Commodities: Oil leading the pack and an interesting spreadWe have an interesting setup here, with oil suddenly breaking up above weekly resistance, and outperforming precious metals, I think we might see a shift in positioning towards oil, and a few laggards that show an increase in commercial long positions for some time according to the commitment of traders report.

I'm watching oats, rough rice, soybeans, corn and wheat here.

Powerful trends look to either stall, or shift down, like the ones in silver, gold, orange juice, sugar, coffee...If everyone already bought and is in positions, who is left there to buy and bid it higher?

Right now, my focus is seeing which commodities moved up for the day yesterday, and then examine the individual setups. I'll post the ones worthy of attention, but meant to publish this as a heads up.

You can read the tickers and the color code on the top left corner.

Feel free to leave comments below.

Cheers,

Ivan Labrie.

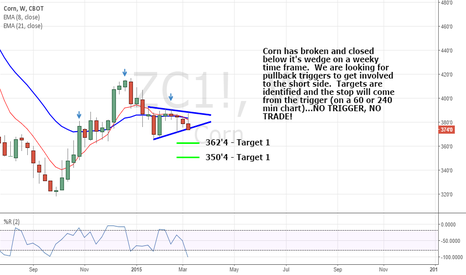

Corn

Corn: Potential time at mode signalIf Corn breaks above the August 19th high, it could be a good chance to enter longs risking a drop under yesterday's low. You can apply this idea to the front month futures, or to an ETF if trading stocks, remember to use the prices corresponding to these dates for your trade parameters.

If not filled in the short term, this idea is invalid.

Good luck!

Ivan Labrie.

Corn (ZC) At Long-Term SupportZC has been sold off stronger than most commodities, and its weekly Stochastics is at an extreme low reading. Note how it together with weekly MACD are beginning to turn up. The daily chart including today's action illustrates this bottoming action more clearly, but I've profiled this weekly chart to point out how ZC is currently beneath a long term down channel support line, which I don't expect to persist for long with ZC trading at an important support zone. Although the weekly RSI appears to still turn down, keep in mind the lag introduced by weekly chart signals. Visit goo.gl for today's technical analysis on $NG_F, $ZC_F, $USDJPY, $VIX_F, $NQ_F, $NFLX, $TSLA, $ES_F, $USDX, $EURUSD, $EURCHF, $CT_F

Website: tradablepatterns.com

FB: facebook.com

Stocktwits: stocktwits.com

Twitter: twitter.com

Linkedin: www.linkedin.com

YouTube: www.youtube.com

Google+: google.com

Email: info@tradablepatterns.com

Corn working wellCorn is working well. As an FYI this (ZC1!) is the continuous contract and is priced a little different than the DEC contract. However, the patterns are still the same and they are both working well. We are still long and looking for the gap fill (on continuous contract). We could see some sideways to down movement over the next few days before we start to see another leg up. Trade well!

Head Fake HarryAnd there she is! After the crop report the boys decided to give a little head fake and run the stops of the weak longs. Now if we get above the 362.2 we could see a nice squeeze would could pop us. We are long and will be holding for the gap fill. Understand we are not fools at OFT... we can read. We understand that the agency is calling for a record 14 billion bushels of Corn which could weigh on an already weak market. This is why we weigh our risk first. We feel this move serves us well. Only time will tell. That's trading. Stay tuned and trade well.

Timber!Corn has fallen to far to quickly. We are now back to the original buy areas. If you are still holding from the buy point this will be a good lesson. It is important to take some profits on the way and trail stops. We missed this trade but for some it was very profitable. If price jumps to our sell zone we will look for a short signal.