3 Key Catalysts Driving the Next ETH Bull Run

A remarkable confluence of powerful market forces is brewing in the Ethereum ecosystem, fueling increasingly bold outlooks for its future valuation. A potent combination of historical price patterns, dramatic supply dynamics, soaring institutional interest, and resilient price action is painting a picture of a digital asset potentially on the verge of a historic expansion. While a target of $20,000 may seem audacious, a granular look at the underlying mechanics reveals a compelling, multi-faceted argument for a significant upward repricing of Ethereum (ETH).

This deep dive will explore the four key pillars supporting this optimistic outlook: a striking historical price pattern that mirrors Bitcoin’s monumental 2021 surge, a critical supply shock evidenced by a mass exodus of ETH from exchanges, record-breaking institutional engagement in the futures market, and a tenacious price strength holding firm at key technical levels.

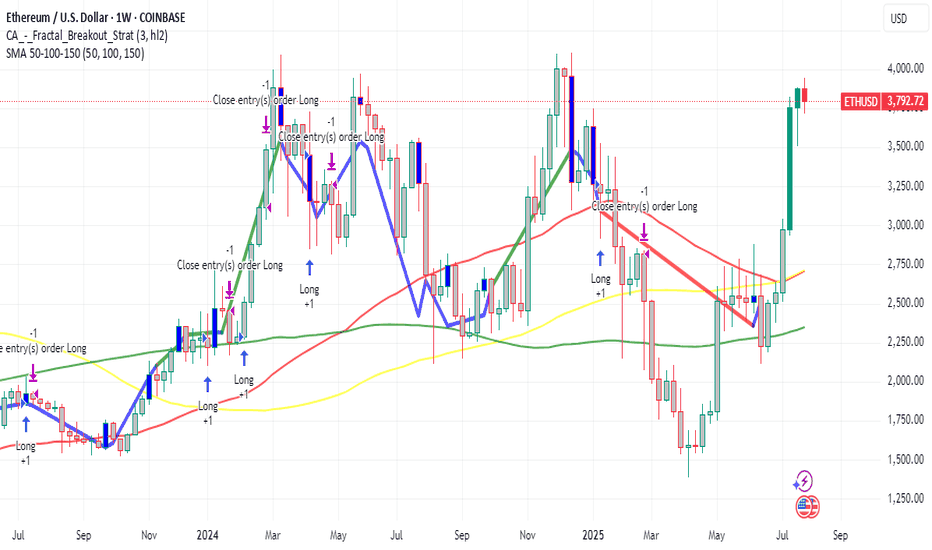

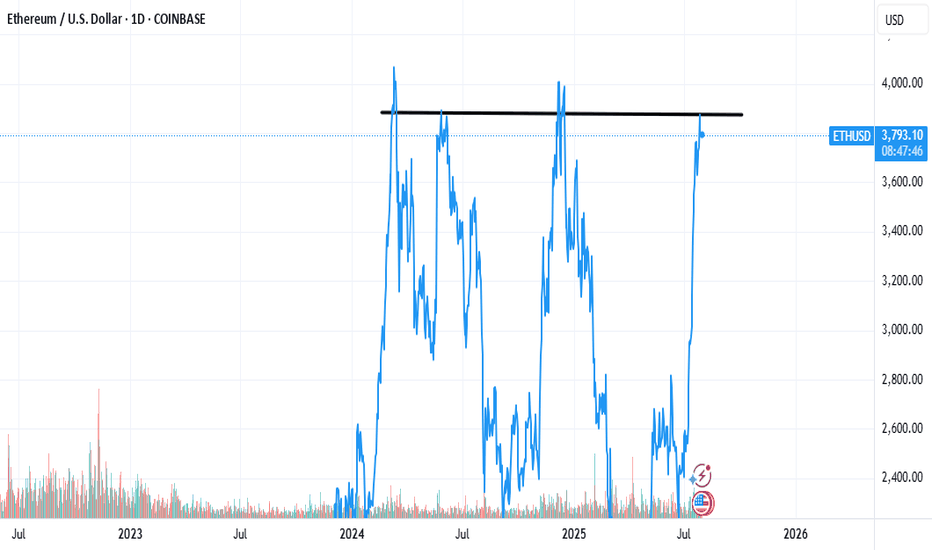

Chapter 1: The Bitcoin Fractal: Is History Rhyming?

In financial markets, history rarely repeats itself exactly, but its patterns often rhyme. Market analysts are increasingly pointing to a "fractal"—a recurring geometric pattern in price action—that suggests Ethereum's current market structure is eerily echoing that of Bitcoin's in late 2020, just before its parabolic surge in 2021.

This analysis highlights that Ethereum's chart is displaying a nearly identical pattern of accumulation, re-accumulation, and price compression that Bitcoin exhibited before its own historic breakout. During that period, Bitcoin experienced a multi-fold increase in value, shattering previous records. The parallel suggests that, much like Bitcoin did, Ethereum has emerged from a prolonged consolidation phase and is now pressing against a long-term downtrend resistance line that has defined its market structure for several years.

Should this fractal play out as it did for Bitcoin, a decisive breakout above this critical resistance could trigger a rapid, exponential move upwards. The potential for such a climb is being fueled by a perfect storm of institutional adoption and favorable market shifts.

A critical catalyst underpinning this parallel is the recent launch and explosive growth of spot Ethereum Exchange-Traded Funds (ETFs). The 2021 Bitcoin bull run was significantly propelled by growing institutional legitimacy and new, regulated investment vehicles. Similarly, Ethereum ETFs are now providing a secure and accessible gateway for a fresh wave of institutional capital. These funds have already seen staggering net inflows, with major asset management firms accumulating billions in assets, signaling deep conviction from the titans of traditional finance. This institutional stamp of approval is a powerful parallel to the forces that drove Bitcoin's last major cycle, providing the foundational capital flows needed for a sustained rally.

Chapter 2: The Great Supply Squeeze: A Mass ETH Exodus from Exchanges

One of the most compelling bullish arguments for Ethereum is rooted in fundamental on-chain economics: a dramatic and accelerating supply squeeze. The "Exchange Reserve," a metric that tracks the total amount of ETH held in the wallets of centralized exchanges, has plummeted at an astonishing rate.

In a recent one-month period alone, well over one million ETH were withdrawn from these platforms. This mass exodus of coins is a profoundly bullish indicator. When investors move their assets off exchanges, it typically signals an intention to hold for the long term in self-custodial wallets, rather than keeping them liquid and ready for a quick sale. This behavior drastically reduces the immediately available supply on the open market. Consequently, even a steady level of demand can exert significant upward pressure on the price.

This trend has pushed the total supply of Ethereum on exchanges down to its lowest level in nearly a decade. The drivers behind these massive withdrawals are multifaceted and all point toward a tightening market:

• Long-Term Conviction and Staking: A growing number of investors are locking up their ETH in staking contracts to help secure the network and earn passive yield. Others are simply moving their holdings to secure "cold storage" with a long-term investment horizon, effectively taking them off the market for the foreseeable future.

• DeFi Integration: A significant and growing portion of ETH is used as the primary form of collateral within the sprawling Decentralized Finance (DeFi) ecosystem, where it is locked into smart contracts for lending, borrowing, and other financial applications.

• ETF Accumulation: The newly launched spot ETFs are required to purchase and hold real ETH to back their shares. This direct accumulation removes vast quantities of ETH from the circulating supply that would otherwise be available to retail and institutional buyers.

This fundamental imbalance between a shrinking available supply and growing demand is creating the perfect conditions for a potential "supply shock." The sustained decline in exchange reserves, even as prices have rallied, reinforces the idea that current holders are not rushing to take profits. This indicates a strong belief in future price appreciation and adds a powerful layer of underlying support to Ethereum's macro bullish structure.

Chapter 3: The Wall of Institutional Money: Futures and Open Interest Soar

The derivatives market, often seen as the playground for more sophisticated and institutional investors, is flashing its own set of glaringly bullish signals. Open Interest (OI) in Ethereum futures—representing the total value of all outstanding futures contracts that have not been settled—has surged to unprecedented levels.

On major regulated exchanges favored by institutional investors, Ethereum futures Open Interest has recently shattered all-time highs. This represents a massive and undeniable increase in institutional participation, as asset managers, hedge funds, and other large-scale players use these regulated products to gain exposure to ETH's potential upside and to manage their risk. This is not an isolated phenomenon; across the global landscape of exchanges, the total Open Interest for Ethereum futures has climbed to record-breaking heights.

Rising Open Interest that occurs in tandem with a rising price is a classic technical confirmation of a strong and healthy trend. It demonstrates that new money is actively flowing into the market, with participants expressing confidence in future price appreciation. This influx of capital adds significant fuel to the ongoing rally. The surge in derivatives activity highlights a maturation of the market, where both institutional and retail investors are increasingly using sophisticated financial instruments to speculate on Ethereum's price trajectory.

While the high levels of leverage inherent in futures trading can introduce volatility and the risk of cascading liquidations, the primary signal is one of immense and growing institutional conviction in Ethereum's medium-to-long-term outlook. The influx of capital into both spot ETFs and the futures market creates a powerful, self-reinforcing feedback loop, enhancing liquidity, legitimizing the asset class, and attracting even more conservative capital off the sidelines.

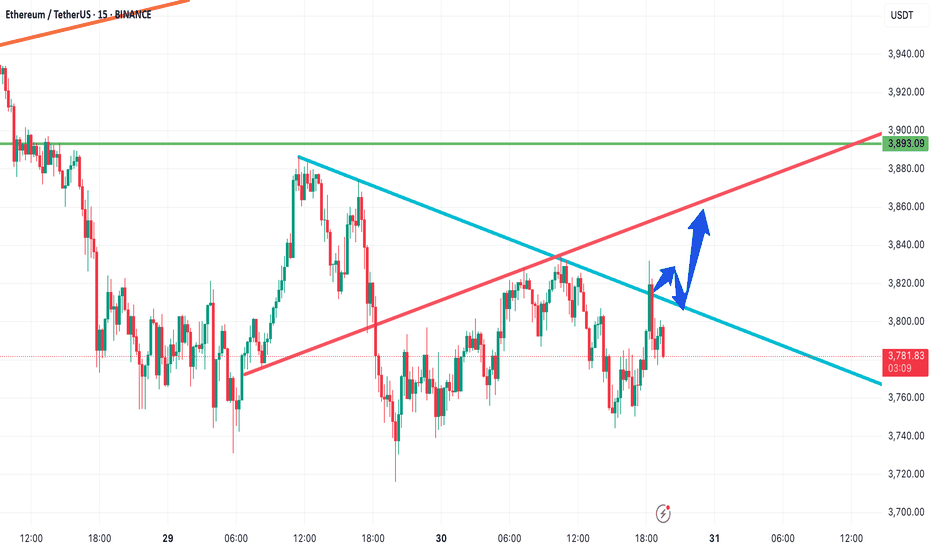

Chapter 4: The Immediate Battleground: Price Action Shows Resilient Strength

Zooming in from the macro-outlook to the short-term technical picture, Ethereum's price action has demonstrated notable resilience, reinforcing the broader bullish thesis. After a strong rally, the price has been consolidating its gains, establishing critical support zones that traders and algorithms are watching with keen interest.

Recent price action shows Ethereum starting a fresh increase above the $3,820 and $3,880 levels. The price is trading near the crucial $3,800 mark and the 100-hourly Simple Moving Average, an indicator that often acts as a dynamic line of support during uptrends. Although there was a brief break below a key bullish trend line that had formed with support at $3,800 on the hourly chart, the ability of the price to remain supported above the broader $3,720 zone is considered vital for a bullish continuation. Should the pair remain supported above this zone in the near term, it could start a fresh increase.

The price has recently faced resistance near the $3,900 and $3,920 levels. The psychological $4,000 barrier remains the next major target. A decisive and sustained break above the $4,000 mark could open the door for a rapid advance, as it would clear the last major resistance area before a potential retest of previous all-time highs.

Technical indicators on higher timeframes remain robust. The price is in a clear long-term uptrend, trading well above its key daily moving averages. While short-term indicators may show temporary overbought conditions or moments of waning momentum, the overall market structure remains decisively bullish as long as critical support levels continue to hold.

Conclusion: A Compelling Case for a New Era of Price Discovery

The prospect of Ethereum reaching a valuation of $20,000 is a monumental forecast, but it is one built on a solid and multi-faceted foundation. The convergence of a compelling historical fractal mirroring Bitcoin's most famous bull run, a verifiable and intensifying supply shock, unprecedented institutional adoption via both spot ETFs and futures markets, and a resilient technical posture creates a powerful case for a sustained bullish continuation.

Each pillar of this argument reinforces the others. Institutional inflows from ETFs directly contribute to the supply squeeze on exchanges. The resulting upward price pressure attracts more speculative interest in the futures market, and the resilient technical picture provides the stable base from which a larger market move can be launched. While no outcome in financial markets is ever guaranteed, and the risks of volatility and sharp corrections remain ever-present, the confluence of these potent factors suggests that Ethereum may not just be knocking on the door of its old all-time high, but preparing to smash through it and enter a new and explosive era of price discovery.

Crypto market

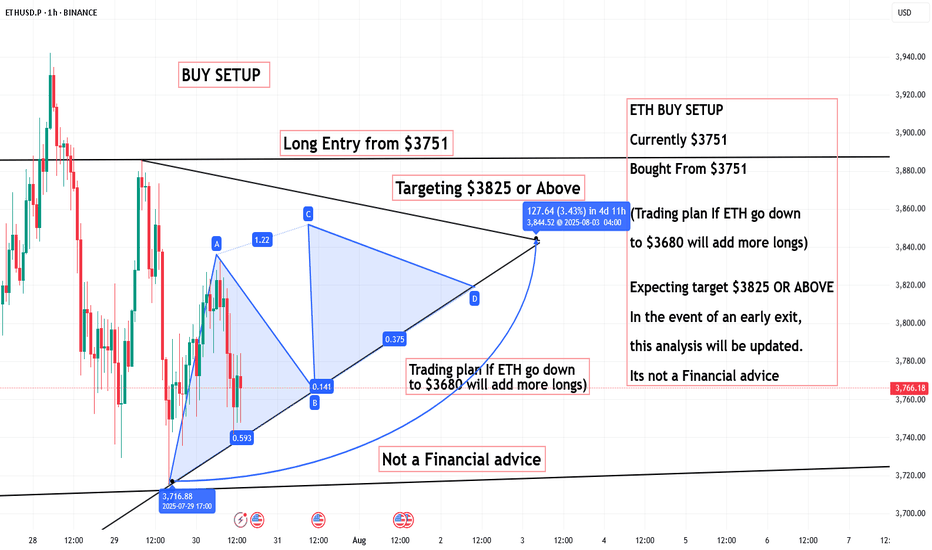

Ethereum Analysis – July 30, 2025📊 Ethereum Analysis – July 30, 2025

Ethereum is currently testing a key descending trendline (blue line).

If the price breaks above this resistance and confirms with strong candlestick closures, there's a high probability that ETH will rally toward the ascending red trendline, acting as the next dynamic resistance.

🚀 A confirmed breakout could trigger a bullish continuation, opening the door for higher targets in the short term.

However, failure to hold above this level may result in a pullback or range-bound movement.

📌 Keep both the blue and red trendlines on your chart — they’re currently the most critical zones to watch for potential entries or exits.

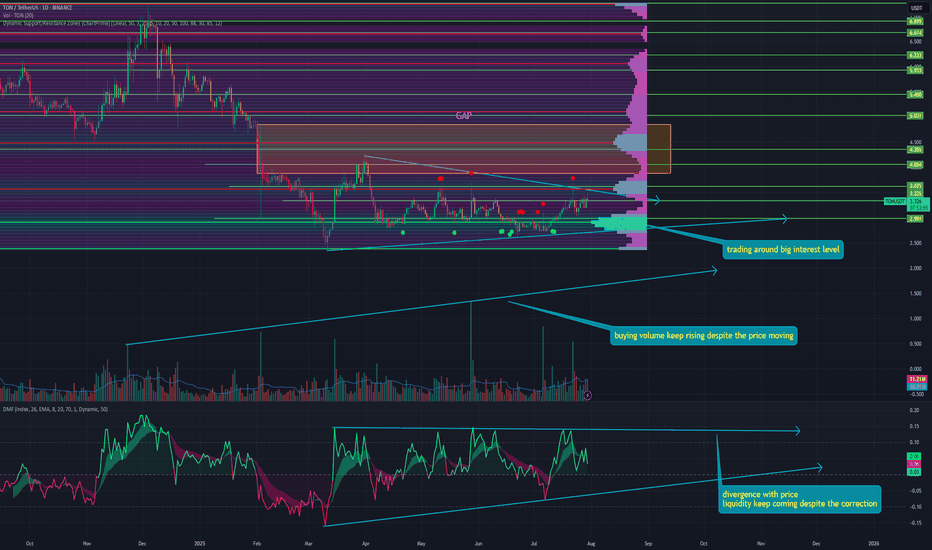

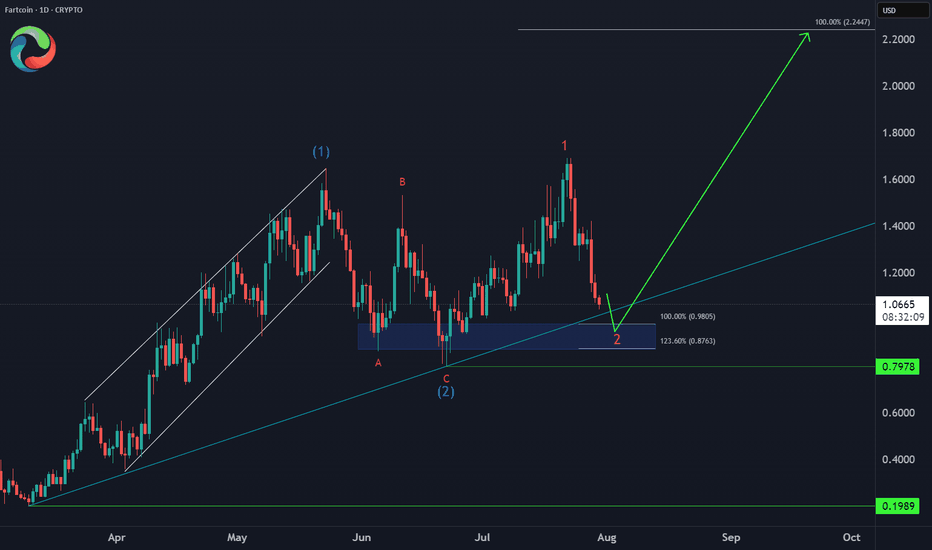

TON is coming back to lifeAfter its past hype on tap-to-earn games and Durov's arrest, many buried the project.

However, it has recently begun to show signs of life and actively develop its ecosystem. Looking at the chart in more detail, I noticed many interesting patterns:

➡️ First, regardless of whether the price of TON is moving up or down, purchase volumes have been growing for a year now. This indicates extremely high confidence in the token and the ecosystem.

➡️ Second, Money Flow also shows inflows of fresh liquidity starting in March 2025. This means that new holders have been entering the token for almost half a year.

There is also a partial divergence with the price, as a flag pattern has formed on the chart since then. At the same time, liquidity has remained virtually unchanged during this period, forming a flat pattern.

➡️ Thirdly, TON is currently trading around the largest support zone at $2.911. With each correction, it reaches this level again, triggering a huge number of limit orders to buy.

➡️ Fourth, during the correction, a GAP was formed at the top at $4.855 - $3.883. And as we know, 99% of GAPs close sooner or later.

📌 Conclusion:

Right now, the token is super undervalued, according to the market and me too. Plus, it's really far from its ATH and is still trading close to its all-time low.

All this makes it a promising asset to buy even right now, in the middle of alt season 🔥

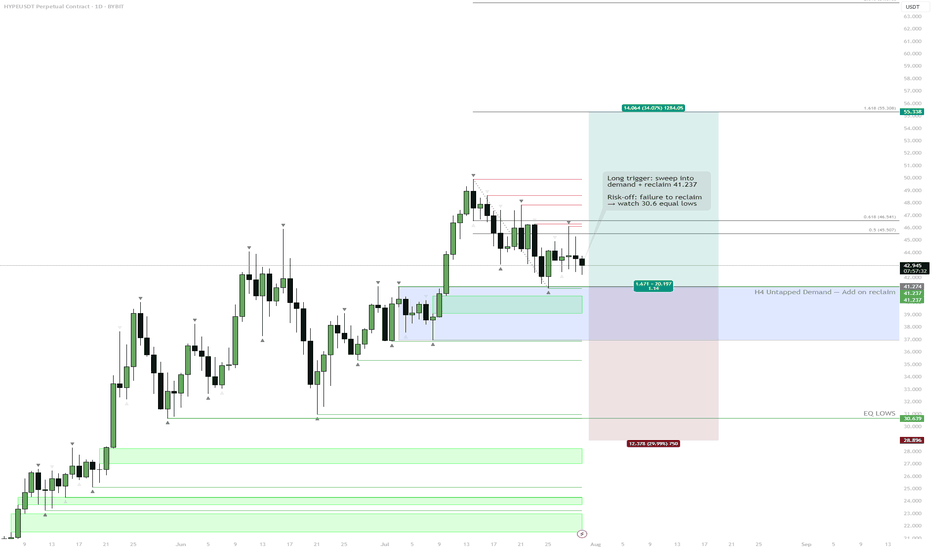

HYPE | Sweep & Reclaim SetupPlan:

Watching for a sweep into the blue H4 Untapped Demand zone, then a reclaim of 41.237 (green line) to add longs.

Ideal target: new ATH and 55 extension.

If the blue zone fails or we can't reclaim 41.237, risk-off mode: equal lows at 30.6 could be the draw.

Reasoning:

A sweep into demand would reset local liquidity and trap late shorts.

Reclaiming 41.237 confirms a shift in momentum and invalidates the breakdown.

Structure is bullish above 41.237; below, risk increases for deeper downside.

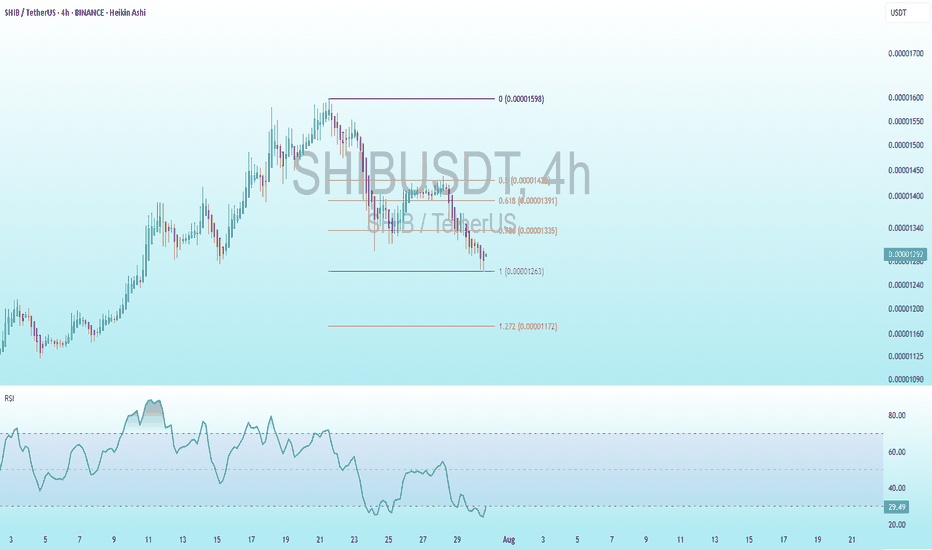

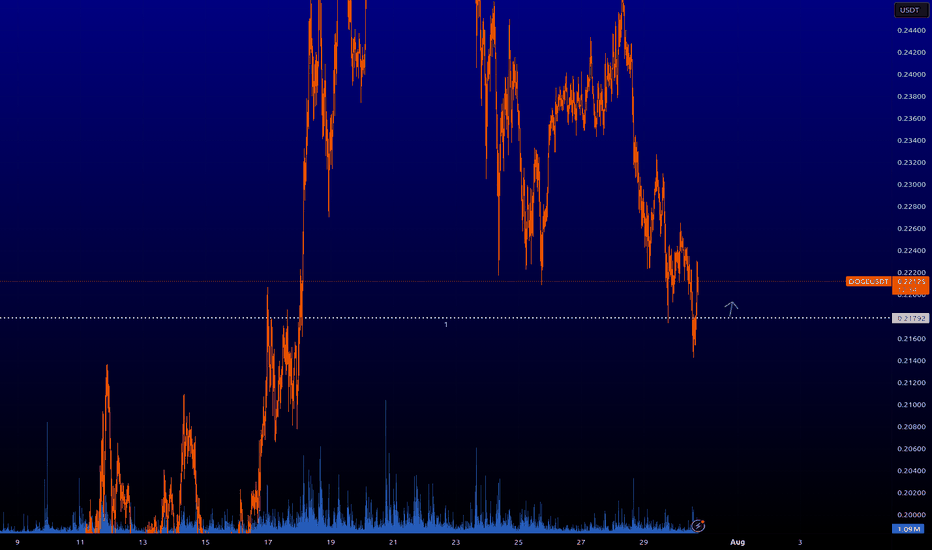

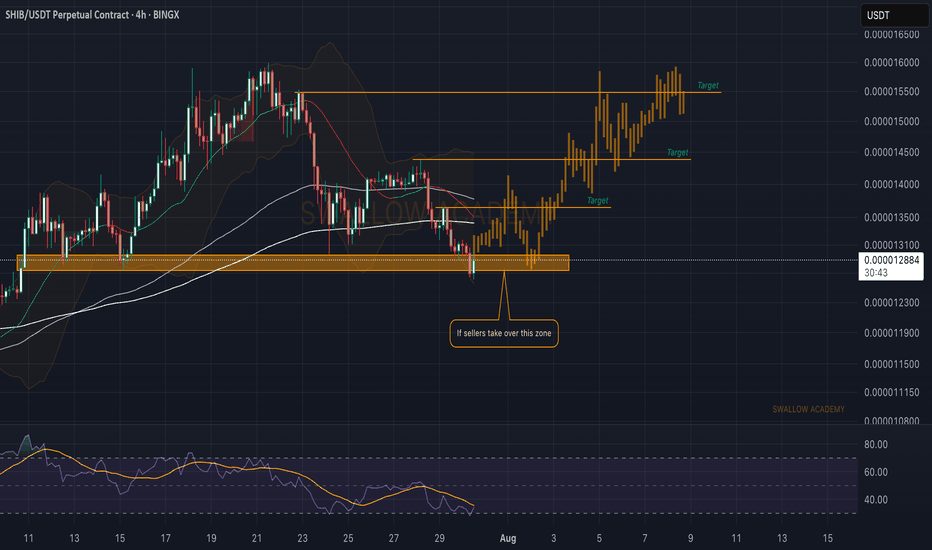

SHIB Bullish DivergenceBINANCE:SHIBUSDT

Trade Setup:

Target 1: 0.00001335 (0.786 Fibonnaci Golden Zone).

Target 2: 0.00001391 (0.618 Fibonnaci Golden Zone).

Target 3: 0.00001430 (0.5 Fibonnaci Golden Zone).

Target 4: 0.00001597 (0 Fibonnaci).

Stop Loss: 0.00001172 (1.272 Fibonnaci).

RSI Analysis: The RSI is showing a bullish divergence, suggesting potential bullish momentum. The current RSI is around 24.02, approaching oversold territory, so caution is advised.

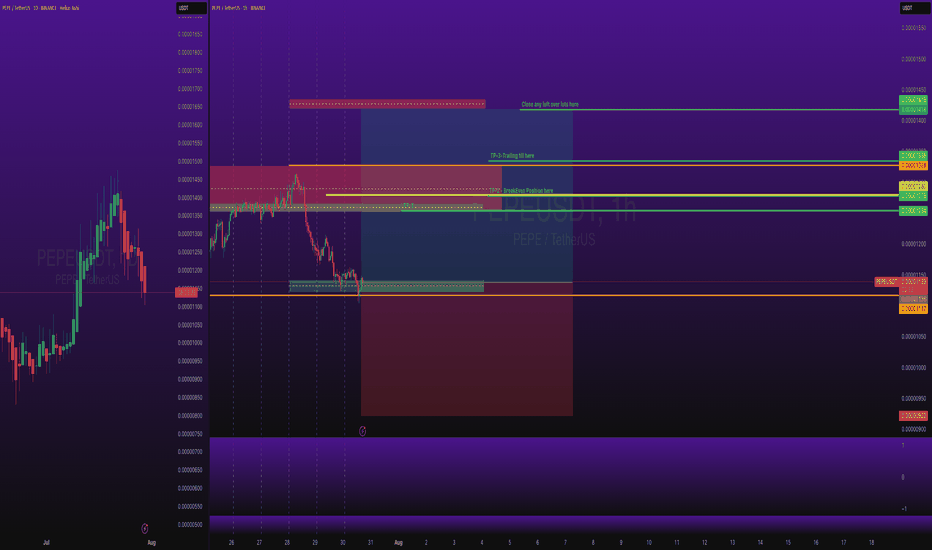

Crypto Trade: PEPEUSDT Long Swing Trade BINANCE:PEPEUSDT Long Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

this is good trade, lets see, don't be greedy, risk what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

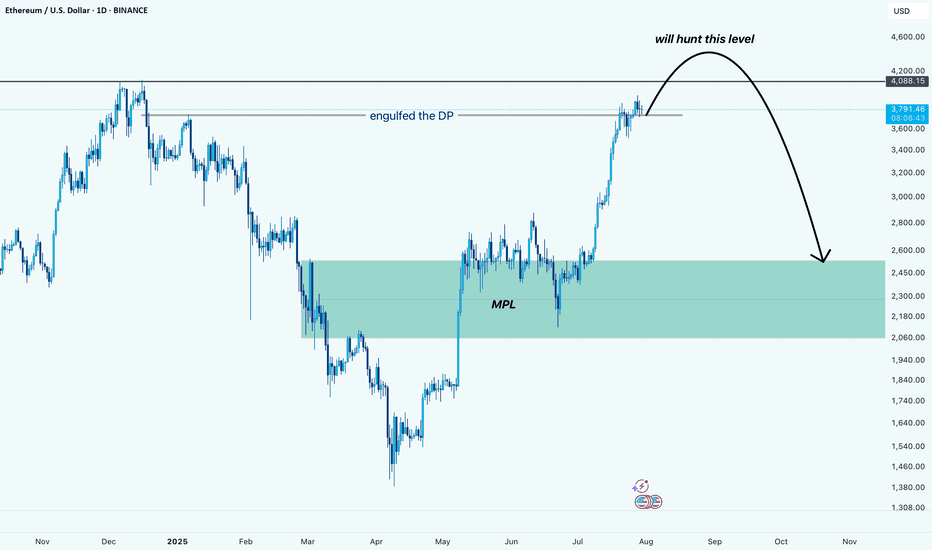

ETH (just a perspective): Potential Liquidity Grab Before DeeperPrice has engulfed the DP and is now pushing higher. Based on the current structure, it looks like ETH wants to hunt the liquidity resting above the $4,080 level.

After grabbing that liquidity, we might see a sharp reversal back down toward the MPL, which sits in the $2,100–$2,500 zone. This area is a strong demand zone and also where the most pain would be felt for late buyers, making it a key level to watch.

⚠️ This is not a prediction, just a perspective based on price behavior and structure.

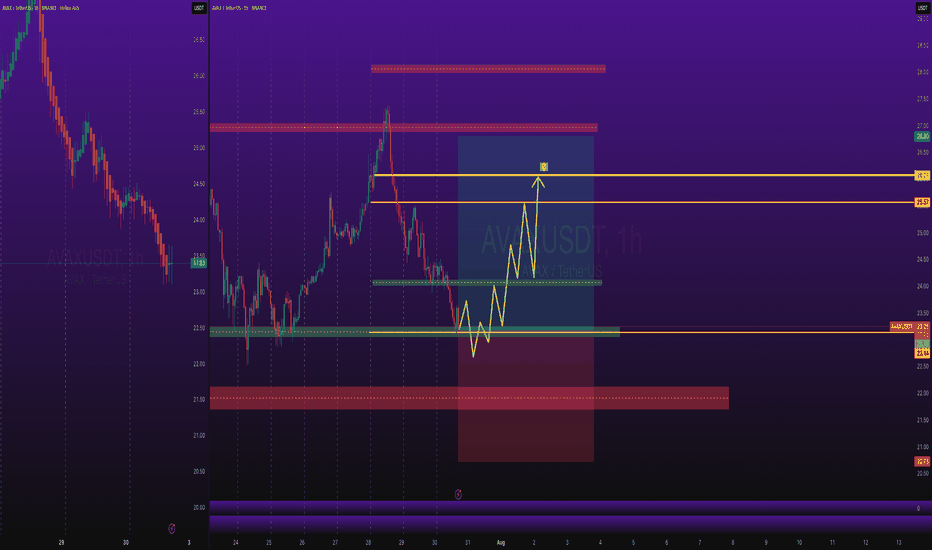

CryptoTrade: AVAXUSD Long Trade with SL and TPCOINBASE:AVAXUSDT Long Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

this is good trade, lets see, don't be greedy, risk what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

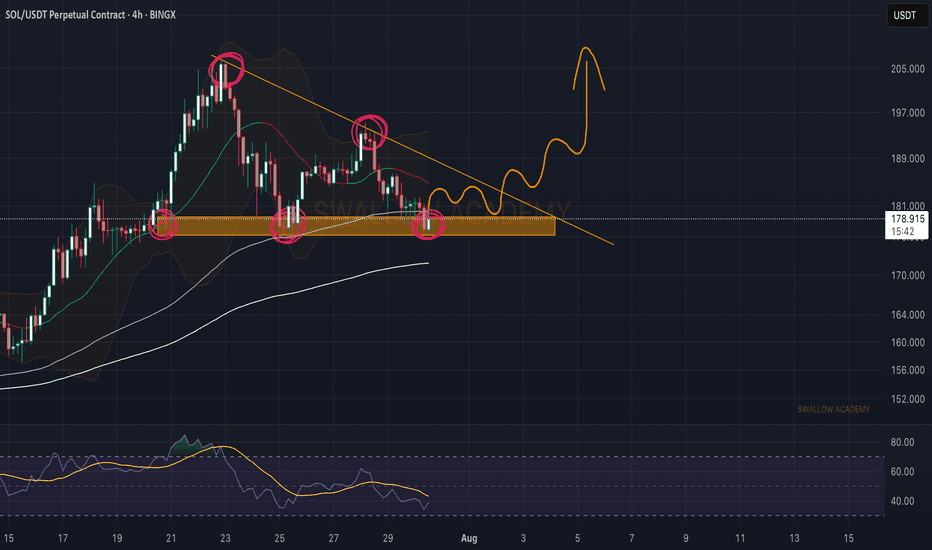

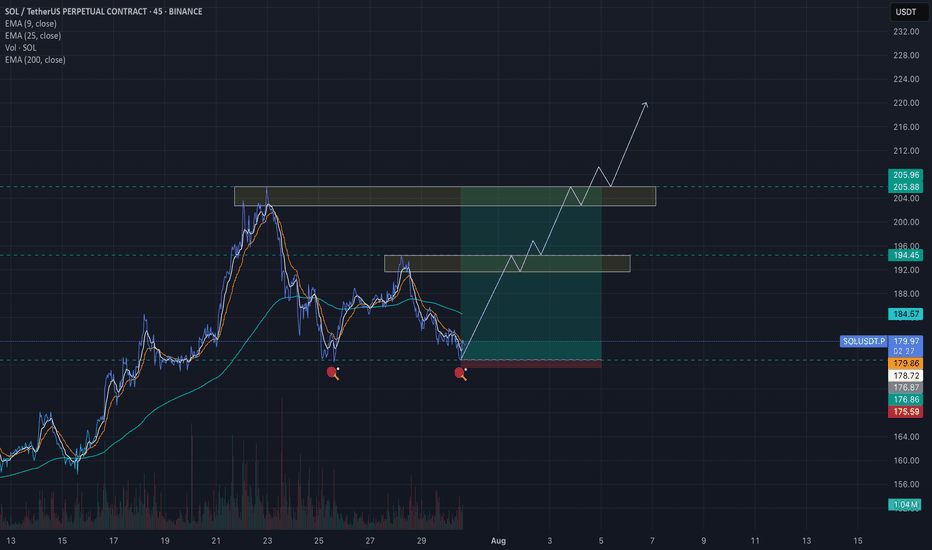

Solana (SOL): Triangle Pattern | Waiting For Bullish BreakoutSolana failed to break down from the local neckline zone (or support zone, for those who want to call it that). What we got instead is buyside dominance, where buyers took back the area and are now pushing the price back toward the upper side of that triangle pattern, so that's where our current target is sitting, as long as we break that line.

Swallow Academy

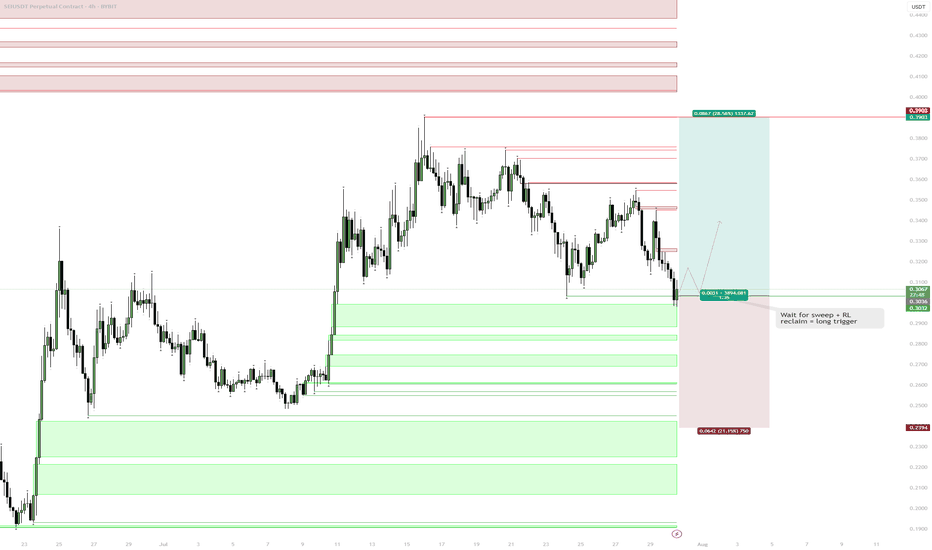

SEI | Setup: Sweep & Reclaim Scenario:Wait for a sweep of the range low (RL) into the Daily FVG (gray box).

Look for a reclaim of RL as the trigger for a long.

Reasoning:

Sweep into FVG traps late sellers and sets up liquidity for a reversal.

Reclaiming RL after the sweep signals strength and confirms a local bottom.

No need to chase entries—best R:R is after liquidity is cleared and level is retaken.

Shiba Inu (SHIB): Might Bounce From Here | Looking For PumpShiba is showing some signs of recovery, where we are seeing the buyers taking back the control near the local support zone, which would then lead to a 10% movement to upper zones (if not more).

So we look for more clarity and dominance from buyers here and once we see it, we are going to go long.

Swallow Academy

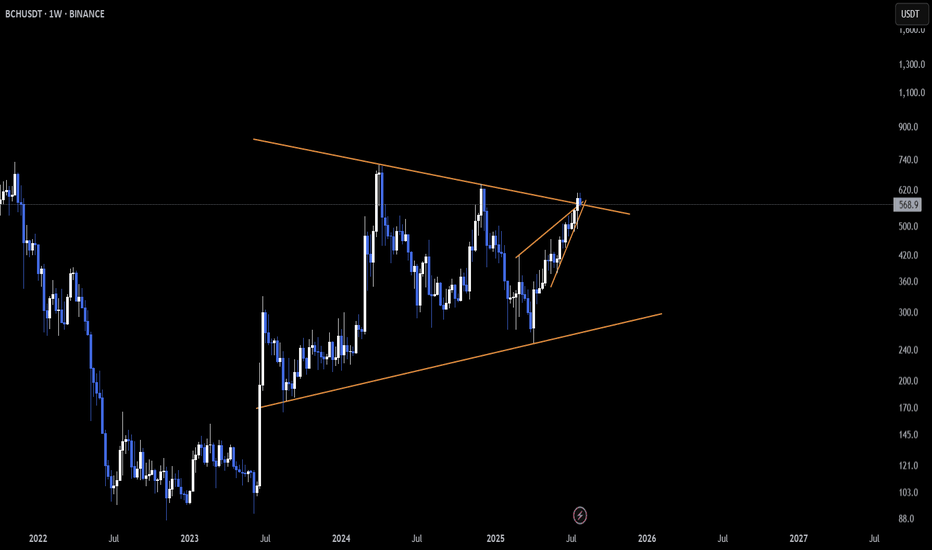

BCH Lights Up Across Multiple Timeframes A Breakout Sequence 🚨 SET:BCH is unleashing strength across all major timeframes—and it’s not subtle.

📆 Daily: Defying the norm by breaking up from a rising wedge 📈

🗓️ 3-Day: Clean breakout above a descending trendline—momentum building 🔓

📅 Weekly: Exploding out of a long-standing pennant formation 🚩

This isn’t just another pump—it’s a multi-timeframe alignment, one of the strongest confirmation signals for technical traders. Price is currently in retest mode, and if support holds, the rally could accelerate fast ⚡

🧠 Grok Insights: Breakouts confirmed on 3+ timeframes see 2.6x higher continuation probability within the next 5–10 candles. BCH’s structure hits that mark.

👀 High-alert zone — this setup is rare, clean, and potentially explosive.

Do you see continuation from here, or is this a bull trap in disguise? Let’s talk.

Not financial advice.

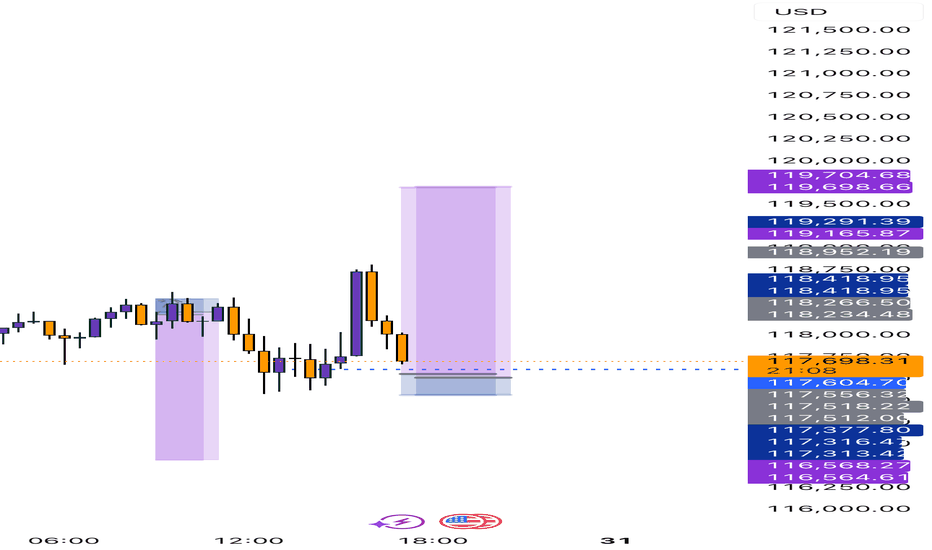

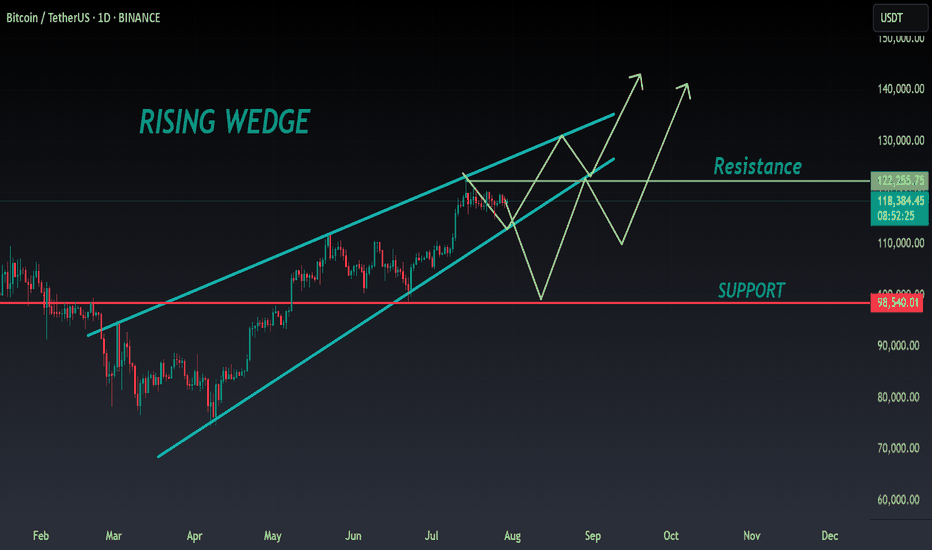

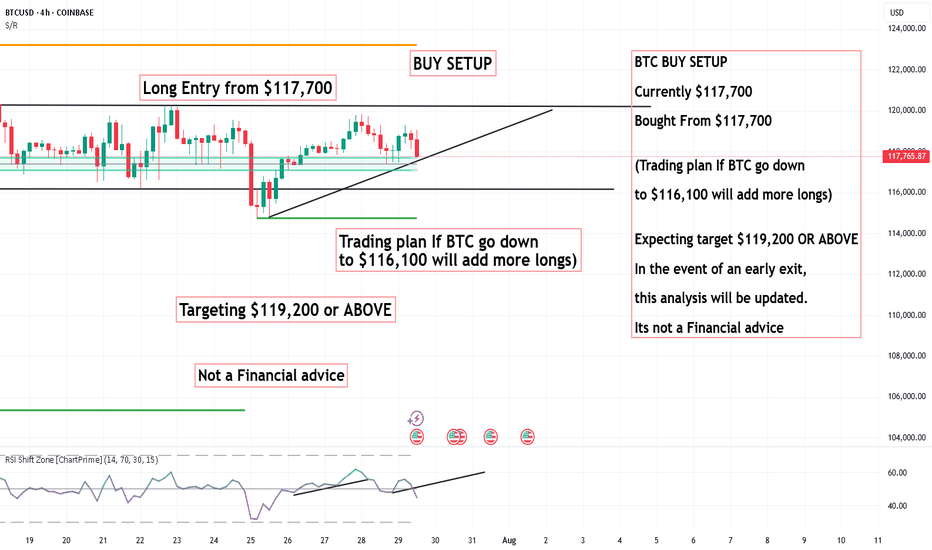

BTC ANALYSIS🔮 #BTC Analysis 💰💰

🌟🚀As we said #BTC performed same. Now, In daily chart we can see a formation "Rising Wedge Pattern in #BTC. There is a strong resistance zone and we could see a rejection from that level but if the price breaks the resistance zone then we would see a bullish move 💲💲

🔖 Current Price: $1,18,590

⁉️ What to do?

- We have marked some crucial levels in the chart. We can trade according to the chart and make some profits in #BTC. 🚀💸

#BTC #Cryptocurrency #DYOR #PotentialBreakout

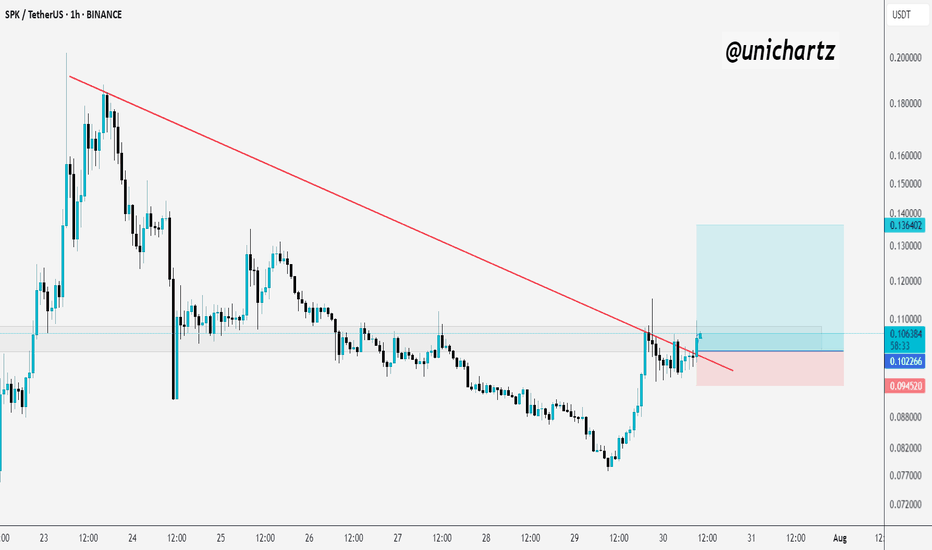

SPK Breaks Trendline – Long Setup with R:R 5.7INDEX:SPK Breaking the Downtrend – Long Setup in Play

SPK has finally broken out of its falling trendline after days of compression. Price is now testing the breakout zone with a small consolidation — a classic sign of strength building.

If momentum continues, we could see a solid upside push.

✅Trade Setup (Long):

Entry: 0.1009

Stop Loss: 0.0945

Target (TP1): 0.1364

DYOR, NFA

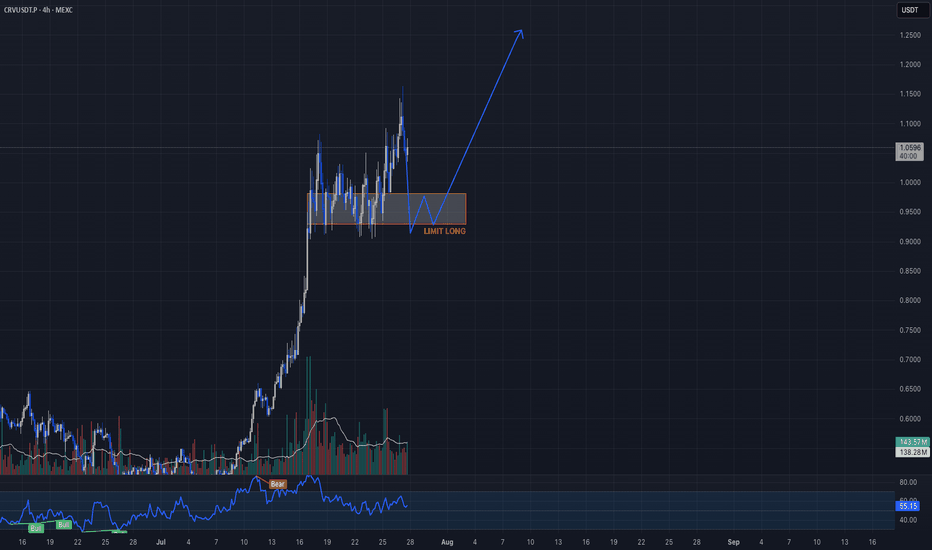

Momentum-backed long setting up on CRVUSDT.PCandle Craft fam — here’s a momentum-backed long setting up on CRVUSDT.P (12H) following a high-conviction trend shift.

Price exploded out of a multi-month base and is now consolidating in a bullish structure. We’re seeing stacked OBs between 0.93–0.98 and volume cooling off after the pump — a classic reaccumulation zone.

Here’s how we’re looking to play it smart:

⸻

🟢 LONG ENTRY PLAN:

Retest Entry (Preferred)

• Entry: 0.9815 – 0.930

• SL: 0.880

• 🎯 Targets:

▫️ TP1: 1.10

▫️ TP2: 1.22

▫️ TP3: 1.35+

Breakout Entry (Aggressive)

• Entry Trigger: Above 1.085

• SL: 0.995

• 🎯 Same targets ☝️

⸻

📊 Why This Setup Matters:

• Broke key structure on volume → now pulling back orderly

• OB stack between 0.93–0.98 = bullish base

• 12H showing HLs, no sign of reversal

• BTC stable = alt rally fuel

⸻

🧩 Candle Craft Note:

We favor precision over hype. This is a textbook continuation play with great RR and structure. Patience pays — don’t chase, let it come to you.

Let’s execute with discipline.

— Candle Craft | Signal. Structure. Execution.