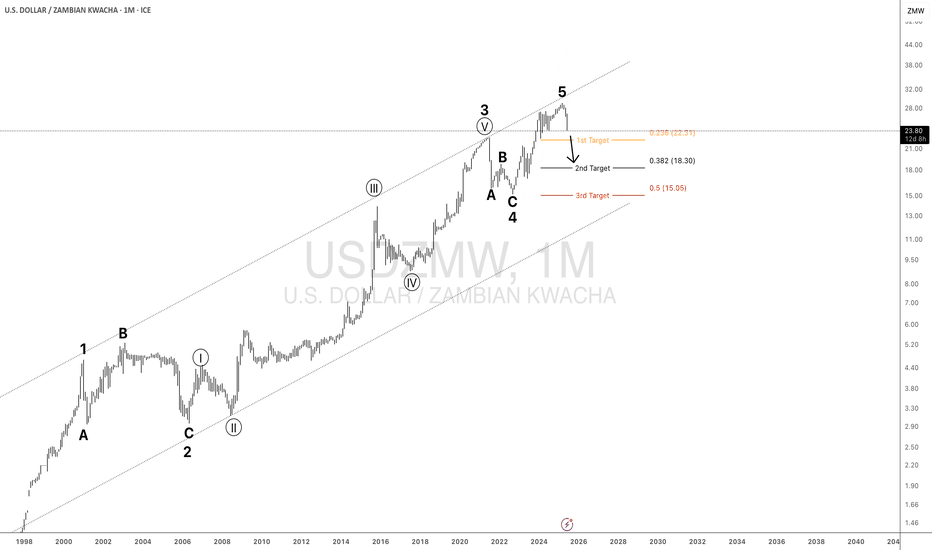

Zambian Kwacha Technical Outlook - A Wave Analysts PerspectiveUSDZMW seems to have reached what appears to be a major market top after completing a classic 5 wave Elliott impulse cycle on the monthly timeframe. This marks the end of a multi-decade bullish structure and signals the beginning of a corrective phase potentially reshaping Zambia’s FX landscape in the medium term.

Key Technical Insights:

The final Wave 5 peaked at 28.97, followed by a sharp decline to 23.90 (at the time of this publication).

A corrective ABC structure is now likely underway with fibonacci based downside targets around:

Target 1: $1 = K22.31 – minor correction (23.6%)

Target 2: $1 = K18.30 – medium correction (38.2%)

Target 3: $1 = K15.05 – deep retracement (50% of the main wave on monthly TF)

While various fundamentals, copper prices, debt restructuring and prevailing fiscal policies play a role, this technical setup suggests a strong medium to long term appreciation of the Kwacha is on the cards.

We may be witnessing the early stages of a multiyear FX shift.

Disclaimer:

This analysis is for informational and educational purposes ONLY and does not constitute financial advice in any way. Market conditions are subject to change and all trading involves risk.

Zambia

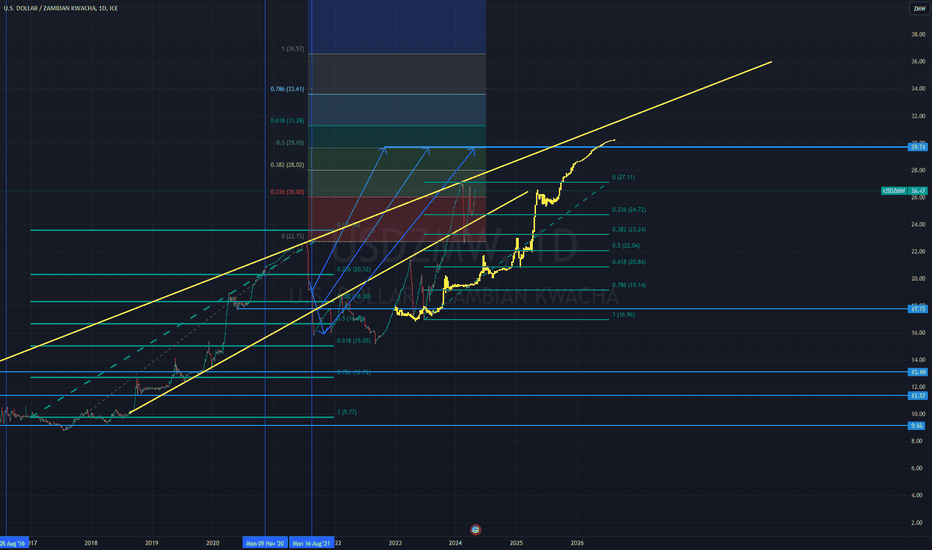

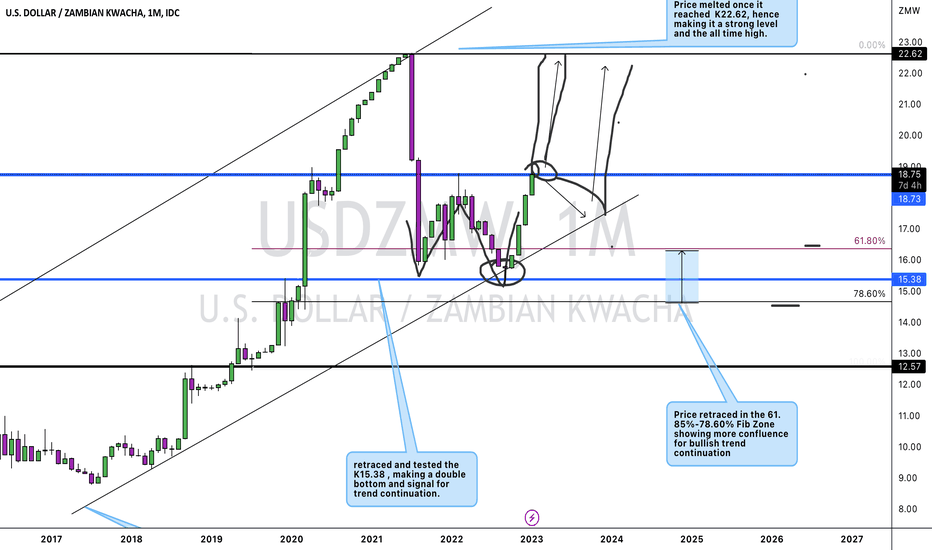

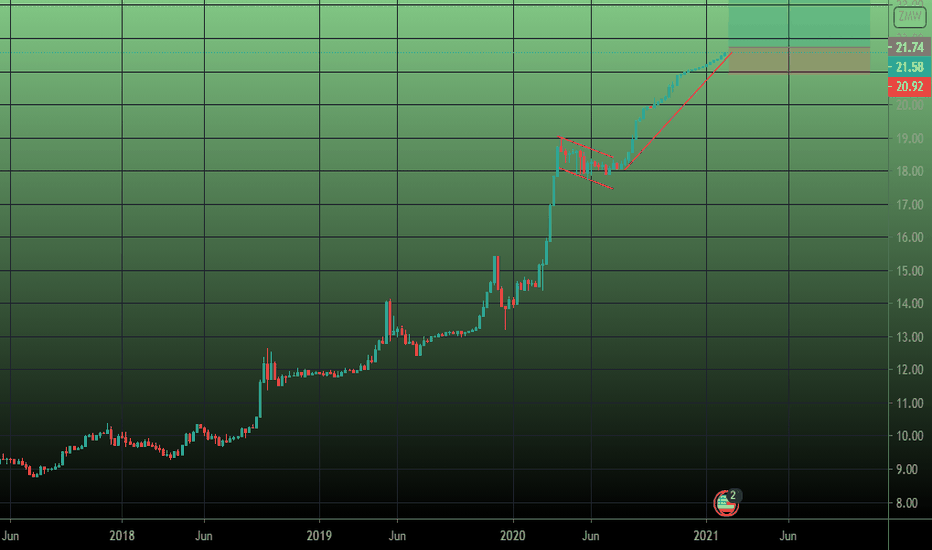

USDZMW (Where do we go from here?)So I have been privately analyzing USDZMW since 2015 and this idea of the USDZMW was created in 2021 after the elections(SEE BLUE HIGHLIGHTED PERIOD from 09 Nov 20 to 16 Aug 2021). Make of it what you will but the 29.71 price range if achieved could spell uncertainty. We have been in an up trend for the majority of the time and the drop from 22 to 16 seemed to have been a consolidation area that was eventually broken out of and rejected for a powerful breakout that brought us to 26. Now we have experience a small consolidaiton and it breaks out and upward it will achieve our 29.71 target.

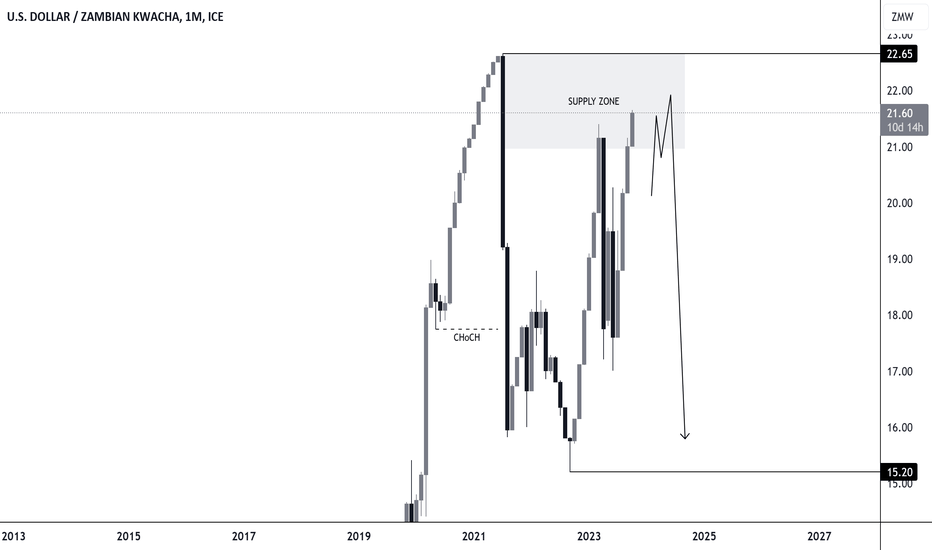

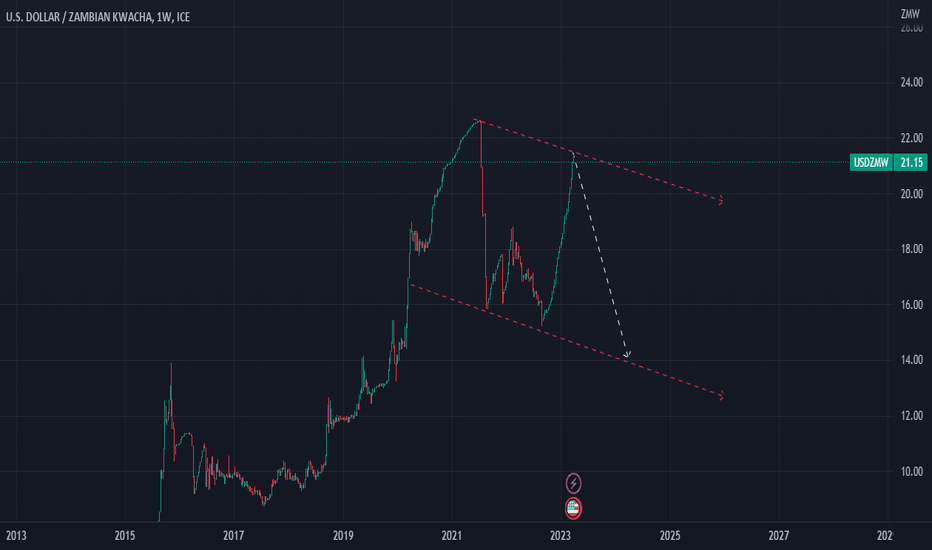

USDZMW SHORT Market traded straight back into the monthly supply zone. Even though this trade idea is about a short back to 15 it will generally take a whole lot of fundamentals to play in favor of ZMW. I personally expect market to stabilize in this zone. Market closing above 22.6 on the monthly Time Frame is not what we want to see as it would trickle to market creating new highs ...... FX_IDC:USDZMW

#supply&demandtrading

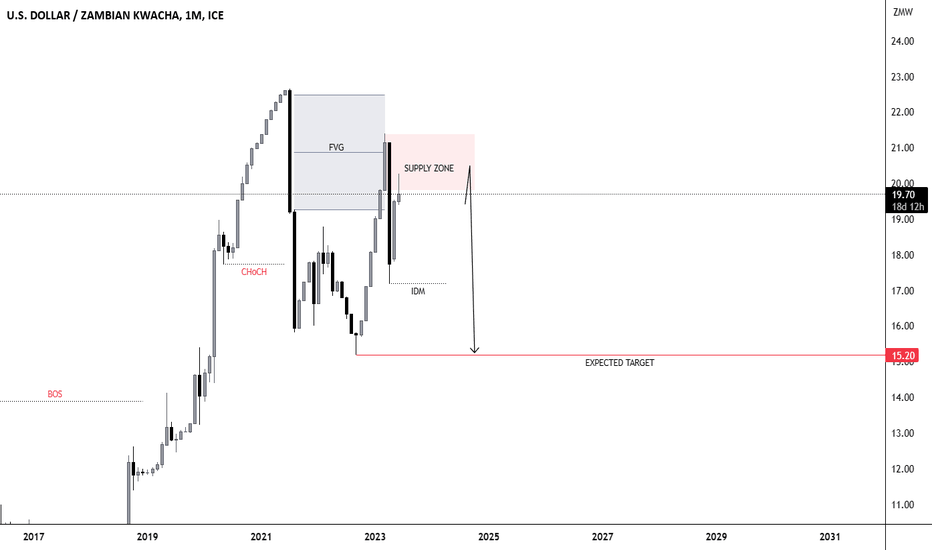

USDZMW USDZMW looking forward to continuation of the down trend after the market mitigated some of the imbalances on the highs.

Markert made a bullish engulf candle signaling a good sell off probability which is currently being tested and mitigated.

Currently the Zambian economy is facing a form of uncertainty as it has not yet successfully come to an agreement to restructure its debt with its official creditors. positive news towards such an agreement will strongly confirm my analysis apart from that low up and down volatility is to be expected.

My thoughts on USDZMWCurrently, the Zambian kwacha is facing several challenges that are impacting its value in the foreign exchange market. One of the main factors is the high inflation rate, which has been driven by a surge in food and fuel prices. In addition, the country's external debt has been on the rise, and this has led to a decline in investor confidence. These factors, combined with a slowdown in economic growth, have put pressure on the Kwacha's exchange rate. While it's difficult to predict the future movements of the currency, my technical view is that it could take another year before the Kwacha drops below K15 due to the technical factors at play.

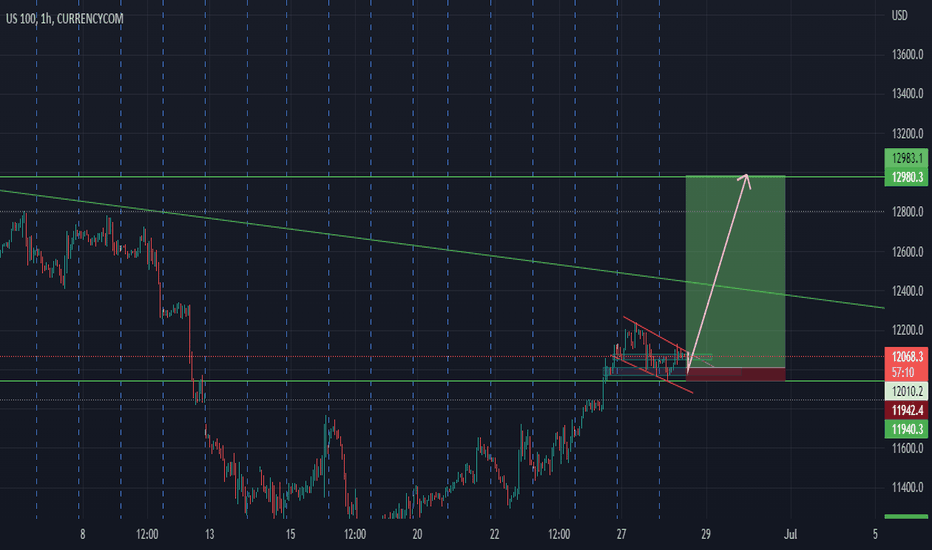

us100 going long after the formation of the falling wedge pattern this indicates that the market price might still be going long which is a long position signal

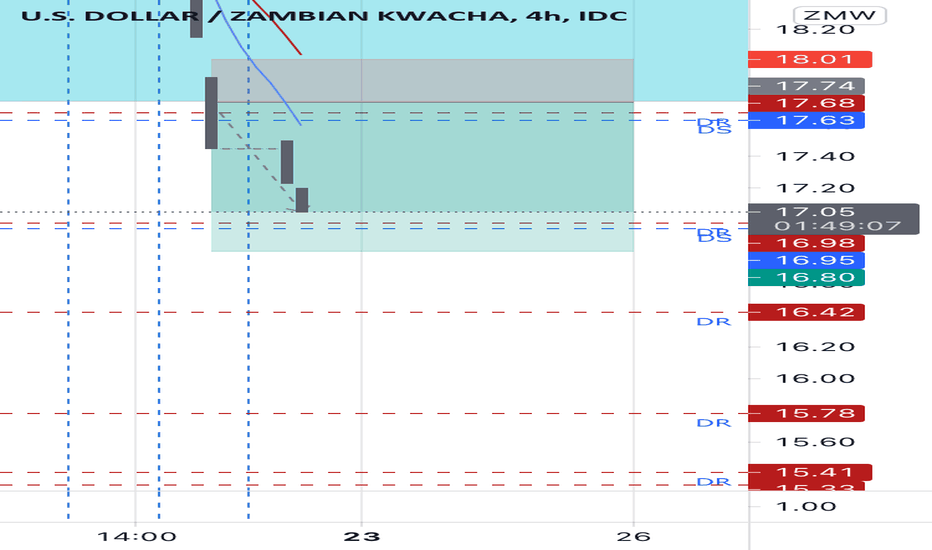

Kwacha is back (almost)Now this is by no means financial advice but mere analysis. When I saw price break the Daily Support at 17.63 , my immediate anticipation was we’re going lower.

Depending on what happens today at the Daily Support & Resistance (16.95) I believe it will reject and hold around that area for a while or it could right off break through and right for 16.4