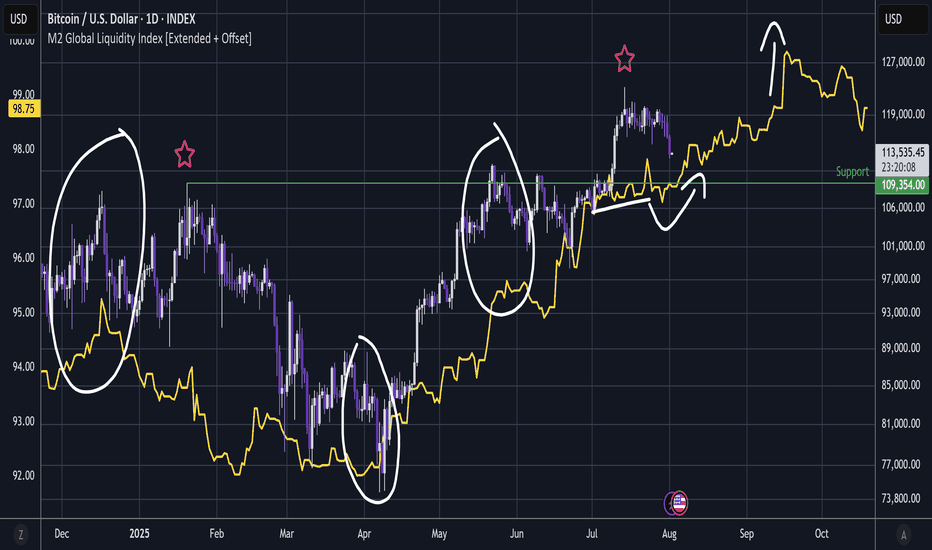

BITCOIN - M2 Global Liquidity Is Silver Lining ?BTC / M2 Global Liquidity (Offset 78 days)

History did repeat and the standout Shooting Star has again led to significant dump action as it .

And the fact that this is happening while stock indexes are wobbling while Trump unleashes more tariffs - should be a cause for concern.

But to lighten moods, I have added M2 Global Liquidity.

To remind, there has been incredible correlation and I have circled a few instances.

Also notice there is quite a flat area in M2 - it looks somewhat similar to the flat area that Bitcoin just slumped from.

Then notice that M2 had a small slump then carries on up until what looks like some sort of blow off phase in September - then corrective action; perhaps a 3 wave correction (before continuing on up).

So obviously this area is very dangerous but there might just be a silver lining 🤔

That said, now that indexes have wobbled, this area is certainly dangerous and we could yet see another wave down in tandem with stock indexes as we did in January.

This analysis is shared for educational purposes only and does not constitute financial advice. Please conduct your own research before making any trading decisions.

Crypto market

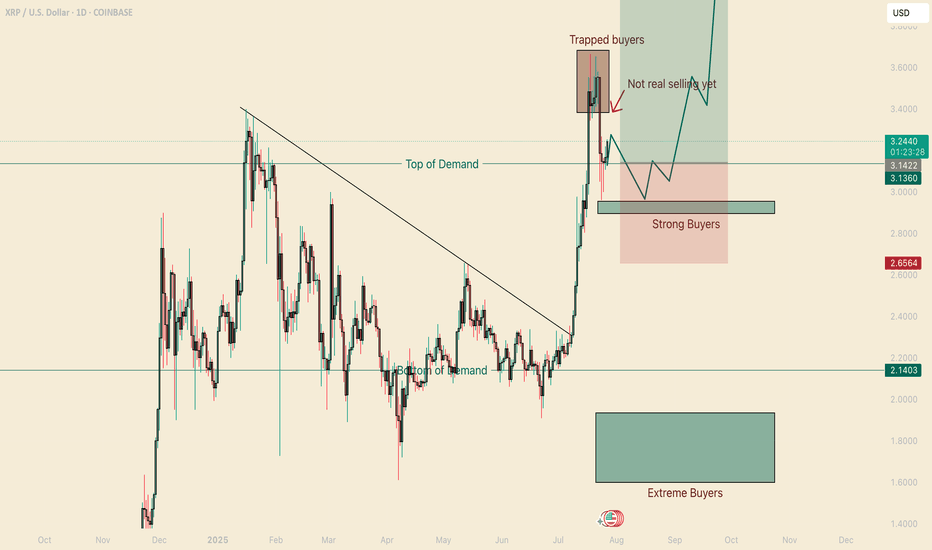

XRP Critical Levels to Play This MonthHello I am the Cafe Trader.

This weekend we are shifting focus into the crypto market for a quick overview. If you read my last XRP article, we nailed the bottom for longs, and the sellers for a great positional play. This time we are going to analyze the current failed breakout.

Are Bulls Trapped? Does this still have room to leg up?

Point 1

We can start with the trend break. Massive buyers pushed this move higher, giving XRP a relatively quick All time high, But July 23rd shorts were able to shove this back inside of the previous high.

This signifies that there are bulls trapped, but the interesting thing to note is that the volume has reduced significantly since the last two ATH's. So this also would indicate a lack of buying interest at the highs.

Buyers are just not willing to to get involved with the same conviction as before (yet). No buyers, no continuation (even if there is not many sellers/profit takers).

Point 2

Strong buyers proved their interest with a "hot" reaction at $2.95.

With no "real" seller coming into this market yet, there is nothing stopping this continuation from legging up (so far).

Therefore I stand bullish, and am looking for a move up to $4.64 as a Target.

Point 3

Buying into this can feel tricky, your first entry for a classic two bar trend break would've been at the top of demand. I do think we will get another opportunity here, I definitely would not chase this, because it could play this range for a while before another leg up.

Setup

Trend break continuation.

Entry 3.13

Stop 2.65

Exit TP 4.64

Risk to Reward 3.1

If there is a close below these strong buyers, this could com all the way back down to 2.15-2.3 at least.

The reason for the wider stop here is because we don't want to get swept and then ran. A more conservative stop could be $2.85 which would be a 6R trade. Take your pick

Long Term

If you are late to the party on XRP (I know many are) here are some entries according to your sentiment:

Almost FOMO = 3.13

Aggressive = 2.95

Good price = 2.15-2.3

Steal = 1.60 - 1.93

That's all for XRP. We are going to be looking at Ethereum ETH Next.

Thanks for reading and happy trading!

@thecafetrader

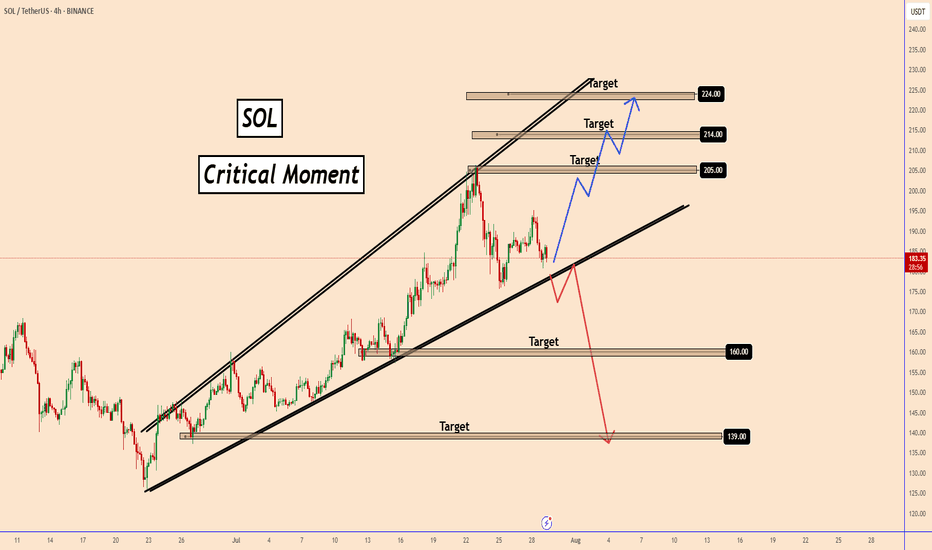

SOL Both scenarios are valid! SOL is still bullishSOL Both scenarios are valid! SOL is still bullish

SOL is in a critical zone. The price is still inside a large bullish pattern and as long as it stays inside the pattern, the trend remains bullish and SOL should follow the bullish scenario.

The bullish targets are at 205, 214 and 224

It may happen that the FOMC will bring surprises, so if SOL manages to break below the pattern, it will activate the bearish scenario after that and the chances of falling will increase further as shown in the red scenario.

The bearish targets are at 160 and 139

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

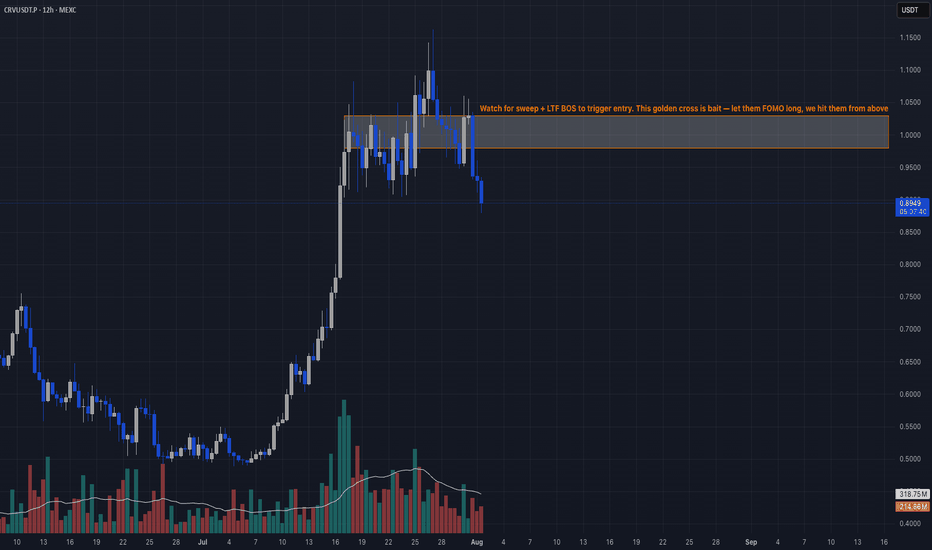

Retail Trap at Resistance📣 Team, get this…

CRV printed 5 green candles, triggered a golden cross, and suddenly every YouTube thumbnail said “TO THE MOON.” 🌝 That’s exactly the kind of retail trap we love to fade. This ain’t DeFi summer, it’s just overheated spaghetti. 🍝

🔥 TRADE SETUP

Bias: Short

Strategy: Retail Trap at Resistance

Entry: $0.98 – $1.03

SL: $1.10

TPs: $0.78, $0.65, $0.50

Why?

– RSI 83 + MACD maxed out = overcooked

– LTF CHoCH after sweeping $1.03

– Positive funding across exchanges → ripe for short squeeze reversal

– Retail buying golden cross = premium exit liquidity

Candle Craft | Signal. Structure. Execution.

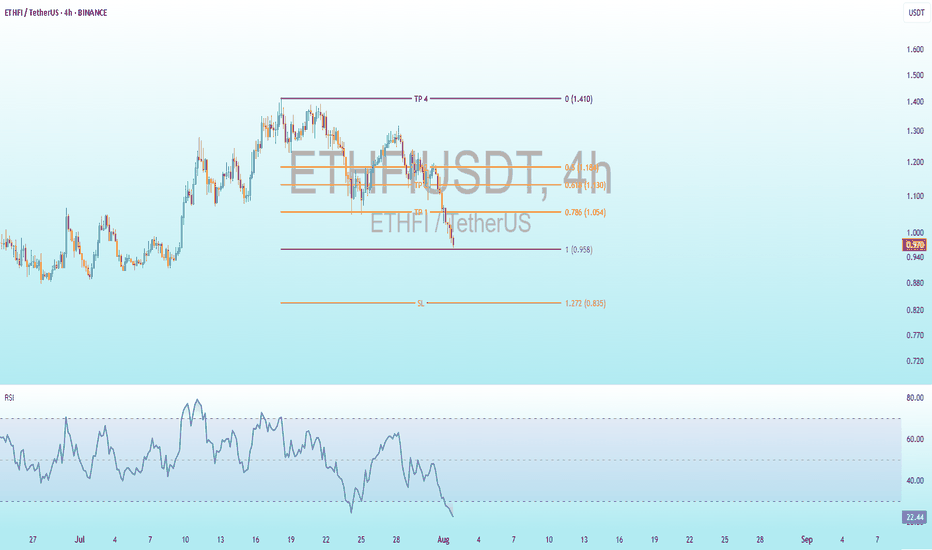

ETHFI Bullish DivergenceBINANCE:ETHFIUSDT

Trade Setup:

Target 1: 1.054 (0.786 Fibonnaci Golden Zone).

Target 2: 1.130 (0.618 Fibonnaci Golden Zone).

Target 3: 1.184 (0.786 Fibonnaci Golden Zone).

Target 4: 1.410 (0 Fibonnaci).

Stop Loss: 0.835 (1.272 Fibonnaci).

RSI Analysis: The RSI is showing a bullish divergence, suggesting potential bullish momentum. The current RSI is around 22.36, approaching oversold territory, so caution is advised.

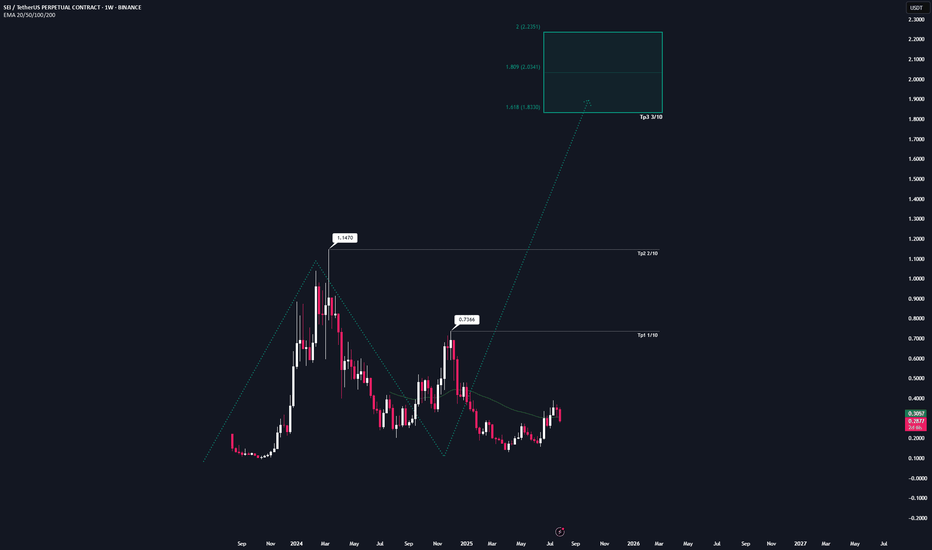

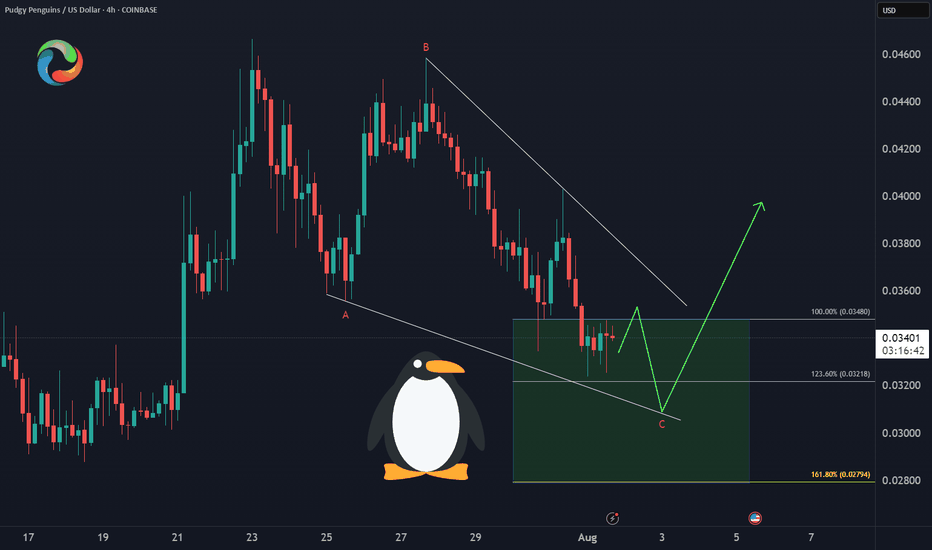

SEI | Full AnalysisHere is the top-down analysis for Sei as requested 🫡

Weekly Timeframe:

We have a potential large structure forming on the weekly chart that will be activated once we break the ATH. Its target zone lies between $1.8 and $2.2.

My sell targets for SEI this cycle are:

TP1: $0.73

TP2: $1.14

TP3: $1.83

These are my sell targets based on my technical analysis. However, I won’t rely on them alone — I also follow several on-chain indicators. Once retail euphoria kicks in and my indicators trigger, I’ll start selling accordingly.

Daily chart:

On the daily, we have a sequence that has already been activated and almost reached its target zone. That’s why the B–C correction level remains a valid buy zone, which I’ll also use for additional long entries.

This would be the second attempt from a B–C correction level, as we’ve already tapped it once (where I went long) and I’ll be entering again here.

Target zone for this sequence: $0.39–$0.44

Local Price action:

On the lower timeframe, we’ve just completed a bearish structure that perfectly overlaps with the B–C correction level. This increases the probability of this setup significantly, as both sides (bulls and bears) want the same thing here: bulls are buying the market, while bears are covering shorts and taking profits.

-----

Thats the my full Analysis for SEI, hope it was helpful if you want me to do another analysis for any other pair just comment down below.

Also, if anyone is interested in how my trading system works, let me know and I’ll post some educational content about it.

Thanks for reading❤️

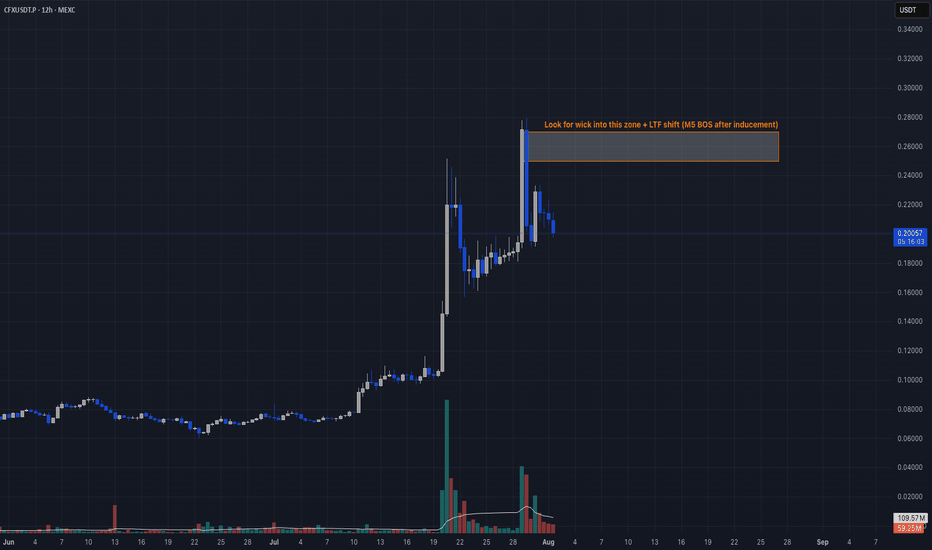

Sell-the-News Reversal📣 What’s up traders!

CFX just got injected with hopium from a pharma deal, a China stablecoin rumor, and the Conflux 3.0 upgrade… but here’s the thing: when price flies 119% and RSI hits 94, smart money starts reaching for the eject button. 🚨

🔥 TRADE SETUP

Bias: Short

Strategy: Sell-the-News Reversal

Entry: $0.25 – $0.27

SL: $0.29

TPs: $0.186, $0.145, $0.120

Why?

– HTF rally straight into resistance

– RSI 94 + $11M in short liquidations = exit liquidity confirmed

– OI and funding surged, now showing early cracks

– LTF BOS + failed continuation at highs.

Candle Craft | Signal. Structure. Execution.

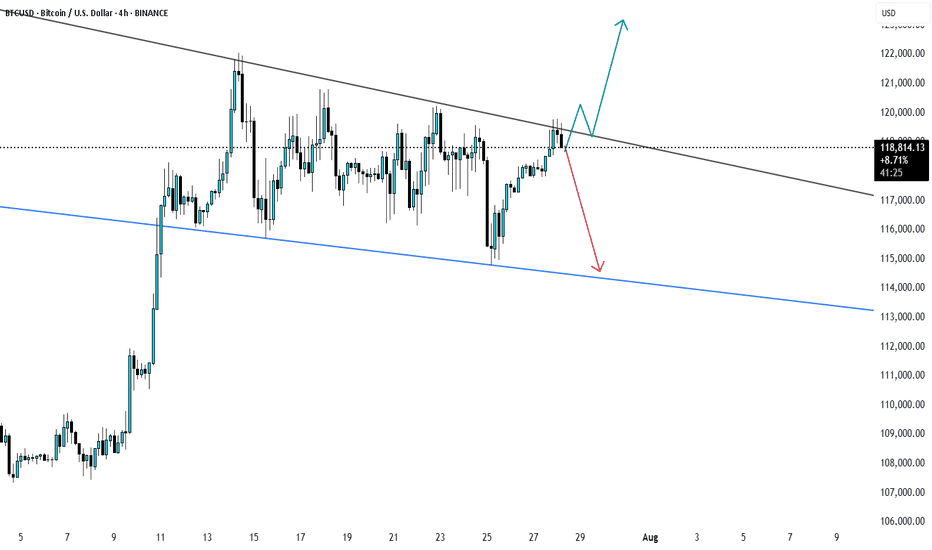

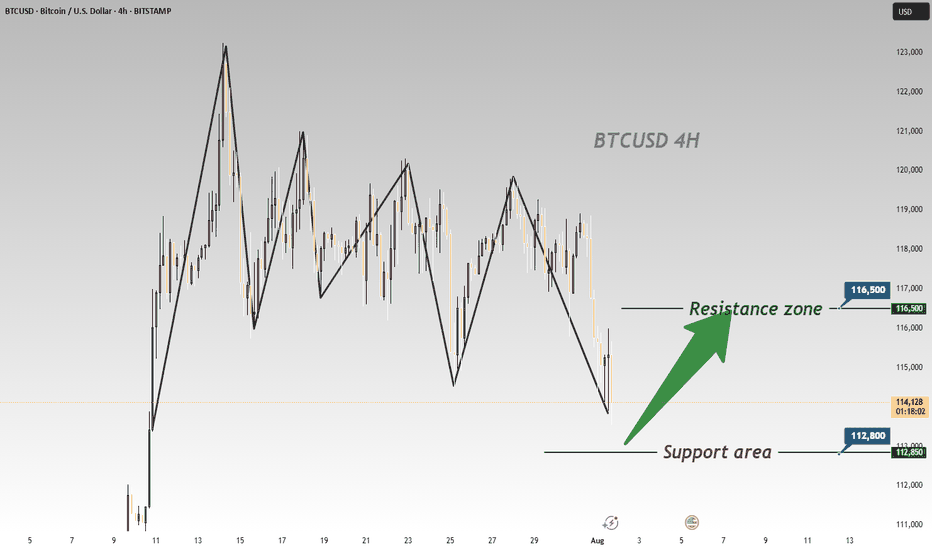

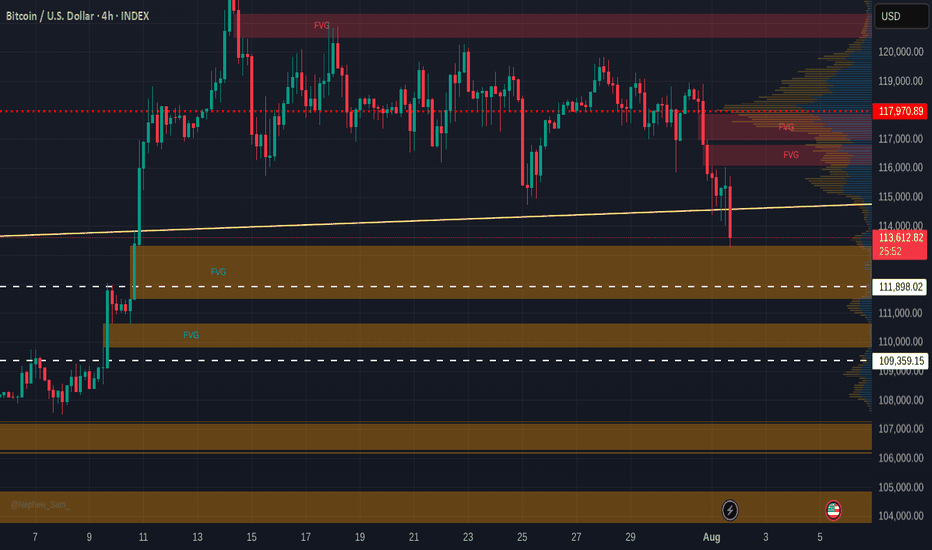

BTC Plummets Post-NFP; Go Long for Rebound to 116500BTC has plummeted significantly under the influence of the non-farm payroll data 📉, and now is an excellent opportunity to go long. Its Support level is around 112800, and according to the current trend, we can wait for a rebound to around 116500.

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Buy@ 113000 - 113800

🚀 TP 114500 - 115500 - 116500

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

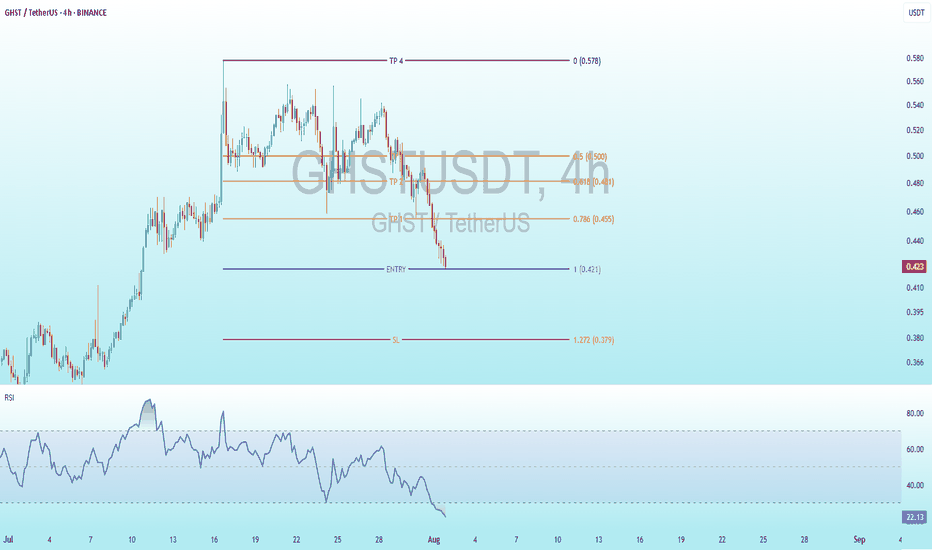

GHST Bullish DivergenceBINANCE:GHSTUSDT

Trade Setup:

Target 1: 0.455 (0.786 Fibonnaci Golden Zone).

Target 2: 0.481 (0.618 Fibonnaci Golden Zone).

Target 3: 0.500 (0.786 Fibonnaci Golden Zone).

Target 4: 0.578 (0 Fibonnaci).

Stop Loss: 0.379 (1.272 Fibonnaci).

RSI Analysis: The RSI is showing a bullish divergence, suggesting potential bullish momentum. The current RSI is around 21.88, approaching oversold territory, so caution is advised.

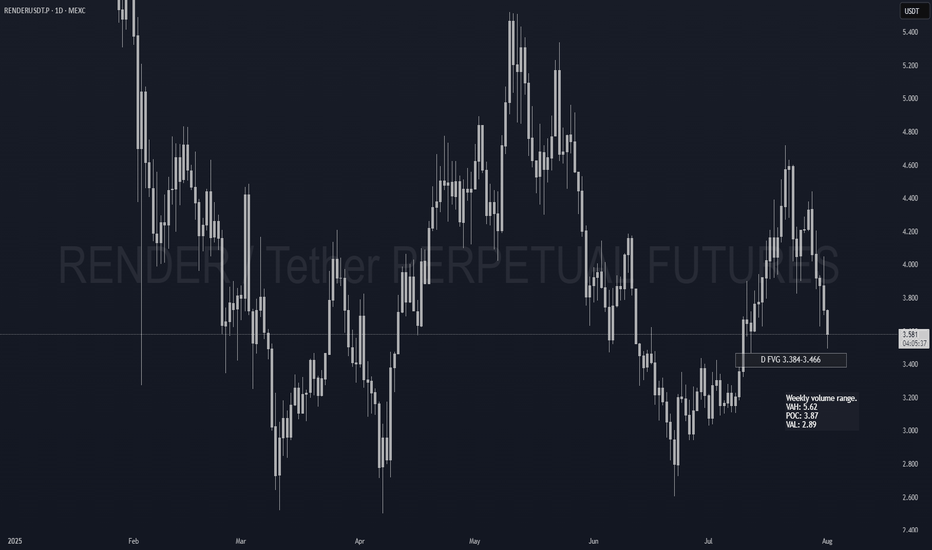

RENDER Spot Re-add PlanAlready holding Render as my biggest spot bag. Just setting clean limit orders to compound on weakness.

📍 Limit Orders (laddered):

• 3.45 → Daily FVG top (40%)

• 2.95 → Weekly VAL zone (40%)

• 2.55 → Deep HTF discount (20%)

Long term hold. Pure add-on entries.

DISCLAIMER:

I am not providing financial advice or investment signals. This post reflects my personal accumulation strategy and is shared solely for documentation purposes. I'm adding to an existing long-term position based on my own analysis and conviction. Sharing this openly helps me stay accountable and focused on my goals. If you choose to act on any of this, it's entirely at your own risk. Always do your own research and make informed decisions based on your situation.

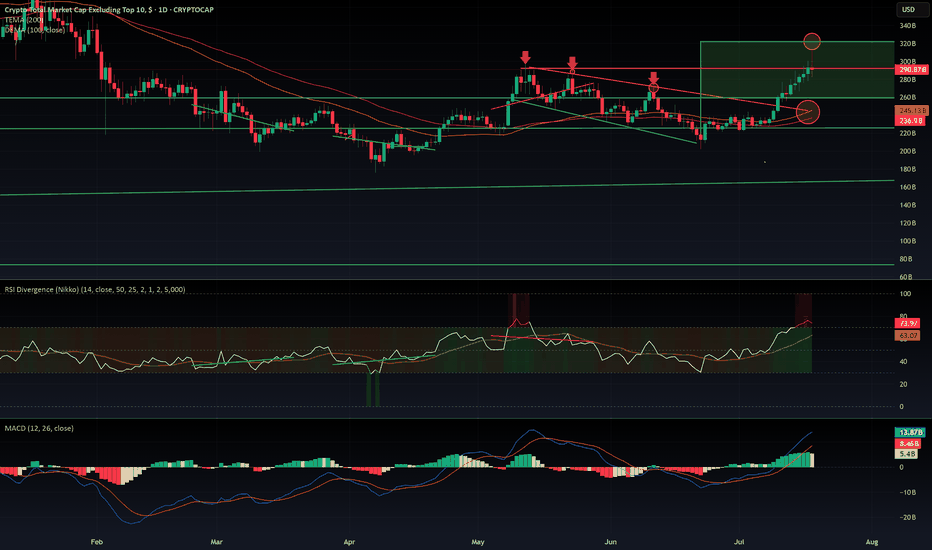

$OTHERS rejected from $320 B resistance. What is next?CRYPTOCAP:OTHERS Rejected at $320B: Is the Altseason on Pause?

CRYPTOCAP:OTHERS just got rejected at the $320B resistance after a decent pump — the kind that usually signals the start of an altseason. But if we dig into the indicators, warning signs are flashing:

- MACD is sitting in overbought territory.

- RSI is heavily extended, signaling potential exhaustion.

- EMA 100 & 200 are colliding with the top of a previous downtrend channel — a zone that historically acted as strong resistance.

The rejection was sharp. So what's next? Are we entering a range between $320B and $260B? It's quite possible. The aIf you wantltcoin market now sits at a decision point: either it keeps pushing higher or takes a breather — potentially pausing the rally until September.

Historically, August is a slow month in the West. People go on vacation, volumes drop, and markets tend to cool off. This seasonal pattern supports the idea of a consolidation phase before a stronger second leg of altseason kicks off in mid-September and carries into Q4.

I’m not posting too many ideas lately because the market landscape has changed. The new players aren’t just trading — they’re manipulating flows with massive capital to hunt retail liquidity.

They’re also using far more sophisticated tools than our classic MACD and RSI — including AI-powered indicators and multi-layered analytics that are beyond retail reach.

In this new environment, predictions are harder and risk is higher.

🧠 Do Your Own Research (DYOR), stay sharp, and don’t blindly trust social influencers.

Bitcoin Free Value Gaps getting filled - 109 K target >

If you look back at the last time I posted a chart with Free Value Gaps ( FVG ) you will see an orange bar where PA currently sits...The reason it is no longer there is because it ogt "Filled"

It is much the sameidea as CME Gaps. Thay also get filled very often/

So, we can see 2 more FVG before 107K line and so, in the current market state and with the knowledge that in August, Markets often Dip, we may well see PA retreat to the Gap at 109K

What a superb buying oppertunity

End of post as I am enjoying an evening in the south of France, with wine and Fun..

What it stopping you ?

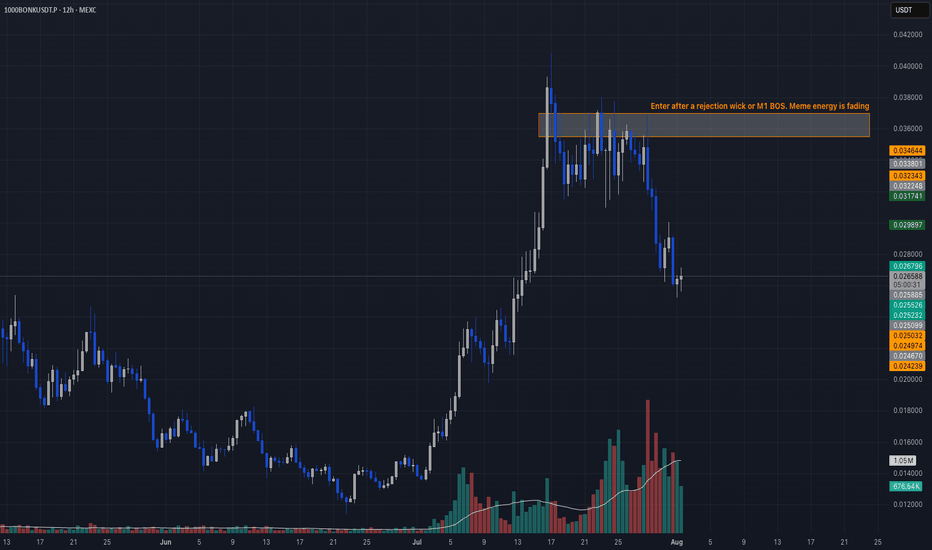

Meme Coin Liquidity Trap📣 Hey CandleCraft fam, remember this one?

We nailed the previous BONK long — while it didn’t tag the absolute top, it delivered us a clean, sharp profit right out of the gate. Now? The story has flipped. Meme energy is fading, funding flipped, and the structure’s screaming reversal. Let’s see how this short idea plays out. 🐶💨

The dog barked loud — BONK went full meme mode with a 203% pump… but now it’s giving off that “walk of shame” energy. 🐶 RSI tanked, funding flipped, and it’s bleeding liquidity. Who let the dogs out? Probably market makers.

🔥 TRADE SETUP

Bias: Short

Strategy: Meme Coin Liquidity Trap

Entry: $0.0000355 – $0.0000370

SL: $0.0000400

TPs: $0.000030, $0.000025, $0.000020

Why?

– Overextended meme coin pullback

– Funding rate negative = longs bleeding

– OI down 35%, RSI from 85 → sub-50

– Price hovering under 20-day EMA support

Candle Craft | Signal. Structure. Execution.

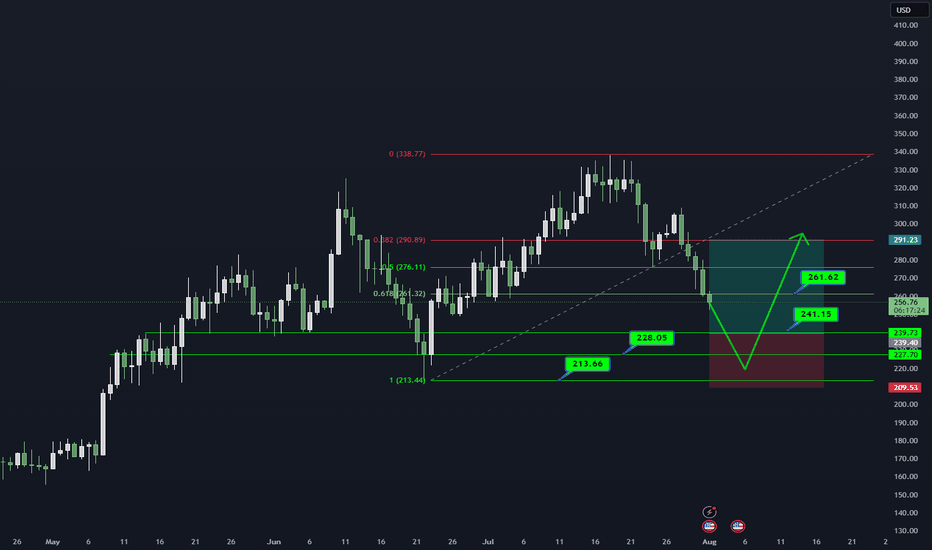

AAVE/USDT DAILY OUTLOOK📊 AAVE/USDT – DAILY TECHNICAL OUTLOOK

🔍 MARKET STRUCTURE

AAVE critical demand zone (241–228) par trade kar raha hai.

Higher timeframe trend bullish jab tak 213 strong base hold karta hai.

📌 KEY LEVELS TO WATCH

Support Zones: 241.15 → 228.05 → 213.66 (Major Base)

Resistance Zones: 261.62 → 291.23

Breakout Confirmation: Daily close above 261 could open path to 291.

🎯 TRADING PLAN (25% SCALING STRATEGY)

Entries ko 25% ke 4 parts me divide karein:

241.15

228.05

220–213 support range

Targets: 261.62 → 291.23

Stop Loss: Daily close below 213

⚠️ RISK MANAGEMENT NOTE

Spot trades safer. Leverage trading = technical gambling.

Capital preservation = long-term survival.

📖 QUOTE

"The big money is made by sitting, not trading." – Reminiscences of a Stock Operator

💬 WHAT’S YOUR VIEW ON AAVE?

Bullish bounce from demand zone or deeper retest ahead?

Share your thoughts in the comments!

#AAVE #CryptoTrading #Altcoins #TradingView #TechnicalAnalysis #CryptoCommunity #RiskManagement #SpotTrading

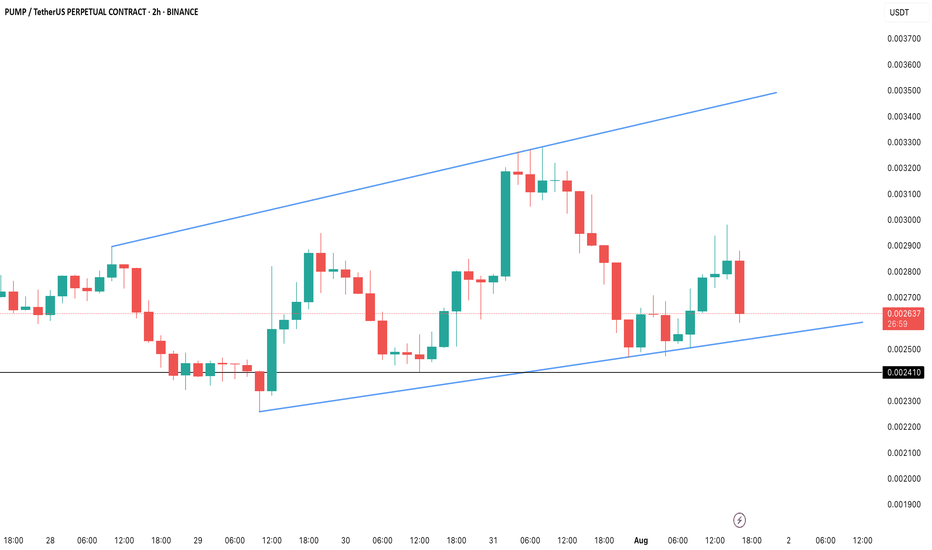

PUMP/USDT: Whales Buy the Dip as Price Holds Key LevelBINANCE:PUMPUSDT.P price has taken a steep 18% hit in the last 24 hours, but the 2-hour chart shows BINANCE:PUMPUSDT.P price action clinging to a critical Fibonacci support near $0.00259. The token is still trading inside an ascending channel, hinting that the bullish structure hasn’t fully broken yet.

Whales have been scooping up the dip aggressively, adding 5.4 billion PUMP tokens over the past week (a 35.8% jump in their holdings). Despite retail selling pushing netflows positive intraday, big wallets continue to absorb supply. Daily accumulation is also up 3.2% in the last 24 hours, reinforcing the demand floor near current levels.

Meanwhile, long positions dominate the liquidation setup, with $7.88 billion in longs versus just $3.6 billion in shorts. If BINANCE:PUMPUSDT.P price bounces, a cascade of short liquidations could amplify the recovery rally. But failure to defend $0.00259 risks opening the door to $0.00241, putting bulls on the back foot.

For now, the $0.00259–$0.00260 zone is the make-or-break level. Holding above keeps BINANCE:PUMPUSDT.P price inside the bullish channel, setting up a potential retest of $0.00284–$0.00294. A breakdown, however, could flip sentiment sharply bearish.

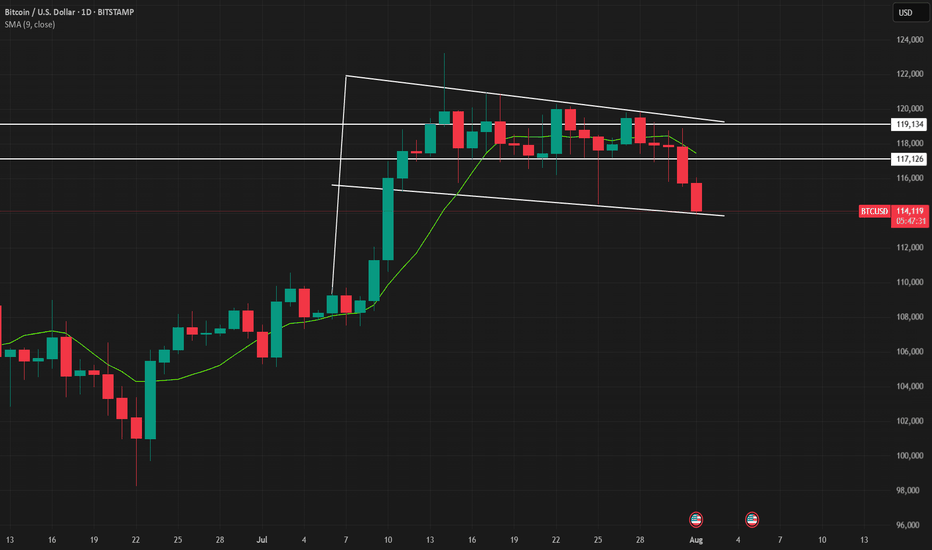

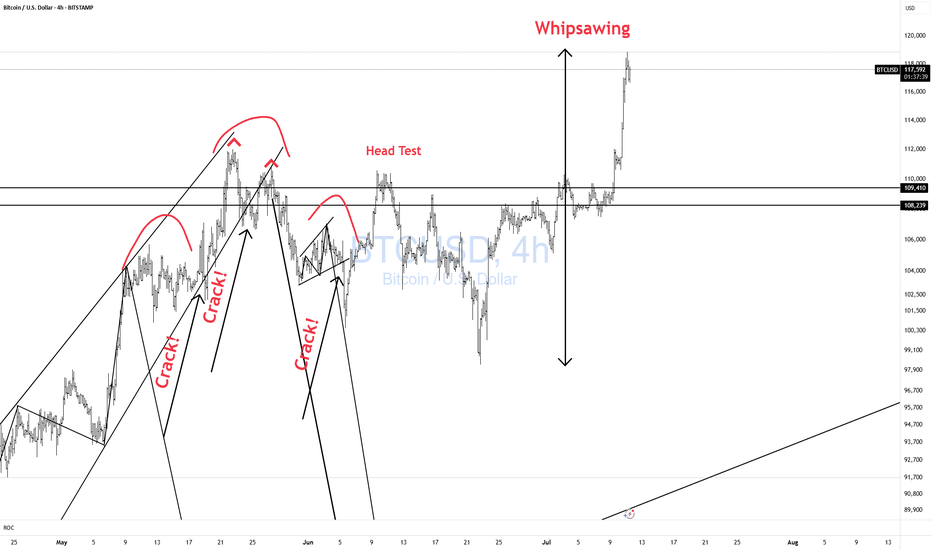

Bitcoin Bull Flag - will it collapse?Bitcoin is currently in a bull flag.

Will it hold — or collapse?

The weekly close will decide.

🔹 If BTC closes above the bull flag support: Possible continuation of the rally.

🔻 If BTC closes below the flag: Expect a deeper correction.

Stay sharp. The weekly close is key IMO.

No FA. DYOR! For educational purpose only.

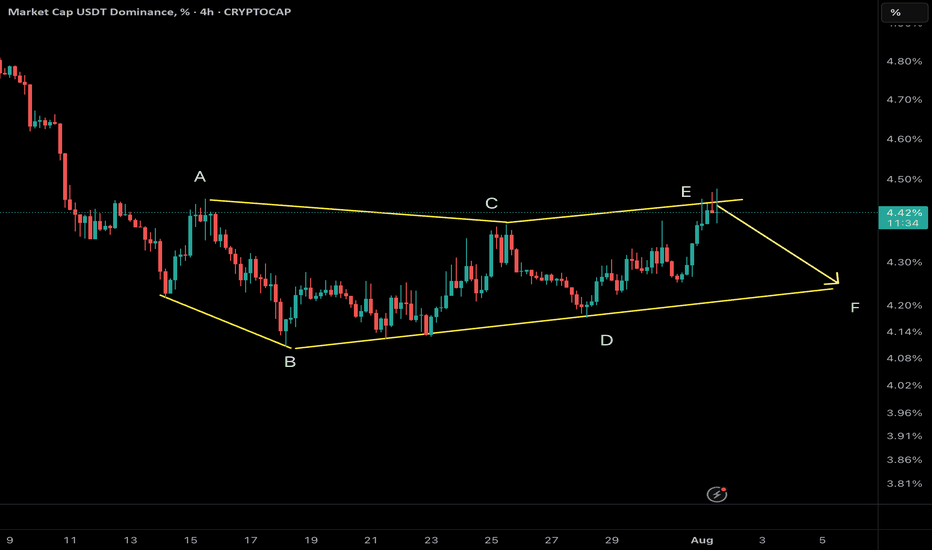

USDT Dominance – Potential Wave F Reversal?

We are tracking a NeoWave Diametric formation (7-leg corrective structure: A–B–C–D–E–F–G) on the USDT Dominance chart. Recently, price reached the projected resistance zone of wave E, and early signs of reversal are emerging.

⸻

🧠 Structural Analysis:

• The structure has developed with alternating legs in price and time, consistent with the symmetrical diametric rules.

• Wave E has likely completed, reacting from prior supply and resistance.

• A pullback from here can mark the beginning of Wave F, which in diametrics tends to retrace significantly toward the internal balance of the structure.

⸻

🔍 What to Watch:

• Confirmation of bearish intent via a break of internal supports or lower-timeframe BOS.

• Possible retracement targets: 4.2% → 3.95%, depending on momentum.

• A decisive break below 4.00% would reinforce the wave F scenario.

⸻

⚠️ Implications for the Crypto Market:

A drop in USDT Dominance typically indicates rotation into risk assets (alts/BTC/ETH). However, context matters — if the drop happens during a general market sell-off, it may reflect risk-off unwinding into fiat, not risk-on rotation.

⸻

🔄 Strategy Note:

• Avoid premature shorts or longs; wait for structure to confirm.

• Watch for smart money traps (e.g., false breakouts or liquidity grabs) around the recent highs.

⸻

📌 This is a high-risk zone for entering long USDT.D — be cautious with stablecoin bias.

📊 Analysis by CryptoPilot – Precision through structure.