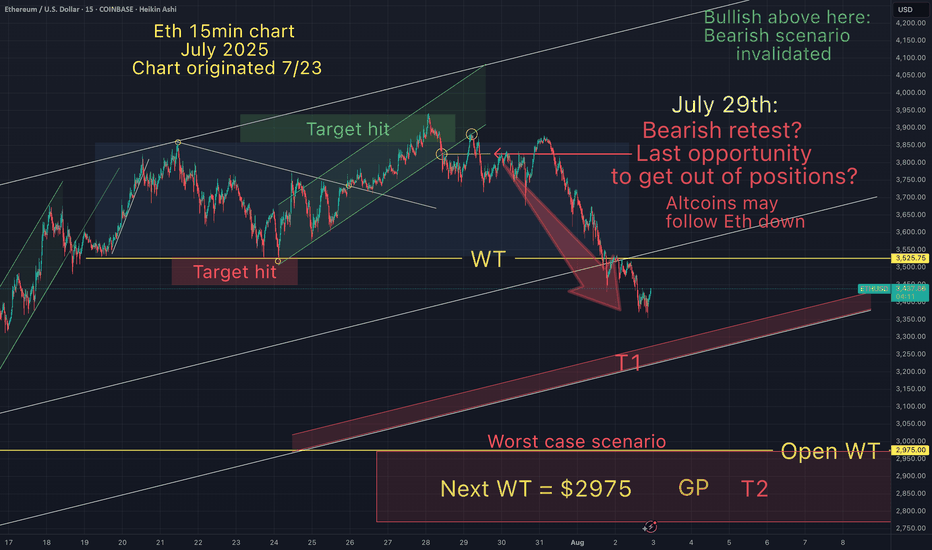

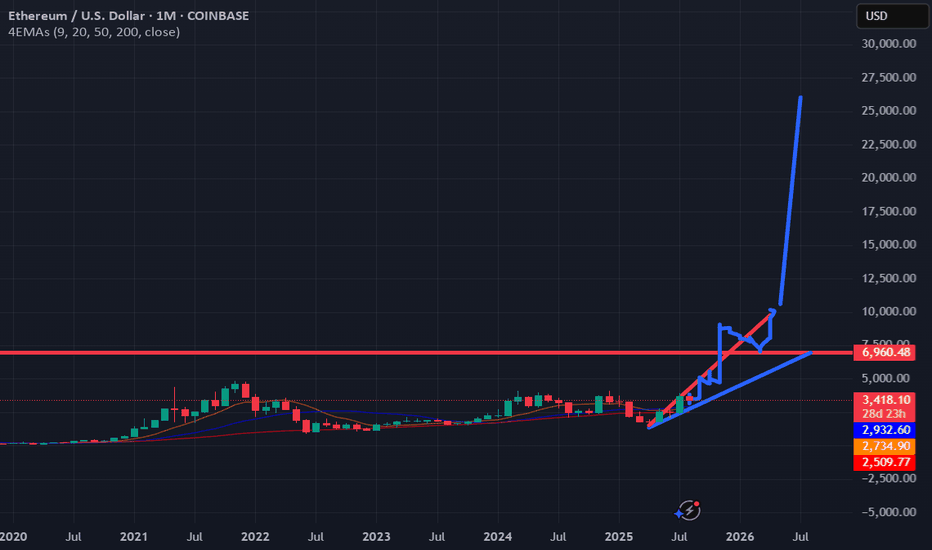

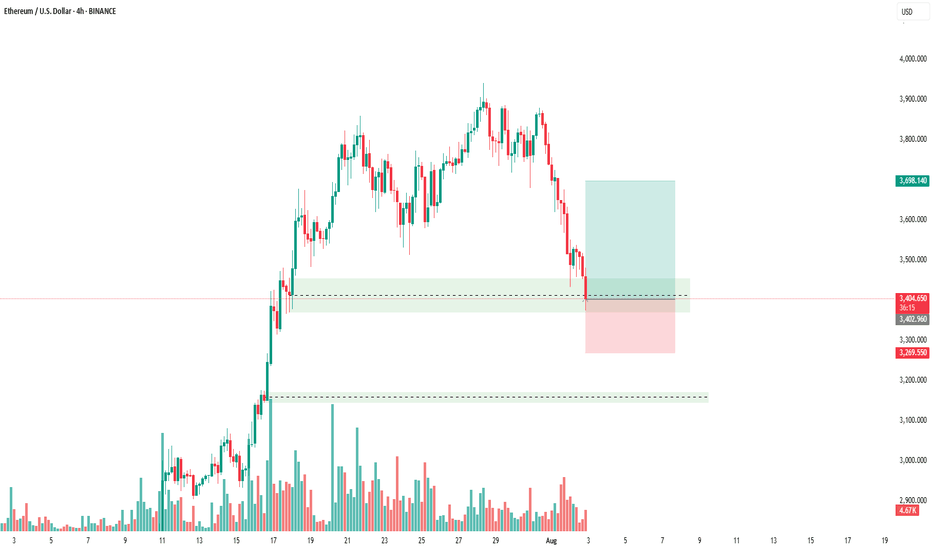

Eth - The descent confirmed. Next target is lower.Recap

-------

On my July 23rd chart I wrote:

"In a bull market the average retrace is between .2 -.4 Fib from the bottom of that run.

Several factors of confluence lead me to believe Eth will hit my red T1 target, bounce to the top of current range (green T1) then drop to a minimum of .35 Fib = $2990".

On July 28th I wrote:

"As anticipated, my bearish T1 target (red) was hit soon after I first posted this chart on July 23rd 2025.

As the arrow indicated, Eth would bounce from my bearish T1 (red) to my bullish T1 (green). This has been confirmed in both price and in the timeframe indicated by my boxes.

There was also a downward arrow from my green T1 pointing towards my bearish T2 (red). Eth is already retracing from my top target, and I belive it will now continue down the red channel towards T2 and possibly T3 (between $2990 - $3200)".

On July 29th on the chart titled "Has Eth begun it's descent?", I wrote:

"On July 23rd, I anticipated that Eth would dump once it took out the range high.

Now that we have witnessed that, along with a bearish retest (as indicated on chart),

I believe the descent has begun. I hope I'm wrong.

But if I'm right, it will provide me with an amazing entry point around $2900-3200"

Aug 2nd:

Eth has crashed 15%. The descent has begun.

Crypto market

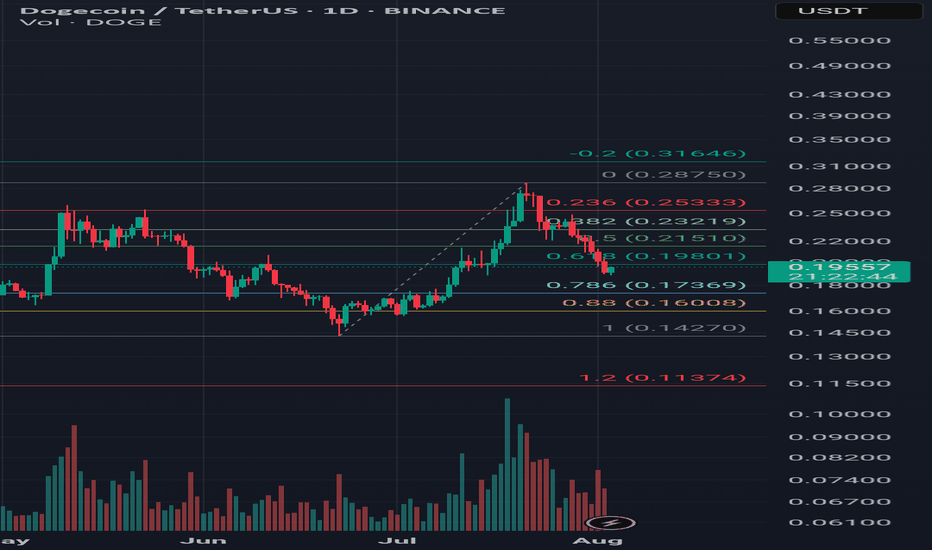

DOGE/USDT Trade Idea – Potential Cup & Handle Pattern Timeframe: Technical Analysis:

Price rallied from 0.142 to 0.287 and is currently forming the handle of a potential cup & handle pattern.

Price is sitting at the key 0.618 Fibonacci retracement level (0.198 USDT).

If this support holds and price breaks above resistance levels with strong volume, the cup & handle pattern may activate.

---

🎯 Targets:

1. First resistance: 0.215 USDT (50% Fib)

2. Second resistance: 0.232 USDT (38% Fib)

3. Key breakout level: 0.287 USDT

4. Classic pattern target: 0.432 USDT

---

🛡 Stop Loss:

Below 0.170 USDT (slightly under the 0.786 Fib & handle bottom)

---

✅ Entry Confirmation Criteria:

1. Hold above 0.198 support

2. Break and close above 0.215

3. Breakout above 0.287 with strong volume

---

💡 This analysis is for educational purposes only and is not financial advice. Always use proper risk management.

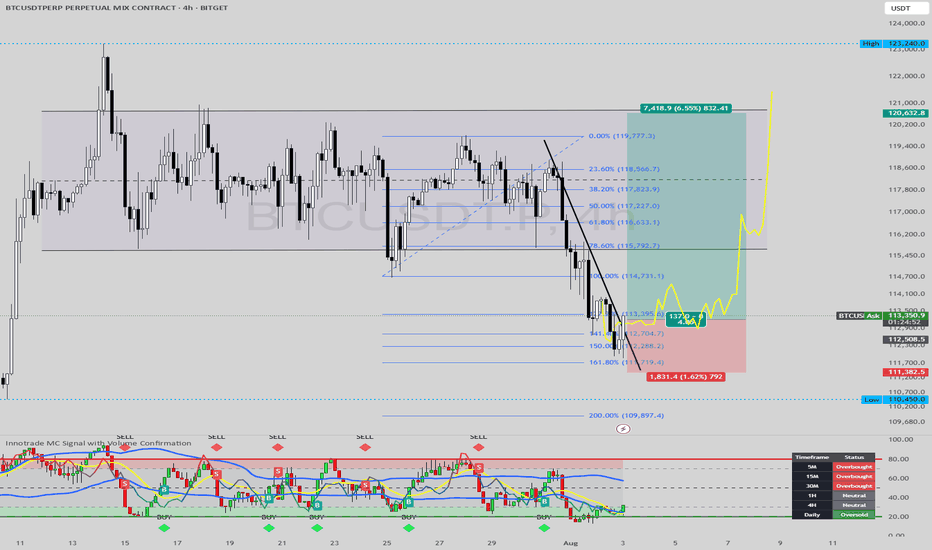

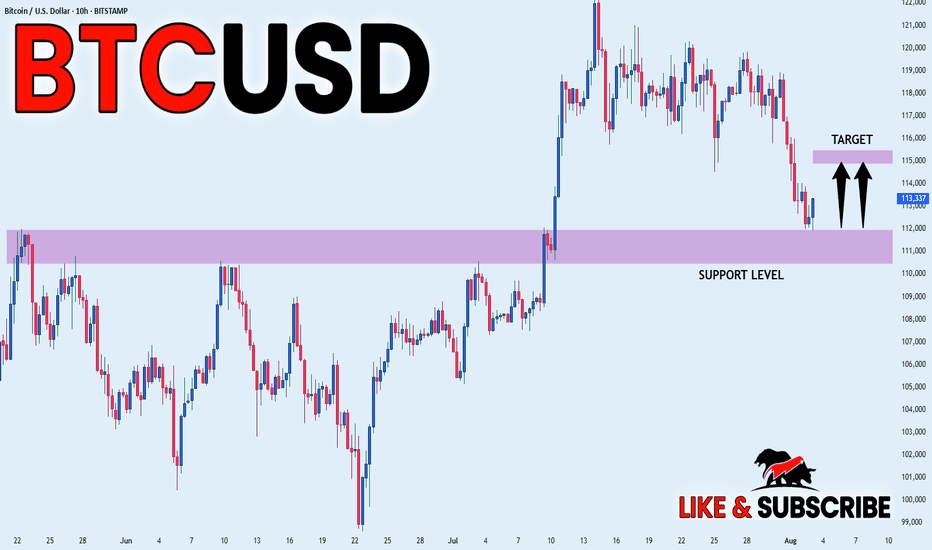

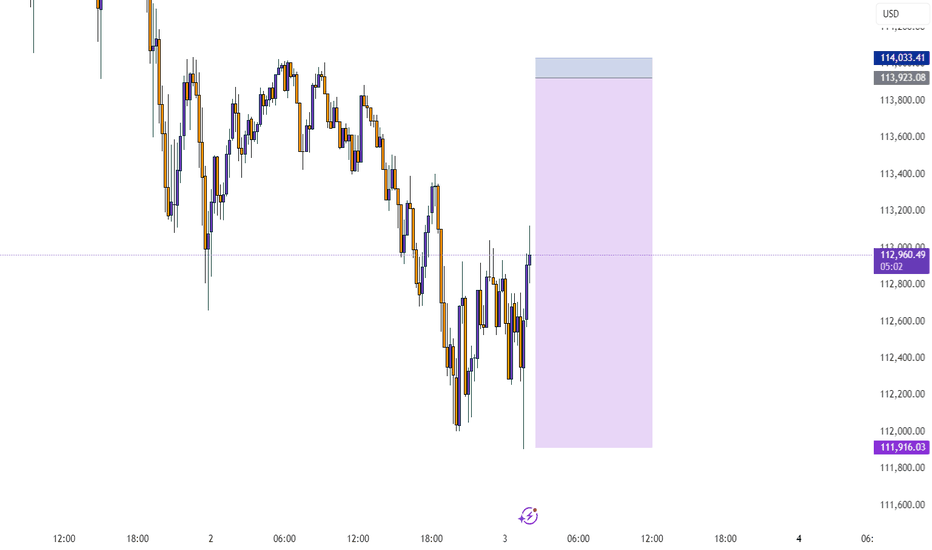

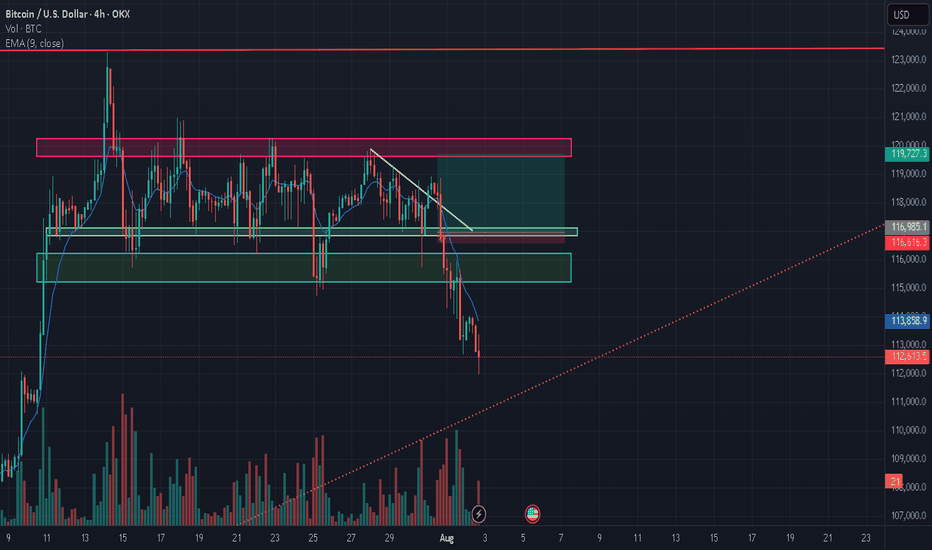

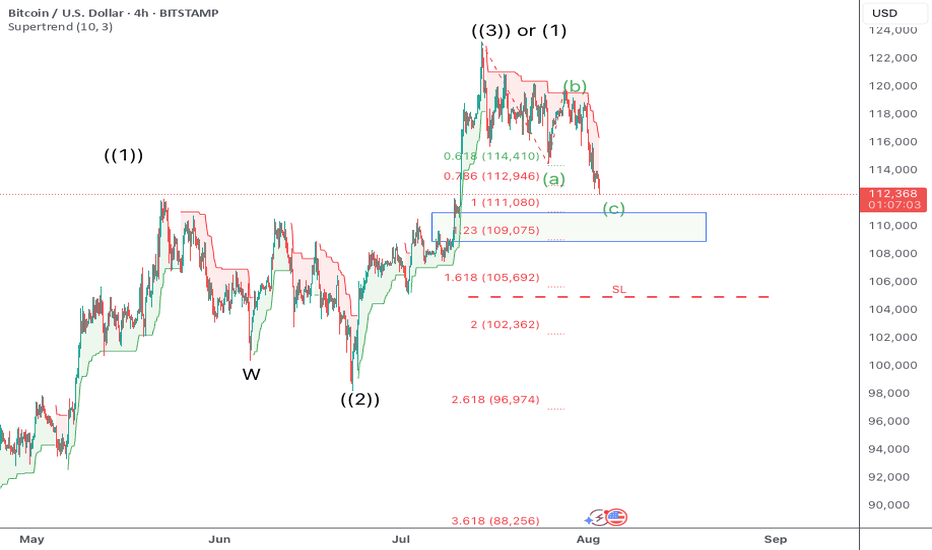

BITCOIN LONG FROM SUPPORT|

✅BITCOIN has retested a key support level of 112k

And as the coin is already making a bullish rebound

A move up to retest the supply level above at 115k is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

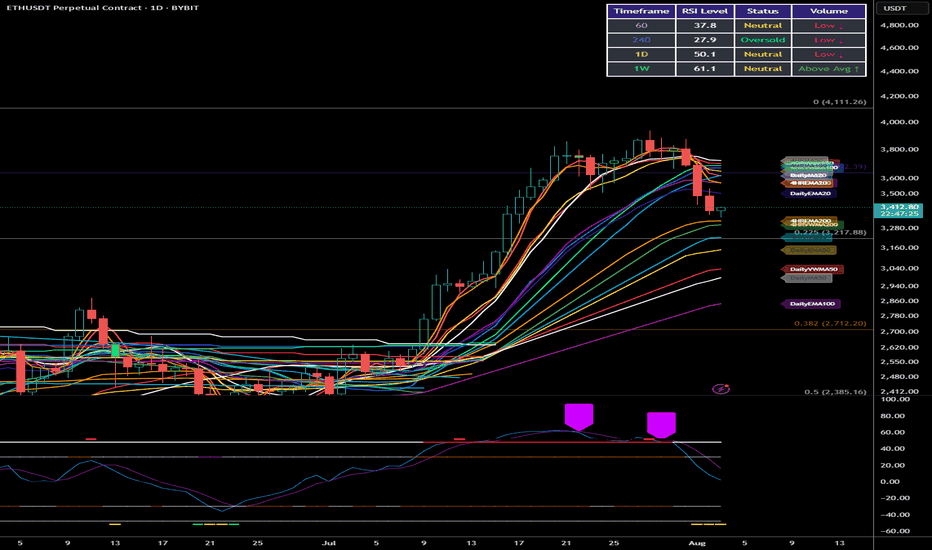

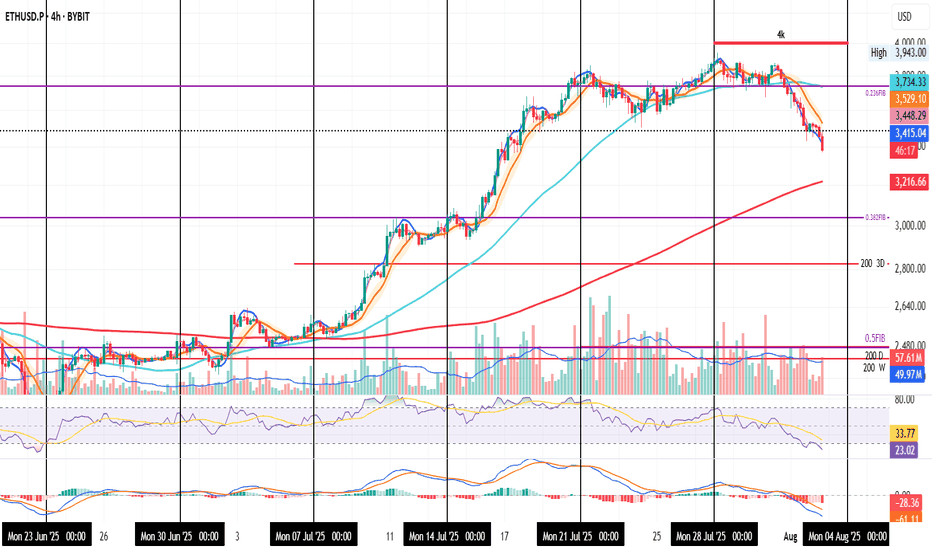

ETH Market Analysis: Where Are We Heading?Current Situation

Ethereum has been on quite a journey in 2025. After climbing steadily since January and reaching nearly $4,000 in July, we're now seeing a pullback with prices around $3,400. This isn't unusual - even in strong uptrends, prices don't move in straight lines.

What The Data Tells Us

Looking at the price patterns and technical indicators:

The big picture remains positive: Despite recent dips, Ethereum is still in an uptrend when looking at the longer timeframe. We're significantly higher than where we started the year.

We're at a decision point: The price is currently sitting at an important level where buyers and sellers have previously shown strong interest.

Support and resistance zones are clear: There have been consistent price levels where Ethereum tends to bounce (support) or struggle to break through (resistance).

Three Possible Paths Forward

Path 1: Resuming the Climb (45% likelihood)

If buyers regain control, we could see Ethereum push back above $3,500, then challenge the recent highs near $3,900. Breaking that level could open the door to the psychologically important $4,000 mark and potentially beyond.

Path 2: Further Pullback (40% likelihood)

If selling pressure continues, Ethereum might drop toward $3,200 first, with stronger support around $3,000. In a deeper correction scenario, we could test the $2,800 area where many buyers stepped in during previous dips.

Path 3: Sideways Movement (15% likelihood)

Sometimes markets need time to digest gains. Ethereum could spend several weeks trading sideways between roughly $3,300 and $3,600 before making its next significant move.

What To Watch For

Breakout signals: A strong move above $3,550 with increasing trading volume would suggest the uptrend is resuming.

Breakdown signals: Falling below $3,350 with conviction could indicate more downside ahead.

Volume patterns: Higher volume on up-days versus down-days would suggest stronger buyer interest.

This analysis is based purely on price patterns and technical indicators, looking at what the market has actually done rather than predictions based on news or sentiment.

Ai16Z on a falling wedgeai16z has been in a bullish falling wedge for the past roughly 200 days. Right now as bitcoin and other cryptos are having a pull back, ai16z is forming a double bottom formation. The pattern is not complete as of yet please wait for a potential break out above the wedge resistance level to enter trade. However if anyone wish to catch the double bottom trade to maximise return you could enter at 10c but like always high risk high return the double bottom could fall further and void this idea. Happy Trading

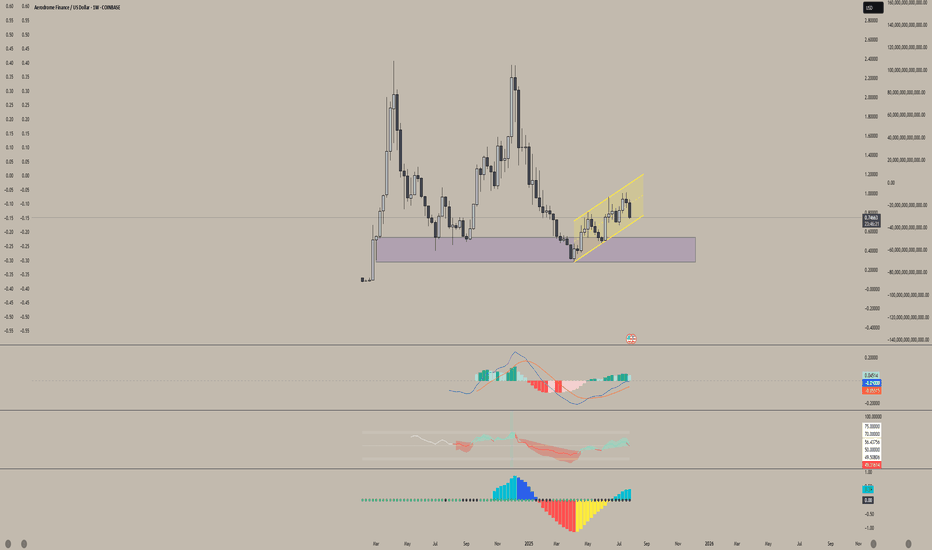

Aerodrome Finance (AERO)Aerodrome (AERO) is showing strong signs of accumulation.

We've been trading within this parallel channel for nearly three months, and it's repeatedly respected both the upper and lower bounds. As we approach the bottom of this range again, it looks like an ideal accumulation zone for long-term holders.

I'm very bullish on this project. Aerodrome is the leading DEX on Base — Coinbase’s Layer 2 network — and with no native Base token currently, AERO is in a prime position to claim that top spot. There's a vacant throne on Base, and AERO is well-positioned to sit on it.

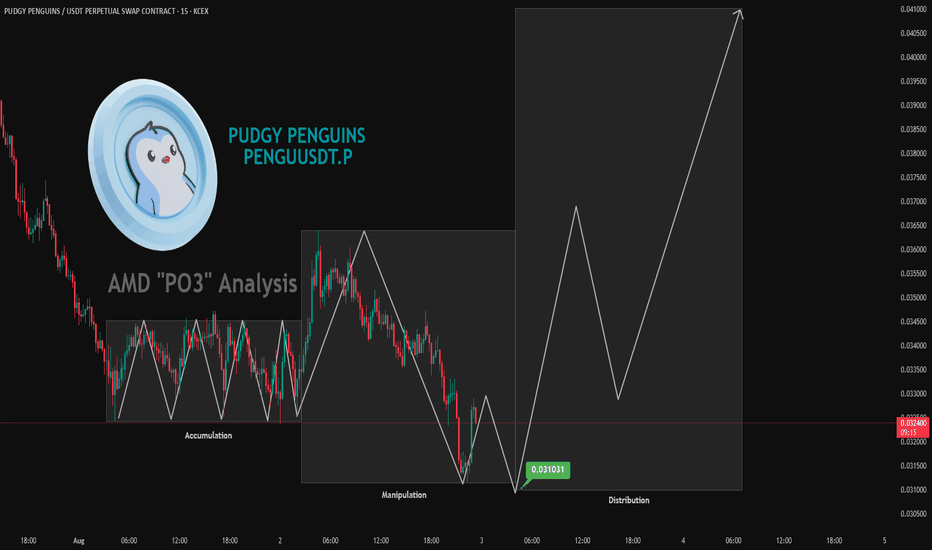

#PENGU #PENGUUSDT #PENGUINS #LONG #AMD #PO3 #Analysis #Eddy#PENGU #PENGUUSDT #PENGUINS #LONG #AMD #PO3 #Setup #Analysis #Eddy

PENGUUSDT.P Scalping Long Setup

This Setup & Analysis is based on a combination of different styles, including the volume style with the ict style. (( AMD SETUP )) "PO3"

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The entry point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Note: The price can go much higher than the specified target and have a very good pump.

Be successful and profitable.

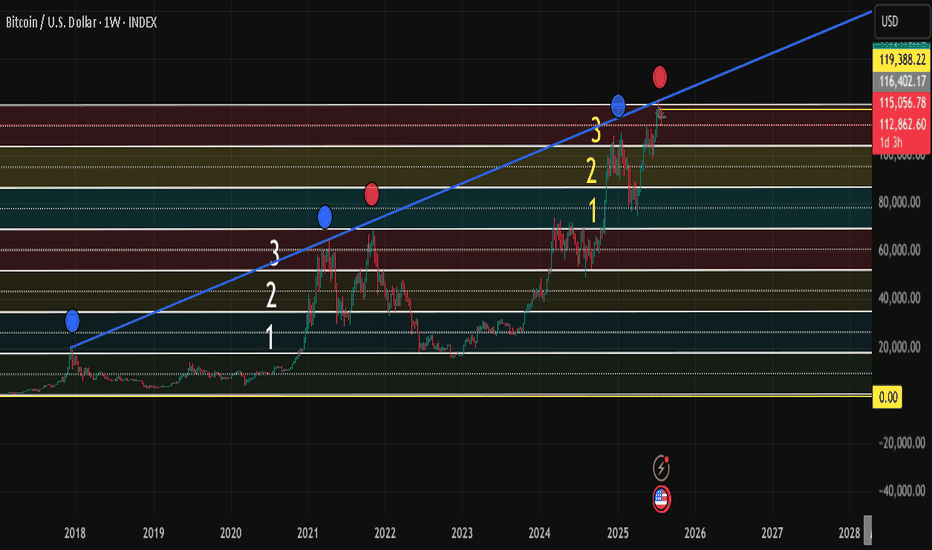

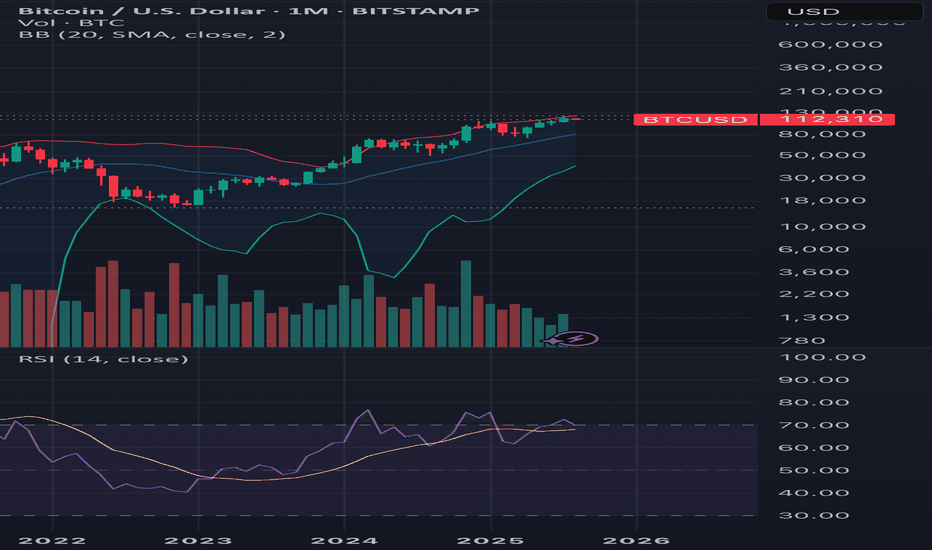

Downtrend to trendsupportHey guys, i this is my prediction for bitcoin. I believe it will drop to my trend support and become a resistance. If it goes below that it would turn into a ranged market and no longer be a trend anymore. Also, once the downtrend is over, it would hit my demand area. I do have some old analytics on this chart, i assumed it would be an uptrend a while ago, but as soon as it went beyond my buy area, i knew it might be a breakout.

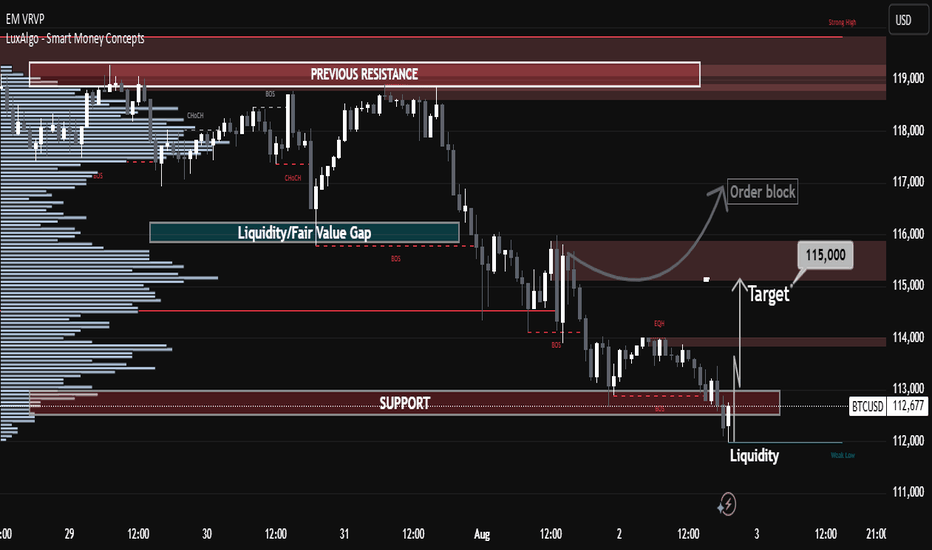

"BTC Sweeps Liquidity – Eyeing 115K Reclaim?""BTC Sweeps Liquidity – Eyeing 115K Reclaim?"

🔍 Technical Analysis – BTC/USD

On the 1H chart, Bitcoin (BTC) is currently displaying a textbook smart money structure, with price action following key institutional footprints.

🔑 Key Observations:

Liquidity Grab at Weak Low

Price dipped below the local support (~112,500), sweeping sell-side liquidity and tapping into a possible reversal zone.

Rejection from Demand Zone (Support Area)

A strong reaction occurred right at the support level, suggesting buyer interest is still present.

Order Block & Fair Value Gap

A visible Fair Value Gap (FVG) sits above current price action, aligning with an Order Block near the 115,000 level — this is a key magnet for price to rebalance.

Target Zone

Immediate upside target is 115,000, where an order block lies. If price reaches that level, expect potential short-term resistance or reversal.

Break of Structure (BOS) Confirmations

Multiple BOS and CHoCHs indicate bearish-to-bullish attempts, but the current structure still needs confirmation above 113,500+ for bullish continuation.

🧠 Conclusion & Expectation:

BTC has swept liquidity to the downside and may now seek to fill the FVG and revisit the 115K order block. However, confirmation is required — watch for bullish engulfing candles, volume spikes, or a CHoCH above 113,500.

“Smart money doesn’t chase — it waits for liquidity, then repositions. BTC may be following the same script.”

ETHUSDT BUYING SETUP !Ethereum (ETHUSDT) is showing a bullish setup as price holds above key support. The market is indicating buyer interest, and a push upward could be expected if momentum continues.

Look for confirmation like bullish candlesticks or a breakout from consolidation before entering. This setup offers a good risk-to-reward opportunity for buyers.

Stay focused, trade with confirmation, and manage your risk properly! 📈🔥

ETH 4H | Eyes on Support |ETH on the 4H

Bears are having their moment — and that’s fine.

Price is heading lower, with the 200MA around $3200 as the next support. If that breaks, the 0.382 Fib near $3000 is the last line before things get ugly.

My plan? Watch RSI for signs of bullish divergence.

Until then, hold tight.

Always take profits and manage risk.

Interaction is welcome.

BTC / BNB Buying opportunityBTC is near equal leg from all-time high, as the dollar index is pulling back, and BTCis on an Equal leg, along with BNB supporting upside possibility

BTC Entry: 111300

SL: 105100

Target: 124000

Risk: Reward - 1:2

BNB Entry: 720

SL: 660

Target: 900

Risk: Reward - 1:3

Watch my YouTube video for detailed analysis

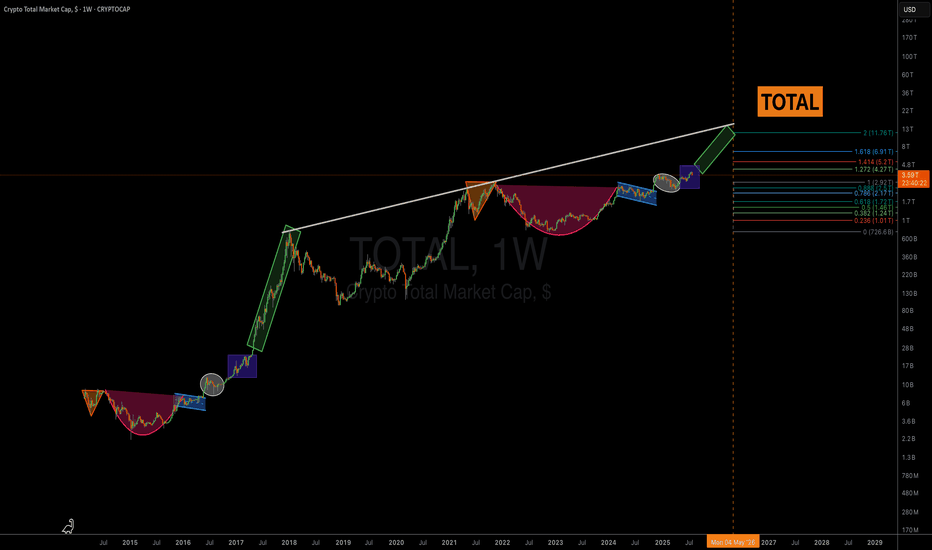

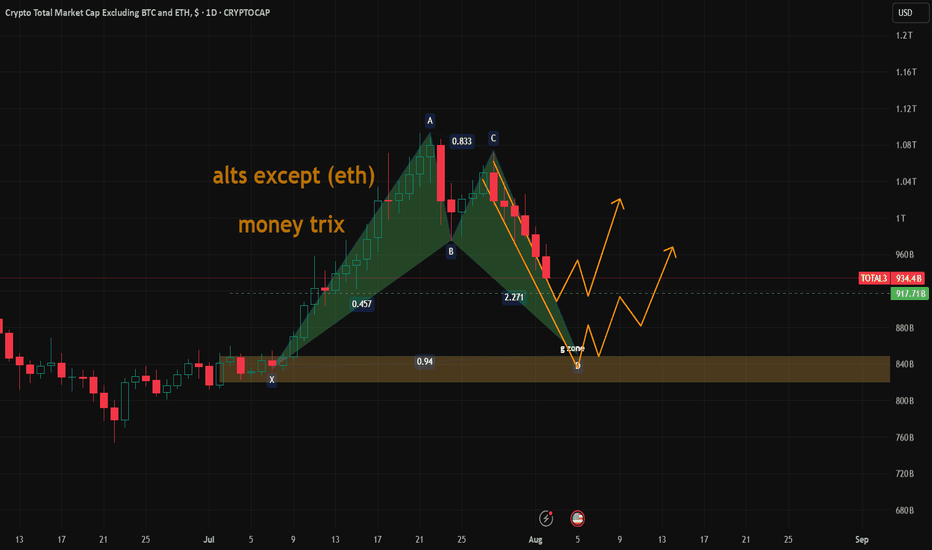

total 3 crypro cap without eth , bearish

Bearish harmonic patterns are advanced technical analysis tools used by traders to identify potential trend reversals to the downside. They are based on the principle that market movements often follow specific geometric and Fibonacci ratio relationships. When a price chart forms one of these patterns, it suggests that the current uptrend is losing momentum and a downward move is likely.

Here are three of the most well-known bearish harmonic patterns:

1. The Bearish Gartley Pattern

The Gartley is one of the oldest and most reliable harmonic patterns. It is a reversal pattern that looks like an "M" shape and forms after an uptrend.

Structure: The pattern is a five-point formation labeled X, A, B, C, and D.

Fibonacci Ratios: It is defined by these specific ratios:

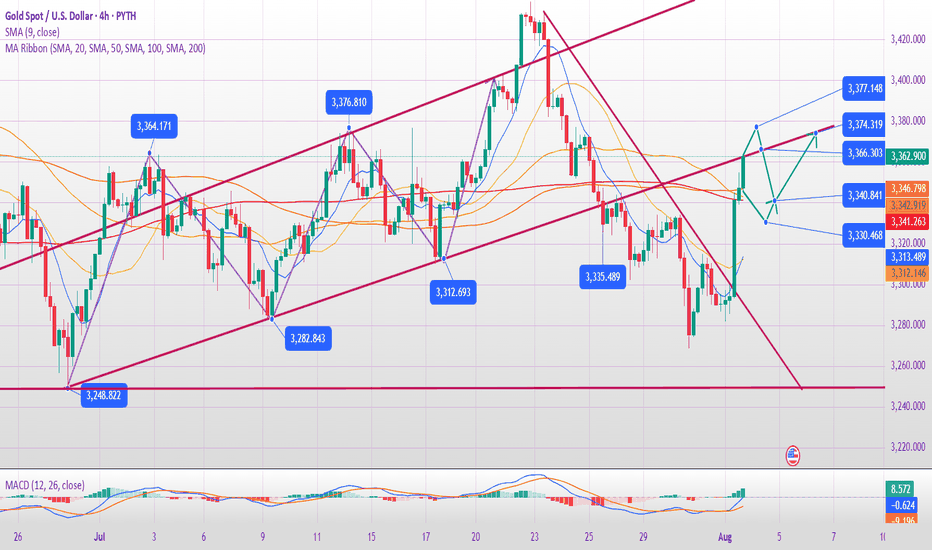

In-depth Analysis of the Gold Bull-Bear Game on August 4th:

I. Gold's Current Core Contradiction

Bull Support Factors

Weak non-farm payroll data reinforces expectations of a Fed rate cut, with the market betting on an over 80% probability of a September rate cut.

Risk Aversion: Although the tariff extension has not yet been finalized, the market remains concerned about escalating trade frictions, and gold is in high demand as a safe-haven asset.

Technical Breakout: Friday saw a strong breakout above the 3340-3350 resistance zone, with the daily chart showing a positive enveloping negative trend. Short-term bullish momentum prevails.

Potential Short-Term Opportunities

Monthly Top Signal: Consecutive high-level doji candlesticks with long upper shadows suggest medium-term selling pressure.

Fundamental Bearish Hidden Dangers:

The Fed's independence remains, and Powell may not cut interest rates prematurely due to pressure from Trump.

II. Key Technical Signals

1. Weekly Level: Range Unbroken

The 3268-3438 range persists, currently nearing its upper limit, so be wary of a pullback.

Bollinger Bands are converging, with the MA5/MA10 convergence signaling an approaching market reversal window.

2. Daily and short-term cycles: Overbought correction needs

After Friday's surge: 4-hour/1-hour RSI is overbought, the Bollinger Band opening is unsustainable, and a technical retracement is needed.

Key positions:

Resistance: 3376 (previous high) + 3385 (Fibonacci expansion level);

Support: 3340 (top and bottom conversion) + 3315 (bull defense line).

3. Triangle convergence pattern:

If it opens high and breaks through 3376 on Monday, August 4, it may test 3400; if it opens low and falls below 3340, it will look down to 3315-3280.

III. Operation strategy for next week on August 4

(1) Response to three opening scenarios

Scenario 1: Opening high (above 3370)

Strategy: Short in batches in the 3376-3385 area, stop loss at 3400, target 3340→3315.

Logic: Positive overdraft + technical overbought, betting on a pullback.

Scenario 2: Flat opening (around 3360)

Strategy: If the price rises from 3366 but does not break through, go short with a light position, stop loss at 3376, target 3340; if it falls below 3340, go short and look at 3315.

Alternative: If the support at 3340 is effective, go long, stop loss at 3330, target 3360.

Scenario 3: Low opening (below 3340)

Strategy: Go long in the 3338-3340 area, stop loss at 3325, target 3360; if it breaks through 3315, go short.

(2) Mid-term layout

Short opportunity: Go short in the 3385-3400 area, stop loss at 3420, target 3245 (monthly support).

Buy opportunity: If the price falls back to 3315-3280 at the beginning of the week and stabilizes, go long in the mid-term, stop loss at 3260, target 3400.

IV. Risks and Warnings

Beware of institutional manipulation: Friday's late-day surge may be a trap for buying; beware of a flash crash at Monday's opening.

Data disturbance: Pay close attention to the speeches of Fed officials. If inflation rebounds or hawkish remarks are made, it will be bearish for gold.

Undetermined trend: The market is still volatile and unilateral trends need to wait for confirmation of a breakthrough in the range.

Conclusion

Short-term: Prioritize shorting in the 3370-3385 area, and enter long positions in the 3340-3315 area when appropriate, maintaining strict stop-loss orders.

Mid-term: The monthly bearish pattern has not changed, and above 3385 is the ideal entry point for short positions.

Key Strategies: "Don't chase long positions during strong resistance; don't sell short during deep declines; follow the trend after a breakout; exercise caution in controlling the market."