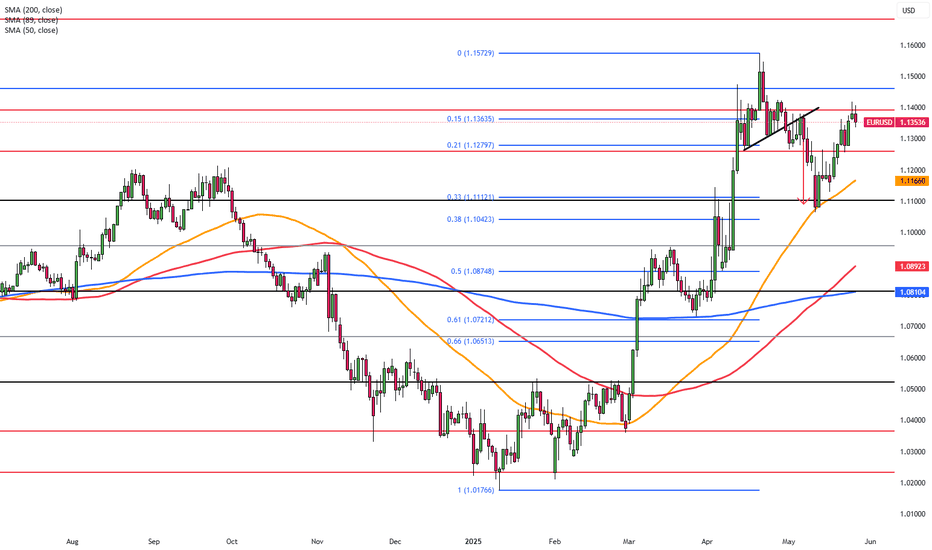

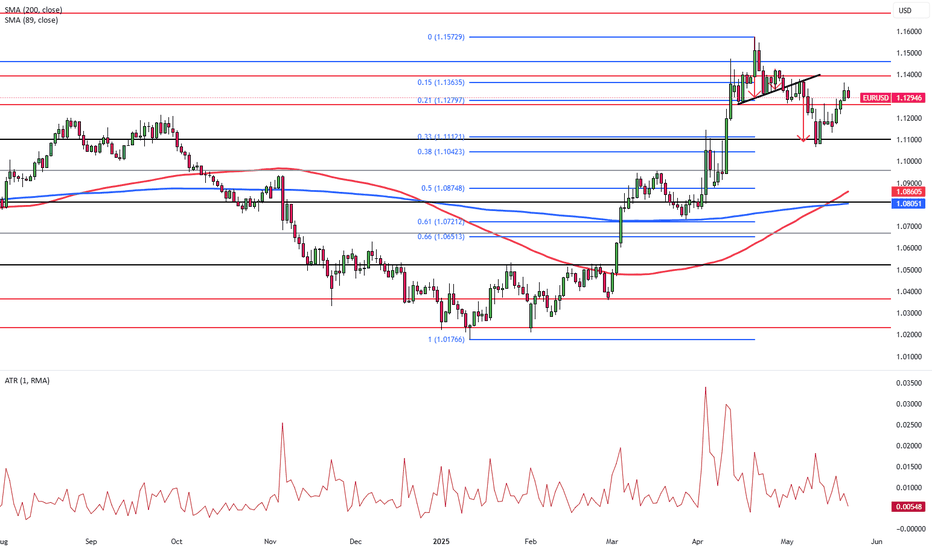

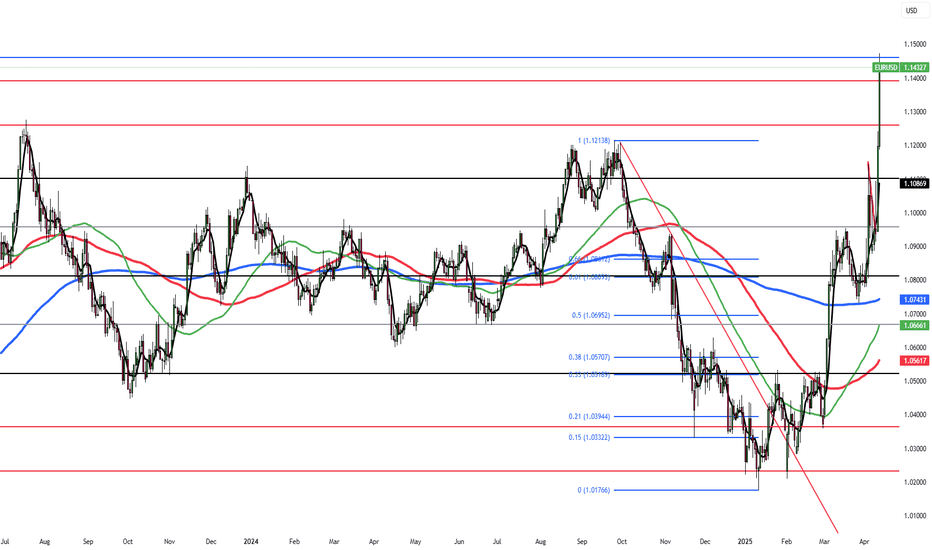

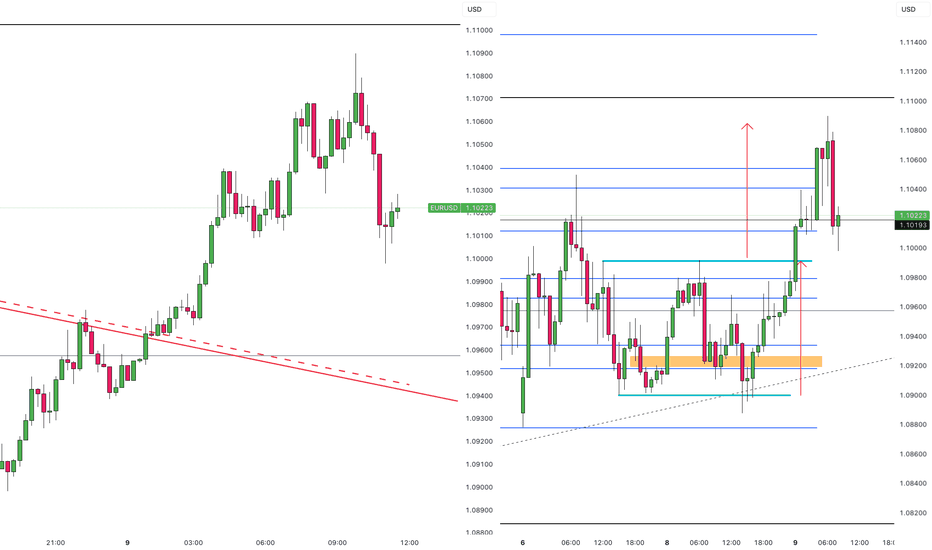

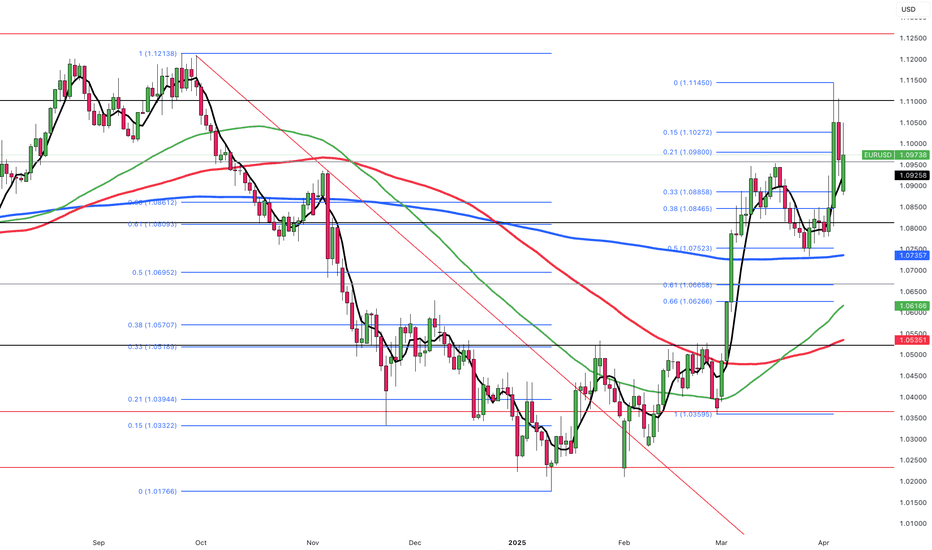

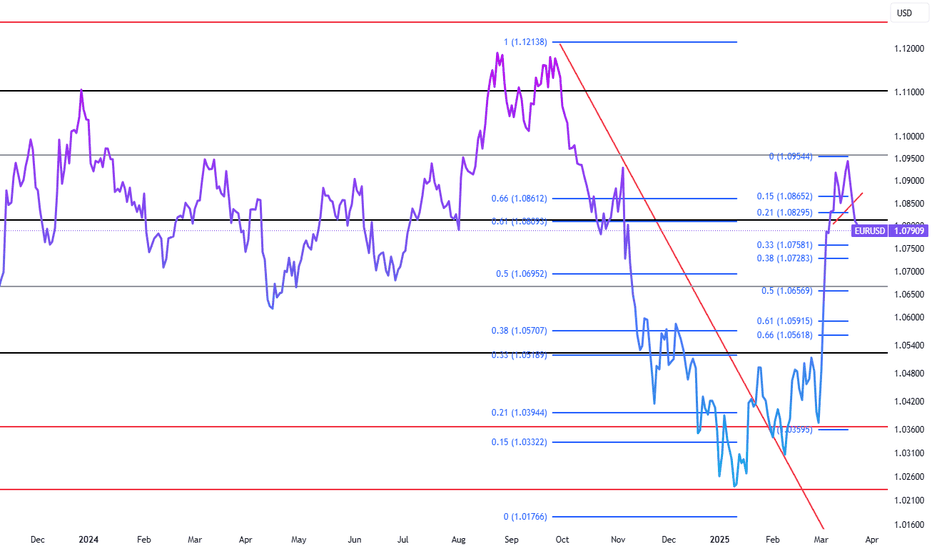

Euro Nears $1.14 as Dollar is PressuredEUR/USD climbed to $1.1395, approaching a one-month high as the dollar softened amid mounting U.S. fiscal concerns and uncertainty over Trump’s tax-and-spending bill. Risk sentiment improved after Trump delayed a planned 50% tariff on EU goods, easing fears of a transatlantic trade clash. The euro also gained from ECB President Lagarde’s remarks that it could strengthen as a global currency if EU institutions were reinforced.

Resistance is at 1.1425, with additional levels at 1.1460 and 1.1580. Support begins at 1.1260, followed by 1.1100 and 1.1050.

Zforexdaily

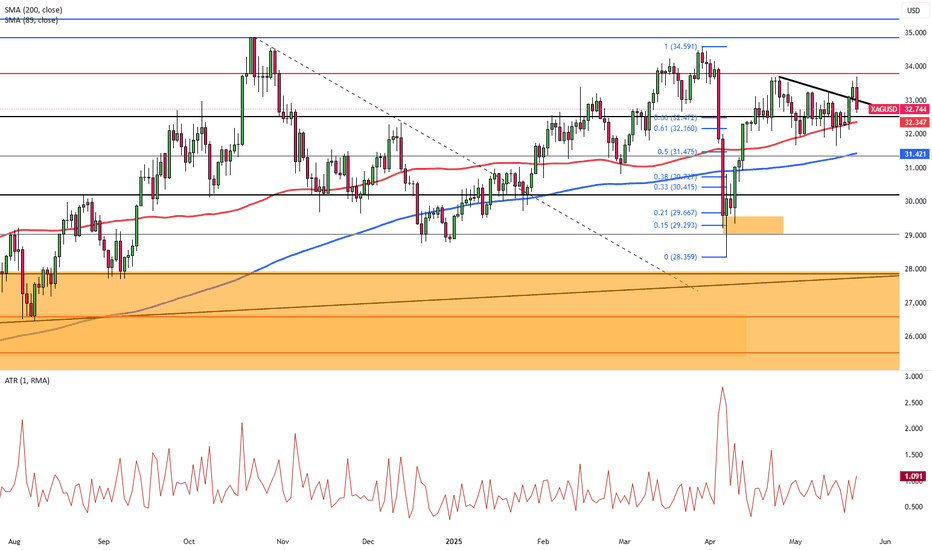

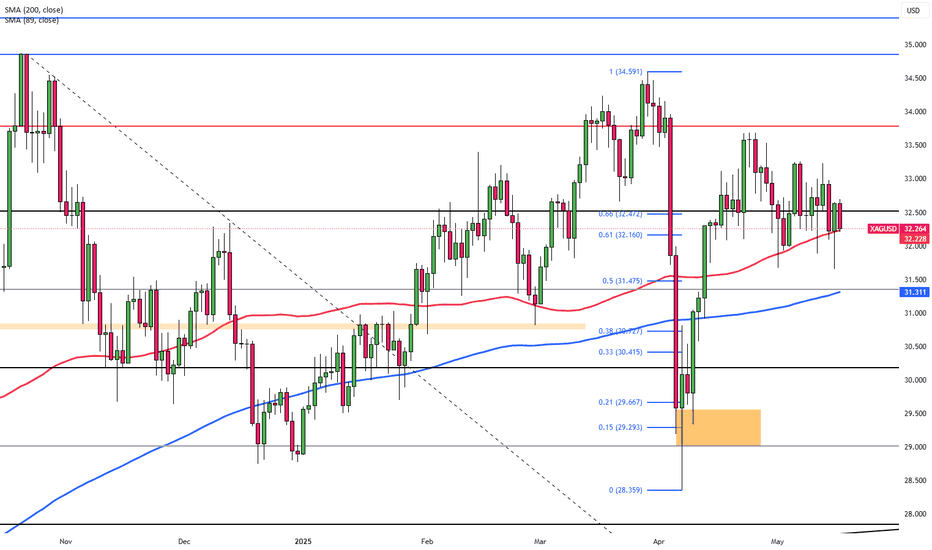

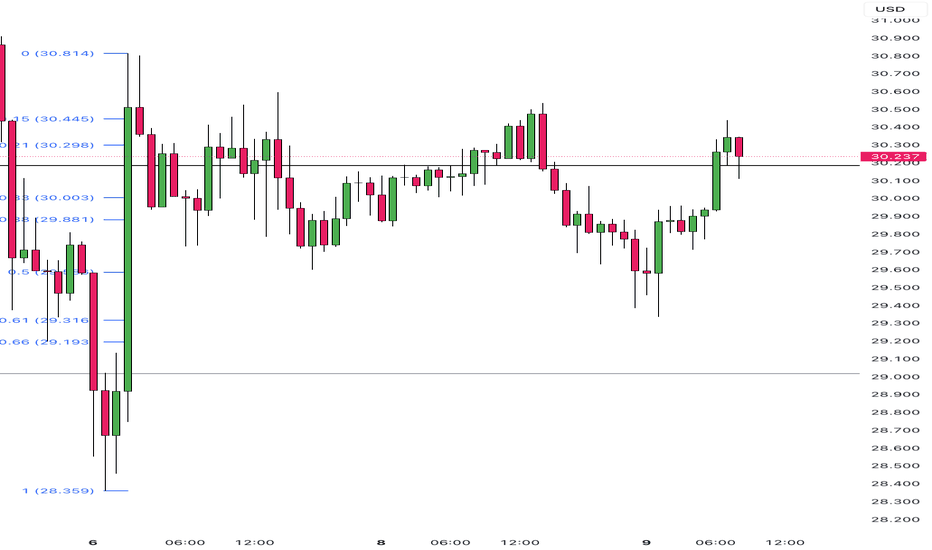

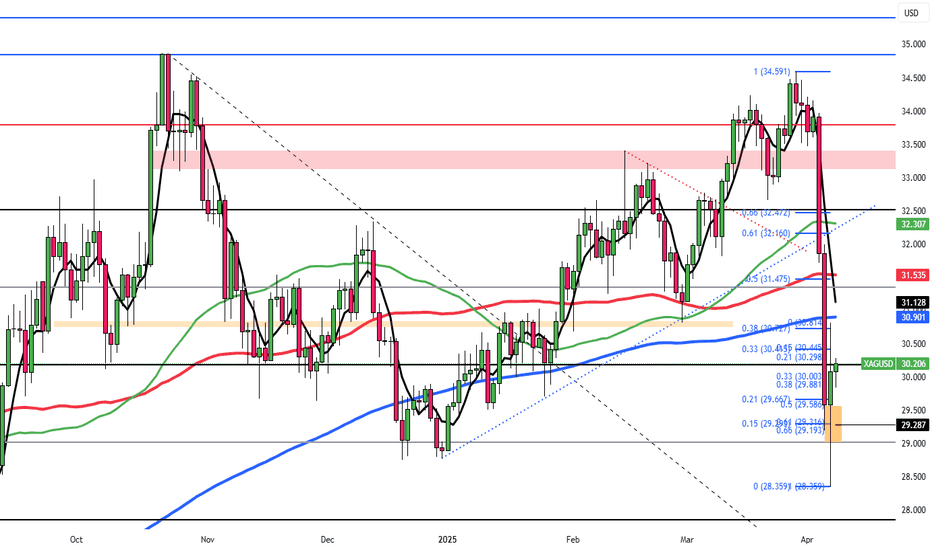

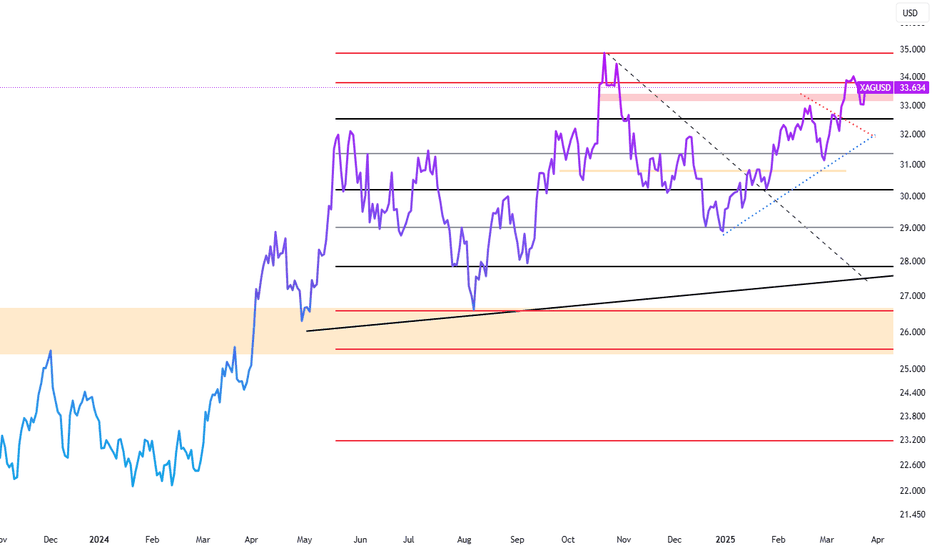

Silver Rises to $32.60 on Safe-Haven DemandSilver (XAG/USD) climbed to around $32.60 per ounce on Thursday during Asian trading, recording its third consecutive gain as safe-haven demand increased amid rising U.S. fiscal concerns and global tensions.

Moody’s recent downgrade of the U.S. credit rating to Aa1, citing growing debt and deficits, added pressure on the Dollar. Ongoing unrest in the Middle East and Israel’s military actions in Gaza also supported precious metal prices. Meanwhile, Ukraine is preparing to urge the EU next week to seize Russian assets and target oil buyers, as U.S. sanctions appear to be losing momentum.

The first critical support for Silver is seen at 33.80, and the first resistance is located at 32.30.

Euro Extends Rally Ahead of PMI DataEUR/USD trades near 1.1340 during Asian hours, close to two-week highs, extending gains for a fourth session ahead of Eurozone PMI data expected to show improved growth for May.

The U.S. dollar remains under pressure as markets await Thursday’s S&P Global PMI. Moody’s downgraded the U.S. credit rating to Aa1, matching earlier cuts by Fitch and S&P, citing rising debt, projected to reach 134% of GDP by 2035, and a nearly 9% deficit.

Trump’s tax-cut plan cleared the House Rules Committee, but the DXY still trades lower near 99.50.

The key resistance is located at 1.1390, and the first support stands at 1.1260.

Silver Retreats on Semiconductor TensionsSilver pulled back to around $32.50 in Friday’s Asian session, giving up part of its recent gains following reports that the U.S. plans to blacklist several Chinese semiconductor firms. Given silver’s integral role in electronics and chip manufacturing, the news weighed on sentiment.

Demand for precious metals has also weakened with easing trade tensions, as the U.S. and China agreed to reduce tariffs, cutting U.S. duties from 145% to 30% and China’s from 125% to 10%. Despite this, silver found support from a weakening U.S. dollar, which followed soft economic data reinforcing expectations for Federal Reserve rate cuts. Powell, however, warned that persistent supply shocks could complicate inflation control moving forward.

Resistance begins at $32.50, with further levels at $33.80 and $34.20. Support is seen at $31.40, followed by $30.20 and $29.80.

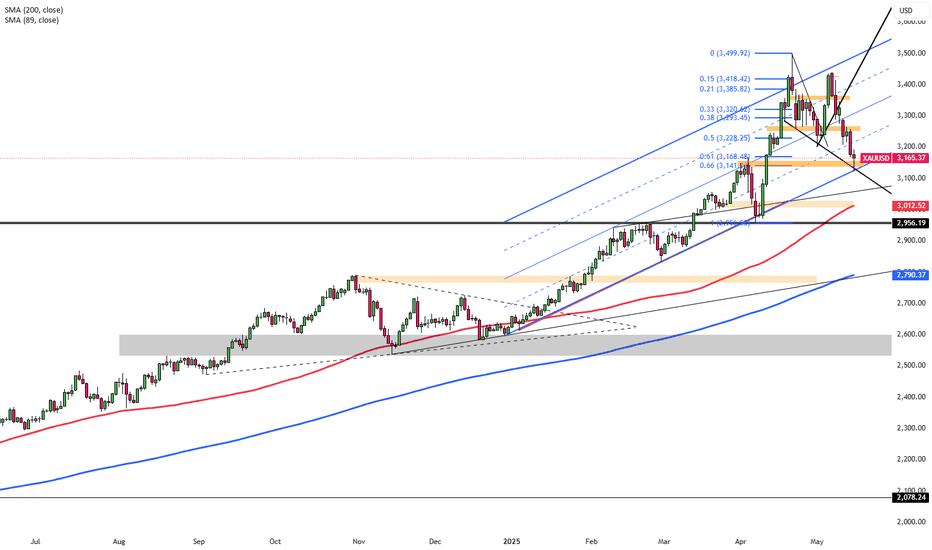

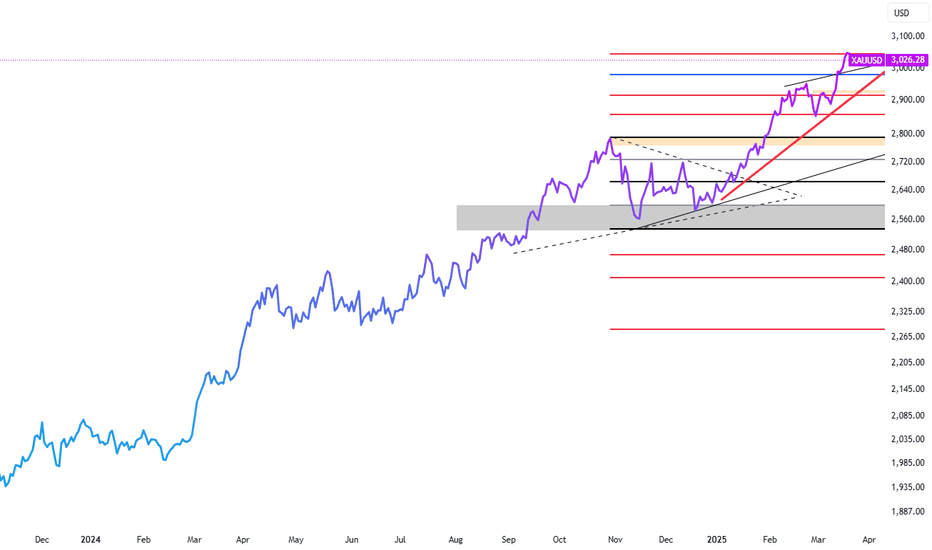

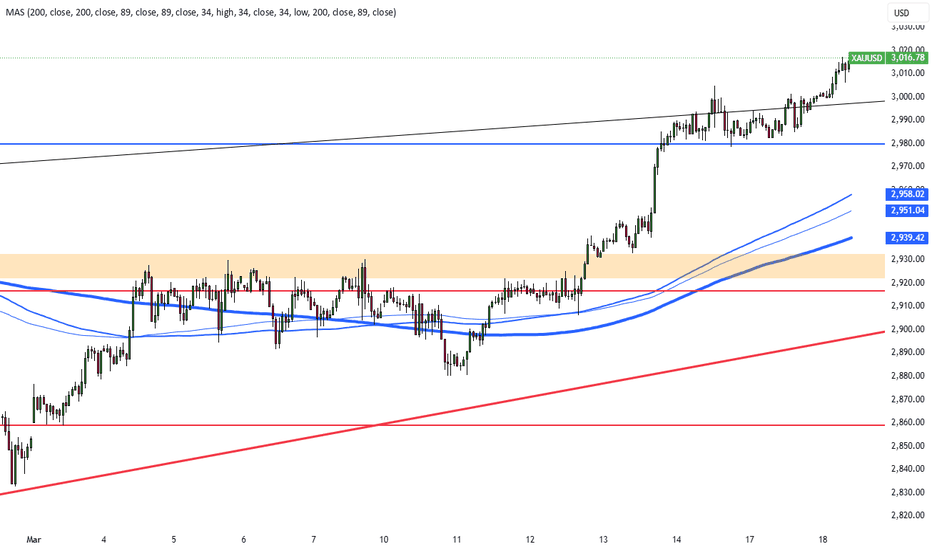

Risk Appetite Weighs on GoldGold hovers near $3,155, attempting to stabilize after falling more than 2% the previous day. The metal trades below $3,200, pressured by improved risk appetite following U.S.-China tariff reductions and upcoming U.S. data releases, including PPI and Retail Sales.

Fed Chair Powell’s speech is also in focus, as markets seek clues on interest rate policy. While the weaker Dollar has lent gold some support, traders remain cautious ahead of potential rate-cut signals.

Key resistance is seen at $3,235, followed by $3,300 and $3,350. On the downside, support begins at $3,120, then $3,030 and $2,956.

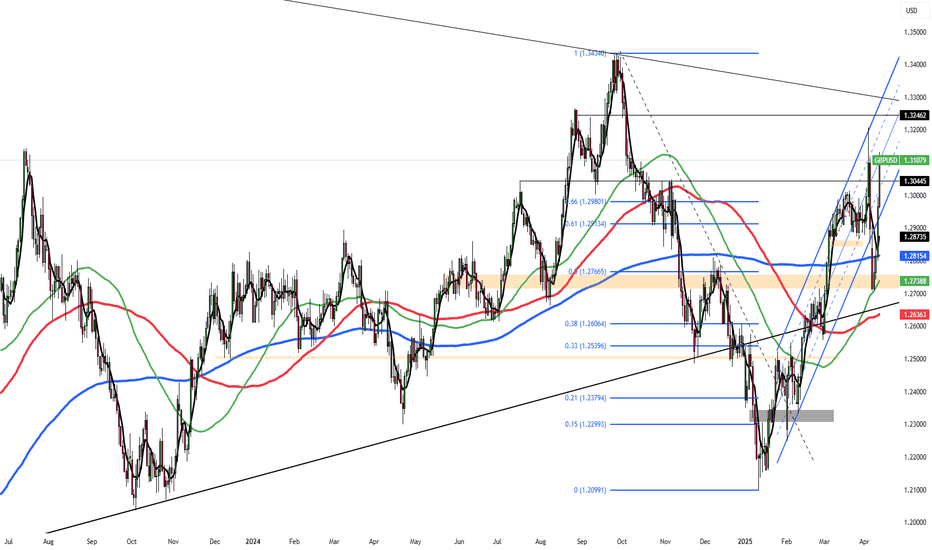

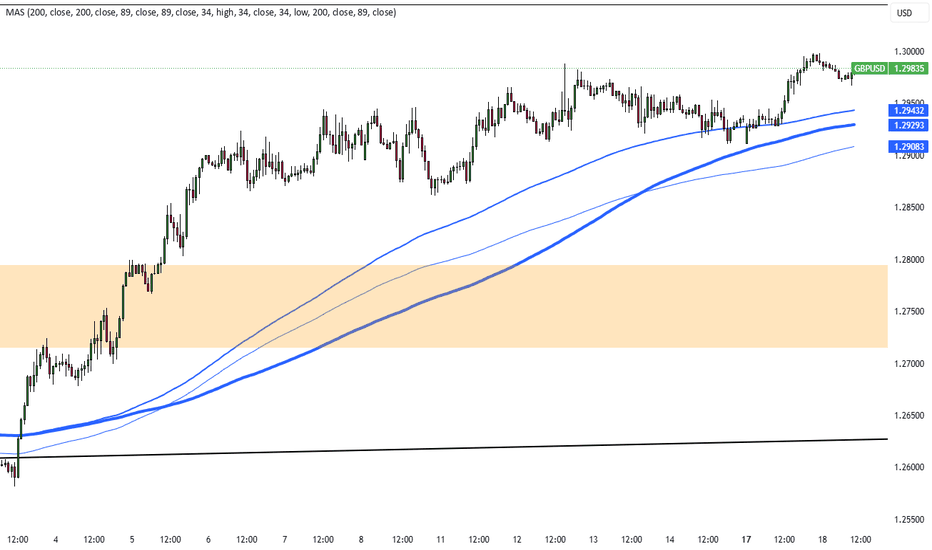

Pound Gains on Dollar Softening, GBP/USD at $1.30The pound extended gains to $1.30 for a third session, as the dollar softened following Trump’s 90-day tariff pause for most countries. However, the 145% hike on Chinese goods kept risks elevated. While volatility persists, traders now expect 66 bps of BoE rate cuts this year, down from 79 bps a day earlier. UK GDP is forecast to grow 0.1% in February, suggesting a slow recovery.

If GBP/USD breaks above 1.3050, resistance levels are at 1.3100 and 1.3200. Support is at 1.2960, followed by 1.2900 and 1.2850.

EU Tariff Relief Drives Euro Above $1.13The euro climbed above $1.13, its highest since September 2024, after the EU suspended new U.S. tariffs for 90 days to allow trade talks. This followed President Trump’s move to cut tariffs to 10% for non-retaliating countries while raising Chinese duties to 125%. While easing global slowdown fears, the mixed signals fueled uncertainty. Money markets adjusted ECB expectations, pricing the deposit rate at 1.8% by December, up from 1.65%, and lowered the probability of an April cut to 90%.

Key resistance is at 1.1390, followed by 1.1425 and 1.1500. Support lies at 1.1260, then 1.1180, and 1.1100.

Yields and Trade Wars Induce Silver InstabilitySilver dropped below $30 per ounce, hitting $29.57 on April 4, its lowest since mid-January, as rising U.S. Treasury yields made non-yielding assets less attractive. The U.S. announced a 104% tariff on Chinese imports starting at midnight, intensifying trade war concerns. Although over 70 countries have reportedly requested tariff relief, market sentiment remains cautious. The EU’s retaliatory tariff plans further fueled risk aversion, pressuring industrial metals. Still, expectations of Fed rate cuts and safe-haven demand offer some support.

Technically, the first resistance level is located at 30.90. In case of its breach, 31.40 and 32.50 could be monitored respectively. On the downside, first support is at 29.00. 28.40 and 27.50 would become the next support levels if this level is passed.

Dollar Under Pressure from Recessionary SignalsEUR/USD climbed about 80 pips to 1.1040 on Wednesday as the dollar index slipped below 105.5, marking a second day of losses. The U.S. dollar weakened amid growing fears of recession, triggered by President Trump's sweeping tariffs. China now faces a 104% levy, with Beijing vowing to "fight to the end." Market sentiment remained cautious as trade negotiations stalled, despite Trump’s outreach to major partners. Concerns that the escalating trade war may tip the U.S. into recession have increased expectations of further Fed rate cuts, weighing on the dollar.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.0900, then 1.0850 and 1.0730.

Silver Holds Ground as Markets Eye Fed CutsSilver hovered around $30 per ounce on Monday, staying volatile as markets reacted to Trump’s escalating trade war. The metal dropped 16% over three sessions as recession fears sparked a broad selloff, with traders liquidating metals to cover losses. China retaliated with tariffs after the US imposed levies on all countries, with others expected to follow. Trump’s tariffs excluded copper, gold, energy, and certain minerals. Despite the slump, silver may regain support as markets bet on more Fed rate cuts this year.

Technically first resistance level is located at 30.90. In case of its breach 31.40 and 32.50 could be monitored respectively. On the downside, the first support is at 29.00. 28.40 and 27.50 would become the next support levels if this level is passed.

EUR/USD Edges Higher Amid Fed Cut BetsThe EUR/USD rose 0.03% to $1.0967 in Asian trade, supported by expectations of Fed rate cuts amid U.S.-China trade tensions. However, gains were limited by concerns over European growth and global trade disruptions. Without signs of market stability, the pair may stay range-bound under risk aversion pressure.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.1000, then 1.0850 and 1.0730.

Silver Rises as Markets Eye Trump TariffsSilver rose above $33 on Tuesday, rebounding as trade and economic concerns supported safe-haven demand. Hopes that Trump may adopt a more targeted tariff plan ahead of the April 2 deadline offered some relief, though his new pledges to tax autos and pharmaceuticals added uncertainty. Expectations of further Fed rate cuts also supported silver. Markets now anticipate one cut in June, another in September, and growing chances of a third in December.

If silver breaks above $33.80, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

Safe-Haven Demand Keeps Gold ElevatedGold edged above $3,020 on Wednesday, near record highs, supported by safe-haven demand amid uncertainty over upcoming US reciprocal tariffs. Trump's April 2 tariff plan is expected to be more targeted than past proposals but still signals a major escalation in trade tensions.

Markets now await Fed officials’ speeches and Friday’s US PCE data for policy clues. Meanwhile, a U.S.-brokered pause in sea and energy attacks between Ukraine and Russia, along with possible sanctions relief for Moscow, slightly eased bullion's appeal.

Key resistance stands at $3082, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

Pound Slips to $1.29 on Soft InflationThe British pound dipped to around $1.29 as traders reacted to softer inflation data and looked ahead to the Spring Statement. UK annual inflation eased to 2.8% in February, below the 2.9% forecast but in line with the BoE's outlook. Services inflation remained at 5%.

The BoE expects inflation to rise toward 4% later this year. Markets see a 92% chance of a 25bps rate cut in August and about a 60% chance of another by year-end. Chancellor Rachel Reeves is set to outline the economic outlook and announce major government spending cuts.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

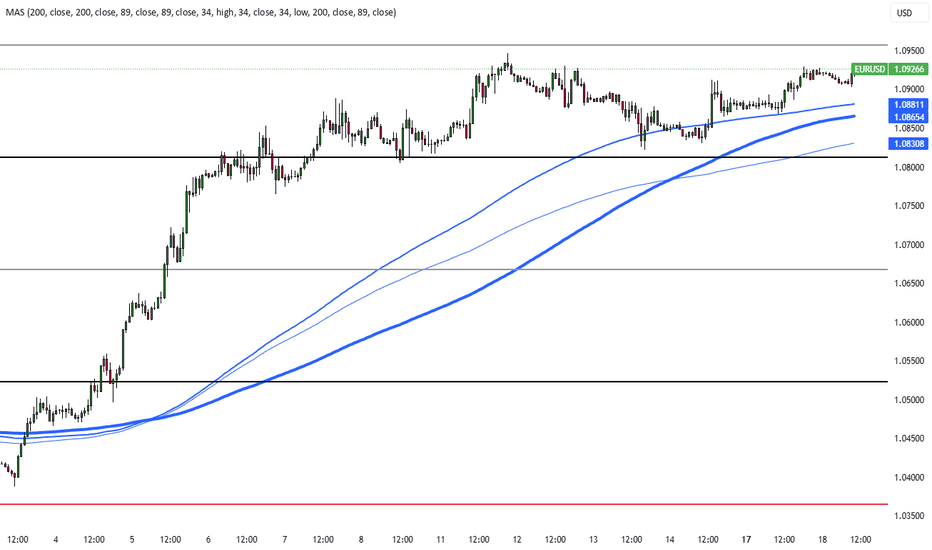

Eurozone Growth Slows, ECB Leans DovishThe euro hovered near $1.08, its weakest since March 6, as investors digested PMI data and ECB comments. Eurozone private sector activity grew at its fastest pace since August but missed expectations, with manufacturing rebounding and services slowing.

ECB’s Cipollone and Stournaras signaled growing support for a rate cut, possibly in April, citing faster disinflation. Lagarde warned of weaker growth but downplayed inflation risks from EU-U.S. trade tensions, suggesting no rate hikes. De Galhau also noted room for further easing.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0730, with further levels at 1.0660 and 1.0600.

Silver Surges to $33.90 as Safe-Haven DemandSilver surged to $33.90, its highest since October 2024, driven by a weaker dollar, geopolitical tensions, and strong industrial demand. Recession fears and trade disputes have supported safe-haven buying, with Trump planning new tariffs on China, steel, and aluminum starting April 2. Middle East tensions added support, as Netanyahu confirmed intensified military action in Gaza. Supply constraints and record industrial demand, especially in solar, 5G, and automotive sectors, further fueled the rally.

If silver breaks above $34.00, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

Gold Surges Past $3,000 Amid Fed UncertaintyGold surged past $3,000, hitting a record high as safe-haven demand grew ahead of the Fed's rate decision. While rates are expected to remain unchanged, investors await economic projections and Powell’s remarks for policy clues amid trade tensions. Market jitters also rose after Trump warned Iran over Houthi rebel attacks and planned talks with Putin on ending the Ukraine war.

Key resistance stands at $3045, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

Pound Steady Near Four-Month Low Amid BoE Rate Hold ExpectationsThe pound traded at $1.294, near a four-month low, as investors awaited the BoE's Thursday decision. The central bank is expected to hold rates at 4.5%, balancing weak growth and inflation risks. Despite forecasts for 2025 rate cuts, none are expected now. The UK labor market is weakening, with unemployment set to hit 4.5% and wage growth slowing. Markets also await Chancellor Reeves’ Spring Statement on March 26 for economic updates. In trade talks, the UK is taking a softer stance with the US than the EU.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

EUR/USD Dips Amid U.S.-EU Trade TensionsEUR/USD is slightly down, hovering near 1.0915 in early Asian trading. The Euro faces pressure from rising U.S.-EU trade tensions after Trump announced new tariffs on European goods. Washington imposed duties on steel and aluminum, prompting Brussels to prepare countermeasures, while Trump threatened a 200% tariff on European wine and spirits, adding downside risks for the Euro.

However, losses may be limited by Germany’s fiscal policy shifts. The Green Party supports debt restructuring, and incoming Chancellor Friedrich Merz proposed a €500 billion infrastructure fund with borrowing rule adjustments. The measures expected to be passed this week could support the Euro.

Weak U.S. Retail Sales data also weigh on the Dollar. February sales rose just 0.2% vs. the expected 0.7%, while January’s figures were revised lower to -1.2%. Annual sales growth slowed to 3.1% from 3.9%, fueling concerns about consumer spending and offering near-term support for EUR/USD.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0880, with further levels at 1.0800 and 1.0730.