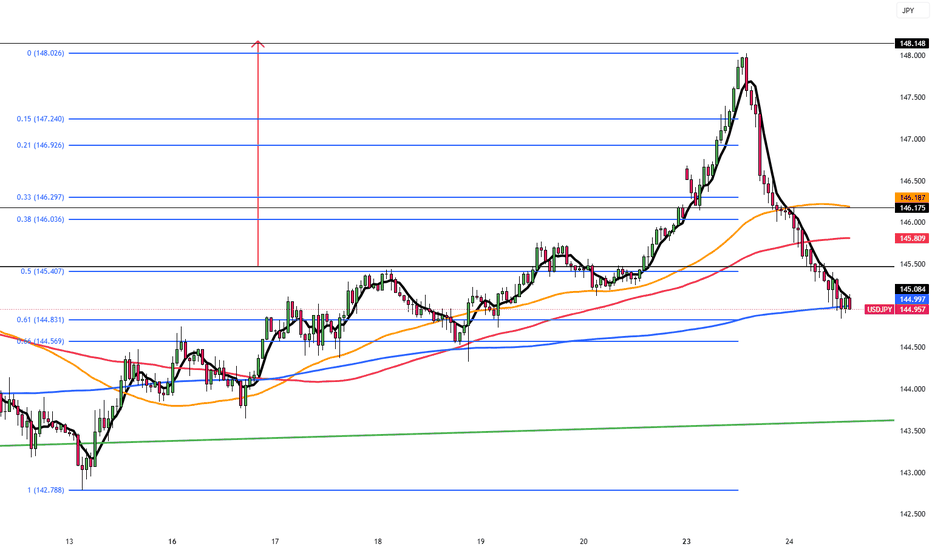

Yen Rebounds as Ceasefire Calms MarketsThe Japanese yen recovered to around 145.5 per dollar on Tuesday, gaining strength after the ceasefire announcement. Although Iran launched missiles at a US base in Qatar, causing no casualties, the gesture was largely seen as symbolic. Tehran’s decision not to target the Strait of Hormuz further eased fears of major disruptions.

The key resistance is at $146.20 while the major support is at $144.85.

Zforexteam

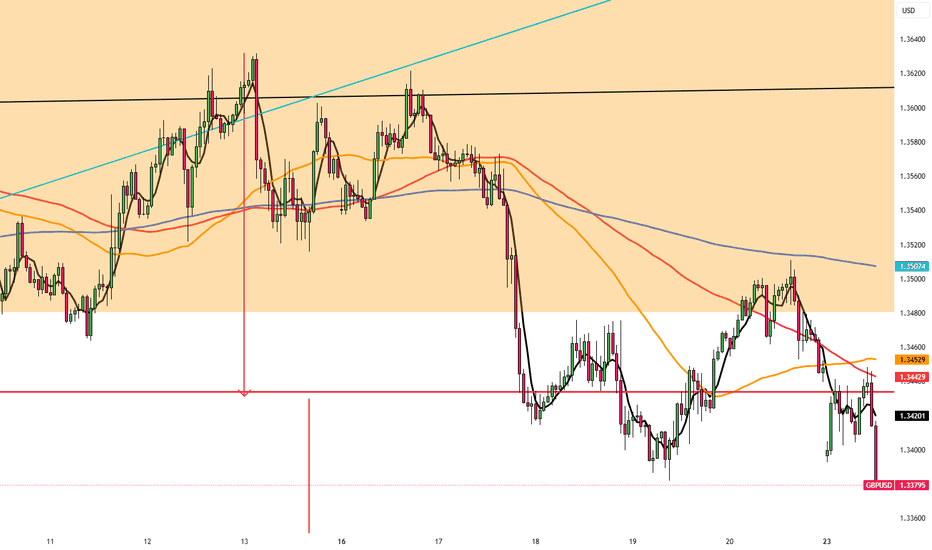

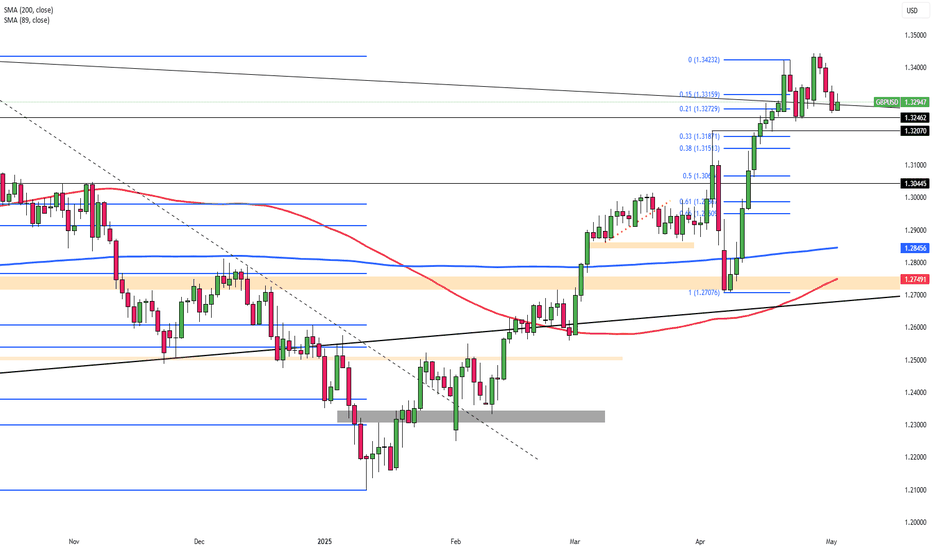

GBP/USD Weakens Ahead of PMI ReleasesGBP/USD fell to around 1.3405 during Monday’s Asian session as safe-haven flows strengthened the US dollar amid rising Middle East tensions. Fears of Iranian retaliation after US airstrikes on three nuclear sites lifted demand for the Greenback. Trump said Iran’s facilities were “totally obliterated” and warned of stronger attacks unless peace is reached. Iran vowed to respond, saying it “reserves all options.”

Investors await June PMI data from the UK and US due later Monday. The Pound remains under pressure after UK retail sales dropped 2.7% MoM in May, well below the expected 0.5% decline and April’s revised 1.3% gain.

The BoE held rates at 4.25% last Thursday. Governor Bailey said rates are on a gradual downward path but warned of global unpredictability. Reuters expects 25 bps cuts in both August and Q4.

Resistance is seen at 1.3500, while support holds at 1.3415.

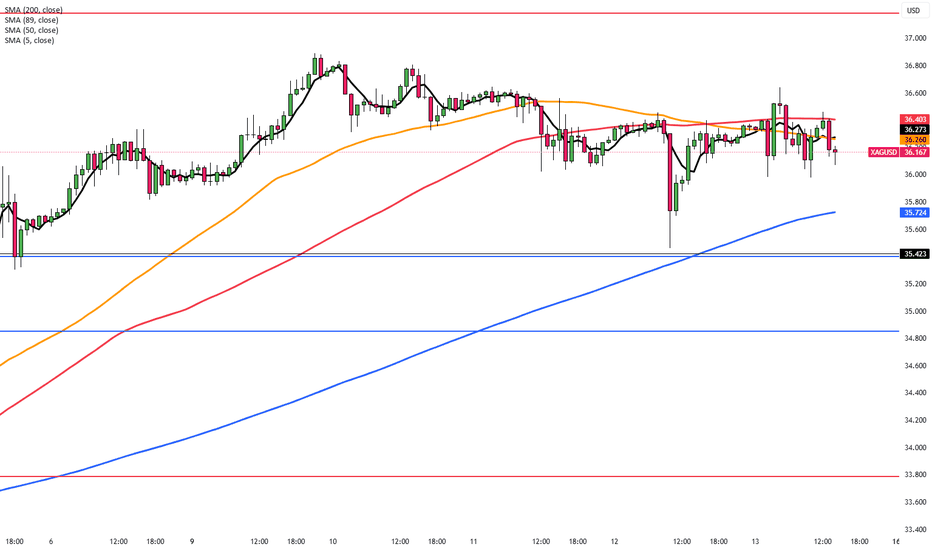

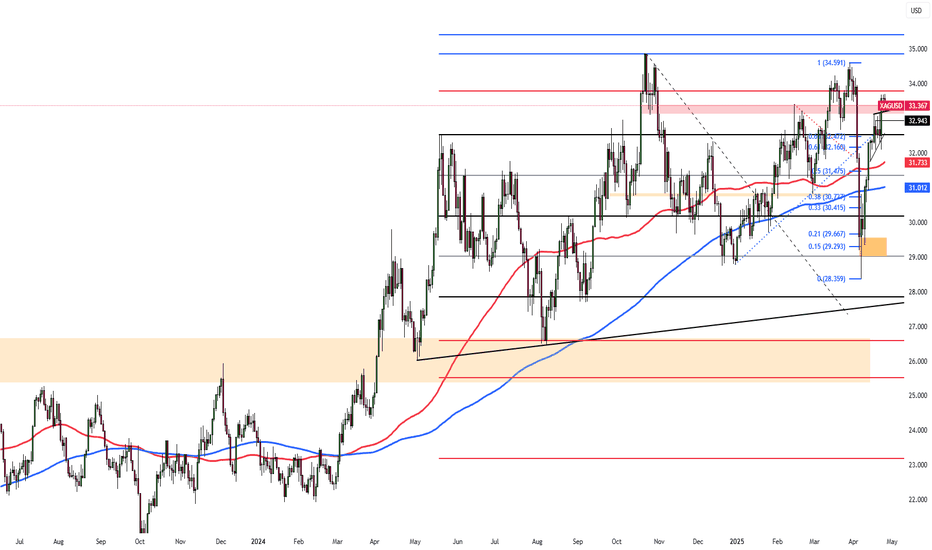

Rate Cut Bets Keep Silver in FocusSilver slipped toward $36 per ounce as investors locked in gains after hitting a 13-year high. The metal remains supported by strong industrial demand, supply deficits, and safe-haven interest during global uncertainty. Industrial uses, especially in solar and electronics, account for over half of the demand. A fifth consecutive annual supply deficit is expected, though the Silver Institute sees the gap narrowing by 21% in 2025. Softer U.S. inflation data for May also increased expectations of Fed rate cuts beginning in September, helping sustain interest in precious metals.

Resistance is set at 36.90, while support stands at 35.40.

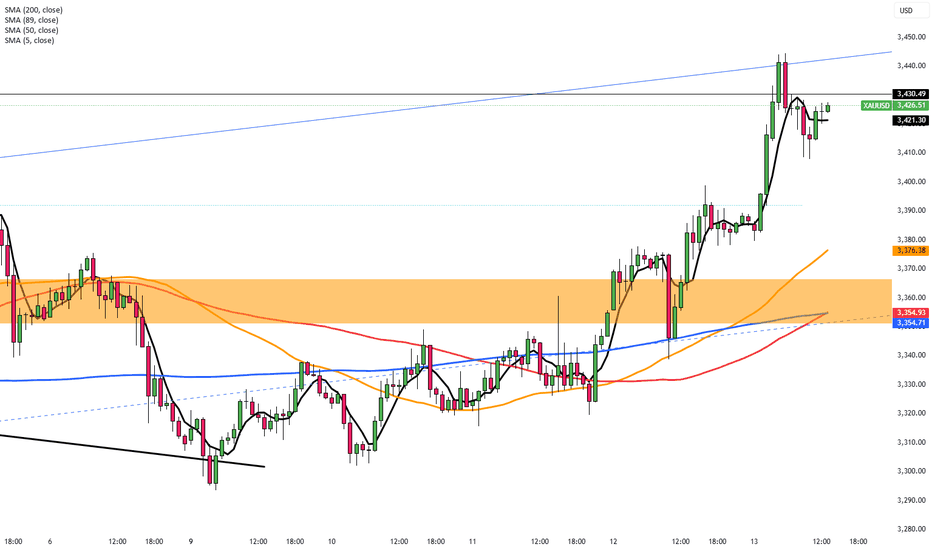

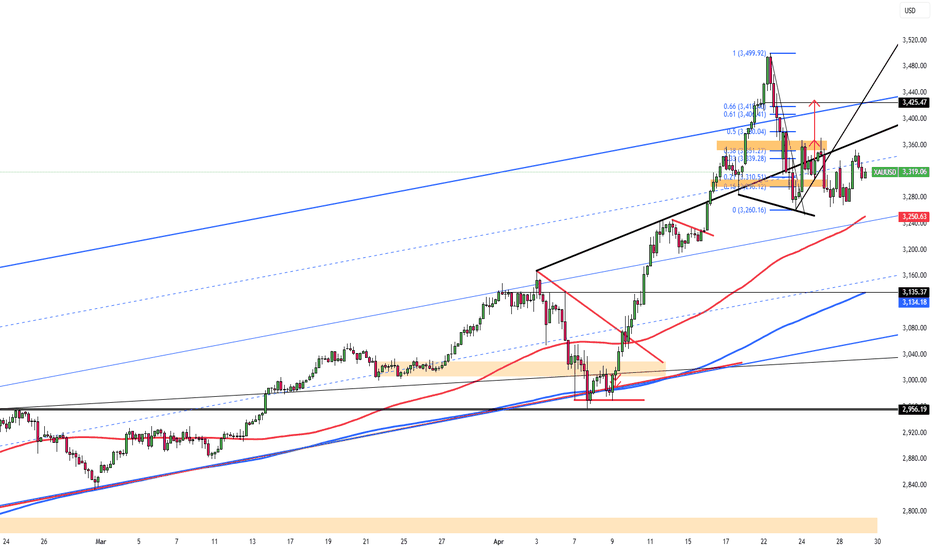

Gold Surges Amid Middle East TensionsGold surged more than 1% to exceed $3,440, approaching record levels amid a sharp rise in safe-haven demand. The gains came after Israel's strike on Iran’s nuclear facilities, fueling concerns over a wider regional conflict. Uncertainty surrounding potential US tariffs added to market jitters. Additionally, softer US inflation data increased expectations for Federal Reserve rate cuts, enhancing gold's appeal as a non-yielding asset.

Resistance is seen at $3,430, while support holds at $3,350.

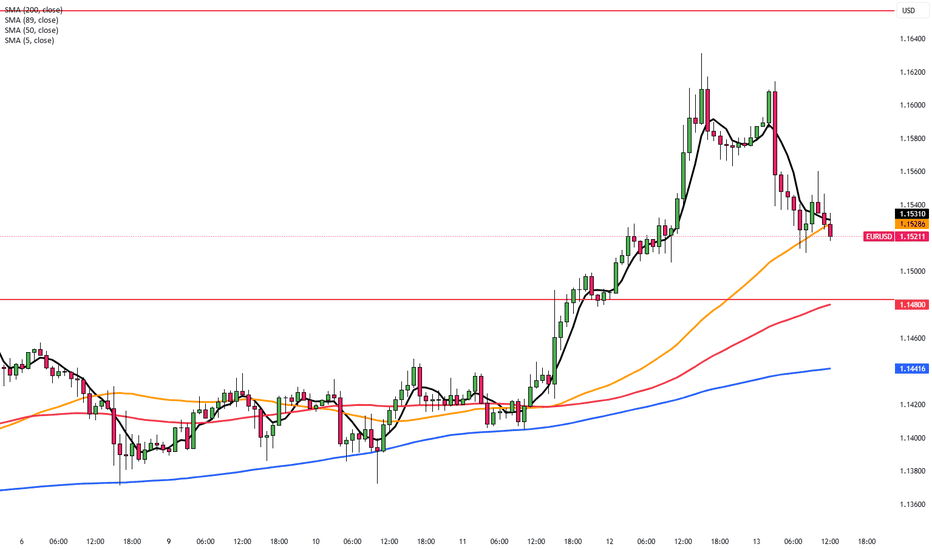

EUR/USD Slips on Geopolitical TensionsEUR/USD dropped to around 1.1530 on Friday, ending a four-day rally, as safe-haven demand lifted the US Dollar amid rising Middle East tensions.

Israel struck Iranian targets to weaken its nuclear program, prompting emergency measures. The US denied involvement but warned Iran not to target its assets.

Trump’s plan to expand steel tariffs from June 23 added trade uncertainty, while soft US inflation data kept Fed rate cut hopes alive.

Markets now await the US Michigan Sentiment report for further signals.

Resistance is located at 1.1580, while support is seen at 1.1460.

Silver Eases Despite Weaker DollarSilver slipped below $31.90 on Thursday, pressured by easing safe-haven demand after the U.S. and China agreed in Switzerland to cut tariffs to 30% and 10% respectively for 90 days. While the deal briefly lifted sentiment, uncertainty looms over what comes next.

The drop in geopolitical tensions has also dampened expectations for aggressive Fed cuts. However, weak U.S. inflation data from earlier this week supported silver by softening the Dollar and improving its appeal to international buyers.

Silver faces resistance at $32.50, followed by $33.80 and $34.20. Support is found at $31.40, with lower levels at $30.20 and $29.80.

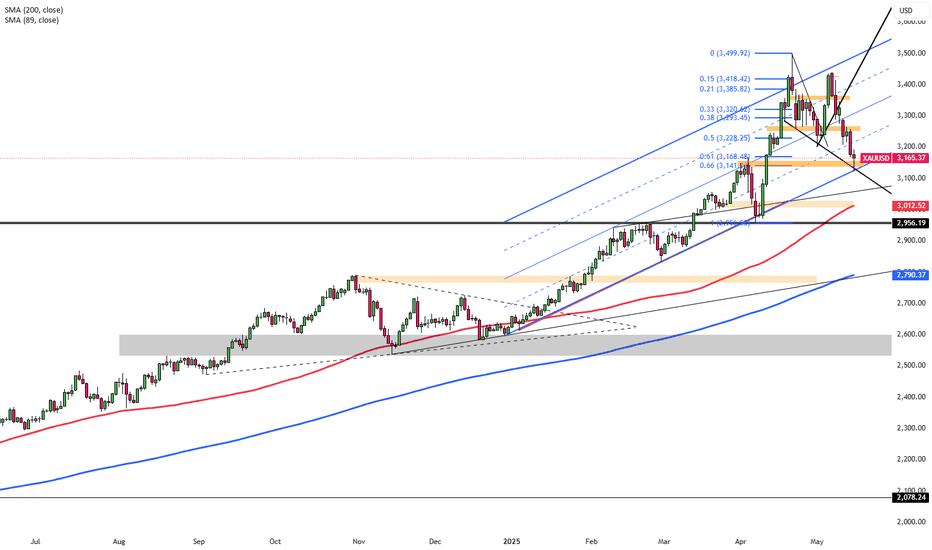

Risk Appetite Weighs on GoldGold hovers near $3,155, attempting to stabilize after falling more than 2% the previous day. The metal trades below $3,200, pressured by improved risk appetite following U.S.-China tariff reductions and upcoming U.S. data releases, including PPI and Retail Sales.

Fed Chair Powell’s speech is also in focus, as markets seek clues on interest rate policy. While the weaker Dollar has lent gold some support, traders remain cautious ahead of potential rate-cut signals.

Key resistance is seen at $3,235, followed by $3,300 and $3,350. On the downside, support begins at $3,120, then $3,030 and $2,956.

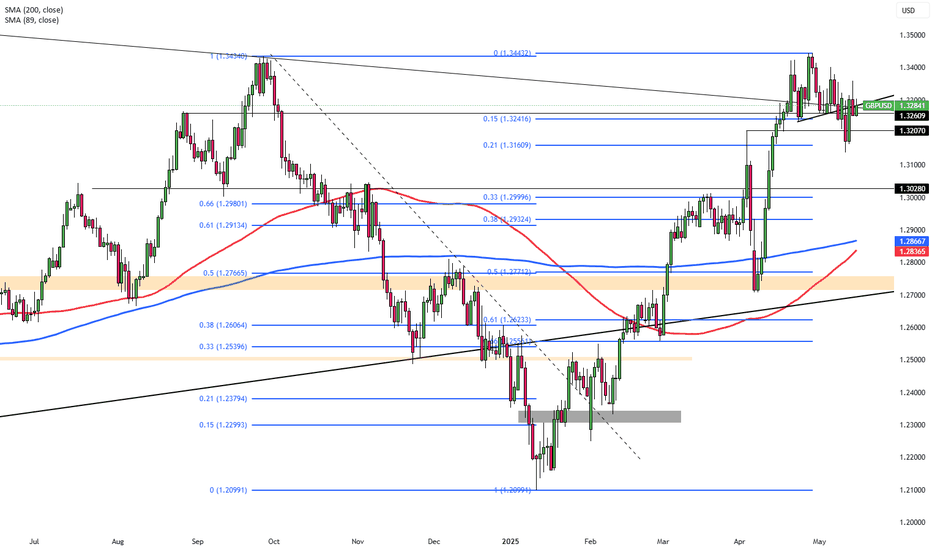

UK Data in Focus as Pound Tests 1.3300GBP/USD trades near 1.3280 early Thursday, recovering recent losses as the dollar softens with ongoing trade policy discussions. Optimism over reduced U.S. tariffs on British goods like cars and steel helps strengthen the appeal of the Pound.

However, weaker UK employment data and slow wage growth may increase pressure on the BoE to consider further easing. Traders now await UK Q1 GDP and U.S. CPI data. Despite global uncertainties, improving trade conditions have reduced bets on aggressive Fed cuts, with markets now pricing a 74% chance of a 25 bp cut in September instead of July.

The pair faces resistance at 1.3320, with higher levels at 1.3450 and 1.3550. Support sits at 1.3160, then 1.3000 and 1.2960.

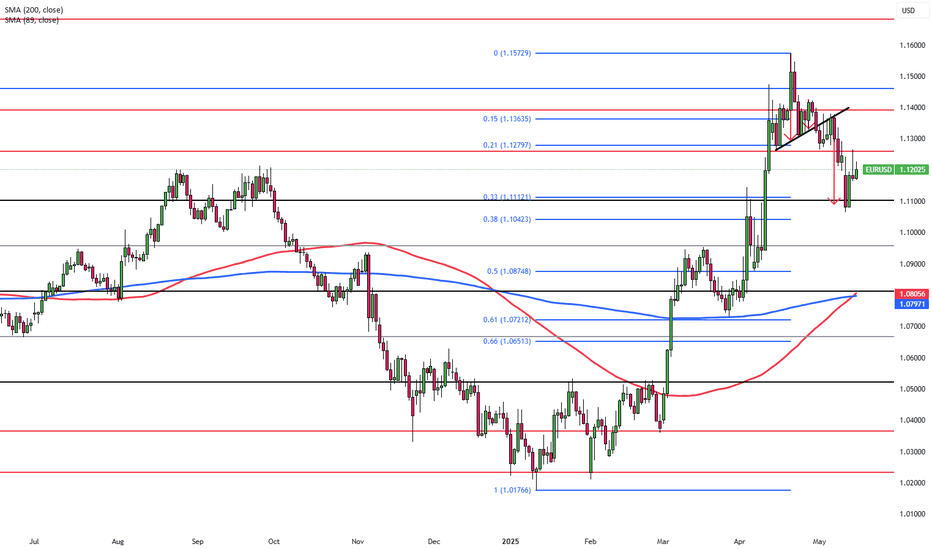

Euro Rises Near 1.1200 on Reserve StatusEUR/USD traded around 1.1200 during Thursday’s Asian session, rebounding ahead of the Eurozone’s Q1 2025 GDP report. The Euro remains supported by its rising role in global reserves, with Capital Economics noting its strongest position in years. U.S. policies under President Trump set this shift in motion, which is seen as weakening the dollar’s appeal as a popular asset. Germany’s increased fiscal spending has also lifted euro demand.

Despite ECB officials signaling more rate cuts, the Euro holds steady against a softer U.S. Dollar, which remains pressured by lingering trade uncertainty. Markets are now focused on U.S. retail sales and PPI data, while speculation grows that the U.S. might allow a weaker Dollar to aid exports.

EUR/USD faces resistance at 1.1260, with further upside near 1.1460 and 1.1580. Support begins at 1.1040, followed by 1.1000 and 1.0960.

GBP Gains as Tariff Risk Stays LowThe British pound rose to $1.332, near its highest level since February 2022, supported by a weaker U.S. dollar. Sterling gained 3.2% in April, its best month since November 2023. The UK is seen as less exposed to U.S. tariffs, which President Trump has delayed until July. In 2024, the U.S. ran a $12 billion goods surplus with the UK, unlike its deficits with China and the EU, reducing trade risk. The pound also benefits from expectations that the Bank of England will be more cautious than others in cutting rates. Markets expect about 85 basis points of easing this year, which is in line with the Fed. Investors now await key U.S. jobs and inflation data for dollar direction.

If GBP/USD breaks above 1.3430, the next resistance levels are 1.3500 and 1.3550. Support levels are at 1.3200, followed by 1.3050 and 1.2960.

Gold Retreats as Investors Eye Key Economic DataGold fell below $3,330 per ounce on Tuesday as investors monitored tariff talks and awaited key economic data. Treasury Secretary Scott Bessent said many top U.S. trading partners made "very good" tariff proposals and noted China’s tariff exemptions signal de-escalation efforts. He stressed it is now up to China to act. A modest rebound in the U.S. dollar also pressured gold. Markets are focused on upcoming reports, including Q1 GDP, March PCE inflation, and April nonfarm payrolls, for clues on the economy and Fed policy.

Key resistance is at $3365, followed by $3,405 and $3,500. Support stands at $3250, then $3165 and $3050.

Silver Holds Ground on Mixed Trade SignalsSilver is trading around $33.50 on Friday morning, continuing to show greater sensitivity to macroeconomic shifts and trade news due to its dual role as both a precious and industrial metal. Recent price movements were shaped by mixed signals in U.S.-China trade relations. Although the Trump administration reportedly considered tariff reductions, Treasury Secretary Scott Bessent clarified that no formal proposals have been made and negotiations have not yet begun.

Technically, silver faces initial resistance at $33.80, with further levels at $34.20 and $34.85 if the upward move continues. On the downside, immediate support is seen at $33.15, followed by $31.40 and $30.20 if further weakness occurs.

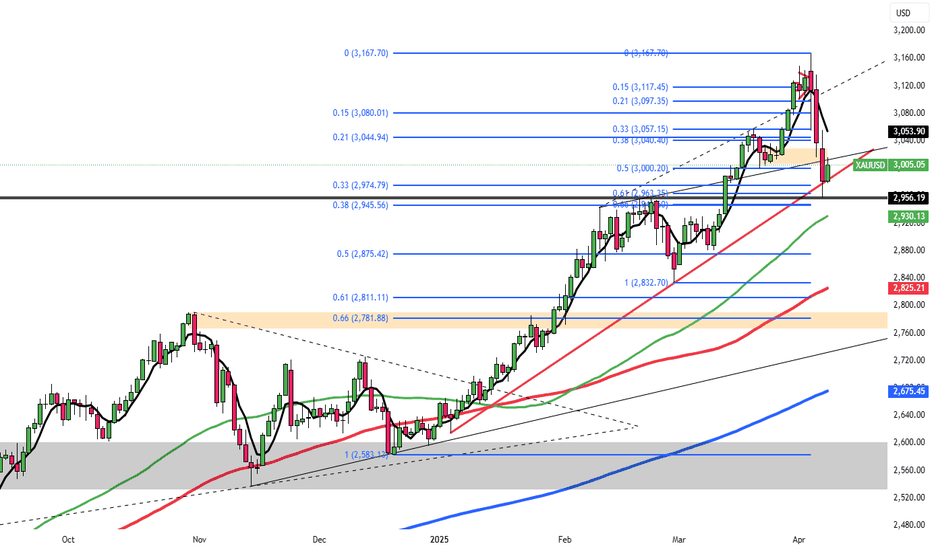

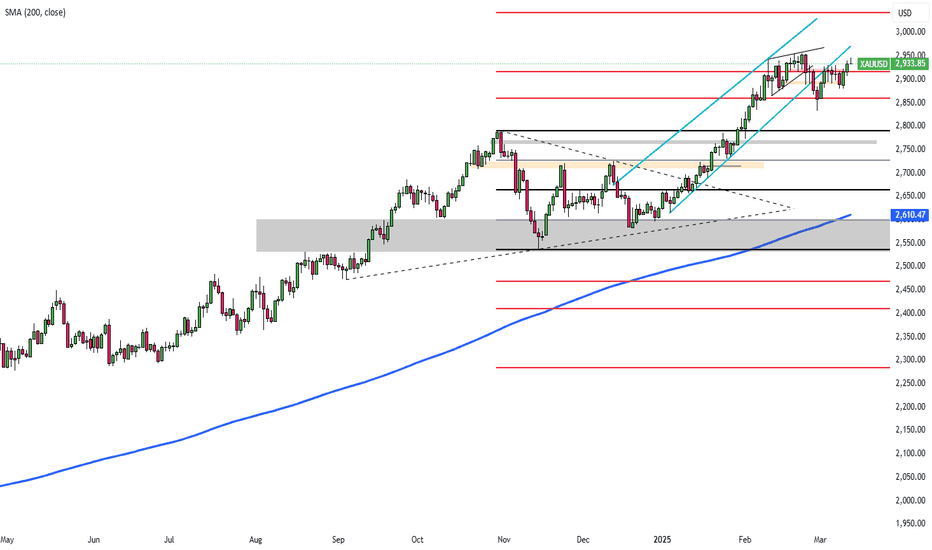

Gold Jumps on Fresh Trade War WorriesGold rose above $2,995/oz on Tuesday, rebounding from a 4-week low as trade war fears fueled haven demand. Trump threatened a 50% duty on China starting Wednesday unless it drops its 34% tariffs, while the EU proposed 25% counter-tariffs on U.S. goods. Markets await Fed minutes (Wed), CPI (Thu), and PPI (Fri) for policy clues. Despite recent losses, gold is still up over 14% YTD.

Key resistance is at $3,050, followed by $3,085 and $3,105. Support stands at $2,956, then $2,930 and $2830.

Euro Firms as U.S.-China-EU Trade Rift WidensThe euro hovered near $1.10, its highest since October 2024, as the dollar weakened and trade tensions escalated. China plans to impose 34% tariffs on all U.S. goods from April 10, following Trump’s 10% tariff on all imports, including 20% on EU and 34% on Chinese goods. France urged firms to halt U.S. investments, and the EU is preparing countermeasures. Markets now price in a 90% chance of an ECB rate cut in April, with the deposit rate seen falling to 1.65% by December from 2.5%.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.0900, then 1.0850 and 1.0730.

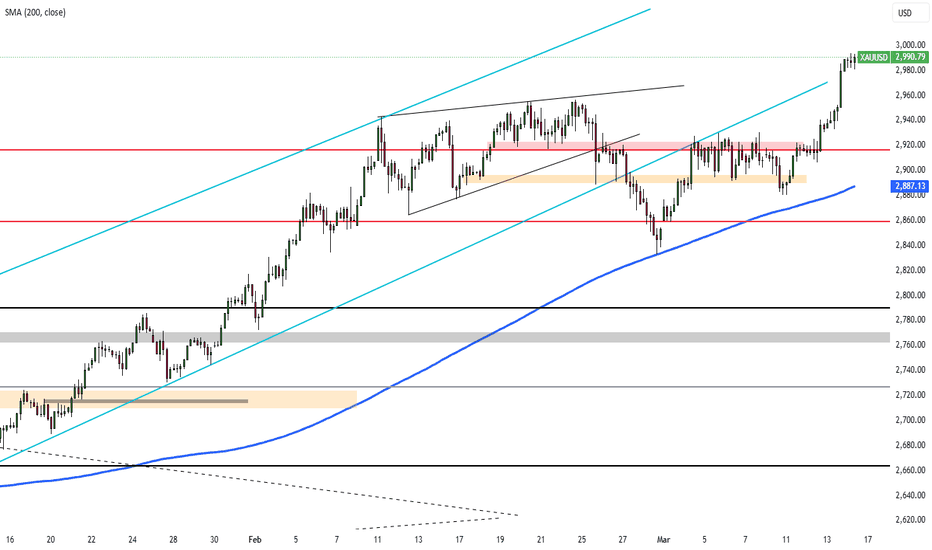

Gold Rallies Past $2,980 as Trade and Inflation Risks MountGold surged above $2,980 per ounce on Friday, hitting a record high and poised for a 2% weekly gain amid risk aversion and rising Fed rate cut expectations. Trump escalated trade tensions, threatening a 200% tariff on European wines after the EU imposed a 50% tax on U.S. whiskey. February's PPI and CPI data signaled easing inflation, increasing Fed flexibility for rate cuts and boosting gold’s appeal. Strong ETF inflows and continued central bank purchases, with China extending its buying for a fourth month, further supported prices.

Key resistance stands at $2,985, with further levels at $3000 and $3,050. Support is at $2,930, followed by $2,900 and $2,860.

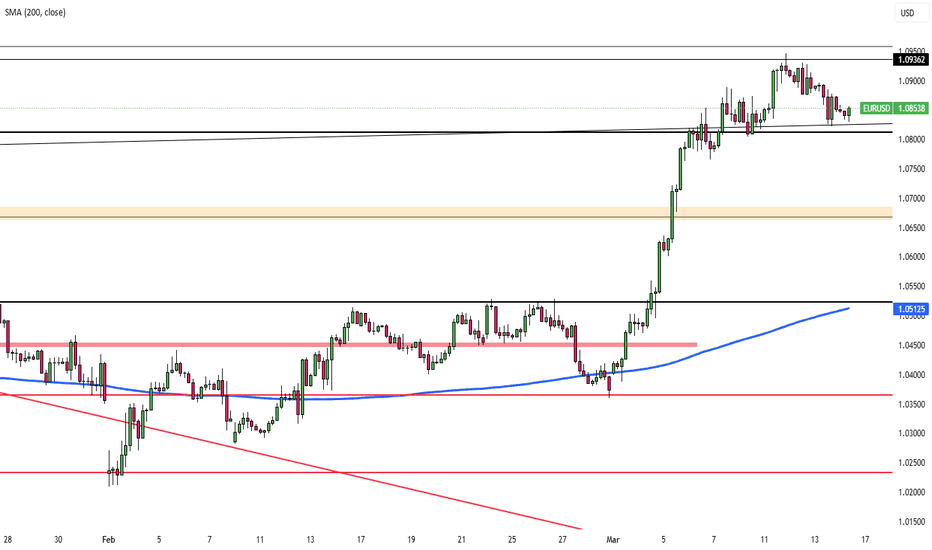

Euro Weakens Against USD Ahead of Key Economic DataThe EUR/USD pair declined to around 1.0835 during Friday’s Asian session, as the Euro (EUR) weakened against the US Dollar (USD) amid rising trade tensions between the U.S. and the European Union. Later in the day, market focus will shift to key economic releases, including Germany’s February Harmonized Index of Consumer Prices (HICP) and the preliminary Michigan Consumer Sentiment Index for March.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0800, with further levels at 1.0730 and 1.0650.

Lower US Inflation Drives Gold's SurgeGold surged to around $2,940 per ounce on Thursday, nearing record highs as escalating trade tensions boosted safe-haven demand. Trump threatened more tariffs on EU goods after retaliatory measures from the EU and Canada, while Commerce Secretary Lutnick confirmed planned trade protections on copper.

Meanwhile, US inflation data came in lower than expected, easing concerns and giving the Fed more room for a less restrictive policy. However, the long-term impact of tariffs remains uncertain, with inflation risks still looming.

Key resistance stands at $2,955, with further levels at $2,980 and $3,000. Support is at $2,860, followed by $2,830 and $2,790.