Crypto market

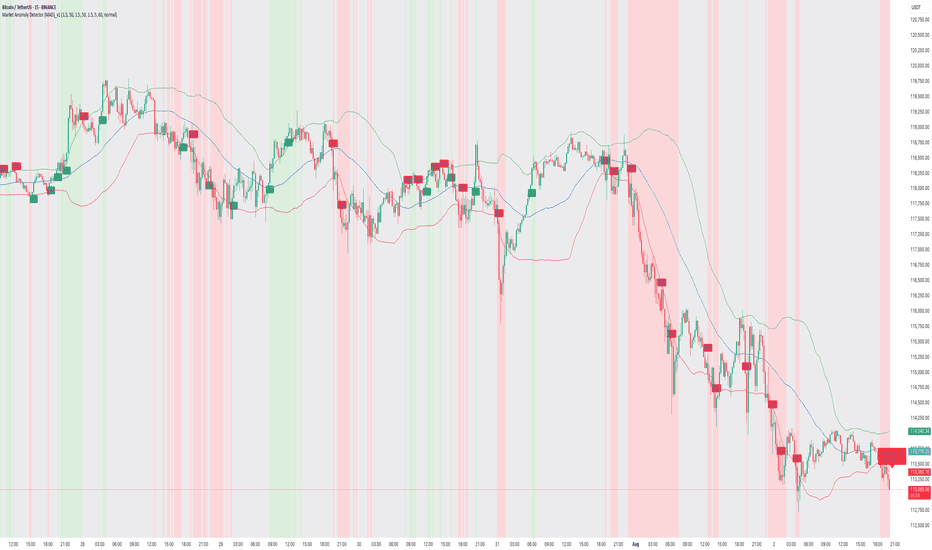

How to Capture Reversals/Breakouts with MAD IndicatorBTC/USDT 15M – Market Anomaly Detector (MAD) Captures Reversals & Breakouts

⸻

Description:

On this BTC/USDT 15-minute chart, the Market Anomaly Detector (MAD) is actively highlighting high-probability market turning points and anomaly zones.

Key Observations from the Chart:

1. Green & Red Zones = Expected Price Range

• Green Line (Upper Band): Expected top of the range.

• Red Line (Lower Band): Expected bottom of the range.

• Price usually travels green → red → green, forming a natural oscillation.

2. Buy/Sell Signals = Breakout + Reversal Detection

• Buy Signal: Triggered when price closes above the green line or recovers from below the red line.

• Sell Signal: Triggered when price closes below the red line or rejects from the green line.

• This reverse psychology logic helps catch false breakouts and stop-loss hunts.

3. Performance on This Chart:

• Signals aligned with key reversals during the sideways-to-downtrend transition.

• The strong downtrend in the second half of the chart shows multiple accurate sell signals, confirming trend continuation.

• Sideways movements had minimal false signals due to cooldown + volume filter.

4. Unique Advantage (USP):

• Statistical approach using Z-Score & Standard Deviation.

• Multi-filter confirmation with RSI, volume, and higher timeframe trend.

• Visually clear anomaly zones:

• Green background = Bullish anomaly

• Red background = Bearish anomaly

• Gray background = Neutral range

Takeaway:

MAD helps traders anticipate anomalies rather than react late, offering high-probability trade entries and reversals in trending and volatile conditions.

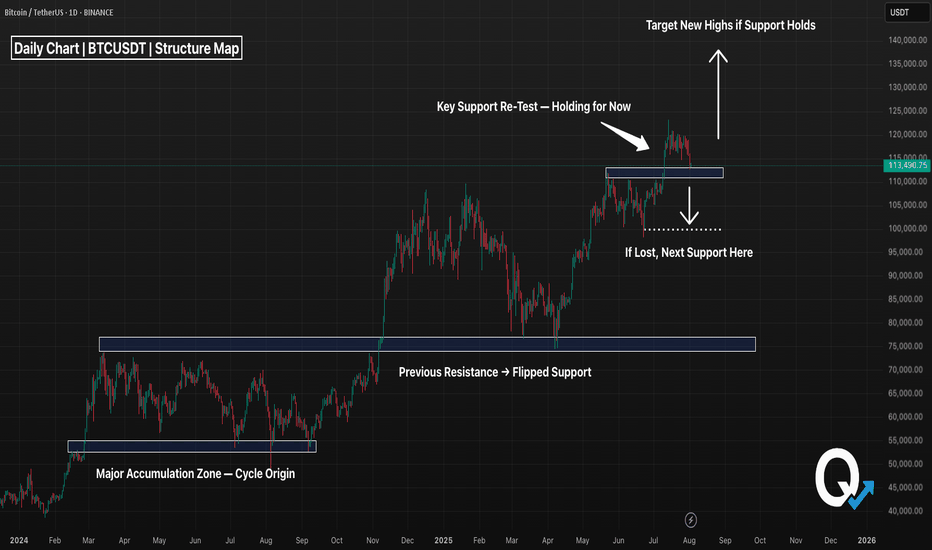

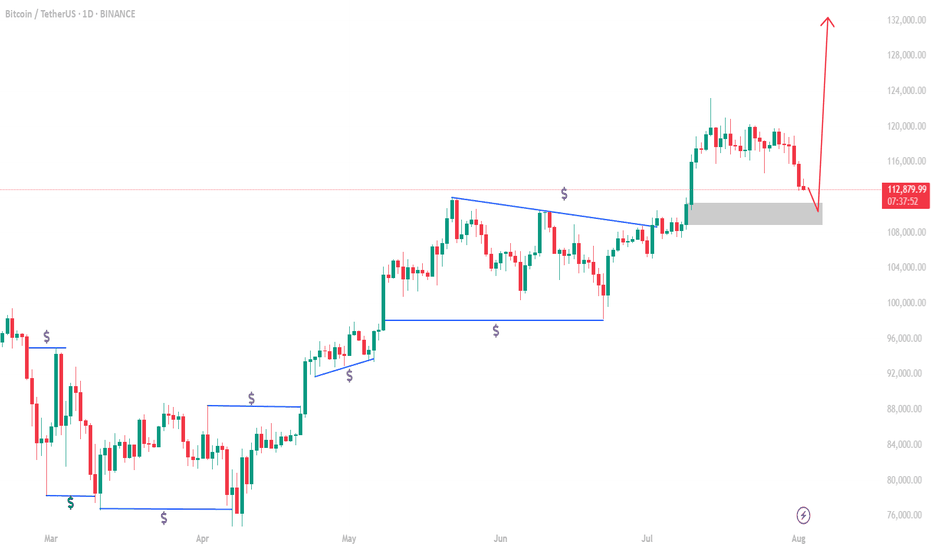

BTCUSDT 1D – Retesting Key Support, Will Bulls Hold the Line?Bitcoin is retesting a crucial structural support level around $112K after its recent local top near $120K. This zone previously acted as resistance and is now being tested as support — a textbook bullish continuation signal if it holds.

Historically, these flips (from resistance to support) have triggered strong upside momentum, as seen after the $78K breakout earlier this cycle. However, failure to hold this level could open the door for a deeper correction toward $100K or even the $90K region.

This chart outlines the major structural zones:

Long-term accumulation base near $70–78K

Resistance flip zone at $110–112K

Local resistance near $120K

📌 If bulls defend this zone and reclaim momentum, we could see another push toward cycle highs. If not, patience is key — the next high-conviction entry may come lower.

How are you positioning around this zone? Let me know in the comments 👇

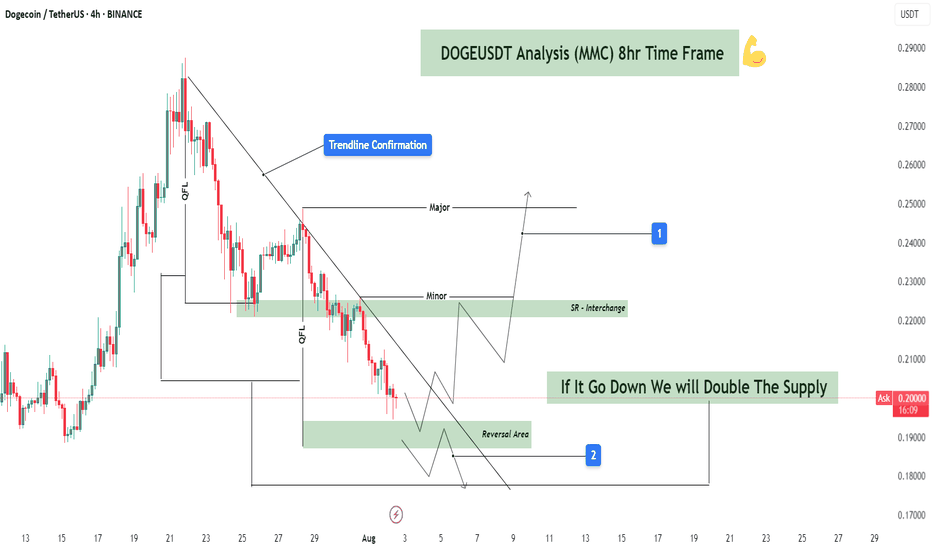

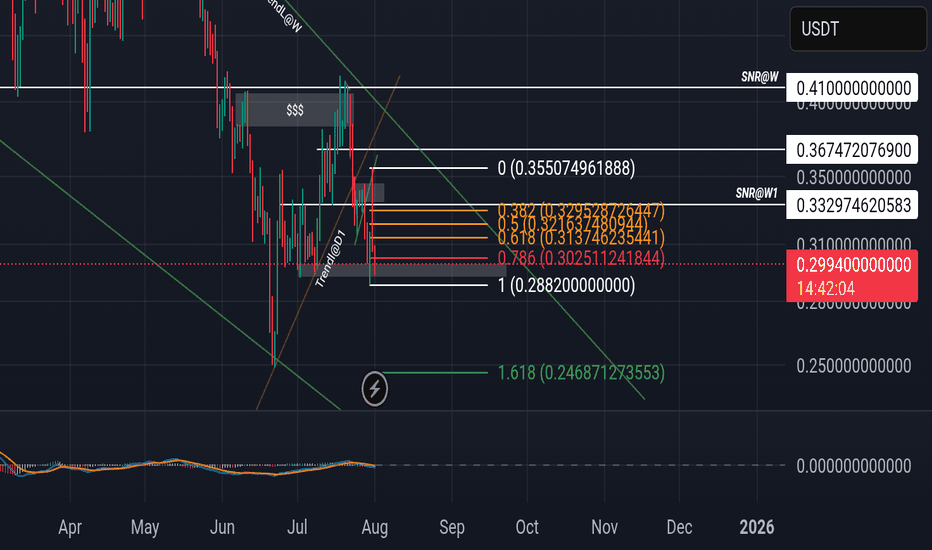

DOGEUSDT Analysis : Trendline Decision & Dual Directional Point📌 Market Context & Current Setup:

DOGEUSDT has been trading within a well-defined descending channel, respecting a strong trendline resistance, which has acted as a bearish ceiling for several sessions. The price action has been heavily influenced by supply zones formed after sharp impulsive drops, creating multiple QFL (Quick Flip Levels) — key to spotting structural bottoms and high-probability reversal zones.

Currently, the price is hovering near a critical decision point, where two key scenarios may play out:

A breakout and bullish reversal toward major resistance

A dip into a deep demand zone for final accumulation before reversal

Your plan reflects MMC (Market-Mind-Confirmation) methodology, preparing for either scenario with clear levels, logic, and psychology in place.

📐 Technical Breakdown:

🔻 1. Trendline Confirmation (Bearish Control):

The price has respected the downtrend line multiple times, confirming strong bearish momentum.

No candle body has closed decisively above it, showing sellers still have control.

However, price is now consolidating near this line, indicating a potential weakening of selling pressure — a classic sign of upcoming trend exhaustion.

🟩 2. Support Zones – Structural Layers:

📍 Minor Zone (S/R Flip – ~$0.215–0.220):

This zone is a previous support turned resistance.

It’s the first checkpoint the price needs to reclaim to confirm a breakout.

A successful flip from resistance back to support would add strong bullish confidence.

🟩 Reversal Zone (~$0.185–0.190):

Marked on your chart as a "Reversal Area" — likely derived from QFL methodology.

Price has historically bounced from this area, indicating buyers are willing to step in aggressively.

This zone aligns with smart money demand accumulation and could serve as a final liquidity sweep zone before a major reversal.

📍 Major Resistance Zone (~$0.250–0.260):

The next major objective once a trendline break is confirmed.

Also aligns with previous highs and volume nodes — a solid target for bullish trades.

🔄 Scenario-Based Strategy:

📈 Scenario 1 – Breakout Toward Major Resistance:

Price breaks above the descending trendline and reclaims the minor S/R zone.

This would confirm a bullish structure shift, validating that sellers are losing strength.

After reclaiming ~$0.215, the path toward $0.240–0.260 opens up.

Retests or flag breakouts within this range can be re-entry points for trend traders.

📉 Scenario 2 – Deeper Retest and Accumulation:

If the price fails to break out and dips further, the reversal demand area (~$0.185) becomes critical.

This is where buying pressure is expected to return, and as labeled in your chart:

👉 “If it goes down, we will double the supply”

This suggests an averaging-down or pyramiding strategy based on strong structural confidence.

This technique is valid only when the area is backed by solid confluence (trend exhaustion, demand, and past bounces).

🧠 MMC Strategy (Market – Mind – Confirmation):

Market: Bearish short-term trend, but price is approaching oversold territory near structural demand.

Mind: You’re prepared for both outcomes – breakout or dip. Emotion is out of the plan.

Confirmation: You wait for signs — break and retest of trendline, bullish engulfing candles, or wick rejections from demand.

This mental clarity helps maintain trading discipline and keeps emotional bias out of decision-making.

⚙️ Execution Plan:

Component Scenario 1 (Breakout) Scenario 2 (Deep Buy Zone)

Entry Signal Break & close above trendline + minor SR reclaim Bullish reversal candle within demand zone

Stop Loss Below trendline + S/R flip (~0.210) Below demand zone (~0.182)

Target 1 $0.235 $0.235

Target 2 $0.255–$0.260 $0.255–$0.260

Risk Level Medium Higher R:R potential

Strategy Notes Aggressive on confirmation only Add to position on wick traps

🧠 Trader Psychology Tips:

Be patient — confirmation beats prediction.

Set alerts at key levels to avoid emotional entries.

Scaling into trades based on zone reactions builds flexibility and control.

"Double the supply" approach must be paired with strict invalidation levels.

✅ Summary:

DOGE is trading within a descending wedge.

Key decision zones are marked clearly (trendline, S/R flip, reversal demand).

Breakout could lead to a quick 15–25% upside.

Reversal zone offers great R:R with accumulation opportunity.

Strategy is well-aligned with disciplined execution and trader psychology.

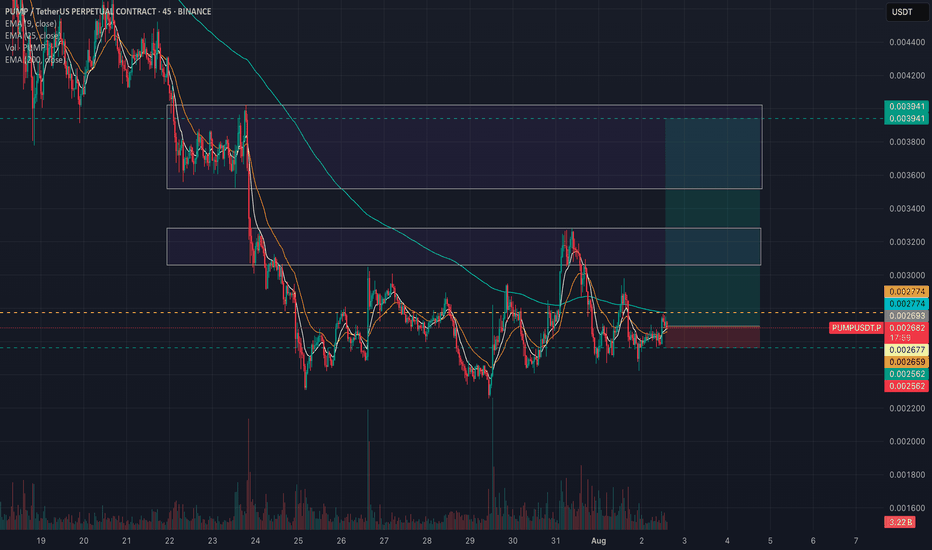

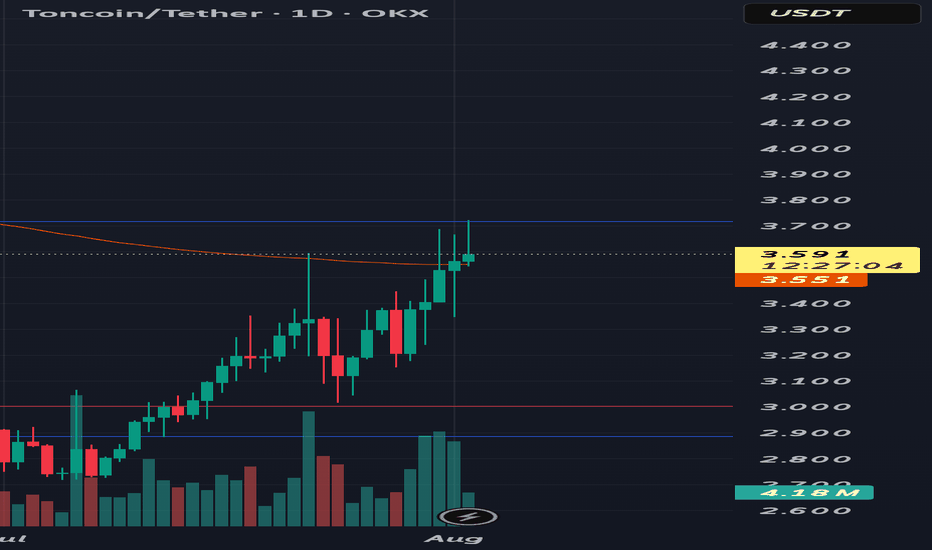

Up only desuTon has crashed a lot from its all time high and it seems to be rebounding now. Today will be the fifth daily green candles in a row and yesterday's daily closed above EMA 200

IN ADDITION TO THIS

Some bullish news for Ton i found from elfabot

The recent surge in CRYPTOCAP:TON price is primarily attributed to strong ecosystem activity, including significant NFT purchases by Pavel Durov (Telegram’s founder), such as buying a Plush Pepe NFT for 15,000 TON (about $53,000), which has boosted market confidence and demonstrated TON’s real-world utility. This has been widely discussed in the crypto community and cited as a bullish catalyst (source).

⦁ Additional bullish factors include Grayscale considering investment in TON, the launch of new Telegram NFT features, and US users being able to access TON Wallet directly inside Telegram without a VPN (source).

So, yea, i think we're breaking previous ATH and hitting $10 soon

cheers

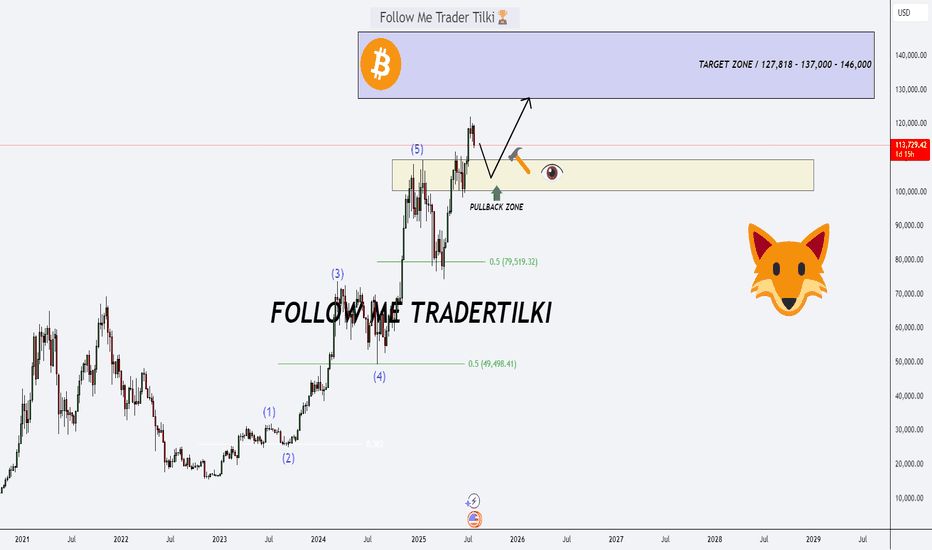

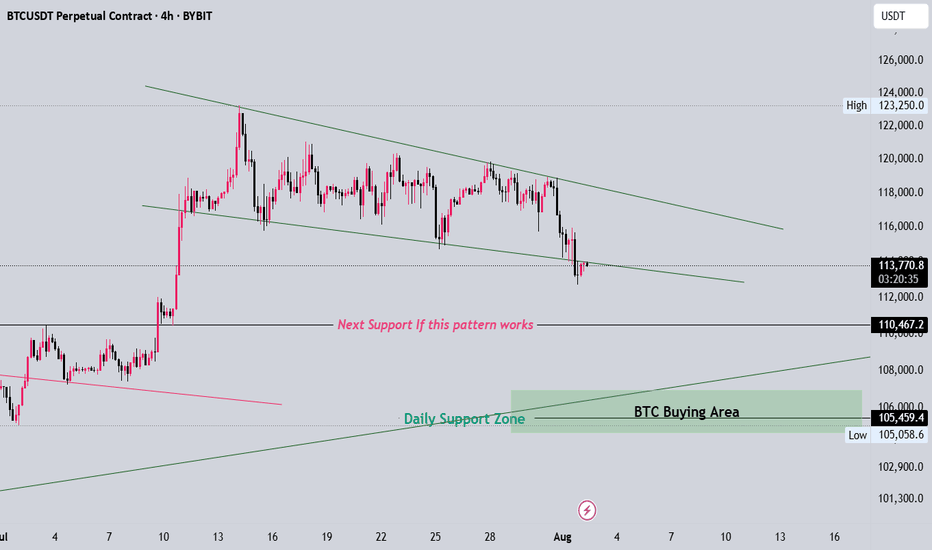

Bitcoin’s Game Has Changed: Fresh Support Zone, Targets Sky-HighHey Dear Friends,

Until recently, Bitcoin had been stuck in a range between 112,331 and 105,344 for quite some time. But that range has now been clearly broken. So, what does this mean? This zone, which used to act as resistance, is now expected to flip and act as support.

According to my weekly trading model, the long-term target levels I’m tracking for Bitcoin are: 127,818 – 137,000 – 146,000.

Since this is a weekly setup, it might take a while for these targets to play out. Even if we see pullbacks to the 112K, 105K, or even 100K levels, I expect to see strong buying pressure from that zone.

I’ll keep sharing regular updates as this setup develops.

To everyone who’s been supporting and appreciating my work—thank you, truly. Your encouragement means the world to me and keeps me motivated to keep showing up. Much love to all of you—I’m grateful we’re in this journey together.

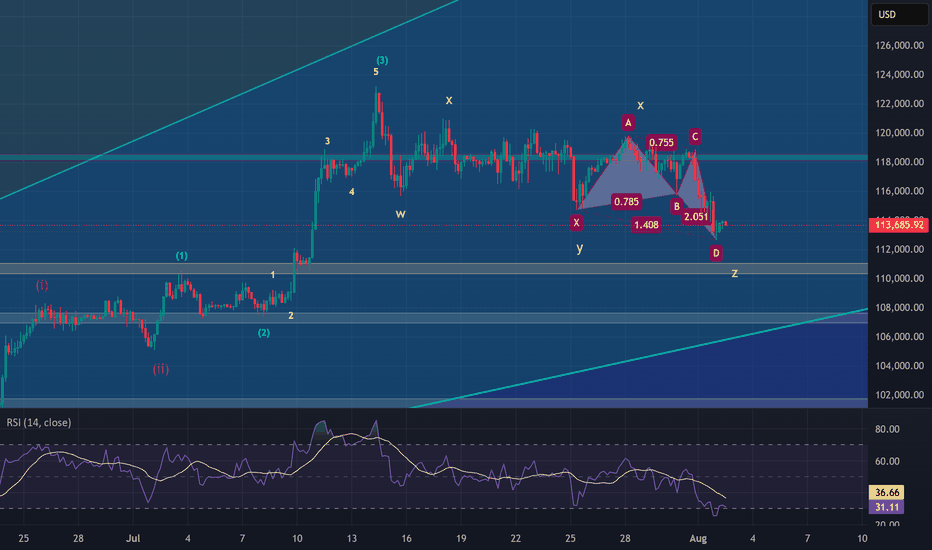

The End of BTC correction? BTC analysis 2/8/2025In my point of view, BTC has completed its correction and is now ready for a strong upward move, potentially targeting the $137,000–$139,000 range, based on the following factors:

1. Confirmation of the Butterfly Harmonic Pattern

The recent reversal occurred within the expected range of the Butterfly harmonic pattern. Typically, the XD leg in a Butterfly harmonic extends to 1.27, but in practice, this can stretch up to 1.414, which is commonly used as a flexible stop-loss zone. After testing the 1.27–1.414 range, a clear 5-wave impulse followed—testing a key trendline and making an attempt to break above the recent high. This sequence, followed by a corrective move, suggests that the broader correction may be complete.

2. Complex WXYXZ Correction Structure

In my previous analysis, I underestimated the duration and depth of the correction. The wave (4) (blue), which is part of the wave (iii), has taken considerable time—likely to allow wave (5) to extend sufficiently to break above the $130,000 level. This would support the assumption that wave (5) (purple) is the extended wave. The overall corrective structure appears highly complex, and can be counted as a W–X–Y–X–Z pattern, supported by the presence of multiple internal corrections within the wave components.

3. 0.618 Fibonacci Retracement of Wave (3)

Wave (4) has now reached the 0.618 Fibonacci retracement level of wave (3), which is significant. Historically, BTC’s corrections rarely retrace beyond the 0.87 level. This deep retracement suggests wave (4) is likely complete—unless price were to fall below that threshold, which would invalidate this assumption.

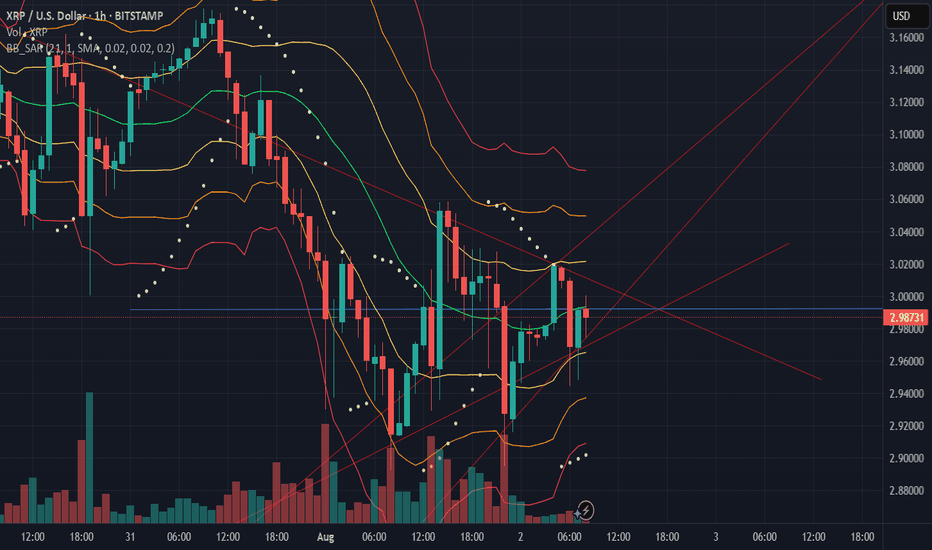

XRP/USD Breakout Watch: $3.22 Target in SightA key blue trendline on the XRP/USD chart that reflects market sentiment. If price breaks above it with strong volume, we could see a rally toward $3.22.

Support zone: $0.55–$0.60

Bullish case: Improved sentiment, easing tariffs, and regulatory cooling

Strategy: Wait for breakout confirmation before entering

Share your thoughts — are you preparing for a breakout?

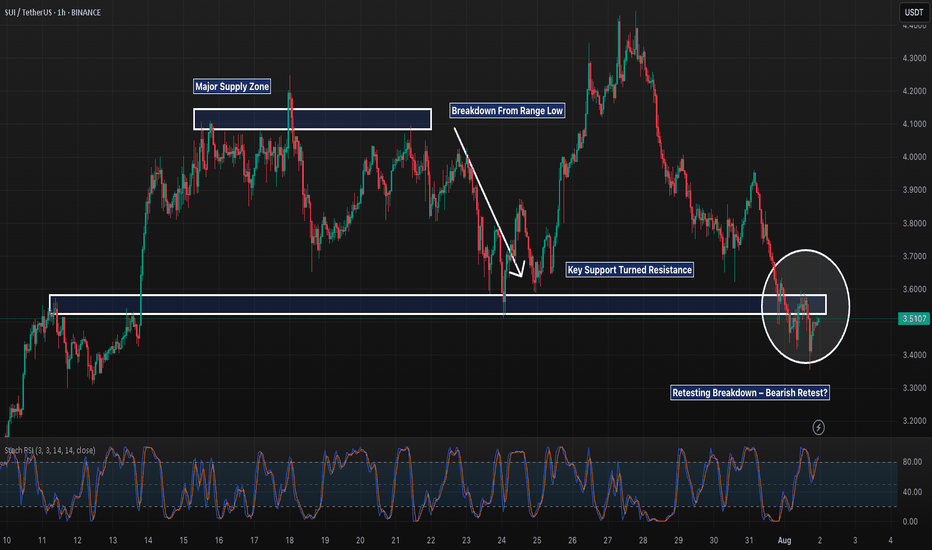

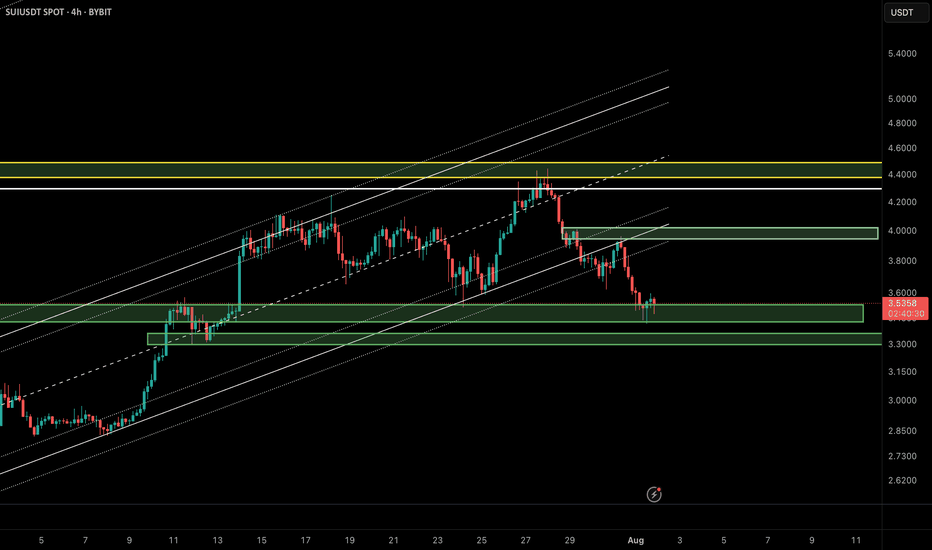

SUI 1H – Breakdown & Retest of Key Support, But Will It Reject?SUI 1H – Breakdown & Retest of Key Support, But Will It Reject or Reclaim?

Description:

SUI just completed a textbook range breakdown after weeks of sideways chop between ~$3.60–$4.10. The prior support floor has now flipped into resistance, and the recent bounce appears to be retesting that structure. If this retest gets rejected, continuation toward lower support zones (potentially $3.30 and below) becomes likely.

However, reclaiming and holding above $3.60 could trap late shorts and fuel a squeeze. Structure still favors bears for now, but it’s decision time.

📌 Breakdown structure

📌 Bearish retest

📌 Eyes on confirmation or invalidation

This is the battle zone — stay sharp.

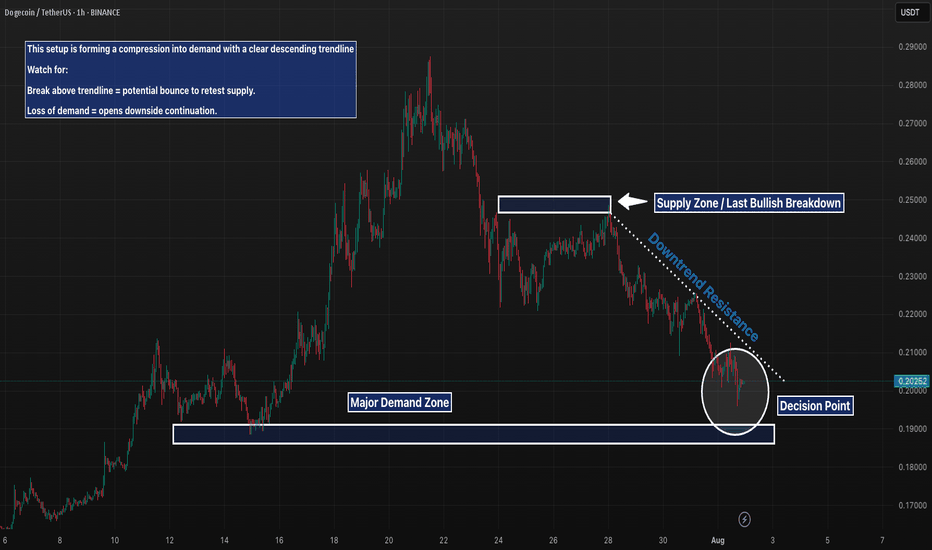

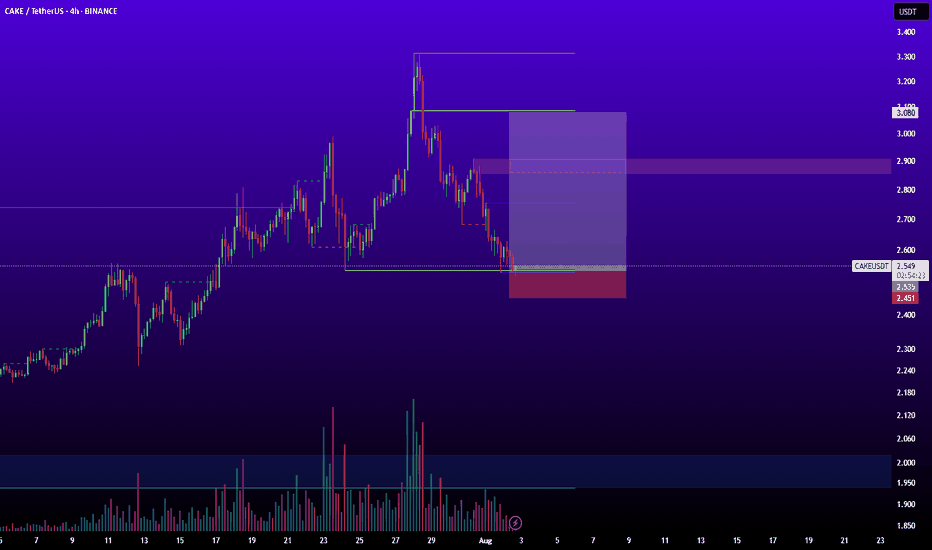

DOGE 1H – Descending Into Demand, But Will Buyers Step Up Again?DOGE is approaching a key inflection point after a clean rejection from the previous supply zone (~0.23) and consistent lower highs. The descending trendline has acted as dynamic resistance, compressing price into a major demand zone that previously triggered a strong rally. If bulls step in here, we could see a breakout and retest of the overhead supply. However, failure to hold this zone opens up potential for a deeper move toward the mid-$0.18s.

📌 Key Levels:

– Resistance: 0.23 (supply zone)

– Support: 0.19 (demand zone)

– Structure: Lower highs into horizontal demand = potential spring or breakdown.

This is a classic make-or-break structure — momentum and volume will reveal the winner.

SUI/USDT Update – Bounce Setup from Demand Zone?In the previous analysis, we highlighted a short opportunity near $4.20, which played out perfectly. Now, SUI has reached a key demand zone around $3.40–$3.55, overlapping with the lower boundary of the ascending channel and a previously defined bullish order block.

🔹 Market Structure:

After breaking the bullish structure, price is now revisiting a major liquidity zone between $3.40 and $3.55.

🔹 Price Behavior:

Wicks to the downside suggest buy-side absorption and potential for short-term reversal.

🔹 Possible Scenario:

If the $3.40 zone holds, we could see a corrective move up to the supply zone around $3.90–$4.00.

📌 Key Levels:

• Support: $3.40–$3.55

• Resistance: $3.90–$4.00

❗️If the $3.40 support fails, bullish momentum will likely be invalidated in the short term.

🧠 Pro Tip (SMC-based):

When a demand zone aligns with liquidity sweep and channel support, it often becomes a high-probability area for institutional re-entries. Wait for a clear confirmation like BOS or bullish engulfing candle before entering.

⸻

🔗 Like, share, and follow for more Smart Money & Elliott Wave-based insights!

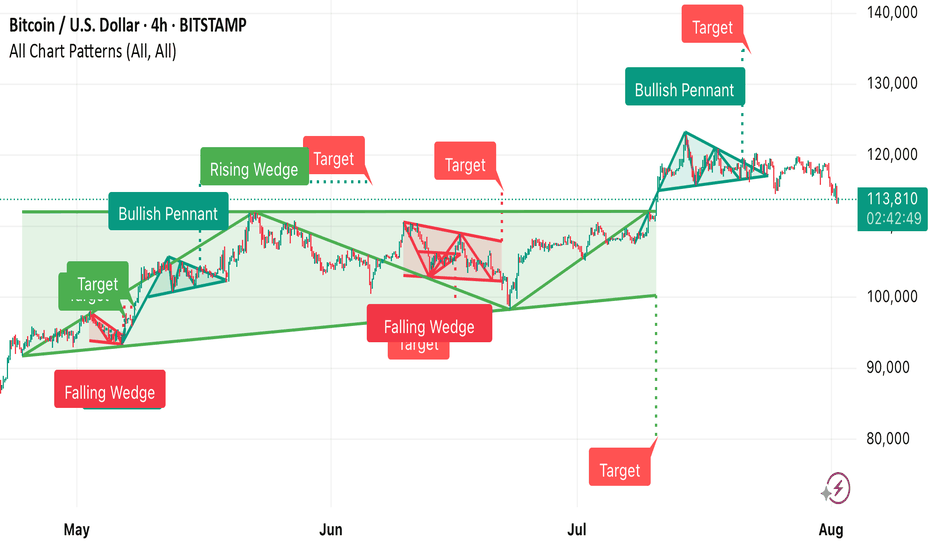

This Bitcoin 4-hour chart from TradingView shows multiple techni • Falling Wedge (early May) → Bullish breakout, target achieved.

• Bullish Pennant → Strong upward continuation.

• Rising Wedge (June) → Bearish breakdown, target met.

• Falling Wedge (mid-June) → Bullish breakout, target achieved.

• Bullish Pennant (late July) → Upward move toward the 140,000 target zone.

Currently, BTC is trading around 113,829, below recent highs, and near the dotted horizontal support zone from the last breakout.

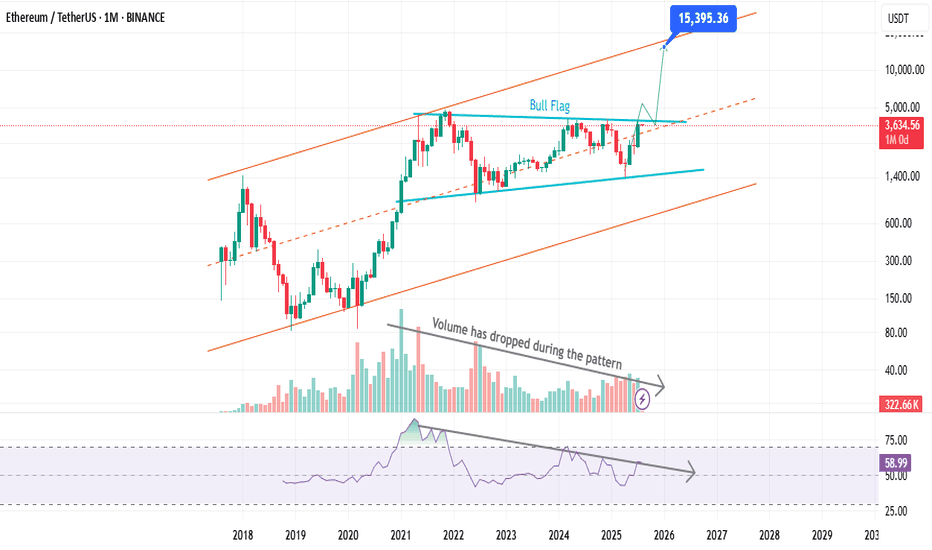

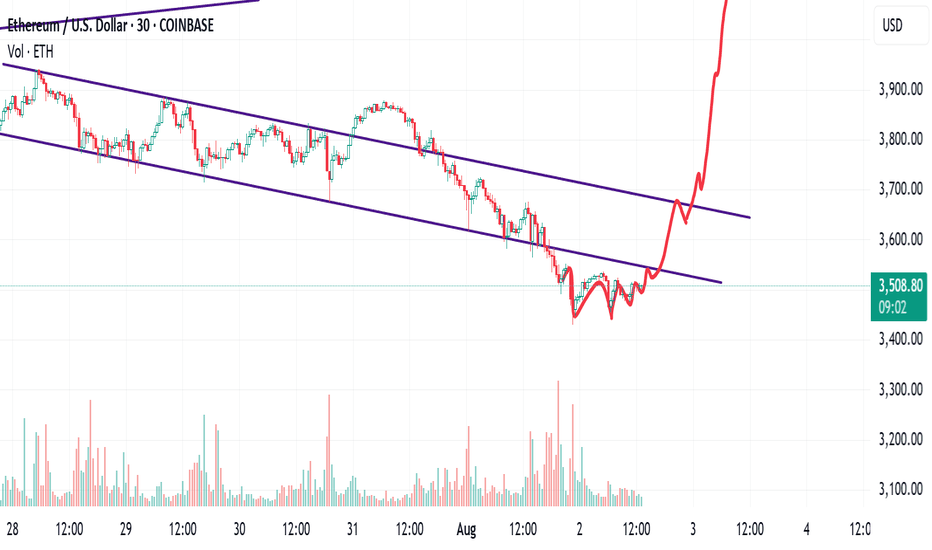

Smart Money Knows: ETH Is Gearing for a Supercycle...Hello Traders 🐺

In this idea, I wanna break down why $15K ETH isn't just a fantasy — it's a real, reachable target. So stay with me 'til the end, because this is just the beginning for Ethereum and the altcoin market.

If you’ve been following my ideas over the past year, you know I’ve been loudly calling for an incoming altseason — especially since ETH hit $1700. I kept saying: “Load up on ETH while you can,” because smart money was clearly rotating into it.

And now? We’re seeing the result.

Since then, Ethereum has nearly 2x’d, and ETH ETFs are pulling in massive inflows — but the price hasn’t exploded yet. Why? Let’s look closer.

Over the past 90 days, ETH has rallied around +180%, but in a quiet, steady climb — which is actually bullish. A strong move with low hype = accumulation. That’s how smart money moves.

📊 Monthly Chart Breakdown:

ETH is moving inside a perfect ascending channel, with clean touches on both support and resistance. Right now, price is forming a bullish flag pattern at the upper range — a classic continuation structure.

Volume has dropped during this flag, which is a textbook sign of accumulation. Add to that: RSI is sloping downward, signaling that large players are shaking out weak hands while loading up quietly.

So yes — ETH has already done +180% during this consolidation phase, which tells us something big is brewing.

🔁 The current pullback on the daily? In my opinion, it’s just a technical reaction to the flag resistance. RSI is also trying to break above its own trendline. If both confirm, the next wave begins.

🎯 Targets?

First target: All-Time High around $4870.

After that? There's nothing but air until we hit the top of the monthly channel near $15,000.

That breakout above ATH is where the real FOMO begins — not just for ETH, but for the entire altcoin market.

Let’s not miss what’s coming.

And as always, remember our golden rule:

🐺 Discipline is rarely enjoyable, but almost always profitable. 🐺

🐺 KIU_COIN 🐺

Sonic is creating wedge pattern in higher timeframeOn our current market structure, sonic is creating wedge bullish pattern.

If you check the current price using Fibonacci there's a possibility that it will goes to 0.24 or worst 0.1552 before it will break its current weekly structure.

You can accumulate within the pattern but if you're planning to make position and do long...please avoid that.

Point of interest is 0.24 to make create double bottom on it. If it's break, 0.1552.

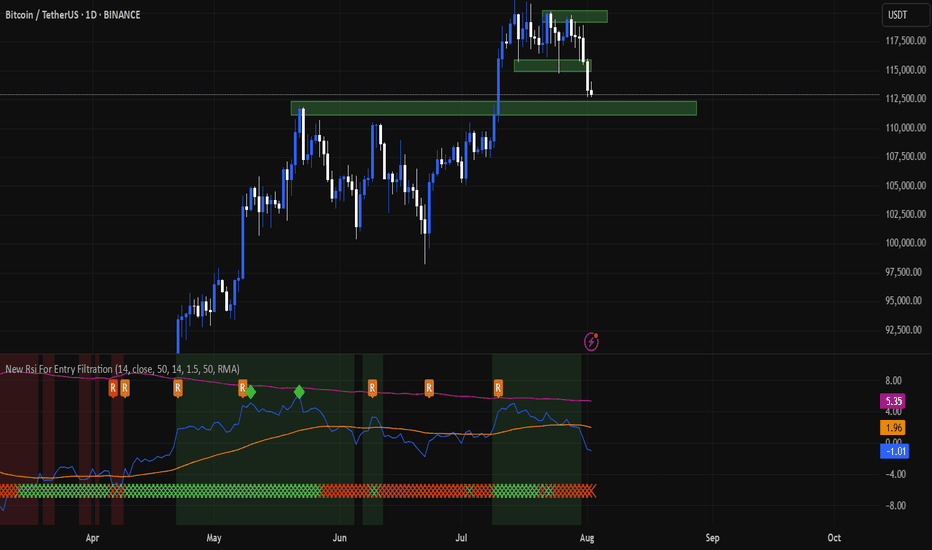

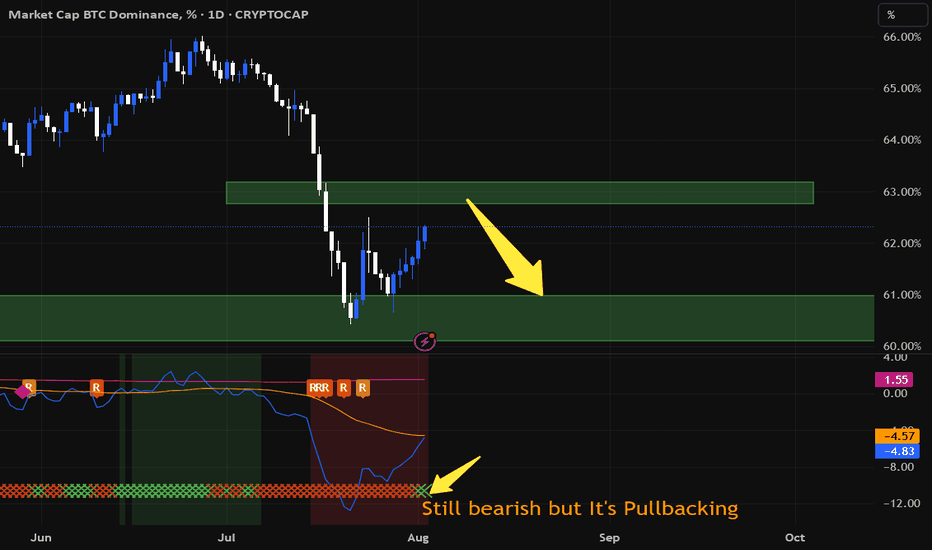

#Bitcoin DominanceWhat I said before is that Bitcoin dominance is in a pull back and the "NEW RSI" indicator also shows it on the daily time frame. Probably, considering the Fibonacci levels at 63%, this pull back is over and after the Bitcoin dominance continues to fall, the pump of altcoins like Ethereum and Ripple will continue.

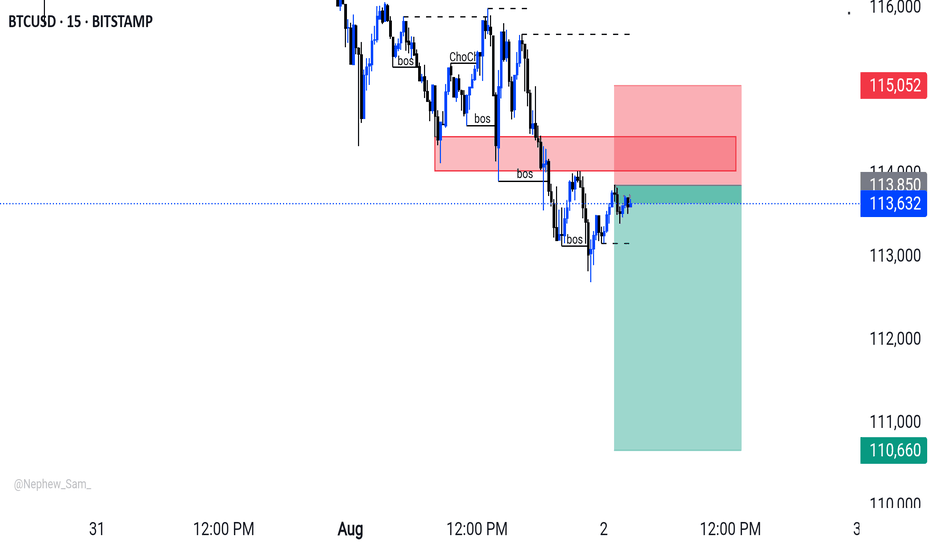

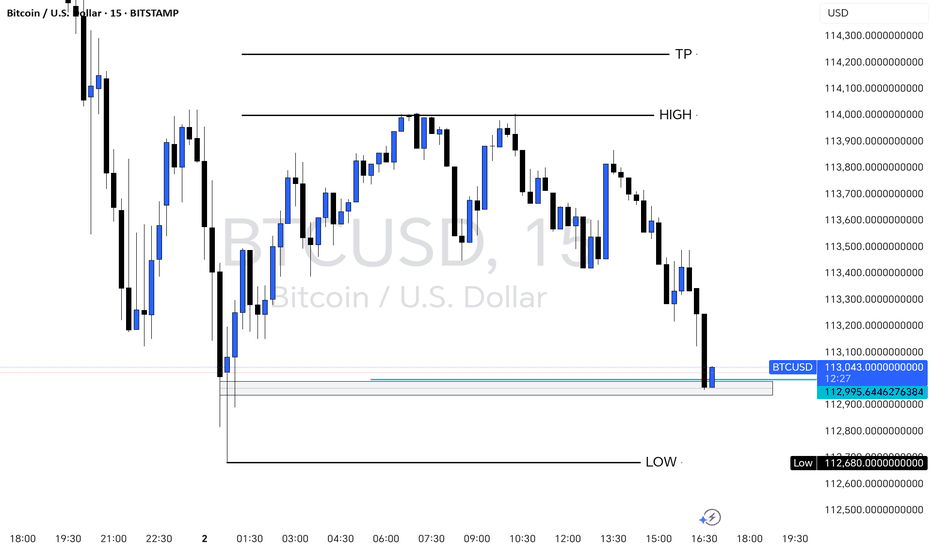

BITCOIN 15-Min Chart – Key Support Retest with Bullish PotentialThis 15-minute BTCUSD chart shows Bitcoin retesting a strong support zone near $112,680 after a clear downward move. The price is currently reacting at a previous demand area, marked in blue, just above the session’s LOW. A possible bullish reversal setup is forming if the support holds, targeting the previous HIGH around $114,000 and a potential TP at $114,200. Traders may look for confirmation signals (e.g., bullish engulfing, order block reaction) before entering long positions.