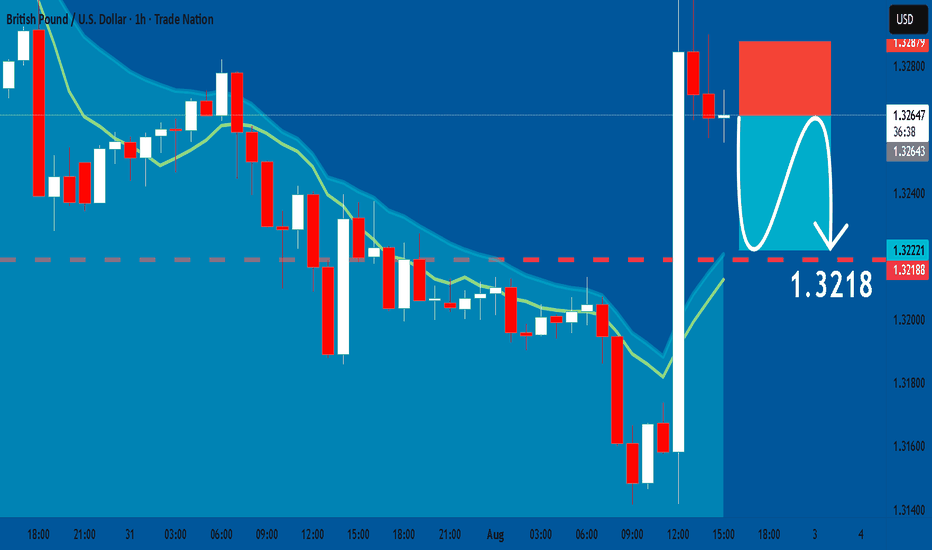

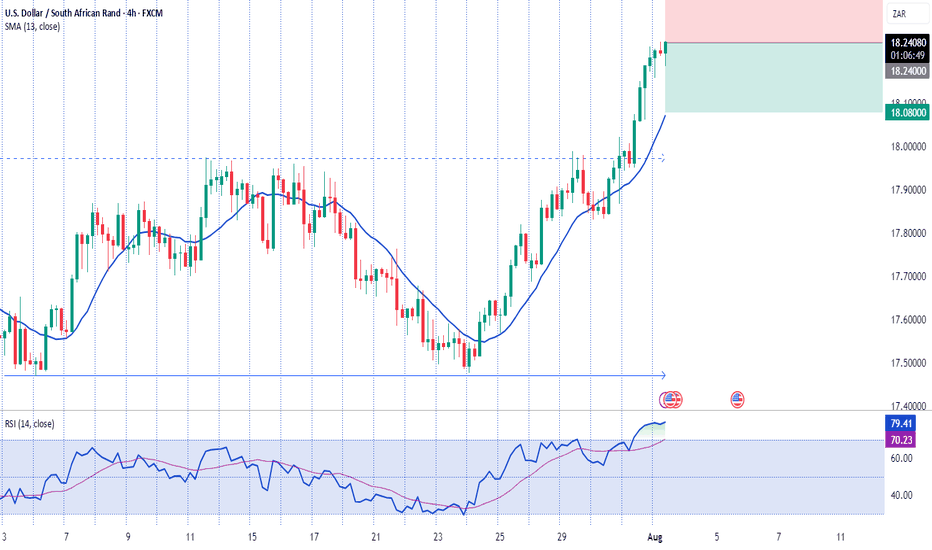

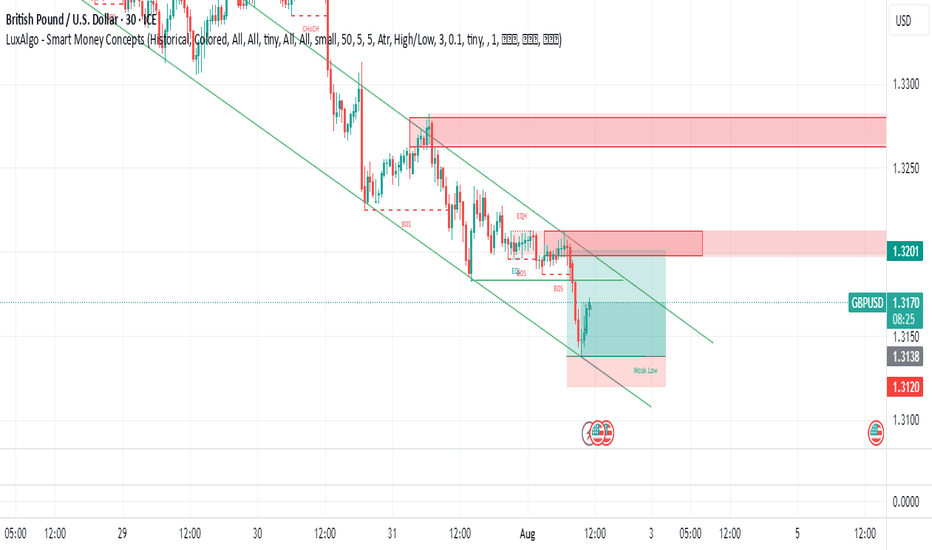

GBPUSD: Bearish Continuation & Short Signal

GBPUSD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short GBPUSD

Entry Point - 1.3264

Stop Loss - 1.3287

Take Profit -1.3218

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️Please, support our work with like & comment! ❤️

Forex market

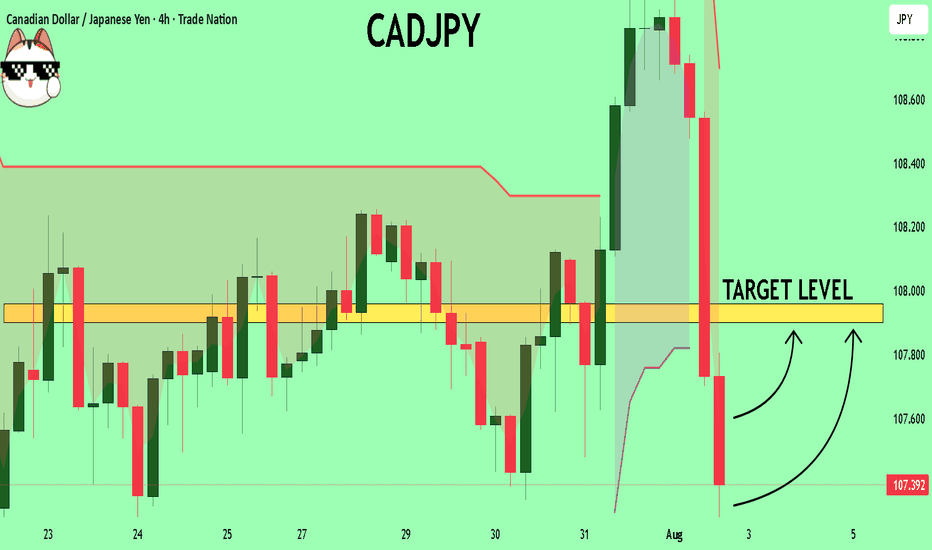

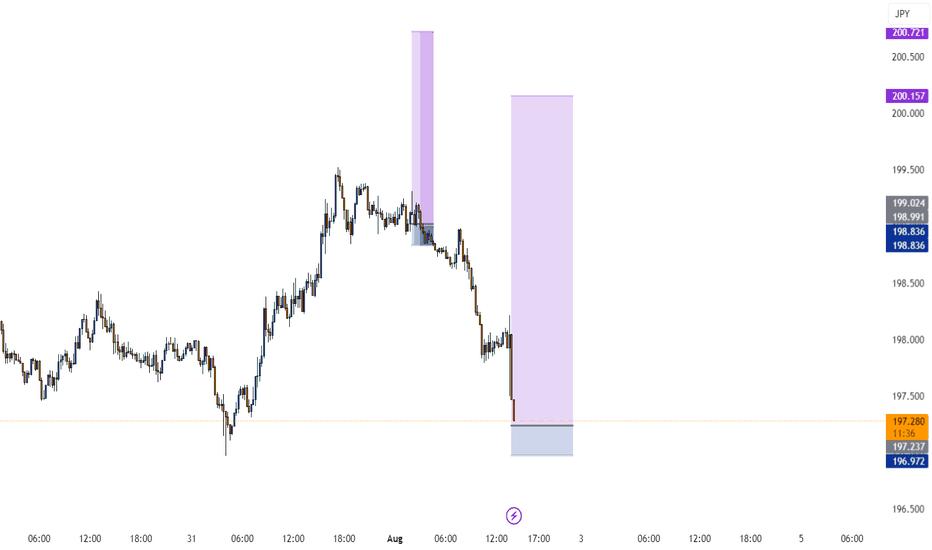

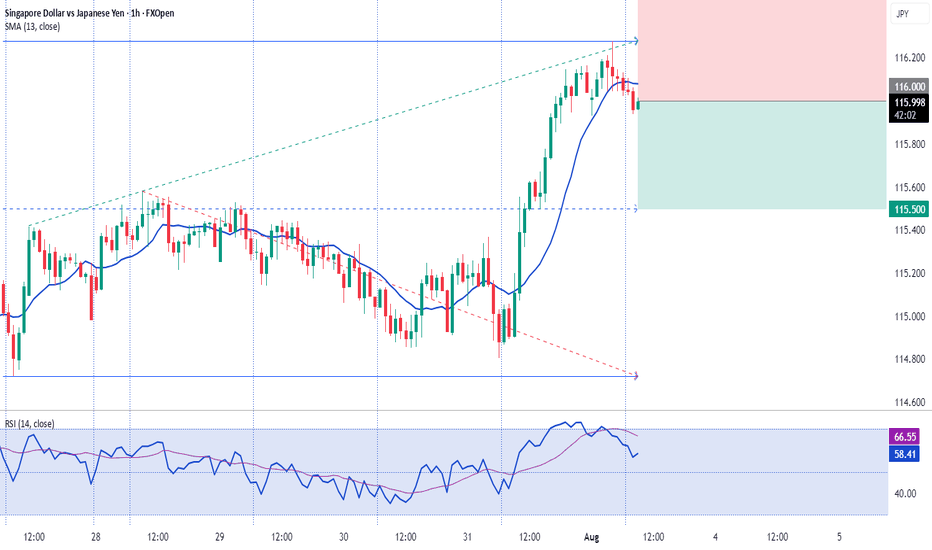

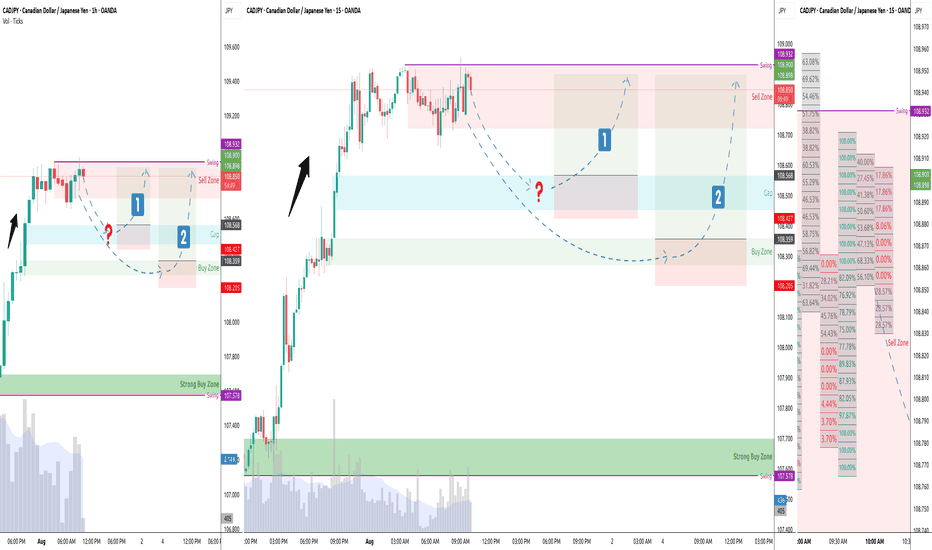

CADJPY Expected Growth! BUY!

My dear friends,

CADJPY looks like it will make a good move, and here are the details:

The market is trading on 107.35 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 107.90

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

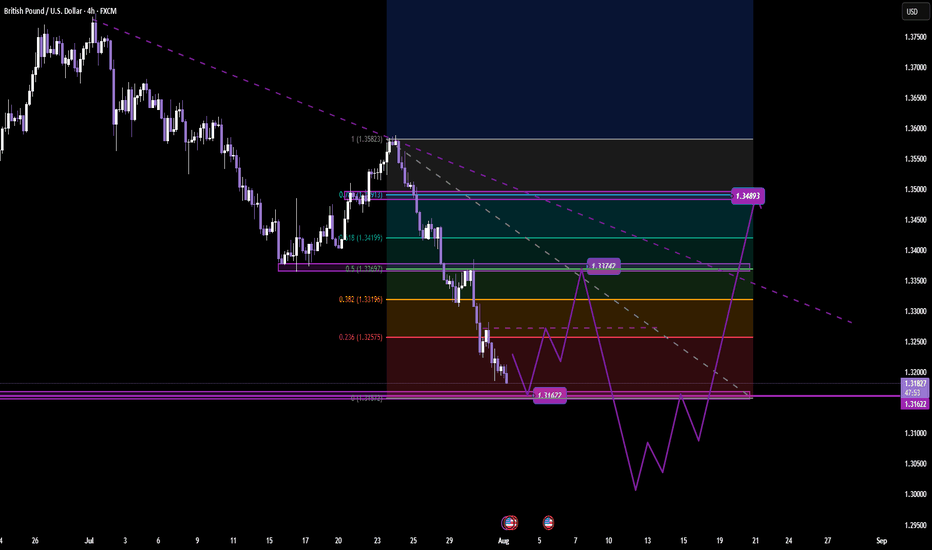

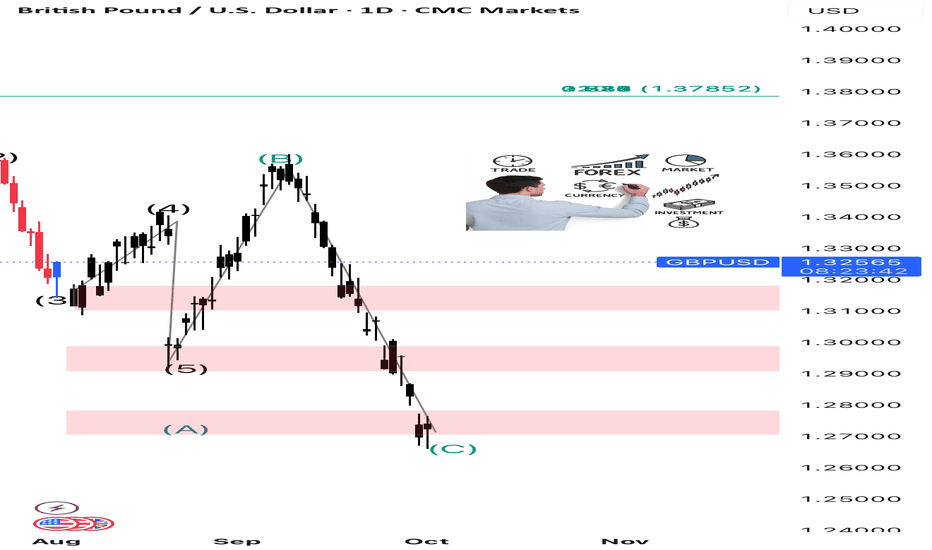

GBP/USD | SMC Roadmap – Clinton Scalper POV🧠 Institutional Structure Overview

GU has been aggressively distributed from the 1.358xx premium zone, creating a strong downward market structure. We now observe:

A clean internal BOS confirming bearish intent

Major liquidity voids left behind

Price currently resting around discount levels (0.236–0.0 zone)

This sets the stage for a "fake recovery" trap before deeper markdown.

📉 Anticipated Smart Money Playbook

🔹 Scenario 1 – Short-Term Internal Rally (Liquidity Grab)

Price may engineer liquidity by forming a corrective retracement toward:

→ First Rejection Zone: ~1.33747 (aligned with fib 0.5 & diagonal internal trendline)

→ Extended Trap Zone: 1.34893 (near fib 0.705 + previous unmitigated OB)

This will allow Smart Money to unload positions before continuation lower. Expect a sharp sell-off post-liquidity sweep.

🔹 Scenario 2 – Continuation Without Full Retrace

If price fails to climb above 1.325xx, we could see an early breakdown after a minor internal rally. Key level to watch:

→ Support-to-Sell Zone: 1.31622

A clean break + retest here opens the way for a bearish expansion toward mid-July lows.

🎯 Key Levels to Monitor

Support Zone: 1.31622 → Valid for potential internal bounce

Short-Term Target if rally forms:

→ 1.33747 → Liquidity Cluster

→ 1.34893 → Final Trap Zone before HTF selloff

Mid-Term Target if breakdown confirmed:

→ 1.3050 → Old demand + final downside imbalance

→ Below 1.30 → Long-term liquidity void

🔍 SMC Takeaways

Premium Zone = Distribution, especially when price is beneath BOS

Discount Zone = Trap/Reload, but not always for bullish continuation

Market seeks efficiency, so every imbalance is eventually filled

True entry is not at key levels, but at confirmations within them (M5/M15 shift after sweep)

🎯 Trade Smart. Think Like Liquidity.

📌 Follow @ClintonScalper for more SMC breakdowns with precision.

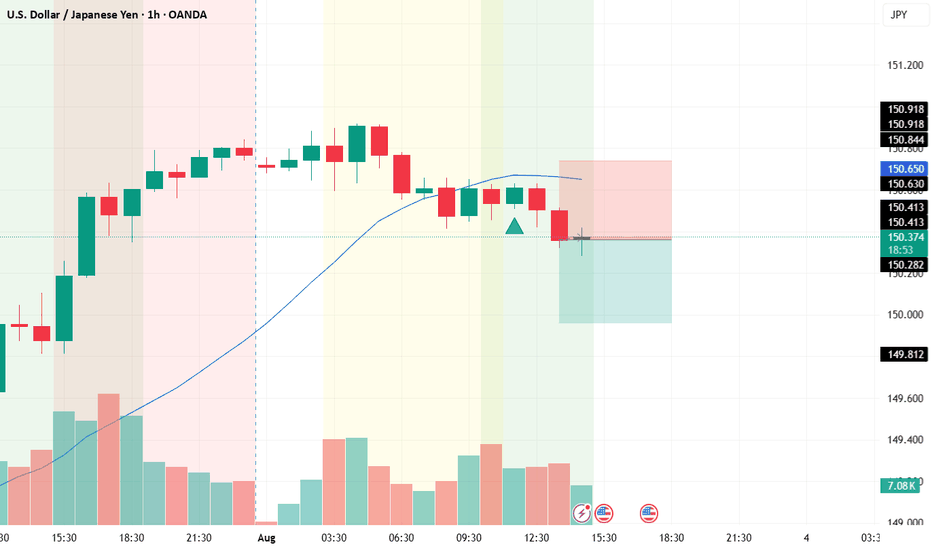

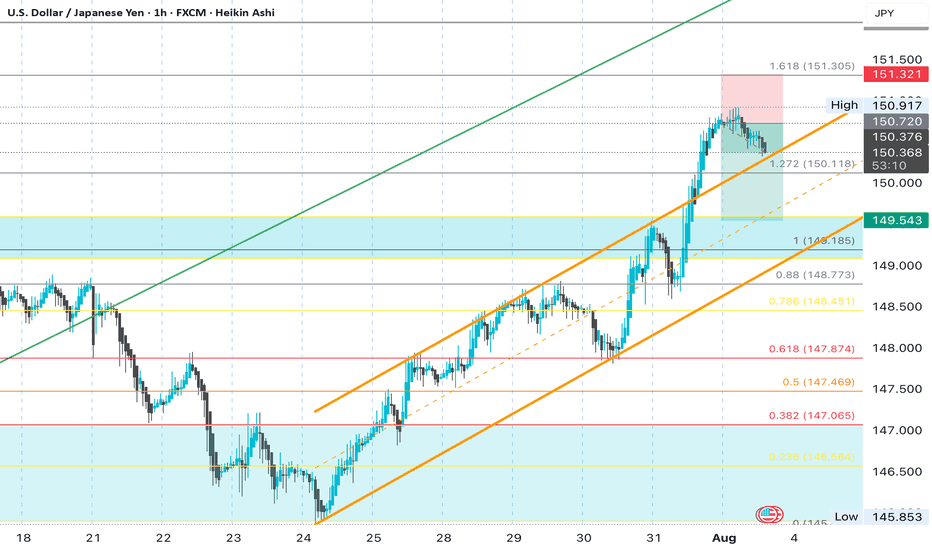

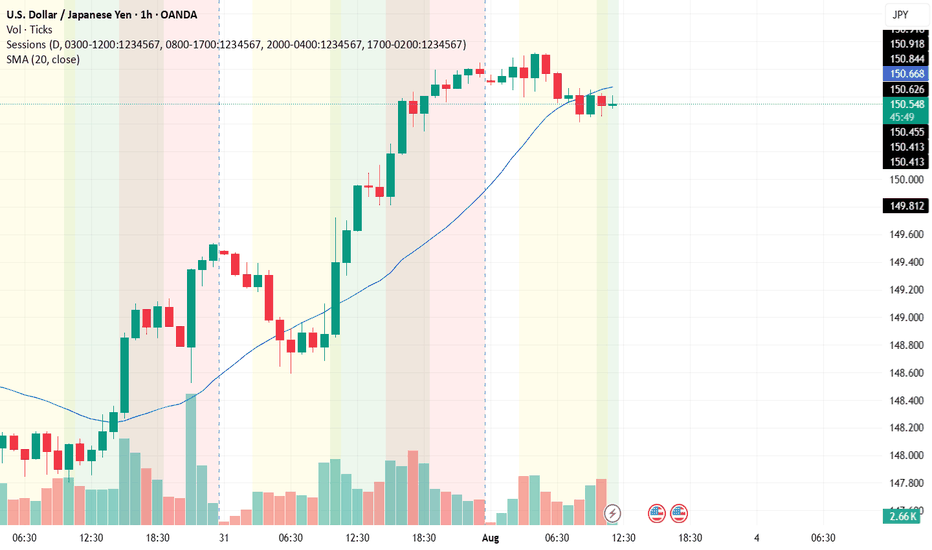

USD/JPYThis is a trade setup for USD/JPY, based on volume and trend analysis.

Entry Price: 150.360

Stop-Loss (SL): 150.740

Take-Profit (TP): 149.963

The trade is intended to be executed instantly at the mentioned price, in alignment with both volume behavior and the current trend direction.

Disclaimer: This setup is shared purely for backtesting purposes and to document trade ideas. It is not financial advice. Always perform your own analysis before making any trading decisions.

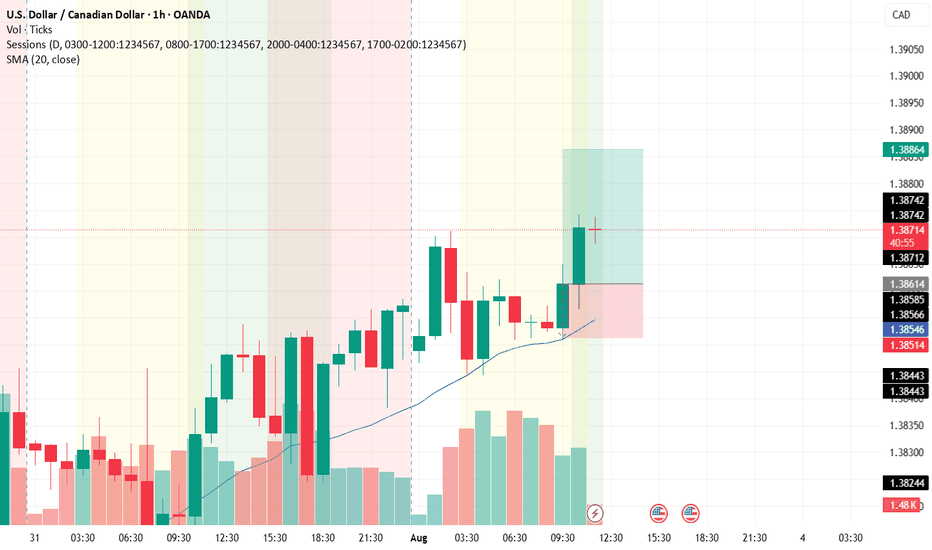

USD/CADThis is a trade setup for USD/CAD, based on volume and trend analysis.

Entry Price: 1.38614

Stop-Loss (SL): 1.38514

Take-Profit (TP): 1.38864

The trade is intended to be executed instantly at the mentioned price, in alignment with both volume behavior and the current trend direction.

Disclaimer: This setup is shared purely for backtesting purposes and to document trade ideas. It is not financial advice. Always perform your own analysis before making any trading decisions.

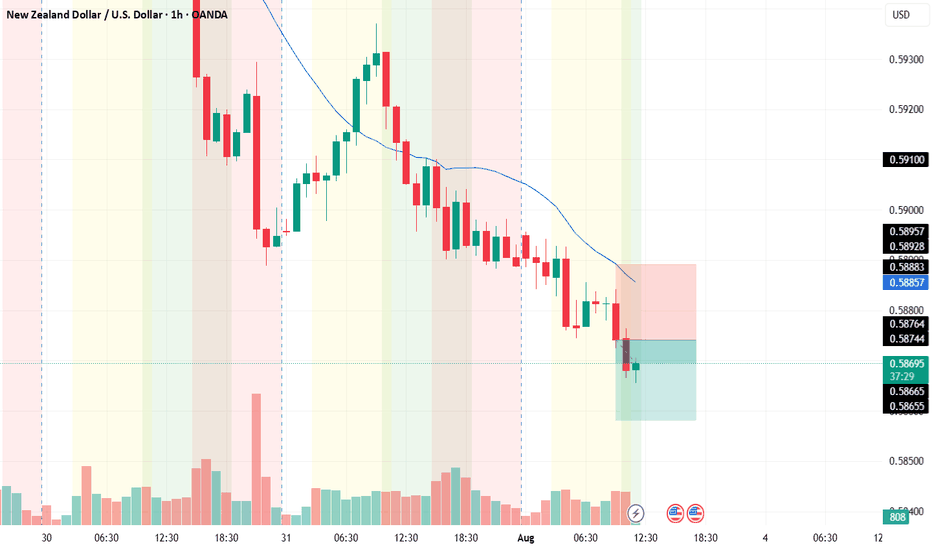

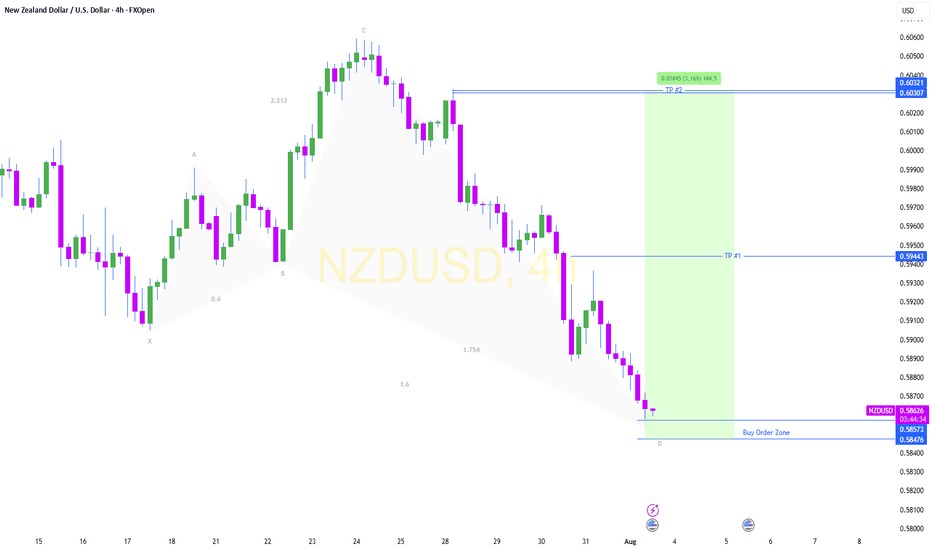

NZD/USDThis is a trade setup for NZD/USD, based on volume and trend analysis.

Entry Price: 0.58742

Stop-Loss (SL): 0.58892

Take-Profit (TP): 0.58582

The trade is intended to be executed instantly at the mentioned price, in alignment with both volume behavior and the current trend direction.

Disclaimer: This setup is shared purely for backtesting purposes and to document trade ideas. It is not financial advice. Always perform your own analysis before making any trading decisions.

Exciting GBP/USD

🚨 **We’re currently deep in wave (2) correction**

What’s unfolding? Most likely a zigzag — or even a double zigzag. Volatility is cooking up something big!

💥 But here’s the real thrill… once this phase wraps up:

📈 **Brace for a fiery wave (3) rally** — a breakout move that could shake up the market 💸

🎯 Ready to ride the next wave? This is not the time to sit back — smart analysis and timely action could make all the difference.

#Forex #TechnicalAnalysis #GBPUSD #OpportunityIsComing

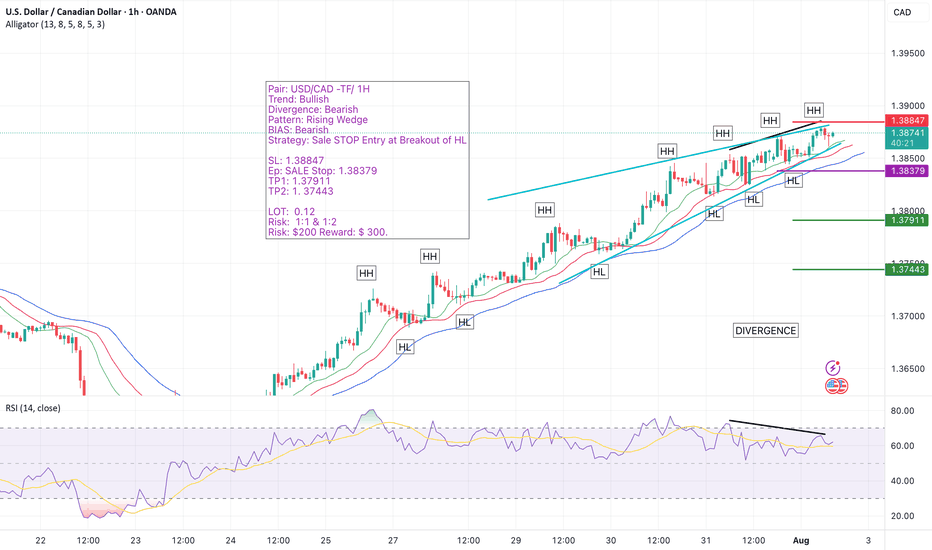

USD/CAD 1H Setup – Bearish Reversal Incoming? We’re closely watching the USD/CAD pair on the 1-hour timeframe, and the chart is flashing multiple high-probability reversal signals.

🔹 The trend has been bullish, but momentum is weakening.

🔹 A clear bearish divergence has formed on the oscillator.

🔹 A rising wedge — one of the most reliable reversal patterns — is fully developed and ready to break.

🔹 All signs point toward an imminent bearish shift, and we're preparing to catch the move early with a Sell Stop below the key Higher Low (HL).

📌 Trade Setup at a Glance:

Pair: USD/CAD

Timeframe: 1H

Trend: Bullish (for now)

Divergence: Bearish

Pattern: Rising Wedge

Bias: Bearish

Strategy: Sell Stop at HL Breakout

🟡 Entry: 1.38379 (Sell Stop)

🔴 Stop Loss: 1.38847

🟢 Take Profit 1: 1.37911 (R:R 1:1)

🟢 Take Profit 2: 1.37443 (R:R 1:2)

📊 Position Sizing & Risk Management

🔹 Lot Size: 0.25

🔹 Risk Per Trade: $200

🔹 Total Reward Target: Up to $300

🔹 Executing two trades – one targeting TP1, the second targeting TP2.

📈 Why This Setup Matters:

✅ Bearish divergence shows clear loss of bullish strength

✅ Rising wedge pattern aligns perfectly with reversal expectations

✅ Well-structured entry with favorable risk-to-reward

✅ Using a split-target strategy to lock in profits smartly

📣 Let’s Discuss!

💬 Drop your thoughts and analysis in the comments — how are you trading USD/CAD?

🔔 Follow me for more high-probability trade setups, chart breakdowns, and real-time analysis. Let’s trade smart and grow together! 🚀

#USDCAD #ForexSetup #RisingWedge #BearishDivergence #PriceActionTrading #SmartMoney #TrendReversal #FXSignals #SellSetup #TradingStrategy #ChartPatterns #BreakoutStrategy #TradeSmart #1HourChart #RiskReward #ForexTrade #TechnicalSetup #TradeIdeas #TradingCommunity #ForexEducation #TradersOfTradingView #SmartEntry #SwingTrading #TradingMindset #TradingViewSetup #ForexAnalysis

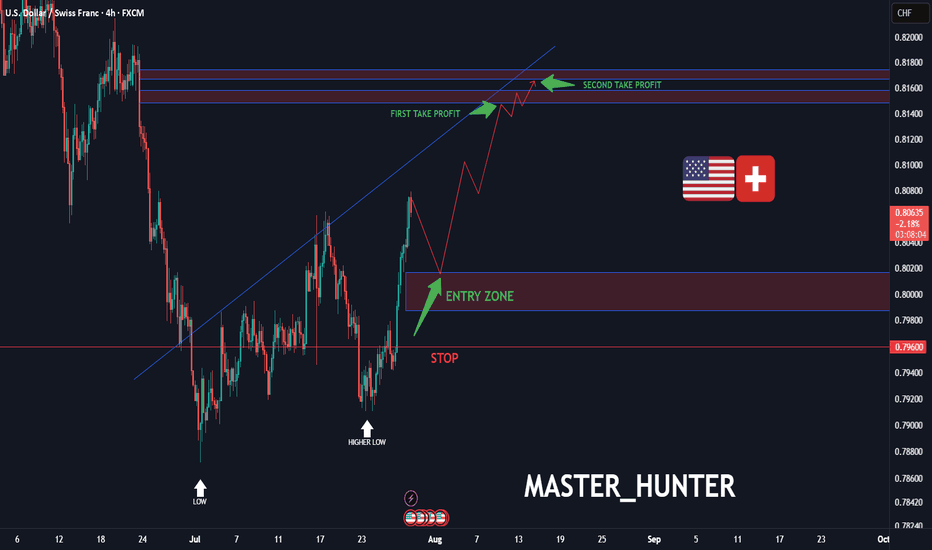

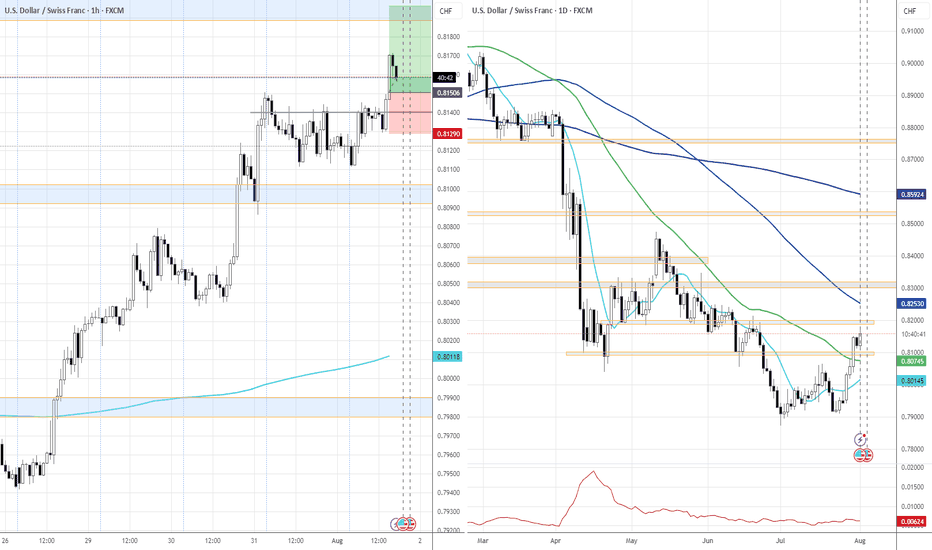

USD/CHF: Swiss Rally Ignited?FX:USDCHF is setting up for a potential rally on the 4-hour chart, with an entry zone between 0.79878-0.80167 near a strong support. First take profit at 0.81485, with a second target at 0.81671 aligning with key resistance. Set a stop loss on a daily close below 0.796 to limit risk. A break above 0.802 with volume could spark this move. Monitor USD strength and CHF economic data. Trade smart!

Share your opinion with me in the comments.

#USDCHF #ForexTrading #TechnicalAnalysis #TradingView #CurrencyPairs #DayTrading #MarketSignals

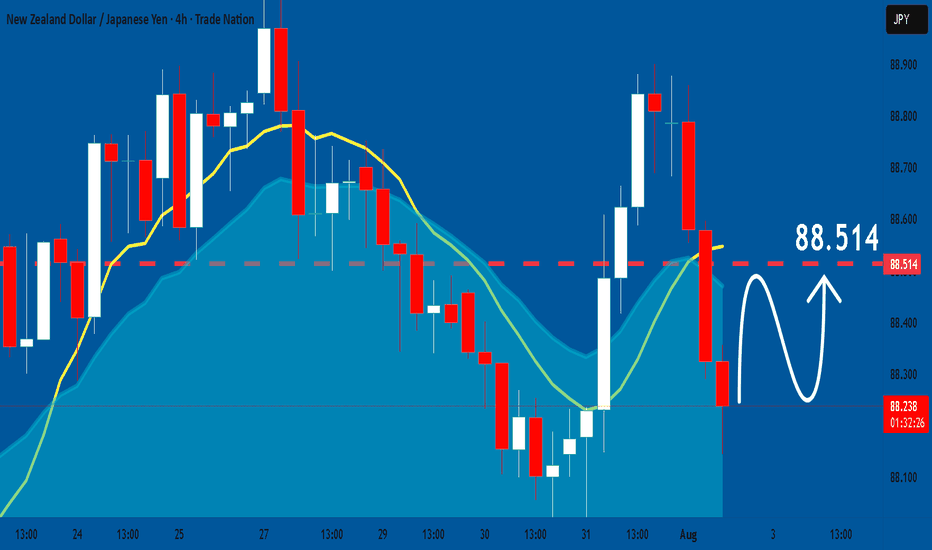

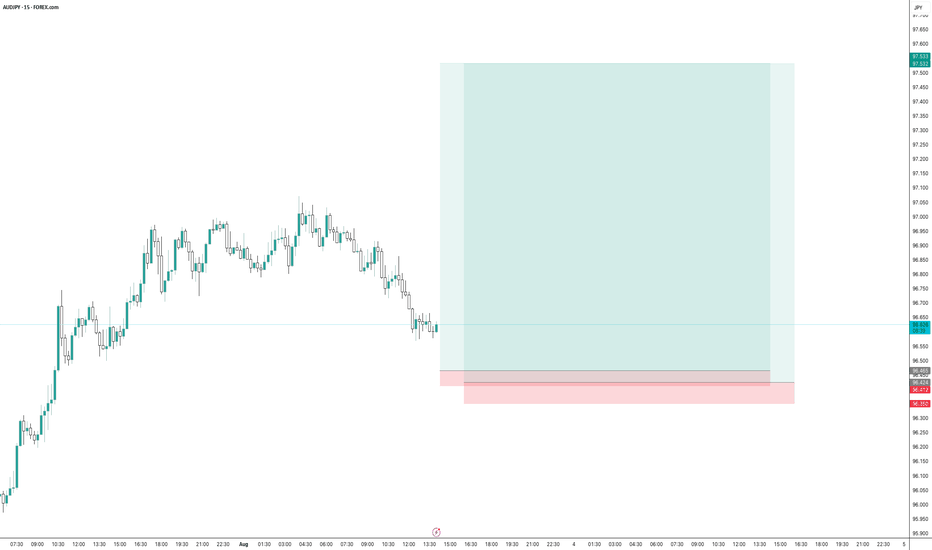

NZDJPY: Bullish Continuation

The recent price action on the NZDJPY pair was keeping me on the fence, however, my bias is slowly but surely changing into the bullish one and I think we will see the price go up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

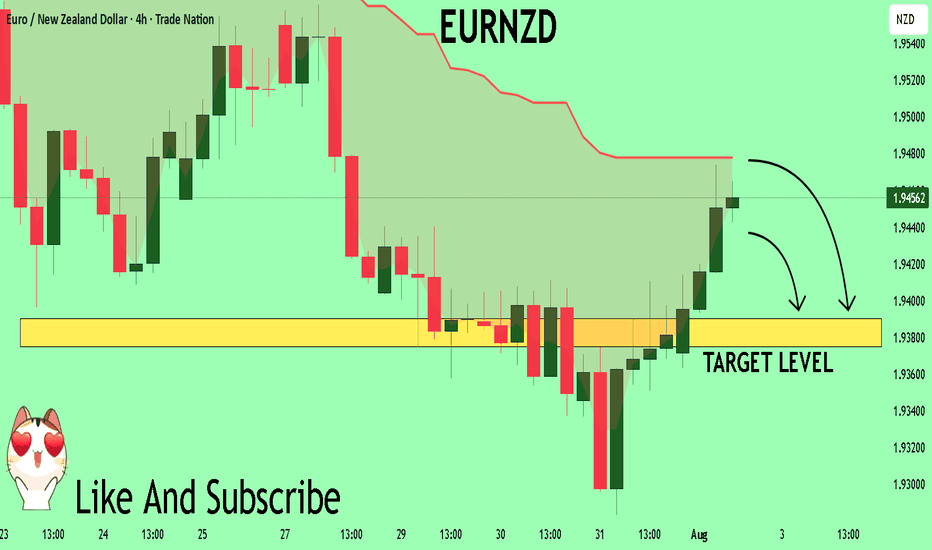

EURNZD Set To Fall! SELL!

My dear subscribers,

This is my opinion on the EURNZD next move:

The instrument tests an important psychological level 1.9459

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.9390

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Second Part ANALYSIS

Part 2: USD/JPY Chart Analysis

It seems that, due to the upcoming NFP news (which will be released shortly), the price is in a state of uncertainty. If the downtrend or price correction continues, this is one possible scenario we could see. However, it might also be better to stay risk-free or even close the trade here.

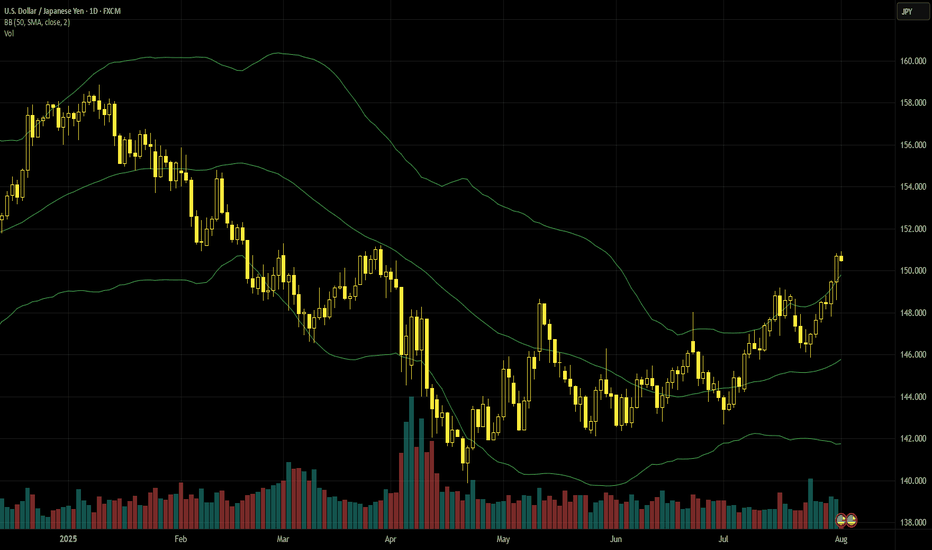

Dollar-yen seems to have made a decisive breakoutBoth the Fed and the BoJ reaffirmed their cautious approaches to changing rates in recent days, but the dollar had the larger boost. The next cut by the Fed isn’t expected until the end of October. While the BoJ upgraded its expectations for inflation this fiscal year, the impact of trade wars on both sides is still developing. Havens haven’t had significant inflows after new tariffs came into force on 1 August.

¥150 is a key psychological area which still hasn’t been clearly broken, so it’d be possible to see consolidation rather than continuation in the near future depending on the results of the upcoming NFP, especially considering overbought signals from the slow stochastic and Bollinger Bands. February and March’s high around ¥151 looks like a possible area of resistance.

The 38.2% weekly Fibonacci retracement definitely seems to have been broken so it might now flip to being a support. Dynamic support could also come from the 200 SMA around ¥148.90. As for euro-dollar, the next immediate movement (or lack thereof) depends mainly on the NFP. Some degree of positive surprise might be priced in since the consensus of 110,000 for total nonfarm seems low relative to the last several months of stronger results.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.

USD/CHF

This is a trade setup for USD/CHF, based on volume and trend analysis.

Entry Price: 0.81473

Stop-Loss (SL): 0.81293

Take-Profit (TP): 0.81673

The trade is intended to be executed instantly at the mentioned price, following confirmation from both volume behavior and the current trend direction.

Disclaimer: This setup is shared purely for backtesting purposes and to document trade ideas. It is not financial advice. Always perform your own analysis before making any trading decisions.