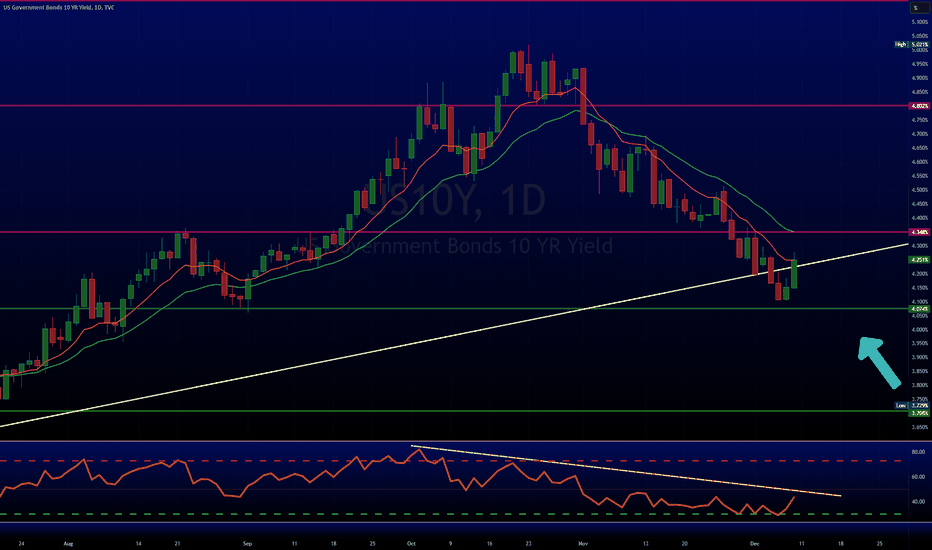

BRR pattern points to a true Santa rally for bonds. A rare chart pattern second in predictive power to only the famous head and shoulders is the Bump and Run Reversal (BRR) technical pattern.

school.stockcharts.com

If it is so powerful, why is it so unheard of?

1) They are rare. But a recent BRR of very high consequence is the 2022 DXY chart.

2) They usually only occur on high time frames as they measure manias and blow off tops, or in the inverse, manic selling followed by a return to normal.

3) They are hard to chart

4) They give predictive power in terms of time, not in terms of a "measured move" of price, but in the other dimension time.

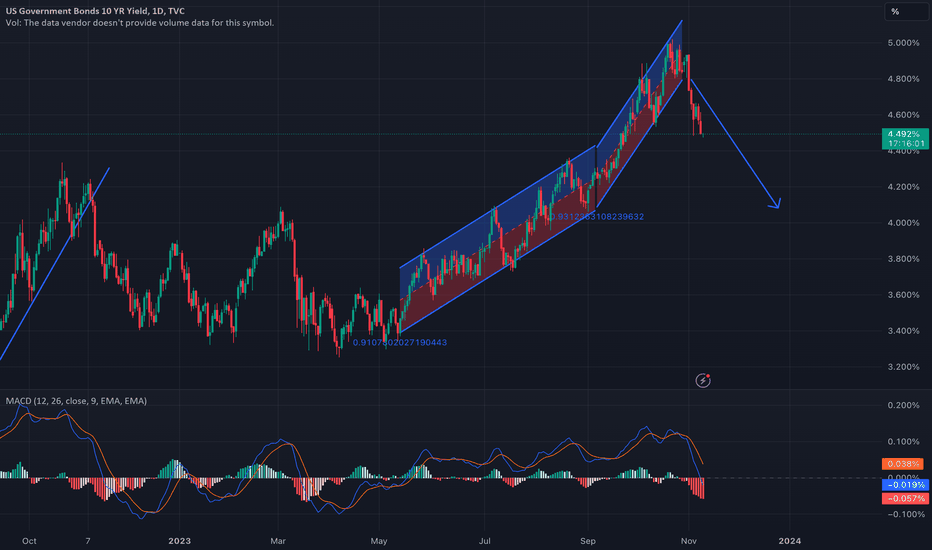

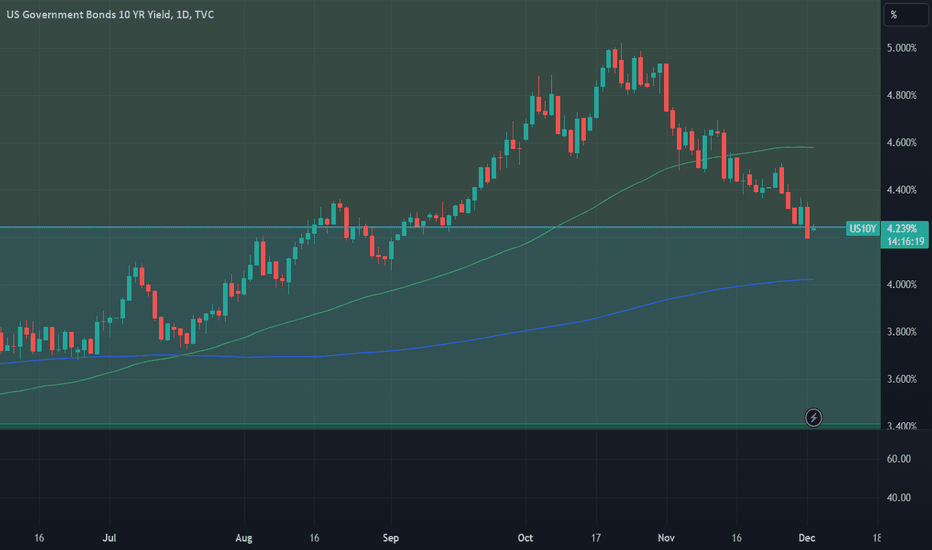

This chart shows a clear BRR reversal, 55 days in the manic up pattern, the "bump". 55 Days in the return to trend or "run". Which would create a 10 year US Treasury bond rally and likely a rally in risk on assets. Which lands us, perfectly, at yields dropping until Monday December 25th 2023.

Merry Christmas Traders!

Government bonds

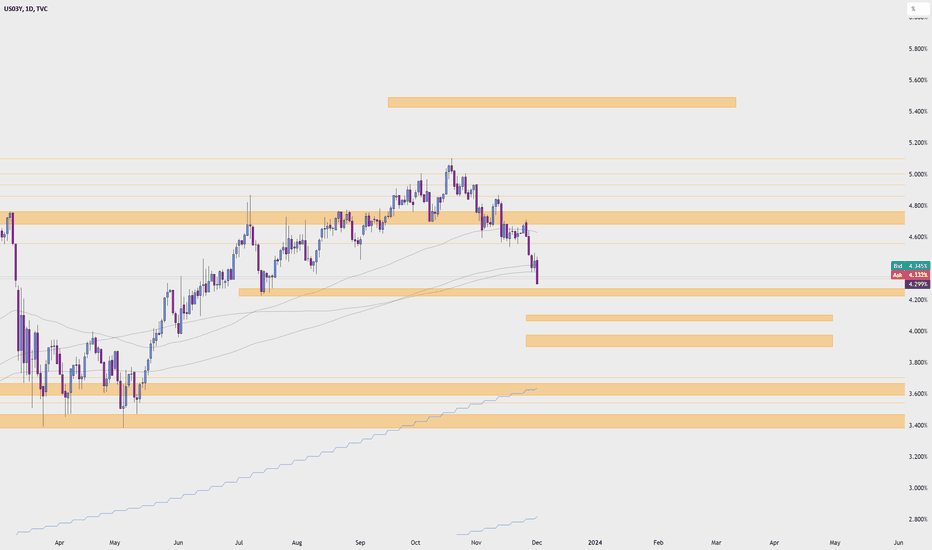

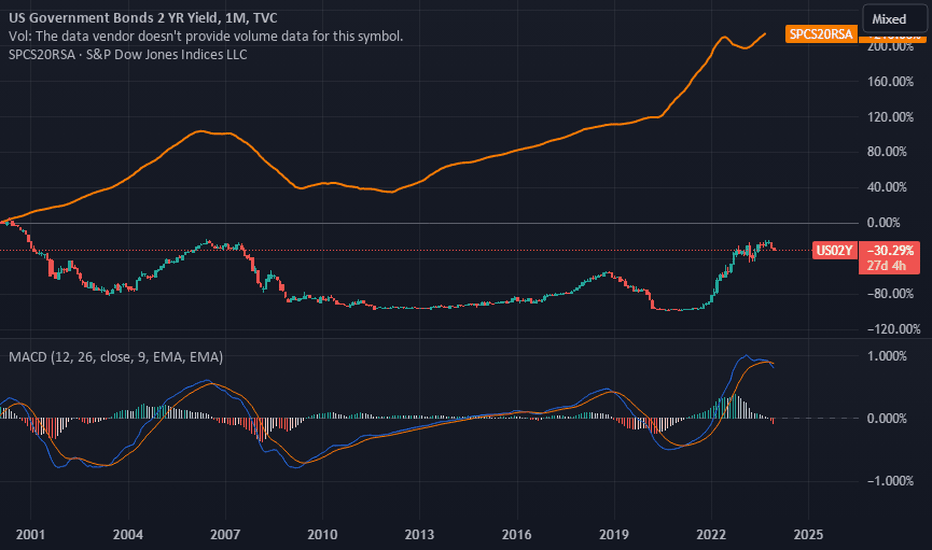

2Y Yields LowerTVC:US02Y

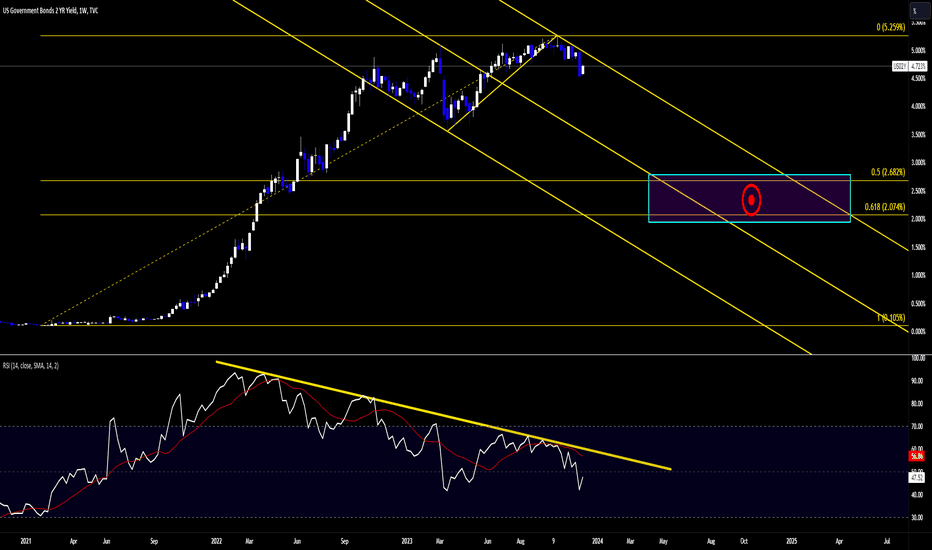

2Y Yields heading lower.

Sometime over the next 12-18ish months, I believe we'll see 2Y yields fall to 200-275 bps.

Headline inflation numbers are lower and dropping.

The Fed has effectively pulled a rabbit out of a hat in the act of raising interest rates by ~500+ bps, while avoiding the obliteration of the economy. (thus far)

If the economy does falter in the coming months; the Fed will lower rates.

(No further explanation needed)

Despite the endless repetition of "higher for longer" from Fed officials; I believe that the Fed will lower rates even if the economy and markets remain strong.

The establishment powers in the political & financial world's that the Fed straddles both crave the same thing... Cheap Debt.

In addition to this, there are over $34+ Trillion reasons to lower rates as soon as possible.

Not to mention, the upcoming election...

The market is anticipating lower yields as well.

We're seeing the market preemptively increase exposure to interest rate sensitive assets.

(i.e. - tech stocks, indices, cryptos, beaten down govt bonds, etc.)

On a technical basis, the weekly chart of 2Y Yields is showing substantial bearish divergence.

Weekly RSI shows a bearish RSI Swing Rejection (March '23 and October '23 highs)

The 50% & 61.8% Fib levels give us a target of 200-275 bps.

The median line set suggests that yields could arrive at the target area sometime between May '24 - May '25.

Conclusion: Short Yields.

Fat_Fat

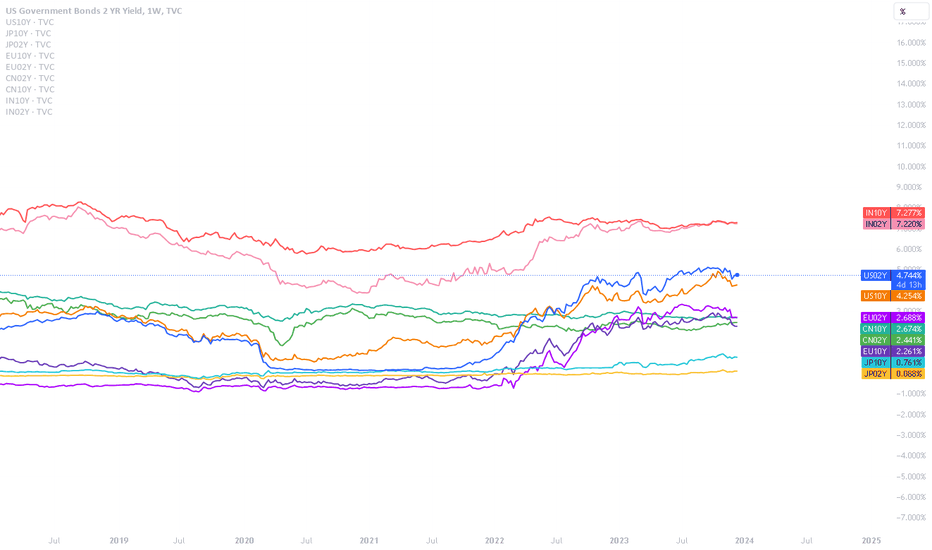

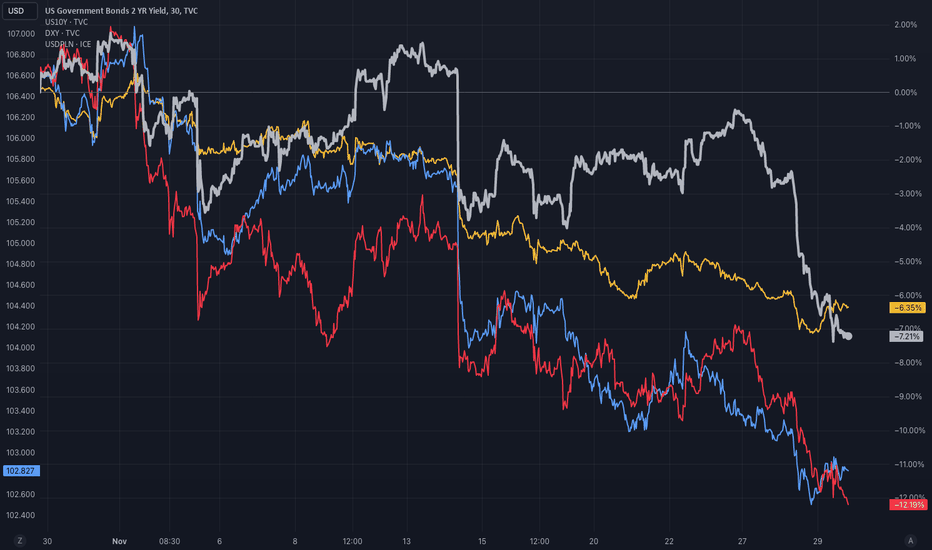

Treasury Yields flash bottom signs, early for some + DXY leadingJUST SAYING.......

NOT implying that the party is over BUT heed some signs by treasury.

1Yr #yield is fighting to close above the 10day Mov Avg (RED).

2 Yr has a possible 3rd day trading above the RED Mov Avg.

10Yr fighting to get above the recent trend it broke & Moving Avg's.

US #Dollar has been fighting & looks to be gaining momentum. We'll see how this does over next few days to get barometer.

TVC:DXY TVC:TNX

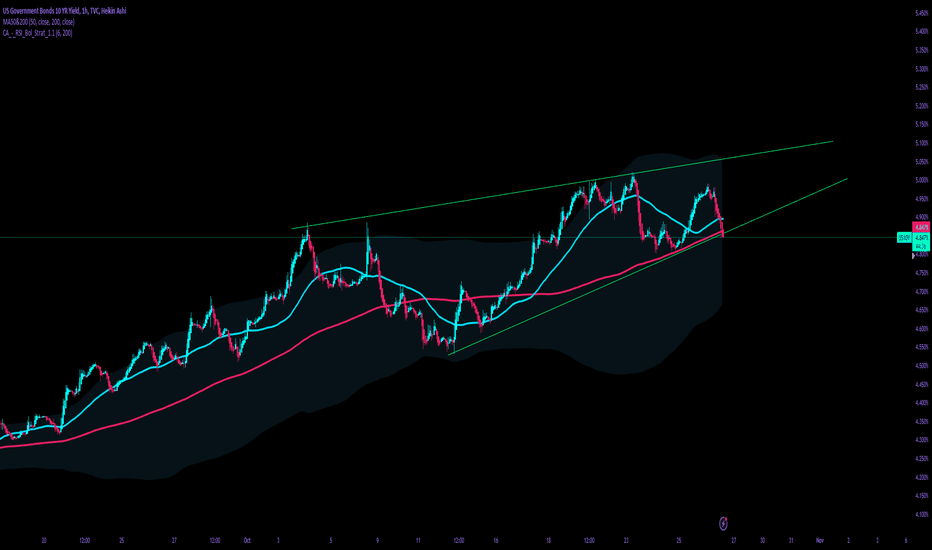

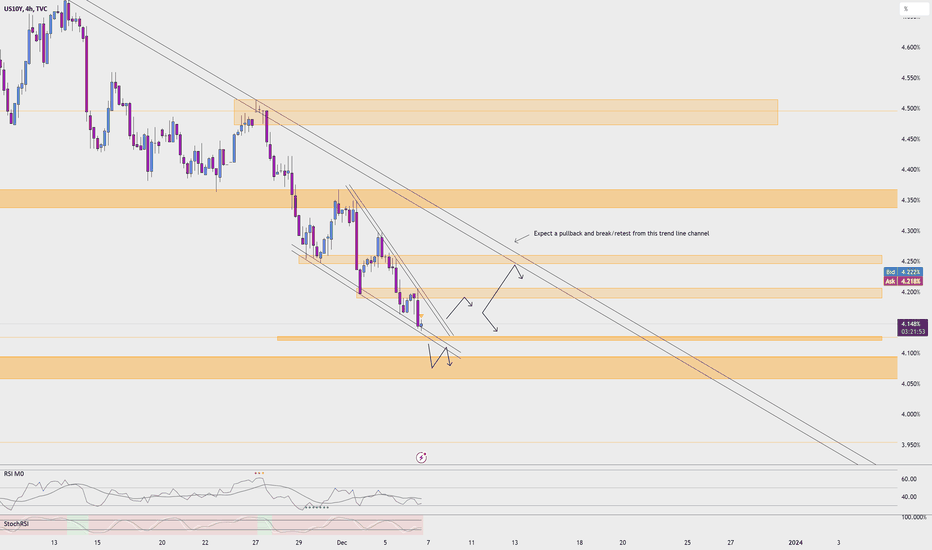

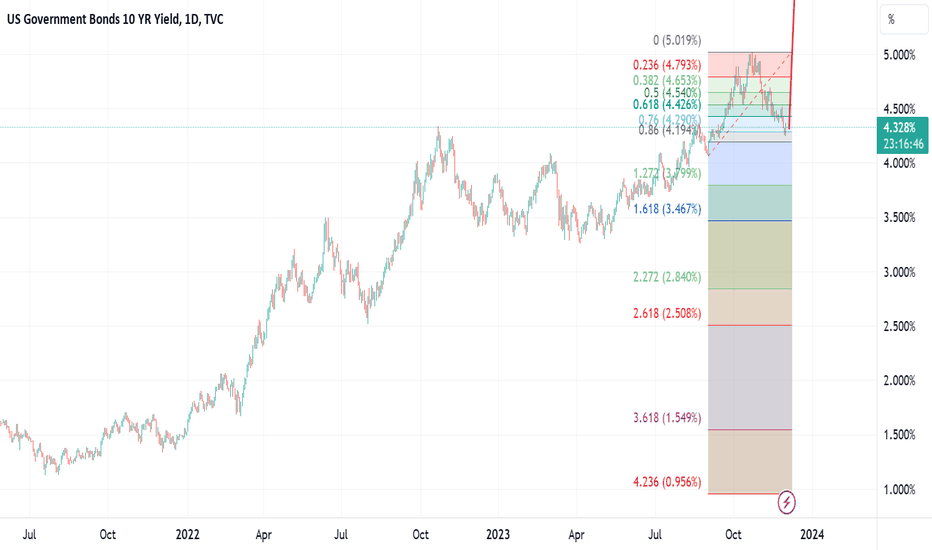

US 10Y TREASURY: FOMC meeting aheadThe yields on the US Treasuries continued to slow down during the course of the previous week. However, a strong US jobs data posted on Friday, made an impact on 10Y yields to revert a bit toward the higher grounds. Although the US equities were supported by the same news, investors in the Treasury bonds still hold a dose of reserve when it comes to the future economic conditions. Namely, as job data remains strong, there is a fear that the Fed might tighten further in order to sustain their 2% inflation goal.

The 10Y Treasuries started the previous week around 4.29% yield. As the week progressed, yields reached the lowest weekly level at 4.10%. However, at Friday`s trading session, they reverted a bit back, ending the week at 4.23%. Regardless of this small reversal, the markets are still generally oriented toward the downside. The market is still pending testing the 4.0% level, which might occur during the following week or two. At the same time, charts are pointing that some short reversal might lead yields shortly toward the 4.3%, less likely 4.4% level, before they make a final reversal toward the level of 4.0%.

Never disregard those weekly & monthly closeSTHOSE LONG TERM TRENDS ARE IMPORTANT.

Remember how the 10 & 30 Yr #yield BROKE daily trends?

Well, they are both still in play, for TVC:TNX it is in better shape.

Let's see how they close.

30 Yr struggling a bit more to recover that close under the trend.

#mortgage rates have also fallen decently.

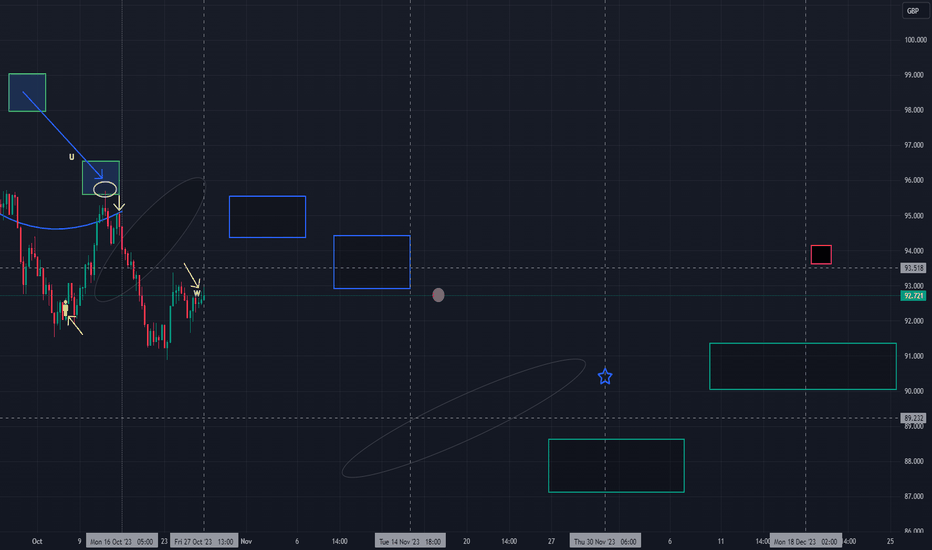

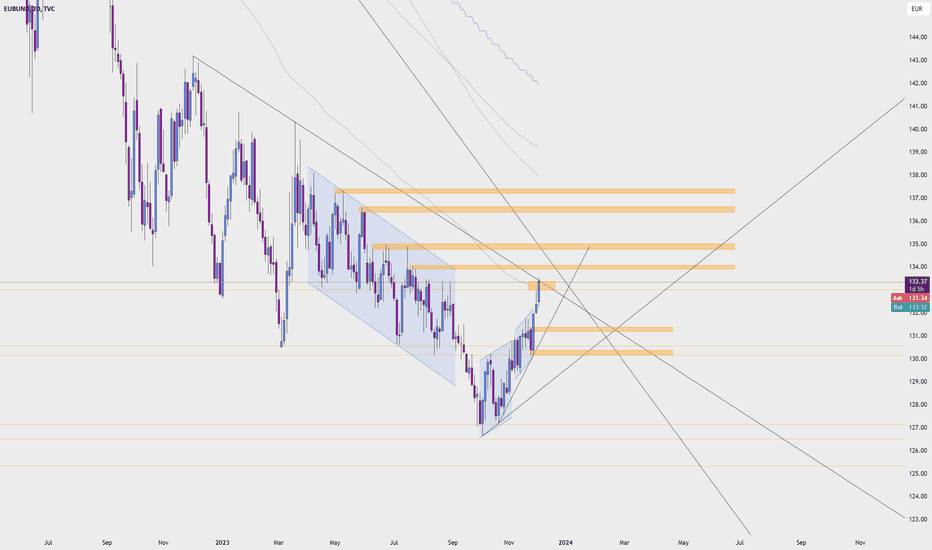

UK Bond Next StepsThe rectangles are potential zones of support/resistance. They also indicate potential tendencies of the sentiment of the market through the pairs of similar color and their relative position (going up or going down). Icons are relative price predictions in time, similar to targets that can be hit. Around the marked time stamps potential pivot points or exceptional events can occur.

This is a project similar to previous ones (Matrix Style) and is also looking at candlestick patterns near the shapes, rebounds or bounces with candlestick shadows, or small coincidences in the price action relative to the elements in the snapshot. This is for the swing trading enthusiasts that seek to maximize gain and minimize risk. For better understanding the general context and approach, the linked idea with previous results can be analyzed.

Always trade with a plan, manage risk, asses all probabilities, and may the force of profits be with you!

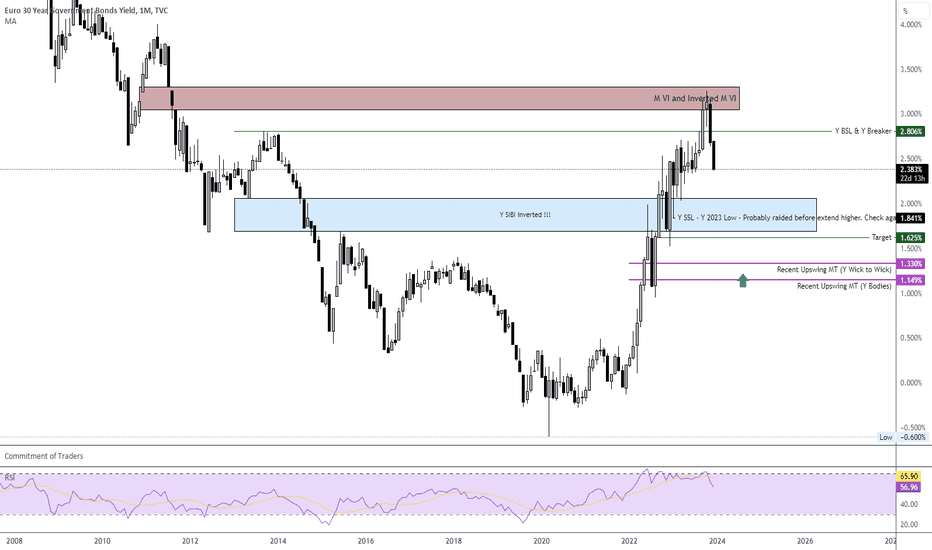

EU 30Y Bond Yield to extend further into 2008 high in 2024Economic

Policy needs to remain restrictive or should tighten further, until clear signs of easing inflationary conditions are available.

Technicals

Favor: Strong yearly candle

Favor: Strong M BiMS

Favor: M BiMS after ATL

Favor: Multiple BSL Levels higher

Currently at 10Y High

Expectation

Downside Retracement Targets (careful Short Term)

1 - 2.057% (Y SIBI Inverted) - 95% Certainty

2 - 1.625% (Target (already traded to)) - 75% Certainty

3 - 1.330% (MT Recent Upswing based on Y H to L) - 65% Certainty

4 - 1.149% (MT Recent Upswing based on Y Bodies) - 55% Certainty

5 - 1% (Beginning of Grind upwards) - 25% Certainty

Upside Targets (After Downside)

1 - 3.160% - Y 2023 High - 95% Certainty

2 - 4.915% - 85% Certainty

3 - 5.738% ( Fib 1.618 Extension) - 65% Certainty

4 - 6.258% (23Y High) - 35% Certainty

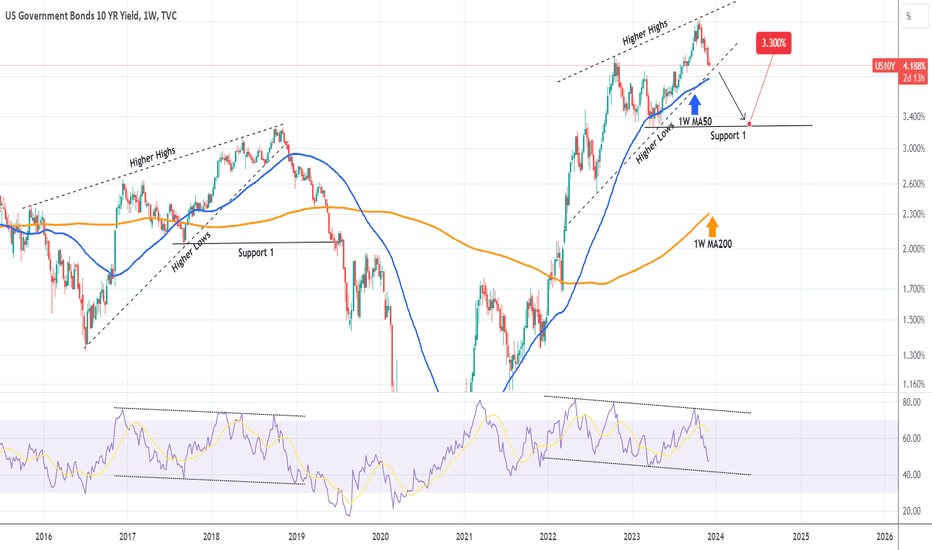

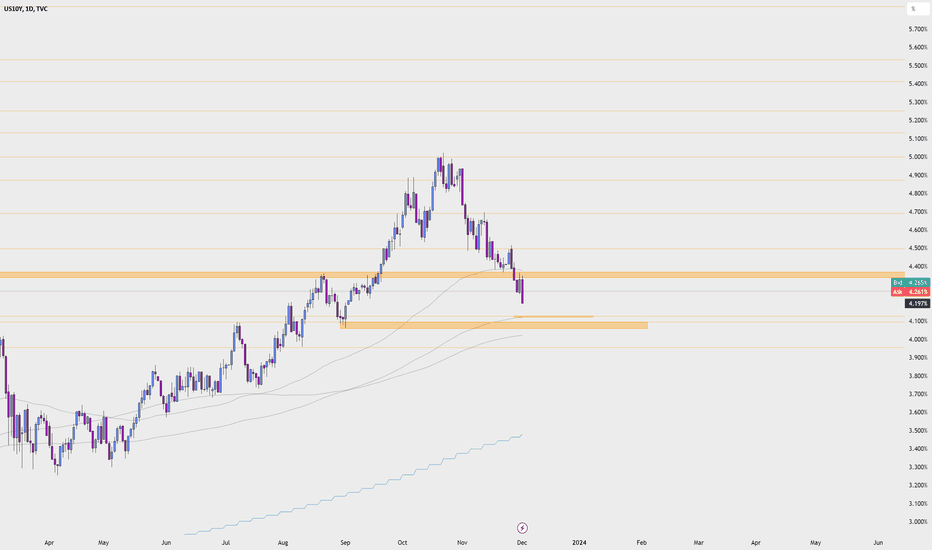

US10Y Is this the end of Bond Yields' 3.5 year run?The U.S. Government Bonds 10 YR Yield (US10Y) is pulling-back towards the 1W MA50 (blue trend-line) and bottom of the Rising Wedge. The pattern is getting too tight and the squeeze will inevitably result in a break-out and new trend/ pattern.

If the Rising Wedge breaks downwards, it will mean the end of the yield's +3.5 year bullish run and will have a high impact both on stocks and Gold. In fact there are high probabilities of that happening as a similar Rising Wedge broke to the downside at the end of 2018.

If that gets materialized, then the first attempt should be on the 3.300% Support 1 level, before the 1W MA200 (orange trend-line) gets closer for the test of its long-term Support status.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

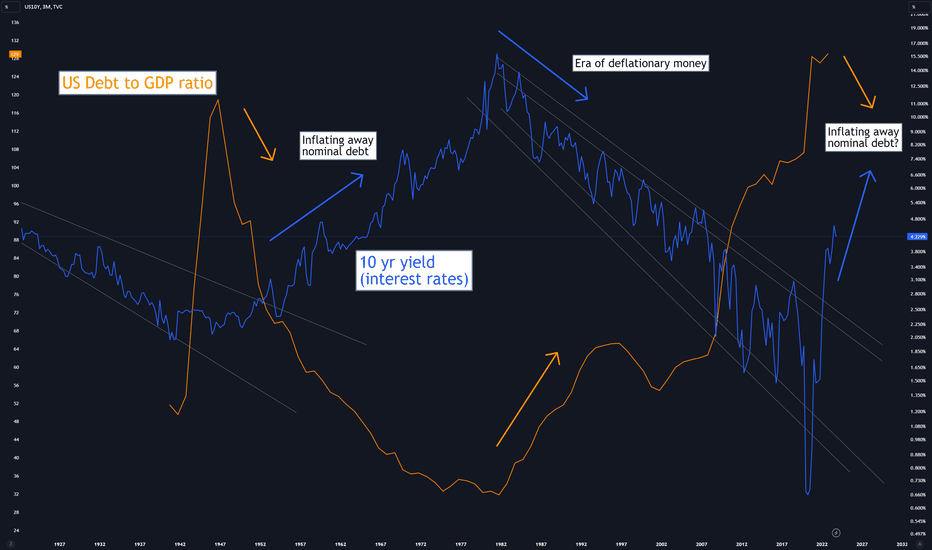

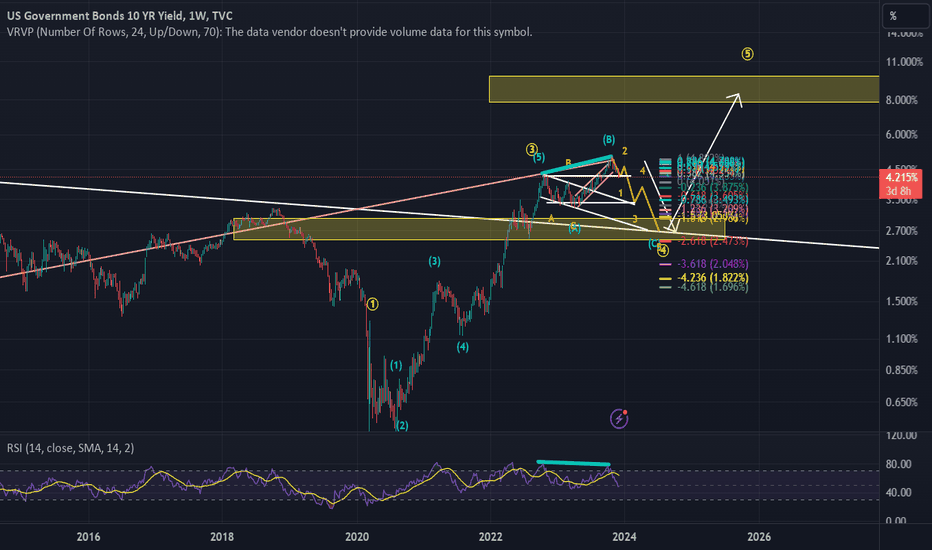

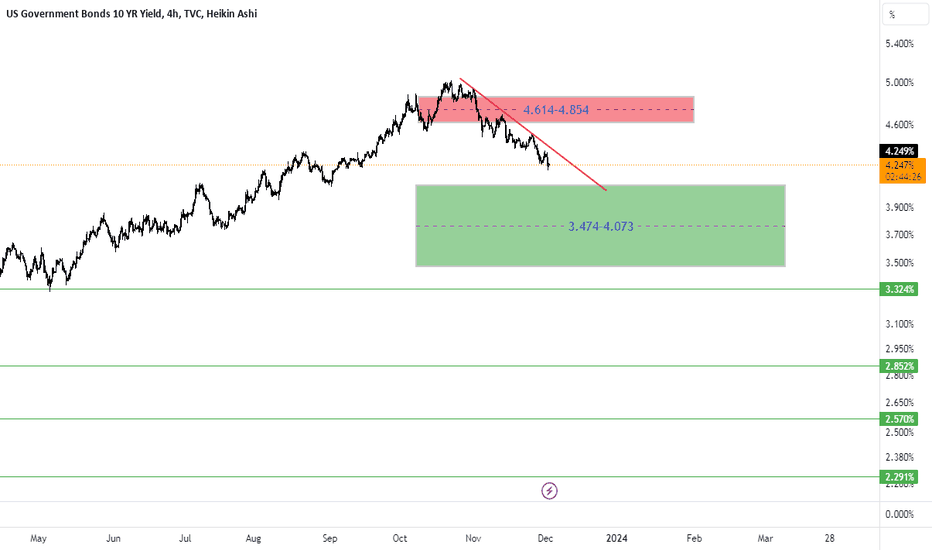

US10 Y forecastIf you believe the all important 10Y yield telegraphs the markets, then pay attention to this chart...I am fairly certain this path will materialize...mid to late 2024 we should see a signifant drop in yields...which should pump markets...and push inflation down. This of course is timed perfectly for the 2024 U.S. presidential elections...coincidence? LOL!

US 10Y TREASURY: Powell and market on opposite sidesFed Chair Powell is speaking, but the market is not listening. Powell was speaking on Friday at Spelman College in Atlanta, noting once again that the current policy might not be restrictive enough, meaning that further rate hikes are possible in case that inflation remains persistent. However, a strong economic output of 5.2% for Q3 and inflation figures which are clearly oriented toward the downside, made the market react quite opposite to Powell`s notes. Almost all assets, including Bitcoin gained during the previous week. Treasury bonds strongly gained during the week, pushing the yields lower.

The 10Y Treasury yields continued with their down trend, starting the week around 4.4% level and ending it at 4.197%. This is more than a clear indication that the market is currently strongly set on rate cuts in the coming period. In case that market perceives that the rate cuts might be higher in 2024, then the 10Y Treasury yields might easily reach the level of 4.0% by the end of this year. Still, for the week ahead, it could be expected that the level of 4.2% is to be tested, with a decreased probability for a reversal toward 4.4% level.

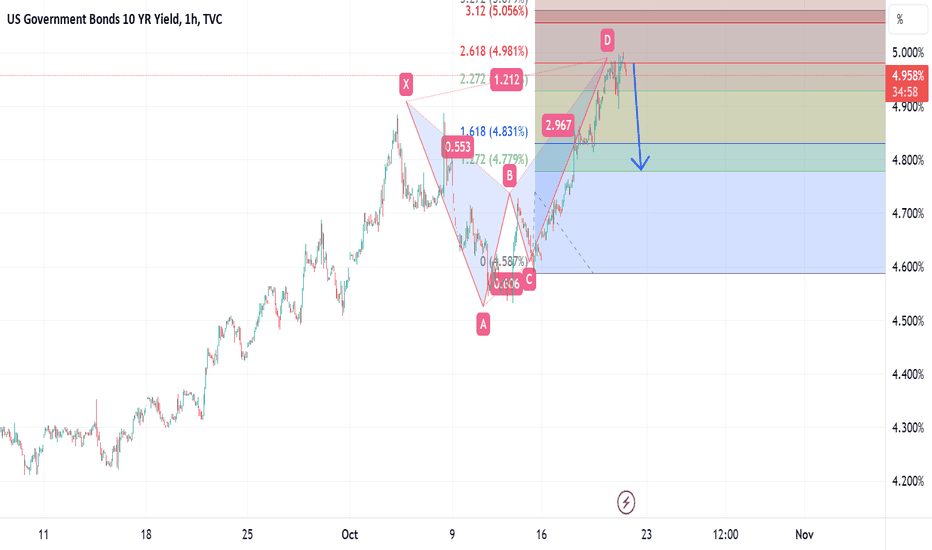

Big Bearish Bat in Yields Complimenting the TLT forecast:

Bat pattern in the 10 year yields. Norms of this pattern is to be super strong into the end, have massive attention and almost everyone expecting the move to continue.

Bats often both top and break with news.

Over the last days I've been strongly suggesting to real life friends they dump risk assets and buy bonds.

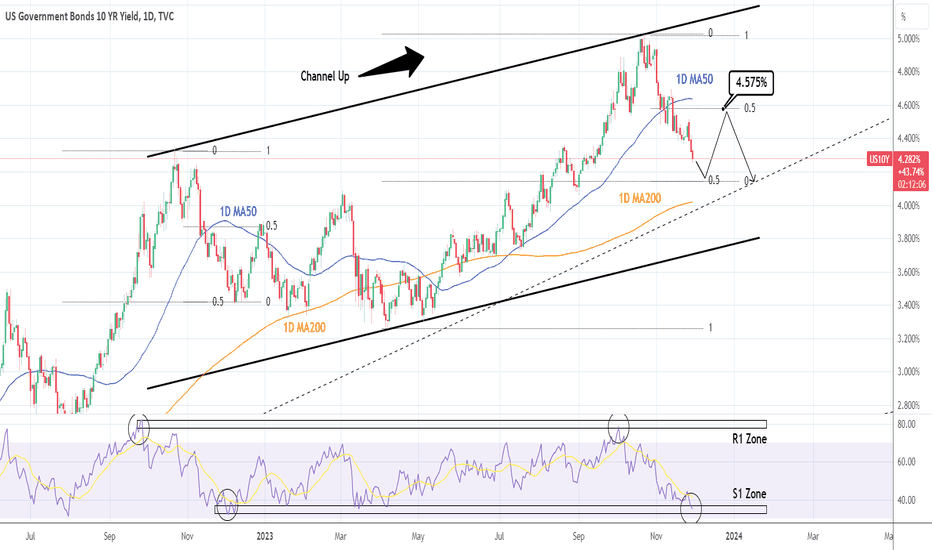

US10Y: The goal from now on should be to buy the bounce.The US10Y is approaching an oversold technical state on the 1D timeframe (RSI = 34.650, MACD = -0.086, ADX = 44.537) as selling was accelerated this week after failing to get close to the 1D MA50. The long term pattern is a Channel Up and the decline since Octobet 23rd is the new bearish leg.

The one prior hit the 0.5 Fibonacci level of the rally and then rebounded to the 1D MA50 with the 1D RSI approximately on the same levels as today (S1 Zone). Consequently, our goal from now on is to start buying on dips and aim for the 1D MA50 and in particularly the 0.5 Fibonacci level from whatever bottom the US10Y makes now (modest estimate TP = 4.575%).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##