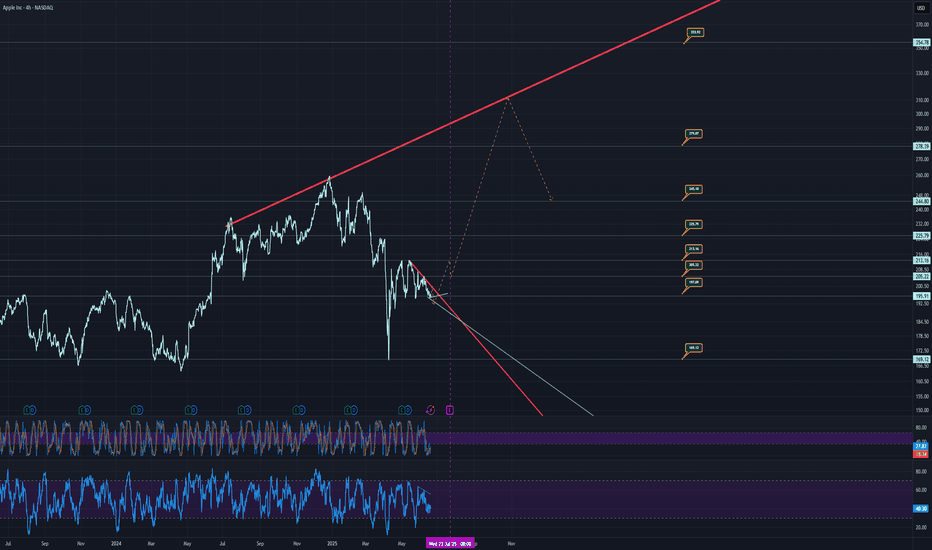

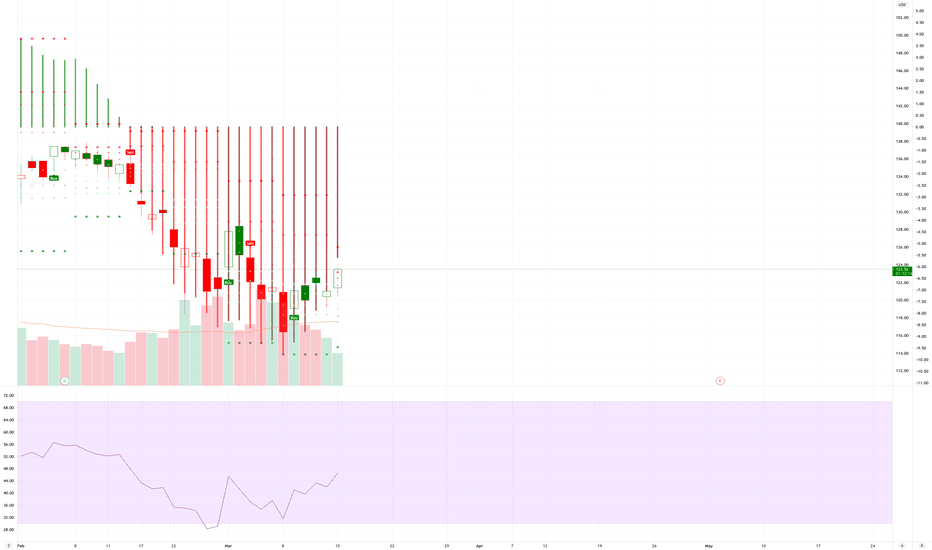

APPLE A FRESH APPLE TO BITEThe chart for Apple (NASDAQ: AAPL) shows the following key elements:

Rejection Trends: Marked in red, indicating levels where the price has faced resistance and reversed.

Support Levels: Marked in green, with horizontal support indicated by dotted lines, showing price levels where the stock has historically found buying interest.

Price Targets: Marked with specific values, suggesting potential future price levels based on the analysis.

Guideline: Represented by a dashed line, likely indicating a trend or channel guideline.

RSI and Trends: Displayed at the bottom, with the Relative Strength Index (RSI) and additional trend indicators in colorful lines.

Earnings: Marked with purple dashed lines, highlighting significant earnings dates or periods.

The chart covers a timeframe from mid-2023 to June 20, 2025, with the latest data point at 12:07 AM EDT on June 20, 2025.

Watch out, because there is a price target to 169. Meaning, we need to be careful.

There is also a price target to 280+ which has support of indicators.

Heading into earnings we might see the 215 mark which could see a slight drop to around 205, and then could see a climb over months to 280. Even 300+

Watch the trends, and price targets, if at trend, look to sell or buy depending on if support or resistance.

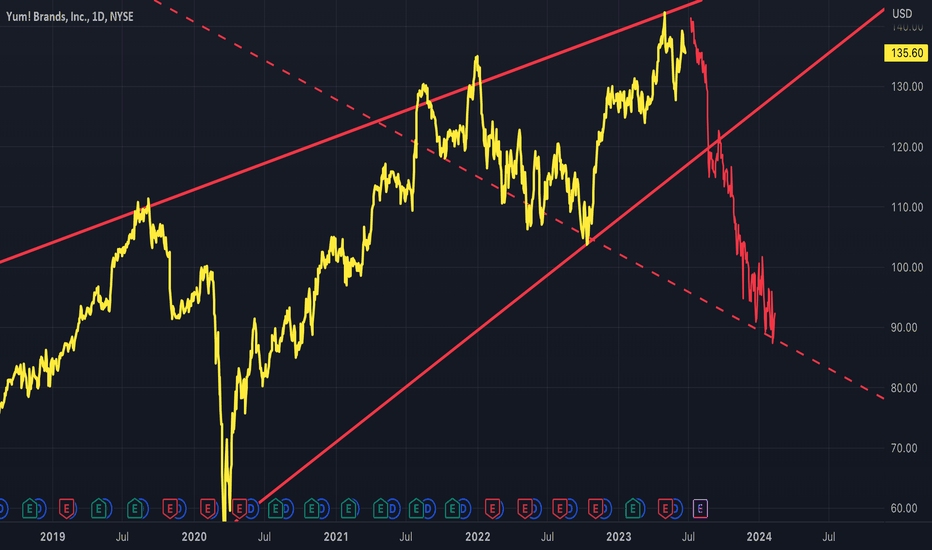

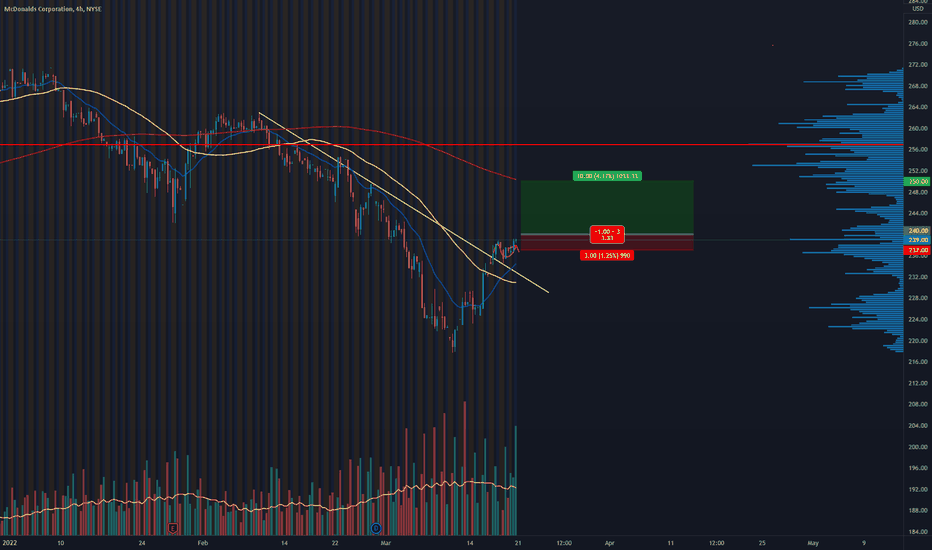

YUM

Fast food restaurant stock prices can potentially declineI am cautious and afraid that fast food restaurant stocks such as McDonald, Pizza Hut, Starbucks etc. will soon see a steady decline. Looking back at history, when USA threatens tariffs on countries such as China, Canada, Mexico and Europe at large, consumers in those countries become hesitant to spend money in American fast food chain. There are too many instances back in history to refer to. Happy cautious trading to my retail friends. www.stimson.org

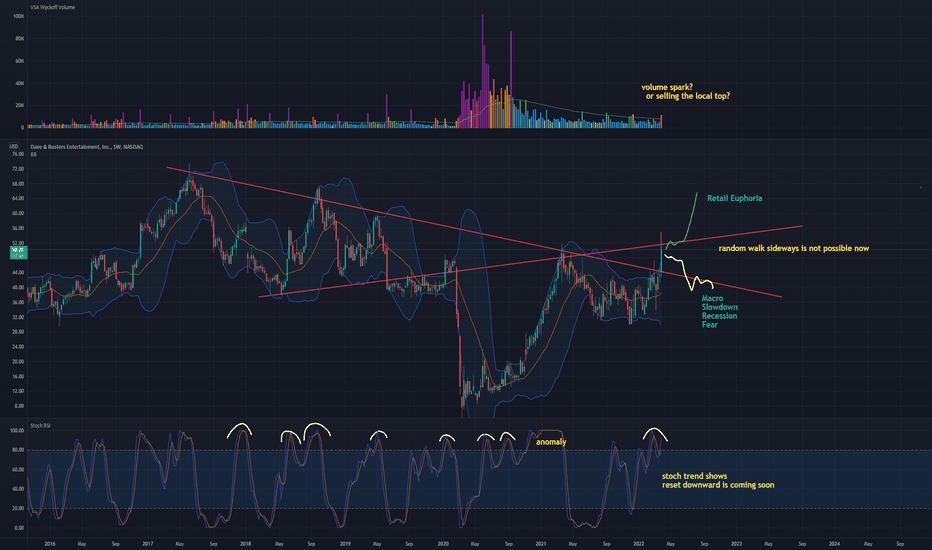

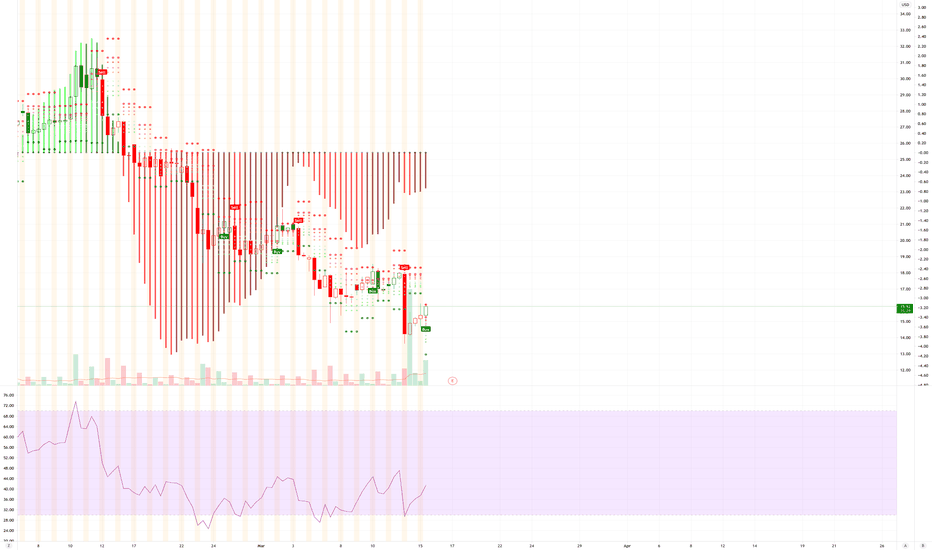

PLAY -ing with Fire Up here - Dave & Busters Eatertainment ChainDave & Buster's is an American restaurant and entertainment business headquartered in Dallas.

Each Dave & Buster's has a full-service restaurant and a video arcade.

As of January 2022, the company has 144 locations in the United States and two in Canada.

A quick scan of Google Maps D&B locations shows that very few are rated above 4 stars

This is a large national chain with a good footprint, however the upside is limited if common Americans begin to slow down discretionary spending.

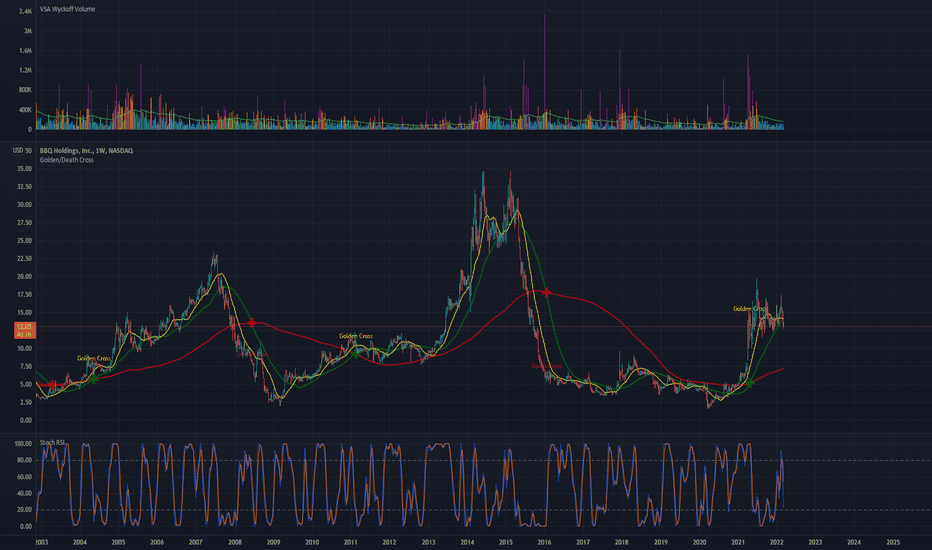

Cycle Peak for BBQ sell now avoid getting smokedAdvocates of capitalism are very apt to appeal to the sacred principles of liberty, which are embodied in one maxim:

The fortunate must not be restrained in the exercise of tyranny over the unfortunate.

Bertrand Russell

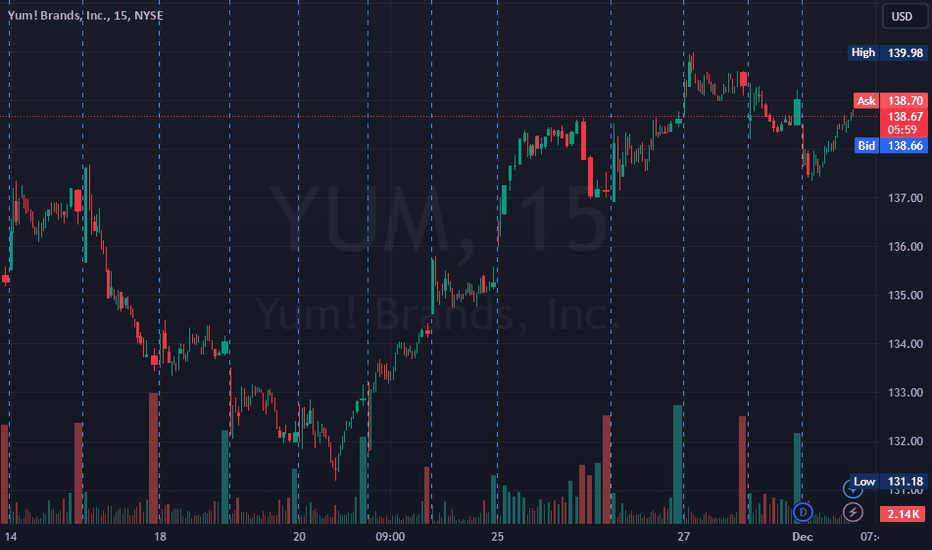

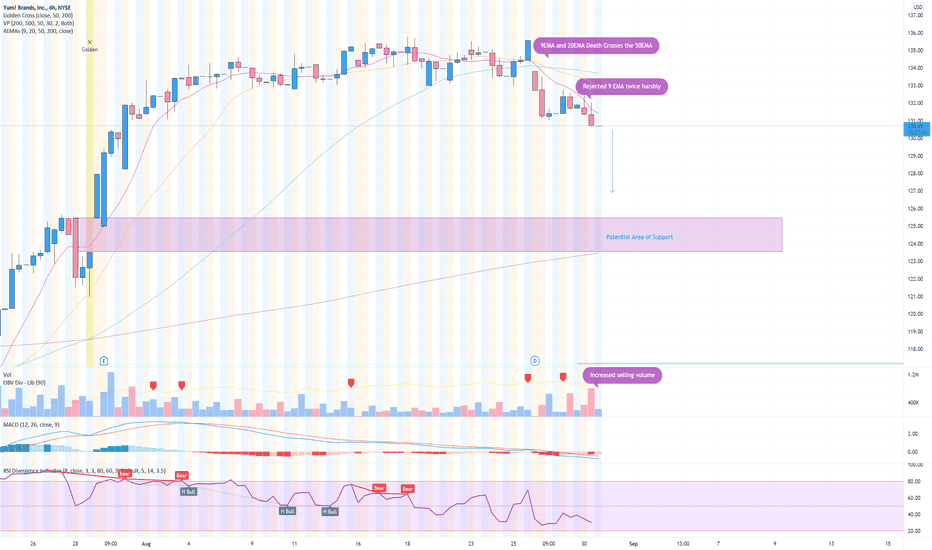

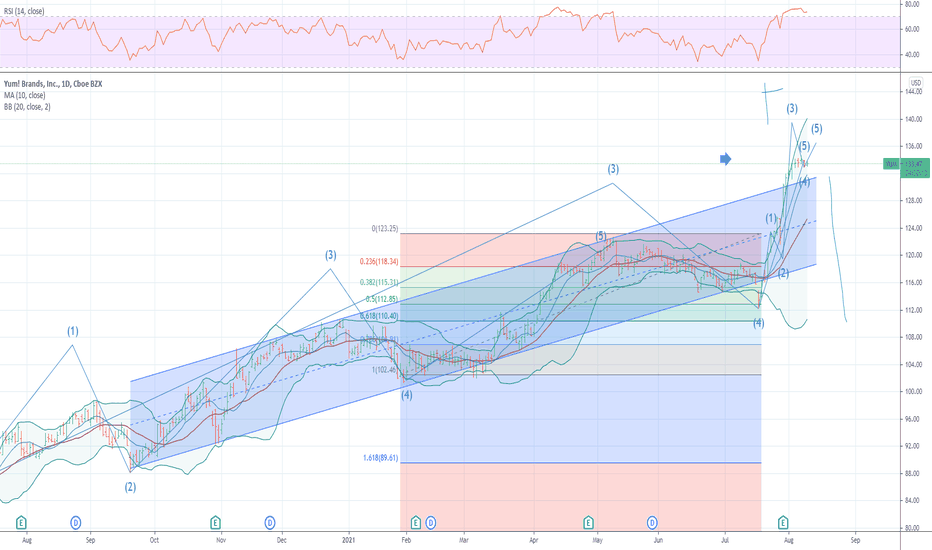

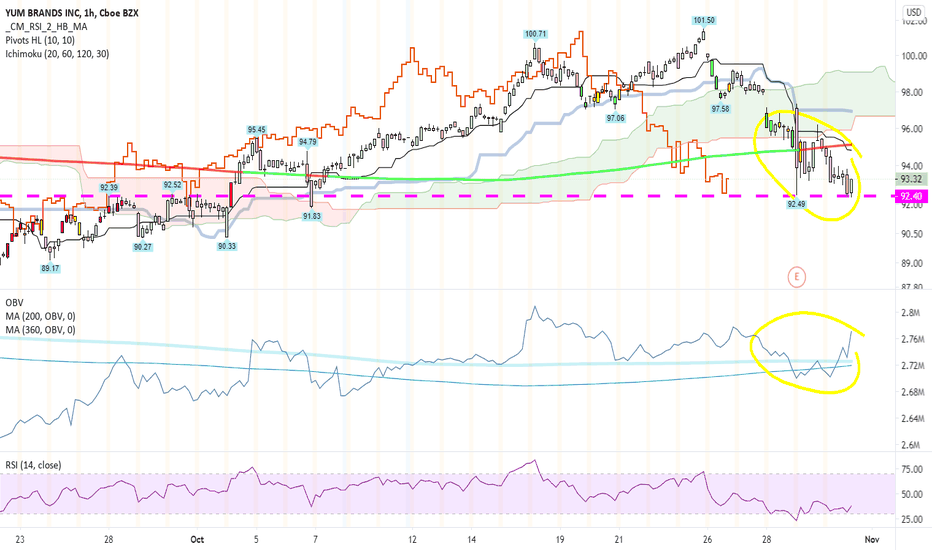

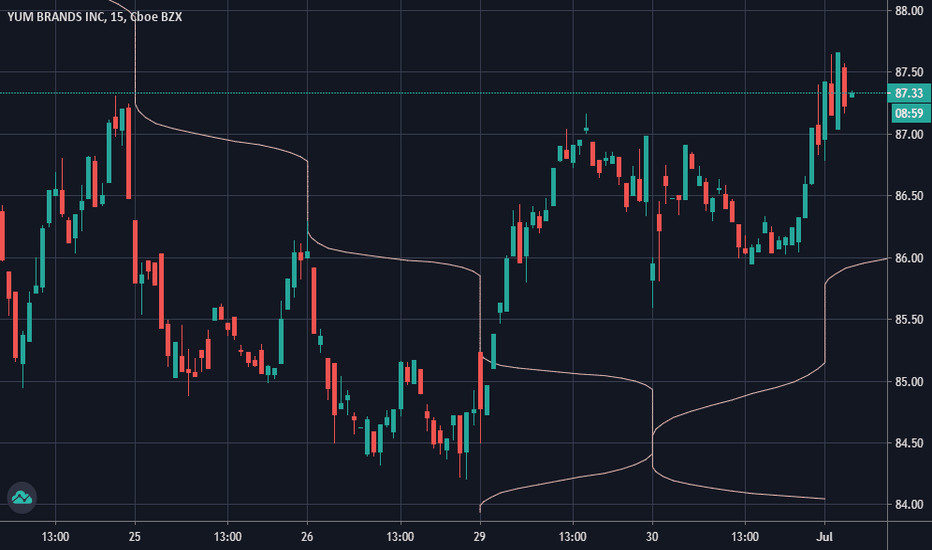

YUM Breaking DownYUM today 8/30 saw loss in a trading day that was mostly green on SPY. In the morning it attempted to regain losses from last week, but any strength was quickly sold and the downward trend continued.

- Rejection at 9EMA --> Short Term Downtrend confirmation

- Short Term EMA are bearishly crossing down to the 50 EMA

- Bollinger bands expanding signaling potential continued drop

- Increased volume on downward trend

- RSI below 50 (30), can continue down to 15s

Suggested Contracts:

BTO Sept 10th '21 132P

BTO Oct 15th '21 130P

Looks like Apple is breaking out on the daily chart!! Yum yum!!It's sweet to see the behemoth of ESG, Apple, perking up and breaking out! I've bought calls for September 2022 because I think that this stock is going to yum yum heaven, more and more so as it approaches the release of Apple car. The company's goal with their supply chain for all products is to be completely closed loop, using only materials from their old products. Now, that's ESG!

Apple seems like a great long hold. REMEMBER it's not just iPhones... it's a severely underpriced electric vehicle company!

Not investment advice 😊

PS: Should I sell my signals? Would you buy them? Comment below

I should have called it sooner, but this is a breakout situationLordstown motors, makers of electric work vehicles, looks yummy on the medium long term! I bought it around 14 and a half dollars, I would. have called it sooner but wanted to make sure it didn't keep sinking!

Do ya research, and check out the stock!

Could be yum yummiest of styles!

Not investment advice

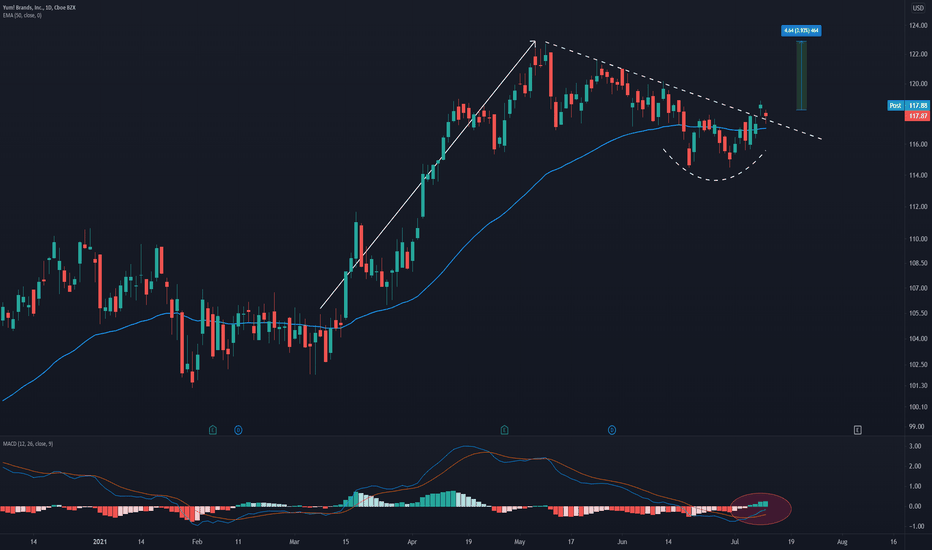

YUM - Monday, Nov 2 - Bounce!There aren't a lot of stocks out there I'd be comfortable holding thru a 2nd or 3rd wave of a pandemic. This one looks promising. Looking for a bounce off of last weeks lows. There's a short term on-balance volume price action divergence. Taco Bell/Pizza Hut/KFC are all doing well enough while other food venues are being forced to shut down. The 2% dividend is as good as a high yield savings, immediately prior to the pandemic.

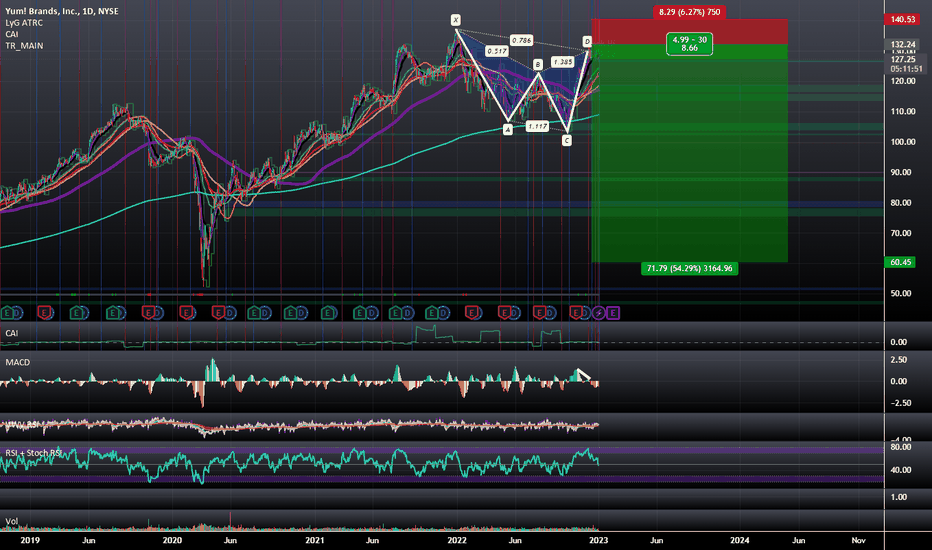

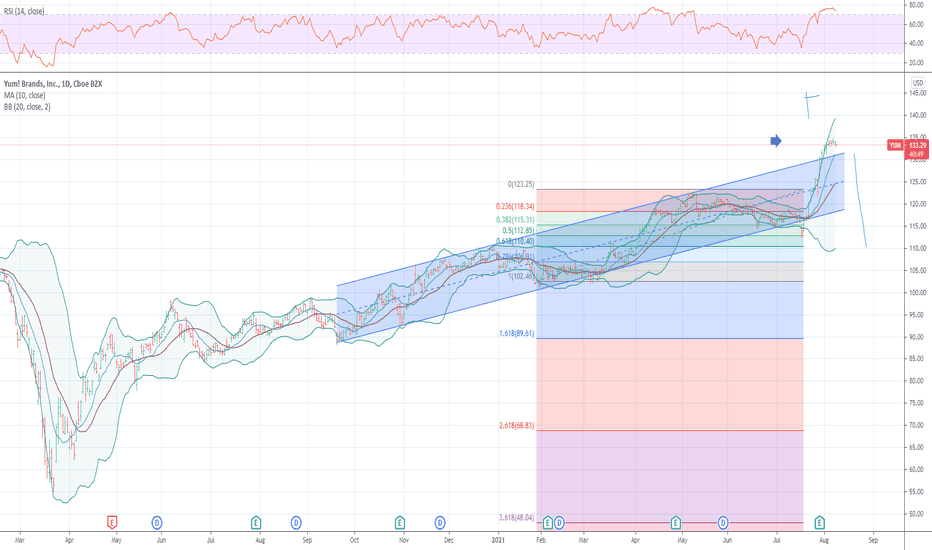

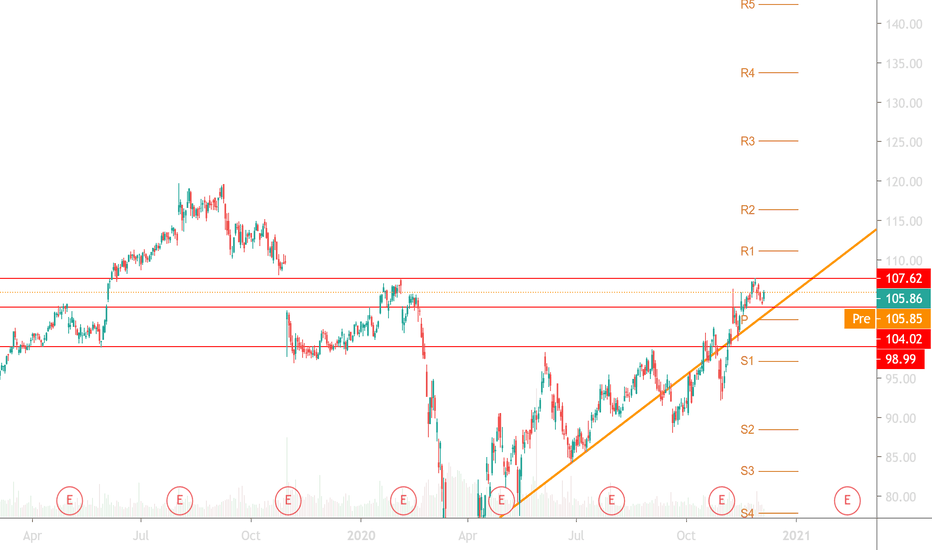

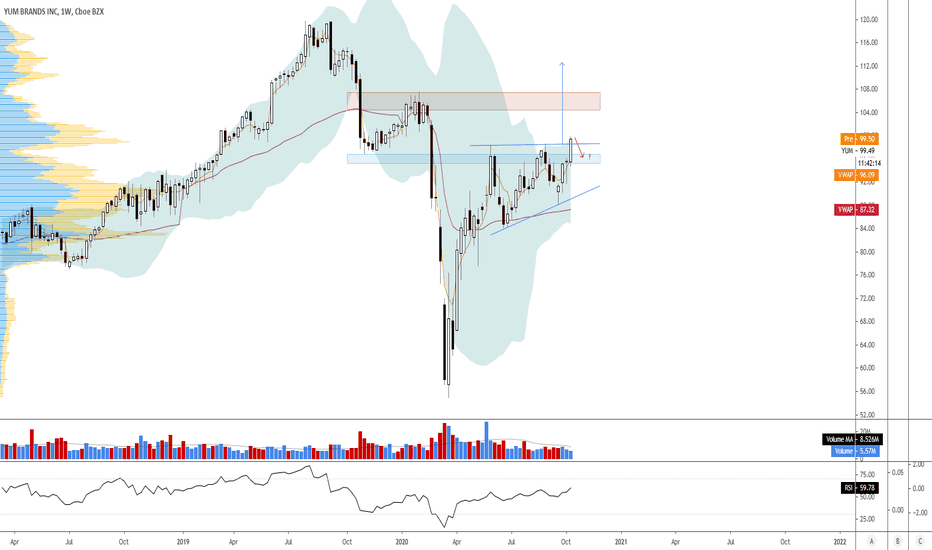

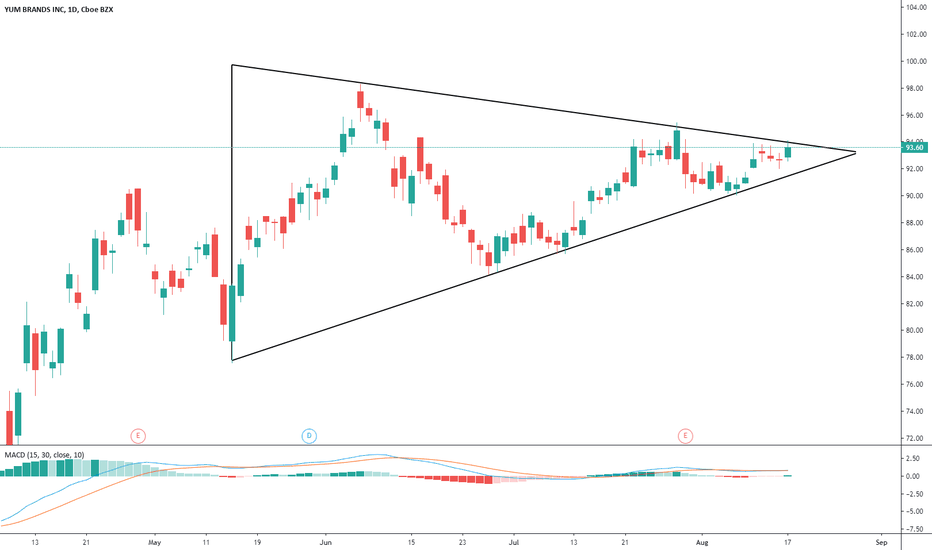

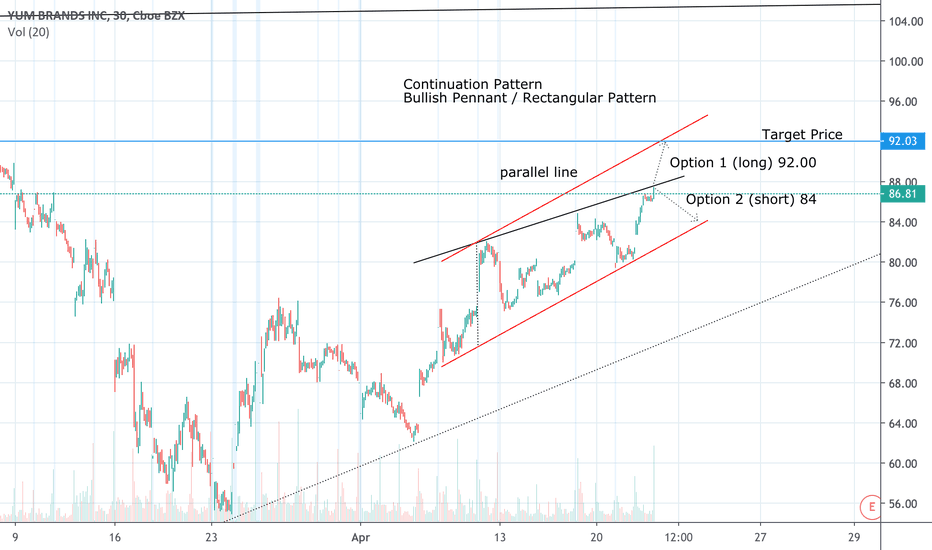

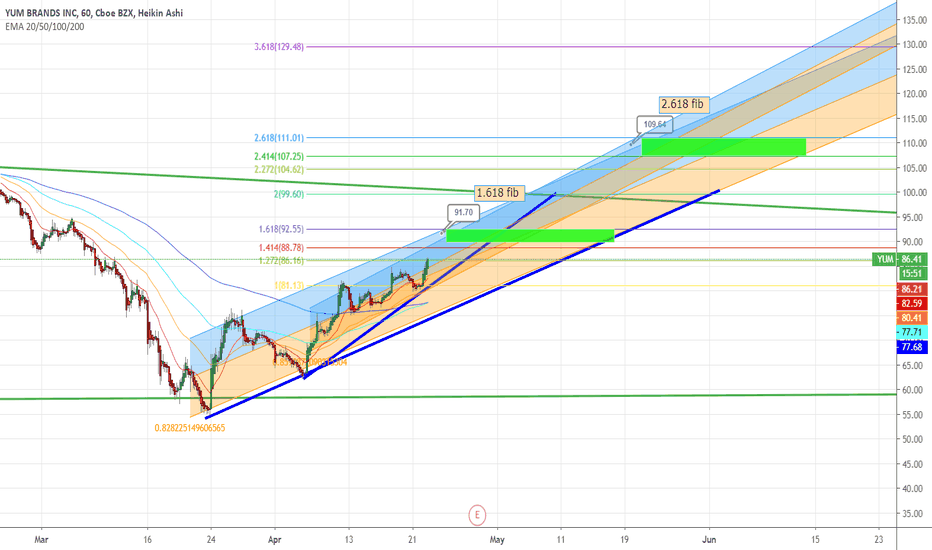

YUM BRANDS (PIZZA HUT, KFC)Yum! Brands

The brand owns: KFC, Pizza Hut, Taco Bell, The Habit Burger Grill and Wing Street worldwide.

Long term analysis - Market was bullish before the Virus and it changes quickly to accommodate the virus/crisis requests, so it should keep going upward - Bullish long term

Short Term I would go Bullish - same direction of the trend, but there is an Option B where the price can jump back to 84.00

Technical Analysis pattern - it seems to be a bullish pennant/flag (rectangular) pattern (more flag less rectangular).

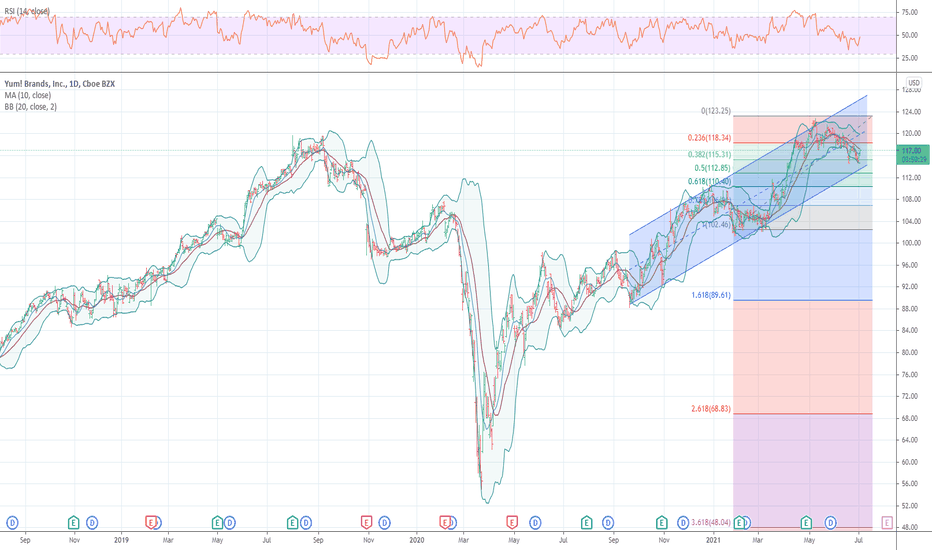

YUM BRANDSYUM BRANDS Trading Plan

Disclaimer:

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature,

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.