ZK/USDT — Testing Long-Term Downtrend: Breakout or Rejection at?Summary

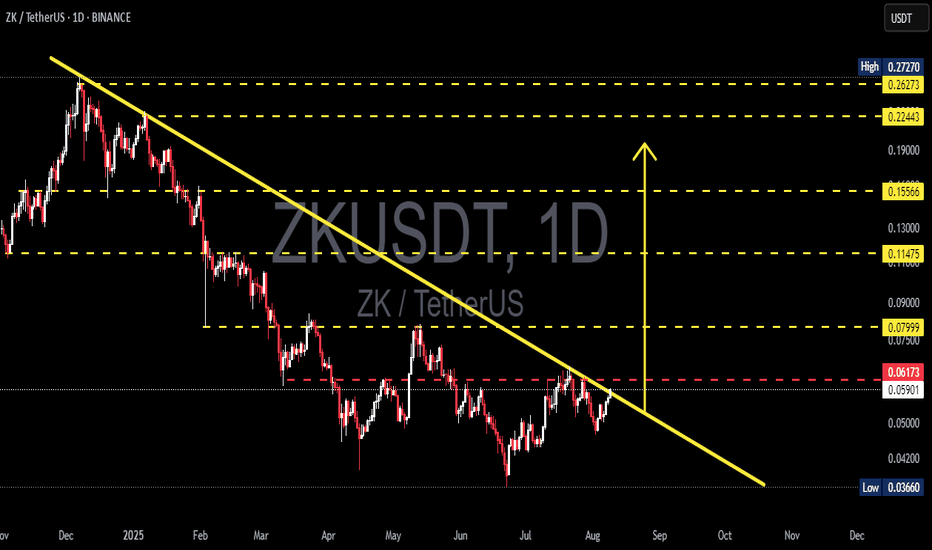

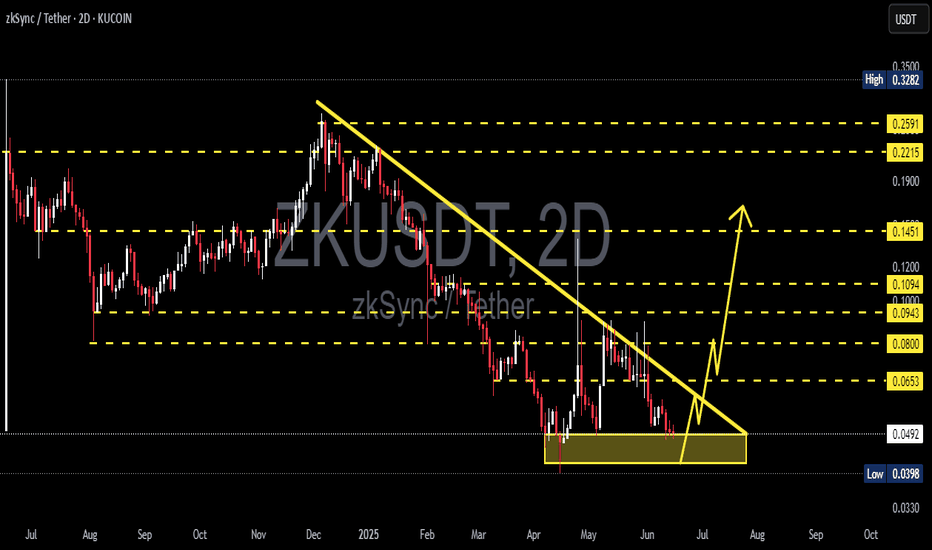

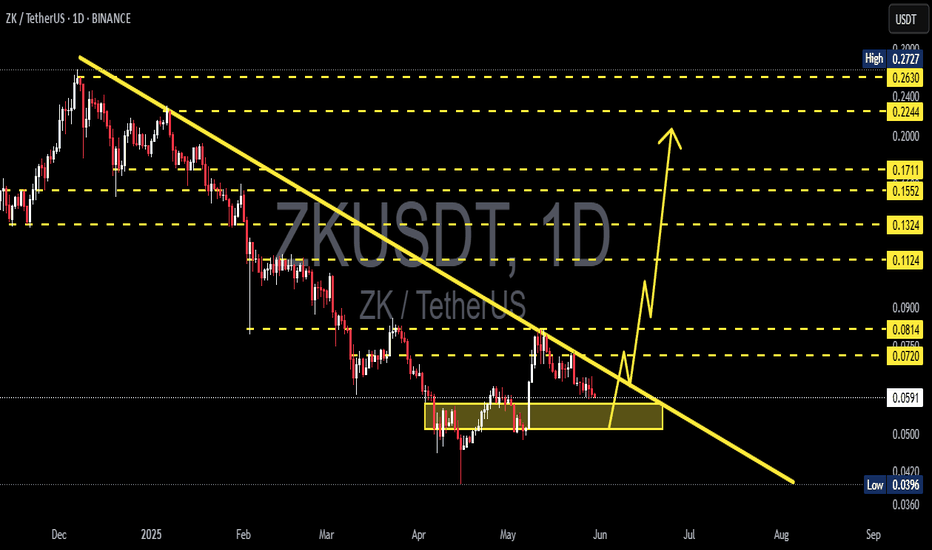

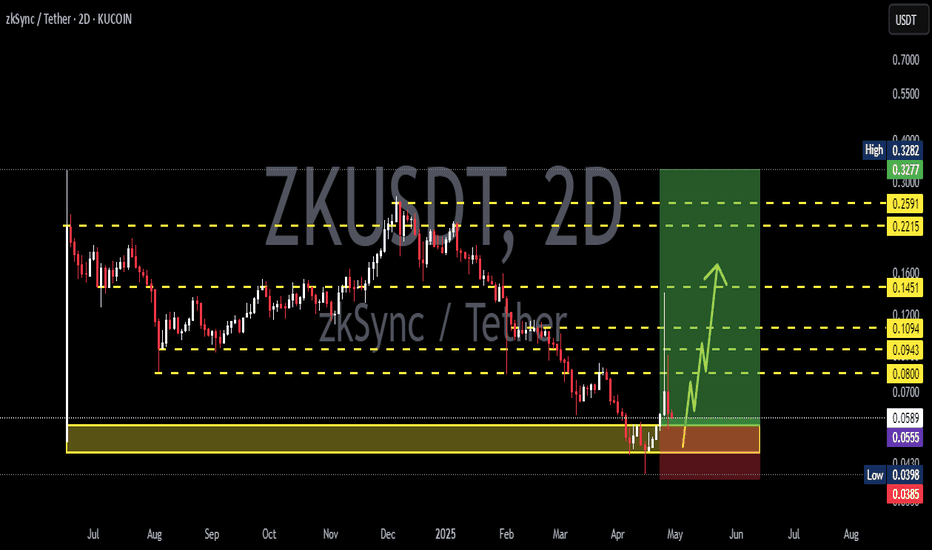

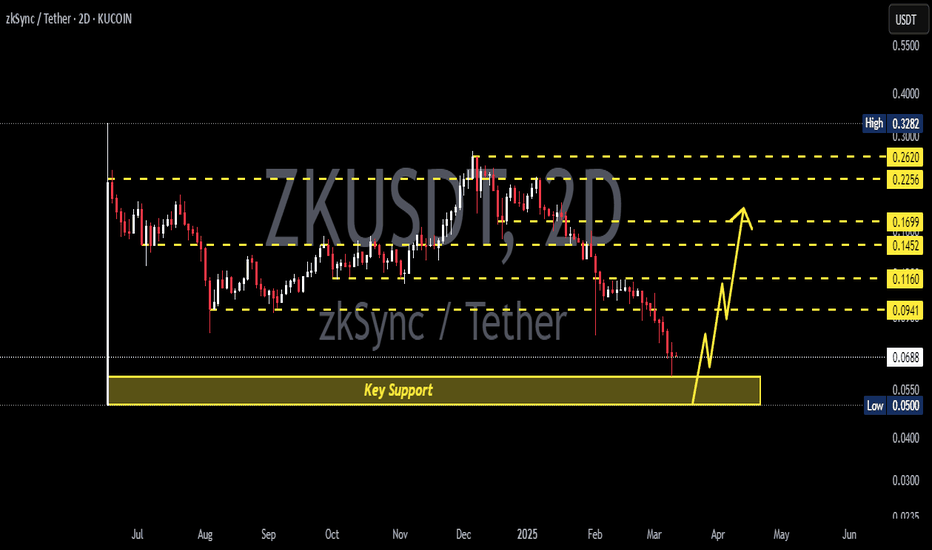

The daily chart shows a clear long-term downtrend from the previous highs — the descending trendline (yellow) has been capping price action, forming a sequence of lower highs and lower lows. Currently, price is hovering around 0.0591 USDT, testing both the trendline resistance and a key horizontal resistance at ~0.06173 (red dashed). Since the low at ~0.0366 (June), the market has been slowly forming higher lows, suggesting potential accumulation, but the main downtrend structure is still intact until a confirmed breakout occurs.

---

Pattern Overview

Descending trendline (yellow) = downtrend structure remains valid until a daily close above it.

Accumulation signs from the 0.0366 low → forming several higher lows.

Key resistance: 0.06173 (decision zone).

Next resistances (yellow dashed): 0.07999 → 0.11475 → 0.15566 → 0.22443 → 0.26273 → 0.27270.

Key support: ~0.042 (intermediate) → structural low at 0.03660.

---

Bullish Scenario (confirmation needed)

1. Breakout confirmation: A daily close above the descending trendline and above 0.0617 with stronger-than-average volume.

2. Post-breakout behavior: Potential retest of the broken trendline as support — a conservative entry point.

3. Upside targets:

Target 1: 0.07999 (~+29% from 0.06173; ~+35% from current price 0.05907)

Target 2: 0.11475 (~+86% from 0.06173)

Extended targets: 0.15566 → 0.22443 → 0.26273 → 0.27270

4. Risk management: Initial stop-loss under retest zone or, for aggressive entries, just below breakout candle’s low.

---

Bearish Scenario (rejection/failure)

1. Rejection at 0.0617 / trendline: If price fails to break and closes bearish with upper wicks, a pullback toward support is likely.

2. Support watch: ~0.042 (intermediate) → 0.03660 (structural low).

Downside from 0.0617: ~−29% to 0.042, ~−38% to 0.0366.

3. Further risk: A daily close below 0.0366 could trigger continuation of the major downtrend.

---

Key Levels (Quick View)

Current: 0.05907

Breakout trigger: 0.06173

Targets: 0.07999, 0.11475, 0.15566, 0.22443, 0.26273, 0.27270

Supports: ~0.042 → 0.03660

#ZK #ZKUSDT #Crypto #Altcoin #TechnicalAnalysis #TA #Trendline #Breakout #PriceAction

ZKUSDC

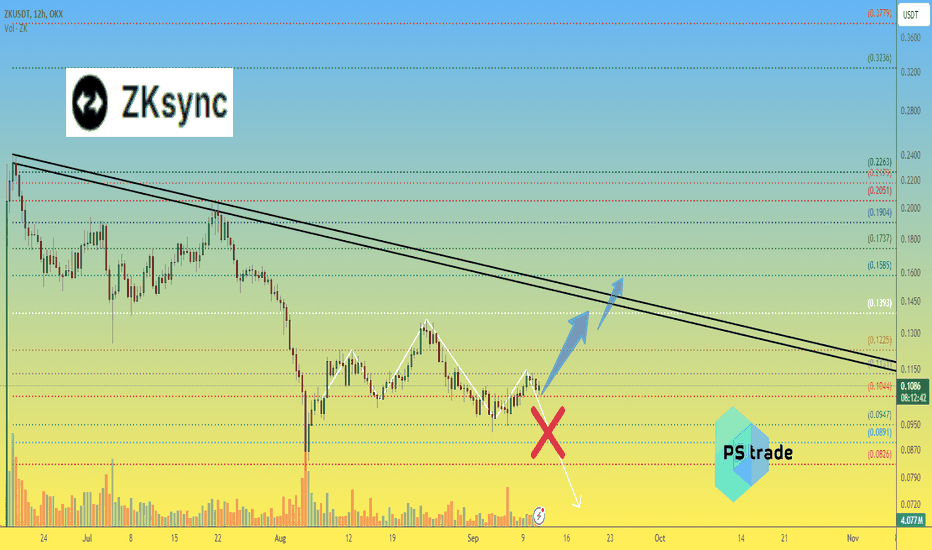

ZKsync ZK price will surprise ?If someone trying to see the Head and Shoulders on the OKX:ZKUSDT chart and tries to short this asset, they will most likely be “punished”

1️⃣ Well, first of all, the "H&S" is a figure of a global trend reversal, not a local one.

2️⃣ And secondly, in our opinion, #ZK is holding quite well and the chance to see $0.14, and if you're lucky, $0.16, is much higher than fall to a new low.

DYOR

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

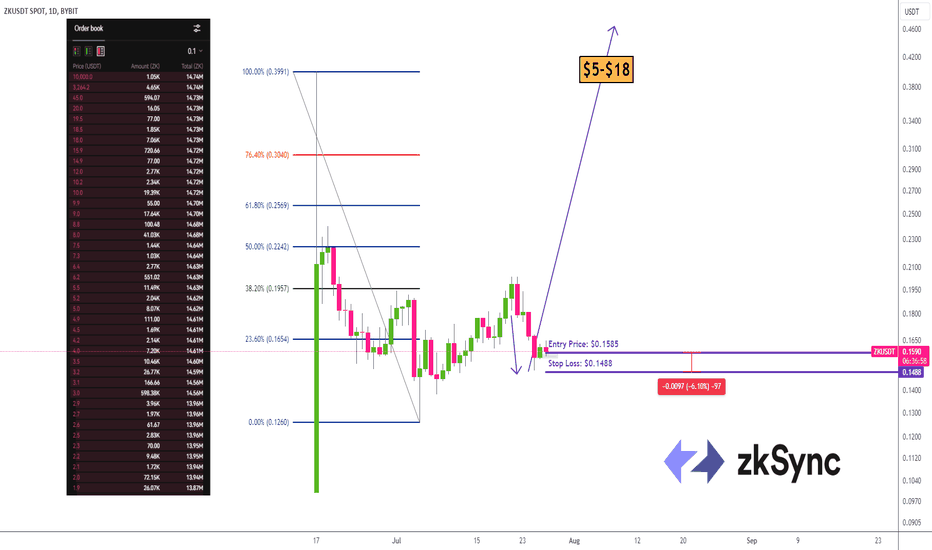

Great Entry Point for zkSyncHello everyone, a good entry point has formed for zkSync. Bitcoin has almost broken $70,000, and you can try going long with a potential rise to the $5-$18 range.

Overall, if Bitcoin continues its rise to $70k-$100k, all cryptocurrencies will follow, with some showing stronger growth and others weaker. May the force be with us.

#zkSync #ethereum #zk

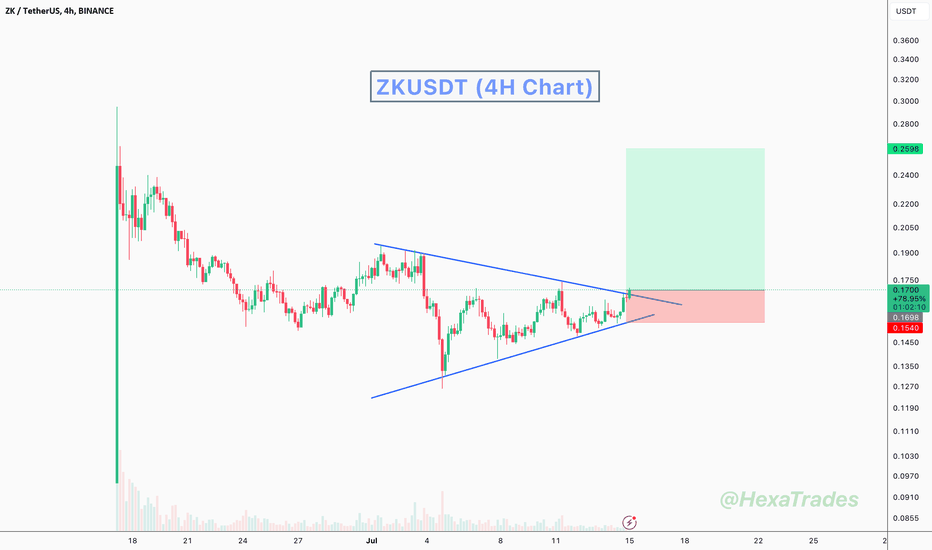

ZKUSDT Triangle Pattern!ZKUSDT technical analysis update

ZK has formed a triangle pattern, and the price is breaking the triangle resistance on the 4-hour chart. If the 4-hour candle closes above the resistance, we can expect a good upward move in ZK.

Buy zone : Below $0.17

Stop loss : $0.154

Regards

Hexa

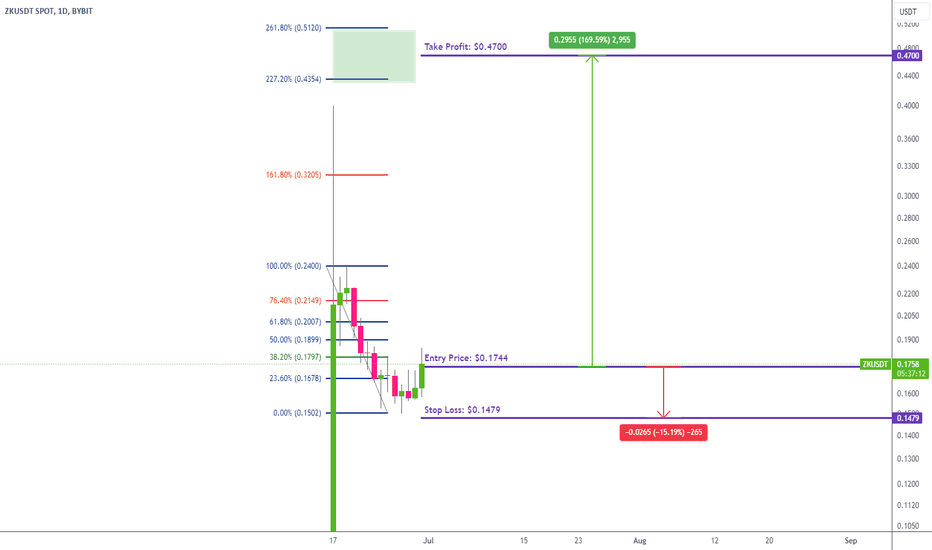

zkSync Entry price: $0.1744(ZK/USDT) (June 30, 2024) (#zkSync #Spot)

Layer Zero has started to grow, and ZK is also showing growth. This formation resembles what happened with Notcoin.

zkSync (ZK) — zkSync is a Layer-2 protocol that scales Ethereum with cutting-edge ZK tech. Our mission is not only to merely increase Ethereum's throughput, but to fully preserve its foundational values – freedom, self-sovereignty, decentralization – at scale.

🕵️ Investors (Tier 1,2):

Union Square Ventures, a16z, 1kx, Variant Fund, Blockchain Capital, Lightspeed Venture Partners, Dragonfly Capital, Coinbase Ventures, Ethereum Foundation.

dropstab.com

cryptorank.io

🟢 Entry price: $0.1744

🟢 Take Profit: $0.4700

🔴 Stop Loss: $0.1479

• Spot Market without leverage.

• Trade risk set at 50% of the deposit.