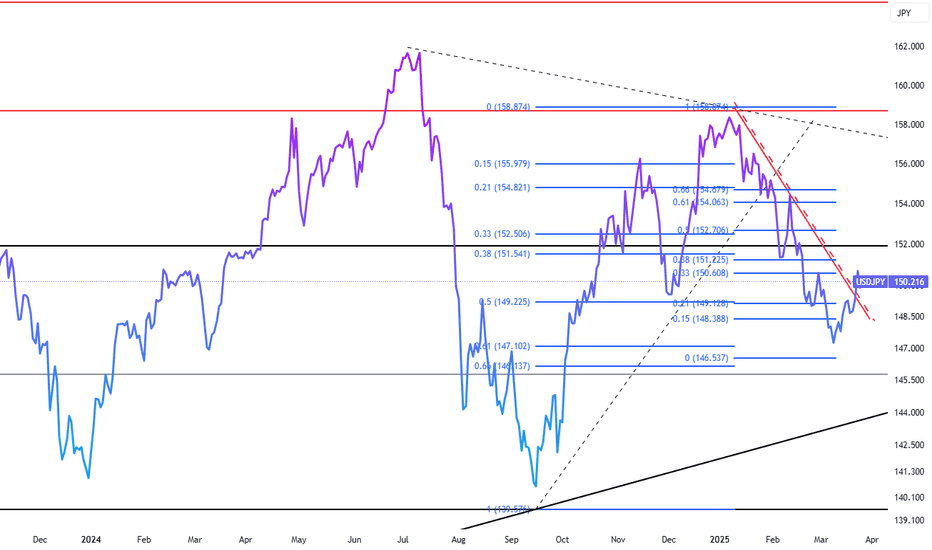

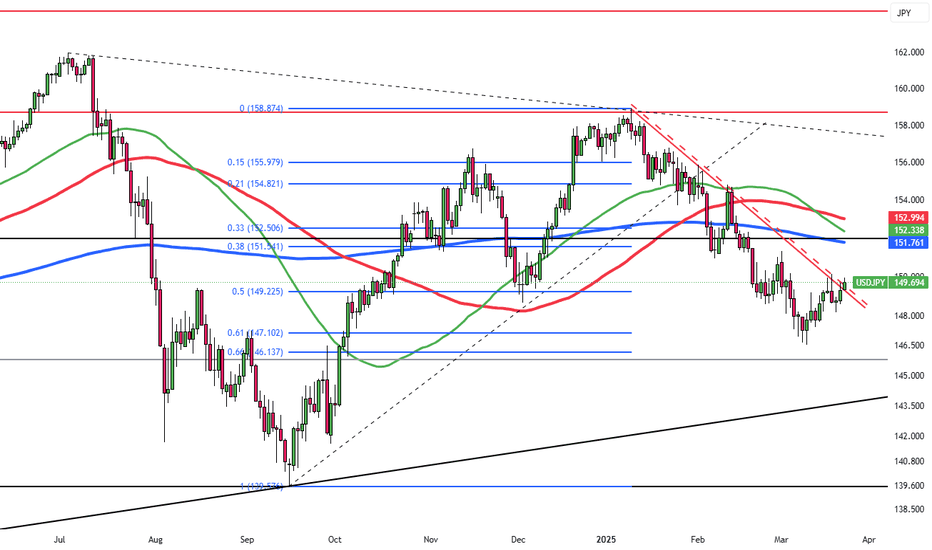

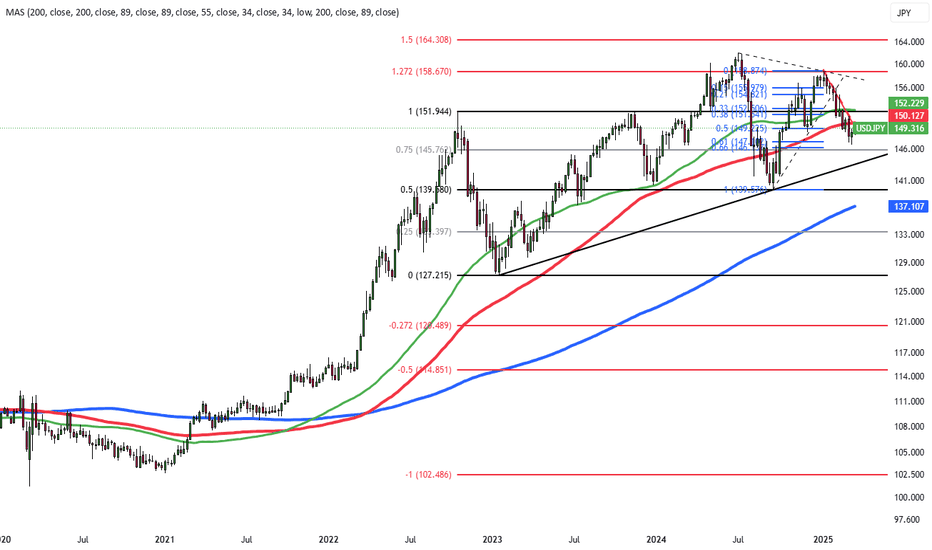

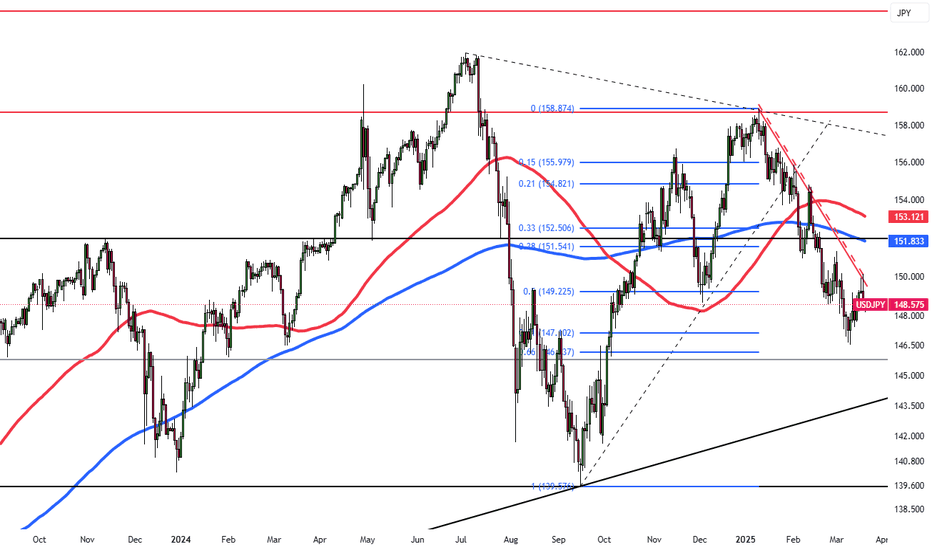

Yen Steady Near 150.7 as Dollar StrengthensThe Japanese yen hovered near 150.7 per dollar on Tuesday as the U.S. dollar strengthened. Concerns grew over Japan’s exports following Trump’s proposed tariffs on autos and pharmaceuticals. BOJ minutes showed officials remain open to future rate hikes, with one member suggesting a 1% rate by late FY2025. The central bank kept rates steady at 0.5% last week, citing global uncertainties.

Key resistance is at 151.70, with further levels at 152.70 and 154.00. Support stands at 147.00, followed by 145.80 and 143.00.

Zforex

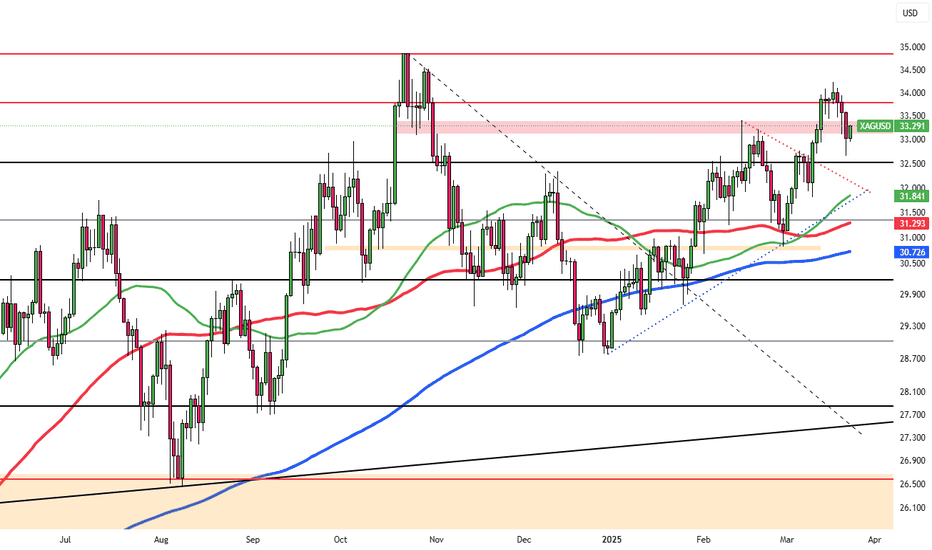

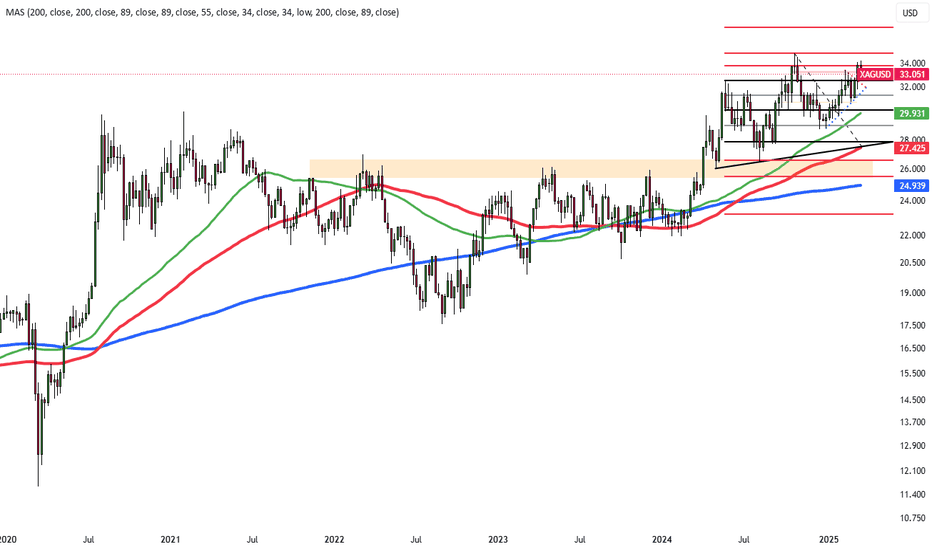

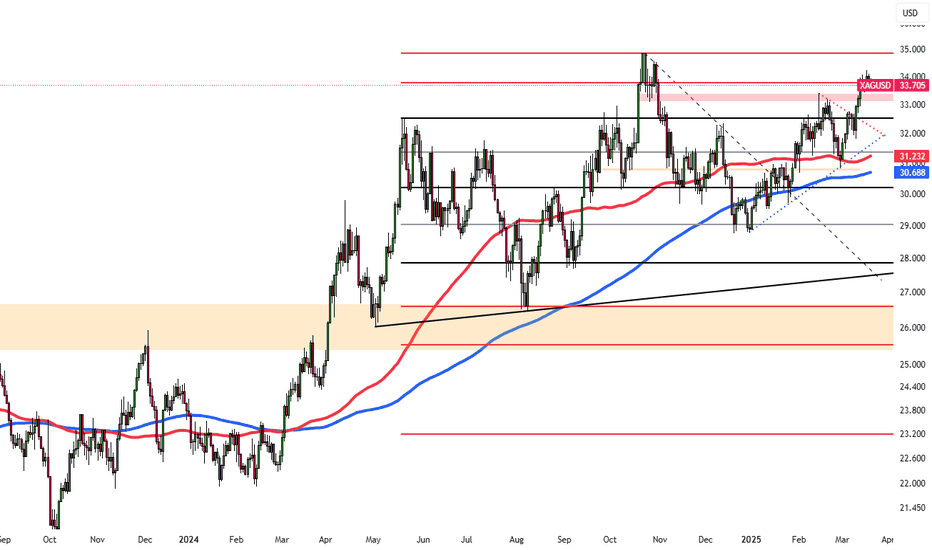

Tariff Fears Drive Silver to $33.10Silver rose above $33.10 per ounce on Tuesday, snapping a four-day losing streak. The market focused on U.S. diplomatic efforts in the Russia-Ukraine conflict and escalating violence in the Middle East after an Israeli airstrike on a Gaza hospital.

A weaker U.S. dollar also supported silver, with concerns growing that Trump’s proposed tariffs could slow economic growth, fueling speculation of further Fed rate cuts. Meanwhile, investors assessed China’s outlook after Premier Li Qiang urged global cooperation to stabilize economic conditions.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

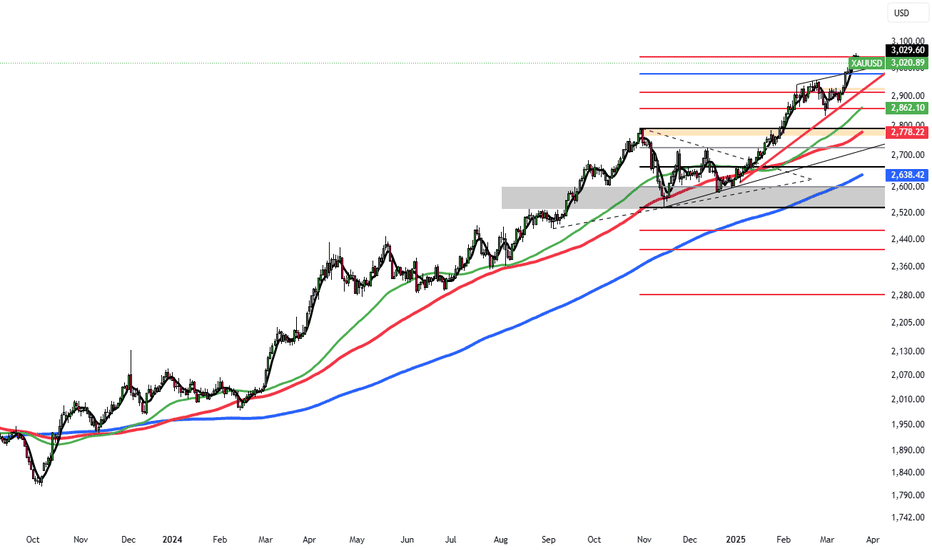

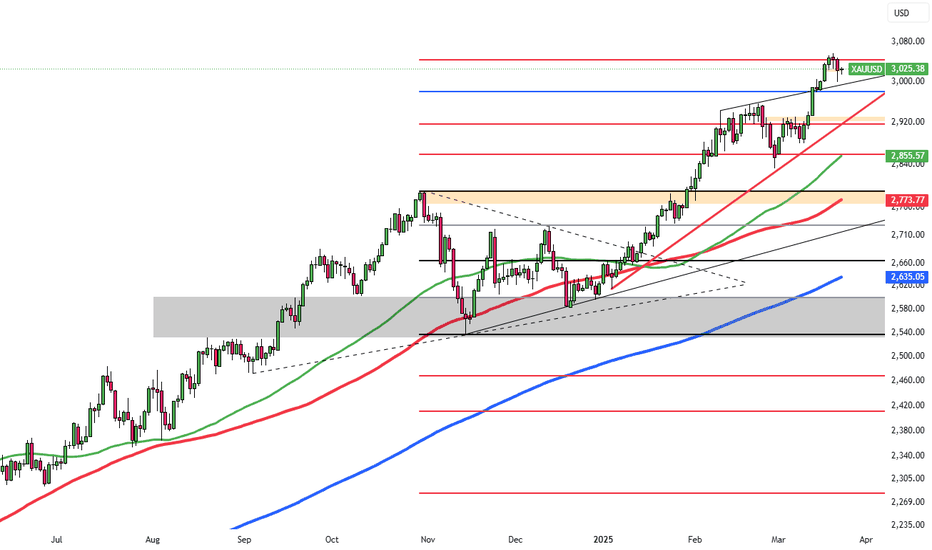

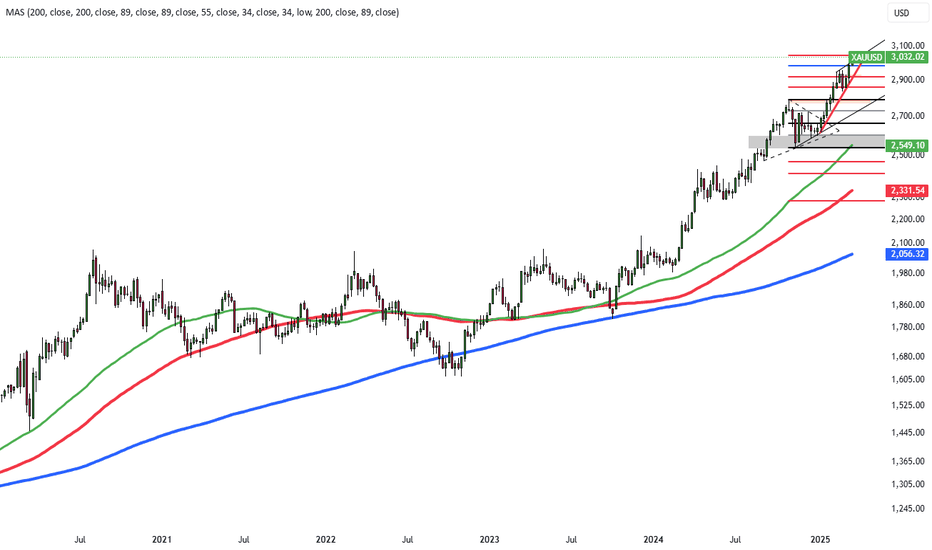

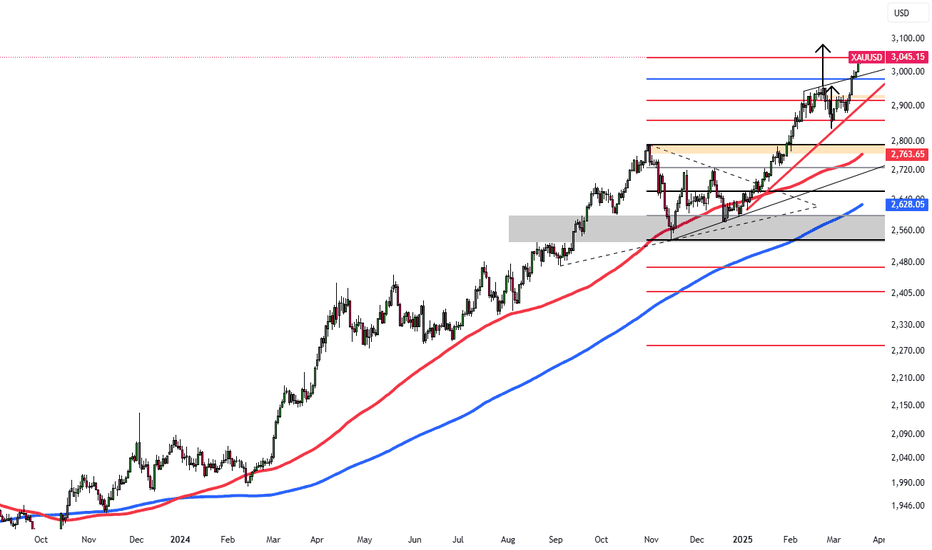

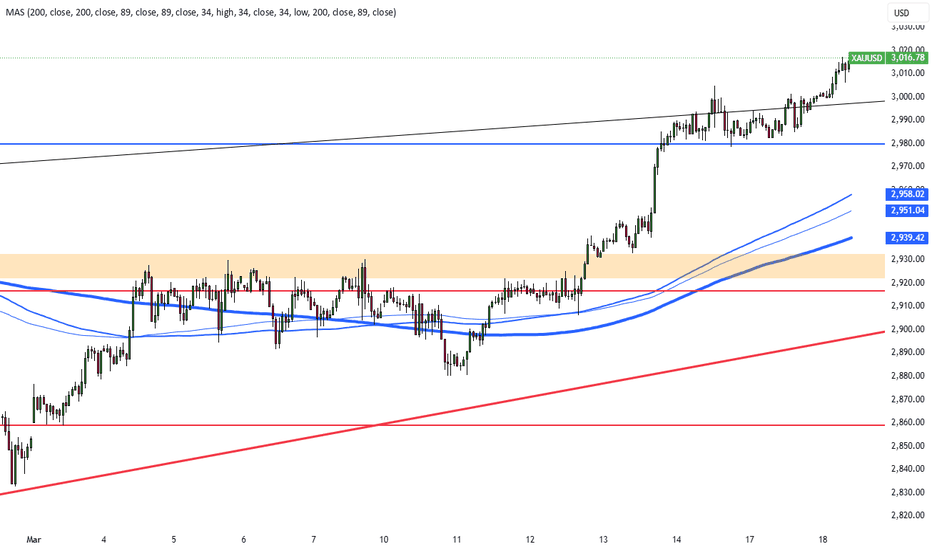

Gold Nears $3,010, PCE in FocusGold hovered around $3,010 per ounce after three straight losses as markets observed Trump’s mixed tariff signals. He suggested possible levies on cars and Venezuelan oil but hinted some countries may be exempt from next week’s reciprocal tariffs, creating uncertainty.

Gold remained supported, though pressure came from Fed official Raphael Bostic, who forecast slower inflation progress and just one 25bps rate cut this year. Friday’s PCE data is now awaited for more clues on the Fed’s next move.

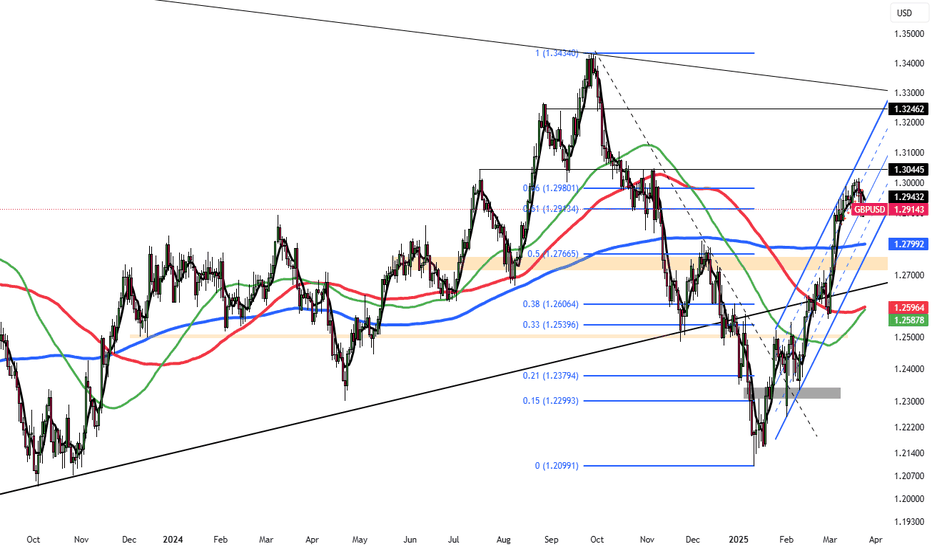

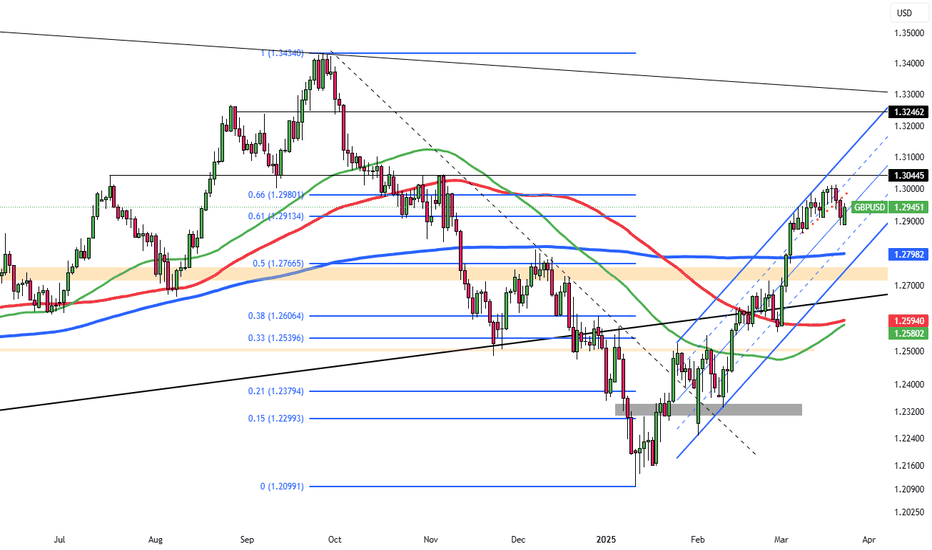

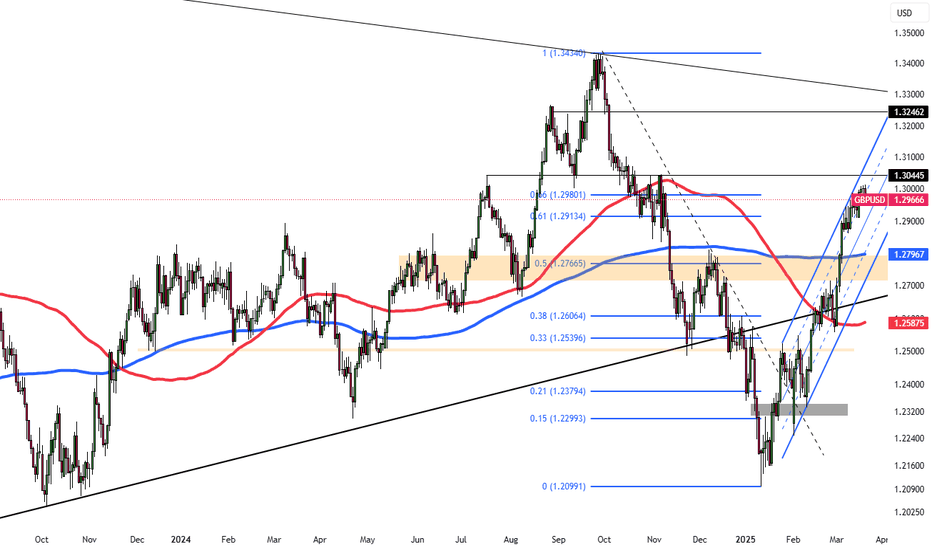

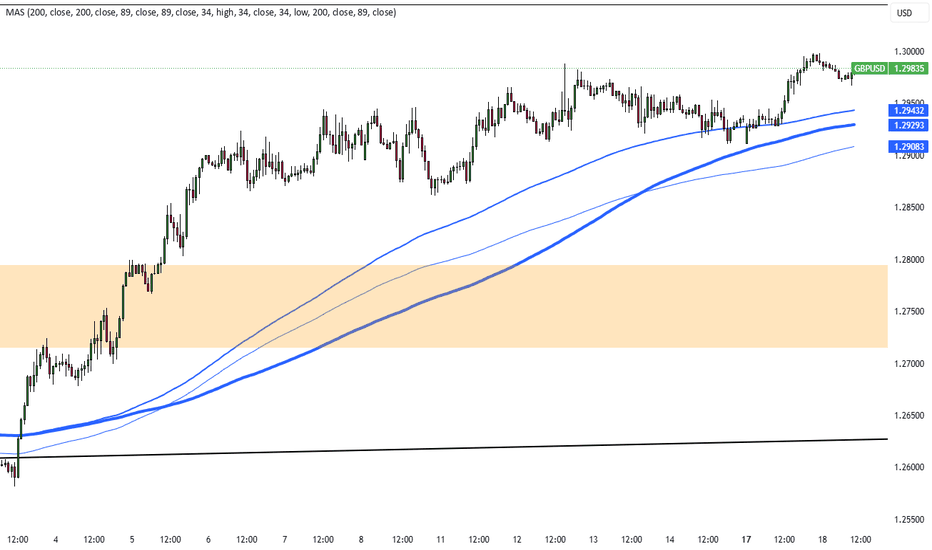

GBP/USD Stable at $1.292: Budget AwaitedGBP/USD is trading steadily around $1.292 as markets await British finance minister Rachel Reeves’ spring budget update. Despite dollar strength from solid U.S. data and rising Treasury yields, the pound remains resilient, supported by cautious optimism over the UK’s fiscal outlook. Traders are watching the upcoming budget for clues on spending and economic forecasts, which could impact GBP/USD in the near term.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

Japan's Tariff Worries and BOJ Rate Hike HintsThe Japanese yen remained weak around 150.7 per dollar on Tuesday, near a three-week low, as the U.S. dollar gained strength. Trump's plan to impose tariffs on autos, pharmaceuticals, and other sectors raised concerns for Japan’s export-driven economy.

BOJ minutes from January showed officials remain open to future rate hikes depending on wage and inflation trends, with one member suggesting a possible increase to 1% in late fiscal 2025. Still, the BOJ kept rates steady at 0.5% last week, maintaining a cautious stance with global tensions.

Key resistance is at 151.70, with further levels at 152.70 and 154.00. Support stands at 147.00, followed by 145.80 and 143.00.

Silver's Limited Rebound at $33.06Posting a modest rebound after last week’s dip, silver currently trades around $33.06 per ounce. The recovery is limited as easing geopolitical tensions compete with the pressure from a strong U.S. dollar. Demand stays strong due to tariff uncertainty and inflation risks, but weak industrial outlook, mainly from China, and hopes for a Russia-Ukraine ceasefire are limiting silver’s gains. Still, tightening supply and global economic concerns are helping keep silver near five-month highs.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

Ukraine Talks and Gaza Tensions Influence XAUUSD Gold dipped to around $3,015 per ounce as hopes for a Russia-Ukraine peace deal grew after talks between Ukrainian and U.S. officials. Further negotiations with Russia are expected later today.

Despite the drop, gold remains supported by the tension over U.S. tariffs and Fed rate cut expectations. The Fed kept rates steady last week while signaling two potential cuts this year. Meanwhile, geopolitical pressures remain high as Israel resumed airstrikes on Hamas targets in Gaza.

Key resistance stands at $3082, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

Dollar Pressure Support GBP/USD at 1.2915GBP/USD is trading around 1.2915, supported by a weaker U.S. dollar and steady investor sentiment. The pound benefits from political stability and steady UK economic expectations with the focus on the upcoming April 2 U.S. tariff announcement. The pair is rebounding from recent lows but remains range-bound as traders await new drivers, especially from U.S. trade actions and global growth indicators.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

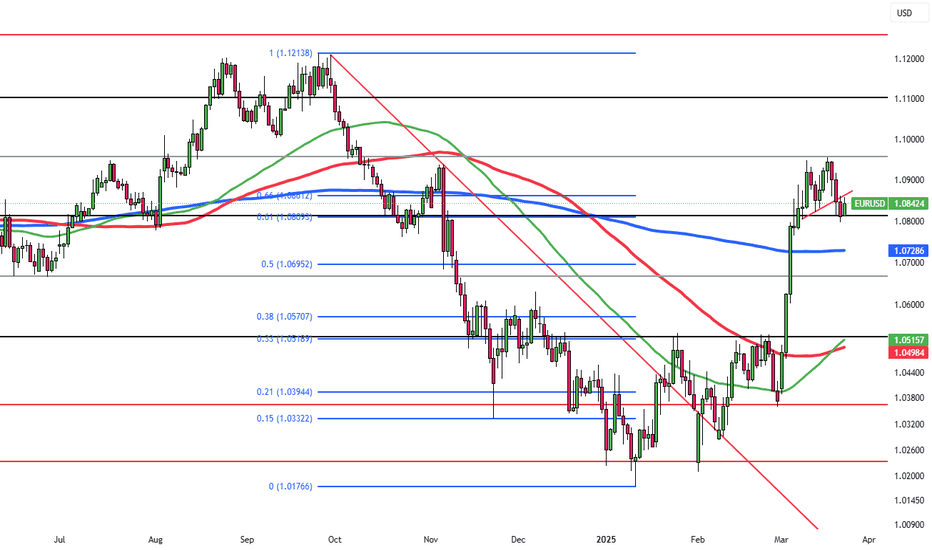

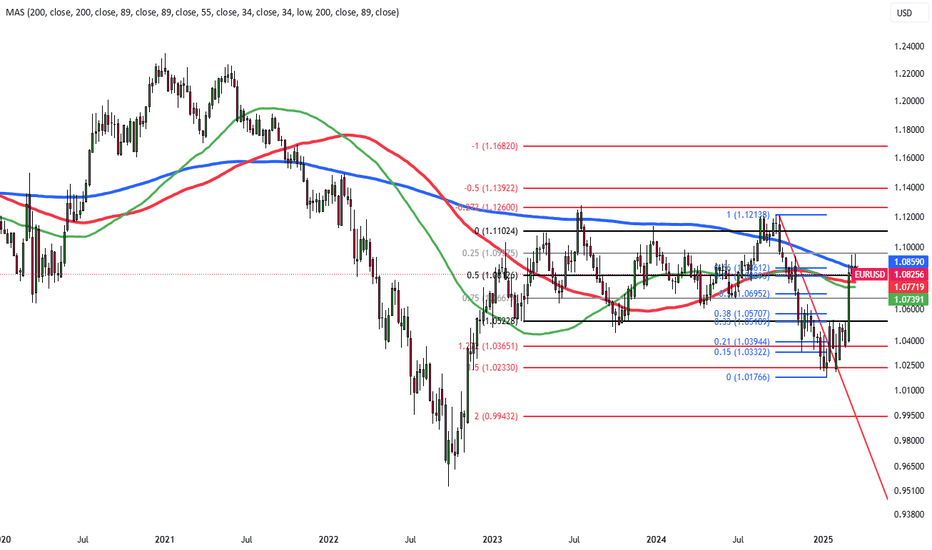

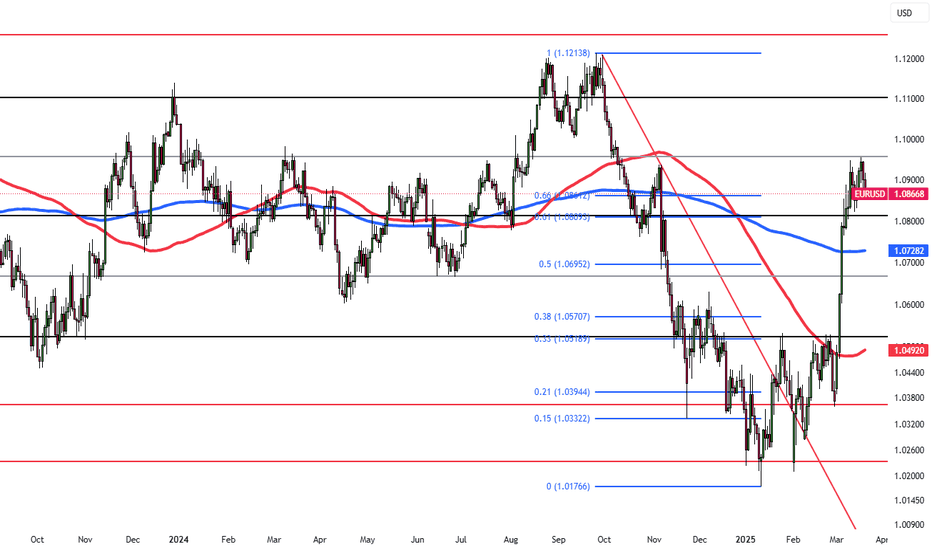

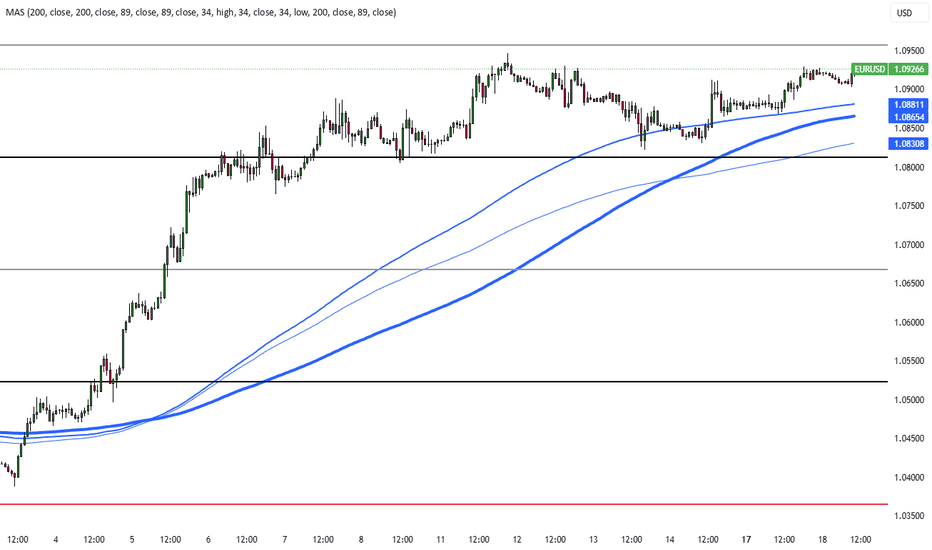

Yields Weigh on EUR/USD: Euro at 1.0820EUR/USD is trading around 1.0820 on Monday, rebounding slightly from last week’s low of 1.0795. The euro has pulled back from its recent high of 1.0955 with uncertainty over Germany’s fiscal policy and rising global trade tensions.

Caution persists before the April 2 announcement of new U.S. tariffs, which could weigh on the eurozone. Despite the modest recovery, the euro remains under pressure from stronger U.S. Treasury yields and demand for the dollar.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0800, with further levels at 1.0730 and 1.0670.

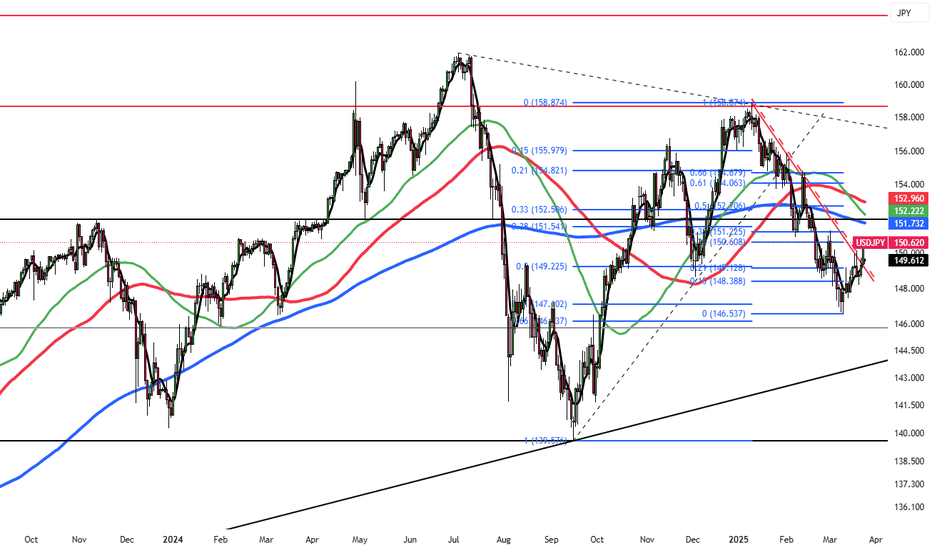

Yen Weakens Toward 150 on Weak DataThe Japanese yen weakened toward 150 per dollar, extending losses as disappointing business activity data overshadowed the BOJ’s hawkish stance. Japan’s private sector contracted in March for the first time in five months, with manufacturing shrinking for a ninth month and services slipping into negative territory.

While the BOJ kept its policy rate at 0.5% last week and maintained a careful tone before Trump’s predicted April 2 tariff announcement, the central bank is still expected to raise rates later this year due to steady inflation and wage growth. Ongoing external pressures also continued to weigh on the yen.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

Silver Steadies Near $33.20 After PullbackSilver hovered near $33.20 on Friday morning after two consecutive sessions of decline. The recent upward momentum, initially fueled by China’s stimulus measures, has temporarily stalled. Nevertheless, the potential for further gains remains intact amid persistent uncertainty surrounding former President Trump’s tariff policies and escalating geopolitical risks. In addition, the Federal Reserve’s soft approach to interest rates, even if temporary, continues to support interest in non-yielding assets like silver.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

Gold Nears $3,030 on Fed Cut HopesGold hovered near $3,030 on Friday, close to record highs and heading for a third straight weekly gain. The rally is driven by dovish Fed signals and strong safe-haven demand. The Fed reaffirmed plans for two rate cuts in 2025 amid rising economic uncertainty, while Powell downplayed Trump’s proposed tariffs as temporarily inflationary but saw no urgency to cut rates.

Geopolitical tensions also supported gold, with Israel escalating operations in Gaza, Hamas striking Tel Aviv and the U.S. continuing airstrikes in Yemen. Markets are also watching the April 2 deadline for Trump’s reciprocal tariffs, fueling trade concerns. Gold is up over 15% year-to-date.

Key resistance stands at $3082, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

Lagarde Flags Slower Growth from U.S. TariffsThe euro fell below $1.085, retreating from its March 18 high of $1.0954, after ECB President Christine Lagarde warned of slower growth risks. Speaking to European lawmakers, she said a proposed 25% U.S. tariff on EU goods could cut eurozone growth by 0.3 percentage points in the first year, or 0.5 points if the EU retaliates. Lagarde added that the main impact would be front-loaded, with limited inflation pressures, suggesting the ECB is unlikely to raise rates in response.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0800, with further levels at 1.0730 and 1.0670.

Yen Slips to 149 as Inflation EasesThe yen fell to around 149 per dollar on Friday, ending a two-day rally, after Japan’s core inflation eased to 3% in February from 3.2% in January, still above expectations of 2.9%. This marked the second month of stronger inflation, reinforcing the case for future rate hikes.

Earlier, the BoJ held rates at 0.5% and maintained a cautious stance, citing global uncertainties, particularly rising U.S. tariffs. The bank also reiterated its focus on monitoring currency moves. A stronger U.S. dollar further pressured the yen amid global growth and trade concerns.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

Silver Holds Near $33.60 as Fed Signals 2025 Rate CutsSilver hovered near $33.60 after the Fed held rates at 4.25%-4.5%, signaling 50 bps cuts by 2025. Despite trade-war fears and Trump’s policies, silver remains near a five-month high.

Lease rates surged as stockpiles shrank, especially in London, with silver flowing to the US for higher prices, widening market price gaps. Spot silver is up 17% this year, outperforming other commodities.

Tariffs strain silver transfers from Canada and Mexico, tightening supply and fueling fears of a prolonged “silver squeeze.”

If silver breaks above $34.05, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

Gold Holds Near Record $3,050Gold hovered near a record $3,050, supported by Fed rate cut expectations and safe-haven demand. The Fed reaffirmed plans for 50 bps cuts this year amid rising economic uncertainty, driving gold.

Middle East tensions escalated as Israel resumed ground operations in Gaza after an airstrike ended a two-month ceasefire. The US continued strikes on Houthi targets, with Trump warning Iran over future incidents.

Trade concerns persisted ahead of new tariffs in April, following the US’s 25% duty on steel and aluminum in February.

Key resistance stands at $3082, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

Sterling Stays Firm as Fed Highlights GrowthGBP/USD held near 1.3000 as sentiment stayed upbeat after the Fed reaffirmed 2025 rate cuts, though delayed. Markets still expect a 25 bps cut in June, with Powell highlighting strong US growth and a healthy labor market.

The Fed lowered its 2025 GDP forecast to 1.7% from 2.1% and acknowledged trade policy risks but sees inflationary effects as short-lived.

Focus now shifts to the BoE’s Thursday rate decision, with no changes expected. On Friday, the UK’s GfK Consumer Confidence is projected to fall to -21.0 from -20.0.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

ECB Rate Cut Hopes Fade, EUR/USD Nears 1.0900EUR/USD fell for a second day, nearing 1.0900 in the Asian session. The pair found support as the dollar weakened on falling Treasury yields after the Fed reaffirmed plans for two rate cuts. However, uncertainty over Trump’s tariff policies kept sentiment cautious.

In Europe, German lawmakers approved a debt plan by likely Chancellor Friedrich Merz to increase growth and defense spending. A shift from Germany’s conservative fiscal stance could drive inflation and influence ECB policy.

Investors await ECB President Lagarde’s speech on economic and monetary affairs in Brussels on Thursday.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0880, with further levels at 1.0800 and 1.0730.

Dollar Weakens Post-Fed, Lifting Yen Beyond 148.5The yen strengthened past 148.5 per dollar, rising for a second session as the dollar weakened after the Fed reaffirmed two rate cuts this year. Fed Chair Powell downplayed Trump’s tariffs as short-lived. The BoJ kept rates at 0.5% on Wednesday, adopting a cautious stance amid global risks, especially US tariffs. It also emphasized monitoring forex markets and their impact on the economy.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

Silver Surges to $33.90 as Safe-Haven DemandSilver surged to $33.90, its highest since October 2024, driven by a weaker dollar, geopolitical tensions, and strong industrial demand. Recession fears and trade disputes have supported safe-haven buying, with Trump planning new tariffs on China, steel, and aluminum starting April 2. Middle East tensions added support, as Netanyahu confirmed intensified military action in Gaza. Supply constraints and record industrial demand, especially in solar, 5G, and automotive sectors, further fueled the rally.

If silver breaks above $34.00, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

Gold Surges Past $3,000 Amid Fed UncertaintyGold surged past $3,000, hitting a record high as safe-haven demand grew ahead of the Fed's rate decision. While rates are expected to remain unchanged, investors await economic projections and Powell’s remarks for policy clues amid trade tensions. Market jitters also rose after Trump warned Iran over Houthi rebel attacks and planned talks with Putin on ending the Ukraine war.

Key resistance stands at $3045, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

Pound Steady Near Four-Month Low Amid BoE Rate Hold ExpectationsThe pound traded at $1.294, near a four-month low, as investors awaited the BoE's Thursday decision. The central bank is expected to hold rates at 4.5%, balancing weak growth and inflation risks. Despite forecasts for 2025 rate cuts, none are expected now. The UK labor market is weakening, with unemployment set to hit 4.5% and wage growth slowing. Markets also await Chancellor Reeves’ Spring Statement on March 26 for economic updates. In trade talks, the UK is taking a softer stance with the US than the EU.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

EUR/USD Dips Amid U.S.-EU Trade TensionsEUR/USD is slightly down, hovering near 1.0915 in early Asian trading. The Euro faces pressure from rising U.S.-EU trade tensions after Trump announced new tariffs on European goods. Washington imposed duties on steel and aluminum, prompting Brussels to prepare countermeasures, while Trump threatened a 200% tariff on European wine and spirits, adding downside risks for the Euro.

However, losses may be limited by Germany’s fiscal policy shifts. The Green Party supports debt restructuring, and incoming Chancellor Friedrich Merz proposed a €500 billion infrastructure fund with borrowing rule adjustments. The measures expected to be passed this week could support the Euro.

Weak U.S. Retail Sales data also weigh on the Dollar. February sales rose just 0.2% vs. the expected 0.7%, while January’s figures were revised lower to -1.2%. Annual sales growth slowed to 3.1% from 3.9%, fueling concerns about consumer spending and offering near-term support for EUR/USD.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0880, with further levels at 1.0800 and 1.0730.