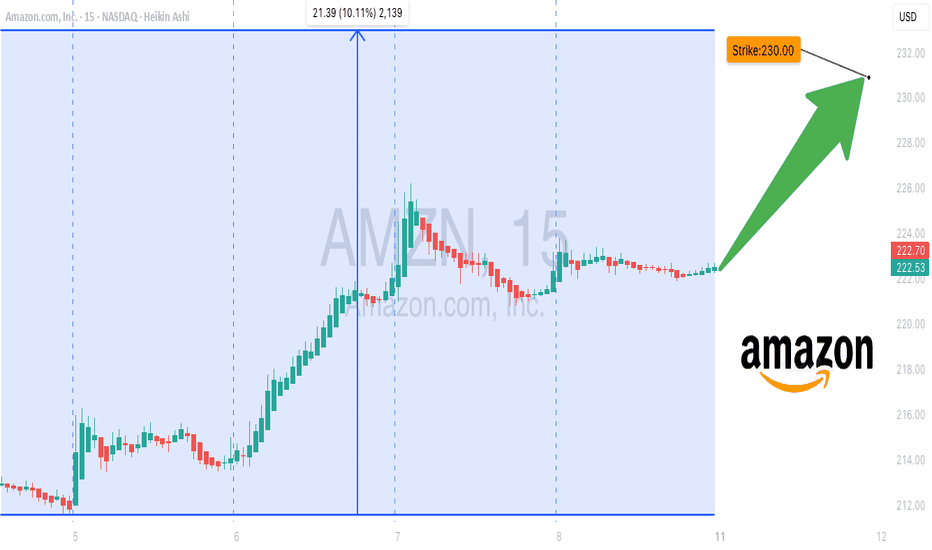

AMZN AMZN Bullish Setup --Don’t Miss Out🚀 AMZN Weekly Call Play — Riding the Bullish Flow**

Amazon (AMZN) shows strong institutional bullish flow with a **Call/Put ratio of 2.09**, backed by favorable RSI trends and low volatility conditions. While volume is weaker than last week, momentum and options flow point toward upside potential into next week.

**🛠 Trade Setup:**

* **Instrument:** AMZN

* **Direction:** CALL (LONG)

* **Strike:** \$230.00

* **Expiry:** 2025-08-15

* **Entry Price:** \$0.63

* **Profit Target:** \$1.26 (100% gain)

* **Stop Loss:** \$0.38

* **Size:** 1 contract

* **Entry Timing:** Market open

* **Confidence:** 65%

**📊 Key Factors:**

* Call/Put ratio: **2.09** — strong bullish options flow

* Daily RSI: 49.0, Weekly RSI: 58.3 — uptrend confirmation

* Low VIX (\~15.88) — supportive for directional plays

* Potential resistance at \$226–\$230

**⚠ Risks:**

* Weak weekly volume (0.8x prior week) may reduce conviction

* Broader market weakness could cap gains

---

**#AMZN #OptionsTrading #CallOptions #WeeklyOptions #BullishSetup #TechnicalAnalysis #TradingView #OptionsFlow #LowVIX #SwingTrade #MarketMomentum**