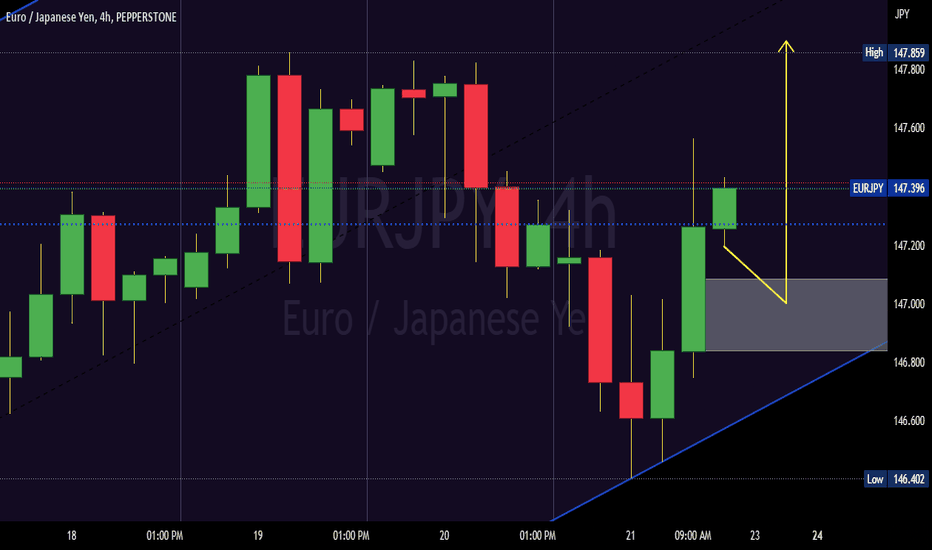

Joe G2H Trade - EURJPY swing failure on the daily?Trade Idea: Selling EURJPY

Reasoning: Major resistance on the daily chart, swing failure?

Entry Level: 147.90

Take Profit Level: 146.41

Stop Loss: 148.66

Risk/Reward: 2.08/1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

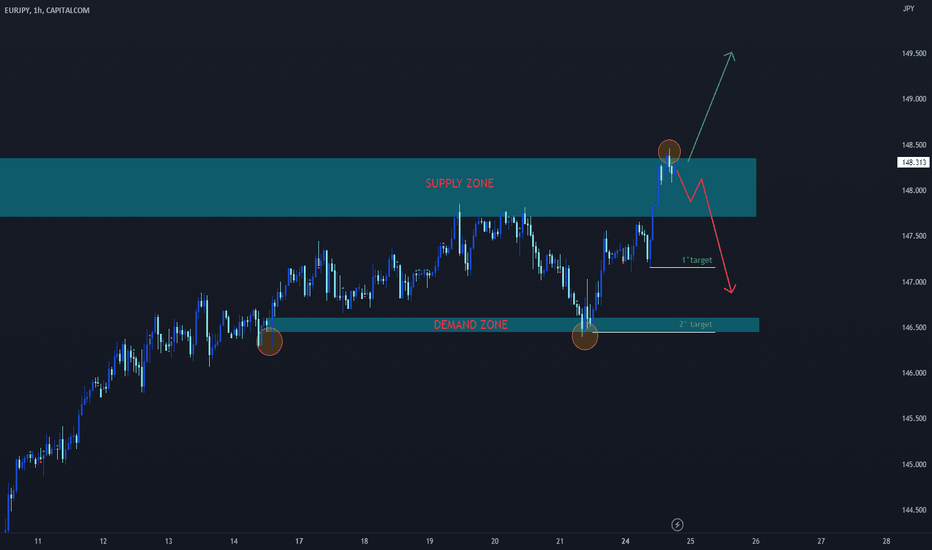

EURJPY Short or Long?On this pair, I have identified a supply zone and a demand zone. The objective will be to find an entry point within the supply zone to open a short trade. If the price, instead, were to break the supply zone, I will look for a bullish setup.

Let me know what you think in the comments.

Have a nice trading!

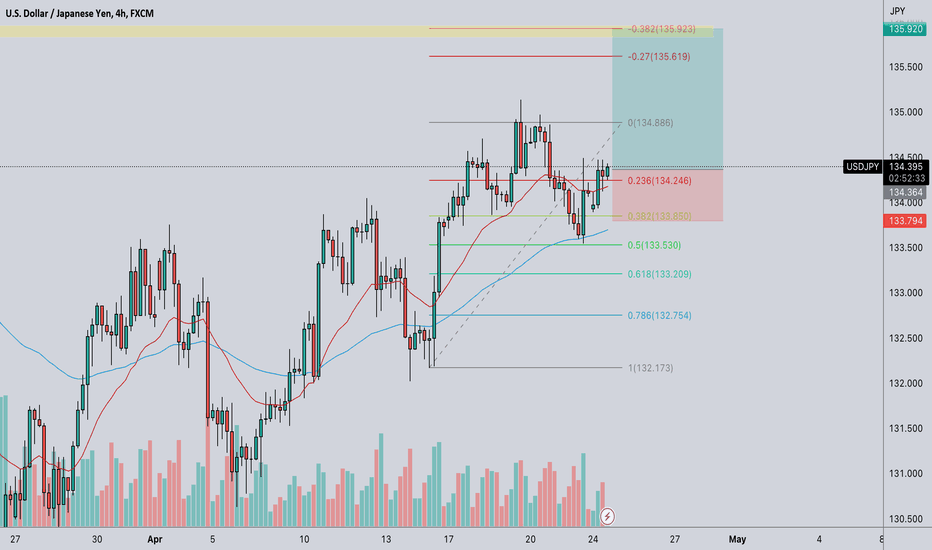

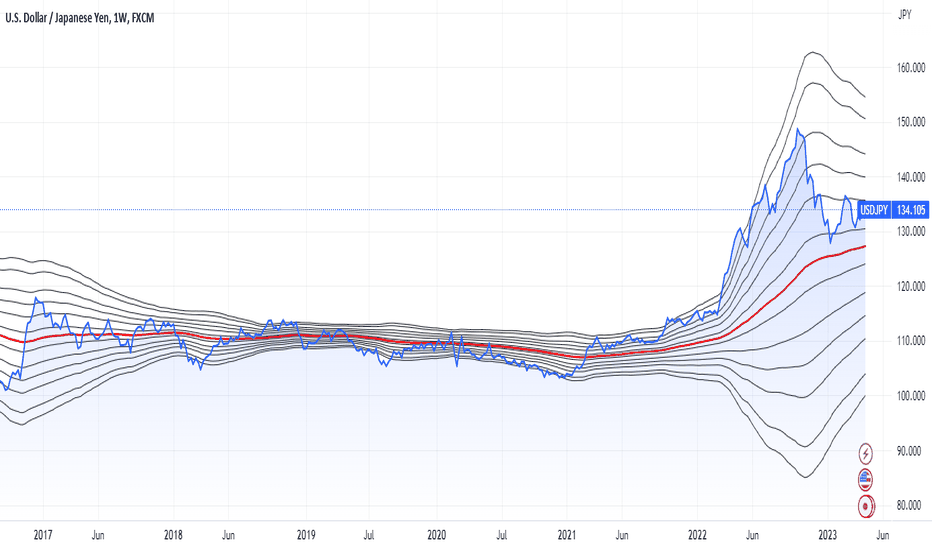

USD/JPY could repeat an uptrend just like last yearHello traders:

USDJPY was stable and low volatile in how the wealthy grew in 2022. Is this trend underway again recently as most western stock markets have flatlined? They may start to decline, and the US dollar could strengthen just like in 2022. What do you think? Are we repeating next year at all?

USDJPY Short or Long?After an initial bearish setup and a short trade closed at 2.5 RR, the market is now showing signs of resistance around 137.70. At this point, I have identified a potential demand zone, which is an area where the price could bounce before continuing its downward trend. However, this zone could also act as a strong resistance before we see the price go even lower. That's why, in case of a short trade, I have set a target price of 132.20.

Let me know what you think in the comments.

Have a nice trading day!

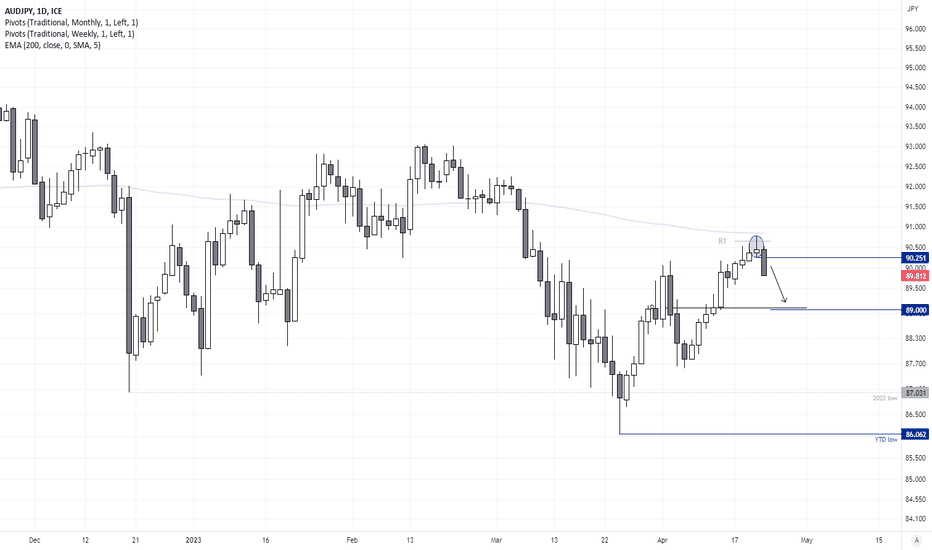

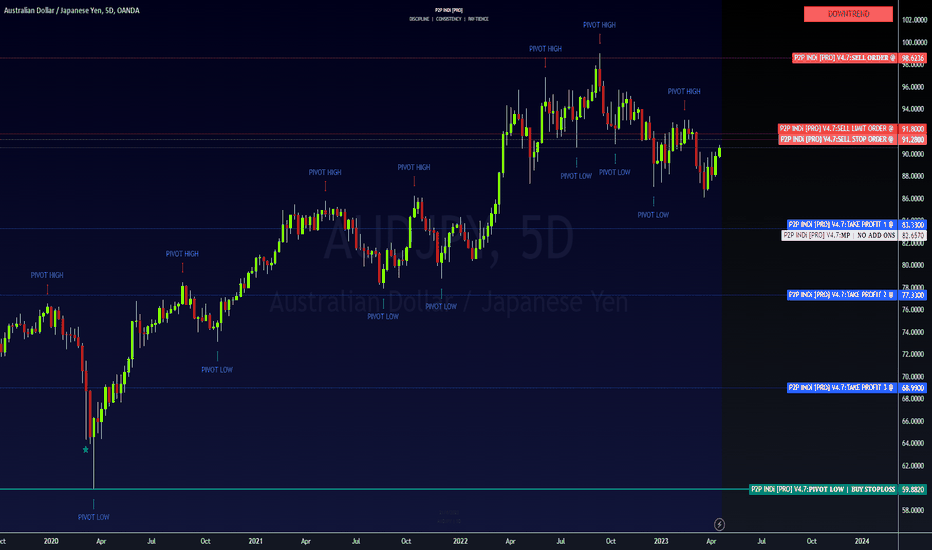

AUD/JPY 3-wave rally stalls at resistanceA 3-wave rally has stalled at the 200-day EMA with a bearish Pinbar. This begs the question as to whether we've seen the end of an ABC correction and the cross is to now break to new lows.

Perhaps. But over the near-term, yen strength is favoured due to sticky inflation data from Japan, rumours that the BOJ are considering tweaking their YCC band later this year and a slight risk-off tone due to concerns over tighter liquidity and the US debt ceiling.

- The bias remains bearish beneath 90.25

- Next target is around the lows near 89.00

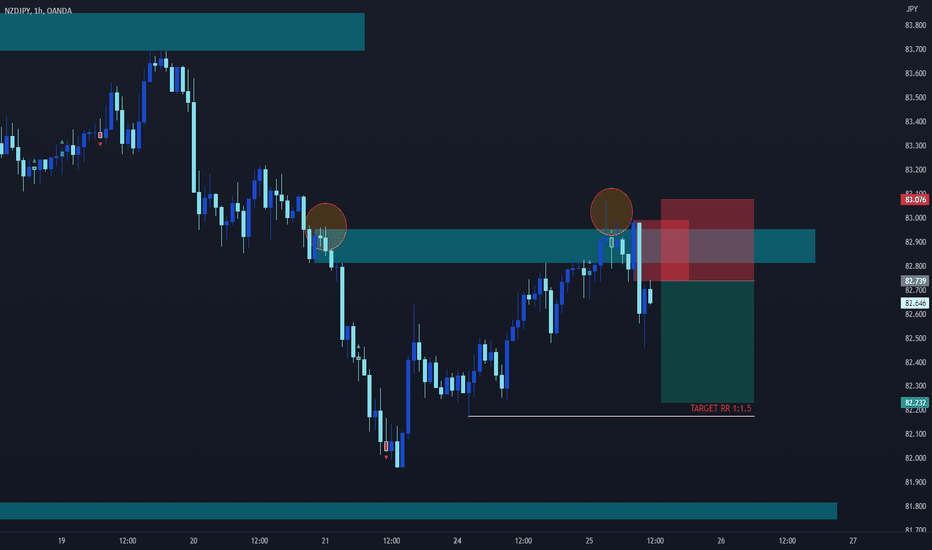

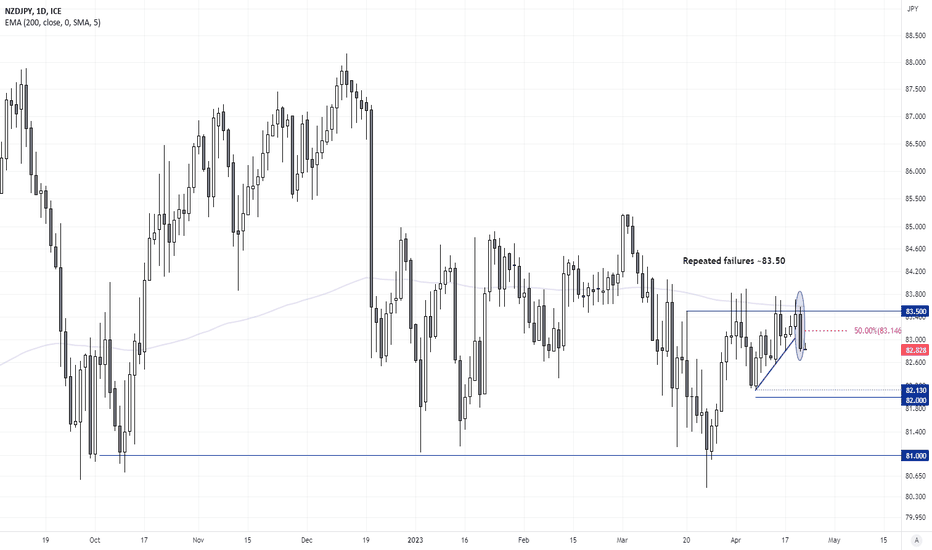

Potential swing trade on NZD/JPYA soft inflation report from New Zealand weighed broadly on the Kiwi dollar yesterday, as traders began to price in the prospects of a 25bp hike (down form 50bp) or even a pause at the RBNZ's next meeting. The slight risk-off tone saw flows into the yen, and risk-currencies such as AUD and NZD were lower which has placed ZD/JPY on our shirt watchlist.

The cross has seen repeated failures to close above 83.50 over the past three weeks, and yesterday's high met resistance perfectly at the 200-day EMA. Given the bearish engulfing candle which has now formed, we suspect a leg lower seems more probably than a break higher. Also note the decisive close beneath trend support.

- The bias remains bearish beneath yesterday's high

- However, we'll seek bearish setups below/around 83.15 (50% retracement of yesterday's open-close range)

- Initial target is the cycle just above 82.0

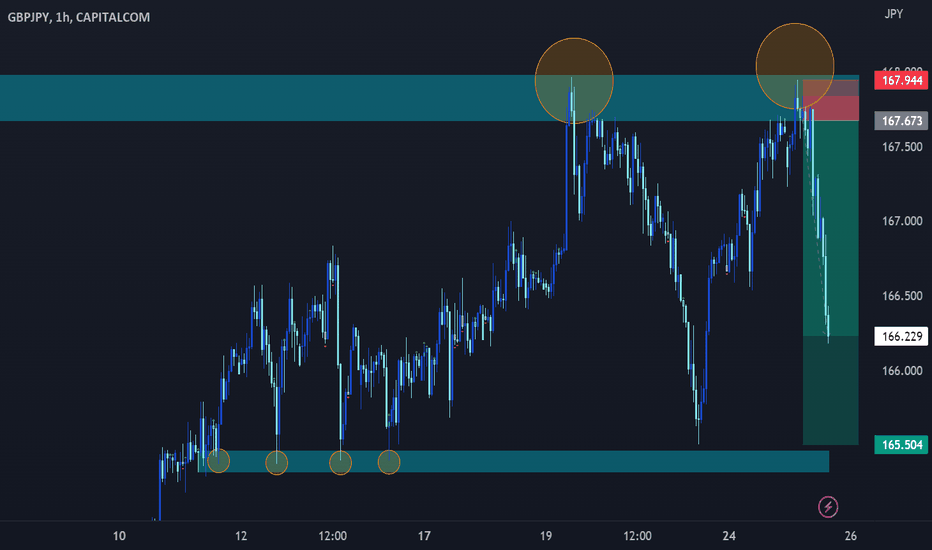

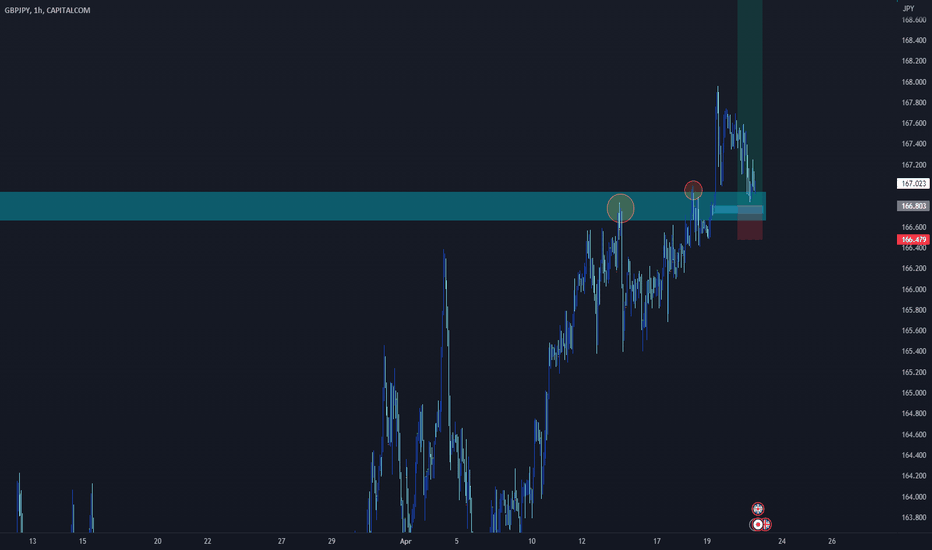

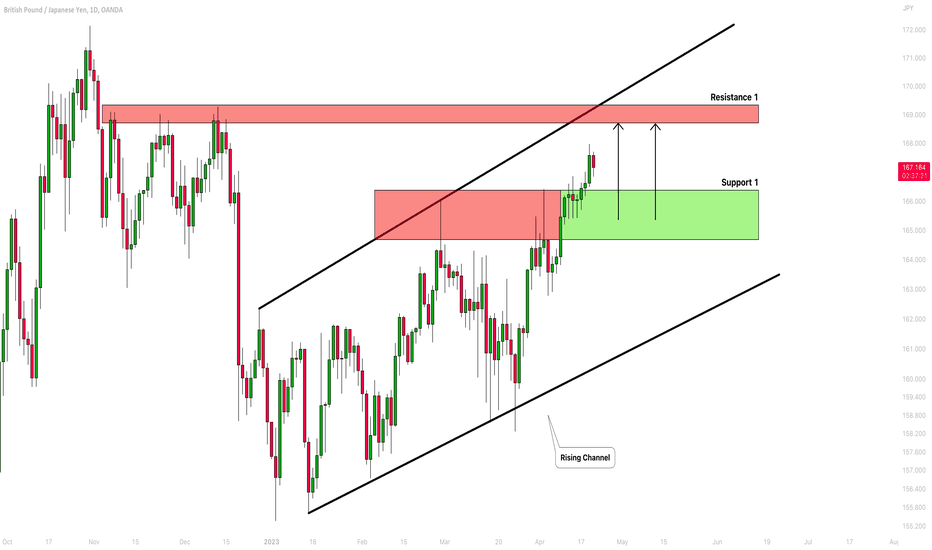

GBPJPY May Keep Growing! Here is Why: 🇬🇧🇯🇵

GBPJPY is trading in a bullish trend on a daily, perfectly respecting the boundaries of a rising parallel channel.

For some time, the price was respecting a wide horizontal supply area within the channel.

It was finally broken this week.

I believe that it may trigger a bullish continuation on the pair.

Next goal for buyers will be 168.7

❤️Please, support my work with like, thank you!❤️

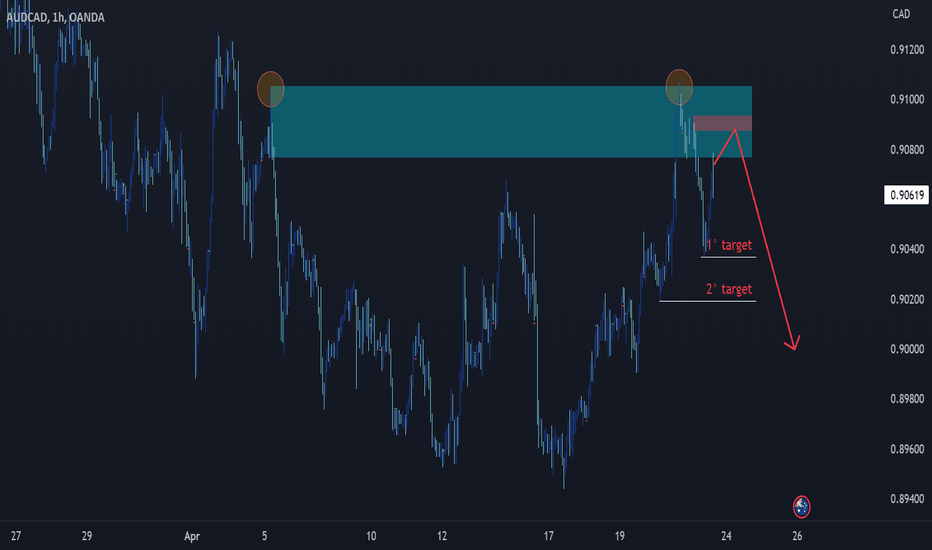

AUDCHFHere we have a supply zone that the price has attempted to break, creating a spike which further validates my bearish scenario. The objective will be to wait for a retracement to a point of interest (POI) that I have highlighted.

Let me know what you think in the comments.

Have nice trading day!