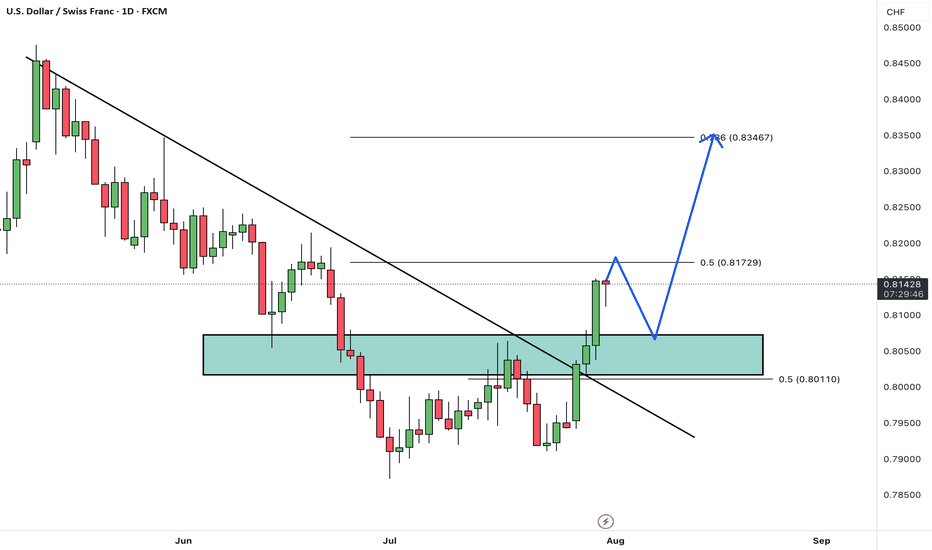

USDCHFHello Traders! 👋

What are your thoughts on USDCHF?

USD/CHF has broken above its descending trendline and cleared a resistance zone, signaling a potential trend reversal and growing bullish momentum.

After some minor consolidation and a pullback to the breakout zone, we expect the pair to continue its rally toward the next identified targets.

The broken resistance now acts as new support, and as long as price remains above this area, the bullish outlook remains valid.

Is USD/CHF ready to extend higher toward its next targets? Share your view below! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

Forex market

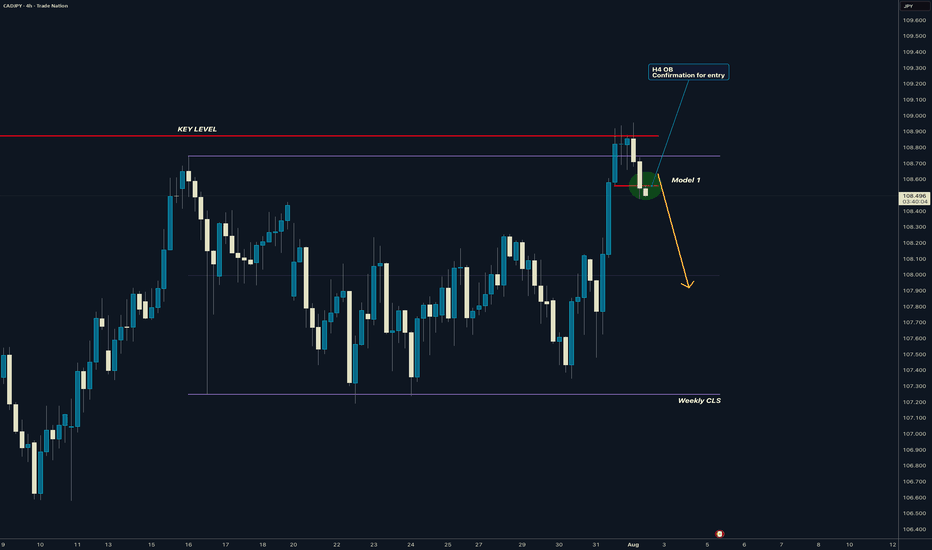

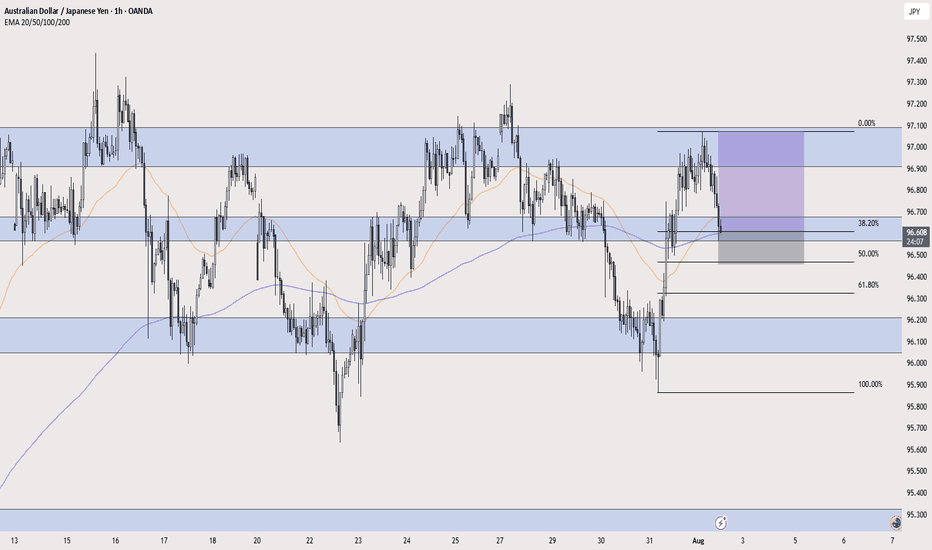

CADJPY I Weekly CLS Range I Model 1 I H4 entry ConfirmedYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Don't hesitate to ask any questions or share your opinions

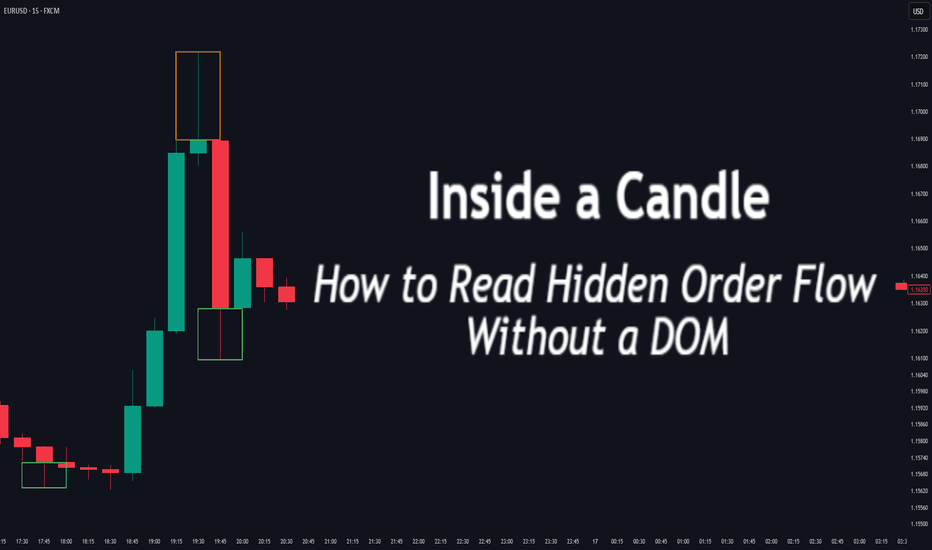

Inside a Candle: How to Read Hidden Order Flow Without a DOM

Difficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is for traders who want to understand the “story” behind a candle’s shape — and learn to spot aggressive buying/selling, absorption, and traps without needing footprint or order book tools.

🔵 INTRODUCTION

Most traders see candles as static shapes — green or red, big or small. But each candle is a battlefield of orders . Even without access to a DOM or volume footprint, you can still extract valuable information from just the candle's body, wick, and context .

🔵 ORIGINS: WHERE CANDLESTICKS COME FROM

Candlestick charts trace back to 18th-century Japan, where rice traders needed a way to visualize price movements over time. A legendary trader named Munehisa Homma , who traded rice futures in Osaka, is credited with developing the earliest form of candlestick analysis.

Homma discovered that price wasn’t just driven by supply and demand — but also by trader psychology . He created visual representations of market sentiment by tracking:

The opening and closing price of rice

The highest and lowest price reached during the session

This system became known as the “Sakata rules,” and it laid the foundation for many patterns still used today — such as Doji, Engulfing, and Marubozu.

Western traders only began using candlesticks widely in the 1990s, when analyst Steve Nison introduced them to the broader financial world through his book Japanese Candlestick Charting Techniques.

Today, candlesticks remain one of the most powerful and intuitive ways to visualize order flow, momentum, and market psychology — even without a Depth of Market (DOM) or depth of book.

In this article, you’ll learn how to read hidden order flow by analyzing:

Wick length and positioning

Body-to-range ratios

Candle clustering and sequences

🔵 HOW A CANDLE FORMS

Before you can read a candle, you need to understand how it comes to life . A single candle represents the full auction process during its time window.

Here’s how it builds, step by step:

Candle opens — this is the open price .

As price moves up during the session → the high] updates.

As price moves down → the low] updates.

The final traded price when the time closes → this becomes the close price .

The wick = price areas that were tested but rejected

The body = where the majority of aggressive trades occurred

If buyers push price up quickly but sellers slam it down before the close — the candle will have a long upper wick and close near the open, revealing seller absorption.

Understanding this flow helps you recognize traps, fakeouts, and reversals in real time.

🔵 CANDLE BODY: WHO'S IN CONTROL

The body of the candle reflects the result of the battle between buyers and sellers. A wide body with minimal wicks means dominance and commitment.

Big body, small wick → clear conviction

In an uptrend: buyer aggression

In a downtrend: panic or aggressive selling

Small body, long wicks → indecision, absorption, or trap

Often appears near tops/bottoms

Indicates both sides were active but neither won clearly

tradingview.sweetlogin.com

🔵 WICKS: THE SHADOWS OF REJECTION

Wicks are not just “leftovers” — they show where price was rejected after being tested.

Long upper wick = seller presence or absorption at highs

Long lower wick = buyer defense or trap spring

Double wick = liquidity sweep / false breakout

Use wick direction to spot:

Failed breakouts

Smart money traps

Exhaustion candles

🔵 HIDDEN ORDER FLOW PATTERNS

1️⃣ Absorption Candle

A large wick with little movement afterward — shows that big orders absorbed market pressure.

2️⃣ Trap Candle

A candle that sweeps above/below a key high/low and closes opposite — classic smart money fakeout.

3️⃣ Imbalance Candle

Large-bodied candle that closes near the high/low with no wick on the other end — implies one-sided aggression (and often leaves an imbalance).

🔵 CLUSTERING & SEQUENCES MATTER

Never read a candle alone. The sequence of candles tells the full story:

3+ rejection wicks near resistance? Liquidity building before breakout or trap

Bearish engulfing after long upper wick = smart money selling into retail buying

Tight-range dojis + volume spike = compression before expansion

Context + volume + structure = hidden flow decoded.

🔵 PUTTING IT TOGETHER: A REAL EXAMPLE

Price breaks above previous high

Candle closes with long upper wick and smaller body

Next candle opens, dumps fast, leaving imbalance behind

Buyers trapped — move likely to continue down

This is how you read order flow from candle anatomy .

🔵 TIPS FOR MASTERY

Use a lower timeframe (1M–5M) to see microstructure

Watch how wicks behave near S/R or OBs

Confirm with volume spikes or delta-style indicators

Use replay mode to slow down the story and study cause/effect

🔵 CONCLUSION

Every candle is a message. You don’t need expensive tools to read order flow — just your eyes, context, and curiosity.

Learn to see candles not as symbols, but as evidence of behavior . Absorption, imbalance, and traps are all visible if you look closely.

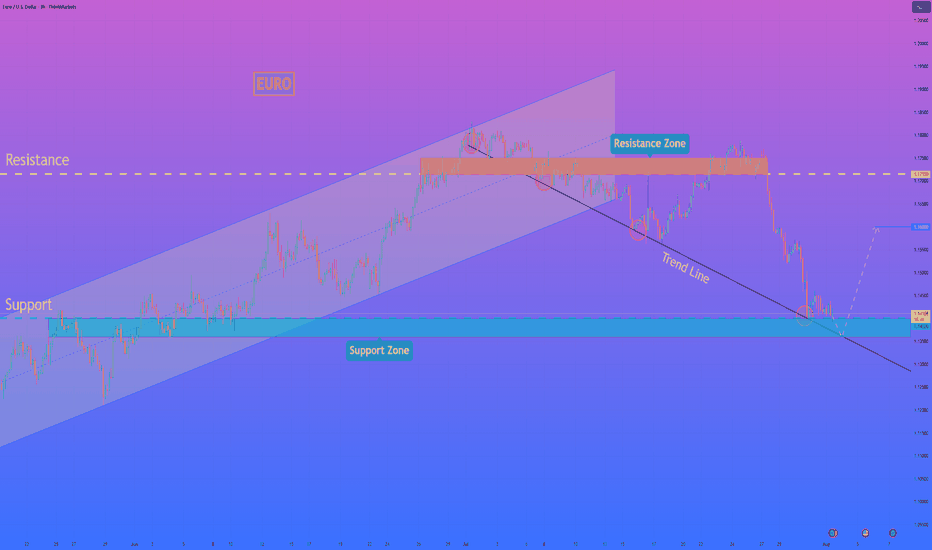

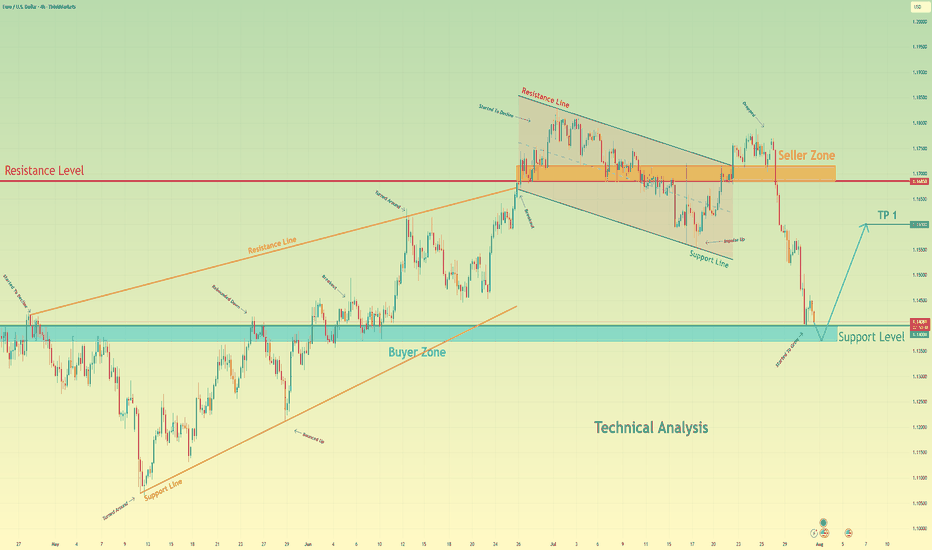

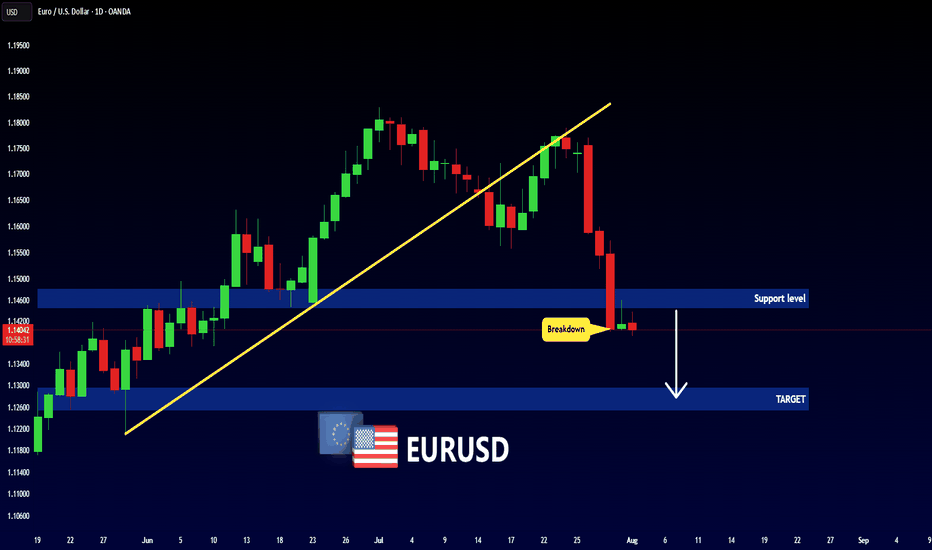

HelenP. I Euro will rebound from trend line to $1.1600 pointsHi folks today I'm prepared for you Euro analytics. A structural review of the chart shows a clear change in market character. The previous long-term upward channel has been broken, and the price has since entered a corrective phase, currently guided by a descending trend line. This decline has brought the asset towards a critical area of interest: the major horizontal support zone between 1.1400 and 1.1360. My analysis for a long, counter-trend position is based on the potential for a strong bullish reaction from the confluence of this historical support zone and the descending trend line. I believe that as the price reaches this intersection, the current selling momentum is likely to be absorbed by significant underlying demand. The main condition for this scenario is a clear and forceful rejection of lower prices from this zone, which would signal that buyers are stepping in to defend this critical level. A confirmed bounce would likely initiate a significant relief rally, and therefore, the primary goal for this move is set at the 1.1600 level, a logical first target for a corrective bounce of this nature. If you like my analytics you may support me with your like/comment.❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

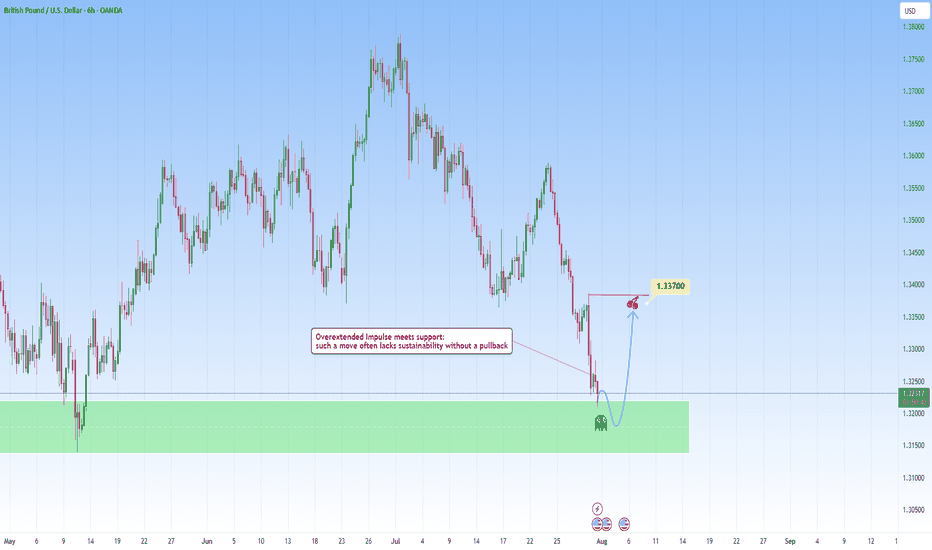

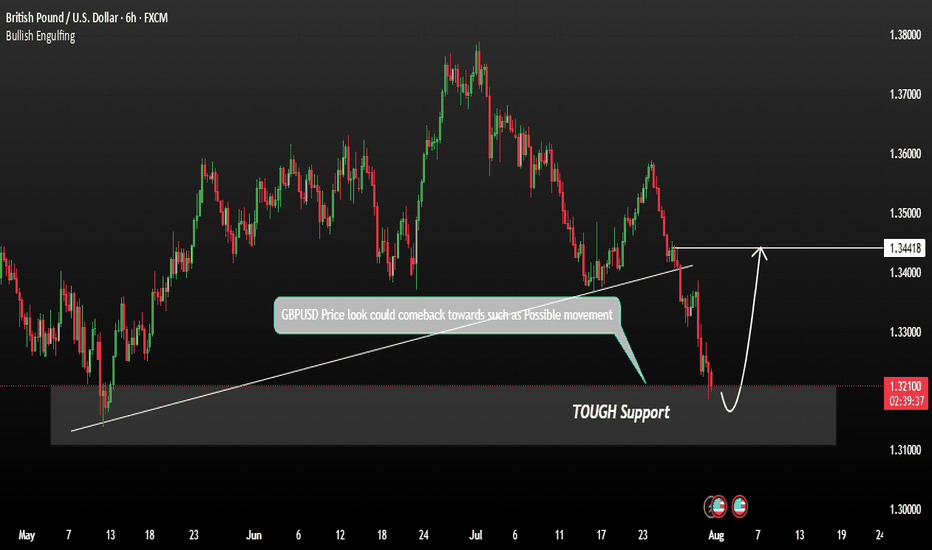

GBPUSD: Overextended move meets with supportAfter a steep and aggressive sell-off, price has tapped into a clear zone. This recent move wasn't gradual: it was impulsive and sharp, which tells us one key thing: exhaustion is likely.

The overextension into it without any meaningful pullback typically highlights imbalance, where price moves ahead of structure and becomes vulnerable to correction. But price doesn’t move in straight lines forever. Markets that fall too quickly tend to burn out just as fast. When such aggressive pushes meet with a clean, resistance like this one, they often trigger the exact opposite, a snapback correction.

I am now watching for signs of absorption and accumulation. This could play out in the form of sideways candles, wick rejections, or a sudden reversal spike. These are early signs that smart money might be stepping in.

My projected target would be toward the 1.33700 area, from the last impulsive drop. It’s a classic mean reversion setup, not just technical but psychological. Traders who chased the move late may find themselves trapped, fueling the correction as they’re forced to exit.

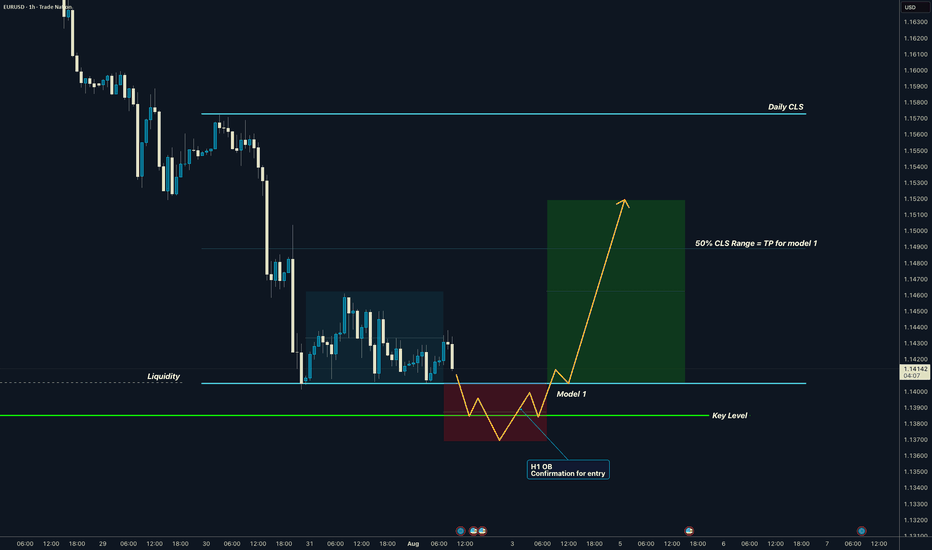

EURUSD I Daily CLS I Model 1 I KL - OB I TP 50% CLSYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Don't hesitate to ask any questions or share your opinions

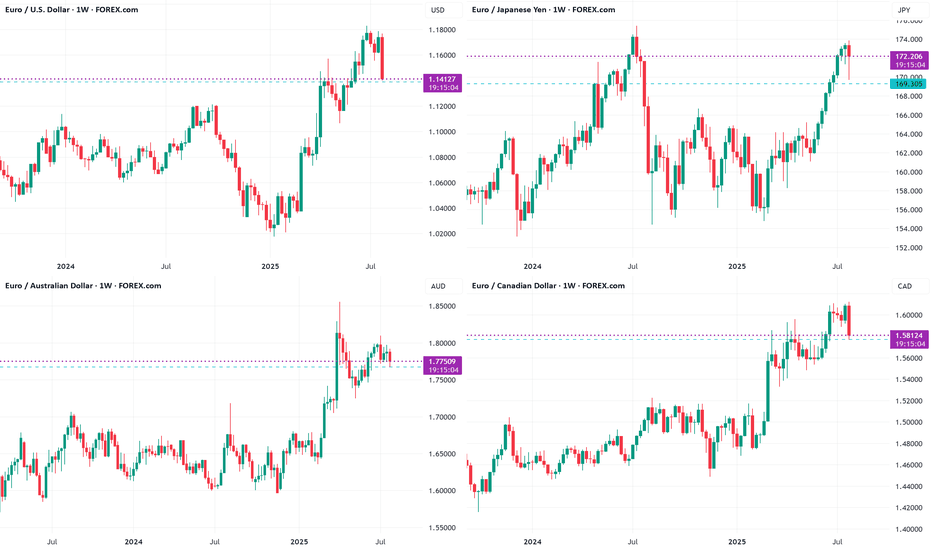

EURO long: The "What If?" tradeHello traders

The Euro is showing signs of bottoming out at the weekly support levels against

USD, JPY, CAD and AUD.

MOST IMPORTANT:

USD:

While King Dollar is clearly reigning after the FOMC indication not to expect rate cuts any time soon and solid economic data, the "What If" factor is NFP tomorrow and to a minor extent month end settling. If the NFP print comes in significantly lower than expectations, the Euro may pop higher. If the print is above expectations, still take a moment to check where the most jobs are. if it is in hospitality and leisure, it is probably summer hiring.

JPY: The BoJ kept rates unchanged.

CAD: The loonie is under siege with Trump's renewed 35% tariffs announced today. However, IF Russian sanctions against oil sales come to fruition, the CAD may strengthen. Watch Oil prices.

AUD: CPI came in below expectations. PPI has just printed lower too.

The Euro Zone's unemployment rate ticked down and German CPI ticked higher. The impact of tariffs seems to be priced in for the moment.

The biggest "What If" ?

The decision of the Federal Appeals Court if the International Trade Court verdict is upheld. In that case, it is all but guaranteed that it will reach the Supreme Court. IF the Supreme Court declares it unlawful, the USD MAY drop like a lead balloon.

The risk assets in these charts are all at right around the weekly 20 SMA.

tradingview.sweetlogin.com

Just some food for thought. Let me know what your thoughts are.

Euro bounce from buyer zone and start to move upHello traders, I want share with you my opinion about Euro. After a prolonged upward trend which formed a large rising wedge, the EURUSD faced a significant rejection from the seller zone near the 1.1685 resistance level. This failure to continue higher marked a key turning point, exhausting the bullish momentum and initiating a new bearish market phase. This new phase has since taken the form of a well-defined downward channel, within which the price has been undergoing a series of downward corrections and impulses. The most recent market action has been a sharp downward fall, accelerating the price's descent towards a critical area of historical significance. Currently, the pair is approaching the major support level at 1.1400, which also constitutes a strong buyer zone where demand has previously stepped in. The primary working hypothesis is a long, counter-trend scenario, which anticipates that the current bearish momentum will be absorbed by the strong demand within this buyer zone. A confirmed and strong rebound from this 1.1400 support area would signal a potential temporary bottom and the start of a significant upward correction. Therefore, the tp for this rebound is logically set at the 1.1600 level, a key psychological and technical point that represents a realistic first objective for a bounce of this nature. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

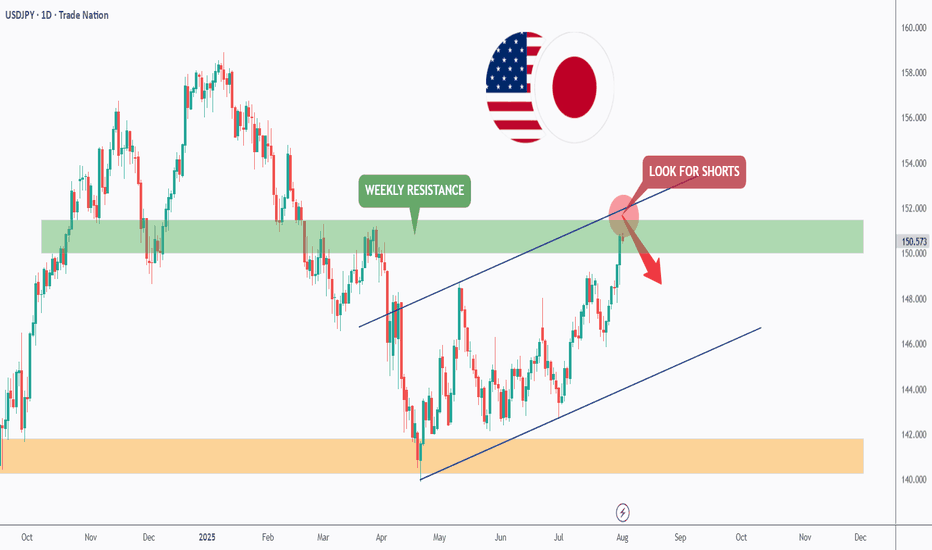

USDJPY - Now or Never!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDJPY has been overall bullish trading within the rising channel marked in blue and it is currently retesting the upper bound of the channel acting as an over-bought zone.

Moreover, the green zone is a strong weekly resistance.

📚 As per my trading style:

As #USDJPY is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

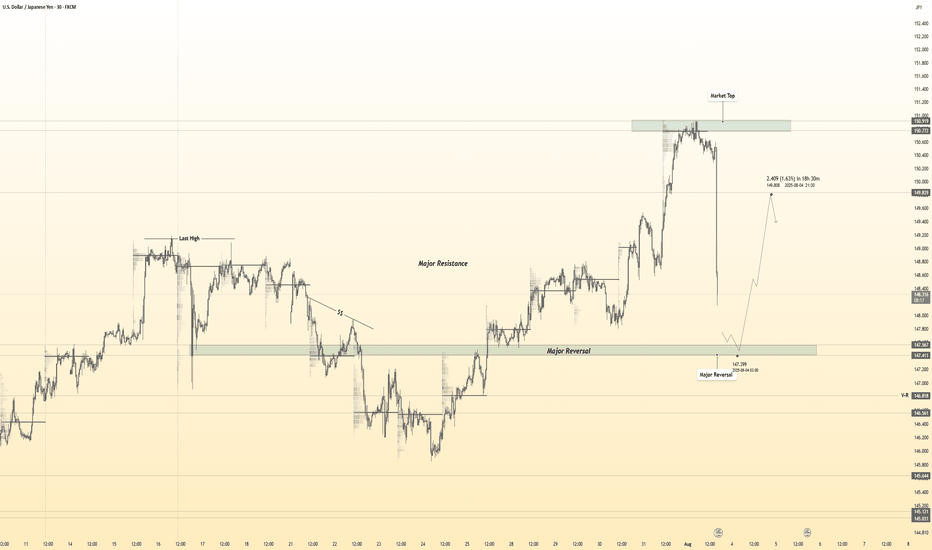

USDJPY 30Min Engaged (Bullish Reversal Entry Detected )➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish Reversal : 147.450

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

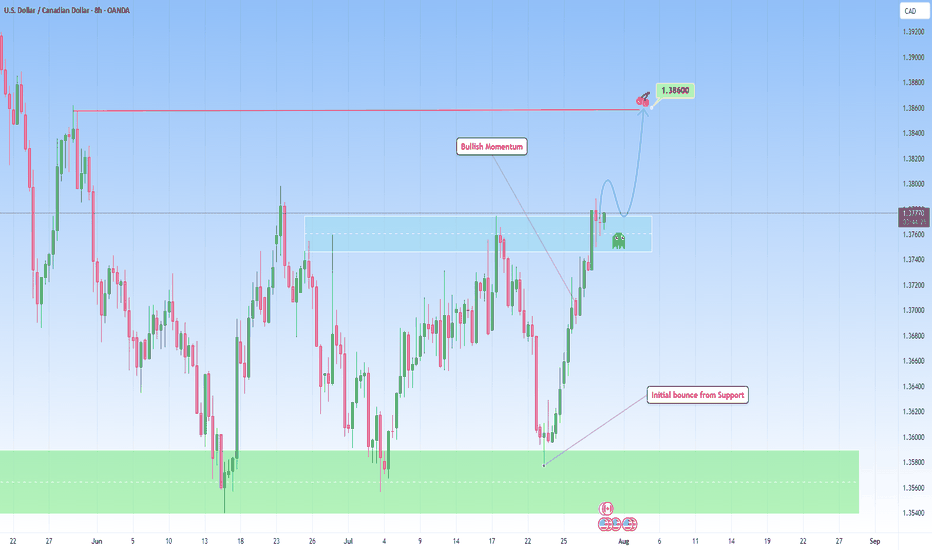

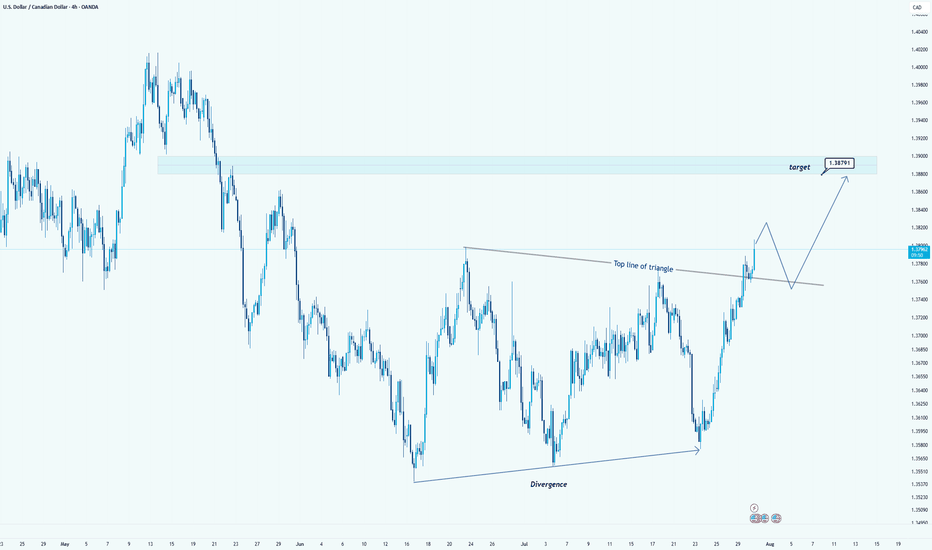

USDCAD bounced from Support and can continue higherLooking at the chart and the overall structure, I think we can favor the continuation setup with a emphasis on price action at key zones, particularly when price breaks out then can revisit this structure for a retest.

This bounce off support has been accomplished in my previous analysis:

Here, if price breaks with strength and dips back into the area and holds with bullish confirmation (likely a wick rejection or bullish engulfing on lower timeframes), that would be the cue to get in.

I am projecting the next target to 1.38600 that makes sense as a logical level for trend continuation and that I find achievable.

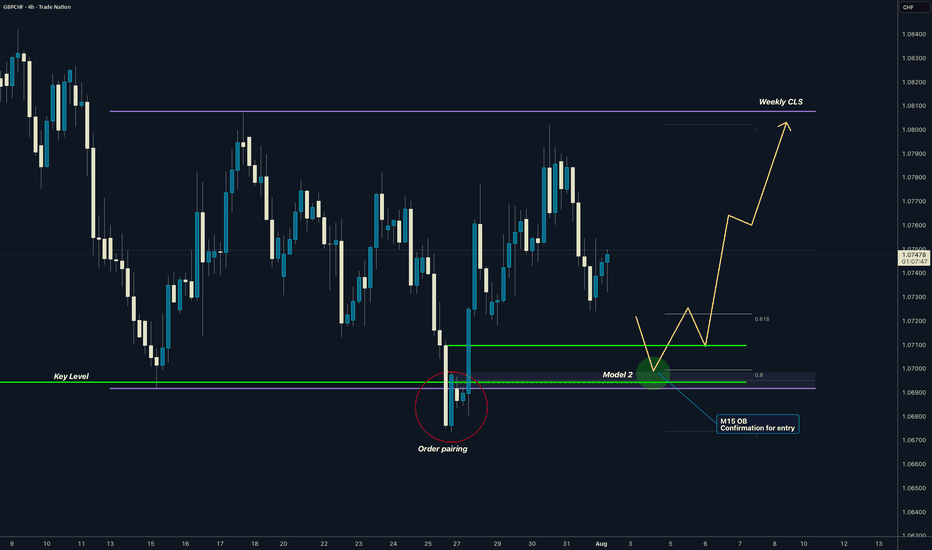

GBPCHF I Weekly CLS I Model 2 I Target full CLS rangeYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Don't hesitate to ask any questions or share your opinions

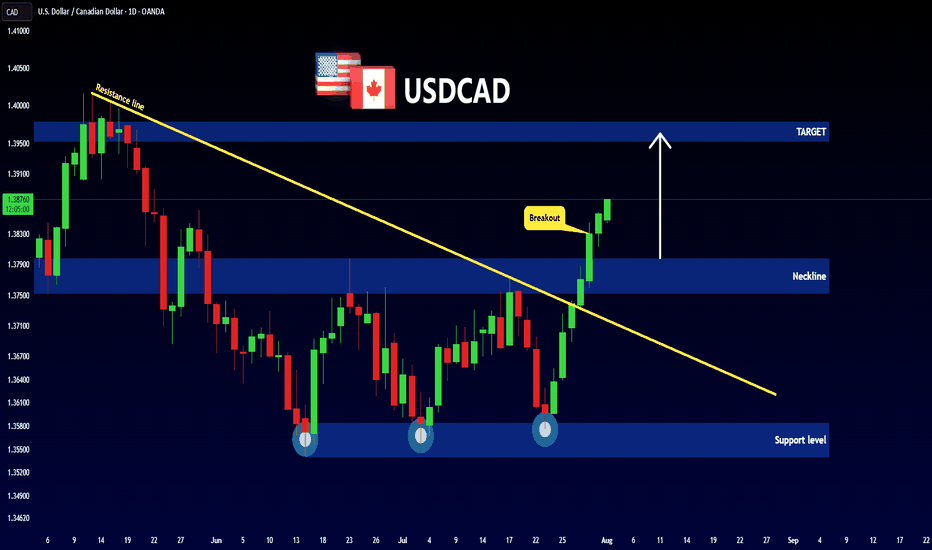

USD/CAD Breaks Triangle: Bullish Target in SightHello guys!

USD/CAD has broken out of a clear triangle formation, signaling strong bullish momentum. The breakout above the top line of the triangle, supported by earlier bullish divergence, confirms that buyers are now in control.

Triangle breakout confirmed

Strong bullish impulse post-breakout

Retest of the broken trendline expected

Target: 1.38791

A clean retest of the breakout level could provide another entry opportunity before price reaches the target zone highlighted in blue.

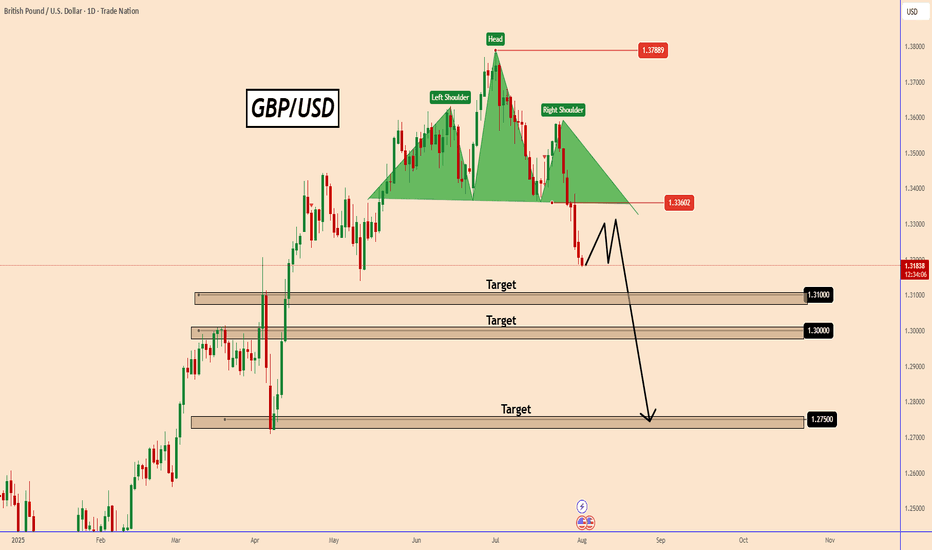

GBPUSD Technical Overview GBPUSD Technical Overview

GBPUSD recently peaked at 1.3790, aligning with a key historical resistance zone from October 2021. On the Daily Chart, this move completed a significant bearish pattern, suggesting the potential for further downside.

Over the last 7 trading sessions, the pair has declined nearly 400 pips, moving decisively lower.

Given the steep drop, a technical correction may be on the horizon before GBPUSD potentially resumes its bearish trajectory, as indicated by the current chart setup.

If NFP data can be strong today, GBPUSD could extend to the first target 1.3100 or 1.3000 as shown in the chart.

Overall, GBPUSD looks like it has started a downtrend.

Let's see how the price will unfolds.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

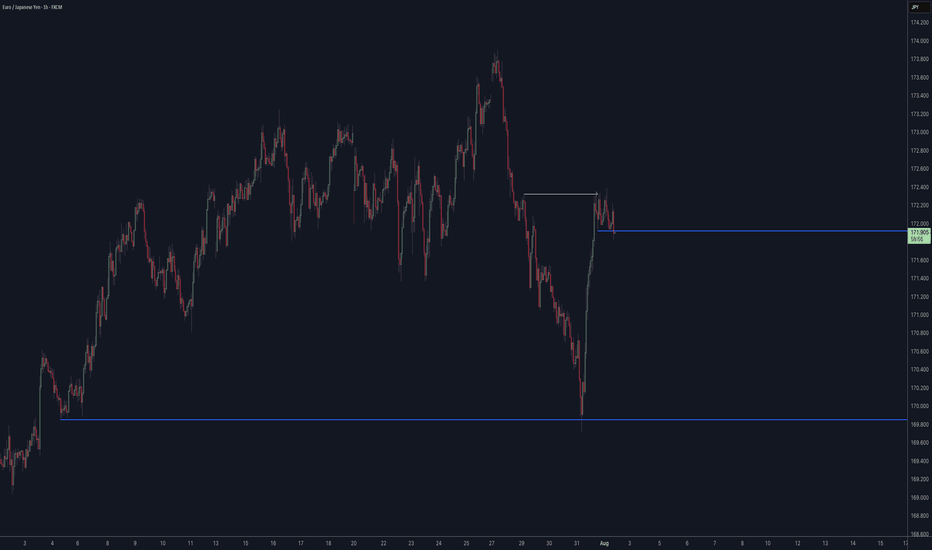

GBPUSD shows signs of a potential recoveryGBPUSD shows signs of a potential recovery towards the resistance zone. This price action indicates a possible short-term reversal or consolidation phase. We are currently observing for confirmation signals such as:

These could signal a build-up for a move back toward the key resistance at 1.34400. Traders should stay alert for price behaviour near this level as it may act as a turning point or breakout trigger.

You may find more details in the chart.

Trade wisely best of luck buddies.

Ps: Support with like and comments like for better analysis.

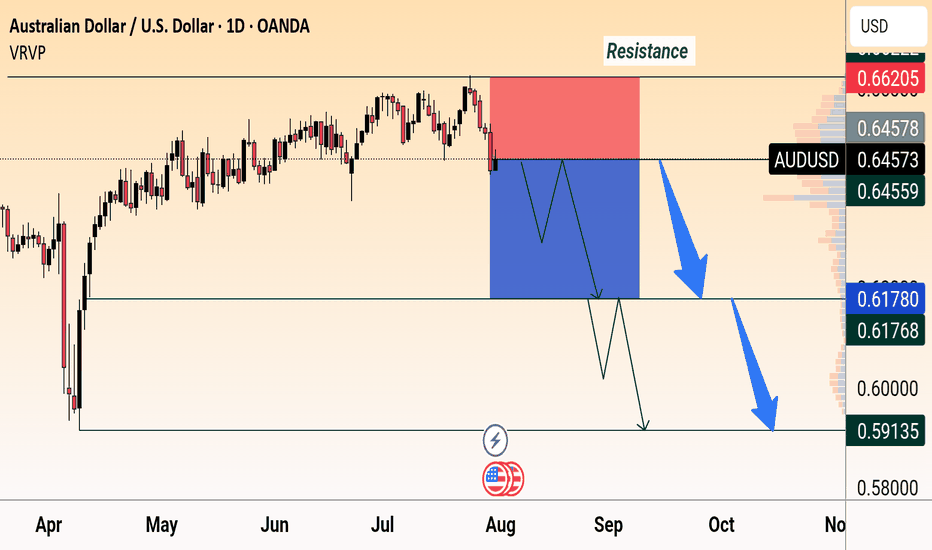

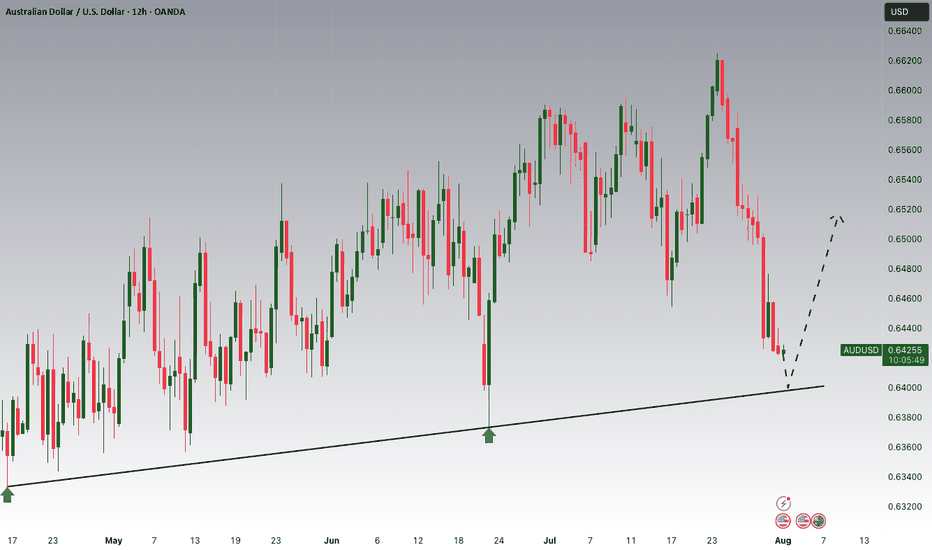

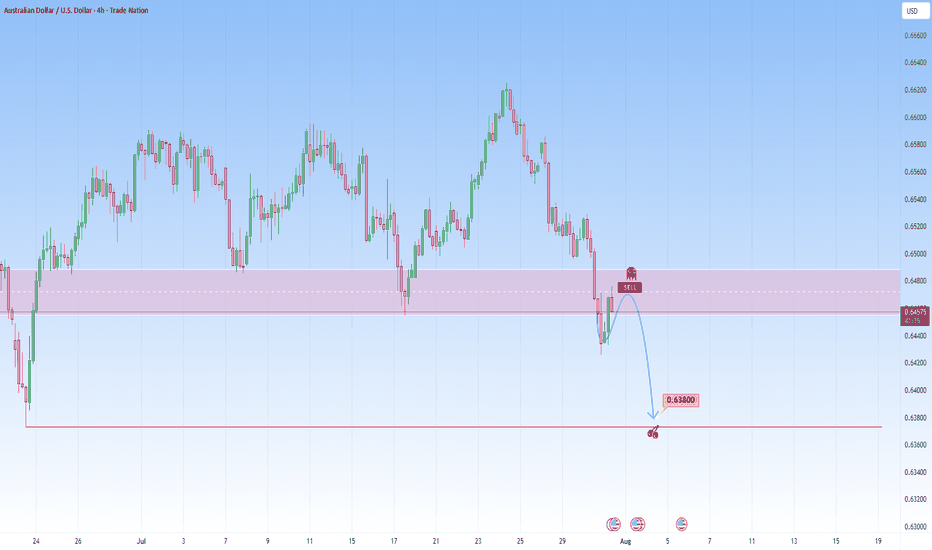

AUDUSD: Bearish Continuation from broken supportThe current setup is a clean example of a trend continuation play. Price recently broke decisively below a structure zone, this break and retest now flips the narrative, what once was a buy zone is now an opportunity for short entries.

Following the aggressive move down, price now began pulling back into that broken zone. The move appears corrective rather than impulsive, characterized by a slower, more rounded structure typical of pullback leg. This is classic behavior in continuation setups: fast drop, slow retrace, and then potential for the next leg lower.

The projected move targets a retest of the swing low at 0.63800. That level is significant, it's a level where prior demand reacted strongly and now it serves as the next probable magnet for price.

What makes this continuation trade high probability is the sharpness of the prior bearish impulse as it signals intent. The market seems to be in a controlled bearish sequence, where sellers dominate momentum and retracements offer fresh entries for trend followers.

The structure and zone alignment all point in the same direction continuation lower, not reversal.

Let me know in the comments what you think

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.