Crypto market

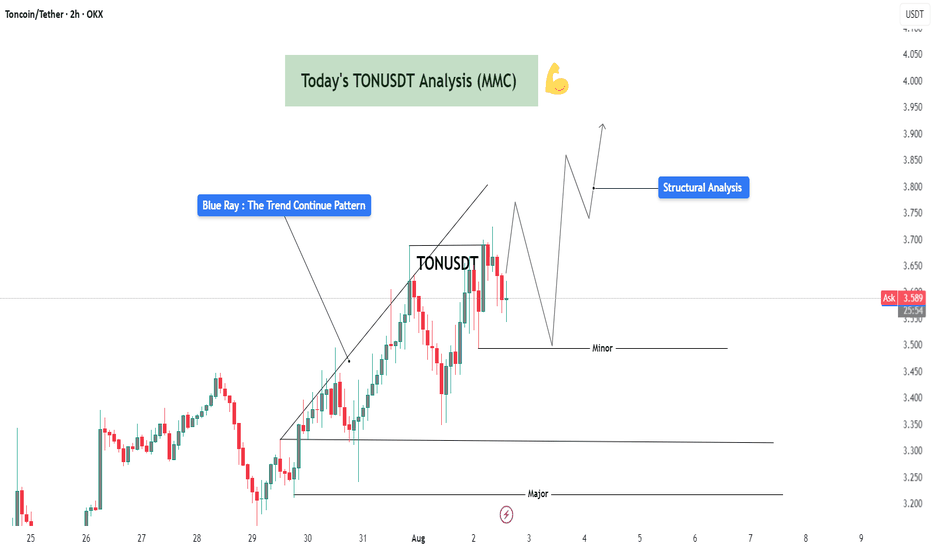

TONUSDT Bullish Structure Continuation – Minor Pullback Leg Up🧾 1. Overview of the Chart Setup:

The current TONUSDT (Toncoin/USDT) 2-hour chart exhibits a strong bullish market structure, characterized by a clear sequence of higher highs and higher lows. This confirms bullish momentum and suggests that the market is in a well-established uptrend.

The key highlight here is the "Blue Ray – Trend Continuation Pattern", which signals sustained bullish pressure following a clean breakout. This breakout was preceded by a consolidation phase, indicating accumulation by smart money before the expansion move.

🔍 2. Technical Structure and Pattern Breakdown:

🔵 Blue Ray – Trend Continuation Pattern:

This diagonal support trendline captured the initial breakout after the market bottomed near July 29–30.

Price respected this ascending line multiple times before accelerating, confirming bullish control.

Once the price broke above the previous swing high, it completed the pattern and triggered a momentum-driven rally.

🔲 Structural Zones – Major and Minor:

Minor Support Zone (~3.50 USDT):

Currently acting as short-term demand.

Price is showing early signs of rejection here, suggesting bulls may reload for a second impulsive move.

If this zone holds, we expect a new higher high to form, potentially targeting 3.80–4.00+ USDT.

Major Support Zone (~3.20–3.25 USDT):

Acts as long-term bullish defense.

In case of deeper retracement or shakeout, this is the key level to watch for possible trend continuation and re-entry.

📈 3. Structural Analysis and Price Projection:

The projected path on the chart shows a classic price action structure:

Impulse

Correction (toward minor support)

Next Impulse (break of recent high)

Higher low (continuation within trend channel)

Potential final push toward the 3.90–4.00 range

This type of Elliott Wave-inspired behavior suggests we're in wave 3 or 5 of a bullish sequence, with minor dips offering low-risk long setups.

📊 4. Candlestick & Market Behavior:

Recent candles show long lower wicks, suggesting buyers are stepping in during dips.

Bearish candles are relatively smaller and followed by immediate bullish response.

This indicates buy-the-dip sentiment, common in a trending market.

🔄 5. Trading Plan & Scenarios:

✅ Bullish Continuation (Base Case):

Wait for a clear bullish engulfing or price bounce at the minor support zone (~3.50 USDT).

Enter with confirmation: bullish candle close, volume spike, or trendline reaction.

Targets:

TP1: 3.80 USDT

TP2: 4.00–4.10 USDT

Stop Loss: Below 3.45 (or structure-based trailing stop)

⚠️ Bearish Case / Deeper Pullback:

If 3.50 fails, look for signs of accumulation around the major support (~3.20–3.25).

This zone can serve as the ultimate defense for trend continuation and provide a second long opportunity with better R:R.

🧠 6. Mindset for Traders:

Don’t chase: Let price come to your level, and focus on confirmation.

Trade with the trend: Structure supports bullish movement — trade in the direction of strength.

Use proper risk management: Define SL and TP before entering. Partial profits at key resistance zones are a smart strategy.

Avoid overtrading : Wait for structural retests or confirmation candles to stay on the right side of the market.

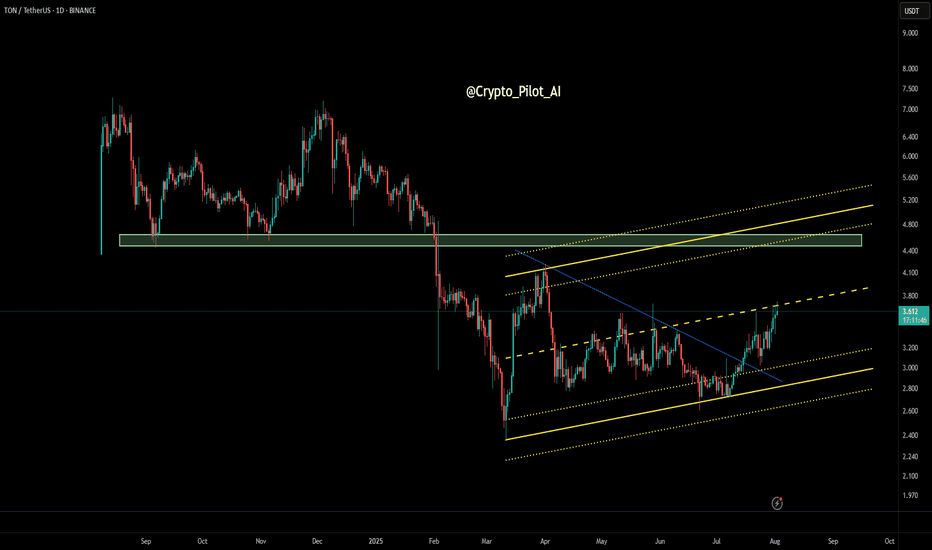

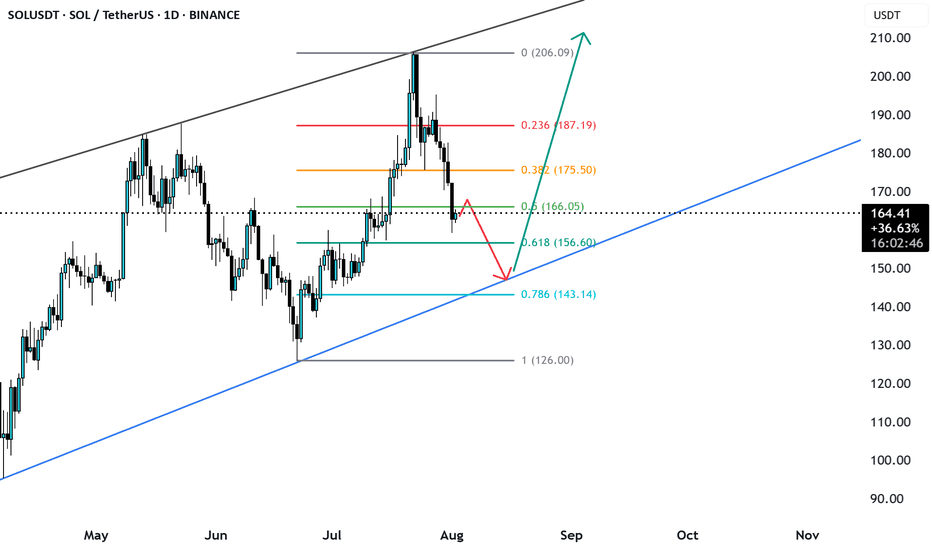

TON/USDT – Daily Price Action Analysis🔹 Price has broken a major descending trendline and entered an ascending channel.

🔹 Currently testing the mid-range resistance zone around $3.60 – $3.70.

🔹 If buyers hold above this area, the next targets could be $4.40 – $4.80.

🔹 If rejected, key supports are at $3.20 and $2.90.

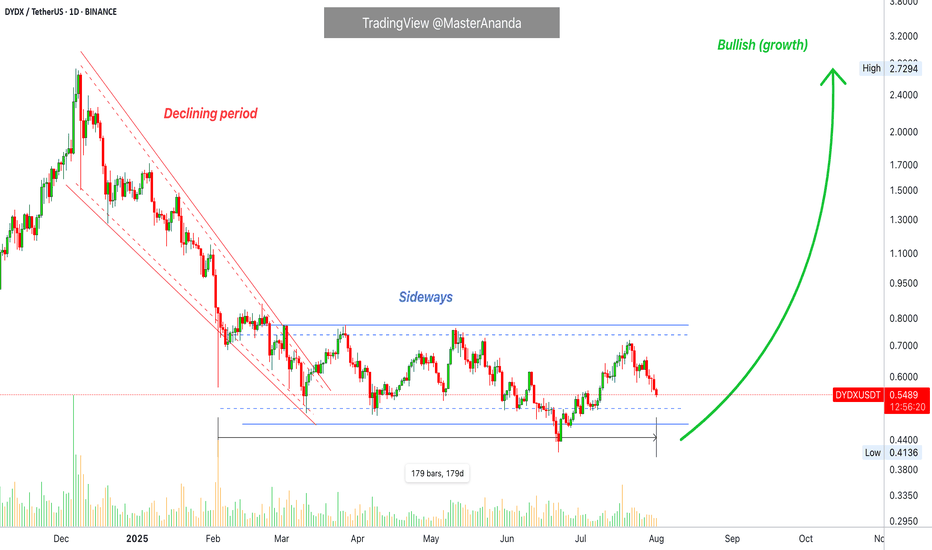

dYdX Bottom Consolidation Continues, Bullish NextHere you are looking at the formation of a bottom. The formation is a process not a single day event. It can take months for a bottom to fully form.

The way you know this to be true is because there is no downtrend. There are no new lows.

DYDX has been sideways now for 179 days, 6 months. Since early February 2025. In just three months, between December 2024 and March 2025, there is a very strong decline; lower highs and lower lows. A bearish move, a down-wave, a downtrend.

Ever since February the downtrend is no more. Rather than new major lows we have shy lower lows and finally not even that, no new lows. You can see the pattern how the market turned from bearish to sideways. This is the transition period. From sideways it will turn bullish, bullish goes next.

This is the point in time when most people will lose patiently and fold at a loss. Sell at the bottom, near support. This is the most important time to be patient, to accumulate, to even buy more and hold because we are looking at bottom prices. When prices are trading at the bottom and you are a bull, you can't go wrong.

Buy and hold. Continue holding because the market will soon turn.

Namaste.

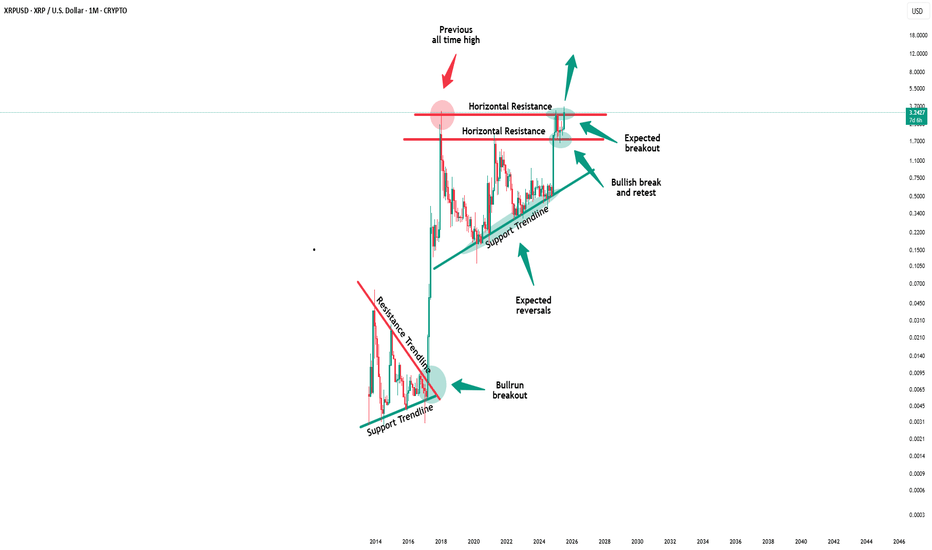

Xrp - This is the bullrun breakout!🔑Xrp ( CRYPTO:XRPUSD ) breaks the triangle now:

🔎Analysis summary:

After the recent bullish break and retest, Xrp managed to already rally another +100%. This is a clear indication that bulls are still totally in control of cryptos and especially Xrp. It all just comes down to the all time breakout, which will then lead to a final parabolic rally.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

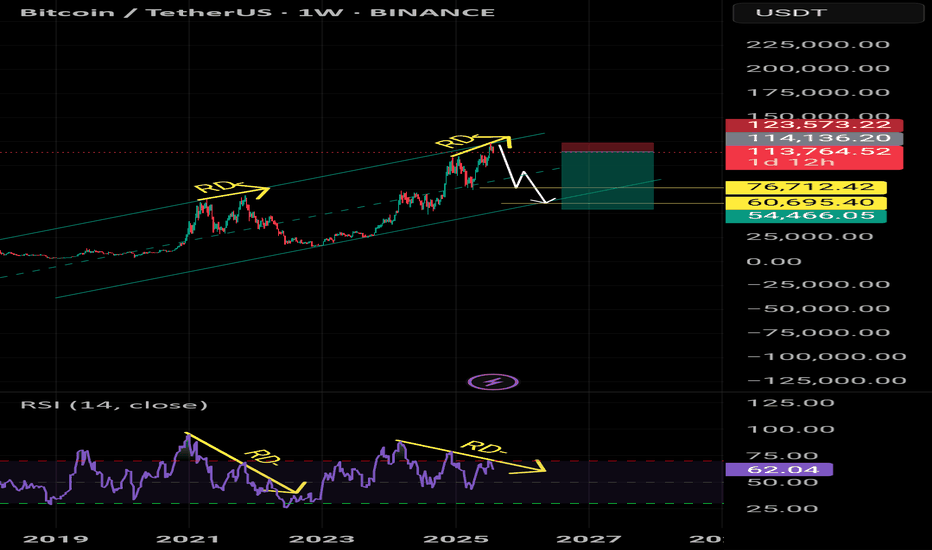

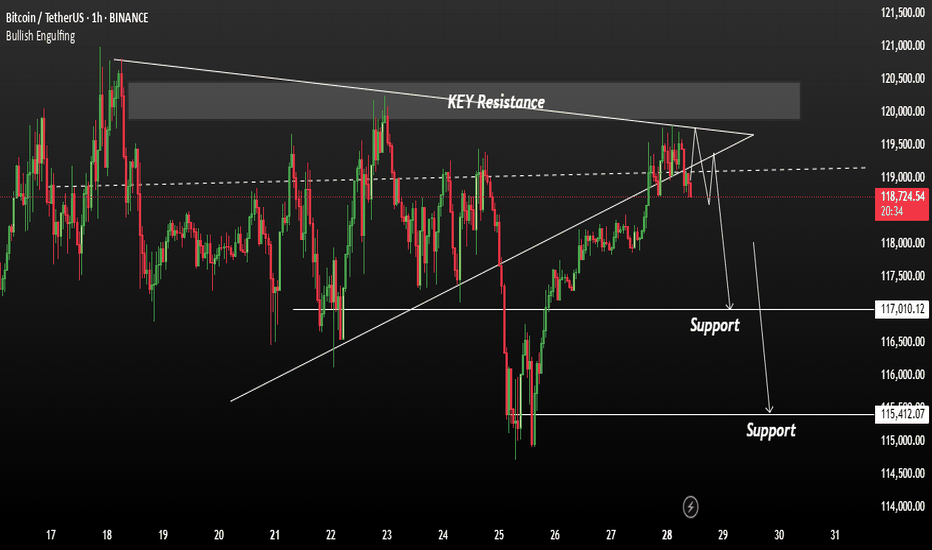

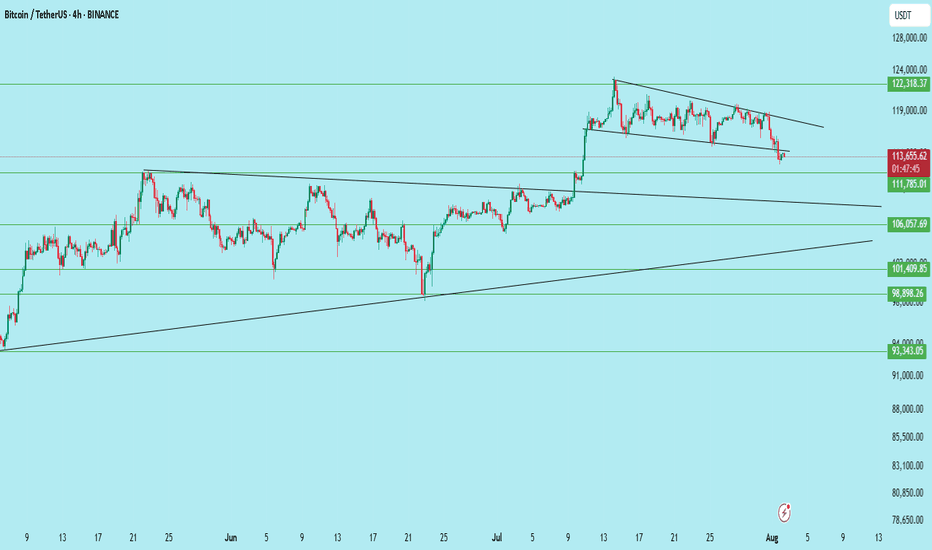

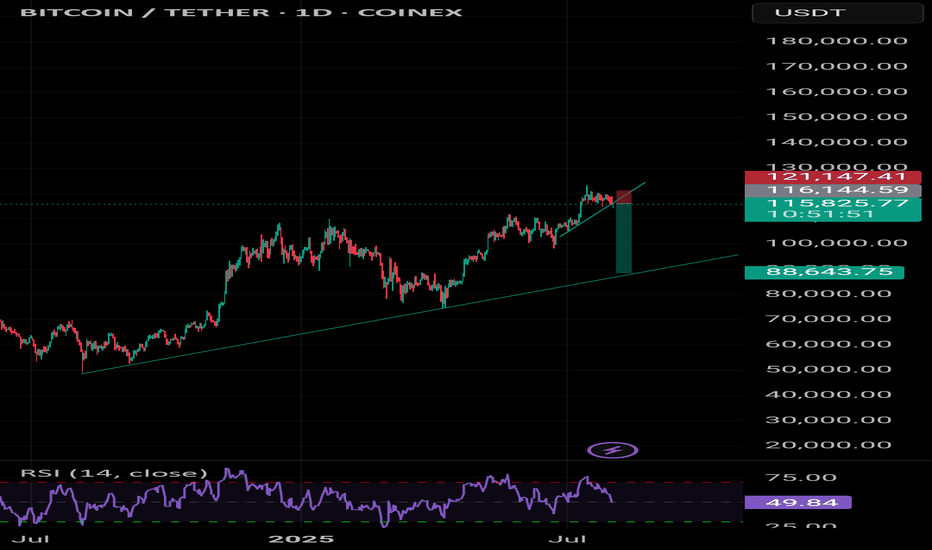

Bitcoin Could Accept bearish TrendBitcoin is currently testing a key resistance zone between 120,000 and 121,000. While price action is attempting to break higher, market conditions suggest the possibility of a false breakout rather than a sustained bullish continuation.

BTC has approached a significant resistance band, and early signs of exhaustion are visible. Unless the price decisively holds above 121,000, any breakout may lack conviction. Given the broader unresolved downtrend, a corrective move remains likely.

If the breakout fails to sustain, we anticipate a pullback toward the 117,000 to 115,000 range. This would align with a retest of previous support zones and continuation of the short-term bearish structure.

Ps: Support with like and comments for better analysis Thanks.

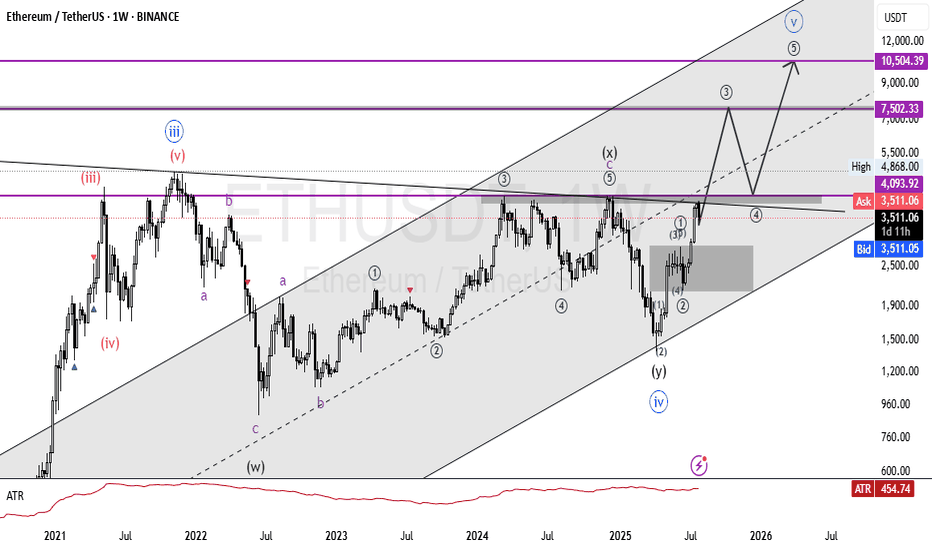

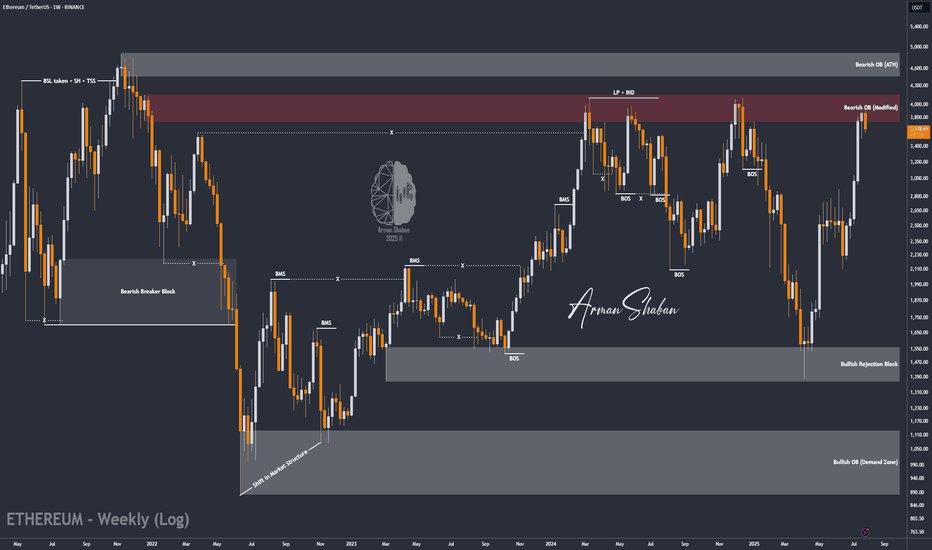

ETH/USDT | ETH Under Pressure – Watch $3500 Support!By analyzing the Ethereum chart on the weekly timeframe, we can see that after reaching the $3940 zone, ETH faced selling pressure and is now trading around $3540. If the price fails to hold the key $3500 support, a deeper decline is likely, with potential targets at $3040 first and possibly $2680 as the second bearish target.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

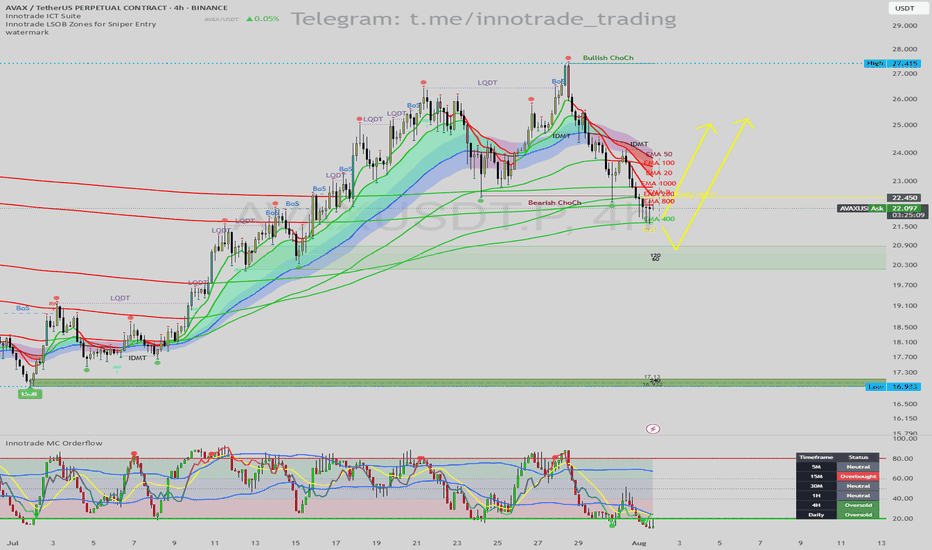

AVAX/USDT: Bullish Reversal at MA Support & Daily OversoldHello traders,

Today's analysis focuses on a high-probability long setup for AVAX/USDT on the 4H timeframe. The price has pulled back to a critical area where a confluence of powerful technical indicators suggests a significant bounce or reversal is imminent.

1. Trend & Context (The "Why")

Following a strong uptrend, AVAX entered a corrective phase, marked by a Bearish Change of Character (ChoCh). This correction has now brought the price to an A+ support zone.

Here are the key confluences for this bullish setup:

Major Support Cluster: The price is currently reacting to a critical support cluster formed by the EMA 200 and EMA 400. These long-term moving averages are major levels where institutions often step in to buy.

Momentum Exhaustion (MC Orderflow): The Innotrade MC Orderflow oscillator provides the critical confirmation that selling pressure is exhausted:

The oscillator is deep in the OVERSOLD territory on the 4H chart.

THE CRITICAL MTF CONFLUENCE: The Multi-Timeframe Cycle Table is the most important factor here. It shows that both the 4H and Daily timeframes are "Oversold". This alignment of higher timeframe momentum at a key technical support level is a very powerful signal for a reversal.

2. Entry, Stop Loss, and Targets (The "How")

The alignment of these factors gives us a clear and actionable trade plan with a great risk-to-reward profile.

Entry: An entry around the current price ($21.50 - $22.10) is ideal, as we are right at the MA support cluster.

Stop Loss (SL): $21.20. This places the stop loss safely below the EMA 400 and the recent swing low, providing a clear invalidation point for the setup.

Take Profit (TP) Targets:

TP1: $24.00 (Targeting the Bearish ChoCh level and the cluster of short-term EMAs).

TP2: $26.50 (The next major swing high, a logical area of resistance).

TP3: $27.40 (The major high of the entire range, a longer-term target if the uptrend resumes).

Conclusion

This trade setup is of very high quality due to the powerful confluence of a major MA support cluster with a confirmed multi-timeframe momentum exhaustion signal (4H and Daily). This synergy creates a high-probability environment for a significant bullish reversal.

Disclaimer: This is not financial advice. This analysis is for educational purposes only. Always conduct your own research and manage your risk appropriately.

$BTC /USDT – Breakdown from Channel, Bears Gaining ControlBitcoin has broken down from its descending channel on the 4H chart after repeated rejection from the upper trendline. Price is now hovering near key support at $111,785.

Key Technicals:

Rejection from the descending trendline resistance

Breakdown of the mini-channel structure

Current price: $113,637

Support levels:

$111,785 (Immediate)

$106,057

$101,409

$98,398

Bearish continuation is likely if $111,785 breaks with volume

If the $111.7k zone fails to hold, BTC could see further downside toward $106k and even $98k in the coming sessions.

Invalidation: Bullish only on reclaim of $117K+ with strength.

DYOR | Not Financial Advice

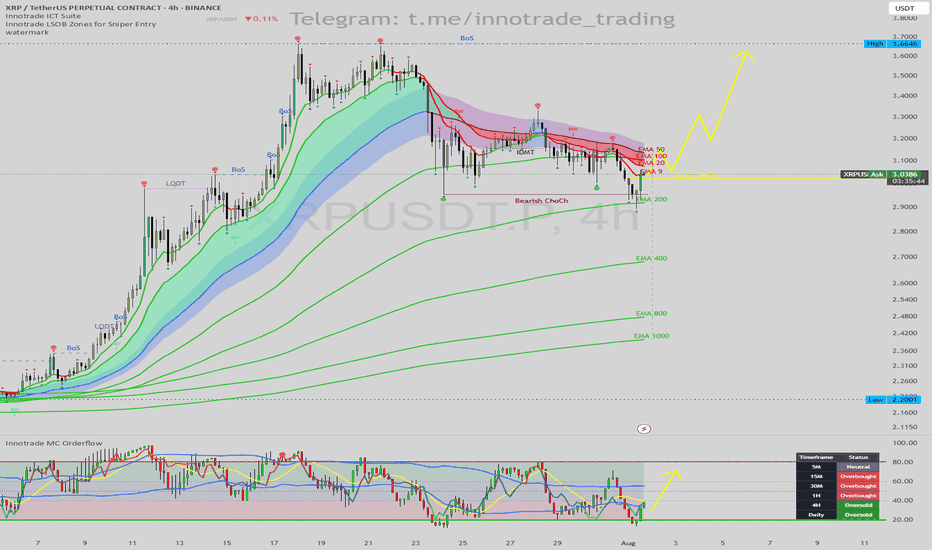

XRP/USDT: Bullish Reversal Setup at EMA 200 & Daily OversoldHello traders,

I'm seeing a compelling long setup forming on the XRP/USDT 4H chart. While the immediate trend has been bearish, multiple key indicators are now signaling that a significant bounce or reversal is highly probable.

1. Trend & Context (The "Why")

After a strong uptrend, the price has experienced a pullback, confirmed by a Bearish Change of Character (ChoCh). However, the price has now reached a critical support level where we can look for long opportunities.

Key Price Action Support: The price is currently finding support directly on the EMA 200. This is a major long-term moving average that frequently acts as a strong floor for price during a pullback.

Momentum Exhaustion Signal: The Innotrade MC Orderflow oscillator is giving a powerful confirmation for a potential bottom:

The oscillator is deep in the OVERSOLD zone (below 20), indicating that selling pressure is exhausted.

CRITICAL MTF CONFLUENCE: The Multi-Timeframe Cycle Table is the key to this trade. It shows that both the 4H and Daily timeframes are "Oversold". When higher timeframes like the Daily show exhaustion, it significantly increases the probability of a strong reversal on lower timeframes.

2. Entry, Stop Loss, and Targets (The "How")

This setup provides a clear, high-probability trade plan with a good risk-to-reward ratio.

Entry: An entry around the current price ($3.03 - $3.05) is viable as we are at the EMA 200 support. For a more conservative entry, wait for the MC Orderflow oscillator to cross back above its yellow MA.

Stop Loss (SL): $2.89. This places the stop loss safely below the recent swing low and the EMA 200. A break below this level would invalidate the bullish thesis.

Take Profit (TP) Targets:

TP1: $3.25 (Targeting the cluster of short-term EMAs and the recent swing highs).

TP2: $3.40 (The next logical area of resistance from the previous price structure).

TP3: $3.66 (The major swing high, a longer-term target if the bullish trend resumes).

Conclusion

This trade idea presents a strong case for a long position. The combination of a major technical support level (EMA 200) with a confirmed multi-timeframe momentum exhaustion signal (Daily Oversold) creates a high-probability environment for a bullish reversal.

Disclaimer: This is not financial advice. This analysis is for educational purposes only. Always conduct your own research and manage your risk appropriately.

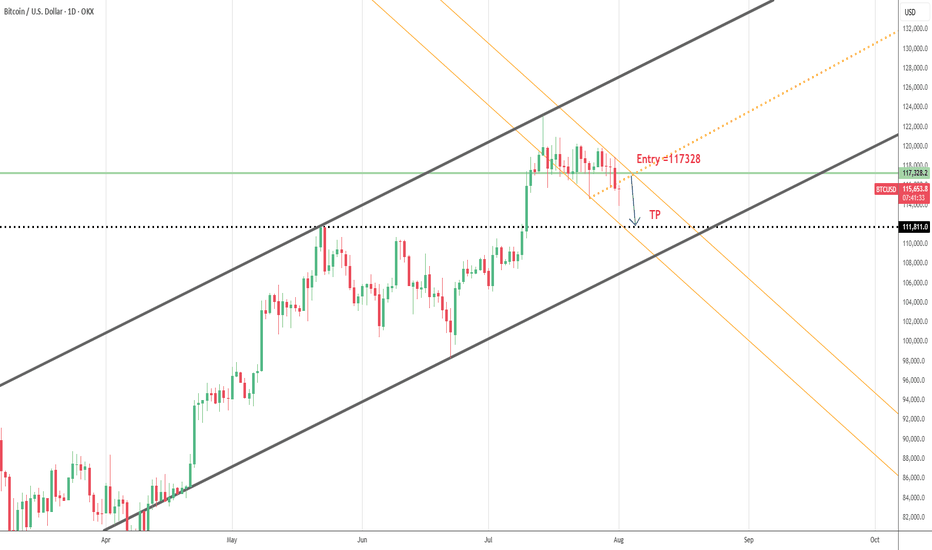

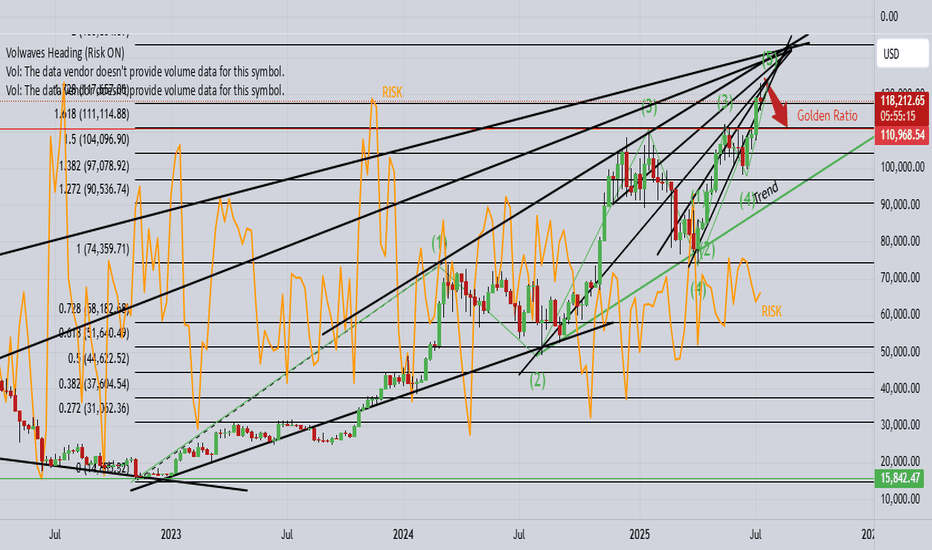

BTCUSD looking for corrective drop towards $111K!1). "Indecisive" weekly Doji retail candle! 2). Price rejection off higher times! 3). Risk indicator is heading south! 4). Trump said "BUY!" 5). There appears to be a cluster of "BUY" orders around $114$K as typically, price drops to trigger those orders!

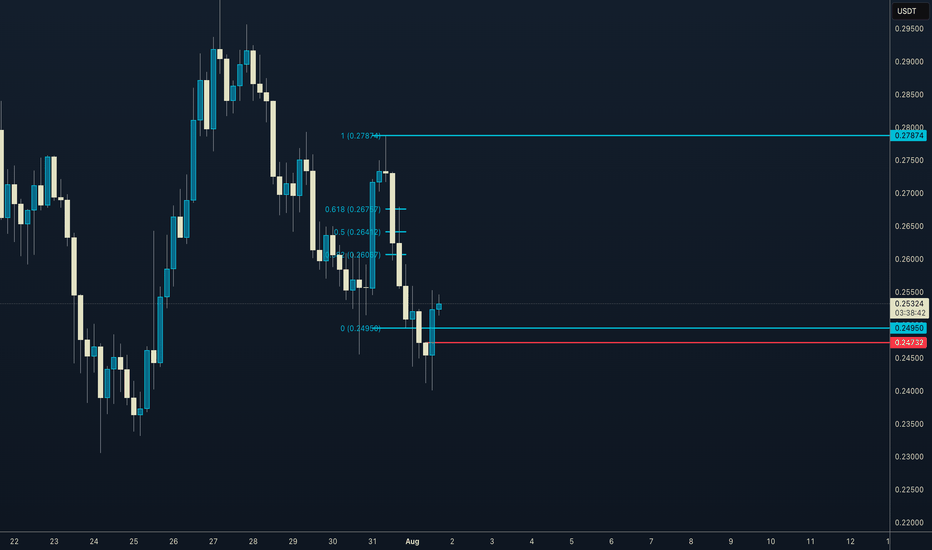

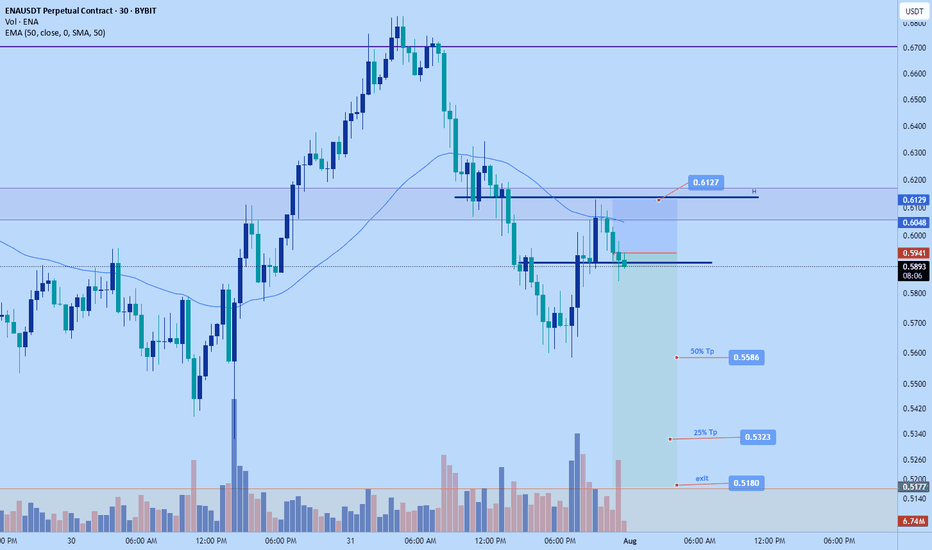

Ena short to $0.5180Just now opened up a short position on ENA. Ena seems like a pair that wants to pump but at the moment I just think its relatively too high and likely will dump down further before correction.

Based on my DTT analysis- Direction, Target and timing it'll probably dump back to $0.5180

That's the direction and target and in terms of timing it'll probably start to do so anytime now given my analysis is correct.

Sl: 0.6127

Tps on chart

Time sensitive

Panic sets in. but its all goodThe crypto market has experienced a strong panic driven correction as the FED refuses to cut rates and inflation is on the rise while wages are slowly in decline.

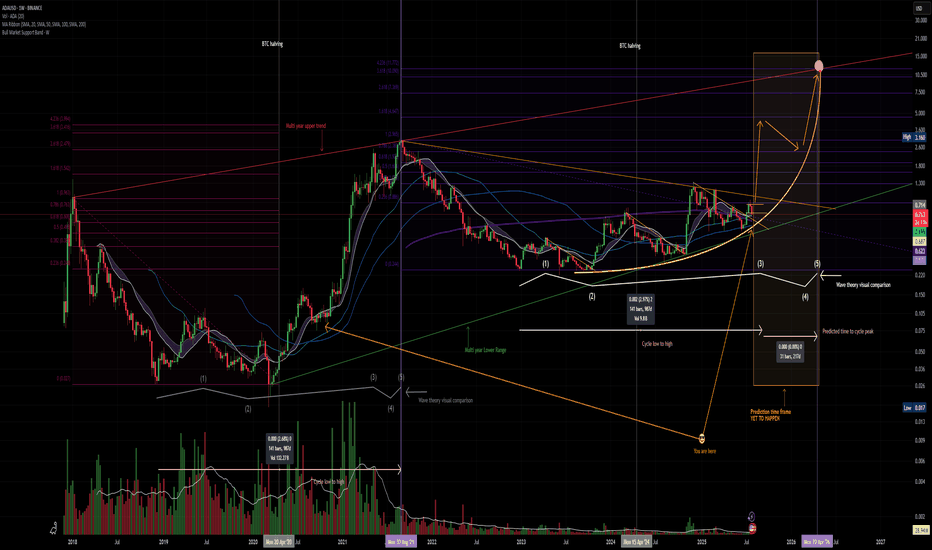

CRYPTOCAP:ADA continues to provide thrills and chills

Is it time to dump? and cry into your empty wallet?

IMO NO, CRYPTOCAP:BTC has recently taken out liquidity below the $117,000.00 price point which is a normal move, if you are over leveraged it can feel horrible but I assess as a normal correction.

CRYPTOCAP:ADA price remains in the range in which it has formed .93 - .71 the possibility that CRYPTOCAP:ADA can dip deeper to .65 is possible but unlikely. This correction provides a cooling off of MACD and RSI on higher timeframes and the chart still remains BULLISH.

Remember be greedy when others are fearful.

A man who says he never had a chance never took a chance!

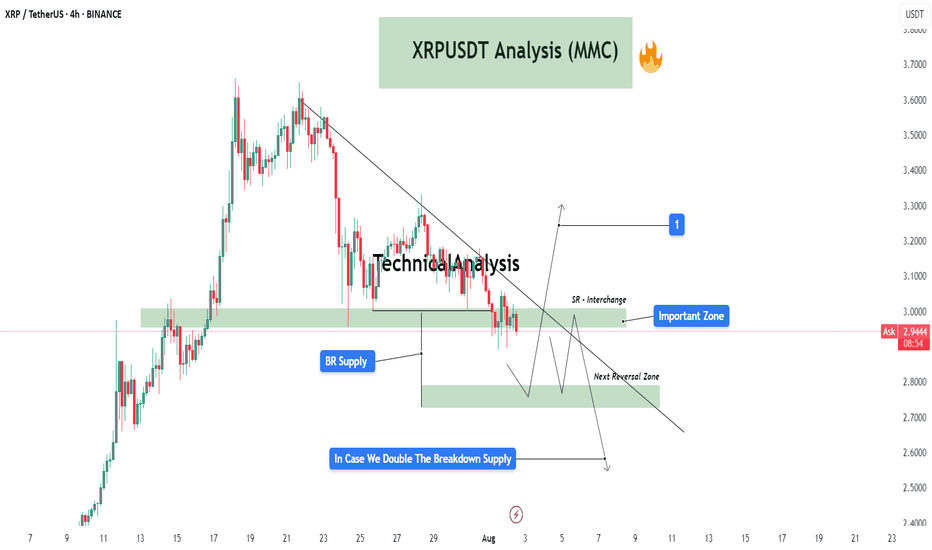

XRPUSDT Analysis (MMC) : Decision Point + Next Move Loading In this 4-hour chart of XRP/USDT, we're observing a critical structure forming under the Mirror Market Concepts (MMC) framework. Price action is compressing near an important descending trendline, suggesting that a breakout or breakdown is imminent. Let’s break it down zone by zone:

🔍 Key Zones & Price Structure:

Important Zone (SR Interchange Zone – $2.95 - $3.05)

This is a major supply-to-demand flip zone. It has served as both resistance and support in the past and is now acting as a potential interchange level. The price is hovering just below this area, retesting it after a significant bearish structure.

BR Supply Zone (Breakdown Retest Supply – $2.93 - $2.98)

After price broke down from this zone, it created a base for a retest. This level has since acted as a cap to further upside movement. It also coincides with the descending trendline, adding confluence to its strength as resistance.

Next Reversal Zone ($2.75 - $2.85)

In case the price fails to reclaim the Important Zone, we could see a bearish continuation move into the next zone of interest. This is a likely reversal or reaction area based on previous demand imprints and price imbalance.

SR Flip Watch

If price breaks above the trendline and sustains above the SR Interchange Zone, this could trigger a potential bullish breakout toward the $3.20+ region (labeled as target “1”). This move would be backed by trapped sellers and liquidity above the descending structure.

📈 Potential Scenarios:

✅ Bullish Case:

Break and close above the descending trendline.

Successful retest of the Important Zone as demand.

Push toward $3.20 - $3.30 where the next supply awaits (target 1).

❌ Bearish Case:

Rejection at the Important Zone and trendline resistance.

Breakdown below $2.90 confirms bearish pressure.

Possible liquidity sweep and reaction from the Next Reversal Zone ($2.75-$2.85).

If this zone fails to hold, continuation toward lower zones becomes likely.

🧠 MMC Perspective:

From a Mirror Market Concepts (MMC) standpoint, the market is currently at a reflection point where a decision between bulls and bears is about to play out. The clean diagonal structure plus clear horizontal liquidity pockets makes this setup ideal for anticipating manipulation traps and smart money moves.

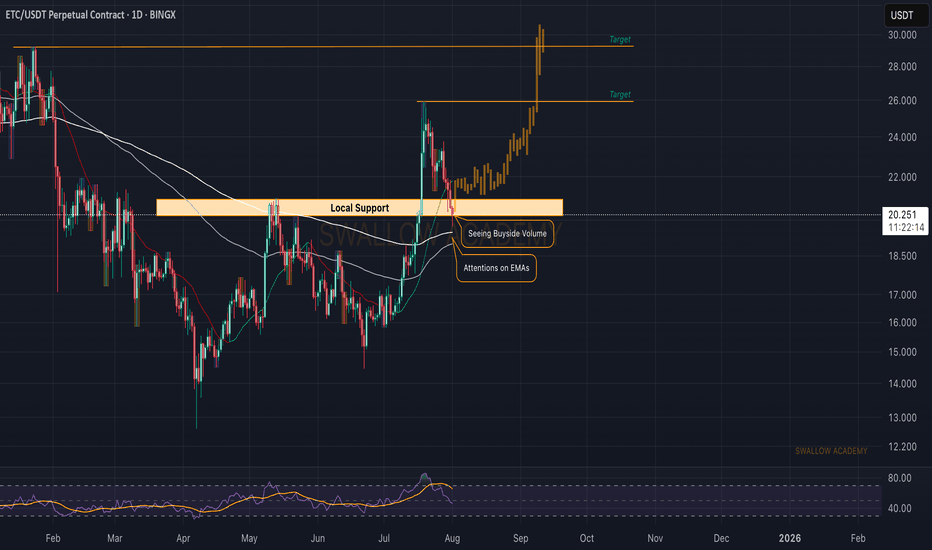

Ethereum (ETH): Might Be Good Zone to Bounce From ETC caught our attention with a local retest of the support zone, which, after a breakout, was a natural movement for the coin!

Now that we have been having that retest, we are looking closely for any signs of recovery, which would give us an opportunity to long from here.

While we see a smaller recovery happening, we need that proper MBS to take place above the support zone, so keep your eyes on it.

As long as we are above the EMAs, this is the game plan we are going to look for!

Swallow Academy