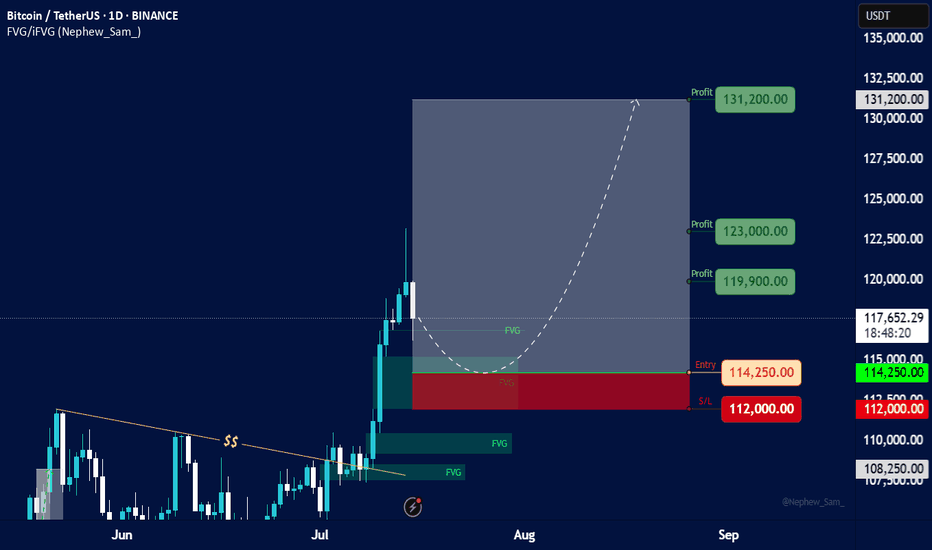

BitcoinBitcoin/TetherUS (BTC/USDT) Trading Analysis - Jul 15, 2025

Key Observations:

Price Movement:

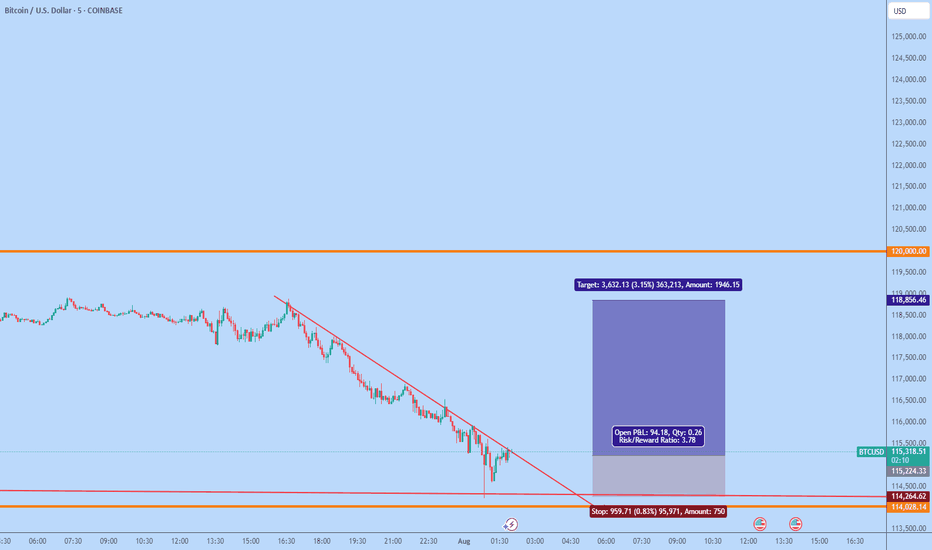

Current Price: $117,692.46

24h Change: -2,148.72 (-1.79%)

Range: Low of $116,250.00 to High of $119,940.83

The price is currently near the lower end of the day's range, indicating bearish pressure.

Support and Resistance:

Support Levels:

Strong Support: $112,000.00 (marked as S/L)

Intermediate Support: $113,500.00 and $110,000.00

Resistance Levels:

Immediate Resistance: $119,900.00

Higher Resistance: $120,000.00 and $122,500.00

Profit Levels:

The "Profit" section lists potential take-profit targets, with the highest at $135,000.00.

The price has recently dipped below the $120,000.00 psychological level, suggesting weakening bullish momentum.

Trend Context:

The chart spans from June to September, but the current price action (July) shows consolidation after a potential pullback from higher levels.

The presence of multiple support levels ($112K–$116K) suggests a critical zone for buyers to defend.

Actionable Insights:

Bearish Short-Term: The price is below key levels ($119,900–$120,000) and has broken below $118,250.00. A retest of support at $112,000.00 is plausible.

Bullish Reversal Signal: If BTC holds above $112,000.00 and reclaims $120,000.00, it could target $122,500.00 or higher.

Risk Management: A break below $112,000.00 (S/L) may trigger further downside toward $110,000.00 or lower.

Conclusion:

The market is currently in a corrective phase. Traders should monitor the $112,000.00 support for potential reversals or breakdowns. A close above $120,000.00 would shift bias to bullish.

Crypto market

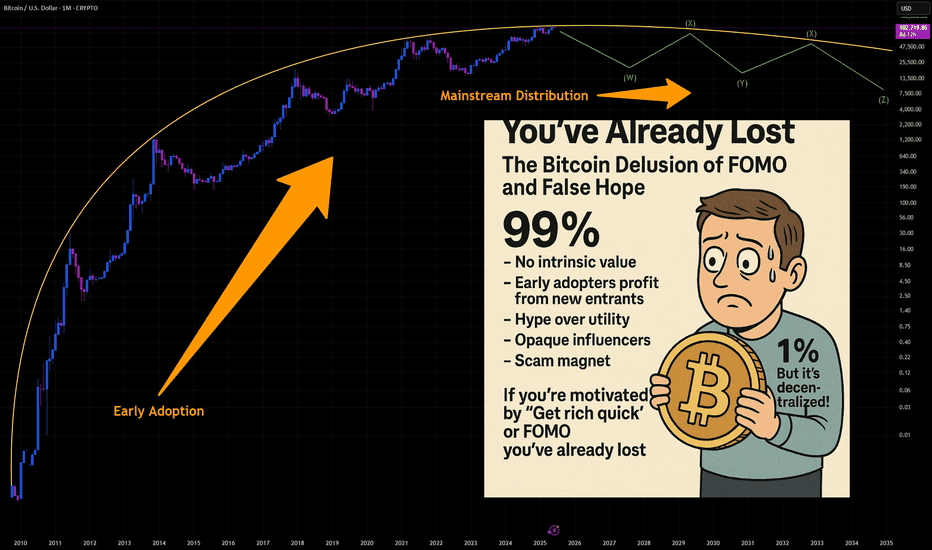

You've Already Lost: The Bitcoin Delusion of FOMO and False HopeLet’s get one thing straight: if you’re staring at Bitcoin, squinting past the red flags, and convincing yourself it’s not a Ponzi scheme because of that one shiny feature that screams “legit,” you’re not investing—you’re auditioning for the role of “next victim.” And if your motivation is the fear of missing out (FOMO) or the fantasy of getting rich quick, well... congratulations. You’ve already lost.

The 99%: Red Flags Waving Like It’s a Parade

Let’s talk about the indicators—the ones that make Bitcoin look suspiciously like a Ponzi scheme. No, it’s not technically one, but the resemblance is uncanny:

- No intrinsic value: Bitcoin isn’t backed by assets, cash flow, or a government. It’s worth what the next person is willing to pay. That’s not investing. That’s speculative hot potato.

- Early adopters profit from new entrants: The people who got in early? They’re cashing out while newcomers buy in at inflated prices. That’s the classic Ponzi dynamic: old money out, new money in.

- Hype over utility: Bitcoin’s actual use as a currency is minimal. It’s slow, expensive to transact, and volatile. But hey, who needs functionality when you’ve got memes and moon emojis?

- Opaque influencers: From anonymous creators (hello, Satoshi) to crypto bros promising Lambos, the ecosystem thrives on charisma, not accountability.

- Scam magnet: Bitcoin has been the currency of choice for over 1,700 Ponzi schemes and scams, according to a University of New Mexico study cs.unm.edu . That’s not a coincidence. That’s a pattern.

The 1%: The “But It’s Decentralized!” Defense

Ah yes, the one redeeming quality that Bitcoin evangelists cling to like a life raft: decentralization. No central authority! No government control! It’s the financial revolution!

Except… decentralization doesn’t magically make something a good investment. It just means no one’s in charge when things go wrong. And when the market crashes (again), you can’t call customer service. You can tweet into the void, though.

FOMO: The Real Engine Behind the Madness

Let’s be honest. Most people aren’t buying Bitcoin because they believe in the tech. They’re buying because they saw someone on TikTok turn $500 into a Tesla. FOMO is the fuel, and social media is the match.

Bitcoin’s meteoric rises are often driven by hype cycles, not fundamentals. Tesla buys in? Price spikes. El Salvador adopts it? Price spikes. Your cousin’s dog walker says it’s going to $1 million? Price spikes. Then it crashes. Rinse, repeat.

This isn’t investing. It’s gambling with a tech-savvy twist.

The Punchline: You’ve Already Lost

If you’re ignoring the overwhelming signs of speculative mania and clinging to the one feature that makes you feel better about your decision, you’re not ahead of the curve—you’re the mark. And if your motivation is “I don’t want to miss out,” you already have. You’ve missed out on rational thinking, due diligence, and the ability to distinguish between innovation and illusion.

Bitcoin might not be a Ponzi scheme in the legal sense. But if it walks like one, talks like one, and makes early adopters rich at the expense of latecomers… maybe it’s time to stop pretending it’s something else.

INDEX:BTCUSD NYSE:CRCL NASDAQ:HOOD TVC:DXY NASDAQ:MSTR TVC:SILVER TVC:GOLD NASDAQ:TSLA NASDAQ:COIN NASDAQ:MARA

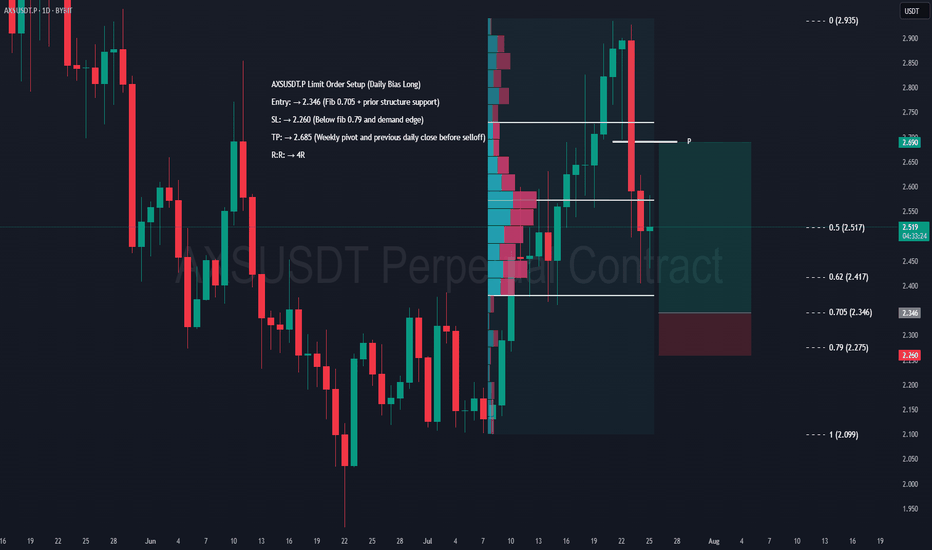

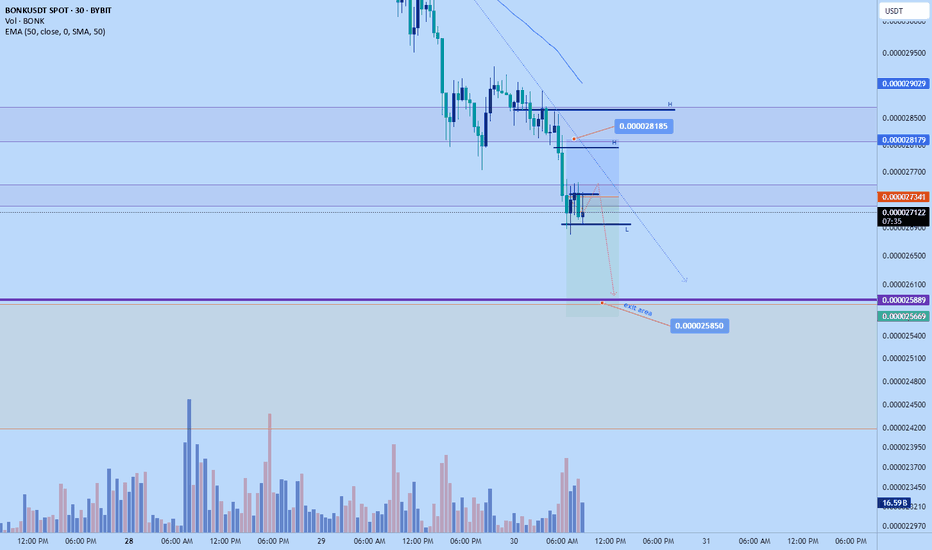

AXS Swing Long Setup – Daily Confluence TradeAXS Limit Order Setup (Daily Bias Long)

Entry: → 2.346 (Fib 0.705 + prior structure support)

SL: → 2.260 (Below fib 0.79 and demand edge)

TP: → 2.685 (Weekly pivot and previous daily low before selloff)

R:R: → 4R

DISCLAIMER: I am not providing trading signals or financial advice. The information shared here is solely for my own documentation and to demonstrate my trading journey. By openly sharing my process, I aim to put pressure on myself to stay focused and continually improve as a trader. If you choose to act on any of this information, you do so at your own risk, and I will not be held responsible for any outcomes. Please conduct your own research and make informed decisions.

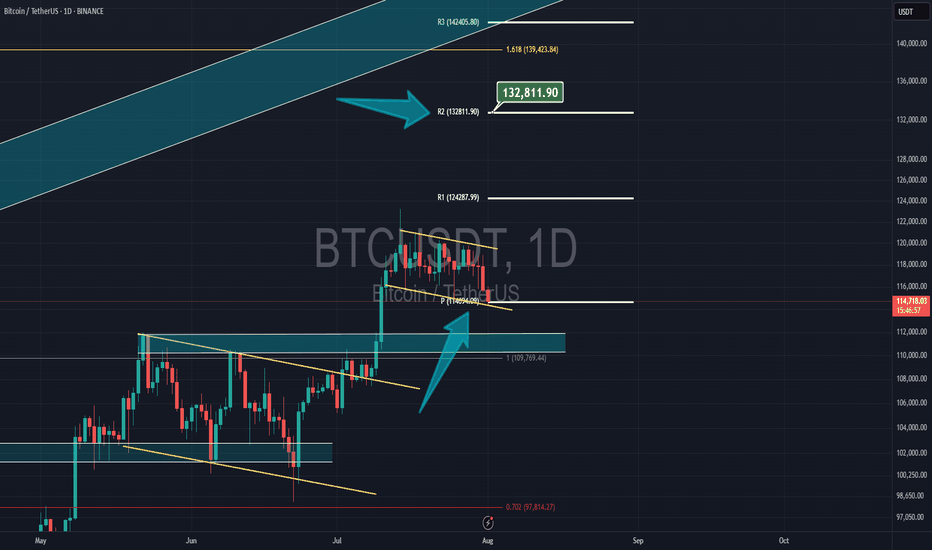

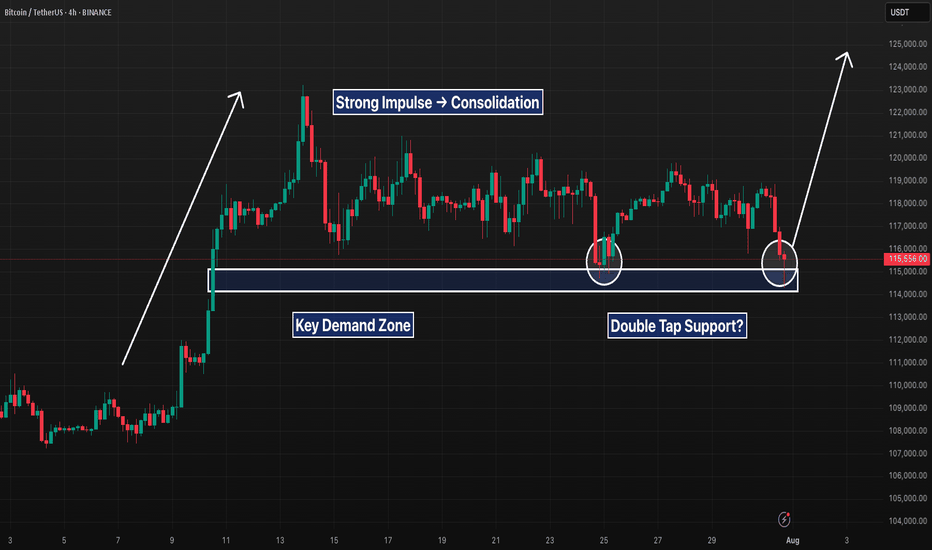

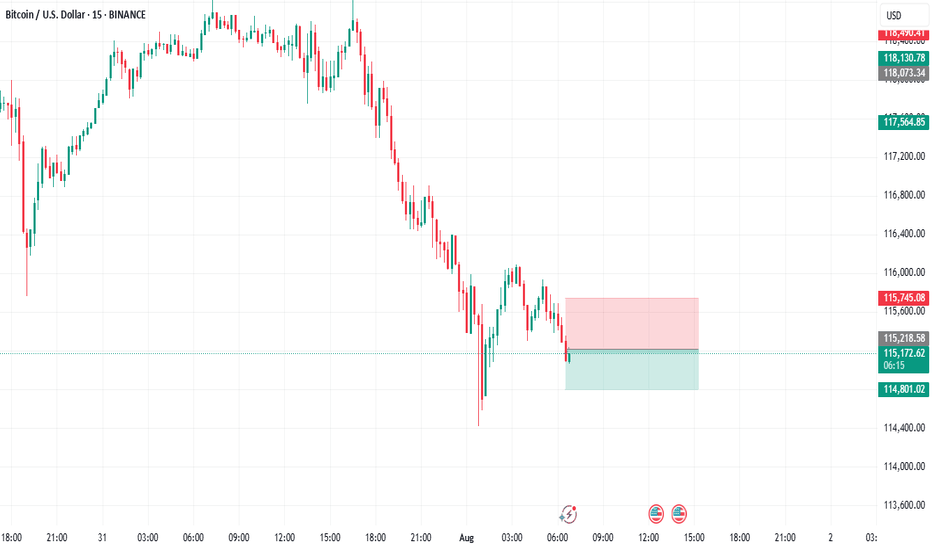

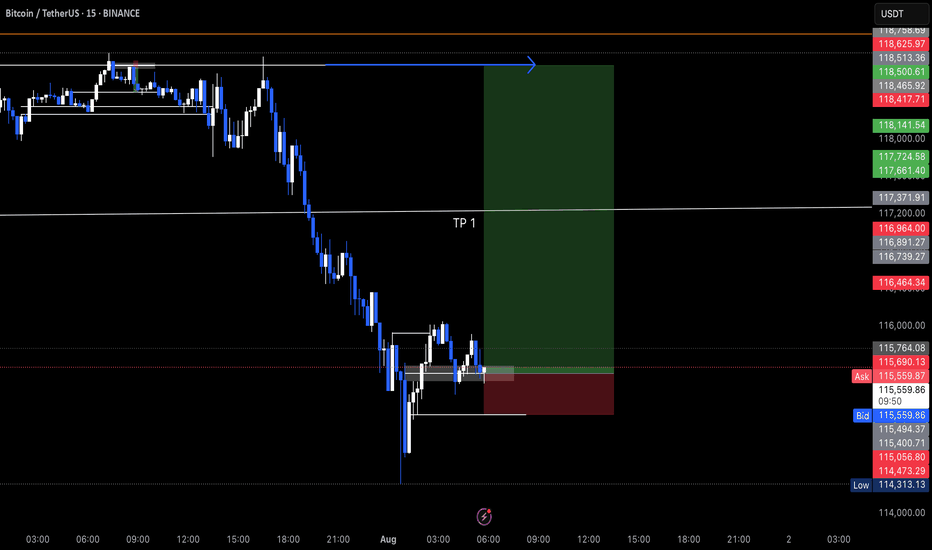

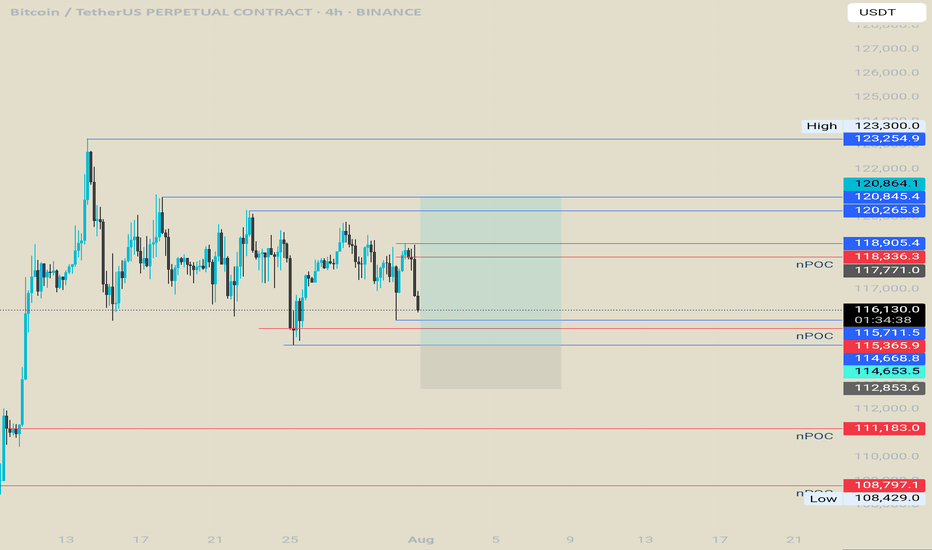

BTC 4H – Support Tapped 2x After Breakout, Will Bulls Step In?Bitcoin is retesting a major demand zone that launched the last breakout. After a sharp impulse move, price has ranged tightly and just tapped this support area for the second time.

A clear double bottom attempt is forming, but failure to hold $115K could open the door to deeper downside. Bulls want to see a quick reclaim of $117K to confirm structure still holds.

Clean levels. Clear reaction zones. Let’s see who takes control.

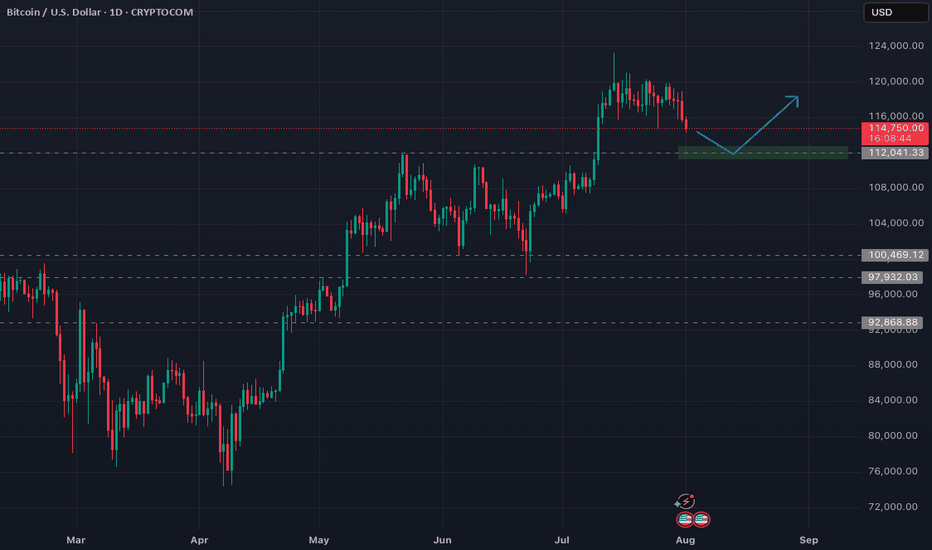

Bitcoin FOMC aftermath & plan aheadHi all,

As you may have noticed, Wednesday's FOMC meeting delivered a less-than-optimistic outlook. The absence of rate cuts, combined with uncertainty about potential cuts in September, triggered a downward move in the markets.

Bitcoin is currently trading 7% below its high from July 14th. I anticipate a relatively shallow downtrend and plan to add to my position around $112,000.

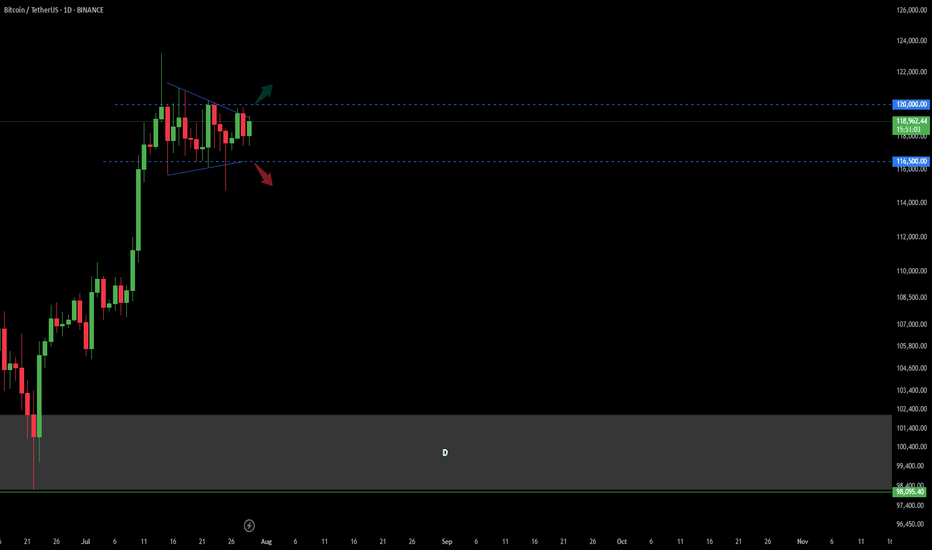

Bitcoin Trend Analaysis UP or DOWN?!Price capped in a wedge in Daily time frame.

There was a fake break from the bottom of this wedge last week and sharply got back to the top of it!

Now : break and confirm above 120 K in Daily would make the market BULLISH

break and confirm under 116.5 K in Daily would make the market BEARISH.

other wise market is still in a range mode...

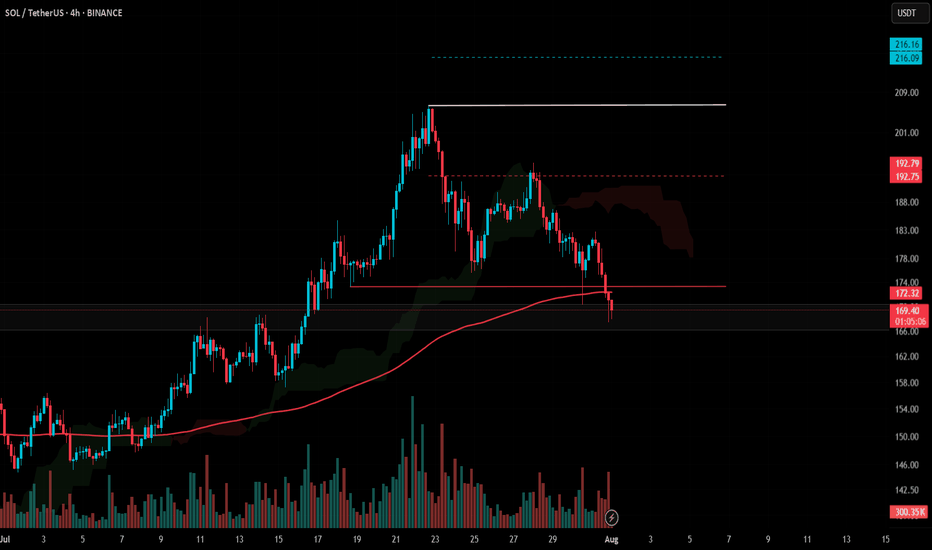

#SOL Update #6 – Aug 01, 2025#SOL Update #6 – Aug 01, 2025

Unfortunately, Solana failed to hold the last low where its most recent impulsive move had started, and it closed below that level. This close also occurred below the MA200 band. In other words, Solana broke a very strong support on the 4-hour chart and moved downward, reaching the previous K-Level zone. It’s hard to say anything positive for Solana at this stage. If the current K-Level fails to hold, Solana may look for support around the $158 level. A long position on Solana is definitely not recommended. I also do not suggest a short position. However, unless there’s a strong reversal, it’s safe to say that Solana has entered a bearish phase on the 4-hour chart.

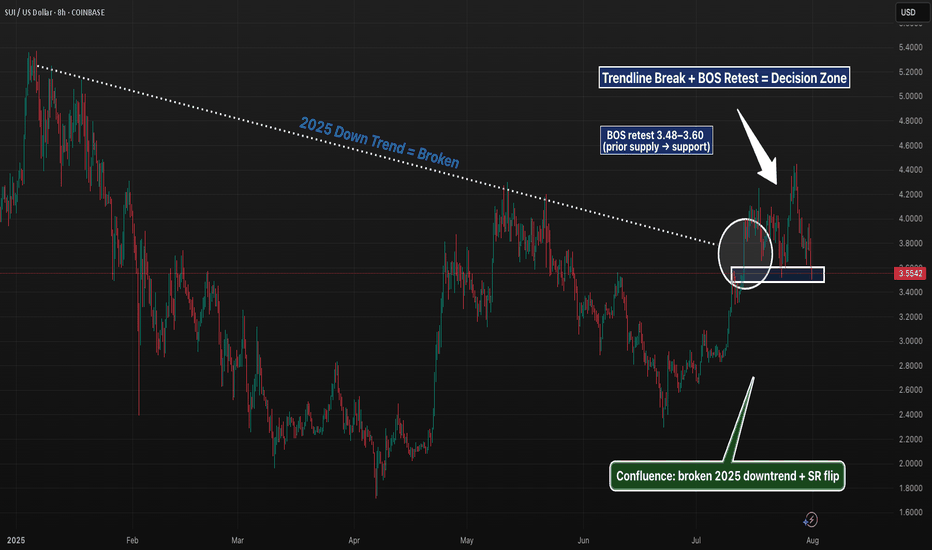

SUI 8H – Trendline Break, BOS Retest, and SR FlipSUI is at a pivotal level after cleanly breaking its 2025 downtrend and flipping prior supply into potential support. The current zone ($3.48–$3.60) marks a textbook BOS retest, aligning with the broken trendline and a clear structure shift.

Price has already printed a higher high, and if this zone holds, it could establish a higher low — a key confirmation for bullish continuation. Momentum traders may watch for reclaim of $3.70 for confluence, while invalidation sits below $3.32.

A break lower opens the door to deeper retracement targets around the 0.618 zone ($3.32–$3.38), but structure remains intact until then. Clean price action, strong confluence, and a clear invalidation level make this an actionable zone to watch.

📊 Structure: BOS → Retest

🧠 Bias: Bullish if $3.48–$3.60 holds

📉 Invalidation: 8H close below $3.32

🔔 Next key levels: $3.90, $4.10, $4.45

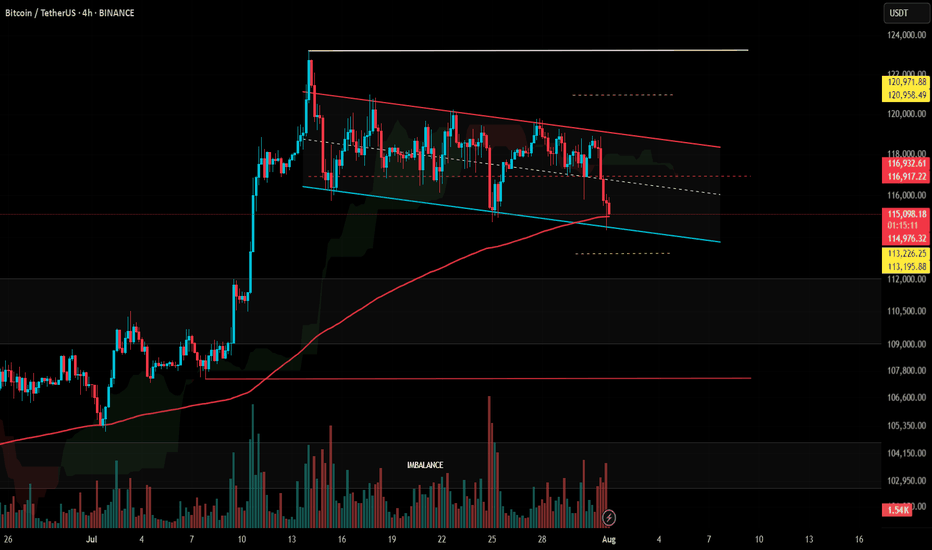

#BTC Update #13 – Aug 01, 2025#BTC Update #13 – Aug 01, 2025

Bitcoin has approached the lower edge of its current channel and received a reaction from there. However, in the current timeframe, the ongoing candle seems willing to pull back again. The MA200 band held the previous candle well, which also represented the bottom of the current channel. There is high liquidity between the $113,200 and $121,000 zones. I believe Bitcoin will continue to move by sweeping through this region. Therefore, I think Bitcoin’s current target is to reach around the $118,000 level with a 3% push move.

If Bitcoin does not make this move and chooses to pull back instead, it may go as far as filling the imbalance at the $110,000 level. The last impulsive move was made around 20 days ago, and since then, the chart has been progressing with a correction of a correction. As long as there’s no close below $107,500, the uptrend will remain intact in the long term. However, if the $107,500 level is broken with a strong candle, we can say that Bitcoin has turned bearish on the 4-hour timeframe. For now, this doesn’t seem very likely. I believe Bitcoin’s next move will target the $118,000 region, continuing to clear out the liquidity accumulating in the upper ranges. However, this channel will need to break at some point.

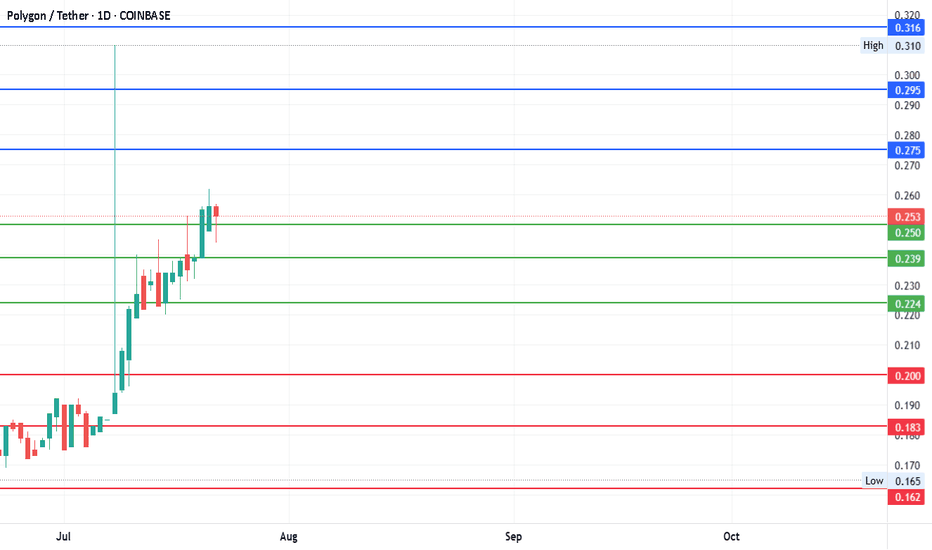

#MATICUSDT - Pivot is $0.239Date: 22-07-2025

#MATICUSDT Current Price: $0.253

Pivot Point: $0.239 Support: $0.224 Resistance: $0.254

Upside Targets:

Target 1: $0.275

Target 2: $0.295

Target 3: $0.316

Target 4: $0.337

Downside Targets:

Target 1: $0.203

Target 2: $0.183

Target 3: $0.162

Target 4: $0.141

#TradingView #Crypto #Bitcoin #BTC #CryptoTA #TradingView #PivotPoints #SupportResistance

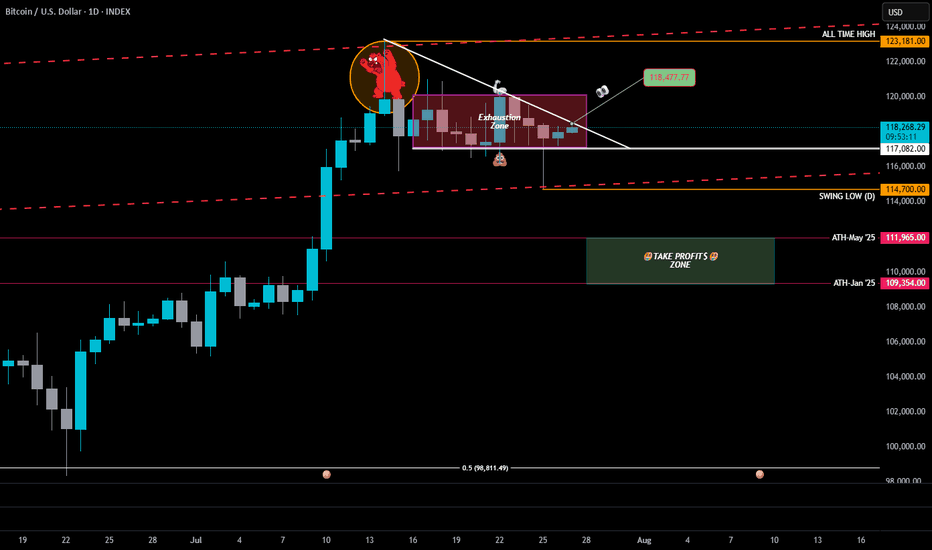

BTC Exhaustion Zone Update: The Bulls Charged… But the Zone HeldExhaustion Zone Update: 2025–208

📉 Exhaustion Zone Update: The Bulls Charged… But the Zone Held

On Friday, BTC dipped to 114,700, printing a fresh Daily Swing Low — a classic liquidity grab. The bulls stormed in for reinforcements, pushed price back up late in the day…

but once again, the Exhaustion Zone stood its ground.

BTC closed lower than Thursday, and since then? Pure chop.

Feels like both bulls and bears took the weekend off to watch Netflix.

—

🔻 The Downward Trendline Still Rules

Today, it’s simple: Bulls must close above 118,477.

That’s the trendline test — hesitation here, and the bears come clawing.

Usually I’d say, "give the bulls until Monday"...

but this year has shown us one thing:

🐋 The Whales Hunt on Sundays.

If the bulls don’t step up today, we might learn the hard way why it’s called the Exhaustion Zone.

—

📉 The Risk if Bulls Fail

BTC already gathered all the bulls it could down at the Daily Swing Low — and they’re tired.

If they can’t break out, the High-Powered Short Zone (dashed red lines) will take over.

The bears? Heavy. Angry. Overdue for a window jump.

🎯 Next floors down:

• May ATH → 111,965

• January ATH → 109,354

That’s the Take Profit$ Zone 👇

And honestly? I’m letting a small short position ride in case the evil whales take us all the way to the 50% level (98,811).

—

📌 The Alpha View

To the bulls: It’s showtime.

Either close above 118,477 today…

or the All-Time High Parade might just reroute — straight down the fire escape. 🐻🔥

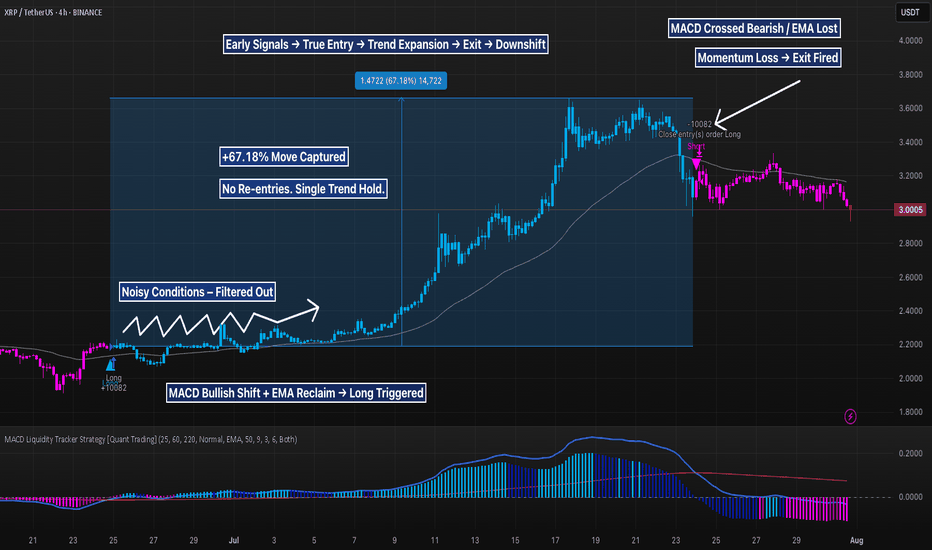

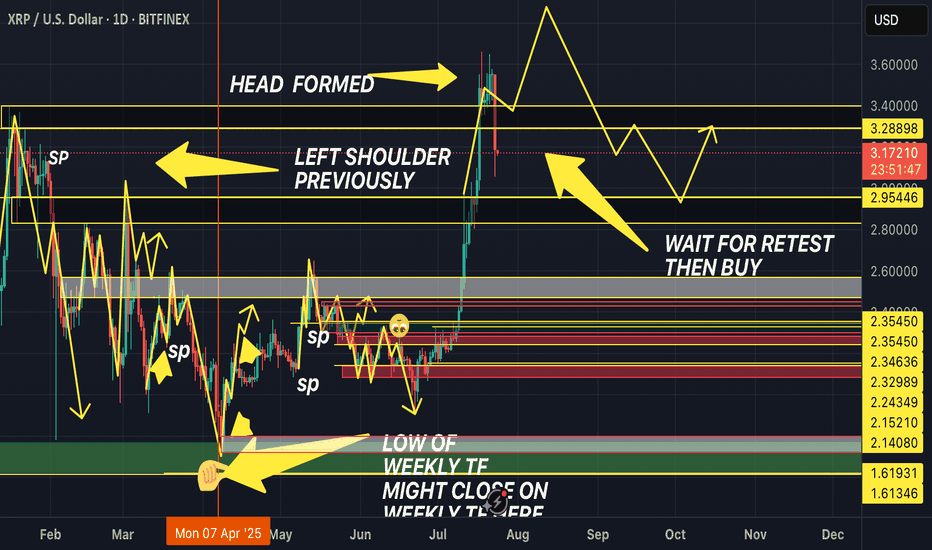

XRP 4H + 67% From MACD Trend Entry, But Is the Pullback Real?This XRP move was a masterclass in filtered momentum trading. The MACD Liquidity Tracker Strategy (Normal Mode) skipped early chop, then fired long once MACD aligned with a reclaim of the 60/220 EMAs — signaling a clean directional shift.

The strategy held through a +67.18% rally, exiting only when MACD flipped bearish and price lost EMA support. From ~$2.12 to ~$3.54, the move was captured in full with zero re-entries or second guessing.

Now price is under pressure, printing pink bars and sitting below both EMAs. The $2.90–$3.00 zone may determine if this is a healthy pullback — or the start of a reversal.

📊 MACD: 25 / 60 / 220

Trend Filter: 60/220 EMA

Mode: Normal | Timeframe: 4H

Educational chart. Drop your take.

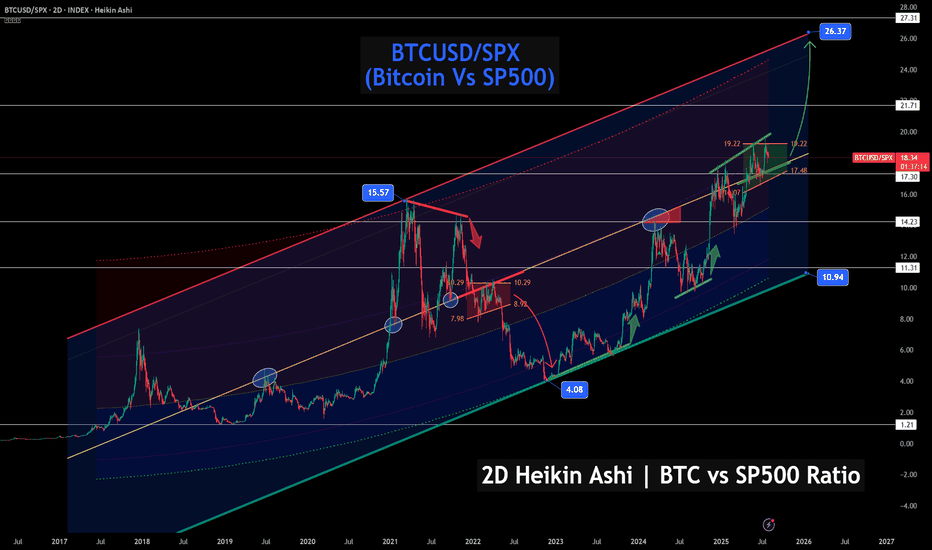

Bitcoin vs S&P 500 – Ratio Signals Strength, Chart favors BTC!🚀📊 Bitcoin vs S&P 500 – Ratio Signals Strength, Even If Stocks Correct 🔍📈

After posting earlier today about VOO (S&P 500 ETF) and the index itself hitting major resistance, I wanted to shift our focus to what could shine even if stocks pull back: Bitcoin.

This chart shows the BTCUSD/SPX ratio – in simple terms, how Bitcoin is performing relative to the S&P 500 . And what do we see? Clear, technical strength.

🔍 Key Observations:

BTC/SPX is currently breaking out from a bullish flag structure just above the 17.30–17.48 region

If the breakout holds, the projected technical target is near 26.37, the top of this multi-year channel

Historically, previous breakouts from similar zones have delivered explosive upside, even when equities struggled

🧠 So what does this mean?

Even if the stock market pulls back—as suggested in our earlier VOO/US500 chart—Bitcoin could still outperform, simply by dropping less, consolidating, or rising while stocks fall. That’s the power of analyzing ratios, not just absolute price.

We’ve already discussed how macro metrics like the Buffett Indicator (Stocks-to-GDP) are showing equity overvaluation. If capital starts rotating out of equities, Bitcoin is positioned as a beneficiary—especially if it maintains this relative strength.

💬 Final thoughts:

Don’t just look at BTC in isolation— look at it relative to what it's competing against

Ratios offer perspective: this one says Bitcoin’s trend vs stocks is up and strong

With solid support at 14.23 and room to run toward 26.37, this could be a chart to watch for months ahead

Are you watching this breakout? Let me know what your game plan is.

FOOD FOR THOUGHT: With Gold prices easing, stock markets at all time highs, is this the PERFECT time for big money to hedge with Bitcoin? Likely yes !

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

HEAD & SHOULDER DAILY TIME FRAME! (DOUBLE WHAMMY!!!!)The market has previously created a left shoulder. Now, it has broken out of the top of the Resistance and broken back into the support and resistance, about to form the right shoulder.

Wait for retest of the resistance then sell to the support, AND THEN BUY IT BACK TTHE RESISTANCE!! DOUBLE WHAMMMY!!

$BTCUSDT: Fictitious Fractal 136KSo. I see we are having a relatively difficult time.

My expectations are in this range for the next appx. 125 days - 365 days.

Downside: 68.6k-69.9k

Topside: 100k to 136k (round to 150k)

I drew this fractal by hand and I want to watch it closely.

I expect in the next few weeks we hit 100k and then do a nice rug to 69k range.

This is probably wrong.

I pretty much extrapolated the red brush circle into a weeks long fractal.

I am longing all the dips to 68k.

Enjoy.

Mr. Storm.

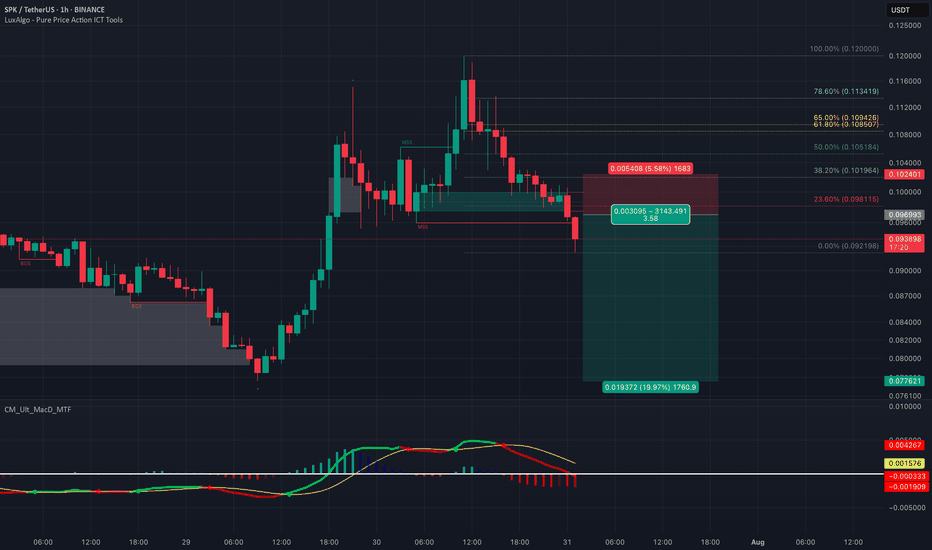

Bearish Retest Setup After BreakdownPrice broke down from the recent bounce and lost the 0.098–0.101 zone, which lined up with the 23.6–38.2 fibs. That area is now likely to act as resistance. Momentum is still bearish. MACD histogram is red and expanding, and no signs of reversal yet. On the daily timeframe, MACD has just started to cross bearish, which adds weight to the downside bias.

If price retests that 0.098–0.101 area and shows weakness (like rejection wicks or small-bodied candles), it’s a clean short opportunity. First target would be the recent low around 0.092, and if that breaks, the next key level is 0.077.

Any push above 0.102 would invalidate the setup for me.