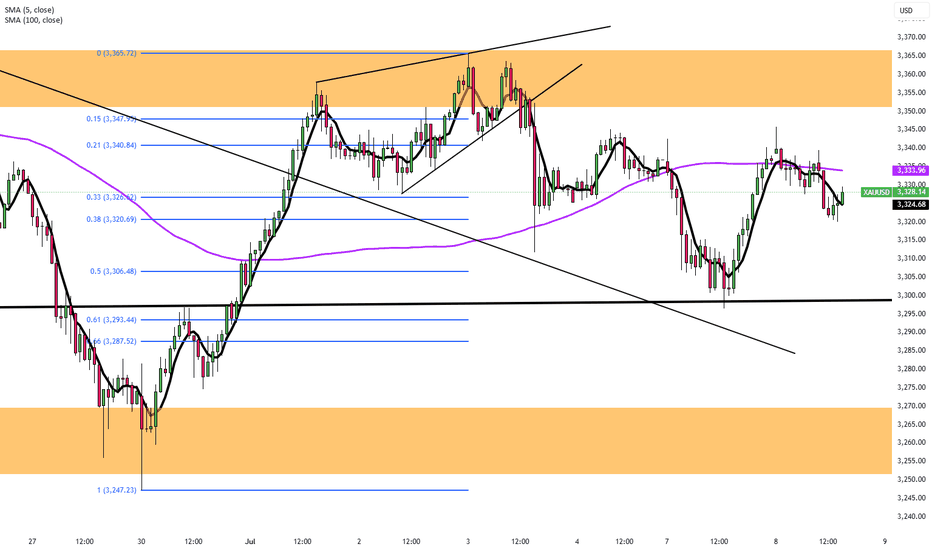

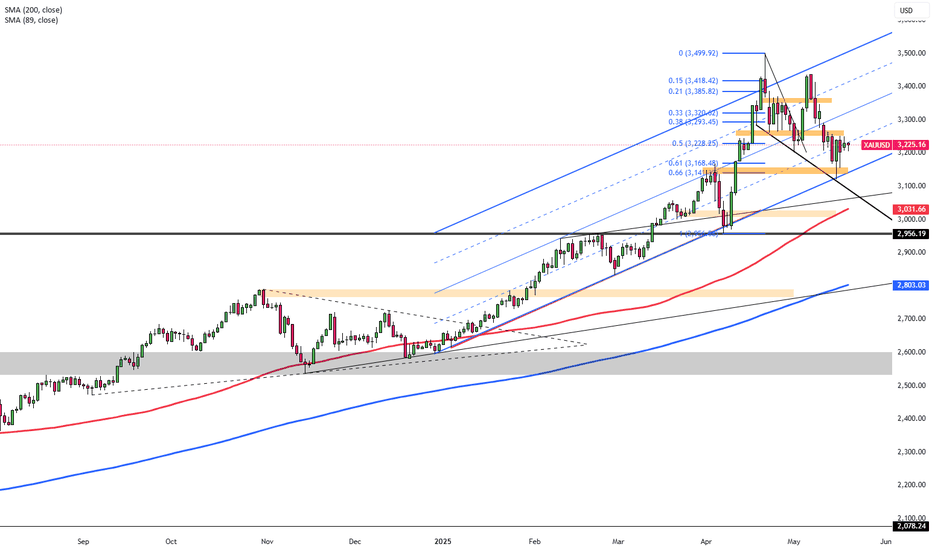

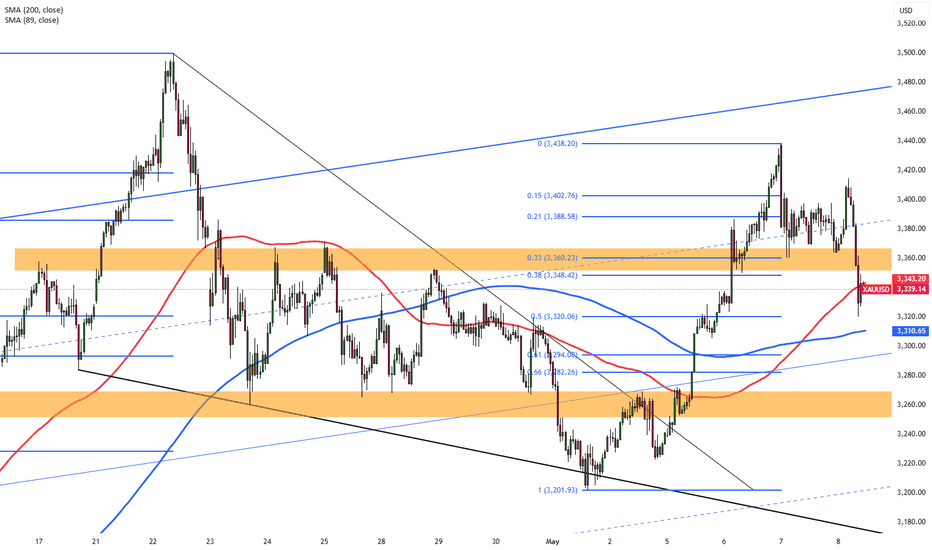

Gold Rebounds Toward $3,350Gold (XAU/USD) rebounded from a five-day low of $3,297, climbing toward $3,350 after Trump announced 25% tariffs on Japan and South Korea effective August 1, with 12 more countries receiving similar tariff warnings ranging between 25% and 40%. The rising risk of a global trade war fueled safe-haven demand, though gold’s gains were capped by simultaneous US Dollar strength.

Resistance is at $3,365, while support holds at $3,300.

Zforexcharts

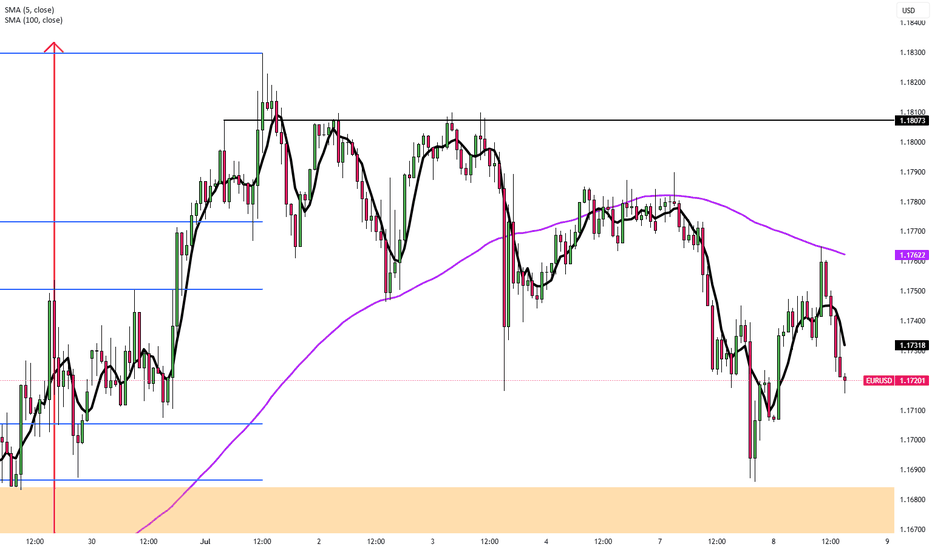

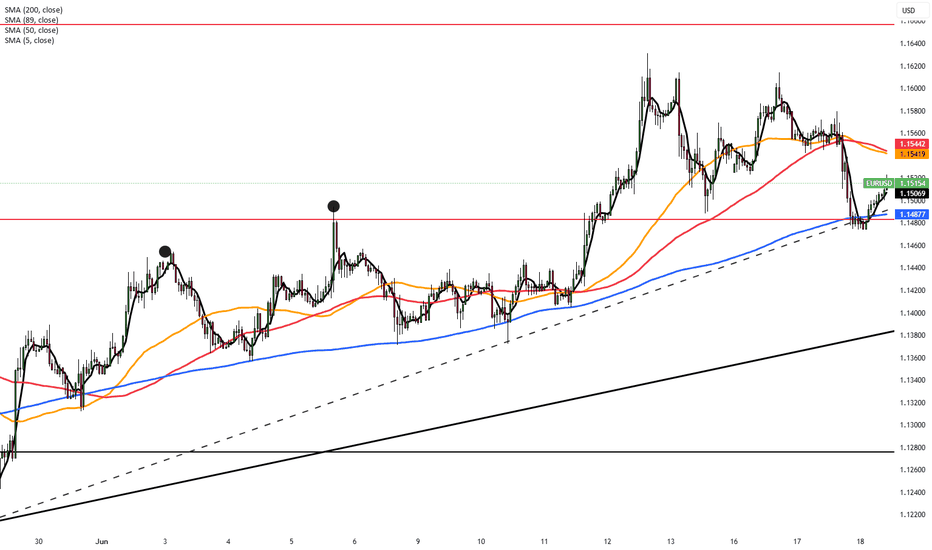

EUR/USD at 1.1750 as EU Pushes Trade DealEUR/USD trades around 1.1745 in Tuesday’s Asian session, supported by strong Eurozone retail sales for May. The Euro benefits as the EU aims to finalize a preliminary trade deal with the US this week, seeking to maintain a 10% tariff beyond the August 1 deadline while negotiations continue. The proposed agreement would keep the 10% base tariff but exempt sensitive sectors like aviation and alcohol, which helps lift market sentiment toward the Euro.

Eurostat data showed retail sales rose 1.8% year-on-year in May, beating expectations of 1.2% but slowing from April’s 2.7%. Monthly sales fell 0.7%, matching forecasts.

Resistance for the pair is at 1.1830, while support is at 1.1730.

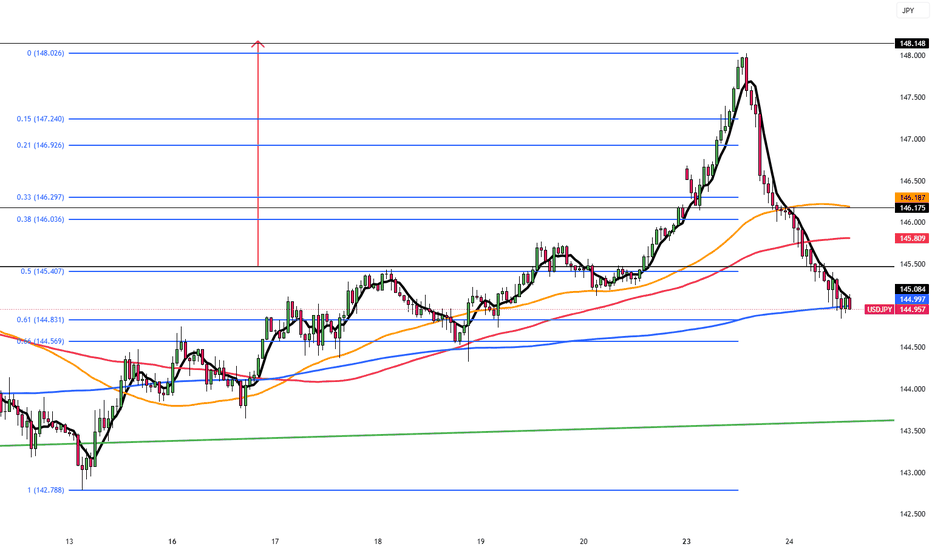

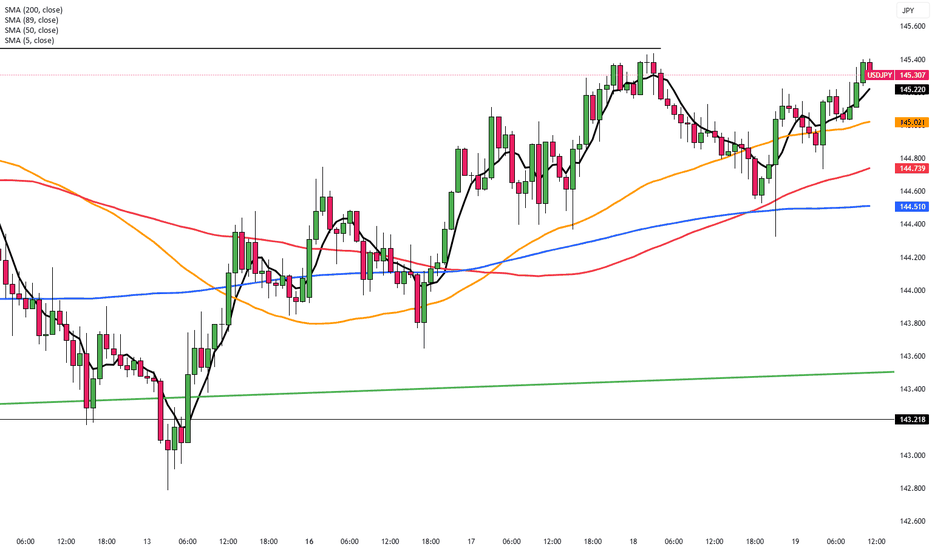

Yen Rebounds as Ceasefire Calms MarketsThe Japanese yen recovered to around 145.5 per dollar on Tuesday, gaining strength after the ceasefire announcement. Although Iran launched missiles at a US base in Qatar, causing no casualties, the gesture was largely seen as symbolic. Tehran’s decision not to target the Strait of Hormuz further eased fears of major disruptions.

The key resistance is at $146.20 while the major support is at $144.85.

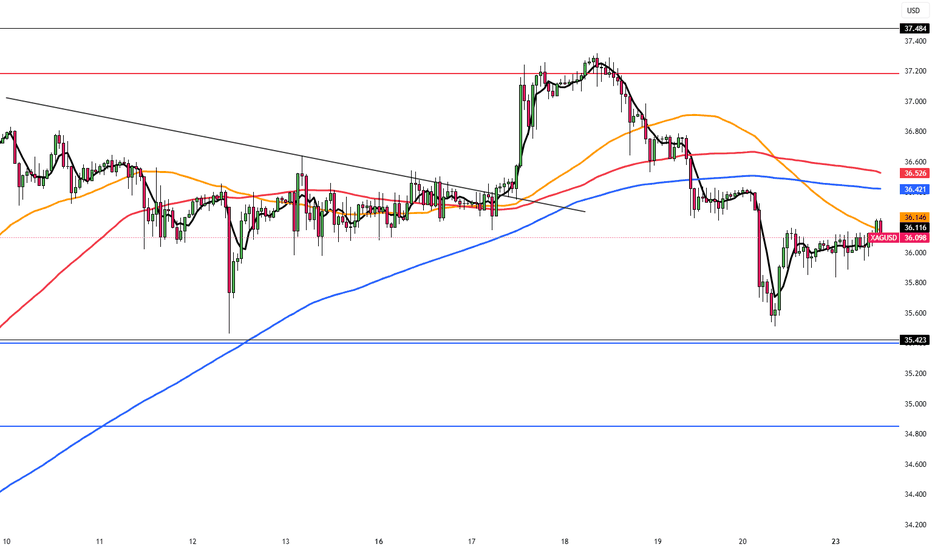

Safe-Haven Flows Lift Silver Near $36.10Silver (XAG/USD) rose near $36.10 on Monday, snapping a three-day losing streak as rising Middle East tensions increased safe-haven demand. The gain followed US airstrikes on three Iranian nuclear sites Sunday. Iran vowed to respond, while Trump warned any retaliation would be met with greater force.

Escalation risks continue to support silver. Additionally, Fed Governor Waller signaled a possible rate cut as early as July. Dovish Fed comments and lower rates tend to increase silver demand by making it more affordable globally.

The first resistance is seen at 37.50, while the support starts at 35.40.

Yen Slips as Fed Holds and Risks MountThe yen weakened past 145 on Thursday, nearing a three-week low as the stronger U.S. dollar gained support from the Fed’s steady rate decision and cautious outlook. Concerns over Trump’s tariffs and Middle East tensions increased safe-haven demand for the dollar over the yen.

The BOJ also kept rates unchanged Tuesday and signaled a gradual asset reduction. Governor Ueda noted that rate hikes remain possible if inflation rises.

The key resistance is at $145.30 meanwhile the major support is located at $142.50.

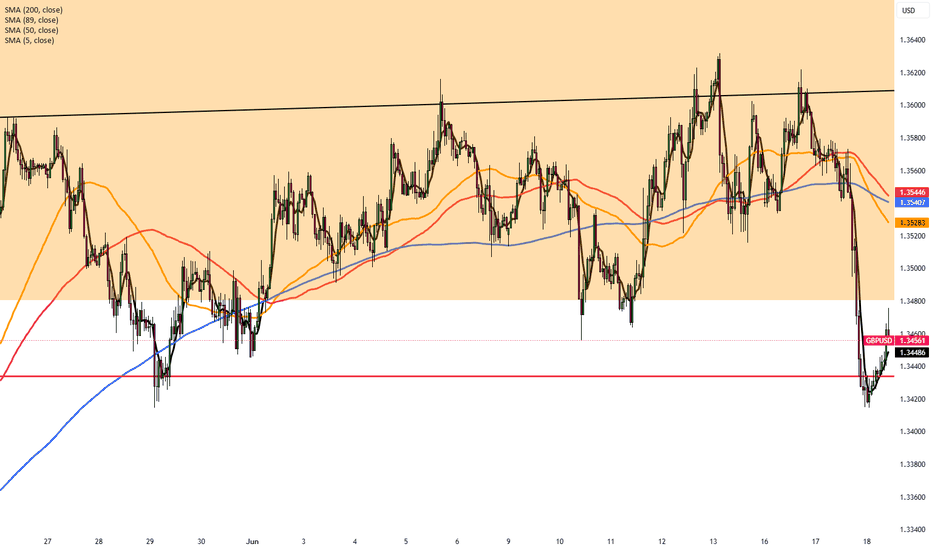

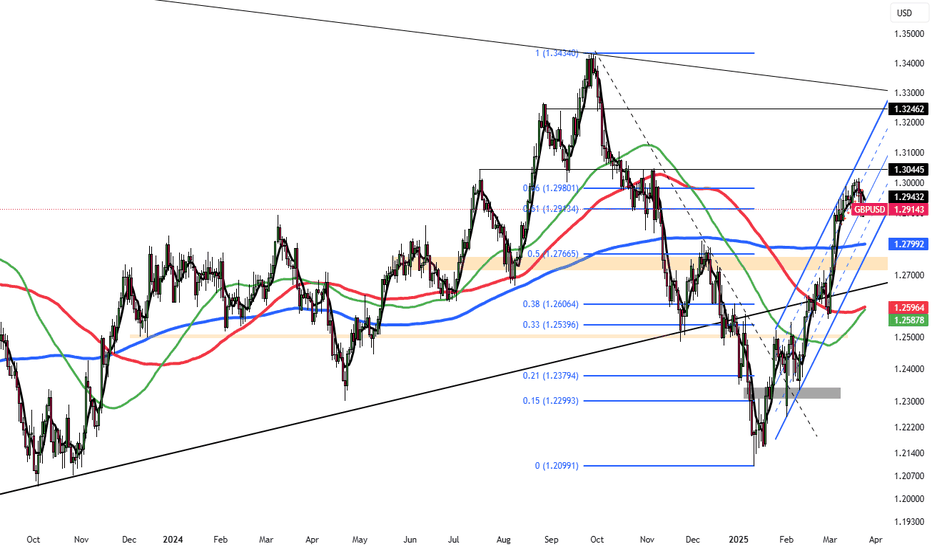

Sterling Flat Before BoE and Fed Policy DecisionsGBP/USD trades near 1.3435 on Wednesday, steadying after a 1.2% drop Tuesday amid rising geopolitical tensions and safe-haven dollar demand.

The pound stays under pressure ahead of today’s UK inflation report and tomorrow’s BoE decision, where rates are expected to remain at 4.25%. Any inflation surprise could shift market expectations.

Ongoing Middle East conflict continues to support the dollar, while traders also await the Fed’s policy announcement later today, which could influence GBP/USD further.

Resistance is at 1.3600, with support around 1.3425.

EUR/USD Pressured by Safe-Haven Dollar DemandEUR/USD traded near 1.15 on Wednesday, under pressure from safe-haven demand for the U.S. dollar as Middle East tensions escalated. Fears of broader conflict involving the U.S. kept the dollar firm. Markets await the Federal Reserve’s policy decision, with rates expected to stay unchanged, though guidance may shape future expectations. The euro remained weak, burdened by Europe’s energy import exposure amid rising oil prices.

Resistance is located at 1.1580, while support is seen at 1.1460.

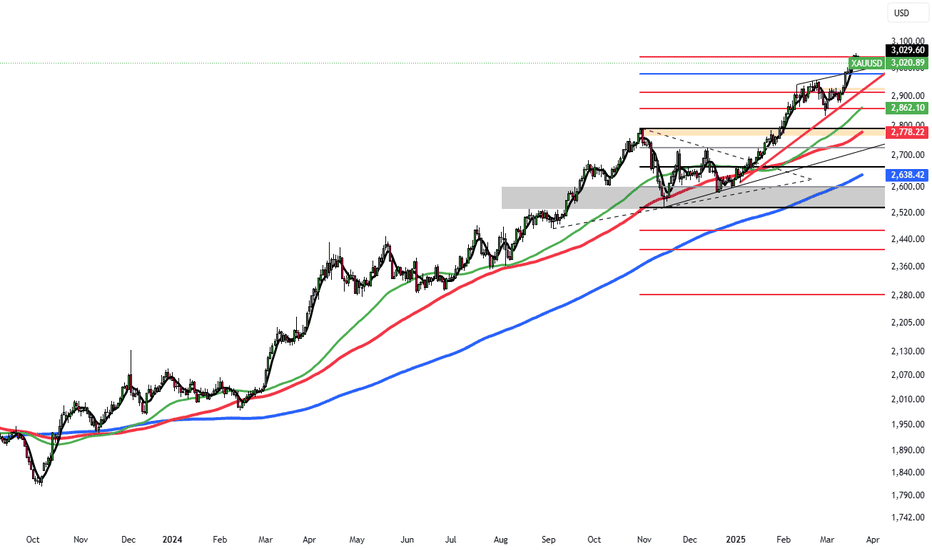

Gold Slips with Ceasefire HopesGold declined below $3,320 per ounce as hopes for a ceasefire between Russia and Ukraine reduced the appeal of safe-haven assets. The drop followed a statement by US President Donald Trump announcing that both nations had agreed to "immediate" talks, potentially without US involvement, after a conversation with Russian President Vladimir Putin.

On Monday, gold had gained 0.6% in response to Moody’s downgrade of the US credit rating to Aa1 from Aaa, which raised concerns about long-term debt sustainability. However, with geopolitical tensions easing and investors awaiting fresh comments from Federal Reserve officials, gold reversed course.

XAU/USD now finds resistance at $3,250, with further levels at $3,300 and $3,350. On the downside, support is seen at $3,120, followed by $3,030 and $2,956.

US Credit Downgrade and Brexit Progress Lift EuroThe euro approached the $1.13 mark on Tuesday, extending its rebound from the one-month low recorded on May 12. The rally followed a broad-based weakening in the US dollar after Moody’s downgraded the US credit rating from Aaa to Aa1, citing mounting government debt and widening fiscal deficits. The downgrade sparked investor concerns about long-term US economic stability and pressured dollar-denominated assets.

The EU and UK finalized a provisional agreement addressing key post-Brexit issues such as defense, fisheries, youth mobility, and security cooperation. The deal may pave the way for UK companies to participate in major EU defense projects, marking a potential turning point in EU-UK relations.

The European Central Bank is expected to initiate a rate cut in June, with additional easing possible later in the year. Despite these expectations, the euro has held firm, buoyed by both geopolitical developments and dollar weakness.

EUR/USD now faces resistance at 1.1260, with further upside barriers at 1.1460 and 1.1580. Support lies at 1.1040, followed by 1.1000 and 1.0960.

Gold Slides Toward $3,220Gold fell to approximately $3,220 per ounce, on track for a weekly loss of more than 3% as appetite for the precious metal diminished with easing global trade tensions. The 90-day tariff truce between the U.S. and China reduced fears of a drawn-out trade war, while geopolitical concerns also eased with a stable India-Pakistan ceasefire.

Talks between Russia and Ukraine are losing momentum. Although soft U.S. inflation data has reinforced expectations for at least two Federal Reserve rate cuts this year, Fed Chair Powell cautioned that future inflation may be volatile due to persistent supply shocks.

Key support is located at $3,120, followed by $3,030 and $2,956. Resistance levels are seen at $3,250, then $3,300 and $3,350.

Gold Dips Toward $3,360 as Fed HoldsGold slipped to around $3,360 per ounce on Thursday, pressured by the Fed’s cautious tone after keeping rates unchanged. Chair Powell dismissed preemptive cuts and highlighted inflation and labor market risks, dampening demand for non-yielding assets. However, gold's downside was limited by trade uncertainties as Trump reaffirmed tariffs before U.S.-China talks in Switzerland.

Resistance is expected at $3,460, followed by $3,500 and $3,550. Support sits at $3,320, with further levels at $3,300 and $3,265.

Yen Near 146 as Trade Hopes WeighThe yen hovered near 146 per dollar Friday after a 1.6% drop, pressured by weaker safe-haven demand amid improving US-China trade prospects. China is open to talks after repeated U.S. outreach, while Japan and the U.S. wrapped up a second round of bilateral talks, aiming for a June deal. Domestically, Japan’s jobless rate rose to 2.5% in March, but the labor market stayed tight. The Bank of Japan held rates at 0.5% and cut its growth and inflation outlooks, signaling limited chances of near-term hikes.

Resistance is located at 145.90, followed by 146.75 and 149.80. On the downside, support levels are at 139.70, then 137.00 and 135.00.

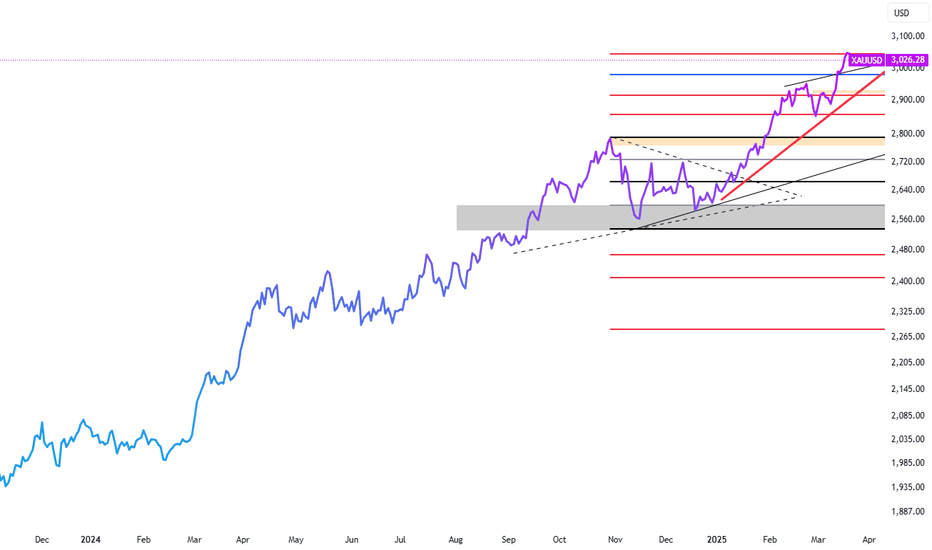

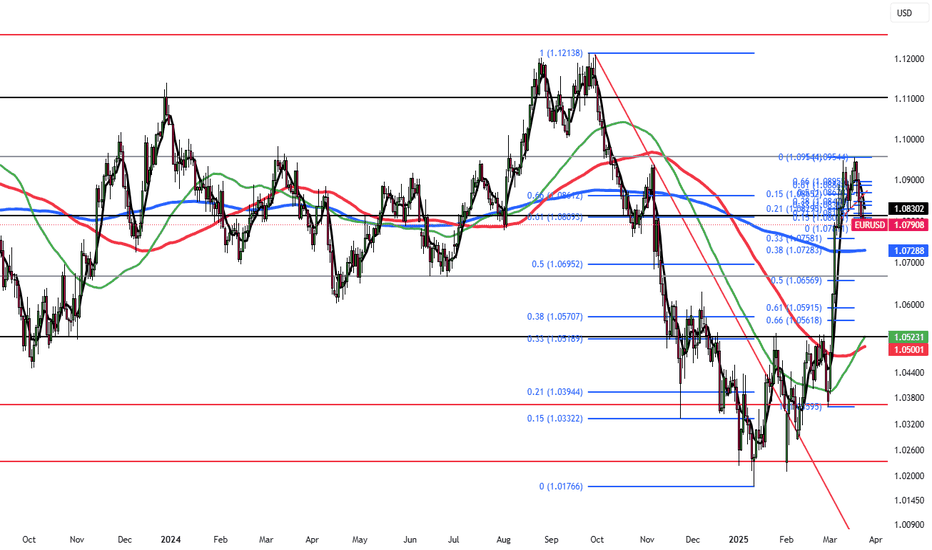

Safe-Haven Demand Keeps Gold ElevatedGold edged above $3,020 on Wednesday, near record highs, supported by safe-haven demand amid uncertainty over upcoming US reciprocal tariffs. Trump's April 2 tariff plan is expected to be more targeted than past proposals but still signals a major escalation in trade tensions.

Markets now await Fed officials’ speeches and Friday’s US PCE data for policy clues. Meanwhile, a U.S.-brokered pause in sea and energy attacks between Ukraine and Russia, along with possible sanctions relief for Moscow, slightly eased bullion's appeal.

Key resistance stands at $3082, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

Gold Nears $3,010, PCE in FocusGold hovered around $3,010 per ounce after three straight losses as markets observed Trump’s mixed tariff signals. He suggested possible levies on cars and Venezuelan oil but hinted some countries may be exempt from next week’s reciprocal tariffs, creating uncertainty.

Gold remained supported, though pressure came from Fed official Raphael Bostic, who forecast slower inflation progress and just one 25bps rate cut this year. Friday’s PCE data is now awaited for more clues on the Fed’s next move.

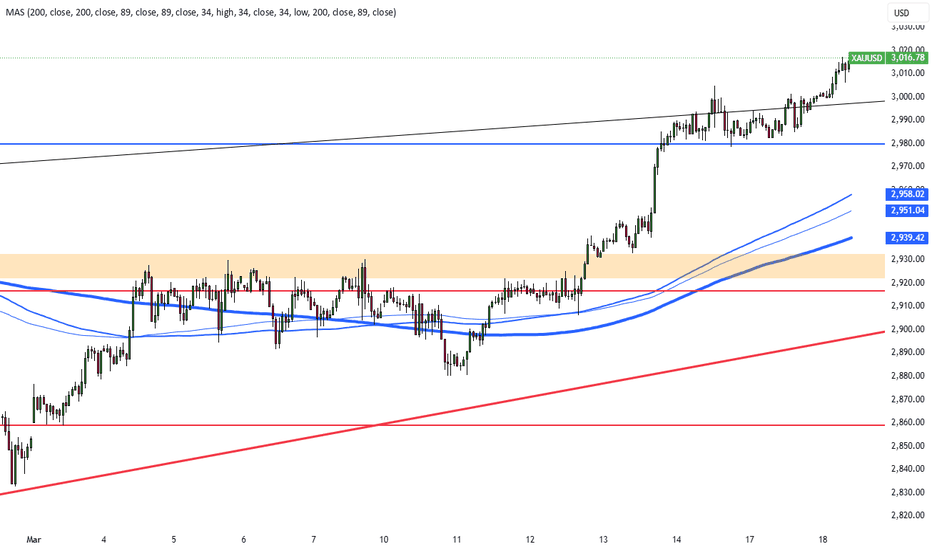

GBP/USD Stable at $1.292: Budget AwaitedGBP/USD is trading steadily around $1.292 as markets await British finance minister Rachel Reeves’ spring budget update. Despite dollar strength from solid U.S. data and rising Treasury yields, the pound remains resilient, supported by cautious optimism over the UK’s fiscal outlook. Traders are watching the upcoming budget for clues on spending and economic forecasts, which could impact GBP/USD in the near term.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

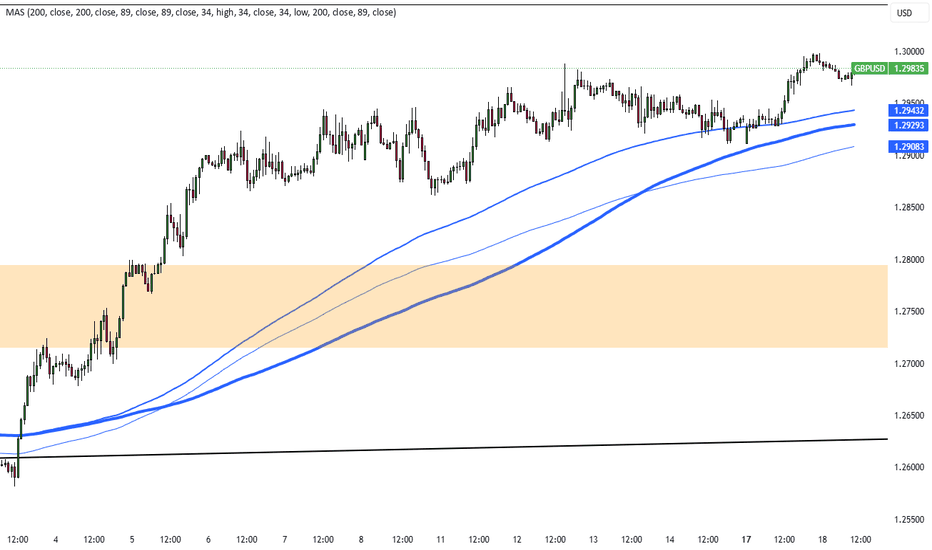

US PMI Strength Drives Dollar HigherEUR/USD is trading at $1.08 as the U.S. dollar strengthens on solid U.S. services PMI data, which signaled economic resilience and pushed yields higher. Confidence in the dollar was further enabled by Trump’s remarks suggesting not all April 2 tariffs will be implemented, with possible exemptions for some countries. Meanwhile, the euro is under pressure as its recent rally fades and Eurozone economic signals weaken, keeping EUR/USD on a downward path driven by dollar strength.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0730, with further levels at 1.0660 and 1.0600.

Silver Surges to $33.90 as Safe-Haven DemandSilver surged to $33.90, its highest since October 2024, driven by a weaker dollar, geopolitical tensions, and strong industrial demand. Recession fears and trade disputes have supported safe-haven buying, with Trump planning new tariffs on China, steel, and aluminum starting April 2. Middle East tensions added support, as Netanyahu confirmed intensified military action in Gaza. Supply constraints and record industrial demand, especially in solar, 5G, and automotive sectors, further fueled the rally.

If silver breaks above $34.00, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

Gold Surges Past $3,000 Amid Fed UncertaintyGold surged past $3,000, hitting a record high as safe-haven demand grew ahead of the Fed's rate decision. While rates are expected to remain unchanged, investors await economic projections and Powell’s remarks for policy clues amid trade tensions. Market jitters also rose after Trump warned Iran over Houthi rebel attacks and planned talks with Putin on ending the Ukraine war.

Key resistance stands at $3045, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

Pound Steady Near Four-Month Low Amid BoE Rate Hold ExpectationsThe pound traded at $1.294, near a four-month low, as investors awaited the BoE's Thursday decision. The central bank is expected to hold rates at 4.5%, balancing weak growth and inflation risks. Despite forecasts for 2025 rate cuts, none are expected now. The UK labor market is weakening, with unemployment set to hit 4.5% and wage growth slowing. Markets also await Chancellor Reeves’ Spring Statement on March 26 for economic updates. In trade talks, the UK is taking a softer stance with the US than the EU.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

EUR/USD Dips Amid U.S.-EU Trade TensionsEUR/USD is slightly down, hovering near 1.0915 in early Asian trading. The Euro faces pressure from rising U.S.-EU trade tensions after Trump announced new tariffs on European goods. Washington imposed duties on steel and aluminum, prompting Brussels to prepare countermeasures, while Trump threatened a 200% tariff on European wine and spirits, adding downside risks for the Euro.

However, losses may be limited by Germany’s fiscal policy shifts. The Green Party supports debt restructuring, and incoming Chancellor Friedrich Merz proposed a €500 billion infrastructure fund with borrowing rule adjustments. The measures expected to be passed this week could support the Euro.

Weak U.S. Retail Sales data also weigh on the Dollar. February sales rose just 0.2% vs. the expected 0.7%, while January’s figures were revised lower to -1.2%. Annual sales growth slowed to 3.1% from 3.9%, fueling concerns about consumer spending and offering near-term support for EUR/USD.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0880, with further levels at 1.0800 and 1.0730.

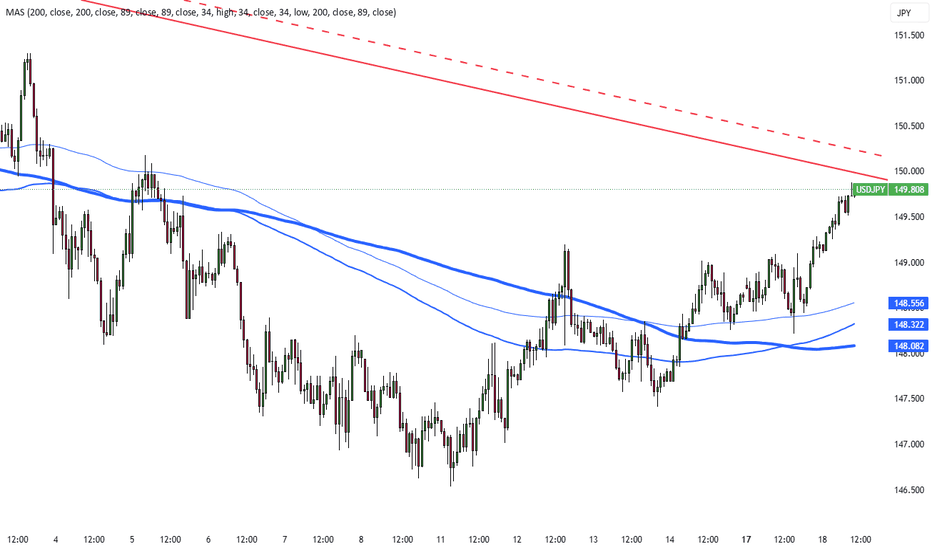

Japanese Yen Hits Two-Week Low Before BoJ MeetingThe yen fell past 149.5 per dollar, a two-week low, ahead of the BoJ's policy decision. The central bank is expected to hold rates at 0.5% on Wednesday while assessing U.S. policy impacts. Despite a pause, rate hikes are anticipated later this year as rising wages and inflation support policy normalization. Major firms agreed to wage hikes for the third straight year, increasing consumer spending and inflation.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.