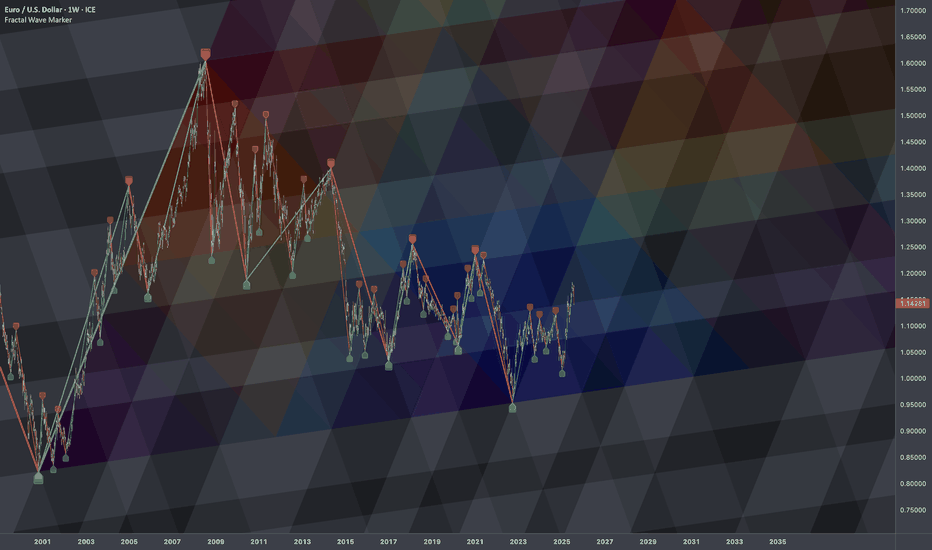

€/$: Fractal Geometry (Cycle 2000-2022)🏛️ Research Notes

Research on order in chaos using scaling laws and math sequences found in nature.

Sierpinski triangle will be used as basic heatmap layer - orienteer for next buildups.

Cross-cycle interconnection 3 cycle knot

Considering the fact that structurally current price is in a new cycle, the core structure which is previous cycle can be extended with another layer that emphasizes phase of the cycle in its angle.

Extended Fibonacci Sierpinski Triangle should look like this:

Forex market

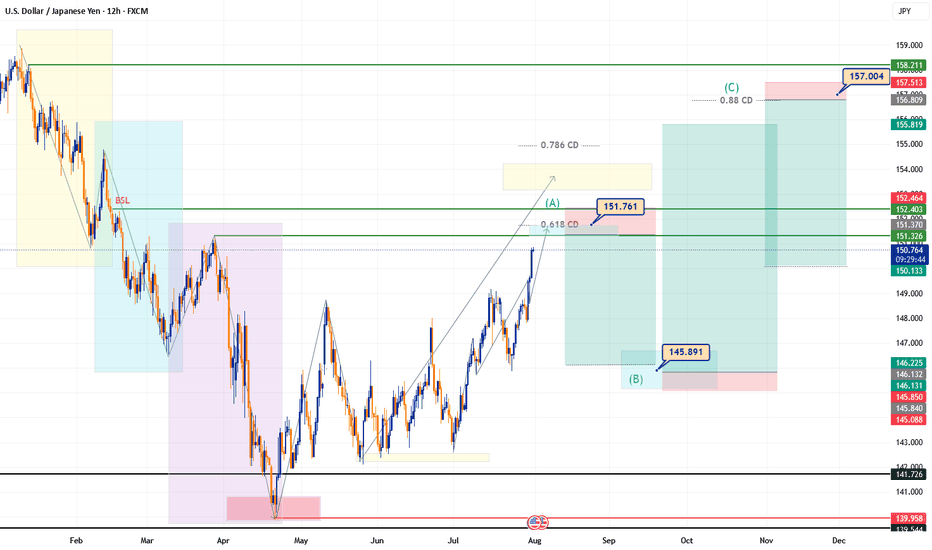

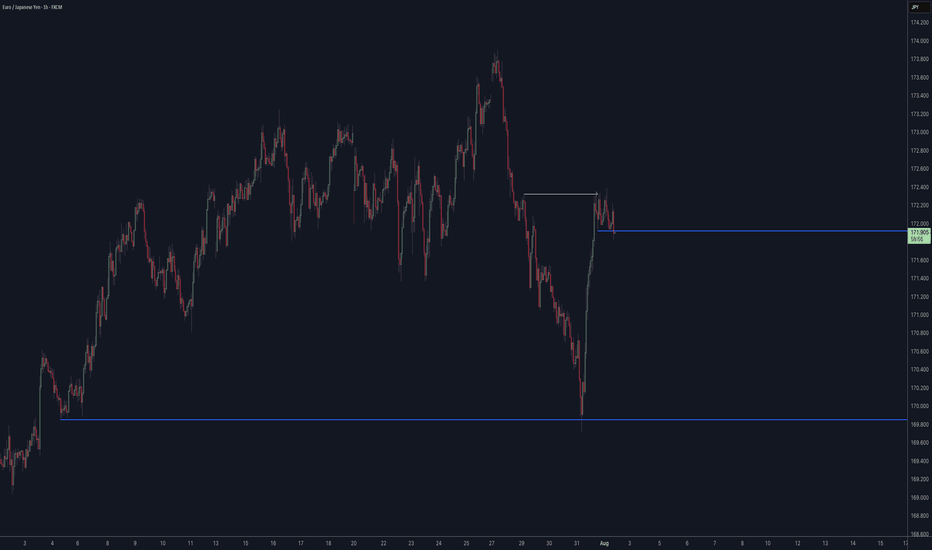

First Monthly Analysis – USDJPYThe USDJPY pair ends the month of July with a strong bullish impulse reaching 150.6, a price area that may signal the exhaustion of the uptrend that has dominated throughout the month.

An ongoing ABC harmonic structure is taking shape, with wave A likely completing between 151.36 and 152.00, which aligns with the 0.618 CD retracement — a confluence that reinforces the zone as a key resistance area.

From there, a potential bearish correction (wave B) may develop, targeting the 145.89 region. If this structure plays out correctly, a final bullish expansion (wave C) could aim for the 157.05 area.

Key Zones for the Week:

Projected exhaustion zone (wave A): 151.36 – 152.00

Expected pullback (wave B): 145.89

Final bullish target (wave C): 157.05

⚠️ Disclaimer

The correction of July’s bullish trend may begin before reaching the expected zone (151.36–152.00) due to liquidity buildup beneath current levels. A premature reversal is possible if institutional players decide to hunt that liquidity before continuing the larger move.

💬 “Sometimes it’s not about if it will get there, but when they let you in. If the party’s heating up above, check if they’re locking the door from below.”

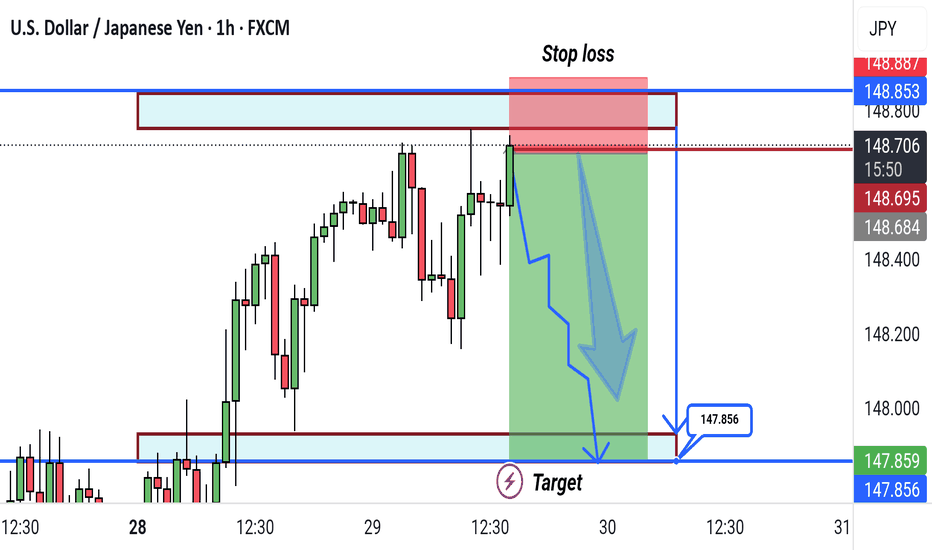

Order Setup (Speculative Idea)

Sell Limit Order

Entry (Open): 151.362

Stop Loss (SL): 152.403

Take Profit (TP): 146.210

Risk–Reward Ratio : 4.79

Use this as a reference setup. Always manage your risk and adapt based on evolving price action

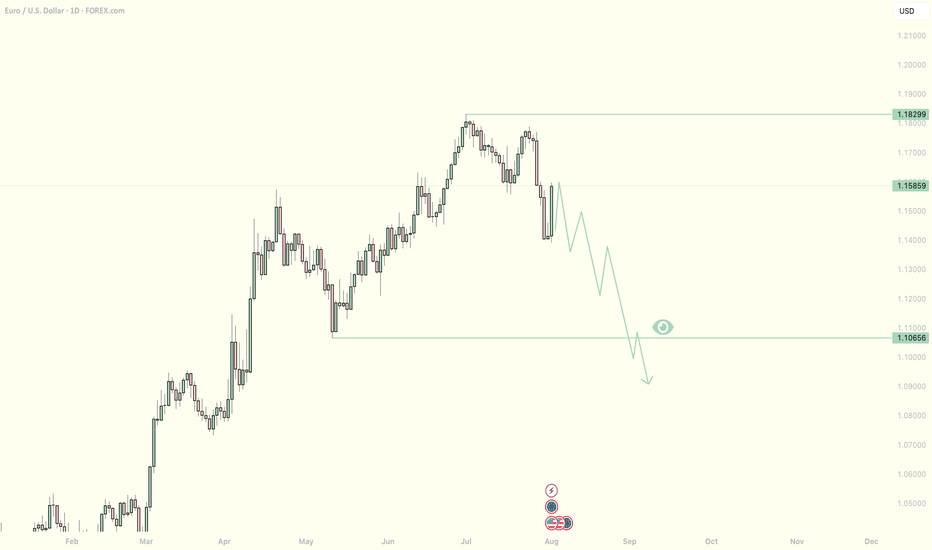

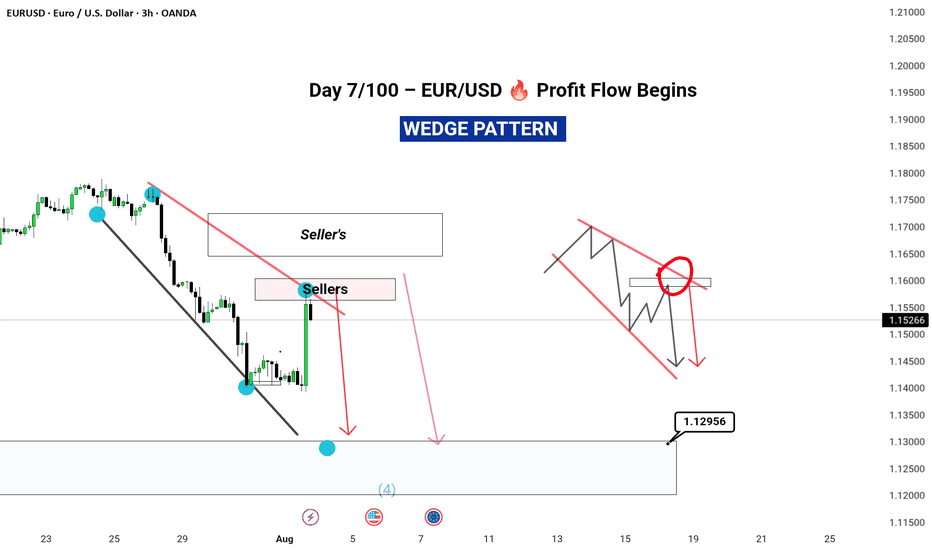

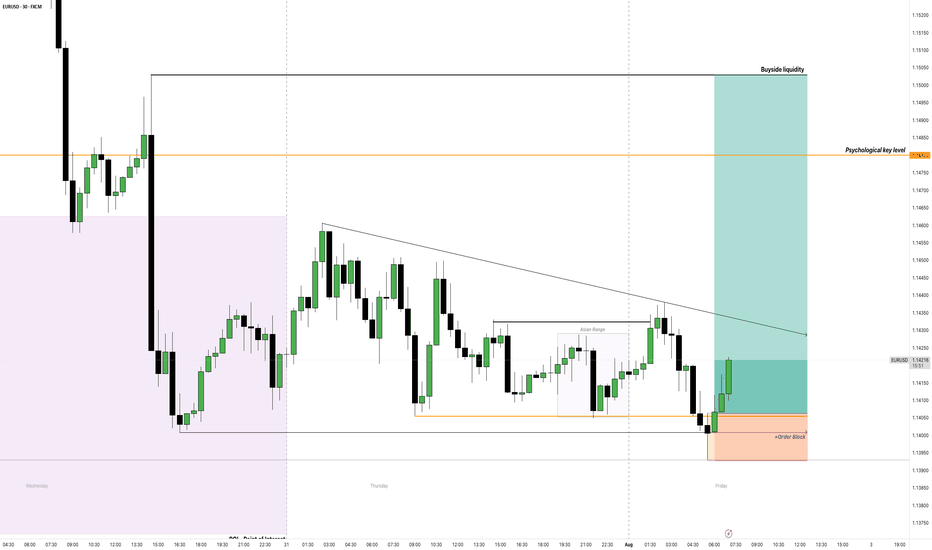

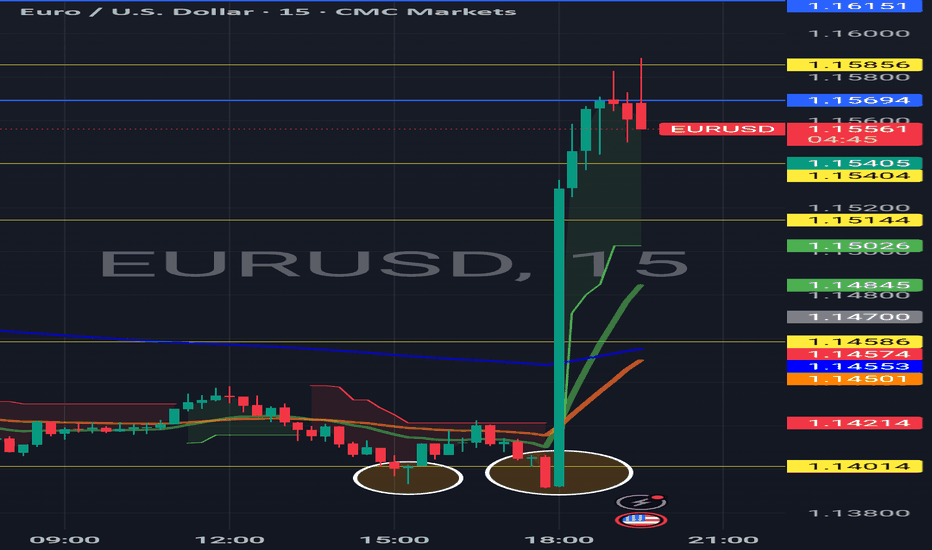

EUR_USD POTENTIAL SHORT|

✅EUR_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching

A horizontal resistance of 1.1632

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

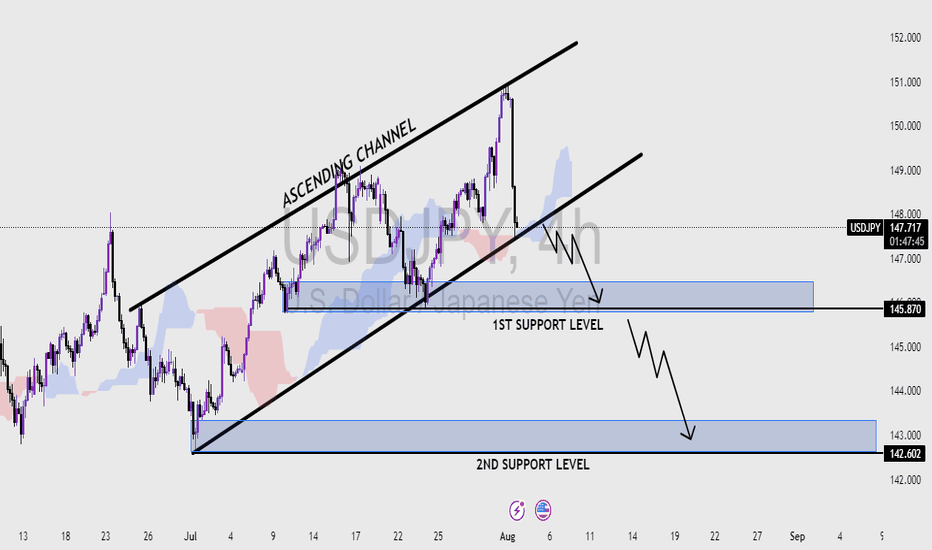

USD/JPY Bearish Setup - Breakout from Ascending ChannelUSD/JPY Bearish Setup – Breakout from Ascending Channel

Price action on USD/JPY has broken down from an ascending channel, signaling potential bearish momentum ahead. The breakdown suggests a possible continuation toward lower support levels.

1st Support Level: 144.800 – 144.200

2nd Support Level: 143.000 – 142.400

Watch for price consolidation or retests at the 1st support level. A clean break below this zone could open the path toward the 2nd support level.

Key Notes:

Bearish volume increase post-breakout

Ichimoku cloud starting to thin, showing weakening bullish momentum

Structure favors selling rallies below the channel

📉 Bias: Bearish

💡 Plan: Wait for confirmation on lower timeframes before entering short positions

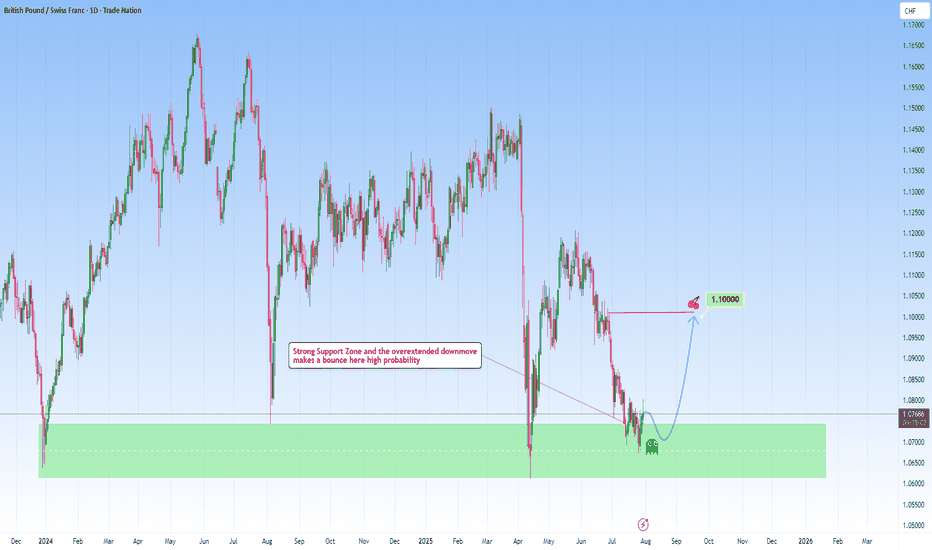

GBPCHF meets strong support: A reversal here is high probabilityLooking at GBPCHF and how it fits within my approach to structure-based trading, this one is really speaking my language.

Price has come down into a key higher-timeframe support zone: a zone that’s proven itself multiple times in the past. Now, price has shown some initial rejection there, making my long position towards 1.1000 a clear, rational target.

What makes this setup different could be the patience behind it. As we let the market complete its downward leg, waited for price to revisit a reliable zone, and now anticipating a bounce back. It’s a move that I’ve captured across my previous charts again and again.

Let me know in the comments what you think

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

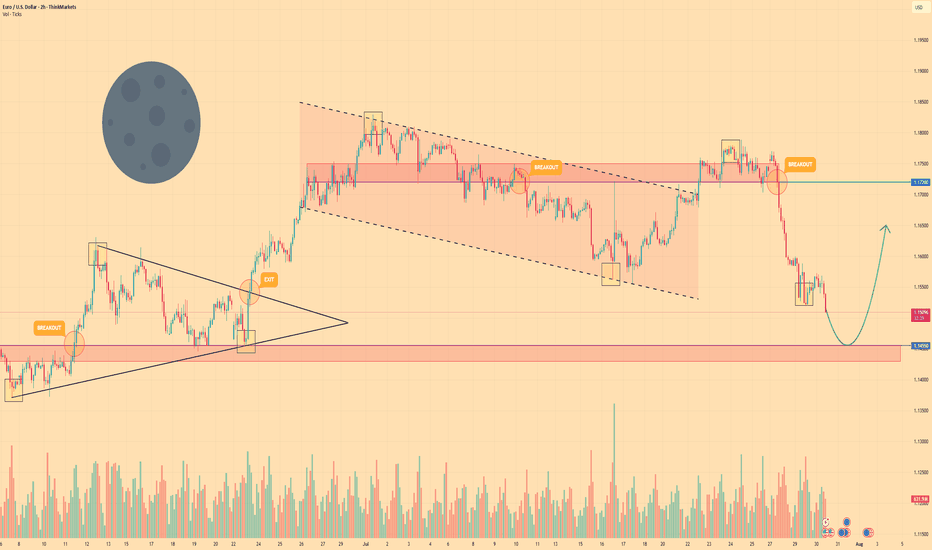

EURO - Price can turn around of support level and rise to $1.165Hi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

The market structure shifted after a breakout from a prior triangle pattern pushed the price higher.

This rally met resistance, and a new bearish trend emerged, creating a distinct falling channel.

The asset made several rotations inside this channel, with the most recent upswing failing at the $1.1720 resistance zone.

That failure to break higher initiated the current strong bearish impulse driving the price down.

Euro is now approaching a critical area of demand, the horizontal support zone near $1.1455.

I expect that buyers will defend the $1.1455 support level, causing a reversal that will carry the price towards the $1.1650 target.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

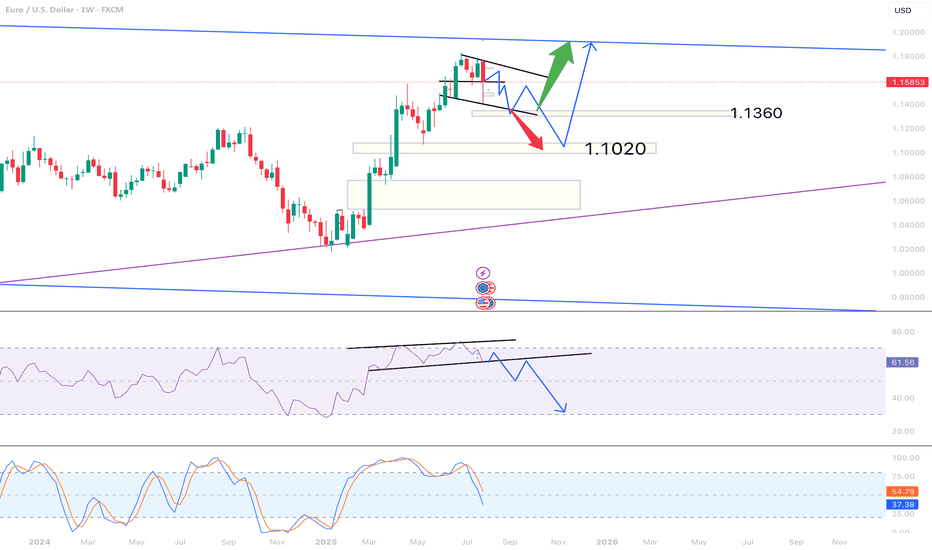

SHORT EURUSD Possible scenarioWeekly chart of EURUSD show potential short coming next coming weeks . MOMENTUM IS UP but the price is declining ,

Two possiblities AT the moment that can play IF ( BIG IF) the price decide to down in the coming days ,

Green arrow show a bounce from 1.1360 area and red arrow show a possiblity for further down to 1.1090.

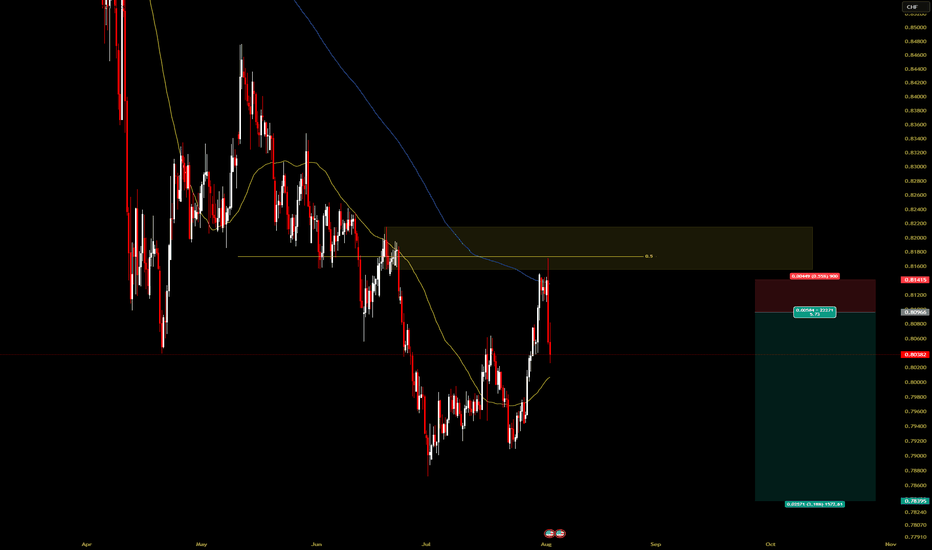

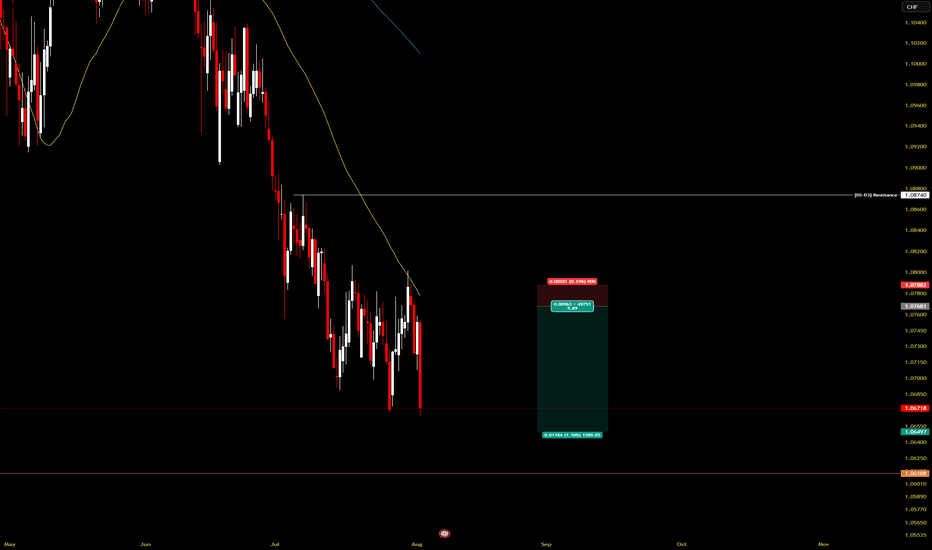

USDCHF SHORT IDEA FULL BREAKDOWNUSD/CHF is flashing a strong bearish signal from both a macro and sentiment perspective.

✅ Bearish USD Drivers:

FOMC Pivot Watch: July meeting minutes hinted at potential rate cuts before year-end due to inflation moderating and soft jobs data.

Rising Swiss Franc Demand: CHF is benefiting from safe haven flows amid escalating tensions in Eastern Europe and shaky U.S. equity markets.

Swiss CPI Stable: Inflation is in check, allowing SNB to maintain their policy stance without pressure.

Institutional traders are reducing their exposure to the U.S. dollar, while retail traders are net long USDCHF — a classic contrarian bearish signal. Seasonality also favors Swiss Franc strength in August. On the macro side, U.S. data is underwhelming: job growth has slowed, services PMI is soft, and inflation metrics (CPI, PCE) are cooling. This has increased expectations for a Fed rate cut later in the year. Meanwhile, the Swiss National Bank remains stable with no urgency to ease policy. Combined with global risk-off sentiment, capital is flowing into CHF, giving it an added edge over the dollar.

Hear me out... I've not been posting much (welcome to adhd/autistic life), but if anyone ever drops me a message, I'm always still trading, so feel free to ask me any questions ever :)

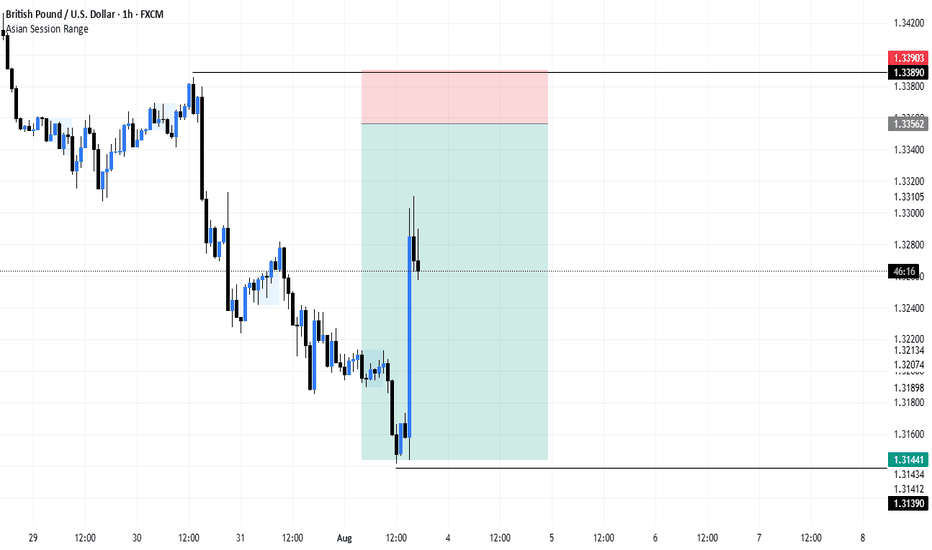

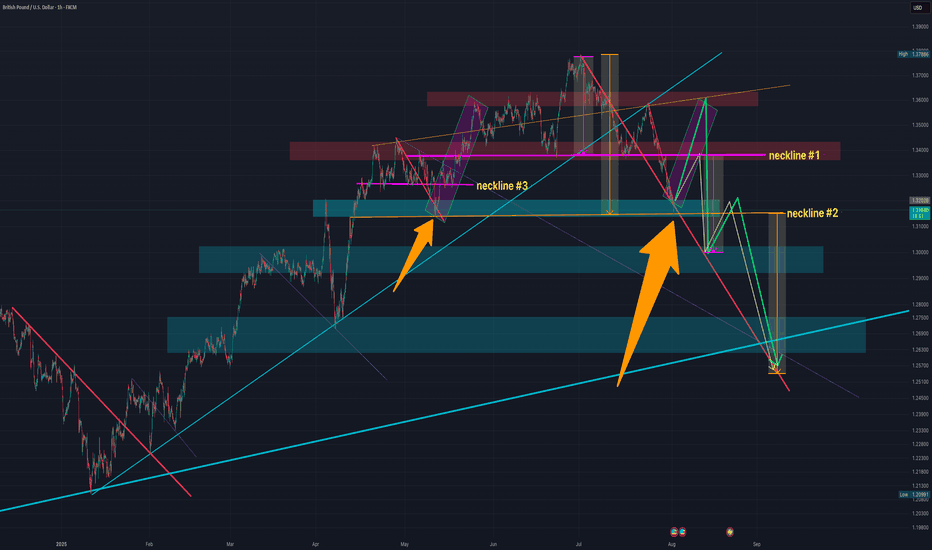

So while much of the tariff movement was priced in with the recent drop from the top (1.38 range), we could (and have seen) an expected fall out, with today being the official tariff announcement/last day from Trump.

This afternoon we have NFP, unemployment rate and PMI.

Based on where we are from a TA standpoint, I imagine these to be positive for GBPUSD (least not much more downfall anytime soon/ much lower than where we bottomed out today).

I'm going to update this idea with further notes, but you can see what we're currently working with and get an idea based on the chart what I'm thinking.

We've got the small H&S pattern at work (neckline #1), and a potentially bigger one at play (neckline #2), and then a previous one which I will discuss in the notes (neckline #3).

You can see across the chart a number of downward resistance lines (red).

I've shown them to express that we can see that every time we cross over the line, while it might bounce off it and then keep dipping further, it never crosses back under.

The only time it does cross back over is usually quite briefly (as per the orange arrows), but it's always short lived.

Case and point, we're not only very close to the current resistance-turned-support red line, but we're also hitting major support area.

This paired with such a big drop out (i.e. we could do with at least some short/mid term reversal) and the possibility of a retest of neckline #1, we've got plenty to work with.

You can see I've posted 2 arrows - one GREEN, the other WHITE.

I'll explain my thesis on that at some point and why I think it could easily cross back over the neckline before continuing to the downside.

We've also got the thin purple lines, which as you can see previously act as a resistance to where the reversal will happen at the lower end of the chart (which lines up with the major support line on the weekly chart, which I'll add to the notes at some point too.

Let me your thoughts.

I have a position open from today's drop to neckline #2, so let's see where it takes us :)

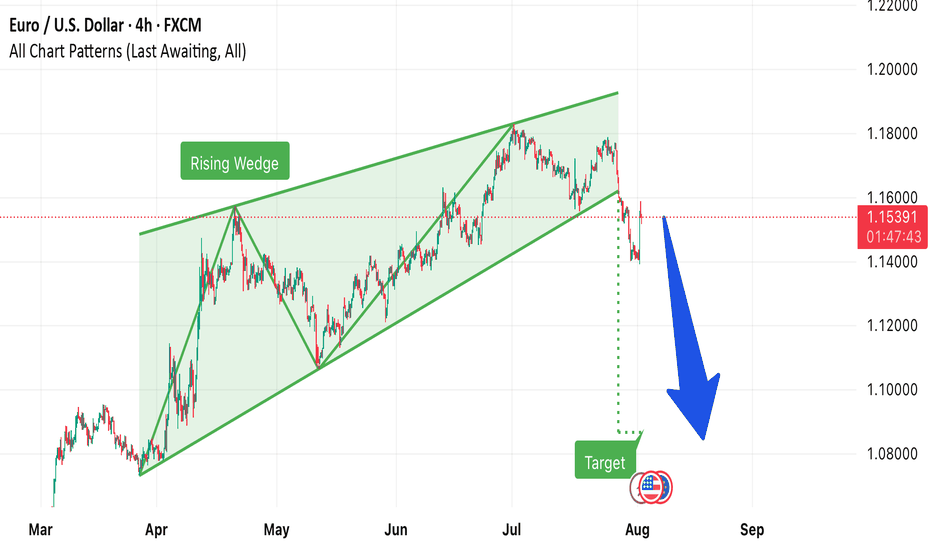

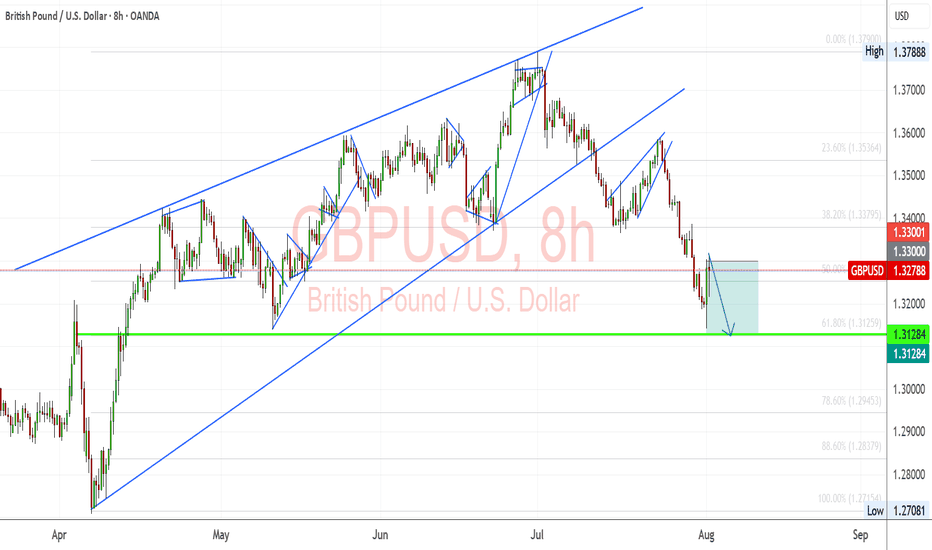

GBPUSD: Bearish Momentum vs. Fundamental Repricing – Key LevelsGBPUSD is at a critical juncture, balancing a clear technical breakdown with a fundamental backdrop favoring near-term volatility. The pair has slipped from its rising wedge structure and is now testing key retracement zones while markets reprice expectations for Fed rate cuts after weak US jobs data. Traders are closely watching whether this bearish momentum will extend toward the 1.3128 support or if a rebound from oversold conditions could trigger a corrective bounce.

Technical Analysis (8H Chart)

Pattern: Clear breakdown from a rising wedge, confirming bearish bias.

Current Level: Price sits near 1.3278, struggling to reclaim the 1.3300 resistance zone.

Key Support Zones:

1.3128 (61.8% Fibonacci retracement) – main bearish target.

1.2945 (78.6% retracement) – extended downside target if selling pressure deepens.

Resistance Levels:

1.3300 (immediate resistance, prior support now flipped).

1.3380 (secondary resistance if a retracement rally occurs).

Projection: Likely bearish continuation toward 1.3128, with a potential retest of 1.3300 before continuation.

Fundamental Analysis

Bias: Bearish in the short term, but Fed policy and risk sentiment remain key drivers.

Key Fundamentals:

USD: Weak NFP (73K), higher unemployment (4.2%), and downward revisions boost Fed cut bets (~75% for September), typically a USD-negative factor.

GBP: BOE maintains a cautious stance due to sticky inflation but lacks clear hawkish conviction as growth slows.

Tariffs: US tariffs add a mild negative weight on GBP trade sentiment.

Risks:

Hot US CPI could slow Fed cut bets, supporting USD.

Hawkish BOE comments could limit GBP downside.

Global risk sentiment shifts could either favor USD (risk-off) or weaken it further (risk-on).

Key Events:

US CPI and PPI for USD direction.

BOE policy updates and UK CPI.

US jobless claims and Fed commentary.

Leader/Lagger Dynamics

GBP/USD is a lagger, mainly reacting to USD shifts. However, its moves directly influence GBP crosses such as GBP/JPY and GBP/CHF.

Summary: Bias and Watchpoints

GBP/USD remains in a bearish phase, targeting 1.3128 with a potential corrective bounce toward 1.3300 first. The primary driver is the technical breakdown, while fundamentals add volatility around US CPI and BOE policy. If CPI surprises lower, the bearish outlook could reverse into a short-term rebound; if CPI is hot, downside momentum could extend. You should monitor USD-driven events closely as GBP/USD sets the tone for broader GBP movements.

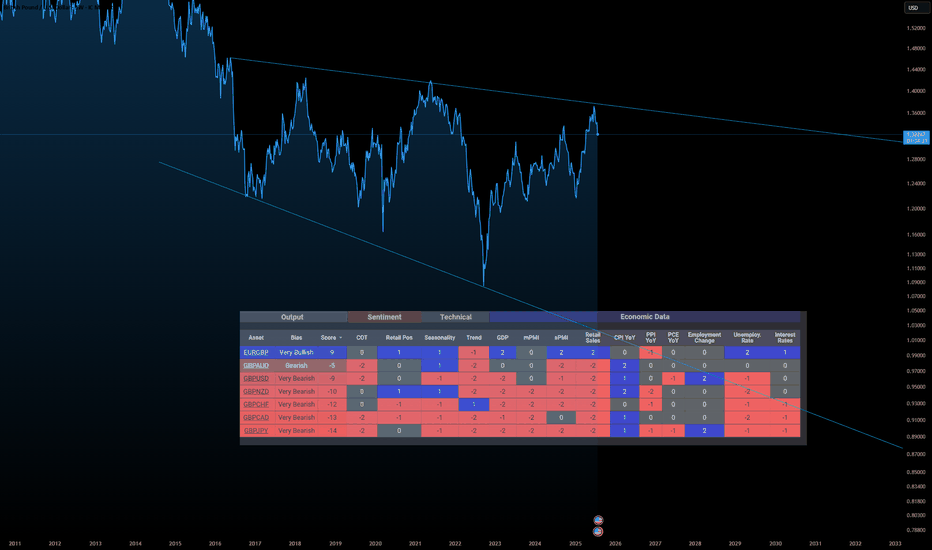

GBPCHF RETAINS BEARISH MOMENTUMInstitutional (COT) data shows a net reduction in GBP exposure, suggesting big money is pulling out of the pound. Retail sentiment also leans heavily against the trend, with traders buying the dip — another contrarian bearish signal. Seasonality does not favor the pair in August either, with historic trends leaning against GBP performance this time of year.

On the macro side, UK economic data continues to weaken. Both manufacturing and services PMI are deteriorating, indicating contraction across sectors.

Retail sales and GDP growth are negative, while inflationary pressure is easing — all of which reduces the urgency for further BOE tightening. Employment metrics are also weak, with poor job creation and falling labor market momentum.

Meanwhile, Switzerland is showing relative macro strength. The SNB is benefiting from stable inflation and its traditional safe-haven appeal, which is further boosted by rising global risk-off sentiment. Interest rate expectations are neutral for CHF but increasingly dovish for the UK, creating clear policy divergence in CHF’s favor.

“Exactly What I Saw” promises value and transparency.

In today's analysis, I’ve identified a clear completion of Wave D, securing a 3% ROI across just two trades – all before the move unfolded.

🔍 What’s inside this breakdown?

• Multi-timeframe analysis: Weekly ➝ Daily ➝ 4H ➝ 1H

• Elliott Wave structure with confluence zones

• Trade psychology at key turning points

• Exact entry & exit insights explained

• Risk management for consistent returns

---

⚡ Highlights:

Precise reversal spotted before it was obvious

No indicator clutter – just clean, confident price action

Part of my 100-day breakdown series: real, raw, and repeatable setups

---

👣 Day 7 of 100 is just the beginning.

Tap Follow to stay ahead of the market – one wave at a time.

#EURUSD #ForexAnalysis #ElliottWave #Forex #TradingViewUK #SwingTrading #PriceAction #RiskReward #FXMindset #ForexTradersIndia #ForexEducation

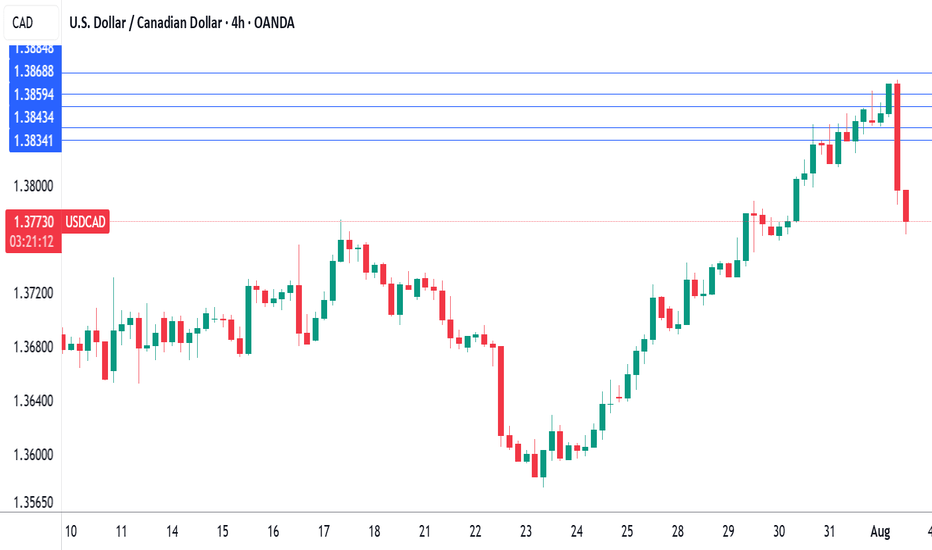

Canada's GDP contracts, US nonfarm payrolls misses forecastThe Canadian dollar continues to lose ground against its US counterpart and is trading at two-month lows. In the European session, the Canadian dollar is trading at 1.3875, down 0.13% on the day. USD/CAD has risen for six straight days, climbing 1.9% during that time.

US nonfarm payrolls for July were softer than expected at 73 thousand, compared to the forecast of 110 thousand. The June report was revised sharply downwards to 14 thousand from an initial 147 thousand.

Canada's GDP posted a small decline of 0.1% m/m in May, matching the market estimate. This followed an identical reading in April, as the economy is essentially treading water. A drop in retail trade was a significant factor in the weak GDP reading, particularly in motor vehicles and parts.

The decline in GDP in April and May can be squarely blamed on the trade war with the US, which has put a chill in economic activity. The markets are expecting a slight improvement in June, with an estimate of a 0.1% gain.

The Bank of Canada held the benchmark rate at 2.75% on Thursday for a third consecutive meeting. The rate statement noted that US trade policy remains "unpredictable" and Governor Macklem reiterated this at his press conference, saying that "some level of uncertainty will continue" until the US and Canada reach a trade agreement.

Meanwhile, the trade war between the two sides is heating up. President Trump announced on Thursday that the US was slapping 35% tariffs on Canadian products, effective Aug. 1. The new tariff will not apply to goods covered under the US-Mexico-Canada Agreement.

Canada's Prime Minister Mark Carney said he was "disappointed" with the US decision and vowed that "Canadians will be our own best customer". These are brave words, but Carney will be under pressure to reach a deal with the US, as 75% of Canadian exports are shipped to the US and Canada can ill-afford a protracted trade war with its giant southern neighbor.

GBP weakness + USD gaining bullish momentumFX:GBPUSD 🧠 What’s Driving GBP Weakness?

❄️ Cooling Inflation: Slows BoE policy tightening

🔻 Contracting Manufacturing: PMI deep in the red

🛍️ Falling Retail Sales: UK consumers are pulling back

💼 Labor Market Cracking: Recent jobs data may be peak

💣 BoE Dovish Pivot Incoming: Markets are anticipating future cuts in 2025

🇺🇸 USD Strength: Fed holding steady, US macro much stronger than UK

🧭 Extra Confluence: USD Strength

USD is being supported by:

Strong US labor market 🟢

Higher for longer Fed 🟢

Global risk-off sentiment 🟢

Positive divergence in US CPI and Retail Sales 🟢

📌 GBPUSD is not just a GBP short — it’s a USD long play too.

🧩 Historical Price Action Pattern

In 2023 Q3, GBP/USD dropped nearly 700 pips in 6 weeks during similar macro shifts — soft BoE + strong USD.

We may be setting up for a repeat pattern now.

🗣️ What’s Your Take?

Are you looking to short GBP/USD this month?

Where’s your target or trigger zone?

Let’s compare setups ⤵️

I’m sharing more breakdowns weekly — follow for macro + technical convergence trades.

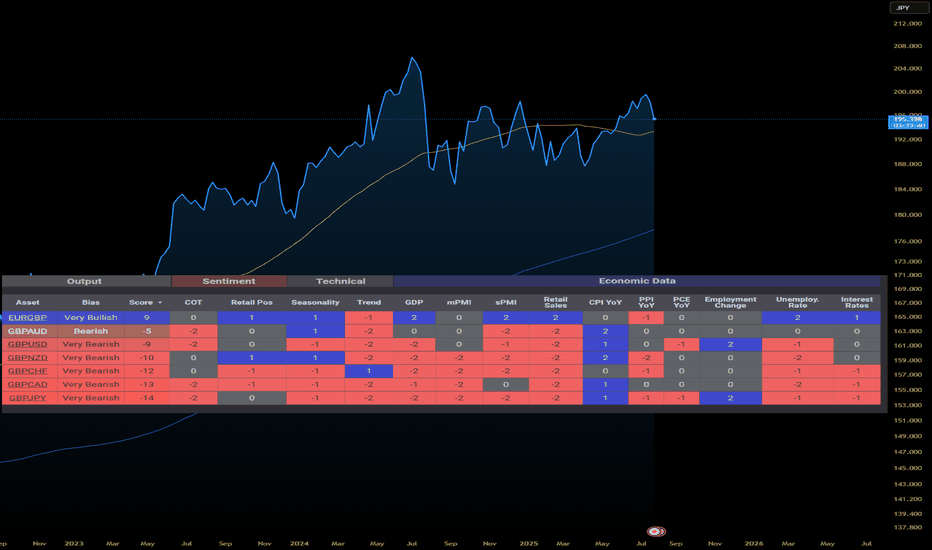

GBPJPY Fundamentally Bearish🧠 Macro-Fundamental Breakdown

🇬🇧 GBP (British Pound)

🔻 GDP Shrinking: UK growth has stalled with below-trend GDP prints 3 quarters in a row.

📉 PMI Weakness: Manufacturing and Services PMIs both under 50 = economic contraction

🧊 Retail Sales Down: UK consumer confidence and demand are cooling

💼 Labor Trouble: Unemployment ticking higher + BoE hinting at peaking rates

🪙 BoE Dovish Pivot?: Market now pricing possible cuts into early 2025.

🇯🇵 JPY (Japanese Yen)

🟢 Inflation is ticking higher

🔄 BoJ is cautiously shifting from ultra-loose policy

🛡️ Yen often strengthens in risk-off environments (which aligns with current market volatility)

🇯🇵 Tokyo CPI surprises have reinforced JPY support

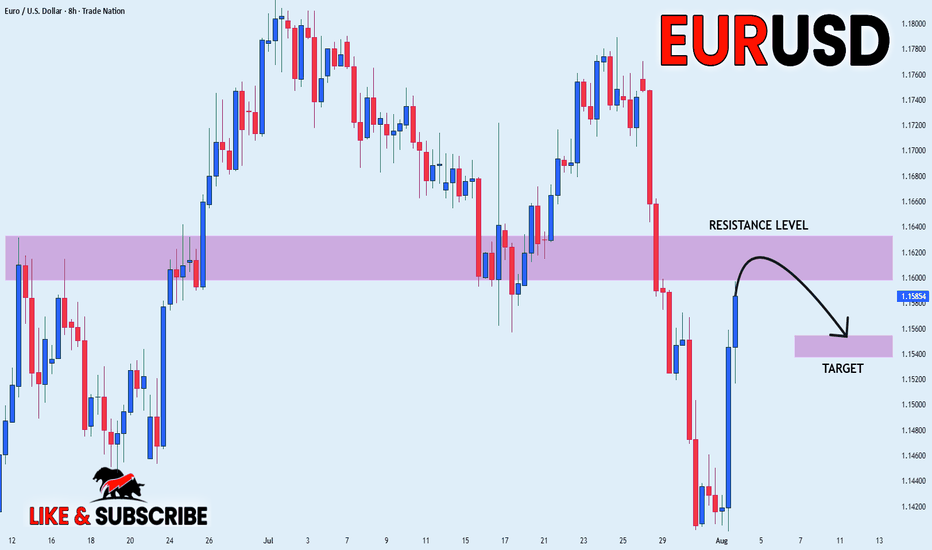

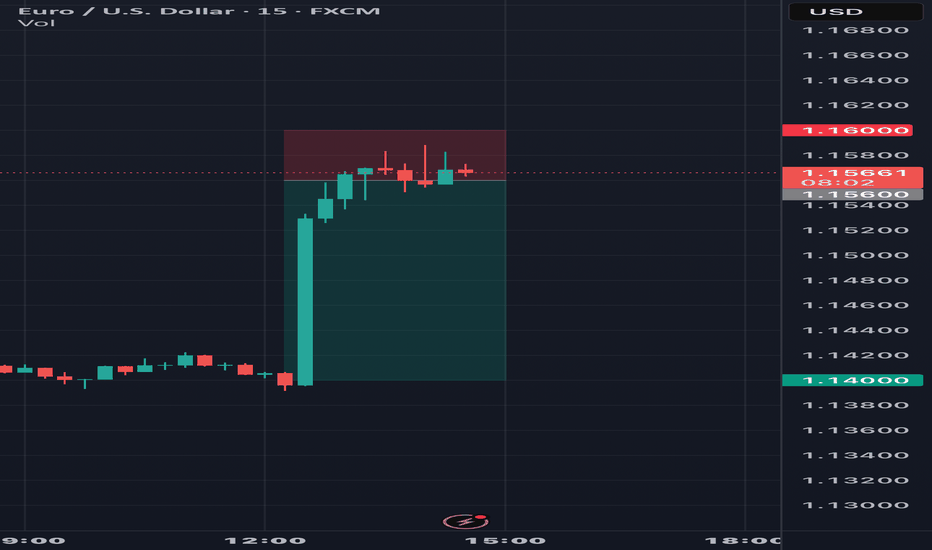

TRADE IDEA – EUR/USD SHORT (T2 TRAP REVERSAL)🔻 TRADE IDEA – EUR/USD SHORT (T2 TRAP REVERSAL)

📍 ENTRY ZONE: 1.1560 – 1.1580

🎯 TARGETS:

• TP1 = 1.150

• TP2 = 1.140

• TP3 = 1.130

• TP4 = 1.120

🛡️ STOP LOSS: 1.1600 (above Tier 2 trap extension)

📐 STRUCTURE SNAPSHOT:

• T1 (Macro): 🔻 Down

• T2 (Structure): 🔻 Trap Zone Active (161.8%)

• T3 (Execution): ⚠️ Rejection confirmed via M1 spike + engulf

• T4 (Micro): 🧨 Trap spike → lower high forming

📊 EXECUTION LOGIC:

• M1 rejection at 1.1580 confirmed

• Bearish engulf candle formed post-spike

• Multiple shorts laddered (1.1565 / 1.1580)

• SL held above extension zone

• Price now below both entries

🚦 TRADE STATE: ⚔️ ARMED

• Add-on only valid under 1.1560

• SL trail after 1.1550 break

• No long bias unless 1.1610 breaks with body close

#Renko #FractalCodex #EURUSD #ShortSetup #TrapReversal #Fibonacci #PriceAction

My Trading Journal on EU 01.08.2025On the first day of August 2025, I am entering a new month filled with opportunities. I am eager to see how the EU performs today, as it has influenced my last two trades. I hope that today marks either a strong or weak start to the month. Let's see how the market reacts in New York.

Be cautious with your trades and remember to pay attention to the high-impact news today: the Non-Farm Payrolls (NFP) and Employment Change reports.