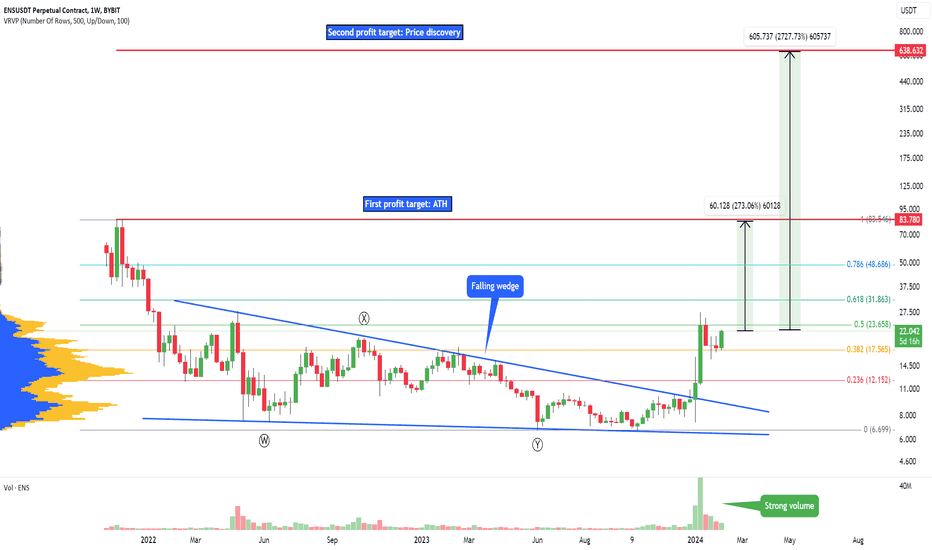

ENS can 30x - Important coin for EthereumENS looks absolutely bullish! We have a great volume on the indicator, as you can see on the chart, which confirms my bullish bias. The price recently broke out of the falling wedge reversal pattern and is now pumping. As per my Elliott Wave analysis, the corrective pattern should be completed. ENS is a very promising coin for the Ethereum Network. 30x is not impossible in 2024/2025. Let me know what you think about my analysis, and please hit boost and follow for more ideas. Trading is not hard if you have a good coach! Thank you, and I wish you successful trades.

What Is Ethereum Name Service (ENS)?

Ethereum Name Service (ENS) is a distributed, open, and extensible naming system based on the Ethereum blockchain. ENS converts human-readable Ethereum addresses like john.eth into the machine-readable alphanumeric codes you know from wallets like Metamask. The reverse conversion -- associating metadata and machine-readable addresses with human-readable Ethereum addresses -- is also possible.

The goal of Ethereum Name Service is to make the Ethereum-based web easier to access and comprehend for humans - similar to how the Internet’s Domain Name Service makes the internet more accessible. Like DNS, ENS also uses a system of dot-separated hierarchical names called domains with domain owners fully controlling their subdomains.

ENS launched with a highly successful retroactive airdrop in November 2021 that rewarded users who had registered addresses before the project launched its token. However, in February 2022, it faced criticism over apparently homophobic tweets by its director of operations.

Zigzag

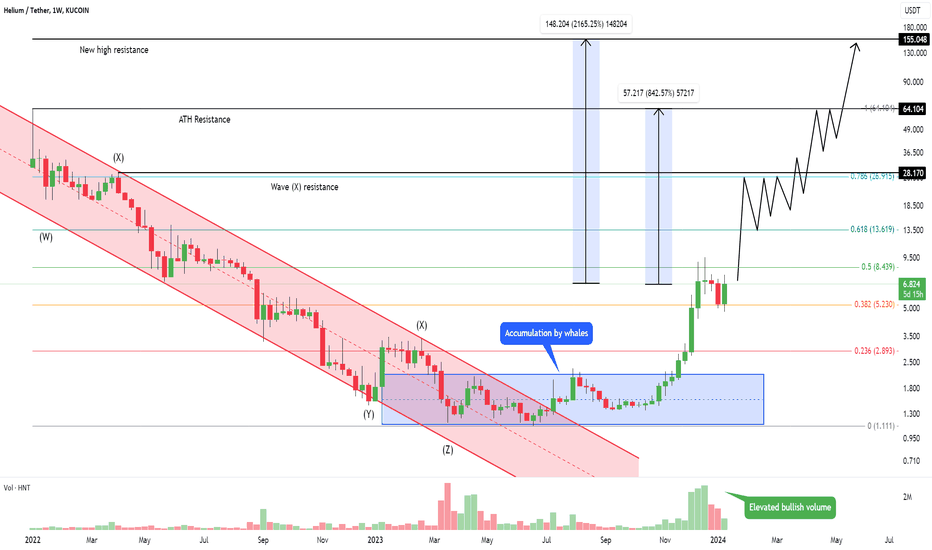

HNT is starting a huge uptrend, time to buy?We can see that HNT Is starting something very big. The downtrend ended with a descending parallel channel, and now we are in a brand new uptrend. The WXYXZ Elliott Wave corrective pattern has been completed, and we have already started a new impulse wave. What about the volume indicator? We have an elevated bullish volume, which is very important and confirms my bullish bias.

Let me know what you think about my analysis, and please hit boost and follow for more ideas. Thank you, and I wish you successful trades!

Helium aims to improve the communication capabilities of wireless Internet of Things (IoT) devices. In 2013, infrastructure around IoT was still in its infancy, but developers wanted to add decentralization to their offering, hence referring to it as “The People’s Network” in official literature.

Its core appeal will be to device owners and those interested in the IoT space, with financial incentives providing further outreach possibilities.

Network participants purchase Hotspots — a combination of a wireless gateway and a miner — or build their own. Each hotspot provides network coverage over a certain radius, and also mines Helium’s native token, HNT.

The network runs on proof-of-coverage, a new consensus algorithm based on the HoneyBadger BFT protocol which allows nodes in a network to reach consensus when connection quality is highly variable.

In addition to HNT, users pay transaction fees in a separate token called Data Credits, which are not exchangeable and tied to individual users themselves. Let me know what you think about my analysis, and please hit boost and follow for more ideas. Thank you, and I wish you successful trades!

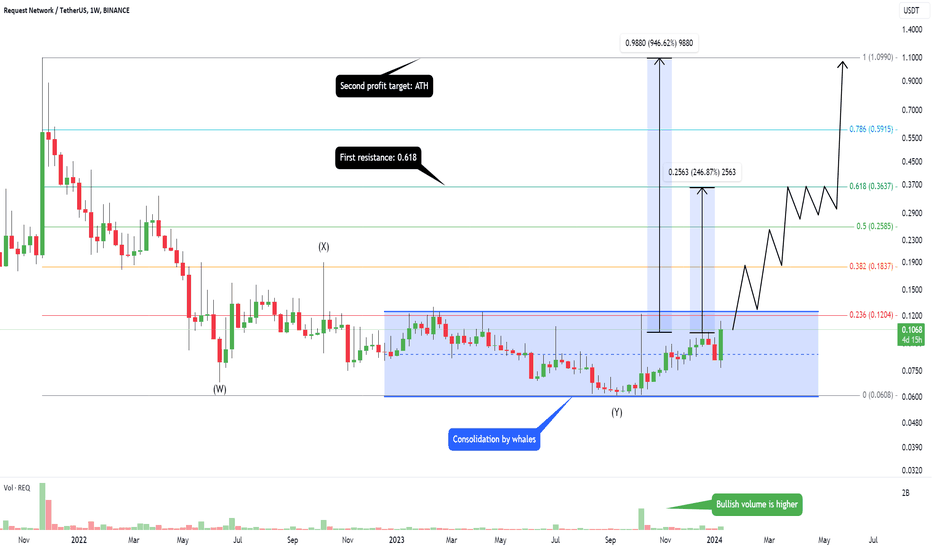

REQ can 10x in the next few weeks. Time to buy?REQ is something I want you to see. The consolidation by whales has been long, and it is time for a breakout. I want to give you some information about this coin before the pump, so you can buy it cheap. The WXY correction has been completed, so from the Elliott Wave perspective, this is a green flag. What about the volume indicator? Bullish volume is much higher, which is also good to see. Let me know what you think about my analysis, and please hit boost and follow for more ideas. Thank you, and I wish you successful trades!

The REQ token powers the Request Network open-source protocol via a few mechanisms: anti-spam; governance; staking; discounts; independency.

The Request (REQ) utility token, launched in 2017, ensures the performance and stability of the Request Network. The Request Network itself is an Ethereum-based decentralized payment system where anyone can request a payment and receive money through secure means. It removes the requirement for third parties in order to provide a cheaper, more secure payment solution that works with all global currencies.

When a user creates a request for payment, they define to which address the payment needs to be allocated and what the amount is. The user can also define the terms and conditions of the payment, upgrading a simple request into an invoice. Once this is completed, the user can share their request to be paid by their counterparty.

Every step is documented and stored on the Request network, allowing everyone involved to easily keep track of all the invoices and payments for accounting purposes.

Request is also integrated with legislation across the world to remain compliant with the trade laws of each individual country.

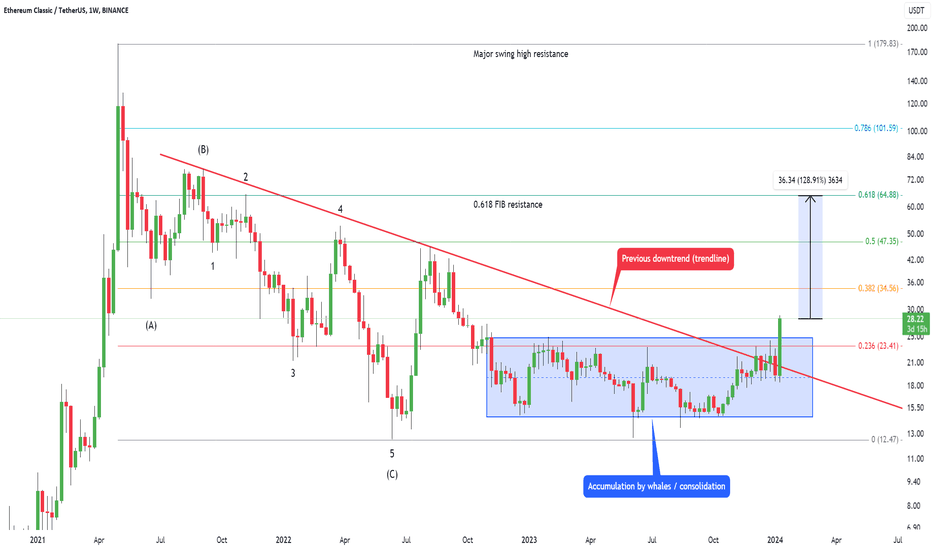

ETC is pumping. Here is why and where to take profitETC is pumping, as we can see. I want to inform you that this uptrend should continue, and another 128% is likely in the next few days / weeks. Take profit at the 0.618 FIB, which is always a strong resistance. If you think ETC is going to go much higher, you can take profit at the previous major swing high. But to me, ETC is bullish, and the downtrend has ended. We see that we had a pretty long accumulation phase by whales as well. Let me know what you think about my analysis, and please hit boost and follow for more ideas. Thank you, and I wish you successful trades!

Ethereum Classic (ETC) is a hard fork of Ethereum (ETH) that launched in July 2016. Its main function is as a smart contract network, with the ability to host and support decentralized applications (DApps). Its native token is ETC.

Since its launch, Ethereum Classic has sought to differentiate itself from Ethereum, with the two networks’ technical roadmap diverging further and further from each other with time.

Ethereum Classic first set out to preserve the integrity of the existing Ethereum blockchain after a major hacking event led to the theft of 3.6 million ETH. Let me know what you think about my analysis, and please hit boost and follow for more ideas. Thank you, and I wish you successful trades!

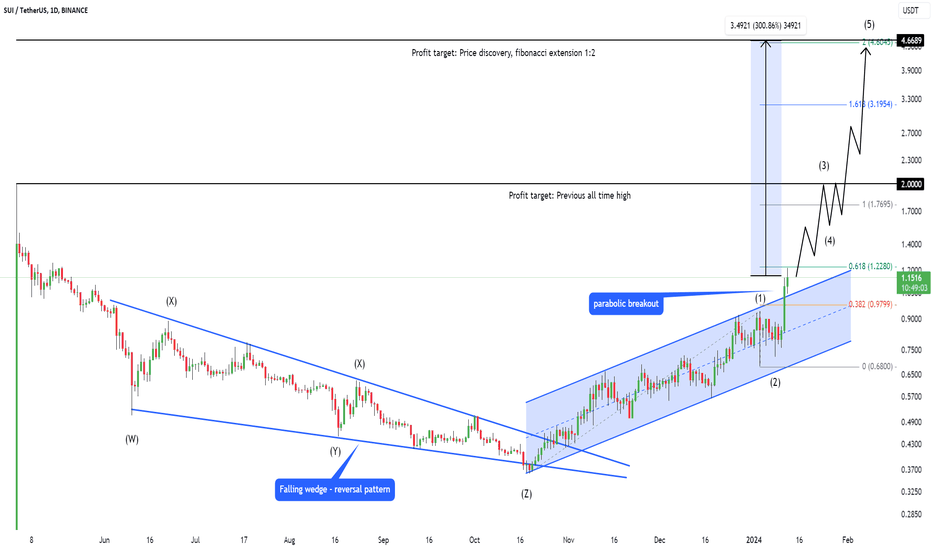

SUI is going parabolic, time to buy? Here is why yesSUI is bullish and currently going parabolic, as you can see on the chart. The price broke out of the ascending parallel channel, which was supposed to break down, not break up. This is a strong sign of strength and that the parabolic uptrend is starting. Time to buy? I think so. 300% profit in the next few weeks is not scifi. We also have a falling wedge pattern on the weekly chart, and by classic technical analysis, the profit target is at the top of the falling wedge, which is the previous ATH. Let me know what you think about my analysis, and please hit boost and follow for more ideas. Thank you, and I wish you successful trades!

What Makes Sui Unique?

Through features such as horizontal scaling, composability, sparse replay, and on-chain storage, Sui’s architecture solves pain points common to first generation blockchains.

Horizontal Scaling

On the Sui network, each group of transactions process in parallel, as opposed to the bottlenecking that occurs in some earlier blockchains due to any lack of distinction between the various objects, resources, accounts, and other components.

Composability

In Sui, unlike most other blockchains, one can directly pass an asset (such as an NFT), directly into a function argument. Sui’s object-centric approach also allows for more esoteric data structures, and the ability to store assets inside such data structures, or in an asset itself.

Sparse Replay

Naturally, a blockchain provides a ledger of every single transaction. For a Sui-specific example, game builders don’t need to track transactions interacting with unrelated dApps. Because querying on-chain data can be expensive, products on Sui will be able to follow the evolution of the objects in this game, without digging out the data from the Merkle tree.

On-Chain Storage

Because assets are directly stored as objects on the Sui blockchain, they are never subject to Merkle tree indexing. Storing assets directly on-chain is used in tandem with conventional means, such as IPFS, to scale the problem of on-chain storage, as it is much cheaper to directly update assets on-chain. Let me know what you think about my analysis, and please hit boost and follow for more ideas. Thank you, and I wish you successful trades!

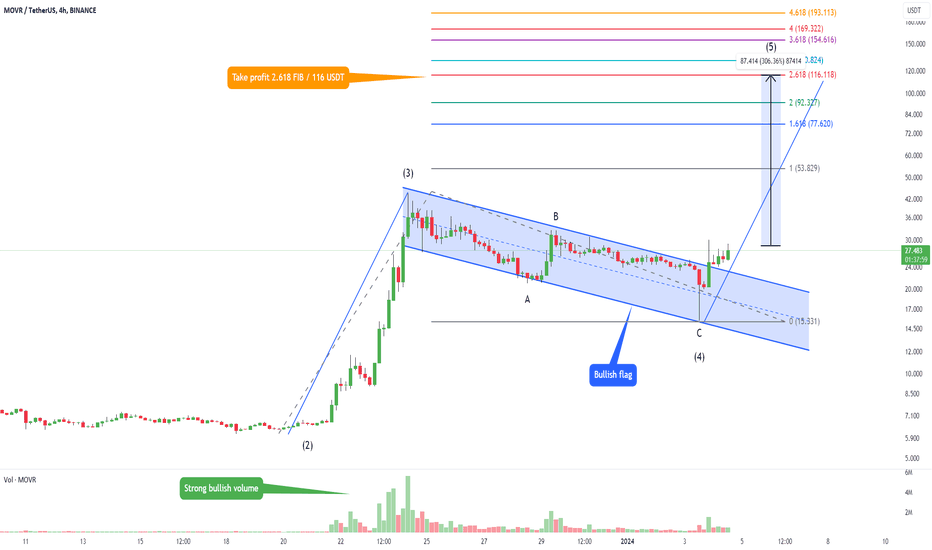

MOVR is forming a bullish flag, 306% profitMOVR is a very hot coin at this moment and is forming this bullish flag. It is a very bullish pattern with a potential profit of 306%. Take the poll of the flag and move it to the end of the bull flag; this is how you find out the profit target. Or you can use the Fibonacci extension tool to find the profit target another way. I prefer both of these scenarios. What you want to do is trade hot coins, not dead coins, and MOVR is definitely one of the top gainers at this moment. Let me know what you think about it, and please hit boost and follow for more ideas. Thank you, and I wish you successful trades.

GOLD → When will the price come out of consolidation?OANDA:XAUUSD closed the trading session with a bearish candlestick on Friday. The asset loses 0.8% for the week, but at the same time it continues to stay inside the range between the strong boundaries of 2067 and 2010.

Pic: Uptrend in the market. Price is testing trend support

The dollar continues to strengthen, testing support as part of the correction and apparently preparing for further growth, which may temporarily have a negative impact on gold. But, if you look closely, technically, gold, on the background of increased interest feels quite confident and the market is trying not to succumb to strong manipulations on the part of the growing dollar.

On Friday XAU is testing the ascending support again, the session closes below the line, but it is a weak signal within the flat. The 2015 level may influence the sales, but only if this area is broken. At the moment, there are no signs that the market will break 2015.6 in the near future. We need to wait for the retest of this support and see how the price reacts. But based on the fact that 2015.6 is a strong liquidity area, gold will not be able to break this area the first time.

Pic: Gold range on H1-H4

The chart above shows the current range. The price has not yet managed to update the local lows, as well as the highs, as evidenced by the neutrality of forces between buyers and sellers. Against the background of the local situation: dollar growth, negative fundamental background for gold, we can determine that in the coming week gold may test flat support before further rebound (or false breakdown), after which the price may continue trading within this range.

The reason for continued consolidation: there is no strong news in the market, the dollar continues to rise as the Fed is not looking to cut rates anytime soon, but buyers are actively trying to contain the declines in gold. The interest in gold is also affected by the interest of the world central banks, as well as the geopolitical crisis, as well as rumors of a banking crisis in the United States.

Regards R. Linda!

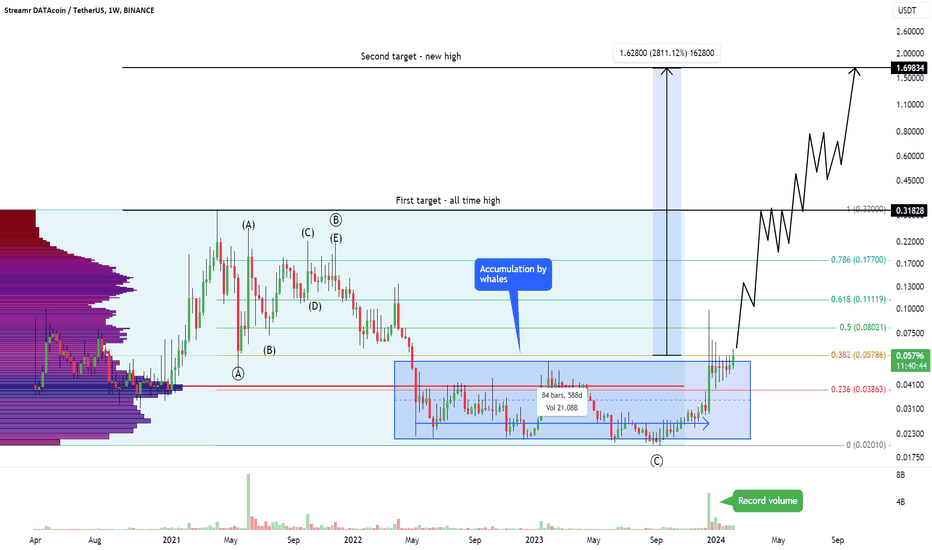

DATA (Streamr) is ready for a massive pump (2811%)DATA is starting something really huge. We can see that whales accumulated for a long time and now the price is breaking out of the accumulation phase. If we take a look at the volume indicator, we can see that the volume is astonishing. This definitely confirm our bullish bias. 2811% profit is not a sci-fi, but a real deal. Elliott Wave ABC corrective pattern is complete. Let me know what you think about my analysis, and please hit boost and follow for more ideas. Thank you, and I wish you successful trades!

Streamr (DATA) is a project focused on seamless data exchange and monetization of this data. It’s a peer-to-peer (P2P) network for real-time data that runs on Ethereum, allowing smart contracts to be used to facilitate the exchange process.

Broker nodes are the key element of the network, which work as follows: data is received from providers (also called publishers) and transmitted to consumers – this is the publish/subscribe pattern that the network uses. Sponsors (which may be publishers) pay DATA tokens into a smart contract (called a Bounty) to secure the operation of the stream. The data stream is secured by broker nodes mining Bounties, and relayed to subscribers through publisher or broker nodes (data streams are segmented).

A number of technologies that have been developed to optimize Streamr are a hierarchically organized complex called the Streamr Stack. This complex supports uninterrupted data transmission in the Streamr network and consists of five blocks: smart contracts (responsible for optimizing relations between participants in the network's information market); streamr editor (a set of programming tools developed for the purpose of the project); streamr engine (responsible for analyzing, processing, refining data and monitoring network events); data market (a center for data streams and a platform where data is transmitted and received); streamr network (used to transfer data). Let me know what you think about my analysis, and please hit boost and follow for more ideas. Thank you, and I wish you successful trades!

OM can 12x in a few weeks. Buy now?Technical analysis

Since my last technical analysis on OM, this coin made 190%. I believe this trend will continue in the next few weeks and month and soon we will hit a new all time high. We can see that the volume is extremely strong and whales are buying. There is absolutely no sign of weakness at this moment and the price action looks absolutely unstoppable.

Let me know what you think about my analysis, and please hit boost and follow for more ideas. Trading is not hard if you have a good coach! Thank you, and I wish you successful trades.

About MANTRA

MANTRA is on a mission to build the world’s preeminent and most-trusted decentralized finance ecosystem by bringing security, compliance and democratized access to DeFi. Through its flagship projects including MANTRA Finance and MANTRA Chain, MANTRA addresses key challenges that have held back institutional adoption of DeFi.

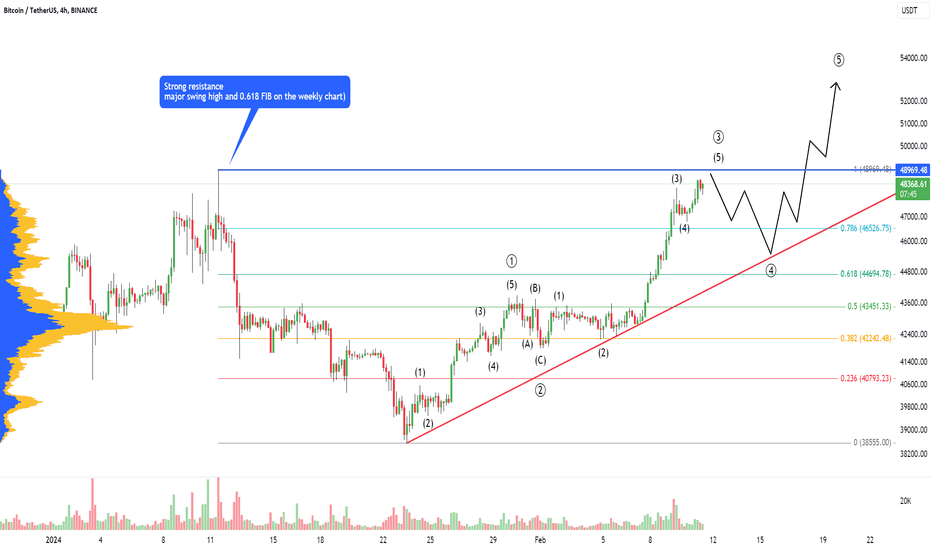

Bitcoin - Elliott wave technical analysisTechnical analysis

This is my bitcoin Elliott Wave technical analysis. Currently, Bitcoin is very bullish, but the market always moves in waves, so we can expect some pullback on the way to the new all-time high. My Elliott Wave primary count suggests that we are currently in wave (3), and soon we should start a corrective ABC pattern back to 45,600 or to the upward trending trendline. The price is approaching the previous swing high on the daily chart, which is at 48950. This is the major resistance not only because of this swing high but also because of the 0.618 FIB retracement on the weekly chart (previous bear market).

Let me know what you think about my analysis, and please hit boost and follow for more ideas. Trading is not hard if you have a good coach! Thank you, and I wish you successful trades.

Fundamental analysis

Bitcoin Energy Consumption

Over the past few decades, consumers have become more curious about their energy consumption and personal effects on climate change. When news stories started swirling regarding the possible negative effects of Bitcoin’s energy consumption, many became concerned about Bitcoin and criticized this energy usage. A report found that each Bitcoin transaction takes 1,173 KW hours of electricity, which can “power the typical American home for six weeks.” Another report calculates that the energy required by Bitcoin annually is more than the annual hourly energy usage of Finland, a country with a population of 5.5 million.

The news has produced commentary from tech entrepreneurs to environmental activists to political leaders alike. In May 2021, Tesla CEO Elon Musk even stated that Tesla would no longer accept the cryptocurrency as payment, due to his concern regarding its environmental footprint. Though many of these individuals have condemned this issue and move on, some have prompted solutions: how do we make Bitcoin more energy efficient? Others have simply taken the defensive position, stating that the Bitcoin energy problem may be exaggerated.

At present, miners are heavily reliant on renewable energy sources, with estimates suggesting that Bitcoin’s use of renewable energy may span anywhere from 40-75%. However, to this point, critics claim that increasing Bitcoin’s renewable energy usage will take away from solar sources powering other sectors and industries like hospitals, factories or homes. The Bitcoin mining community also attests that the expansion of mining can help lead to the construction of new solar and wind farms in the future.

Furthermore, some who defend Bitcoin argue that the gold and banking sector — individually — consume twice the amount of energy as Bitcoin, making the criticism of Bitcoin’s energy consumption a nonstarter. Moreover, the energy consumption of Bitcoin can easily be tracked and traced, which the same cannot be said of the other two sectors. Those who defend Bitcoin also note that the complex validation process creates a more secure transaction system, which justifies the energy usage.

Another point that Bitcoin proponents make is that the energy usage required by Bitcoin is all-inclusive such that it encompasess the process of creating, securing, using and transporting Bitcoin. Whereas with other financial sectors, this is not the case. For example, when calculating the carbon footprint of a payment processing system like Visa, they fail to calculate the energy required to print money or power ATMs, or smartphones, bank branches, security vehicles, among other components in the payment processing and banking supply chain.

What exactly are governments and nonprofits doing to reduce Bitcoin energy consumption? Earlier this year in the U.S., a congressional hearing was held on the topic where politicians and tech figures discussed the future of crypto mining in the U.S, specifically highlighting their concerns regarding fossil fuel consumption. Leaders also discussed the current debate surrounding the coal-to-crypto trend, particularly regarding the number of coal plants in New York and Pennsylvania that are in the process of being repurposed into mining farms.

Aside from congressional hearings, there are private sector crypto initiatives dedicated to solving environmental issues such as the Crypto Climate Accord and Bitcoin Mining Council. In fact, the Crypto Climate Accord proposes a plan to eliminate all greenhouse gas emissions by 2040, And, due to the innovative potential of Bitcoin, it is reasonable to believe that such grand plans may be achieved.

Let me know what you think about my analysis, and please hit boost and follow for more ideas. Trading is not hard if you have a good coach! Thank you, and I wish you successful trades.

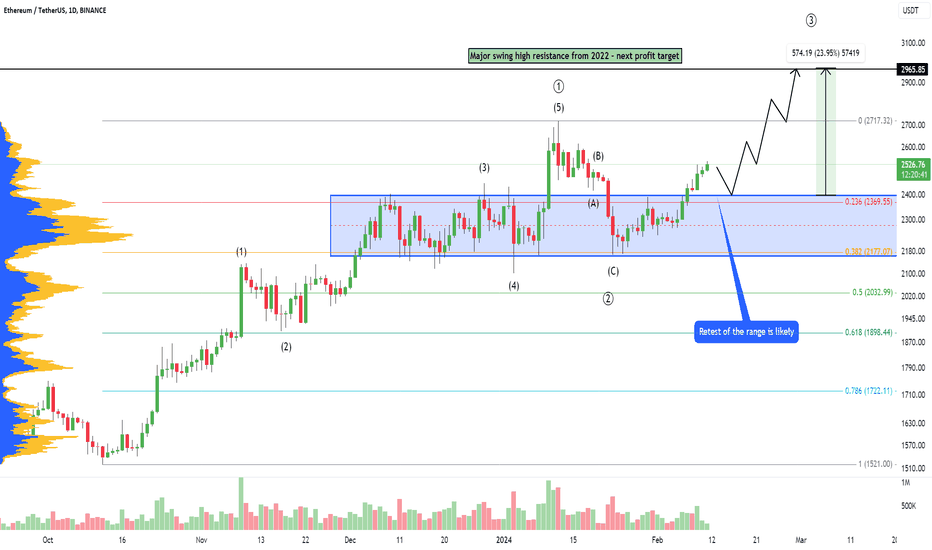

ETH: Buy here for the long-termTechnical analysis

Ethereum is very bullish, the price went above the trading range, which is a strong sign of strength. We want to wait for a retest of the trading range, do not FOMO in. Make sure your entry price is good! We can see that the ABC correction has been completed and we have already started a new impulse wave. This is my quick update on ETH.

Let me know what you think about my analysis, and please hit boost and follow for more ideas. Trading is not hard if you have a good coach! Thank you, and I wish you successful trades.

Fundamental analysis

What Makes Ethereum Unique?

Ethereum has pioneered the concept of a blockchain smart contract platform. Smart contracts are computer programs that automatically execute the actions necessary to fulfill an agreement between several parties on the internet. They were designed to reduce the need for trusted intermediates between contractors, thus reducing transaction costs while also increasing transaction reliability.

Ethereum’s principal innovation was designing a platform that allowed it to execute smart contracts using the blockchain, which further reinforces the already existing benefits of smart contract technology. Ethereum’s blockchain was designed, according to co-founder Gavin Wood, as a sort of “one computer for the entire planet,” theoretically able to make any program more robust, censorship-resistant and less prone to fraud by running it on a globally distributed network of public nodes.

In addition to smart contracts, Ethereum’s blockchain is able to host other cryptocurrencies, called “tokens,” through the use of its ERC-20 compatibility standard. In fact, this has been the most common use for the ETH platform so far: to date, more than 280,000 ERC-20-compliant tokens have been launched. Over 40 of these make the top-100 cryptocurrencies by market capitalization, for example, USDT, LINK and BNB. Since the emergence of Play2Earn games, there has been a substantial increase in interest in the ETH to PHP price.

Let me know what you think about my analysis, and please hit boost and follow for more ideas. Trading is not hard if you have a good coach! Thank you, and I wish you successful trades.

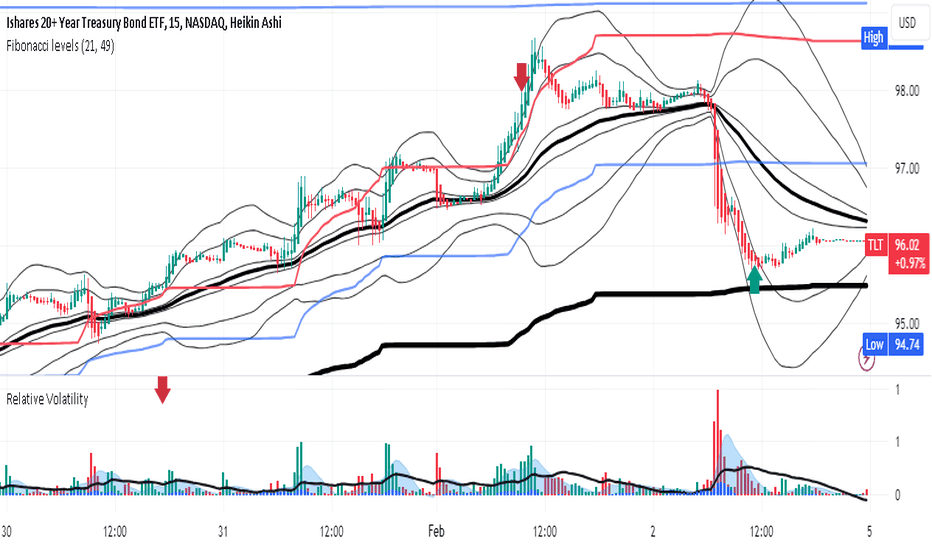

TLT Long at VWAP Bounce T- Bills 20 yearsTLT on the 15 minute chart in the past two trading sessions consolidated and then fell into

a pullback to the support of the anchored mean VWAP. Relative volatility spiked and has

now contracted. I see this as a good entry to add to my TLT position having sold a good portion

of it three trading days ago when price showed topping wicks outside the fibonacci highest

band. This will be about $ 1.00 cheaper than before that sale and is part of a zig-zag

strategy for TLT overall.

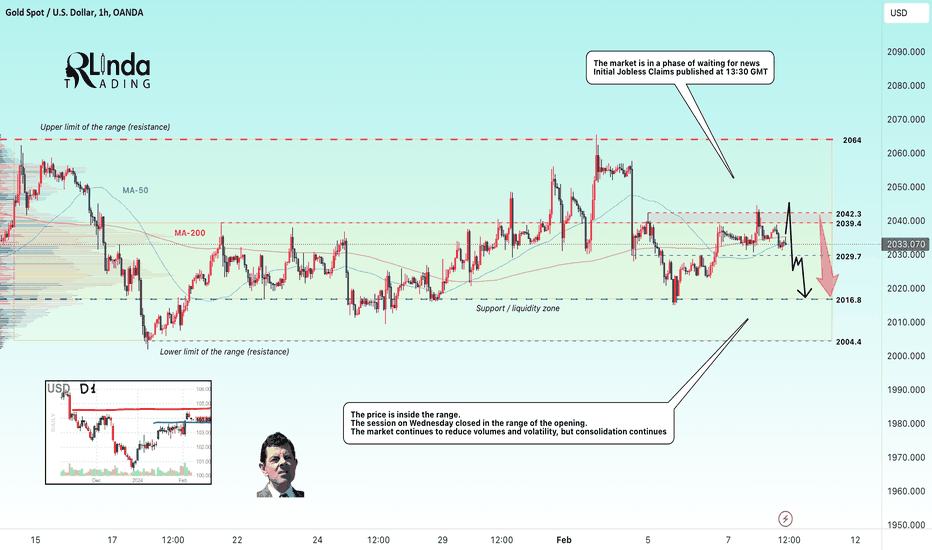

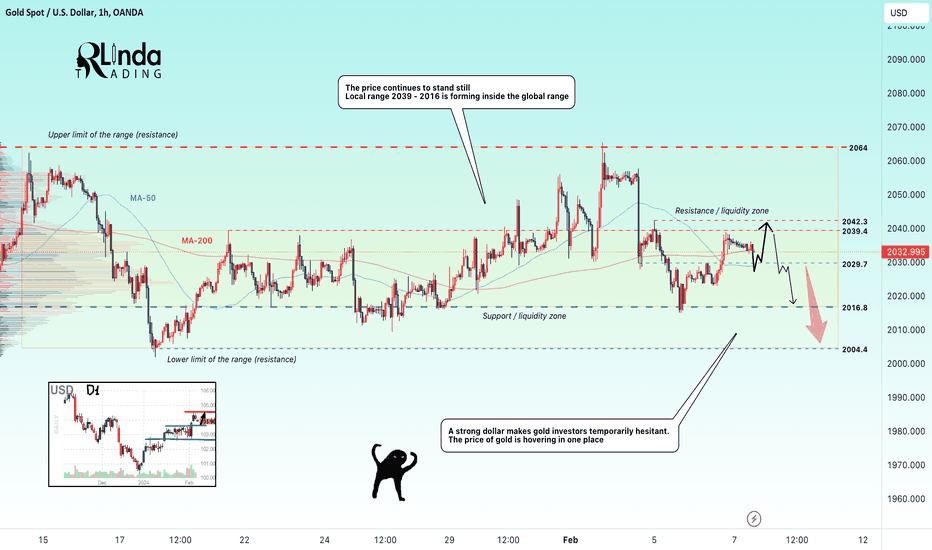

GOLD → The calm (consolidation) before the storm ⚡︎OANDA:XAUUSD closes Wednesday's session with a minimal range of motion. The market is getting tighter and tighter every day, volatility as well as volumes are decreasing. The calm before the storm.

Today, at 13:30 Initial Jobless Claims are published, at this time the dollar in the correction phase is testing the consolidation area and in all likelihood may strengthen if the market supports the index.

Gold makes a false break of the resistance area 2039-2042 and forms a consolidation in a narrow range in the phase of waiting for news. Technically, the market continues to stand still. On D1 there is a global flat, but the borders of a symmetrical triangle are present, volatility is decreasing and the range is narrowing. It is interesting that trading volumes are decreasing, but the profile shows a different situation. The market is consolidating liquidity, because at the moment investors do not know what to expect and in the medium term they are aiming to hear some news about the interest rate reduction. Such consolidation may continue until March-April. But the distribution in one side or the other will be very strong, but when it will happen, nobody knows yet :)

Resistance levels: 2039, 2042, 2048

Support levels: 2029, 2016, 2004

There is a chance to see bullish news for the dollar today, which could negatively, within a range, affect gold. But, before a possible fall, the price of the metal may test the resistance

TVC:DXY TVC:GOLD COMEX:GC1! COMEX_MINI:MGC1!

Regards R. Linda!

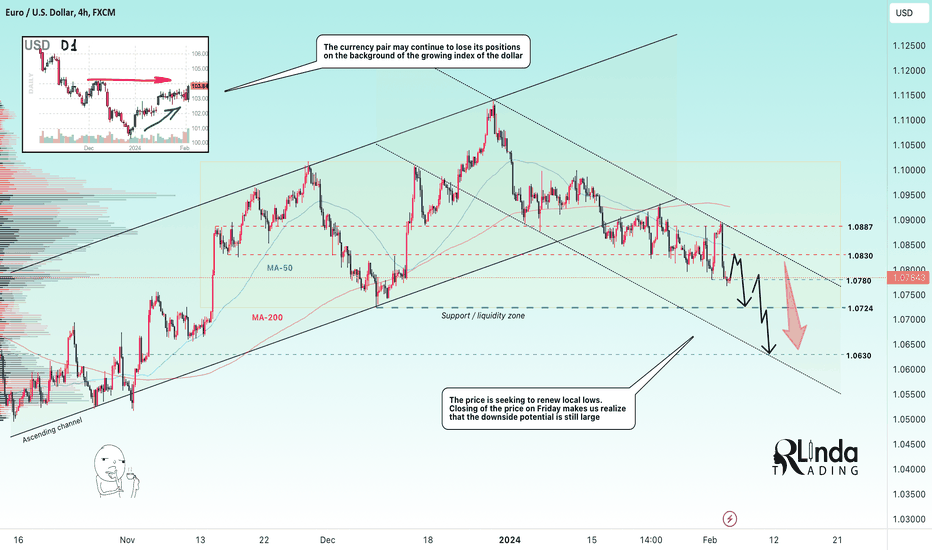

EURUSD → How long will the bearish trend continue?FX:EURUSD tested downtrend resistance earlier, bears are keeping the price down and forming a tight stance amid a strengthening TVC:DXY .

On the high timeframe we see the current bearish trend, within which the price movement will continue until more favorable times. The target in the medium term may become the area of 1.06300 - 1.0450

On H4 we are interested in the support at 1.0780. Since this is a local risk area for sellers, a strong downward impulse may be formed if this area is broken and the price consolidates below it. But, no less important level is 1.0724 from which a rebound may follow, as it is the lower boundary of the range. But another retest of this zone may lead to a breakout and further decline.

Resistance levels: 1.0830, 1.0887

Support levels: 1.0780, 1.0724

In the long term, with a negative fundamental background and bearish trend, the price may continue its decline to the above targets.

Regards R. Linda!

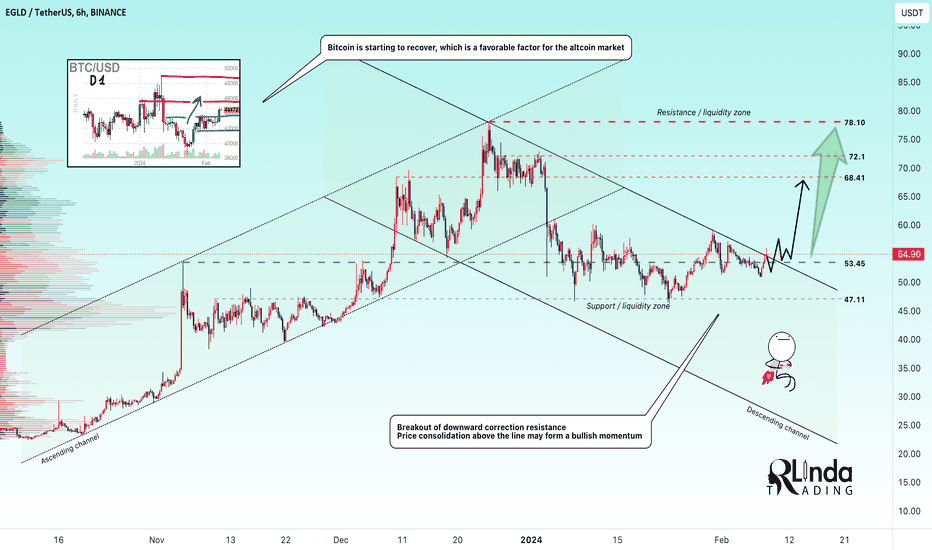

EGLDUSDT → Growth may resume after the correction stopsBINANCE:EGLDUSDT is trying to finish the technical phase of correction and continue the global uptrend amid the realization of 2-year accumulation.

Since the middle of last year, the coin was in hibernation, or rather in the consolidation phase. Formed a bottom, a narrow corridor allowed the formation of a strong support area. On the background of cryptocurrency market recovery, the growth of the flagship - bitcoin, EGLD revives, but at the same time forms trend resistance. On D2 the resistance is broken and for a few weeks the price forms a consolidation above the line, on H6 it is a descending range (correction).

On the main chart we see an attempt by price to break the correction resistance. Consolidation of price above 53.45 will form a bullish potential that could resume the uptrend.

Support levels: 53.45, 51.4, 47.11

Resistance levels: 60.1, 68.48

I expect the continuation of the global trend, but for this the bulls need to finish the correction phase, which is within the current descending channel. A breakout of the resistance and consolidation above this level will be a good signal

BINANCE:BTCUSD CRYPTOCAP:TOTAL

Regards R. Linda!

GOLD → Trading intra-range.. The price continues to stand stillFOREXCOM:XAUUSD has simply been standing still for months now. At least on D1 the range is narrowing and this could lead to something in the medium term.

The dollar is forming a correction after a false breakdown. Fundamentally, the index is strong and continues to be supported by US regulators. At 19:00 GMT Bowman FOMC speaks, it is worth paying attention to his comments.

Gold at 1 is still in a range. It is quite difficult to anchor an entry point to something because there are no safe zones to open orders inside such consolidation. The good news is that the range is narrowing and the denouement of the situation is approaching.

On H1, the price is inside the local range 2039 - 2016 and gold can continue trading inside this consolidation for quite a long time. The resistance was tested earlier, a retest is possible, but on a negative fundamental background and a strong dollar, gold may decline a bit.

Resistance levels: 2039, 2042, 2057

Support levels: 2029, 2016, 2004

A retest of the resistance is possible before a further decline within a range trading strategy. It is worth paying attention to the range 2039 - 2029. Breakout of the boundary and price consolidation above resistance or below support will form a signal for price movement in the corresponding direction.

COMEX:GC1! TVC:GOLD COMEX_MINI:MGC1! TVC:DXY

Regards R. Linda!