China's Economic Storm: A Global Wake-Up CallChina, the world’s second-largest economy, is facing a perfect storm of demographic collapse, a housing market crash, and a strategic sell-off of US treasuries. These interconnected crises threaten not only China’s stability but also global markets, impacting forex traders, investors, and businesses worldwide. This article unpacks the unfolding challenges and their far-reaching implications, as discussed in our latest Edge Forex podcast.

A Demographic Time Bomb

China’s population is aging faster than any major economy in history, driven by a fertility rate of just 1.1–1.2 children per woman—well below the 2.1 needed to sustain a population. The legacy of the one-child policy has left a shrinking workforce and a projected 400 million people over 65 by 2050, comprising one-third of the population. This demographic cliff strains pensions and healthcare systems while youth unemployment, reported at 20% in 2023, fuels social discontent. Government subsidies to boost birth rates have failed, as high living costs and a drying job market deter young couples from starting families.

The result? A shrinking labor force, slowing GDP growth, and brewing social unrest. By 2080, China’s population could halve, leaving empty cities and businesses without workers. This isn’t just a numbers game—it’s a crisis that could derail China’s economic engine for decades.

Housing Market Collapse: A Crumbling Pillar

Once the backbone of China’s economic miracle, the housing sector is now a liability. New home prices have plummeted 23–25%, with monthly declines of 6–7%. Accounting for 25–30% of GDP, this sector’s collapse is catastrophic. The liquidation of Evergrande in 2024, with $310 billion in debt, exposed the over-leveraged nature of China’s property market. Goldman Sachs estimates $13 trillion (93 trillion RMB) in excess inventory—millions of empty condominiums in ghost towns, with malls and highways leading nowhere.

Housing represents 60–70% of Chinese household wealth, so falling prices are crushing consumer confidence and spending. Local governments, reliant on land sales, face budget crises, and an 8 trillion RMB stimulus has fallen short. This slow-motion crash, reminiscent of Japan’s 1989 property bubble but worsened by demographic decline, threatens financial stability and global economic growth.

US Treasury Sell-Off: A High-Stakes Gamble

In 2024, China slashed its US mortgage-backed securities holdings by 20%, part of a broader sell-off of US treasuries. This isn’t a choice but a necessity, driven by declining export revenues and insufficient funds to meet domestic and international obligations. The sell-off, fueled by a trade war and a sharp drop in US exports post-tariffs, forces China to liquidate treasuries to access US dollars. However, this move risks raising US interest rates, disrupting global housing markets, and escalating geopolitical tensions.

Charts show China’s treasury holdings peaking around 2005 before a sharp decline, while other economies like the Eurozone and UK increase their purchases. This shift could flood bond markets, pushing up yields and affecting forex pairs like USD/CNY. While short-term relief for China, this sell-off is a long-term gamble that could isolate it financially and signal deeper economic distress.

Global Implications for Markets and Forex

China’s export slump, treasury sell-offs, and housing crisis paint a picture of a nation losing its economic grip. For forex traders, the weakening Chinese Yuan against the US Dollar (USD/CNY) is a key focus, as economic stagnation and treasury sales pressure the currency. Higher US interest rates from these sell-offs could strengthen the USD, impacting global currency pairs and emerging markets. Investors in Chinese equities or real estate face risks from declining growth prospects, while businesses reliant on Chinese demand—think commodities or luxury goods—may see revenues shrink.

At Edge Forex, we see this as a red flag for long-term investors. Diversifying into assets less tied to China, such as Eurozone or UK markets absorbing treasury sales, could mitigate risks. The global ripple effects are undeniable: China’s slowdown could depress demand, disrupt bond markets, and create volatility across forex and equity markets.

What’s Next for Traders and Investors?

Monitor USD/CNY: Expect volatility as China’s economic woes weaken the Yuan.

Track Global Rates: Treasury sell-offs could push up US yields, impacting housing and forex markets.

Diversify Portfolios: Reduce exposure to Chinese assets and explore26% of Chinese household wealth, so falling prices erode consumer confidence.

Yuan

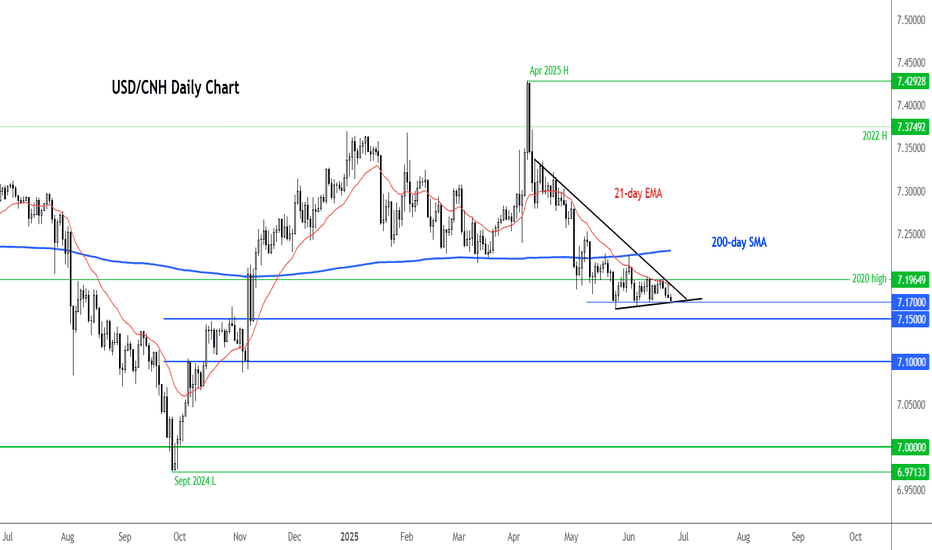

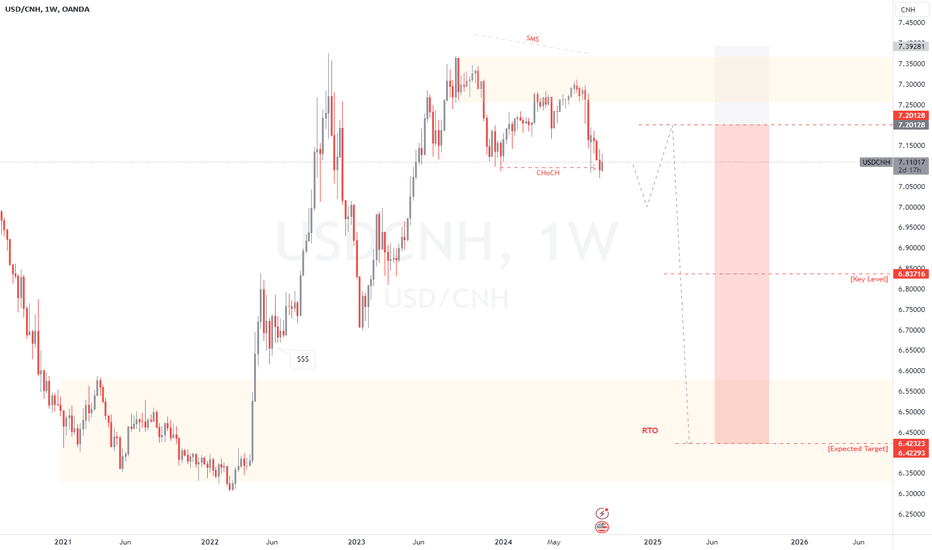

USD/CNH coiling for a breakdown?Over the past several days, the USD/CNH has been coiling inside a tight range, awaiting direction from the oil market. Well oil prices collapsed, and down went the dollar and up went risk assets. The net impact on the yuan was positive. The USD/CNH pair has weakened a little bit more today. If it can take out support at 7.1700 on a daily closing basis then this could potentially pave the way for more technical selling towards 7.1500 initially, ahead of potentially lower levels next. But if risk appetite sours again, or we otherwise see a breakout above the bearish trend line, then in that case all bearish bets would be off the table again.

By Fawad Razaqzada, market analyst with FOREX.com

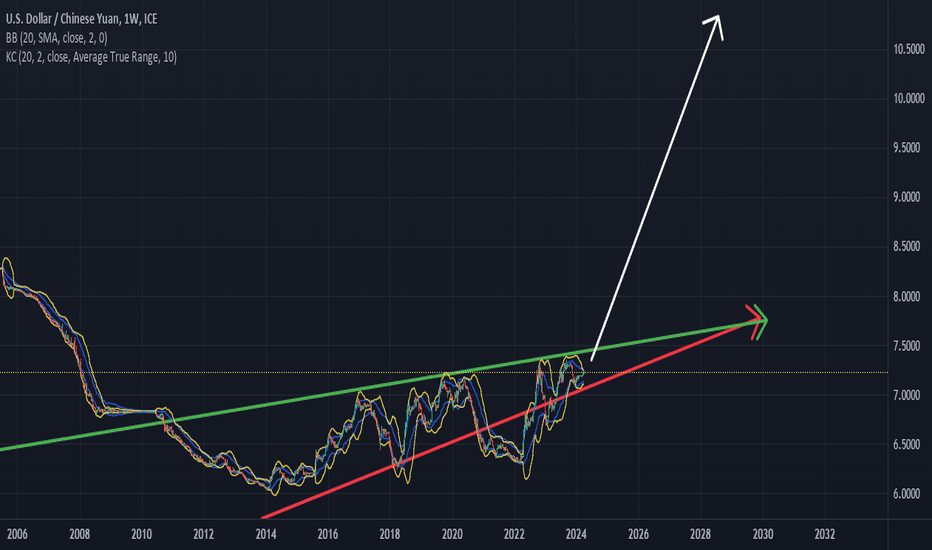

USDCNH Tests Key Pattern Resistance on PBOC’s Loose Yuan FixThe trade war between China and the U.S. is escalating, and the Chinese yuan is starting to feel the pressure. After the U.S. raised tariffs to a total of 54%, China responded with a 34% increase of its own. Now, Trump has threatened an additional 50% tariff hike if China doesn’t withdraw its retaliation.

It appears unlikely that either side will back down at this stage, and the trade war is set to intensify further.

In addition to retaliating, China is also preparing to defend its economy. According to several news reports, Beijing is planning to frontload stimulus measures aimed at boosting domestic consumption, subsidizing exporters to cushion the blow from reduced U.S. trade, and supporting stock market stability. The People’s Bank of China will likely play a central role in this effort, using tools such as rate adjustments and daily yuan fixings.

The latest yuan fixing came in above 7.20, the highest level since 2023. With this looser fixing and ongoing trade war pressure, USDCNH is pushing higher. The ascending triangle formation which typically breaks to the upside is also supporting bearish bets on the yuan.

If China proceeds with a small and controlled devaluation, as many expect, a breakout from this triangle pattern is likely.

The potential target for the breakout could align with one of the parallel lines of the lower boundary of the formation, which are currently around 7.61 and 7.75, and gradually rising. With time, a move toward 7.80 is well within reach by the end of the year.

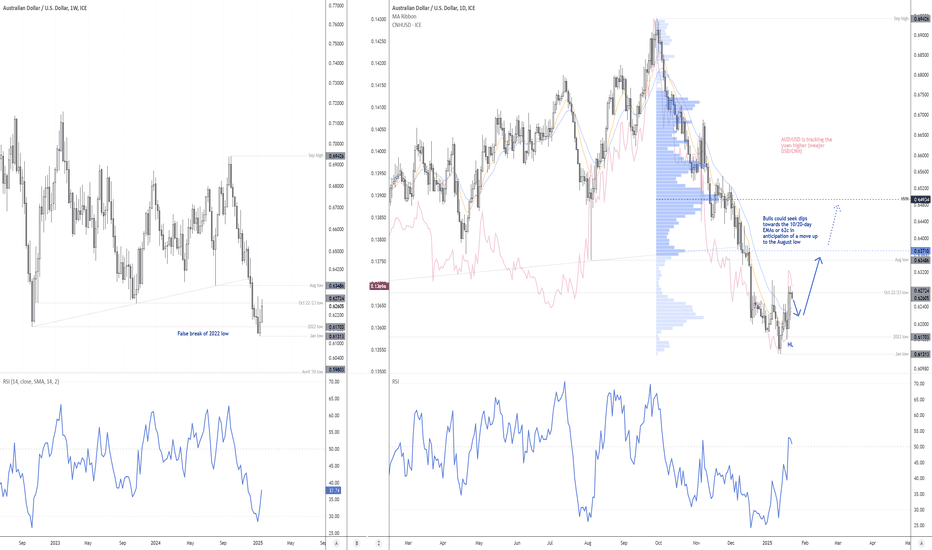

Why dips appear favourable for AUD/USD bullsTrump's reluctance immediately sign an executive order to implement tariffs on China has allowed the yuan to rise against the US dollar. And where the yuan goes, AUD/USD tends to follow these days. And give AUD/USD has already seen an extended move to the downside, some bullish mean reversion is surely due.

The weekly RSI reached oversold ahead of a false break of the 2022 low, and a bullish divergence also formed on the daily RSI. A higher low has formed on prices, and I suspect AUD/USD is due at least one more leg higher.

Bulls could seek dips towards 0.621 or the 10/20-day EMAs in anticpation of a move up towards the August low, a break above which brings 65c into view near the high-volume node (HVN) from the decline from September to January.

Matt Simpson, Market Analyst at City Index and Forex.com

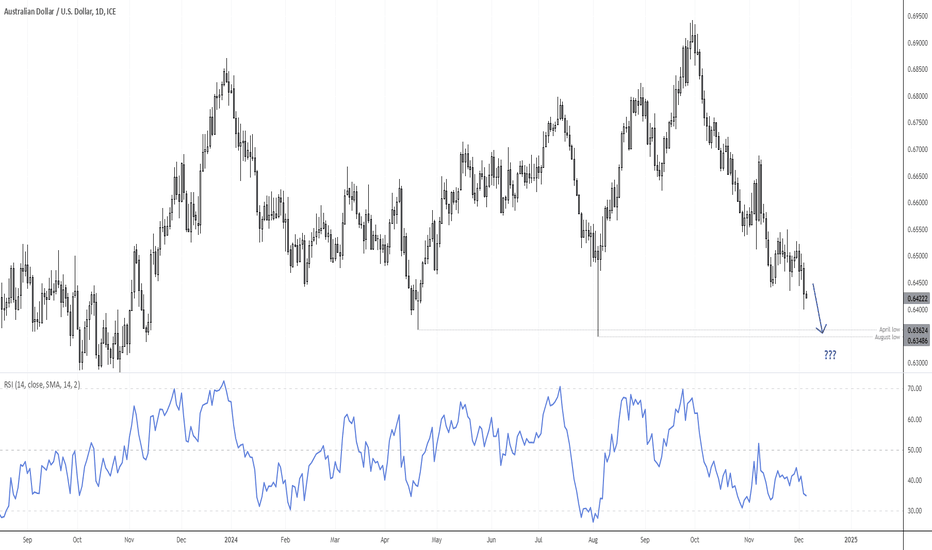

This is why AUD/USD bears need to watch USD/CNHBets are back on for the RBA to cut, with markets having now fully priced in three 25bp cuts beginning in April. Weak GDP was the culprit, which leaves the Aussie susceptible to further weakness should incoming data continue to deteriorate. However, Aussie bears may also need to factor the yuan into the equation.

USDCNY | Market outlook

The USD/CNY strengthened on Tuesday as a stronger U.S. dollar and concerns over a weak Chinese economy put pressure on the Yuan.

Recent data from China revealed that manufacturing activity fell to a six-month low in August, while growth in new home prices also slowed during the same period.

Additionally, the property sector has yet to respond positively to Beijing's series of stimulus measures, continuing to drag down the overall economy.

USD/CNH: BofA’s Caution, JPM’s WarningsUSD/CNH: BofA’s Caution, JPM’s Warnings

Bank of America (BofA) has expressed caution about betting against the US dollar in the face of recent improvements in sentiment towards China's economic policy stimulus. Recent policy actions by China have sparked optimism, leading to a weakening of the USD. However, BofA advises against making hasty financial moves based on these developments alone.

BofA believes that the effectiveness of Chinese Economic policies in stimulating significant new economic activity remains uncertain. Investors are encouraged to wait for more definitive signs of a sustained recovery in China's credit and property sectors before making significant currency moves.

Just last month, BofA expressed a bearish outlook on several Asian currencies, including the Chinese yuan, South Korean won, Taiwan dollar, Thai baht, and Vietnamese dong. BofA anticipated sustained depreciation pressures on the yuan into the second half of the year due to several factors particularly due to the delayed easing by the Federal Reserve.

On the other side, Jamie Dimon, the CEO of JPMorgan Chase, has been continuing his warnings at the JPMorgan Global China Summit in Shanghai. Dimon suggested that the chance of stagflation in the US—a period of stagnant economic growth combined with high inflation—is higher than most people think. Last week, he did not rule out the possibility of a hard landing for the US economy.

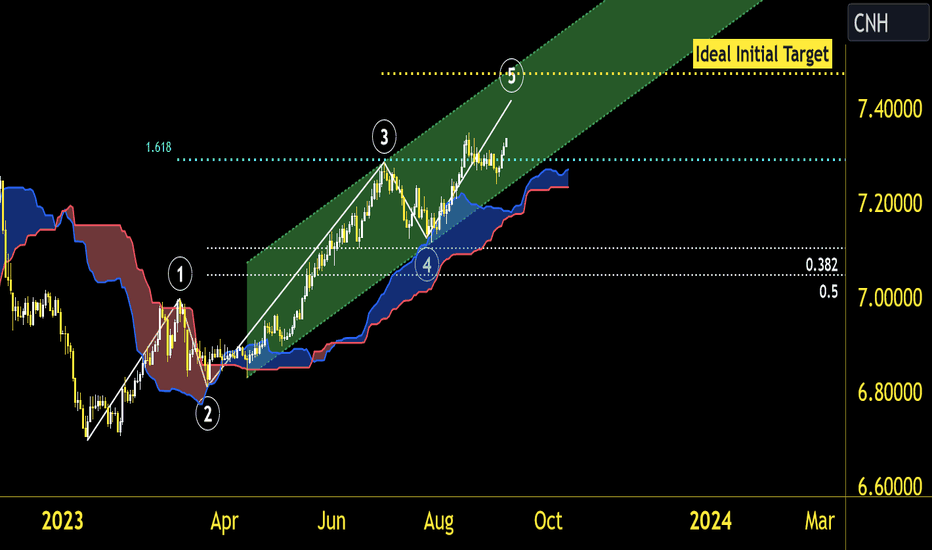

Ascending Triangle Points Towards Yuan Devaluation This SummerNote: the technical indicators show a TTM squeeze ready on EVERY TF except Monthly, which is about to happen shortly by this summer - which means a massive move will happen. BOJ will blow up this summer and will devalue against the dollar forcing China to devalue to stay export competitive. I see a 50% devaluation - which will have the opposite effect on everyone else. If China devalues, that means they invite inflation into their economy, which forces deflation throughout the whole world. This will push up the dollar and blow up everyone else's currency. I see the dollar TVC:DXY going to 140-160+ before it too blows up. Of course this implosion will be blamed on some external false flag event - while the FED trots out CBDC's via DigitalID anchored to social credit scores that allows the FED to effectively use negative interest rates via social credit scores and time value of the credits. Gold and silver really won't matter because people will be looking for food.

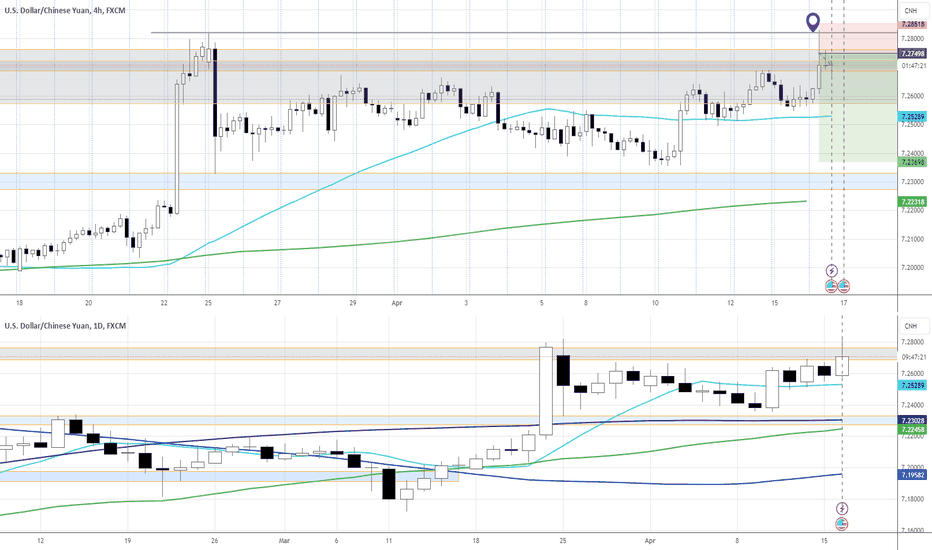

Divergence here, divergence thereFundamentals & Sentiment

USD:

The sentiment has been bullish for a while as US CPI remains sticky. As the dollar gained strength. However, it became overpopulated with buyers, as evident from CFTC reports. So, it should take some trigger for those buyers to start covering their longs - a good potential for dollar downside. The CESI differential for USDCNH has been forming a decent divergence since February.

CNH: The economic data came out pretty mixed this morning. It seems the market focused more on slacking Industrial Production YoY and Retail Sales YoY as ChinaA50 closed the session with a sharp recovery, viewing the miss in data as another reason for stimulus from PBoC.

Technical & Other

- According to seasonals DXY should stay flat for the next 3 weeks

Setup: S(RTF)

Setup timeframe: 4h

Trigger: 15m

Medium-term: Sideways

Long-term: Uptrend

Min target: range boundary

Risk: 0.14% (0.5R<)

Entry: Market

🇺🇸 President Joe Biden’s Bearish Remarks on the USD vs. CNY 🇨

Ladies and gentlemen, my fellow Americans, and all you Zoomers out there, gather 'round! Uncle Joe’s got some thoughts about our greenbacks and those sneaky Chinese Yuan. Buckle up, because we’re diving into the financial rabbit hole. 🐇

1. “The Dollar’s Got Swagger”

You know, folks, the U.S. dollar has been strutting its stuff for centuries. It’s like that cool kid in high school who always had the latest sneakers and a killer mixtape. Well, guess what? The dollar’s still got swagger. 💸

2. “Yuan? More Like Yawn!”

Now, let’s talk about the Chinese Yuan. Sure, it’s got pandas on its bills, but pandas don’t pay the rent, my friends. The Yuan’s like that kid who shows up to the party with a veggie platter. Nice try, but we’re here for the pizza. 🍕

3. “Quantitative Easing? Nah, We’re on a Diet!”

Our Federal Reserve’s been flexing its muscles, printing money like it’s going out of style. But guess what? We’re not on a doughnut binge. We’re on a financial diet. No more QE buffets. 🍩

4. “Trade Wars? More Like Pillow Fights!”

China and the U.S. have been duking it out in trade wars. But honestly, it’s like watching two toddlers in superhero costumes pillow-fighting. Cute, but not exactly world-changing. 🛌

5. “0.11 CNY/USD? That’s a Bargain!”

So, rumor has it the yuan’s gonna dump to 0.11 CNY/USD. Well, let me tell you, that’s practically a yard sale price. Sell one, get one free! 🛒

6. “Zoomers, HODL Your Avocado Toast!”

To my Zoomer pals: Forget avocado toast for a sec. HODL those dollars like they’re vintage Pokémon cards. Trust me, when the Yuan’s doing the cha-cha, you’ll thank me. 🥑💰

7. “Crypto? Nah, I Prefer Monopoly Money!”

And don’t get me started on crypto. It’s like playing Monopoly with invisible cash. Pass Go, collect Bitcoin. But give me that real green paper any day. 💵

In conclusion, my fellow Americans, let’s keep our eyes on the prize. The dollar’s been through wars, recessions, and disco fever. It ain’t backing down. As for the Yuan, well, pandas are cute, but they won’t save your retirement fund. Stay woke, stay dollar-wise, and remember: In Joe we trust (and a little bit of Ben Franklin). 🇺🇸💪

Disclaimer: This post is purely fictional and for entertainment purposes. No actual financial advice here, folks. Consult your financial advisor, not Uncle Joe. 🎩🤝

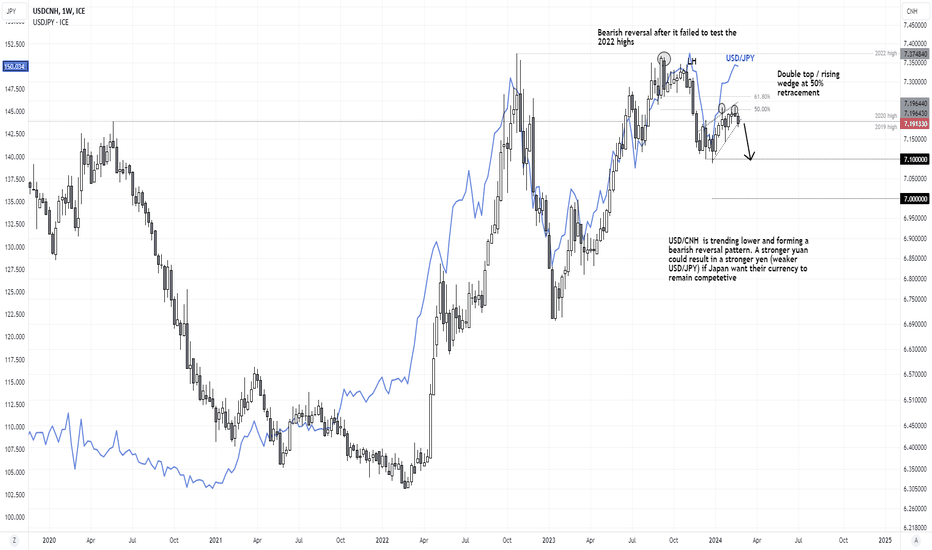

A stronger yuan could spell trouble for USD/JPYA downtrend has formed on USD/CNH since it failed to retest the 2022 high in September. Since then, a lower high, aggressive selloff and a bearish continuation pattern (rising wedge) has formed on the daily chart. The rising wedge projects a downside target towards the cycle lows ~7.1.

If the yuan continues to depreciated (lower USD/CNH), it could prompt other Asian currencies such as the Japanese yen to also depreciate, in order to remain competitive with trade. And as USD/JPY is approaching 152 - a level it failed to test due to BOJ intervention (and subsequent concerns of another intervention) - there's a reasonable chance that USD/JPY may struggle to break above 152.

For now, USD/CNH looks ripe for a move lower given the double top / rising wedge around the 50% retracement level, and bearish momentum picking up. Bears could have a stop above the cycle highs and target the lows around 7.1. But if the Fed begin to drop dovish clues further out, it could also break below 7.1 and head for 7.0.

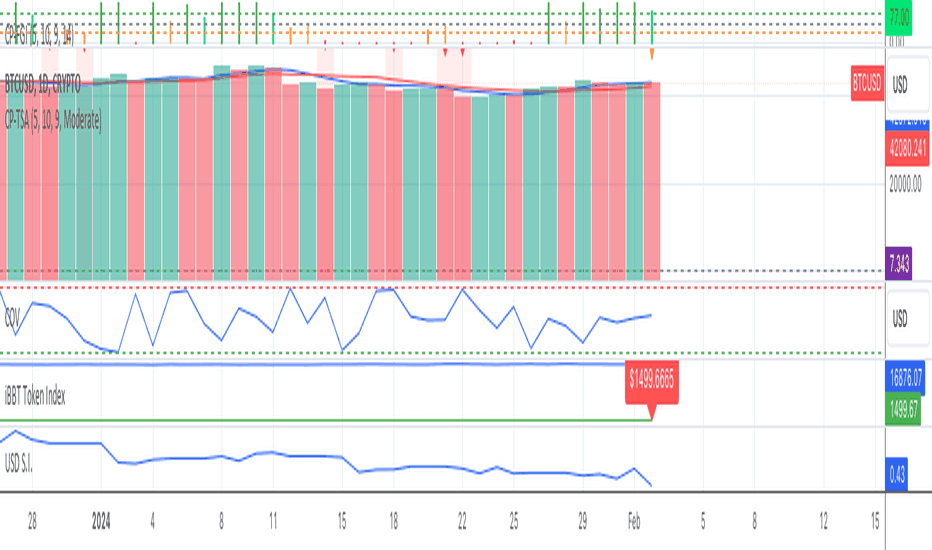

The USD Strength vs the IMF's SDRThe USD Strength Indicator's relationship with the SDR basket is foundational to understanding global currency dynamics. Since the SDR comprises major currencies like the USD, Euro, Yuan, Yen, and Pound, the indicator's assessment of USD's performance against these currencies offers direct insights into its comparative value. This evaluation helps gauge the USD's global economic standing, influencing international finance, trade decisions, and the IMF's monetary strategies. It's a critical tool for analyzing shifts in currency power and their broader economic implications.

Currency scuffleAs you can see we prepared update for the currency agenda, we have added gd, jpy, rub, and inr to the fuse, as you can see fibonacci cycles stayed the same in the anbsence. We think or at least clearly see on a chart that rub was the most profitable currency available. In the later arrivals we will try to discover most profitable assets nominated in rubles and compare them to assets in other curencies. Feel free to read, analyse, comment and enjoy the party.

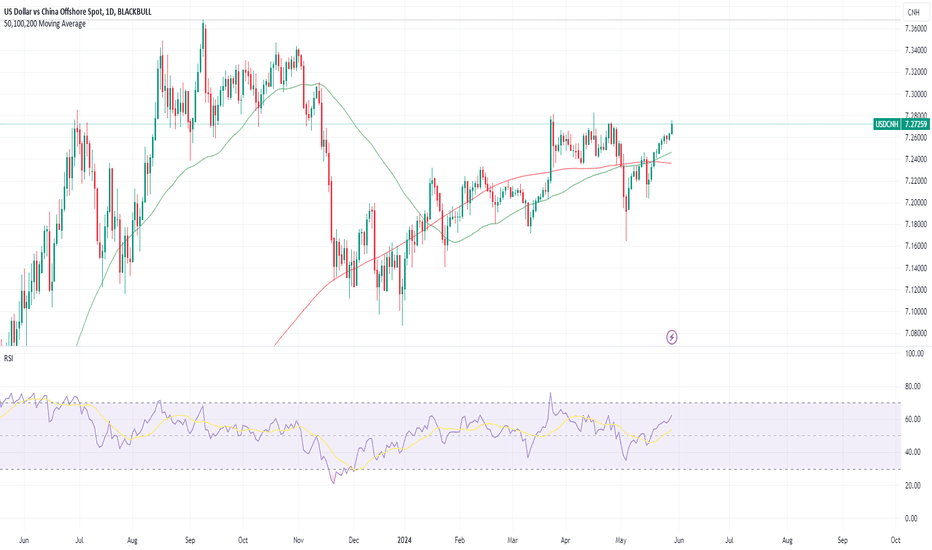

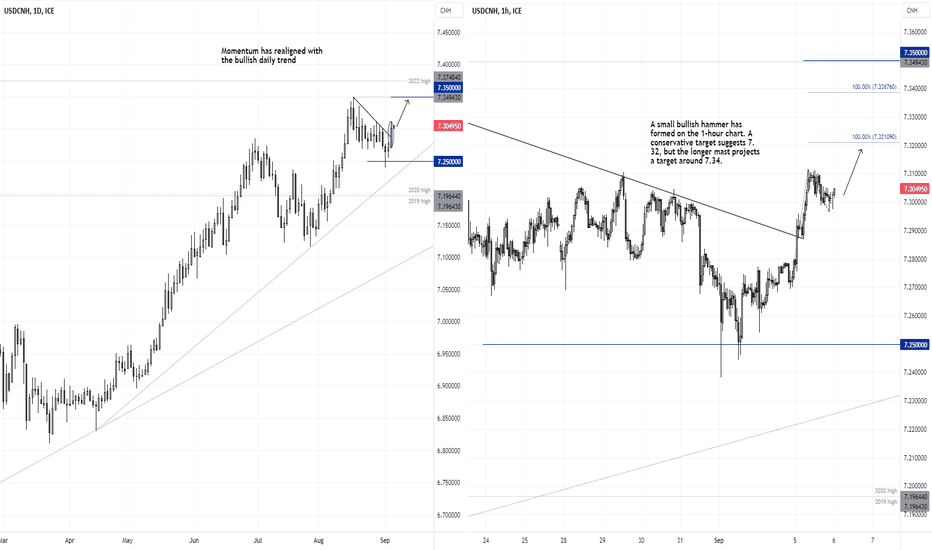

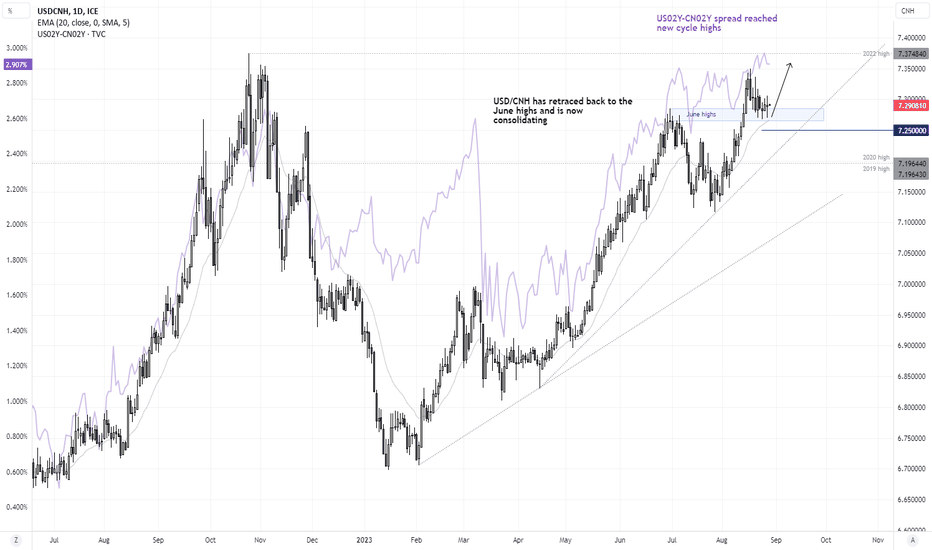

USD/CNH looks set for its next leg higherUSD/CNH remains in a soliud uptrend on the daily chart and, after consolidating around the June highs and forming a bullish hammer at 7.25, the swing low appears to be in. A bullish range expansion day broke the bearish resistance line, and bulls could seek to enter upon any pullbacks towards yesterday’s low for a tigher long entry.

The bias remians bullish above Last weej’s hammer low, and we could now be heade for 7.35 or the 2022 high.

A small bulish hammer has also formed on the 1-hour chart. A conservative target projected from the recent leg higher suggests 7.32 for bulls, whilst if we use the run up from 7.27 it projects a target atound 7.34.

USD/CNH - potential swing trade longUSD/CNH remains within an established uptrend on the daily chart, and the US02Y-CN02Y spread has reached a new cycle high to suggest upside pressure could be building on USD/CNH.

Prices have retraced and are now trying to build a base around the June highs. Bulls could seek dips around the cycle lows with a stop below 7.25 in anticipation of a move to 7.35, the 2022 high or beyond.

CAN BRICS Gold Standard Threat USD in Nearest Months?Last month there were several claims, and rumors, that BRICS will back its united future currency by gold.

The return of gold as money has been heavily discussed by gold bugs for about the last 10 years. Below I provided their general thoughts:

The gold bugs nailed that China and Russia have significantly boosted their gold reserves.

The countries conduct independent geopolitical policy that contradicts the West.

Dollar days are over. The White House sanction policy which escalated last 2 years combined with permanent US debt growth and dollar depreciation make it impossible to use USD in global trade, global investments, etc. The world needs to return to gold, because the last 50 years after Nixon suspended USD convertibility to gold, have shown that fiat is the pyramid of growing debt and continuous inflation.

In other words, claims about the BRICS gold standard perfectly fit these gold bugs' dreams.

During the year there were proposals for BRICS membership, from Algeria, Saudi Arabia, the UAE, and many other developing countries from different regions.

It is hilarious for me, that the acronym BRICS was coined by the British economist Jim O'Neill from Goldman Sachs. Today countries that oppose the West or conduct independent from the West policy, use the English acronym BRICS to describe themselves. West created BRICS (not only the acronym, but investments, favorable trade laws, etc.), and BRICS opposes the West.

I see five internal pillars to establish gold-backed supranational currency. You need

a united bank that will manage the currency

gold reserves,i.e. the funds for the currency

economic strength, that usually measured by GDP to compete with fiat and unfriendly regulations from non-block countries

established robust relations in international trade between members or potential members

supranational and national legislation that will regulate the currency without undermining national currencies, FX markets, monetary policy, etc.

Several years ago BRICS established the supranational bank New Development Bank (the NDB). Possibly, it may become the alliance central bank and the issuer of gold-backed currency. Its total equity in the 1Q of 2023 was equal to 11.17 billion USD. It is big enough for private institutions from emerging markets, but not enough if you pretend to alternate the American dollar. The bank applies USD as its reporting currency. It makes sense if you do not oppose the dollar hegemony. According to the bank investor fact sheet, the bank is a bond market participant with high credit ratings, that regularly issues bonds in USD (again, hated dollar) and currencies of the members (CNY, RUB, ZAR bond programmes).

The bank has adopted the Contingent Reserve Arrangement (CRA). It is a framework to provide liquidity during financial stress. To my knowledge, it wasn't used in February 2022- March 2023 when the Russian financial system and especially the ruble were under enormous pressure . Russia closed its markets and imposed currency control measures to cool off unfavorable trends. It highlights how uncoordinated and unhelpful BRICS is. One excuse may exist if other members offered Russia to use the CRA and it refused.

You can say, that the NDB can easily increase its 11.17 billion USD equity using the gold reserves of the union. Let's move to gold holdings.

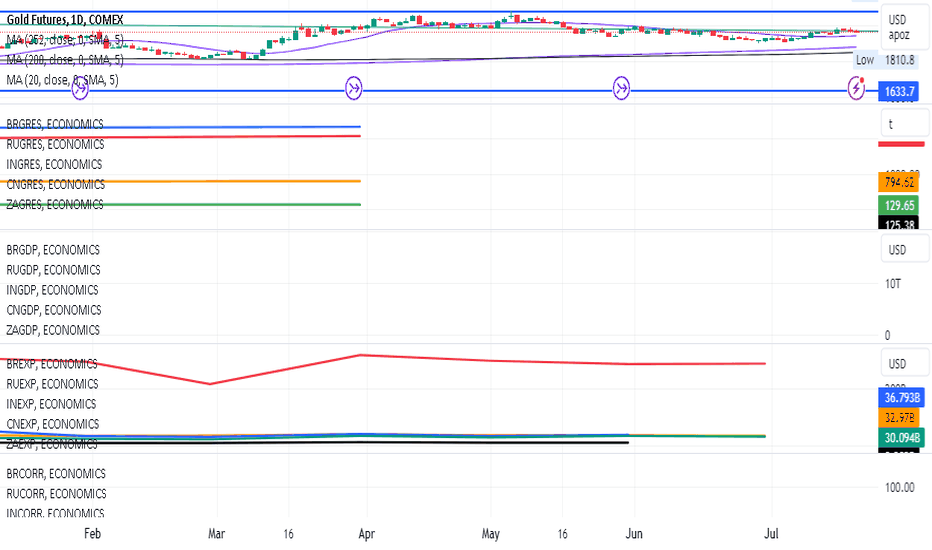

The first pane, under the continuous gold futures price, shows BRICS gold reserves performance according to the World Gold Council (WGC). At the end of Q1 2023 the combined reserves exceed 5444 (5444.53) tonnes or 175.045 million oz. It is noticeably higher than all world gold demand, which was estimated by the WGC at 4742 tonnes in 2022.

London Gold fix was 1963 USD/oz on July 21. Applying the price, the gold reserves of BRICS surpass 343.6 billion USD .

The major share is provided by Russia and China. Russia held 2326 tonnes (42.72% of the BRICS reserves), and China possessed 2068 tonnes or 37.98% of reserves. It was followed by India with 794.6 tonnes or 14.5%. Brazil and South Africa held almost the same amount of yellow shinning metal: 129.6 tonnes (2.38%), and 125 tonnes (2.3%) respectively.

It is the first striking difference that members have an uneven metal distribution that can undermine the future of a possible united monetary union . However, not necessarily countries would invest all their gold to create the gold-backed currency.

Another drastic difference is in their GDP size . The merged GDP of the block was about 25.91 trillion USD in 2022 . China had 17.8 trillion USD, significantly exceeding others or accounting for 68.7% of the alliance. While it held 37.98% of all group gold reserves.

The next was India with 3.3 trillion USD providing 12.74% to the union's GDP. Its GDP share is close to its gold reserves share of 14.5%.

The third was Russia with 8.6% GDP share or 2.24 trillion USD. [ Important to note that Russian GDP dollar estimation was hampered by the overpriced ruble in 2022. It was caused by Western sanctions on Russian imports, while Russia was receiving plenty of dollars for its commodities. That finally ballooned the country's current account surplus to the historical highs being a magical pill of ruble strength. ]. It is not the big GDP share, while the country's gold reserves proportion was 47.7%.

Russia was followed by Brazil with a GDP equal to 1.92 trillion USD contributing 7.4% to the merged GDP. Brazil's GDP stake exceeded its metal reserves.

The South African GDP was 0.4 billion USD providing 1.54% of GDP. The GDP share is slightly below the country's metal stake in BRICS.

The economic strength of members does not equal countries' gold reserve s. Only India and South Africa had close estimations of share in GDP and gold inventory.

The inclusion of export data in analysis can't show all the depth of international trade between the members, but quantitative figures will uncover the trade patterns. Not sure that export data on the 4th pane has equal periodicity, but I have to apply that all 5 countries have the same monthly periodicity. The summarized monthly exports are about 393 billion USD. The figures have some seasonality, more volatile than annual GDP and quarterly gold funds data, but their volatility will not wreck the analysis and the general situation.

China is the leader with 72.5% in the group exports.

Russia is the second with 9.1%.

India is sat next to it with 8.39%.

Brazil is close too, with 7.63%.

As in the previous rankings, the last one is the South African Republic with a 2.3% export share in the related group.

There are discrepancies between export share, GDP, and gold funds among the block. Again the South Africa figures of exports close to its gold reserves and GDP contribution, while for others they do not match.

Among the total export figures, we should take into account with whom the countries trade and what they trade. The primary buyers of Chinese exports are the USA, Japan, South Korea, and the EU or the West which use USD and partly EUR in their international contracts. The main export partner of Russia, Brazil, and South Africa is China . But the main export partner of India is the USA.

Nothing is surprising here, the predominant goods in Brazilian, Russian, and South African exports are commodities. The main world factory of consumer and industrial goods is China which buys commodities and consumes commodities to make the final goods. India is in the middle, it exports some goods, like pharmaceutical products, but the majority of the exports are commodities or refined commodities (like petroleum).

Worth noting that has happened after the West imposed sanctions on Russia. Russia has decreased its dependency on the West and extraordinarily increased market share in non-West countries, like India, Turkey, and China. They say Russia supplies its commodities with heavy discounts.

What currency do Russia and its non-western partners use? According to Reuters' article published on May 4, 2023, between Russia and India most of the transactions happened in the American dollar , other parts were made in Indian rupees, the UAE dirham (AED). Because Russia couldn't spend rupees, the two countries suspended their rupees trade. Russia preferred CNY and part of transactions were routed via China.

It says a lot about BRICS partners and their bilateral trade, transactions, and payment currencies. Even sanctioned Russia was ready to receive the dollar (thanks to a few exemptions provided for USD payments to Russian commodities), to receive AED, which is pegged to USD (quasi-dollar) and Chinese yuan. China is the main importer of Russia, so it is comfortable for Russia to receive yuan for its exported commodities and spend it on its imports. Why single supranational currency can be created after all the mentioned facts?

According to the Bank of Russia statistics, the yuan share in Russian exports payment was about 25% in May 2023, compared with the combined USD and EUR share of about 33%. About 30% of Russian imports were paid in Chinese yuan compared with 33%-34% of payments in USD and EUR.

Even being under sanctions and having the necessity to go away from the USD and EUR, Russia still significantly uses them. Having 2326 tonnes of gold and being #1 in the gold reserves ranking, Russia hasn't used it in its international trade. There are no official statistics that can prove using gold in Russian international trade. Why not use gold? Do the Western sanctions on Russian gold transactions undermine the Russian ability to use its gold in foreign trade? If the answer is yes, then for me it is hard to believe that not only gold-backed currency can be established, but also play an important role in the international trade between members of BRICS. It can be the BICS gold standard. Yuan-gold back standard, anything without Russia.

International trade is also about the trade of goods and services and international investments. The topics are out of the scope of my analysis. Of note, the majority of international reserves of these countries are invested in USD-denominated assets, predominantly bonds . I believe the most diverse is Russia which has invested its reserves in CNY, AUD, CAD, CHF, and GBP. All Russian reserves, except CNY-denominated, are under sanctions now. Will gold-backed BRICS currency have the assets nominated in the gold-backed units allowing economic agents to earn interest? At the minimum, it should provide opportunities to store value, be volatile as the American dollar or less, and be liquid to be exchanged in fiat and goods.

Finalizing 1,2,3,4, I want to add, that only current members were analyzed. If new members join, it will change amounts, countries share and their positions in gold funds, GDP, and international trade, and likely will demand to increase the NDB equity letting new members in.

I can imagine that the countries can adopt supranational and national legislation to establish gold-backed currency. But I can't imagine how many problems it will create. How it will work with their national currencies? How it will affect taxation? If it is backed by gold, then its currency rate will mimic the gold price. Can they issue debt in the new gold-backed currency? It will be like a creation of the European Union and its Eurozone with its fiat Euro. It can't work without a lot of frameworks and treaties. As Europe shows, treaties are not followed by its member states. If BRICS doesn't have aims to use their unborn currency in trade between private companies, and individuals, it will be like the SDR of the IMF. If exporter/importer (no matter, whether an individual or a company) can't use the currency, it will not outshine dollar transactions. Just a new measure of calculation of debt and assets for its members.

The internal factors were analyzed. There is one important external one. To protect the new currency, and develop its popularity to substitute the dollar you need to build trust in the currency among others.

On the bottom of the superchart, corruption ranks show. The least corrupt has first place among all other countries. The ranking compares countries with each other. You can argue that it is biased data. Yes, it can be. But I believe, it shows the general scene. China the best member-state, ranks 65th, South Africa is on 72nd place, India on the 85th, Brazil on 94th and Russia takes 137th place.

With these figures, I doubt that the supposed currency can be confidently used by the private sector and will be trusted by the private sector and non-member states.

All in all, there are a lot of contradictions in the creation of gold-backed currency, the USD substitution. If a country wants to use gold right now in international trade, it can do it, if its counterparty agrees, and there is no need to create the supranational monetary surrogate that is backed by gold. The current situation shows that countries are more likely to continue using USD, a national currency in international trade than create a confident and useful gold-backed currency.

Creation of a single currency can take years, countries will need time to adopt their laws and monetary policy, and business habits to use this currency. It may be a smooth long-term process to create the gold-backed currency. Even the situation with Russia, when the country needs to stop using 'poisonous' USD, has shown their economic agents still pay and receive USD.

In my opinion, that it is more probable, they would create a yuan-backed CBDC, than the BRICS gold-backed single monetary unit that will threaten the dollar.

Favorable rumors and estimations from experts could buoy gold prices until the end of the BRICS summit (August 24, 2023).

On the technical side, gold seems weak to breakout the 2100 USD/oz resistance in the nearest month. Presumably, it would float between 1900 and 2100 USD/oz.

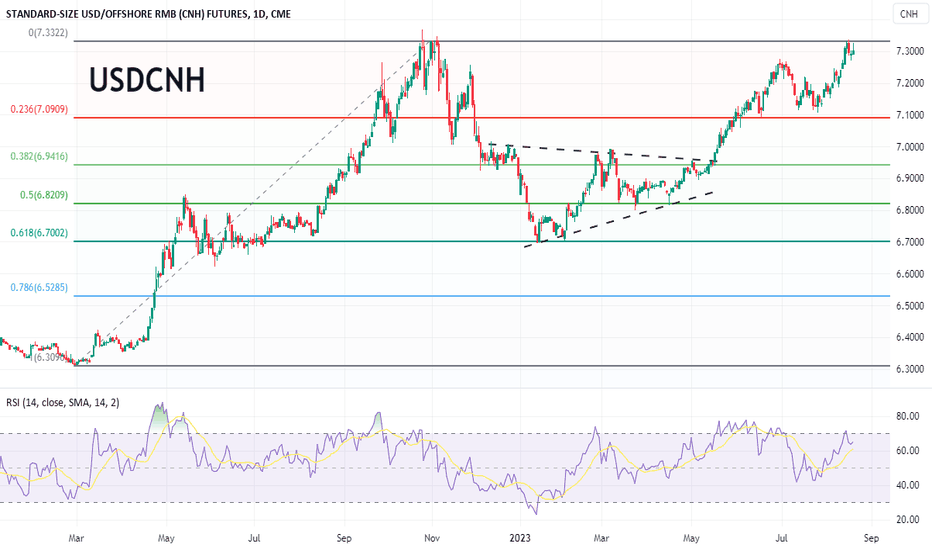

USDCNH - Testing new highsThe trajectory of the USDCNH is a burning question as it approaches the highs witnessed in November 2022.

Recent weeks have seen China's economic robustness wane, and as a result, attempts by its central bank to ease the situation have led to a weakening of the CNH. This dynamic becomes clearer when considering the interest rate differential between China and other nations. In contrast to the U.S., which is on a rate-hiking journey, China's recent interest rate reductions have amplified the rate gap between the two nations. Overlaying the USDCNH currency pair with this interest rate differential reveals a clear correlation: as the differential grows, the USDCNH rises in tandem, driven by the depreciating CNH against the USD. A possible factor behind this movement is the "carry trade", where investors borrow in CNH at low-interest rates to invest in higher-yielding assets.

This phenomenon isn't unique to the USDCNH. Japan, another country that has adopted an easing stance, exhibits similar patterns. As the rate differential between the U.S. and Japan expands, so does the USDJPY currency pair.

Examining the dollar independently, there's potential for an upward surge. It's currently trading close to the top edge of a descending channel, with the RSI indicating it isn't oversold yet. With the Jackson Hole Symposium slated for later this week, all eyes and ears will be sensitive to any unexpectedly hawkish remarks from the Federal Reserve Chair, which could lead to another surge in the dollar, driving the USDCNH higher.

On the one hand, the dollar has the potential to break higher based on technical, on the other hand, the PBOC is likely to ease policy further as it deals with the economic fallout of its property sector. Considering the above in an eventful week when the Jackson Hole Symposium is to be held, we see opportunity for a risk managed long position in the USDCNH at the current level of 7.3126 with a tight stop at 7.245 and take profit at 7.460. Each 0.0001 per USD increment in the USDCNH future is equal to 10 CNH.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.sweetlogin.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Reference:

www.cmegroup.com

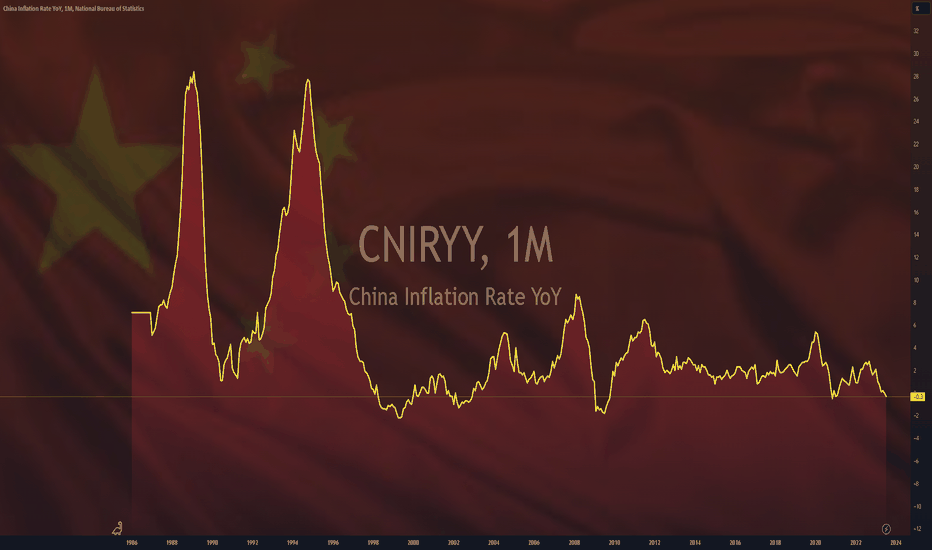

$CNIRYY - Deflationary CPI- While ECONOMICS:USIRYY numbers remain inflationary,

having the latest increase to 3.2% on August 10th,

on the other side of the World from the second Global Superpower,

ECONOMICS:CNIRYY came Deflationary at negative 0.3% on 9'th of August,

just a day prior to numbers of ECONOMICS:USIRYY .

Note that The Head of Federal Reserve,

our pal Jerome Powell,

stated that Feds do not see Inflation ECONOMICS:USIRYY coming down to their norm target of 2% CPI

by 2025.

Jerome still believes on a 'Soft Landing'..

How about another Joke, Powell !?

Using the News to better prepare for your day-tradingI'm not much for getting into the politics of things but I did see a news release this morning that discusses how Chinese banks are offloading a lot of their U.S. dollar holdings in relation to raise the value of the Yuan.

Now you might wonder how can this affect American markets or how does it affect the US dollar, and in the article below I'll give you some insight into that.

For me the details below reflect what I should be expecting from the New York Stock exchange which is what I'll be trading later today. This is how I prepare for my morning and how you should probably do the same.

If Chinese Banks offload much of their US Dollar Holdings, how does that effect the US?

Impact on the US Dollar: When Chinese banks offload a significant portion of their US Dollar holdings, it means there will be an increased supply of US Dollars in the foreign exchange market. With more supply and less demand, the value of the US Dollar would likely decrease relative to other currencies. In simple terms, the US Dollar may depreciate in value.

And how does it effect the New York Stock Exchange?

Impact on the NY Stock Exchange: A weaker US Dollar can have both positive and negative effects on the NYSE. On the positive side, a weaker US Dollar can boost exports for US companies, as their products and services become more competitive in international markets. This can lead to increased revenues and potentially higher stock prices for US exporters.

The Counterpart

On the negative side, a weaker US Dollar can lead to higher import costs, as it becomes more expensive for US companies to purchase goods and services from foreign countries. This could put pressure on their profit margins and could negatively affect stock prices for companies heavily reliant on imports.