In-depth Analysis of the Gold Bull-Bear Game on August 4th:

I. Gold's Current Core Contradiction

Bull Support Factors

Weak non-farm payroll data reinforces expectations of a Fed rate cut, with the market betting on an over 80% probability of a September rate cut.

Risk Aversion: Although the tariff extension has not yet been finalized, the market remains concerned about escalating trade frictions, and gold is in high demand as a safe-haven asset.

Technical Breakout: Friday saw a strong breakout above the 3340-3350 resistance zone, with the daily chart showing a positive enveloping negative trend. Short-term bullish momentum prevails.

Potential Short-Term Opportunities

Monthly Top Signal: Consecutive high-level doji candlesticks with long upper shadows suggest medium-term selling pressure.

Fundamental Bearish Hidden Dangers:

The Fed's independence remains, and Powell may not cut interest rates prematurely due to pressure from Trump.

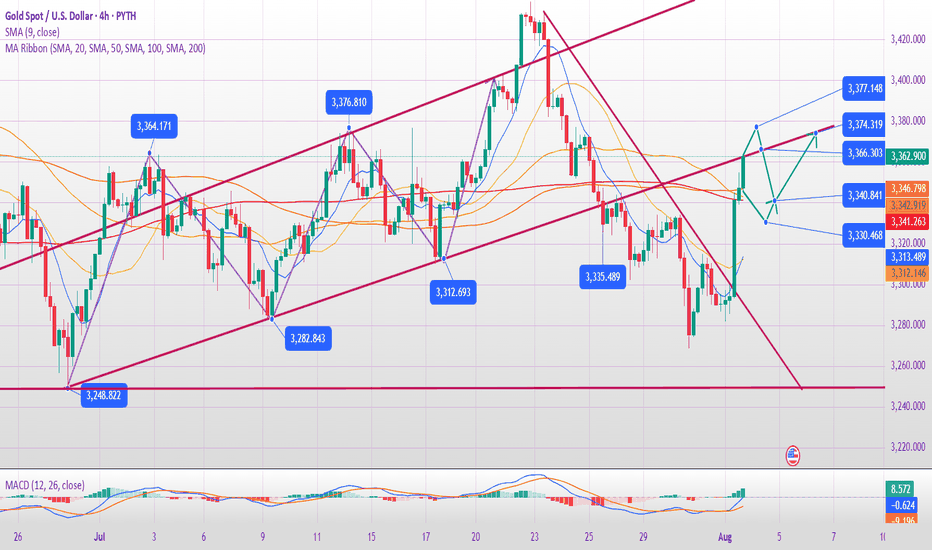

II. Key Technical Signals

1. Weekly Level: Range Unbroken

The 3268-3438 range persists, currently nearing its upper limit, so be wary of a pullback.

Bollinger Bands are converging, with the MA5/MA10 convergence signaling an approaching market reversal window.

2. Daily and short-term cycles: Overbought correction needs

After Friday's surge: 4-hour/1-hour RSI is overbought, the Bollinger Band opening is unsustainable, and a technical retracement is needed.

Key positions:

Resistance: 3376 (previous high) + 3385 (Fibonacci expansion level);

Support: 3340 (top and bottom conversion) + 3315 (bull defense line).

3. Triangle convergence pattern:

If it opens high and breaks through 3376 on Monday, August 4, it may test 3400; if it opens low and falls below 3340, it will look down to 3315-3280.

III. Operation strategy for next week on August 4

(1) Response to three opening scenarios

Scenario 1: Opening high (above 3370)

Strategy: Short in batches in the 3376-3385 area, stop loss at 3400, target 3340→3315.

Logic: Positive overdraft + technical overbought, betting on a pullback.

Scenario 2: Flat opening (around 3360)

Strategy: If the price rises from 3366 but does not break through, go short with a light position, stop loss at 3376, target 3340; if it falls below 3340, go short and look at 3315.

Alternative: If the support at 3340 is effective, go long, stop loss at 3330, target 3360.

Scenario 3: Low opening (below 3340)

Strategy: Go long in the 3338-3340 area, stop loss at 3325, target 3360; if it breaks through 3315, go short.

(2) Mid-term layout

Short opportunity: Go short in the 3385-3400 area, stop loss at 3420, target 3245 (monthly support).

Buy opportunity: If the price falls back to 3315-3280 at the beginning of the week and stabilizes, go long in the mid-term, stop loss at 3260, target 3400.

IV. Risks and Warnings

Beware of institutional manipulation: Friday's late-day surge may be a trap for buying; beware of a flash crash at Monday's opening.

Data disturbance: Pay close attention to the speeches of Fed officials. If inflation rebounds or hawkish remarks are made, it will be bearish for gold.

Undetermined trend: The market is still volatile and unilateral trends need to wait for confirmation of a breakthrough in the range.

Conclusion

Short-term: Prioritize shorting in the 3370-3385 area, and enter long positions in the 3340-3315 area when appropriate, maintaining strict stop-loss orders.

Mid-term: The monthly bearish pattern has not changed, and above 3385 is the ideal entry point for short positions.

Key Strategies: "Don't chase long positions during strong resistance; don't sell short during deep declines; follow the trend after a breakout; exercise caution in controlling the market."

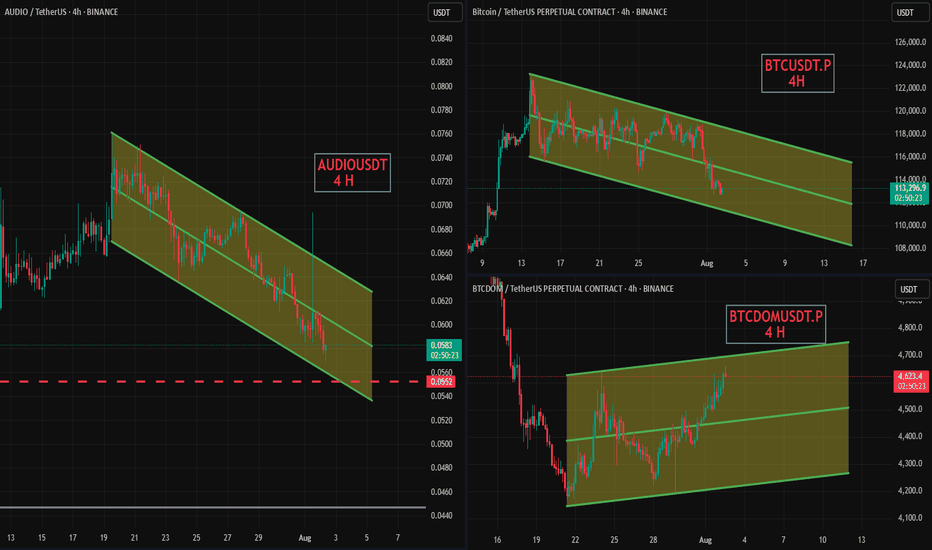

Crypto market

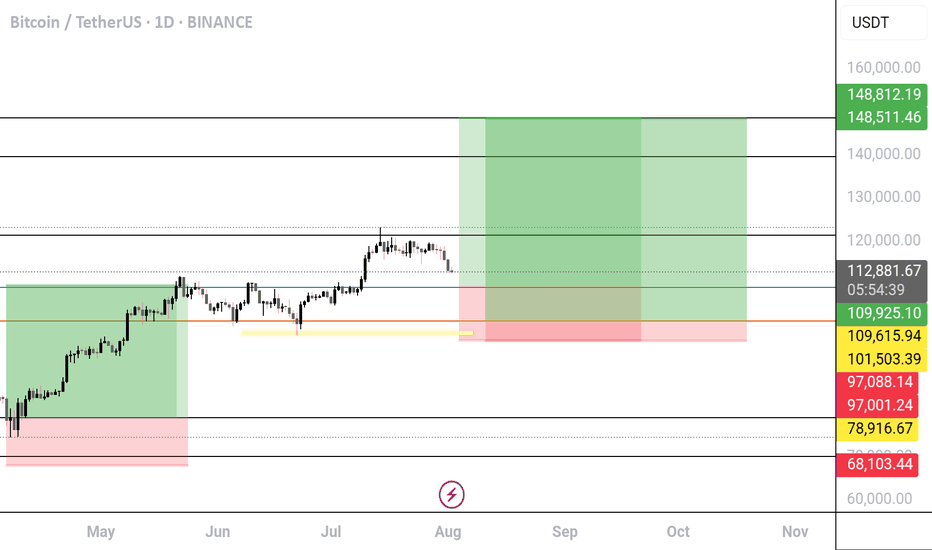

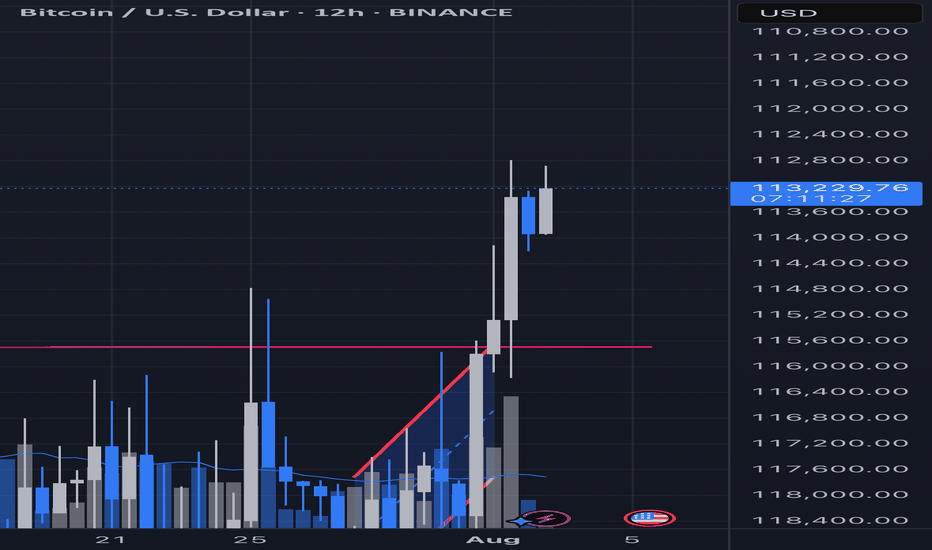

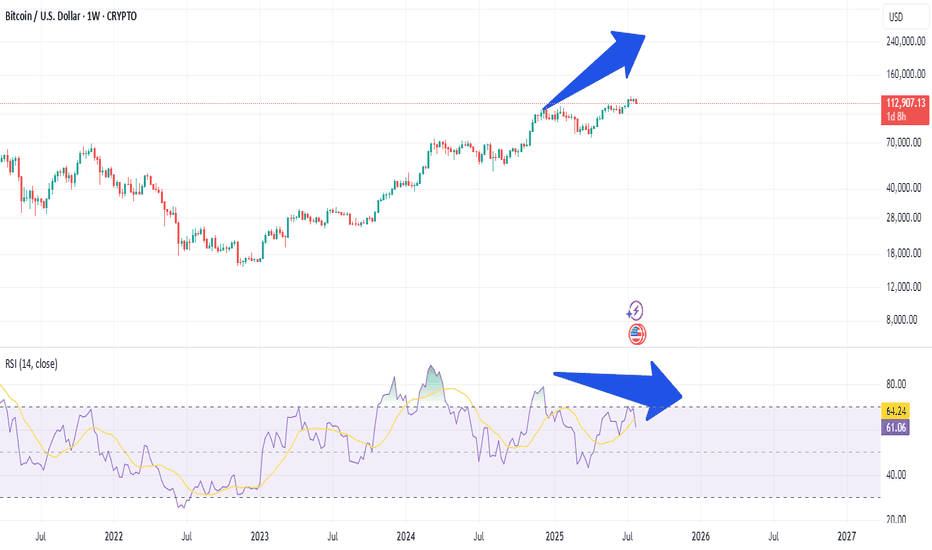

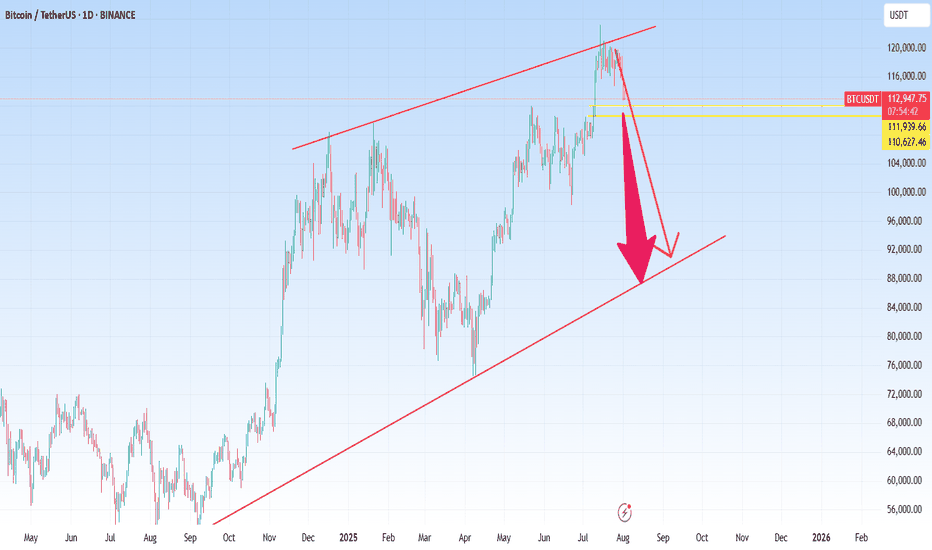

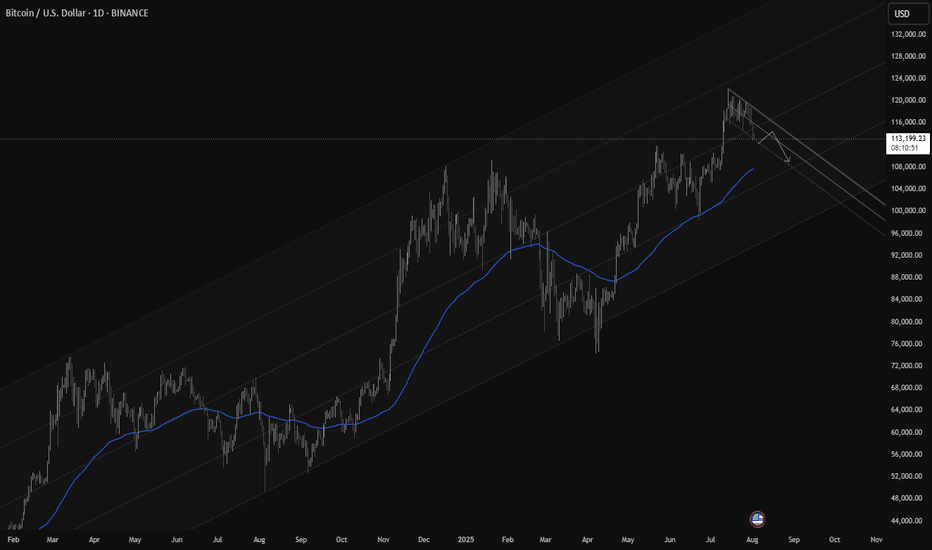

BTC/USDT Long Setup - Dual entry position

🟢 BTC/USDT Long Setup – Dual Entry Position

I’m going to be positioned long on BTC with two entries:

Entry 1: 109K if don't holds

Entry 2: 101k

Stop-loss: 97K

Target: 148.5K

R/R: ~5.4:1

Reasoning:

Market structure remains bullish with clean higher highs and higher lows.

The recent selloff is seen as a healthy pullback into a demand zone — not a trend reversal.

Both entries are placed to catch either a shallow bounce or a deeper liquidity sweep without overexposing risk.

Setup remains valid unless we see a clean daily close below 97K.

Letting price play out — no mid-range noise, no overtrading. Focused on structure, trend, and reward.

---

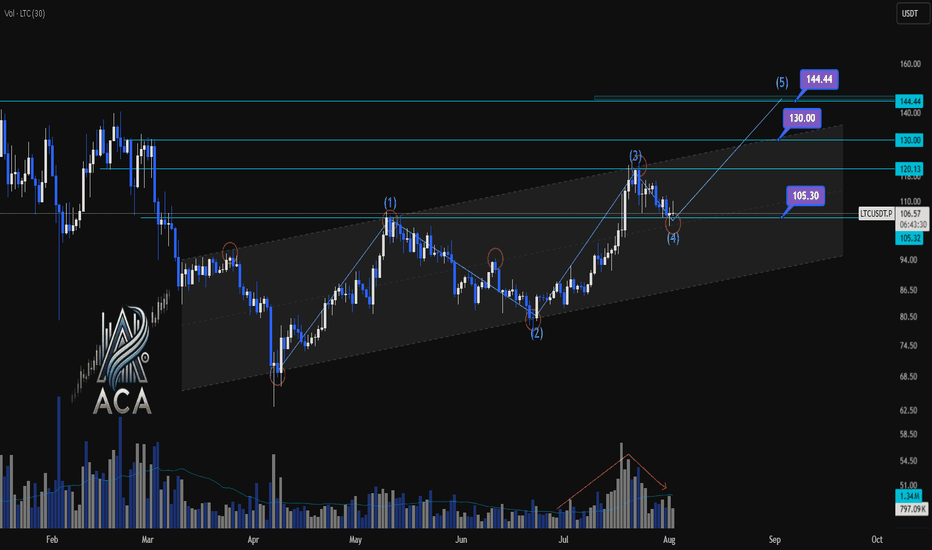

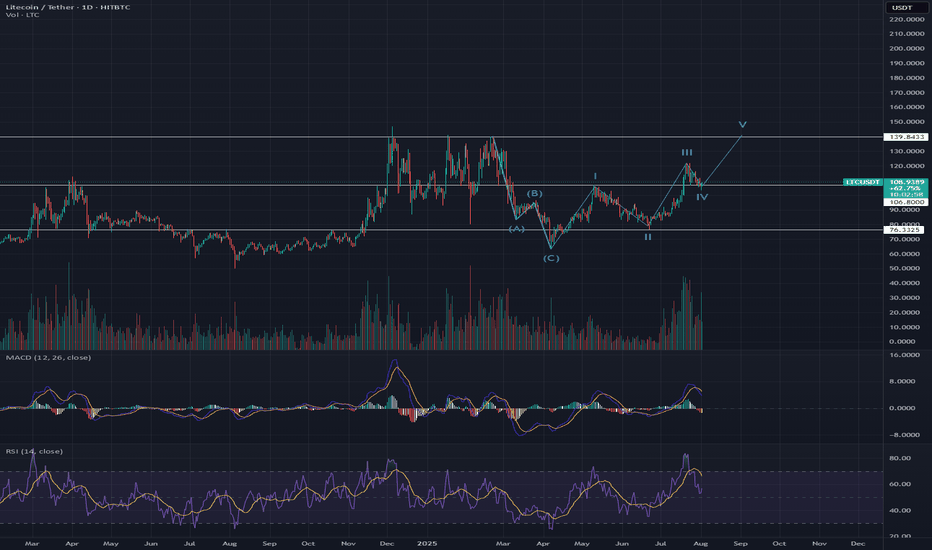

LTCUSDT | Daily Chart Analysis | Bullish Structure UnfoldingLTCUSDT | Daily Chart Analysis | Bullish Structure Unfolding

🔍 Let’s break down LTC/USDT’s technical setup, focusing on volume, Elliot Wave structure, and key target levels for this bullish scenario. If you're following this channel, be sure to react and let us know your thoughts on the roadmap!

⏳ Daily Overview

LTCUSDT is moving within a defined ascending channel, supported by increasing bullish momentum and clear Elliot Wave progression. The recent wave count points to a textbook impulse, setting up the next key move.

🔺 Long Setup:

The market has completed Waves (1) through (4), and we’re now looking at the development of Wave (5) to the upside.

- Wave (5) Target Zones:

- $130.00

- $144.44

These are the next resistance levels based on previous highs and channel dynamics.

- Key support to watch:

- $105.30 — this zone may act as a springboard for the next rally if tested.

📊 Key Highlights:

- Volume has shown a clear bullish divergence as price advances, signaling growing interest and strength heading into Wave (5).

- The bullish channel remains intact, and each dip has been met with higher lows, confirming the ongoing uptrend.

- Elliot Wave structure suggests further upside, with the $130.00 and $144.44 levels as potential targets.

🚨 Conclusion:

LTC bulls should keep an eye on price action as it approaches support at $105.30 — a bounce here could ignite the next leg higher toward our target zones. Reaction from the channel community will be crucial as Wave (5) unfolds. Show your support with a reaction below if you’re riding this wave!

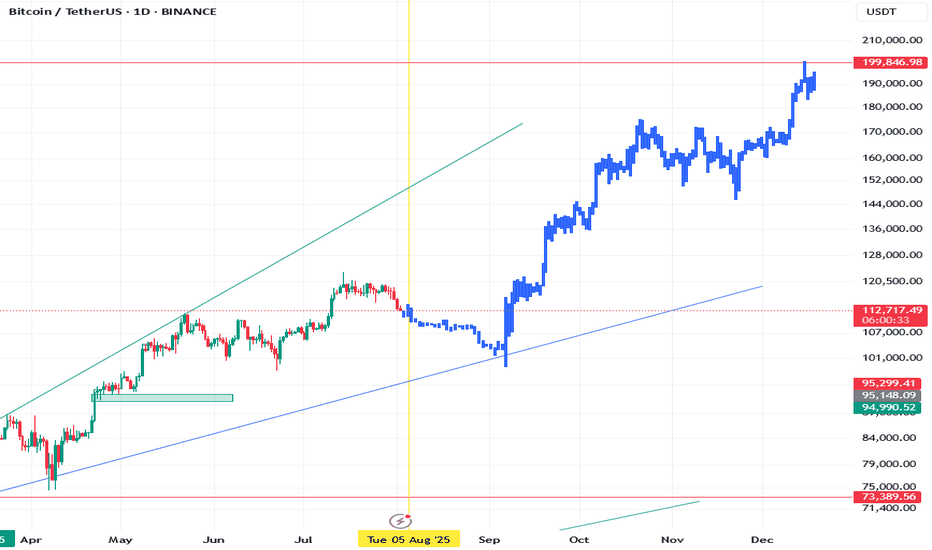

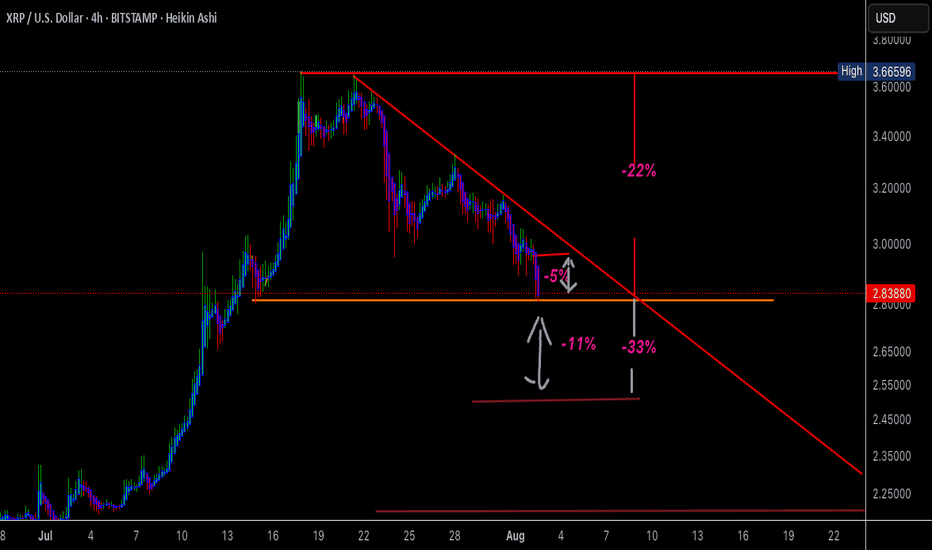

Short-term: Jump over the creek, ready for markupWhen market is in an uptrend, I look for divergence in the price as it holds 50%.

The chart as you see it pictures a perfect scenario for a trade entry, but make sure to have a stop loss set at fib retr. around 70%.

We could see the price going upwards from right here and right now.

Please note that I don't trade real money - I'm in it just for the thrills and fun.

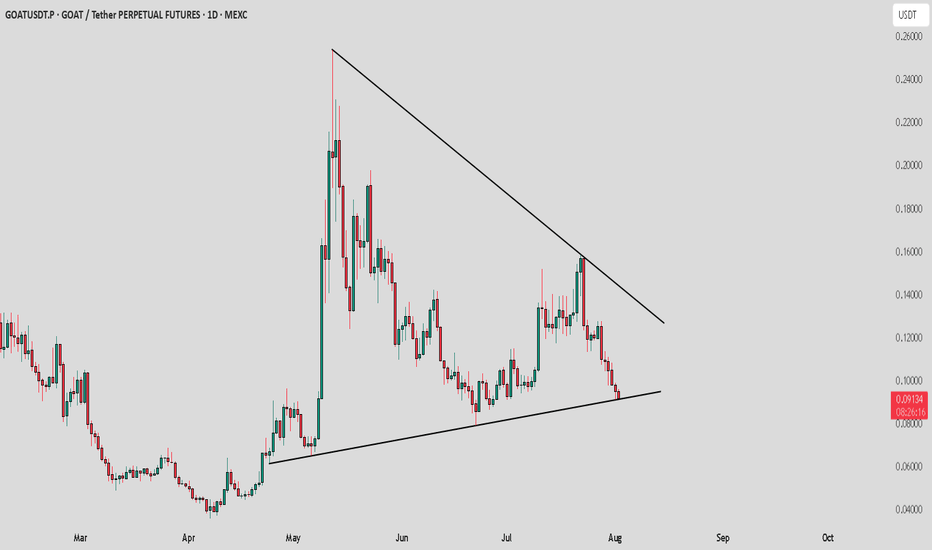

GOAT / USDT : Watch closely for a breakdownGOAT/USDT - Watch Closely!

Currently testing the critical support trend line.

Bullish Scenario: If it holds here and bounces, we could see a potential upward move.

Bearish Scenario: A breakdown below this support would confirm further downside, and I'd be leaning bearish in that case.

Pro Tip: Wait for confirmation before entering – either a strong rejection off support for bullish entry or a clean break for a bearish setup.

Stay alert and trade wisely!

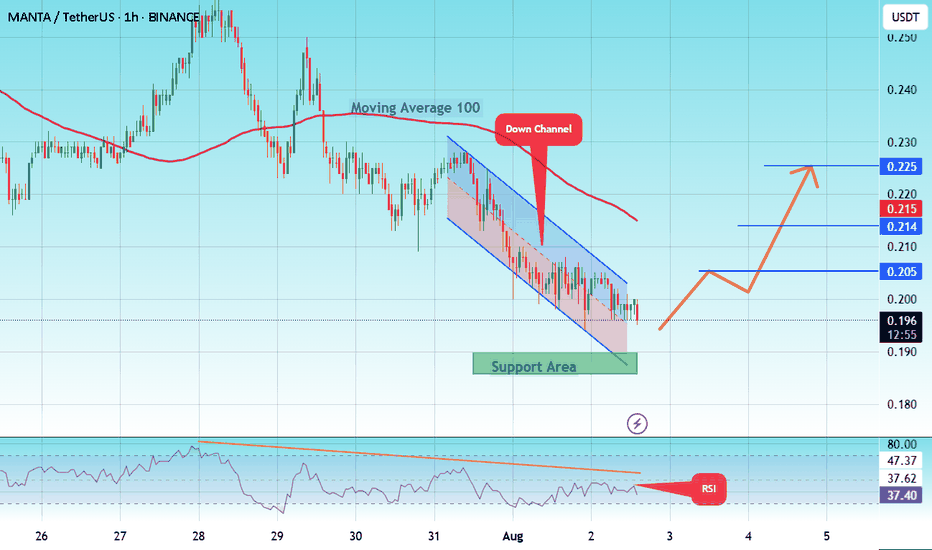

#MANTA/USDT – Bullish Setup Alert ?#MANTA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.190, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.186.

Entry price: 0.196

First target: 0.205

Second target: 0.214

Third target: 0.225

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

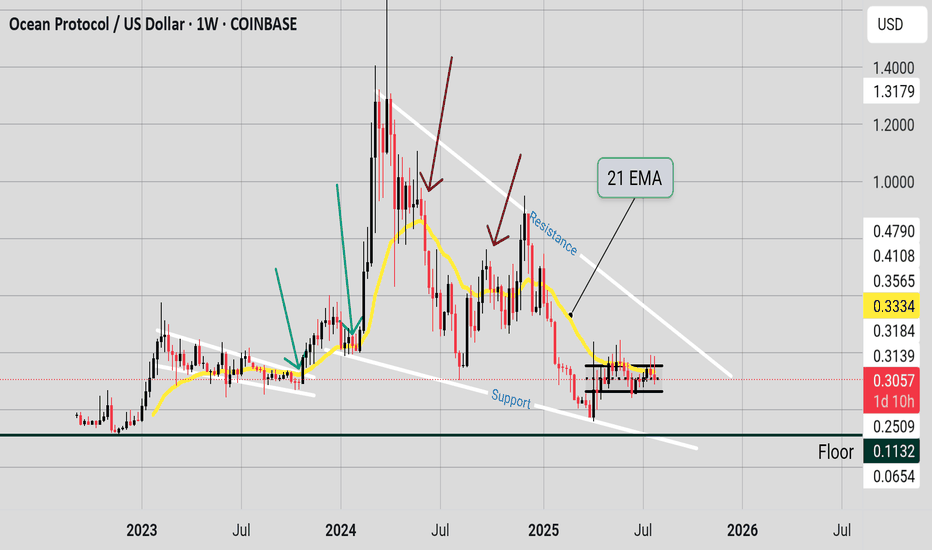

The Power of Support, Resistance, and Moving Averages**Analyzing Ocean Protocol (OCEAN/USD): The Power of Support, Resistance, and the 21 EMA**

When trading or investing in the ever-changing world of cryptocurrencies, technical analysis tools offer vital insights into price action and market psychology. Let’s explore how these concepts play out in the recent price chart of Ocean Protocol (OCEAN/USD).

**Dynamic and Static Support/Resistance: A Quick Primer**

Support and resistance are foundational concepts in technical analysis:

- **Support** refers to price zones where a declining market tends to find a “floor,” often pausing or reversing losses.

- **Resistance** marks zones where rising prices tend to stall or reverse, acting as a “ceiling.”

On the OCEAN/USD weekly chart, I marked these static levels at price points where the market has historically reacted, reflecting the areas of repeated reversals or consolidation. Identifying these levels allows traders to anticipate potential moves and manage risk.

**The 21 Exponential Moving Average (EMA): A Dynamic Barrier**

A standout element on our chart is the 21-period EMA, plotted as a gently curving yellow line. Unlike static horizontal lines, the 21 EMA moves with price action, providing a dynamic measure of the prevailing trend. My analysis confirms that:

- In uptrends, the 21 EMA often acts as a support, helping price bounce higher during pullbacks.

- In downtrends, it acts as resistance, causing rallies to stall or reverse.

Repeated interactions between OCEAN’s price and the 21 EMA further validate its role as a crucial area to watch, where buyers and sellers contend for control.

**Descending Resistance and Support: Guiding the Trend**

I’ve also drawn descending (diagonally sloping) trendlines to highlight the broader bearish structure since mid-2024. These lines mark a channel where price has generally been contained, further defining the primary market trend and its boundaries.

**Conclusion: Clarity from Structure**

Through the combination of classic support and resistance lines and the dynamic 21 EMA—which both reliably reflect real market turning points—this analysis brings clarity to OCEAN’s current market structure. These tools not only offer traders a roadmap for likely reactions but also foster a disciplined approach to navigating crypto’s volatility.

*By combining proven tools like horizontal and diagonal support/resistance with the dynamic insight that moving averages provide, traders can approach complex charts like OCEAN/USD with greater confidence and objectivity.*

Please keep an eye for a breakout above the 21 EMA 0.33 price area for possible bullish action. Be cautious of fakeouts and liquidations.

(Some help with the AI Perplexity)

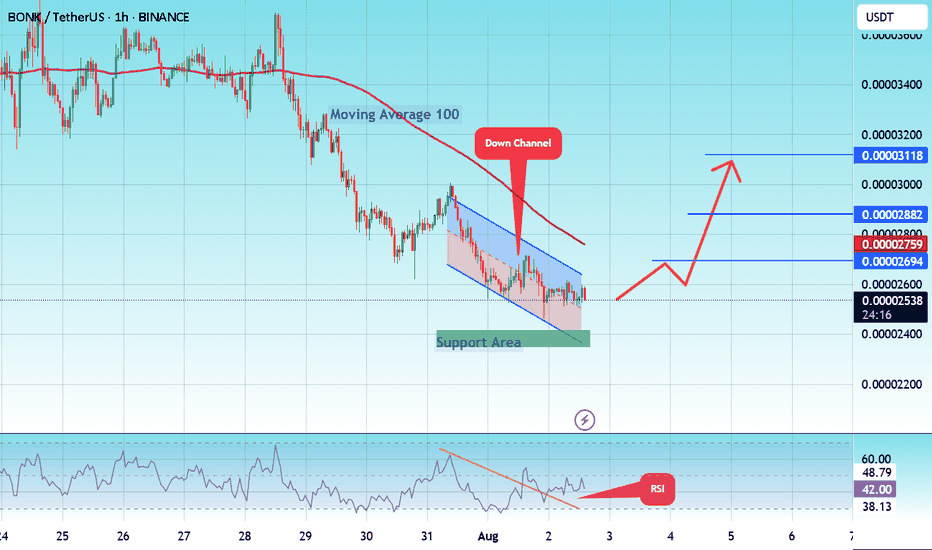

#BONK/USDT About to Break Out !#BONK

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.00002440, acting as a strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.00002372.

Entry price: 0.00002552.

First target: 0.00002694.

Second target: 0.00002882.

Third target: 0.00003118.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

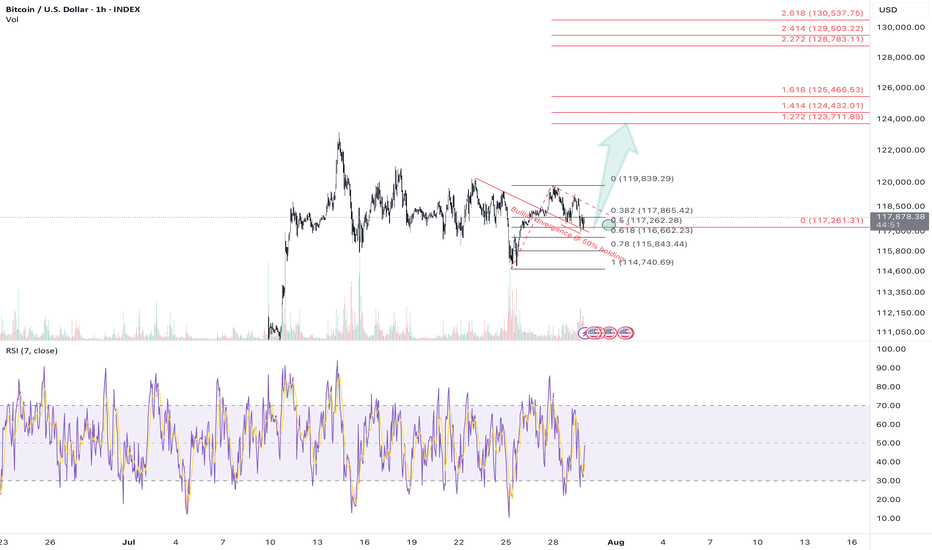

Bitcoin Structure in Stillness, Power in Silence, Just Control?⊣

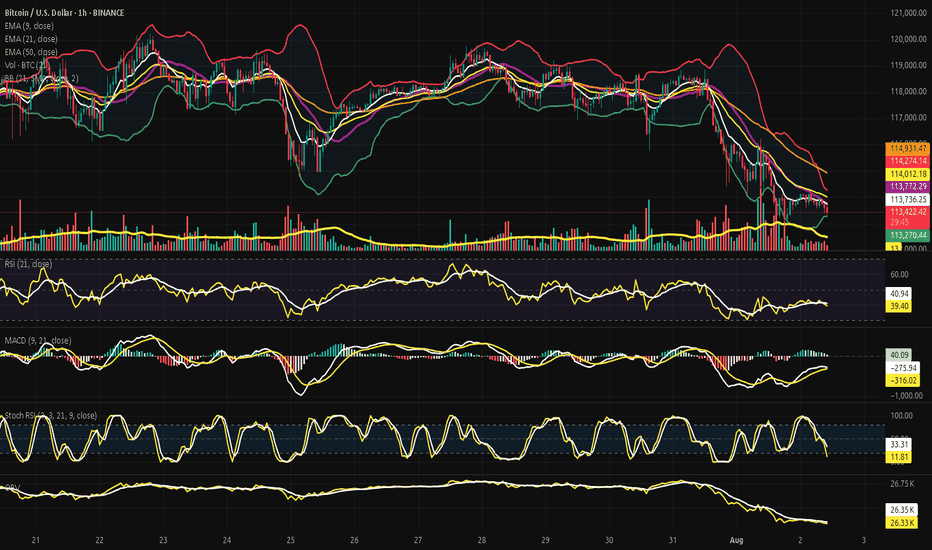

⟁ BTC/USD - BINANCE - (CHART: H1) - (Aug 02, 2025).

◇ Analysis Price: $113,869.77.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1H):

▦ EMA9 - ($113,889.32):

∴ The price is trading just below the EMA9, which acts as immediate reactive resistance;

∴ The short-term slope remains negative, with no breakout signal;

∴ Buyers are unable to push the price above this threshold, indicating technical weakness.

✴️ Conclusion: Momentum remains capped; the EMA9 has not been reclaimed.

⊢

▦ EMA21 - ($113,896.52):

∴ The EMA21 stands as a tactical compression line in this range;

∴ The close proximity of EMA9 and EMA21 forms a technical knot - indecision zone;

∴ Past rejections in this region reinforce it as a powerful barrier.

✴️ Conclusion: Mid-range resistance holds; continuation is blocked unless breached with volume.

⊢

▦ EMA50 - ($114,128.22):

∴ EMA50 defines the current macro resistance on the 1H chart;

∴ The price has yet to test this level directly after the last drop;

∴ For structural recovery, this line must be broken cleanly with follow-through.

✴️ Conclusion: Primary obstacle on the path to reversal - decisive zone.

⊢

▦ BB (21 + EMA9) - Status: Compression:

∴ Bands are tightening around the price, signaling low volatility;

∴ Price action is contained within the central channel;

∴ Indicates upcoming volatility spike - direction still unknown.

✴️ Conclusion: Volatility compression is active; no directional bias confirmed.

⊢

▦ Volume + EMA21 - (3.84 BTC):

∴ Trading volume remains below the EMA21 period average;

∴ No surge of bullish commitment visible;

∴ Momentum lacks conviction without participation.

✴️ Conclusion: Absence of volume undermines the strength of any move.

⊢

▦ RSI (21, 9) - (42.37):

∴ RSI hovers in the lower neutral band - weak momentum;

∴ Slight upward curve suggests a modest rebound;

∴ No divergence or strength signal confirmed.

✴️ Conclusion: Minor relief rally underway - structurally weak.

⊢

▦ MACD (9, 21, 9) - (MACD: -238.89 / Signal: -340.58):

∴ Bullish crossover confirmed, histogram positive;

∴ Both lines remain in bearish territory - (below zero);

∴ Trend momentum is building but not strong enough to reverse.

✴️ Conclusion: Technical rebound in play - not a structural shift.

⊢

▦ Stoch RSI (3, 3, 21, 9) - (%K: 58.90 / %D: 52.70):

∴ Positive crossover established and advancing in neutral-upper zone;

∴ No overbought signal;

∴ Possibility of further upside if confirmed with price action.

✴️ Conclusion: Oscillator supports continuation - contingent on volume.

⊢

▦ OBV (21, BB2) - (26.35K):

∴ OBV remains flat, indicating market indecision;

∴ No divergence with price movement;

∴ No fresh buying pressure detected.

✴️ Conclusion: Neutral volume behavior - flow not favoring bulls.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The 1H chart of (BTC/USD) reveals a battlefield sealed in compression and anticipation.

The price is locked beneath converging exponential resistances (EMA9, EMA21, EMA50), forming a triple entrenchment zone. None have been broken - each rejection reinforces the stronghold;

∴ The Bollinger Bands constrict like a ritual binding. Volatility is silent - too silent - awaiting the spark. Yet no participant steps forward with force; volume remains suppressed, showing that neither side has declared war;

∴ Momentum oscillators (RSI, Stoch RSI) hint at an upward drift, but these are echoes, not proclamations;

∴ The MACD crossover is not a trumpet - it is a murmur in the underworld, below the zero line, concealed from the living trend;

∴ The OBV confirms it: no one is entering the field with conviction. This is not a battlefield - it is a waiting room;

✴️ And yet, amidst this silence, the Code speaks:

∴ If the zone between ($114.1K and $114.6K) is breached with volume and confirmation, this will mark the first true structural challenge to the prevailing descent. If it fails - the repique folds into another trap, devoured by gravity.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + EMA9 - (All Exchanges) - (6.2K BTC):

∴ The total Bitcoin flowing into centralized exchanges remains subdued, with no signs of aggressive sell-side pressure;

∴ The EMA9 confirms a flat, low-intensity behavior, distinct from capitulation spikes;

∴ The absence of major inflows during price compression implies a strategic wait state.

✴️ Conclusion: No incoming threat detected - institutions are not preparing to sell.

⊢

▦ Exchange Netflow Total + EMA9 - (All Exchanges) - (-644.5 BTC):

∴ Netflow remains negative, indicating Bitcoin is being withdrawn from exchanges rather than deposited;

∴ A negative netflow during a price downtrend reflects silent accumulation behavior or rotation into cold storage;

∴ The EMA9 shows a consistent drainage pattern, not episodic outflow.

✴️ Conclusion: This confirms defensive posture by large holders - supporting the technical compression.

⊢

▦ Spent Output Profit Ratio - (SOPR) + EMA9 - (1.003):

∴ The SOPR hovers just above 1.0, suggesting coins moved on-chain are being sold at or near cost basis;

∴ No signs of aggressive profit-taking or panic selling - rather, equilibrium behavior;

∴ The 9-period EMA confirms stability in this zone.

✴️ Conclusion: Market psychology is suspended - no one is winning or losing.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ All on-chain signals reflect preparation without declaration;

∴ No pressure enters, and no blood leaves;

∴ The field is not empty - it is coiled;

∴ Withdrawals - (Netflow) - suggest protective accumulation;

∴ Low Inflow signals no new panic supply;

∴ SOPR near 1.0 says: (We're all waiting - and none are ahead);

∴ The technical compression in price is not betrayed by the chain;

∴ The silence is consistent;

∴ But silence is not peace - it is a veil.

✴️ Conclusion: If volume does not breach $114.6K - all remains a ghost echo beneath resistance.

If broken - the coil unwinds.

⊢

⧉ III. Contextvs Macro-Geopoliticvs - Interflux Economicvs - (Aug 02, 2025):

⟁ All movements of the market's breath are influenced not only by price, nor volume, but by the tides beyond the chart. Here begins the reading of the outer realm:

▦ EVENTVM I - (Wall Street Silent Accumulation) - (U.Today + Coindesk):

∴ Institutional actors are actively acquiring BTC and ETH through stealth operations - not OTC spikes, but ETF inflows and treasury balance shifts;

∴ Tom Lee (Bitmine/Fundstrat) confirms: Wall Street is not waiting for clarity, it is accumulating in silence;

∴ SEC’s Project Crypto and “in-kind” ETF mechanisms further reduce friction for institutional entry.

✴️ Conclusion: Price stagnation conceals power transfer - retail hesitates while funds consolidate control.

⊢

▦ EVENTVM II - (SEC’s “Project Crypto” Activation):

∴ Regulatory framing under “Project Crypto” unfolds in phases: transparency, compliance infrastructure, and institutional bridges;

∴ Despite its regulatory mask, the program facilitates liquidity channels into crypto markets;

∴ Legalized ETF's now serve as strategic vacuum points for Bitcoin supply.

✴️ Conclusion: What appears as regulation is in fact an alignment mechanism - structure over rebellion.

⊢

▦ EVENTVM III - (July ETF Flows (US) - $12.8B Inflow):

∴ U.S.-based crypto ETF's report record-breaking $12.8 billion inflows in July alone;

∴ Largest flows tracked in BlackRock, Fidelity, and VanEck vehicles - no signs of reversal;

∴ These flows occurred during price weakness, not during breakout - a signature of accumulation.

✴️ Conclusion: The public hesitates while custodians act - the veil of weakness conceals a new floor.

⊢

🜎 Strategic Interpretation - Macro Context:

∴ The charts compress. The flows retract;

∴ But the outer forces converge - Wall Street is no longer watching. It is acquiring;

∴ Through structure, silence, regulation, and engineering of access;

∴ This is no longer the market of peer-to-peer rebellion;

∴ This is the codification of power into institutional hands;

✴️ Conclusion: Price may appear static - but ownership is shifting.

⊢

𓂀 Stoic-Structural Interpretation:

∴ The chart does not lie. The data does not beg. The market does not care. Bitcoin remains trapped beneath resistance - not by force, but by inaction, by lack of intention, by silent contest;

∴ On-chain signals whisper: no one is selling in panic, no one is buying in euphoria;

∴ The macro realm reveals: the hands of power are moving beneath regulation, using silence as shield;

∴ Thus we see a paradox - the technical shell compresses, the on-chain bloodstream circulates without fever, the macro structure redefines.

⚖️ The Stoic mind recognizes this not as chaos, but as necessary stillness.

∴ The Arcane practitioner does not chase a move - he maps the pressure points and waits;

∴ He acts only when the veil thins;

∴ To act prematurely is to violate the structure;

∴ To wait blindly is to betray the will;

∴ The Stoic Arcane path demands this: know the boundary, seal the insight, then act - once - with clarity;

∴ At ($114.6K) the veil may part. If it does not - the silence continues.

⊢

✦ Structure Bearish.

▦ This is a bearish containment, not a breakdown.

∴ The market is not collapsing - it is being held below by absence of volume, of intention, of structural reversal;

∴ The EMA's are stacked above like iron gates;

∴ The price has failed to break $114.6K - the veil remains intact;

∴ On-chain data confirms neutrality, not optimism;

∴ Macro signals suggest accumulation by institutions - but not defense for the public.

⊢

🜎 Therefore:

∴ Technically Bearish - (structure not yet reversed);

∴ Tactically Neutral to Bearish - (fragile repique);

∴ Strategically in Transition Phase - (institutions buying beneath silence).

✴️ Conclusion: Until ($114.6K) is broken with conviction, the structure remains bearishly biased - wrapped in stillness.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

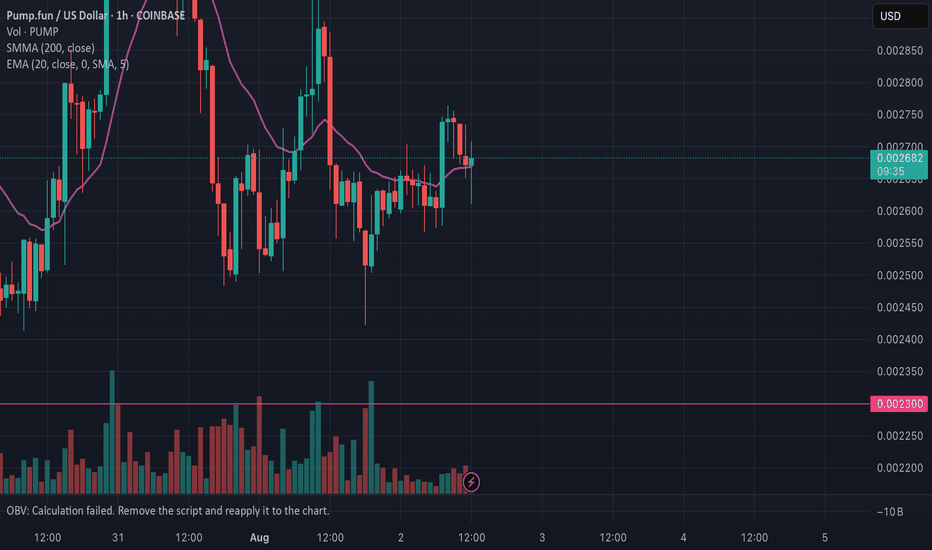

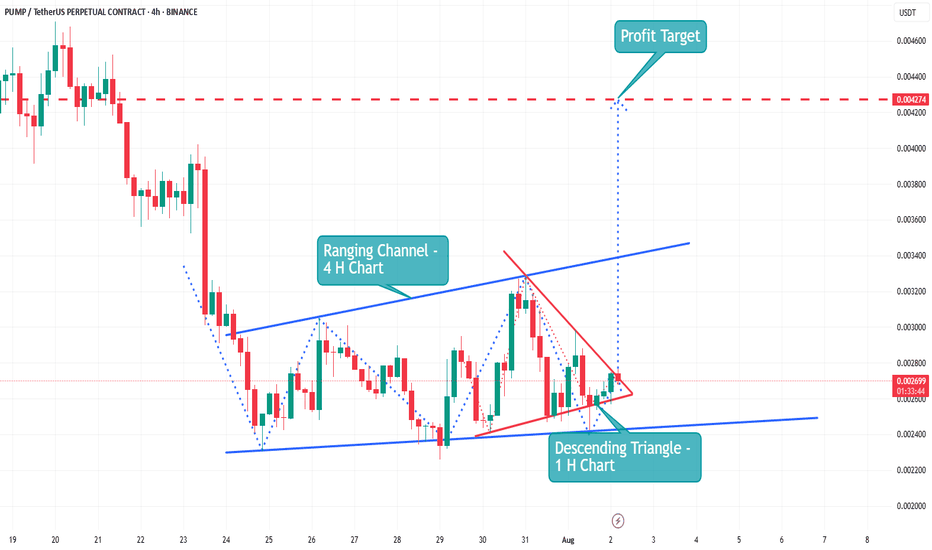

The Pump coin is now showing an upward trend | Live AnalysisPump ▶️

The Pump coin has now touched its All Time Low.🕯

The coin is now showing an upward trend.👀

🛫 a Descending Triangle is currently forming a breakout on the 1H chart.

🛫 Making a Ranging Channel on the 4 H Char

🛫 Make A CHoCH (1H)

🛫 Bullish OB (1H)

🛫 Buy Tag (1 H)

🛫 Making Golden Cross (1 H

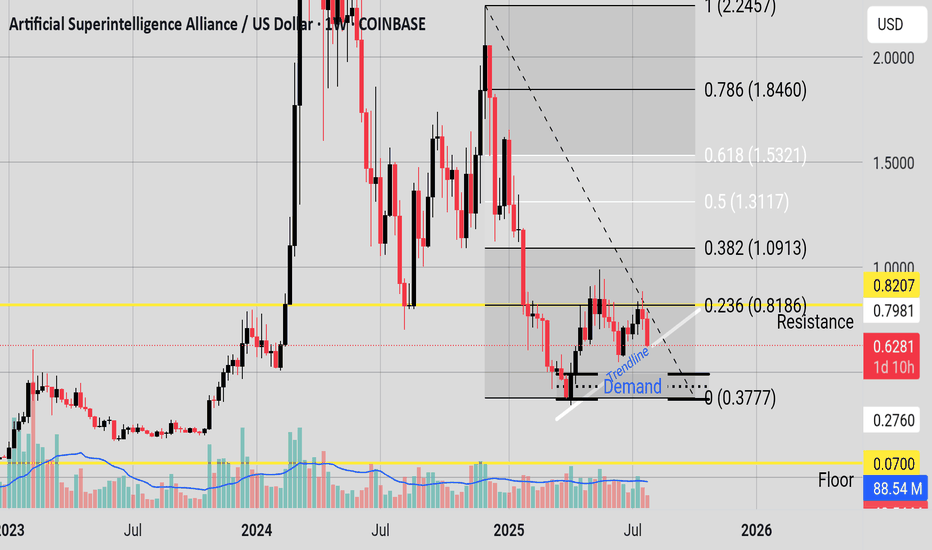

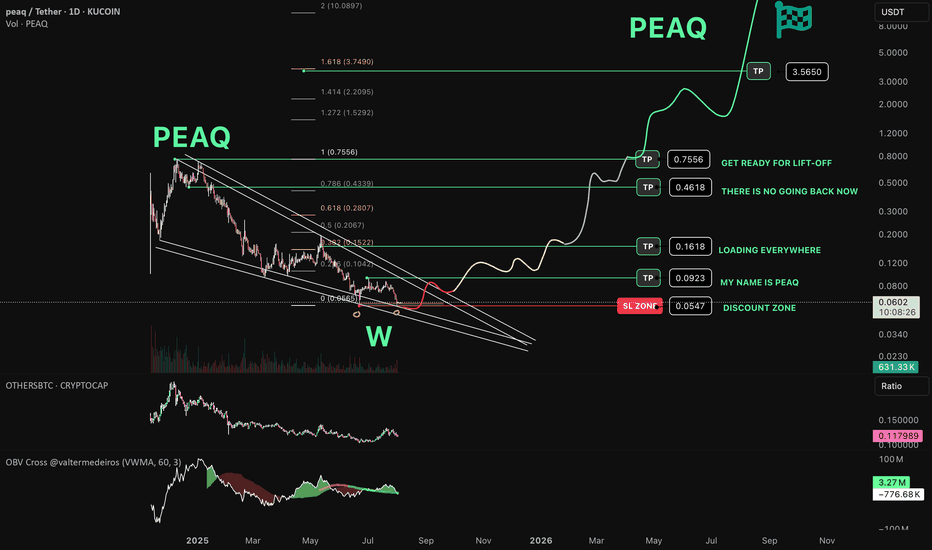

PEAQ Network about to make another pea(q) ? Bottom can be IN!

// ==================================

// ====THE===========================

// ========MACHINE=============^^====

// ===============NEEDS===TALK=======

// ====================TO============

// ==================================

Is this the time?

Chart Recap

🔍 Pattern:

Price formed a falling wedge pattern, which typically signals a potential bullish reversal.

A large W-shaped double bottom pattern is highlighted at the wedge's base, adding strength to the bullish thesis. Can this be the awaited bottom?

🟢 Accumulation & Support Zone :

"DISCOUNT ZONE" is marked near $0.0547, aligned with the wedge support.

Repeated touches at this level suggest strong buyer interest — also called "MY NAME IS PEAQ" and "LOADING EVERYWHERE"

🚀 Bullish Scenario & Targets:

If the wedge breakout plays out:

TP1: $0.0923 – early target near the local range high.

TP2: $0.1618 – aligns with the 0.382 Fib level.

Labeled as “LOADING EVERYWHERE”

TP3: $0.4618 – near the 0.618 retracement.

“THERE IS NO GOING BACK NOW”

TP4: $0.7556 – previous swing high.

“GET READY FOR LIFT-OFF”

TP5: $3.5650 – long-term Fib extension target (1.618).

Ultimate moonshot-level target.