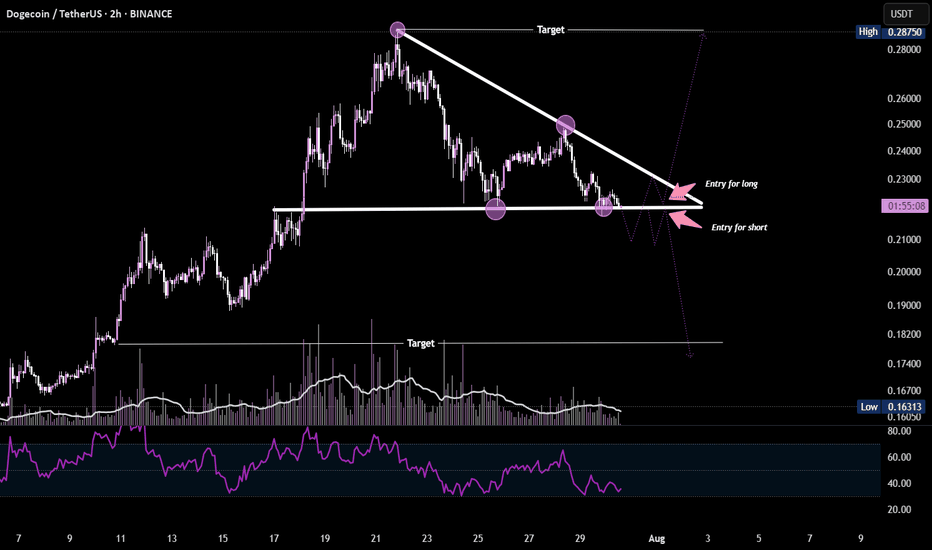

DOGE at Decision Point Dogecoin is forming a descending triangle pattern on the 2H chart, indicating a potential breakout setup.

A close above the resistance trendline ($0.23) could trigger a bullish move, while a breakdown below support ($0.215) may signal a bearish continuation. RSI and volume are suggesting weakening momentum — wait for confirmation before entering.

Crypto market

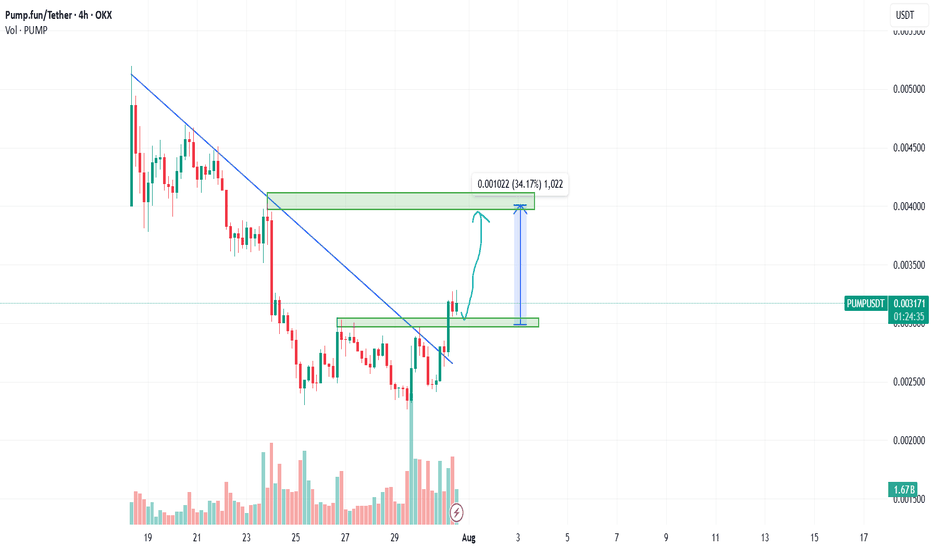

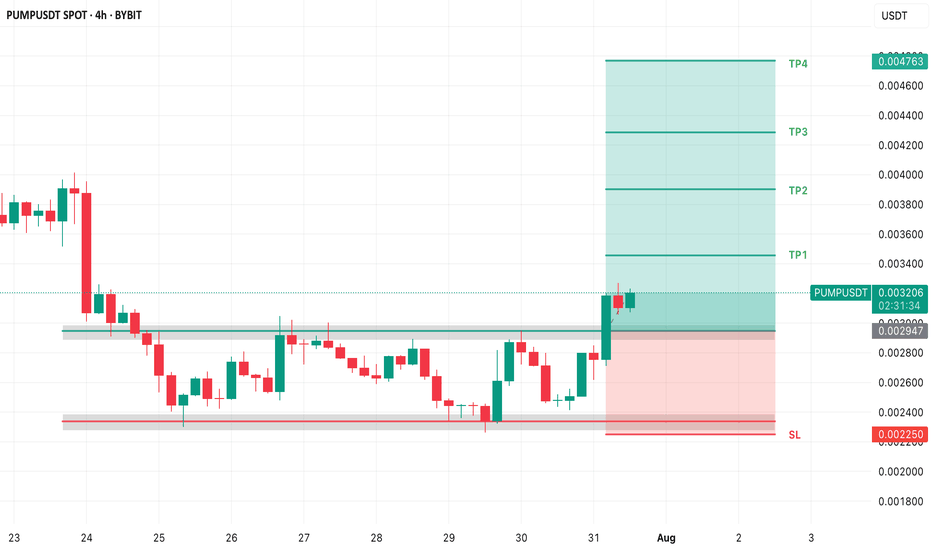

PUMPUSDT: Bullish Breakout and Retest - A Potential 34% Upside?Hello, traders!

Today we're looking at the PUMP/USDT pair on the 4-hour timeframe, and a very clean technical setup is unfolding that points towards potential bullish continuation. Let's break down the key elements of this analysis.

The Analysis

The chart presents a classic breakout and retest scenario, which is often a strong indicator of a trend reversal or continuation.

Descending Trendline Breakout: The most significant feature is the decisive breakout from a major descending trendline that had been capping the price for a considerable period. Breaking this trendline is a primary signal that the previous bearish momentum is weakening and buyers are starting to take control.

Break of Horizontal Resistance (S/R Flip): Following the trendline break, the price also successfully pushed through a key horizontal resistance zone, identified on the chart between approximately $0.002966 and $0.003044. This level has now, as expected, turned into a new support base.

The Retest: We are currently witnessing a pullback to this newly established support zone. This "retest" is a critical phase. A strong bounce from this level would confirm the breakout's validity and suggest that the market has accepted this price floor, paving the way for the next leg up.

Volume Confirmation: Notice the volume bars at the bottom of the chart. There was a visible spike in volume during the initial breakout candles, which adds conviction to the move. It indicates that the breakout was backed by significant buying interest.

The Trade Idea

Based on this structure, a potential long opportunity presents itself.

Entry: A favorable entry point could be found within the current support zone ($0.002966 - $0.003044), especially upon seeing confirmation of a bounce (e.g., a bullish engulfing candle or a hammer on the 4H or 1H chart).

Target: The analysis points to a primary target at the next major resistance level, located around the $0.004000 psychological mark. As measured on the chart, this represents a potential upside of over 34%.

Invalidation: This bullish outlook would be invalidated if the price fails to hold the current support and decisively closes back below the $0.002966 level. Placing a stop-loss below this zone is a prudent risk management strategy.

Conclusion

In summary, PUMPUSDT is displaying a textbook bullish setup. The combination of a trendline breakout, an S/R flip, and a live retest offers a compelling case for potential upside. As always, manage your risk carefully and wait for your preferred confirmation signals before entering a trade.

Disclaimer: This is not financial advice. The analysis provided is for educational and informational purposes only. Trading cryptocurrencies involves a high level of risk. Please conduct your own research and risk assessment before making any investment decisions.

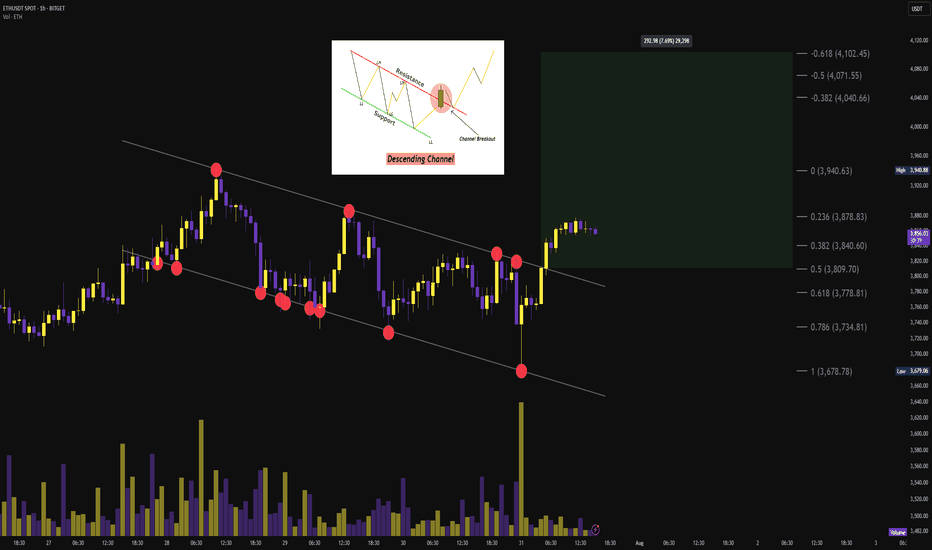

$ETH 1H Descending Channel Breakout🟩 Breakout Level: $3,770

🟩 Fib-Based Targets:

→ $3,878 (0.236)

→ $3,940 (0)

→ $4,040 (0.382)

🟥 Invalidation:

Break back inside the channel + loss of $3,678

Momentum Summary:

Perfect touchpoints across the descending channel. Final wick tagged demand with massive volume, followed by impulsive breakout and retest. Short-term structure favoring bullish continuation.

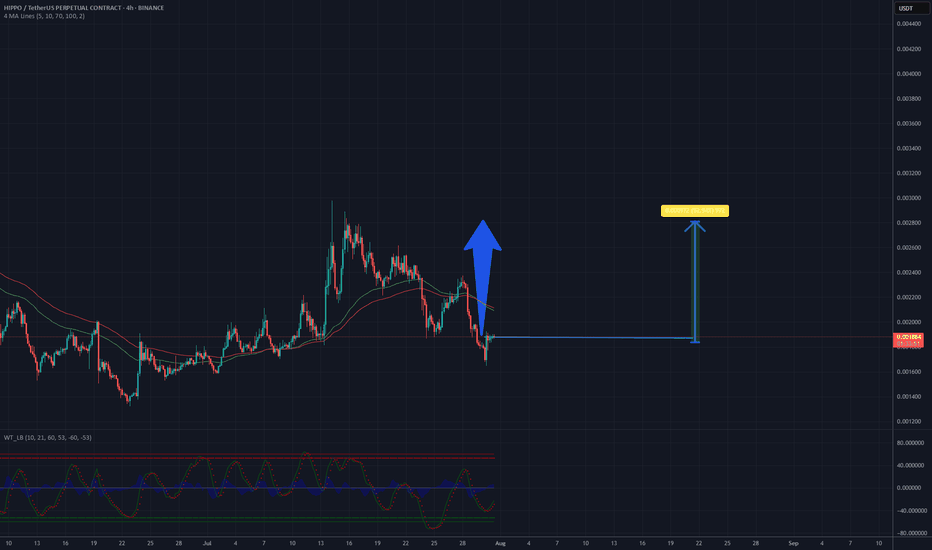

Is a time for HIPPOUSDT? Potential 50% - 0.0028 USD CRYPTOThe chart displays a 4-hour candlestick pattern for the HIPPO/USDT perpetual contract on Binance, showing price movements from late June to mid-September 2025. The price has recently experienced a downward trend after reaching a peak, with a noticeable drop from around 0.0028 to the current level of approximately 0.00186. The moving averages (red and green lines) indicate a potential bearish crossover, suggesting continued downward pressure in the short term. However, the price is approaching a support level near 0.0017, where historical buying interest might emerge. The oscillator at the bottom shows mixed signals, with a slight uptick that could hint at a potential reversal if momentum builds. Based on this analysis, a price recovery to 0.0028 seems plausible if the support holds and buying volume increases in the coming sessions.

Potential TP: 0.0028 USD

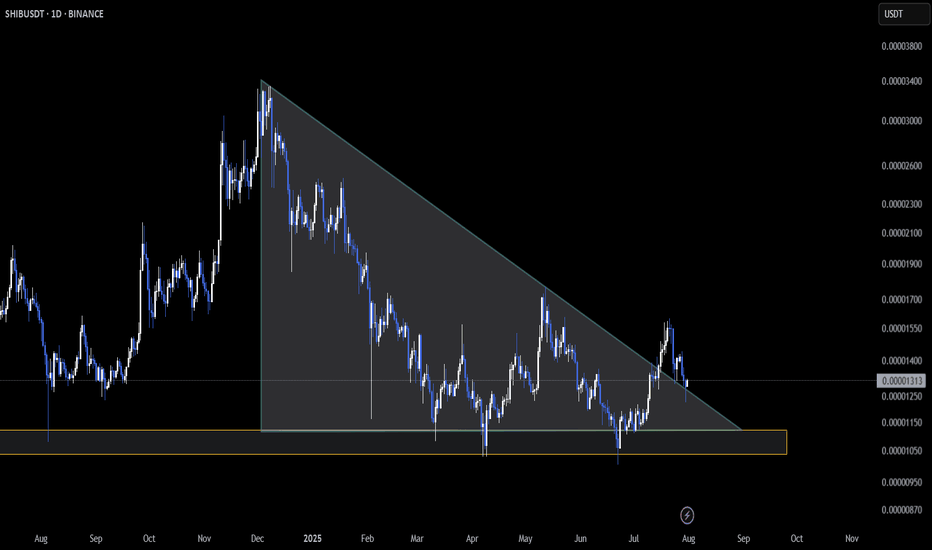

SHIB Retests Triangle Support as Pressure Mounts🔥 CRYPTOCAP:SHIB is locked into a key zone on the daily chart — price is retesting the base of a descending triangle structure 🛡️

So far, support is holding, but the range is tightening. A strong bounce here could kick off a recovery move 📈

⚠️ On the flip side, a breakdown would confirm bearish continuation and shift momentum to the downside.

👀 This is a must-watch level — clean structure, high stakes.

Do you see SHIB bouncing from here or breaking below?

Not financial advice.

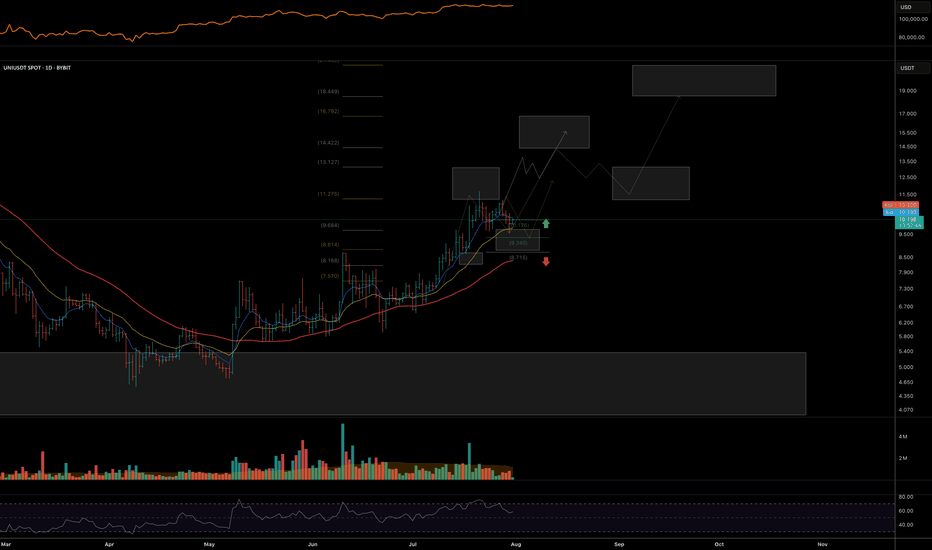

TradeCityPro | ONDO Builds Strength Beneath Key Supply Barrier👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ONDO coin for you — one of the RWA projects, currently ranked 37th on CoinMarketCap with a market cap of $2.93 billion.

📅 Daily Timeframe

In the daily timeframe, as you can see, this coin has formed a range box between the levels of 0.7354 and 1.1933, and the price is currently sitting in the upper half of this box.

✔️ At the moment, the price is hovering around 0.9037, and it’s forming a higher low above 0.7354. If this low gets confirmed, the probability of breaking above 1.1933 increases.

⭐ The 1.1933 zone is a very significant supply level that was previously acting as support in late 2024, and after being broken, has since acted multiple times as resistance.

📊 If this area breaks, we can open a long position, or even buy this coin in spot. Personally, if this trigger is broken, I’ll open a long-term long position.

✨ The target for this position is 2.0565, and once the price reaches this level, we can take profits and consider a spot buy.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

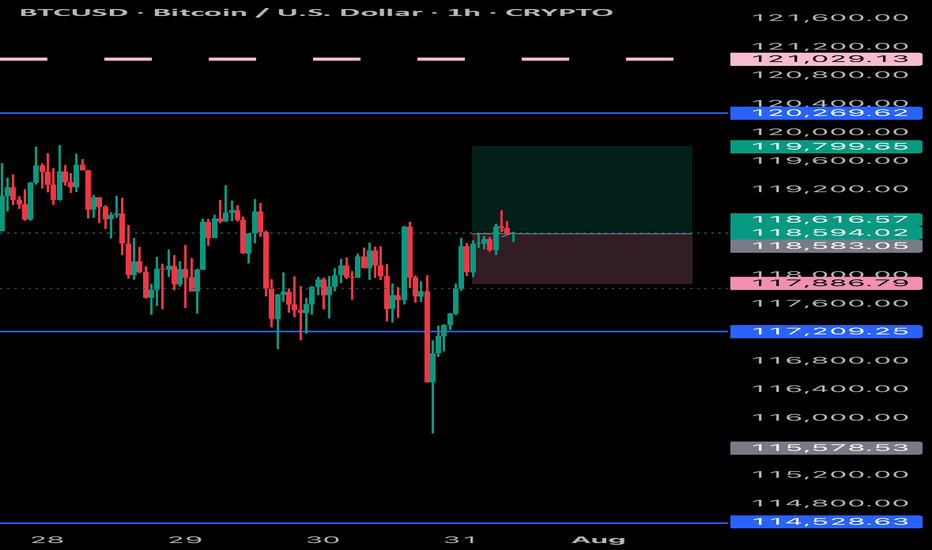

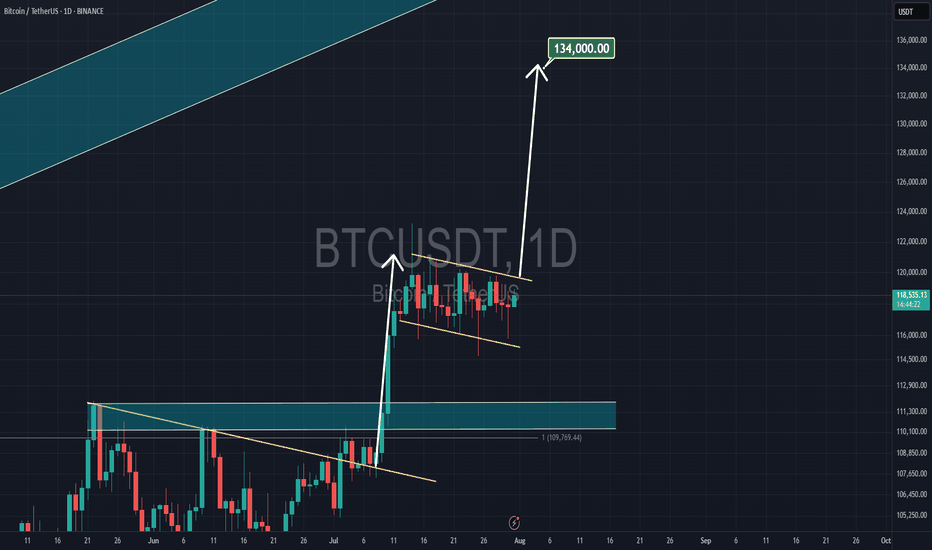

Crypto market review: Bitcoin, ETH, and Altcoins Setting Up for Prepared a new in-depth crypto market video update covering BTC, Ethereum, and key altcoins. Here’s a quick summary of the current landscape and what I’m tracking in the charts:

We’ll begin with Bitcoin. After the Fed’s decision, BTC showed a constructive shakeout and has been consolidating tightly around the same range for three weeks. I previously anticipated resistance near the 1.23 area and expected a sideways phase within the 1.15–1.13 support zone. That’s exactly what we’re seeing—shakeouts and quick recoveries. As long as we stay above 1.13 structurally, and especially above yesterday’s highs short-term, I expect BTC to push higher toward the 1.26–1.30 resistance zone.

Institutional buying during the post-Fed dip has been significant. Volume on Coinbase and Binance indicates strong participation, and Bitcoin treasuries have been accumulating. This bolsters confidence in the underlying trend structure.

I wrote in mid-July about BTC’s broader macro structure—this resistance region may trigger a prolonged consolidation, but ideally without breaking June lows. Short-term bias remains bullish.

Ethereum remains the strongest large-cap altcoin. It has respected the 8EMA on pullbacks and shows strength to target 4300–5100 in the coming weeks. It continues to lead risk-on sentiment.

XRP has been deep in consolidation, but we may be seeing a higher low forming. Any rally in BTC and ETH could lift XRP toward 3.30–4.60 levels, possibly even 5.00.

Solana showed strong action through late July, pulling back into mid-term support. As long as this structure holds, I expect upside toward 220–230 and potentially reclaiming ATH zones.

Hyperliquid has been a laggard but held its key macro support. If yesterday marked a bottom, I’ll be watching for higher lows and a move toward 55–60.

Other notable setups:

Brett: Both showing impulsive structures from April lows. Brett in particular looks poised for 74–77, potentially retesting May highs around 95.

ONDO: Recovering key zones and shaping a potential bottoming pattern.

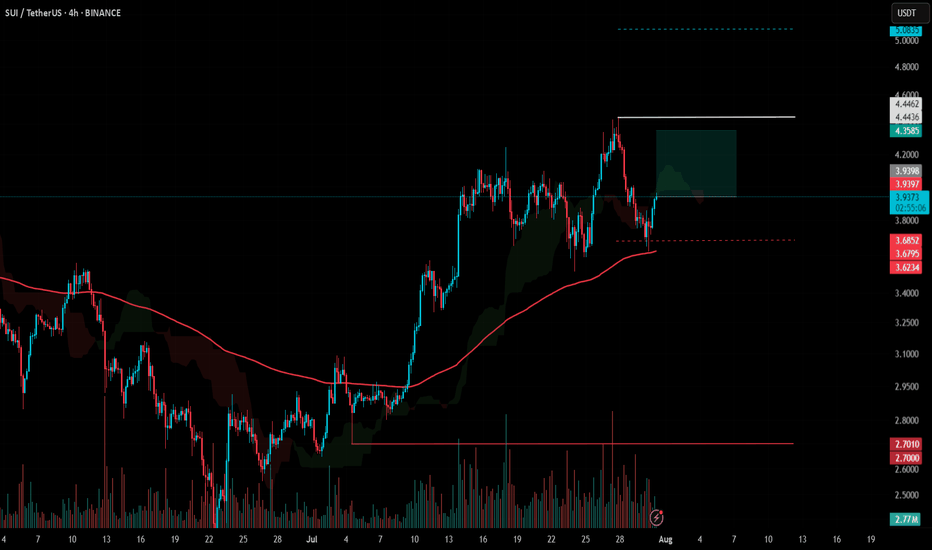

SUI: Leading structure from July lows. After a likely wave-one completion, it could extend toward 5.15–7.70 before topping.

RENDER: Looks to have finished its correction. Potential long-term upside beyond May highs; the macro uptrend might already be underway.

SUPER: Since July breakout, forming a strong trend structure. If it holds the higher low, could reach 1.20–1.46 in coming weeks.

TON: Slow mover, but the macro pattern suggests a bottom with potential toward 4.60 short-term.

LINK: Hasn’t finished its move. Watching for 21–22 as a next target.

FET / Fetch.AI: Macro structure looks great. Watching for recovery from June lows with potential for strong continuation if structure holds.

Trump Coin: In a diagonal pattern post-failed impulsive breakout. If higher lows hold, watch for rally toward 13–14.

LTC: Linear and clean structure. Looks ready to push toward 130–145 before potential base-building.

UNI: Targeting 14–18+ in wave continuation if structure holds.

Let me know in the comments if there’s a specific coin you’d like me to go over. I’ll include it in future updates or make a quick standalone video.

Thanks for watching, and I wish you a successful trading week ahead. Let’s see how far this rally can go through the rest of the summer!

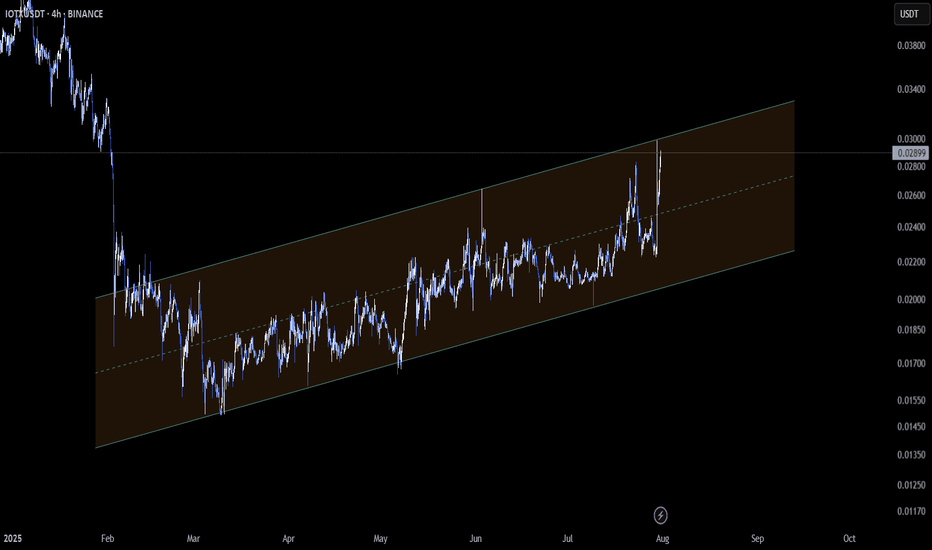

IOTX Presses Against Channel Resistance on Daily Chart💥 SEED_DONKEYDAN_MARKET_CAP:IOTX is back on breakout radar as price tests the upper boundary of its ascending channel on the daily timeframe 📈

The structure has held cleanly so far, and price action is now tightening just beneath resistance 🔍. If buyers push through this level, we could see an explosive move to the upside 🚀

However, a rejection here might trigger a short-term pullback toward mid-channel support ⏬

👀 Critical moment unfolding — break or bounce?

Let’s see who takes control from here.

Not financial advice.

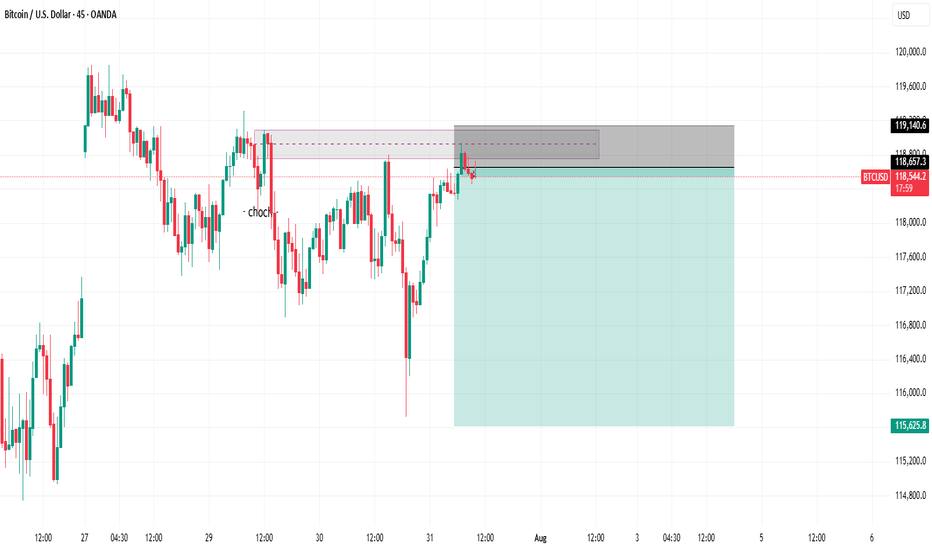

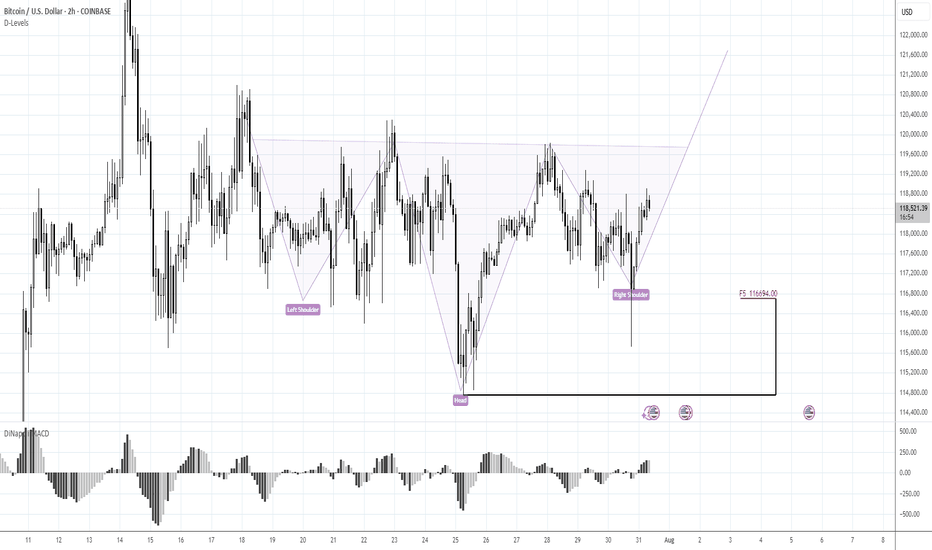

Keep following to the H&S PatternMorning folks,

To be honest, not too many things to talk about. We've prepared our scenario with H&S is still valid. Reaction to GDP numbers was quite welcome as it set the right arm's bottom. The only thing that we have to be busy with is to control its validity - reaching of the neckline and price standing above 116 lows and right arm.

At the first signs that market is start falling back - do not take any new longs. H&S failure is also the pattern and in this case we get deeper correction. But daily chart still makes me think that bullish context is here

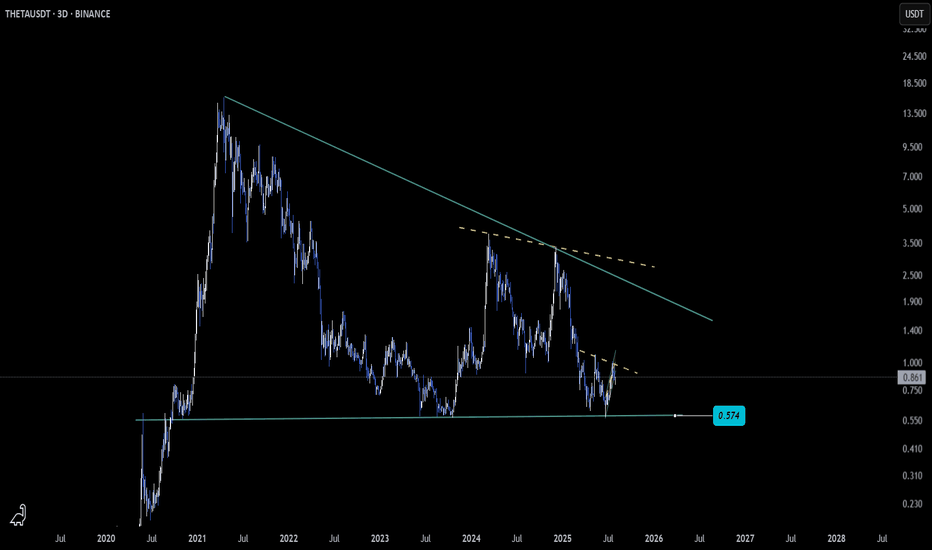

THETA Breaks Structure With Triangle Pressure Forming

🚨 MYX:THETA just slipped below its ascending channel on the 4H timeframe 📉—a key breakdown that shifts the short-term bias.

📆 On the Daily and 3D charts, a descending triangle pattern is starting to take shape 🧊

This combination of lower highs and horizontal support could lead to further downside if bulls don't step in soon.

The next few candles are critical—either THETA reclaims the broken structure, or it slides deeper into bearish territory.

👀 Eyes on this zone—momentum could flip fast.

Is this a fakeout or the start of a deeper breakdown?

Not financial advice.

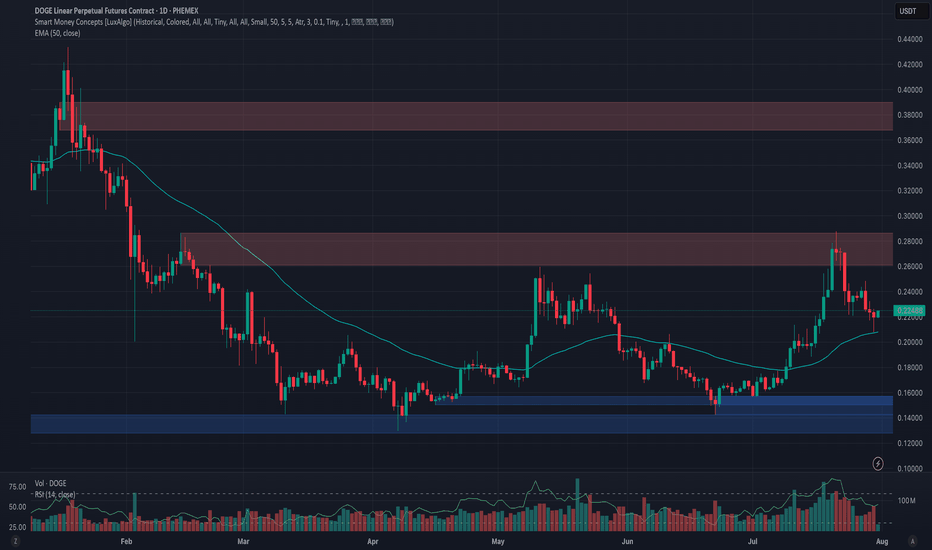

Phemex Analysis #101: Is Dogecoin (DOGE) Ready to Moon Again?Dogecoin ( PHEMEX:DOGEUSDT.P ), the original meme cryptocurrency, is once again capturing investor attention, fueled by impressive bullish movements. Currently trading around $0.2245, DOGE surged approximately 70% in July, decisively breaking the key resistance at $0.22 and challenging the next resistance level near $0.28.

With whale accumulation intensifying, renewed retail investor enthusiasm, and heightened speculation surrounding possible ETF approvals, Dogecoin appears poised to potentially sustain or even amplify its recent gains. But the key question remains: is DOGE truly ready to moon again, or is caution necessary following such rapid price movement?

Let’s carefully explore a few potential scenarios to inform your trading strategies:

Possible Scenarios

1. Bullish Continuation—Targeting Higher Levels

After successfully breaking above the crucial $0.22 resistance, Dogecoin could maintain its upward momentum if buying pressure remains strong. In this bullish scenario, DOGE might swiftly retest the immediate resistance at $0.25, then target higher levels near $0.28, and potentially surge toward the significant resistance at $0.39.

Pro Tips:

Entry Signals: Watch for a confirmed breakout above $0.25, especially if accompanied by rising trading volume, as a potential bullish entry point.

Profit-Taking: Strategically secure partial profits at resistance zones around $0.28 and $0.39.

Risk Management: Implement tight stop-loss orders just below the key support at $0.20 to guard against unexpected reversals.

2. Retest and Accumulation—Neutral Scenario

Given DOGE’s rapid price rise, a short-term pullback towards previous resistance-turned-support at $0.22 or even $0.20 is plausible. Such retracements, particularly on decreasing volume, might signal healthy consolidation, setting the stage for future bullish momentum.

Pro Tips:

Buying Opportunities: Look to accumulate DOGE if a low-volume pullback occurs toward support zones around $0.22 or $0.20.

Monitor Volume: Observe closely for decreasing trading volume during retracements, which typically indicates positive consolidation rather than a bearish reversal.

3. Bearish Scenario—Deeper Correction Possible

Should overall market sentiment shift negatively or DOGE fail to hold crucial support at $0.22, bearish pressure could escalate, potentially pushing Dogecoin down to deeper support levels around $0.198, and possibly as low as $0.15 or $0.13.

Pro Tips:

Risk Management: Consider reducing or exiting positions if DOGE decisively breaks below $0.22 on increased selling volume.

Long-Term Accumulation: Long-term holders may strategically accumulate DOGE at historically strong support levels ($0.15 or $0.13) once price stabilization occurs.

Conclusion

Dogecoin (DOGE) stands at a pivotal point, balancing bullish enthusiasm against the possibility of a correction. Traders should carefully monitor resistance at $0.25, the critical support at $0.22, and closely observe volume dynamics. By strategically aligning their trades with these outlined scenarios and employing disciplined risk management, traders can confidently navigate DOGE’s volatility and potentially capitalize on its next significant move.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

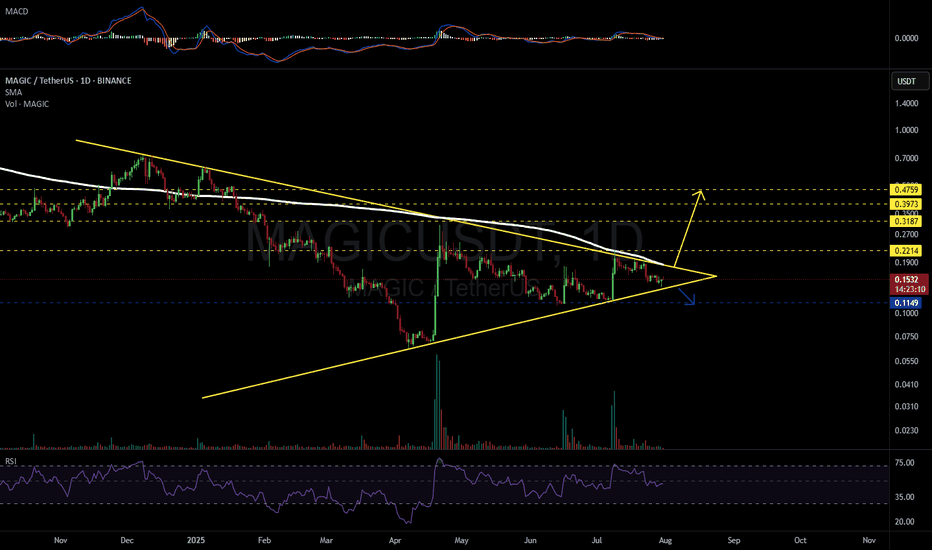

MAGICUSDT 1D#MAGIC is moving inside a symmetrical triangle — it's decision time: breakout or breakdown?

If it manages to break above the triangle resistance and the daily SMA200, the potential upside targets are:

🎯 $0.2214

🎯 $0.3187

🎯 $0.3973

🎯 $0.4759

However, in case of a breakdown and a daily candle close below the triangle, it may retest the support level at $0.1149.

⚠️ As always, use a tight stop-loss and apply proper risk management.

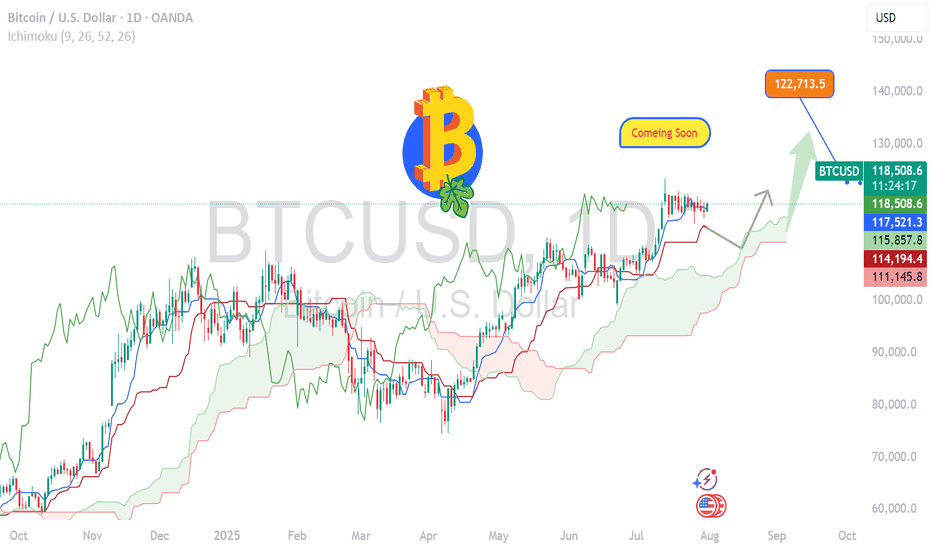

BITCOIN- Charging Towards 122k Momentum Building BTC/USD Long Setup – Targeting 122K 🔥

Bitcoin is holding strong above 118500, signaling bullish momentum.

✅ Price broke key resistance & forming higher lows.

🟢 Current structure favors buy-side continuation with next major target at 122000.

Support Zones:

🔹 117800 – intraday bullish retest

🔹 116500 – strong demand zone

Resistance Ahead:

🔸 120200 – short-term reaction

🔸 122000 – major target

🚀 Expecting bullish wave continuation.

If momentum sustains above 118K, 122K breakout highly probable!

#BTC #Bitcoin #CryptoSetup #BTCUSD #CryptoTrading #BTC122K #ChartAnalysis #BullishBreakout

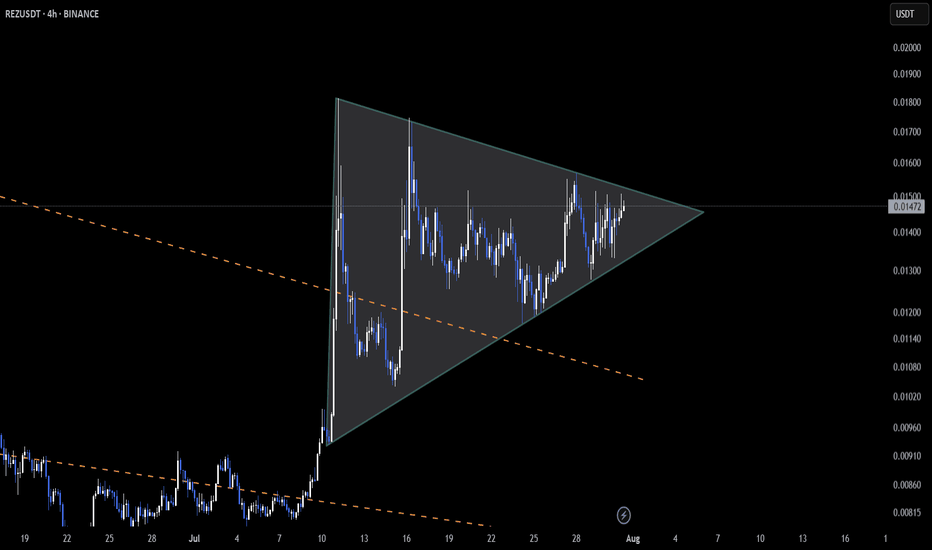

REZ Tightens Into Apex With Breakout Pressure Building AMEX:REZ is winding up inside a symmetrical triangle on the 4H chart 🔺—and it’s nearing decision time.

The price is approaching the apex with reduced volatility, often a sign that a sharp move is around the corner.

Earlier, AMEX:REZ broke out of a falling wedge, but follow-through was weak. This current structure might be the second shot—if volume steps in, momentum could finally shift higher 📈

👀 Compression is tight, and breakout pressure is real.

Will bulls take control this time or is another fade incoming?

Not financial advice.

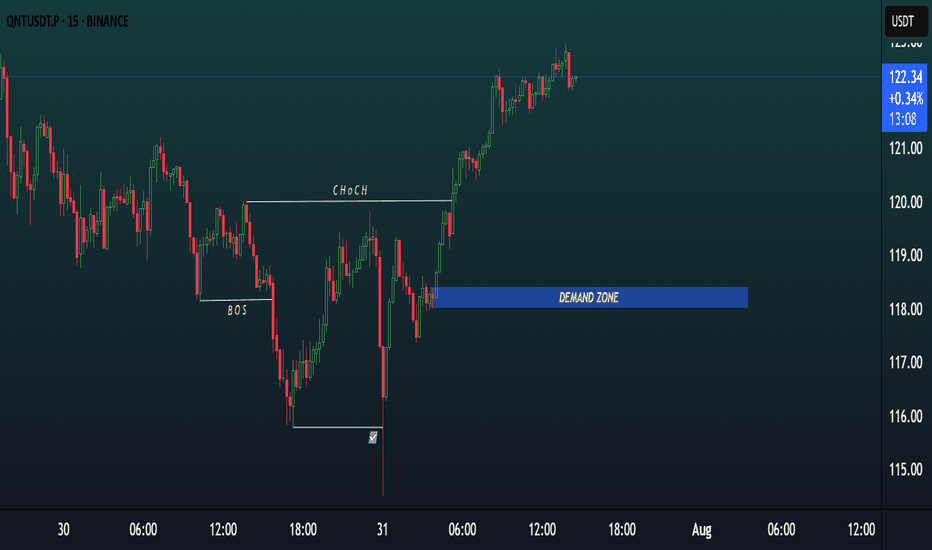

QNT/USDT 15m SETUP.QNT/USDT 15m Setup 🔥

Price made a strong Change of Character (ChoCH) to the upside, confirming bullish intent.

After the shift, price rallied and created a clean Demand Zone around $117.80–$118.50.

✅ Now waiting for a potential pullback to this zone for a high-probability long entry.

SMC-based setup — wait for confirmation before entry

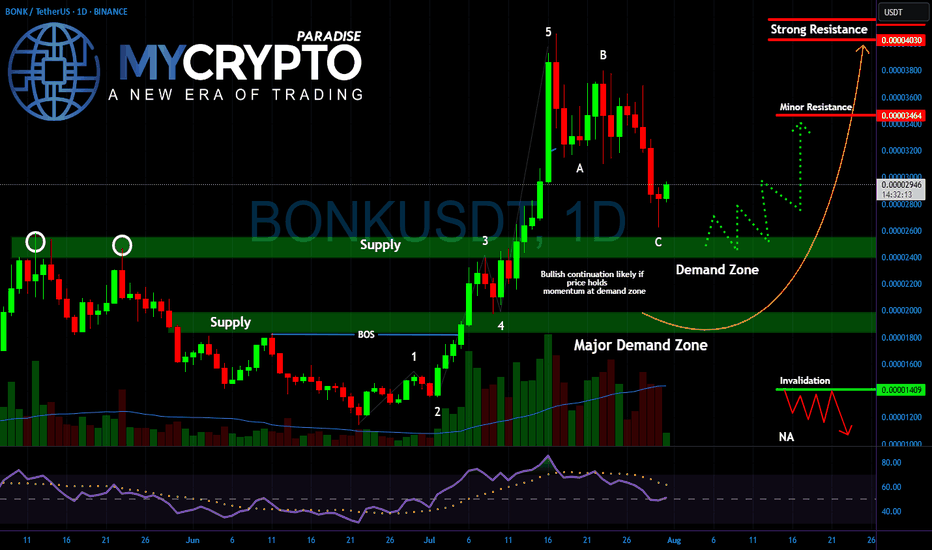

BONK About to Break Out or Break Down?Yello Paradisers! Are you ready for the next explosive move in #BONK? After nailing the last rally and spotting the impulsive 5-wave structure early, we’re now entering a critical phase — and what happens next could decide whether BONK flies or collapses.

💎The recent pullback has followed a clean A-B-C corrective structure, landing perfectly into the key demand zone between 0.00002600 and 0.00002200. This zone now acts as the battlefield between smart money buyers and weak-handed sellers. Price action is slowing down, volume is drying up, and RSI is resetting all classic signs of a potential bullish continuation. But if buyers fail to step in with conviction, the market could easily sweep lower to test the major demand zone closer to 0.00001800.

💎As long as price holds this area and confirms a reversal with follow-through momentum, we could see #BONK heading back toward 0.00003460 as the first stop, and possibly a retest of the 0.00004030 resistance. However, if price closes below 0.00001409, that would invalidate the bullish setup and confirm a deeper corrective phase.

Patience and strategy win the game, Paradisers! The market is designed to shake out weak hands before the real move happens.

MyCryptoParadise

iFeel the success🌴

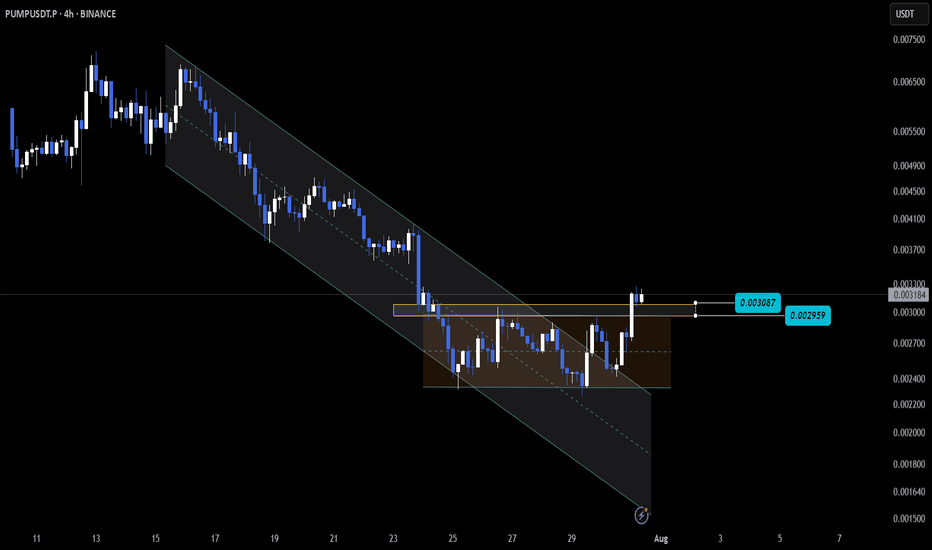

PUMP Clears Channel Resistance and Retests Support🚀 NYSE:PUMP just broke out of a descending channel and has already pulled back for a clean retest — a classic breakout confirmation setup.

✅ The breakout structure held firm

🔄 Price bounced right off the previous resistance zone

🟩 0.0029 is acting as solid support, anchoring the move

Momentum is starting to build again, and a push above current levels could open the door for a stronger leg upward 📈

👀 Watching for follow-through here — will bulls step on the gas or stall at the next zone?

Not financial advice.

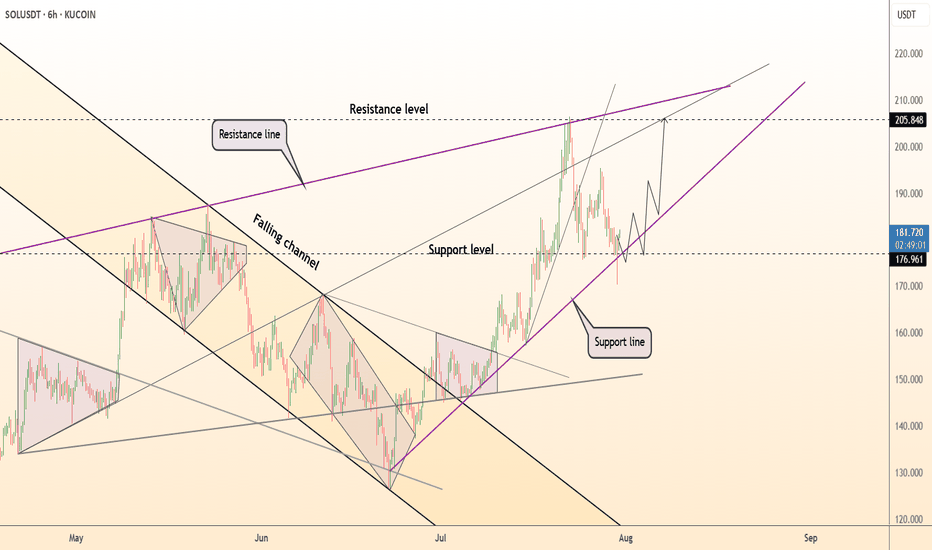

DeGRAM | SOLUSD is holding the $177 level📊 Technical Analysis

● SOLUSD is bouncing from the rising trendline support at 177 after a retracement, maintaining structure within a bullish ascending wedge.

● Price holds above the prior resistance-turned-support near 176.9, with a clear path to retest the 205.8 and 219–222 confluence zone.

💡 Fundamental Analysis

● Solana's 30-day DApp volume ranks top 3 among L1s, signaling increased utility. Institutional SOL inflows also continued for a fifth week, per CoinShares.

● Strong user metrics and positive funding rates suggest bullish momentum remains supported on-chain and through derivatives markets.

✨ Summary

Buy dips above 177. Targets at 205 ▶ 220. Long setup holds while price stays above 175.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

#SUI Update #2 – July 31, 2025#SUI Update #2 – July 31, 2025

SUI has completed the correction of its last impulsive move and has started another upward movement. Although it currently appears to be a weak move, I believe it will provide around a 10% profit. As shown in the chart, I have opened a long position.