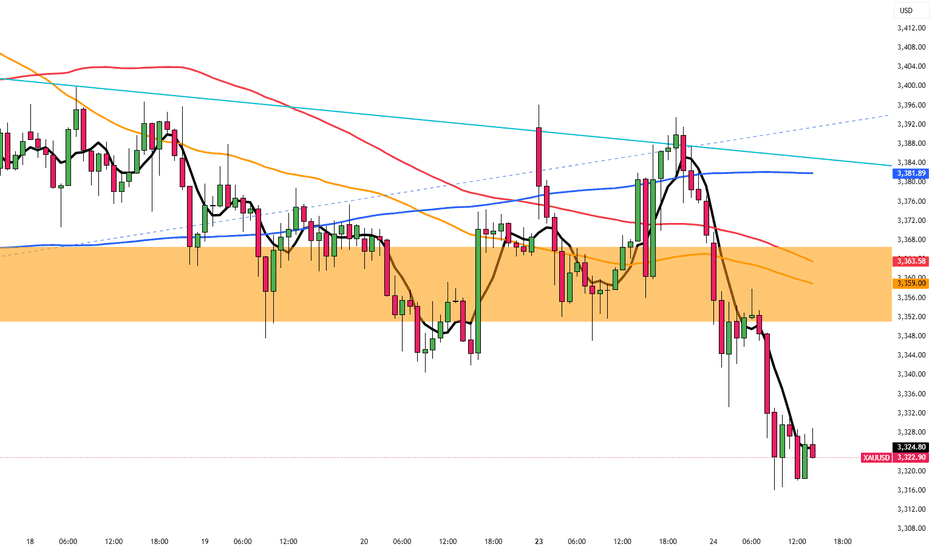

Gold Falls to Two-Week Lows Gold fell to around $3,350 per ounce on Tuesday, its lowest level in two weeks, as the ceasefire reduced geopolitical stress. The truce announcement, set to begin with Iran immediately and Israel 12 hours later, cooled safe-haven demand. The metal’s recent run paused despite lingering tensions in the region.

Resistance is seen at $3,355, while support holds at $3,285.

Zforexchart

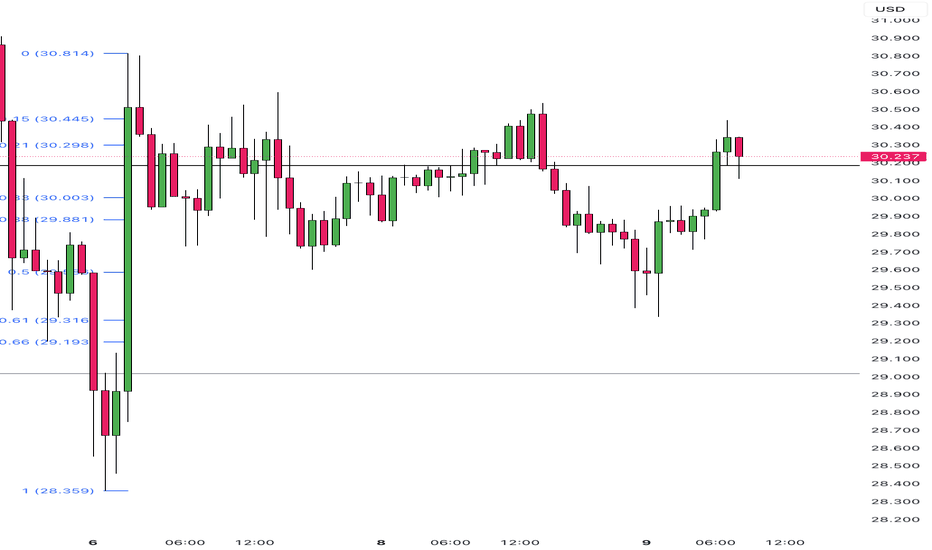

Yields and Trade Wars Induce Silver InstabilitySilver dropped below $30 per ounce, hitting $29.57 on April 4, its lowest since mid-January, as rising U.S. Treasury yields made non-yielding assets less attractive. The U.S. announced a 104% tariff on Chinese imports starting at midnight, intensifying trade war concerns. Although over 70 countries have reportedly requested tariff relief, market sentiment remains cautious. The EU’s retaliatory tariff plans further fueled risk aversion, pressuring industrial metals. Still, expectations of Fed rate cuts and safe-haven demand offer some support.

Technically, the first resistance level is located at 30.90. In case of its breach, 31.40 and 32.50 could be monitored respectively. On the downside, first support is at 29.00. 28.40 and 27.50 would become the next support levels if this level is passed.