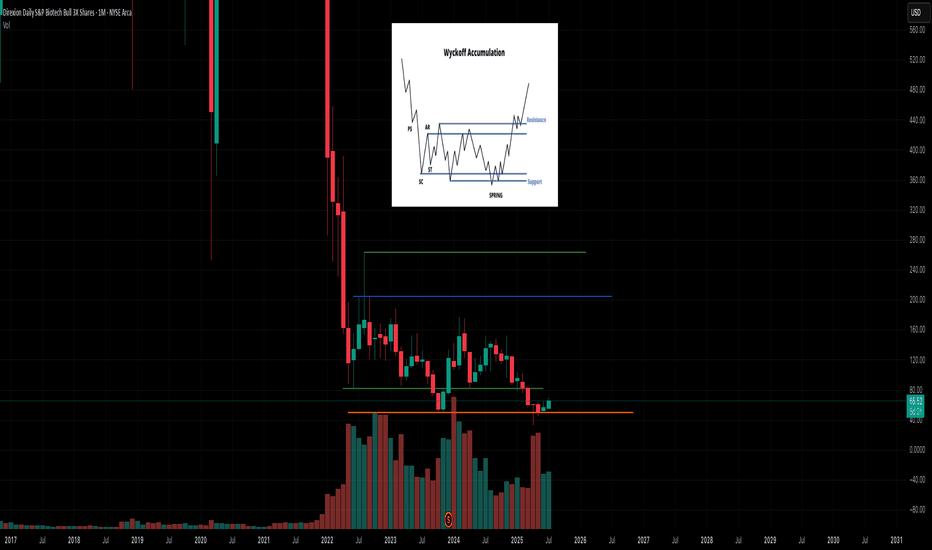

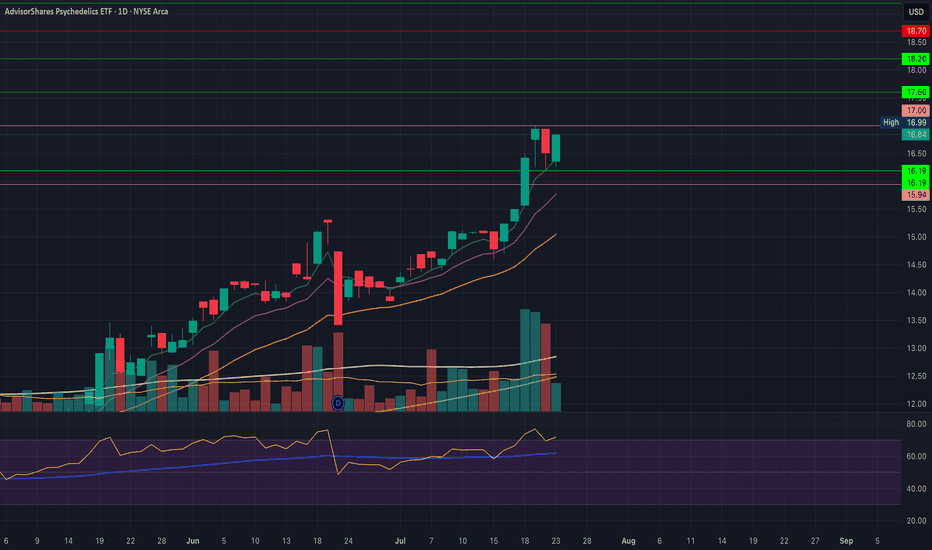

If you can hold for 2 years could be a nice entry around here haLooks to be in a very SLOW accumulation process. We will have a BIO-tech revolution it's inevitable; just make take years before it actually manifests in the sector. I have psoriasis and the should be a FKIN cure by now rofl. BS. AI will make it happen. MONTHLY CHARY

ETF market

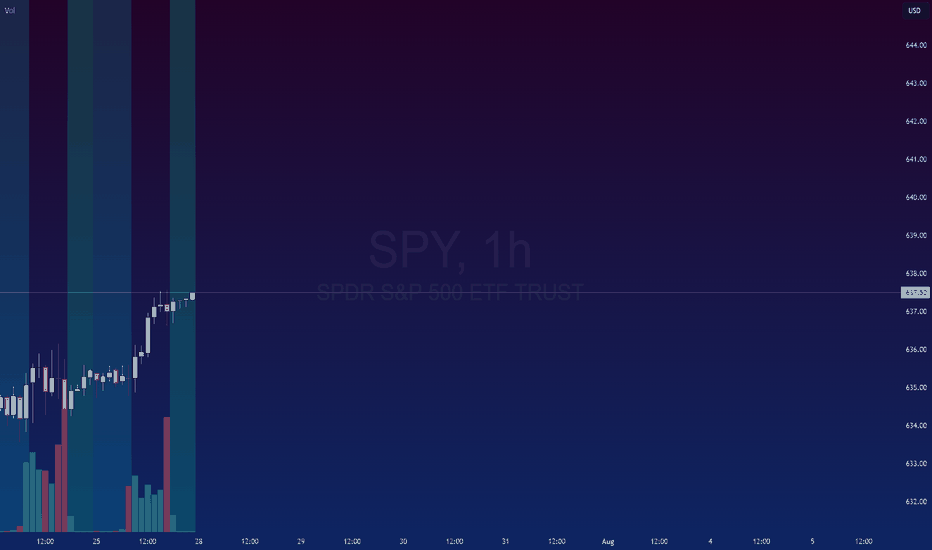

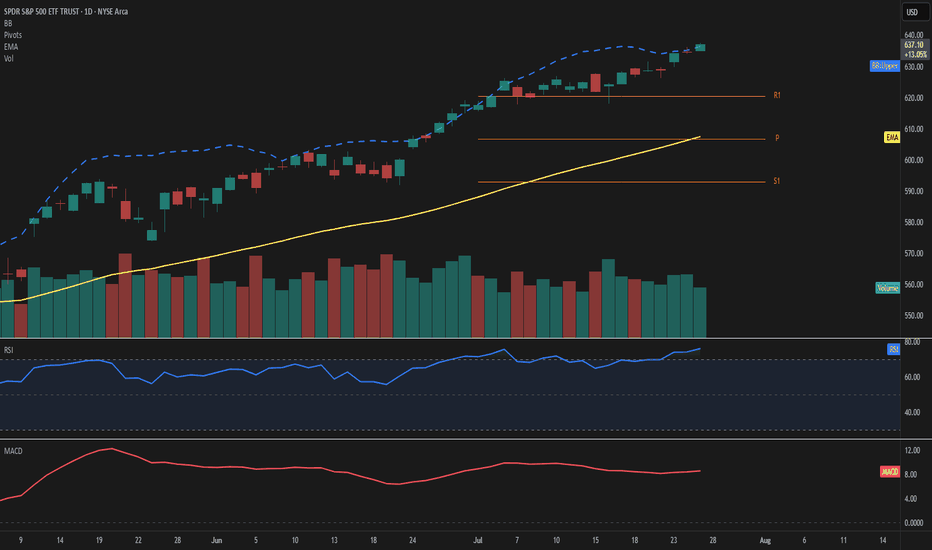

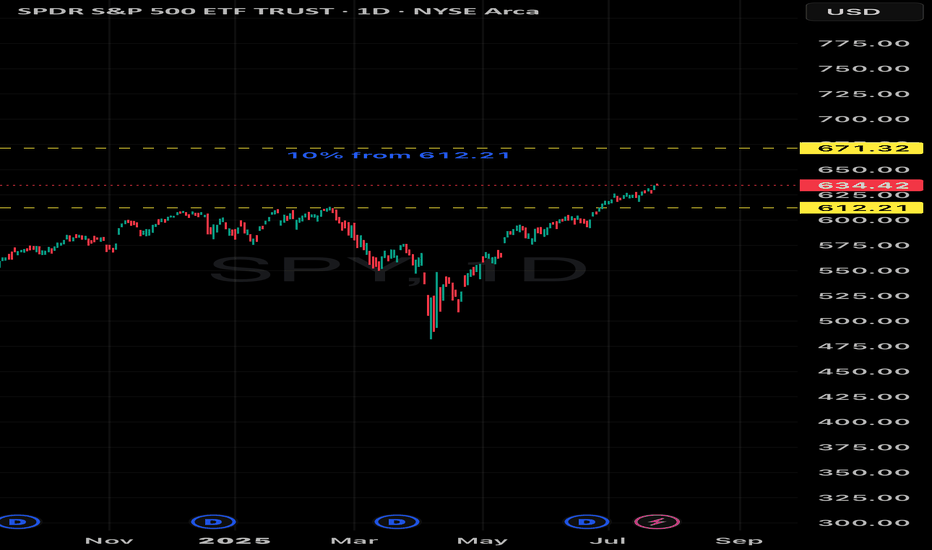

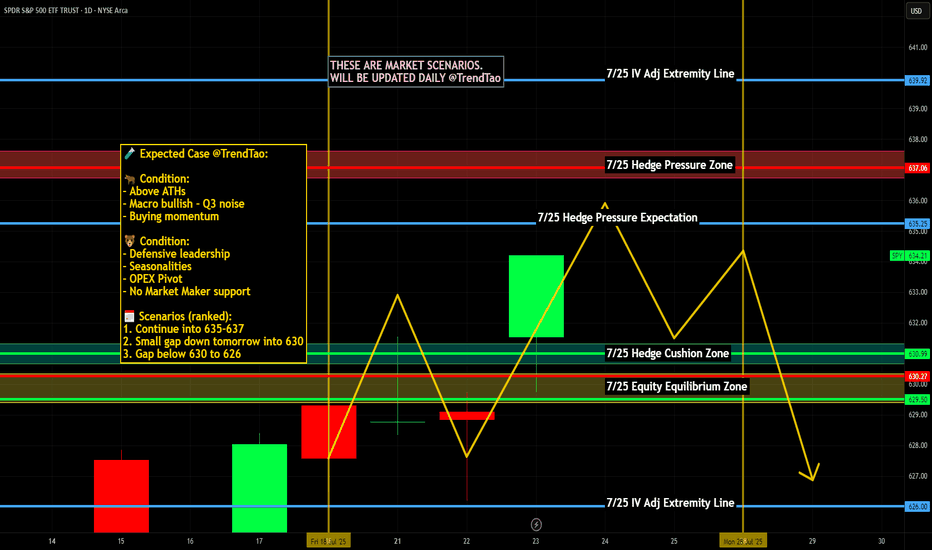

Spy.. 650 topLooking for a top this week

The top of this monthly trendline dating from 2009 should be tagged this week around 643-645.00. As you can see price can grind up here for weeks until the BIG drop.

That grind would possibly be distribution with

A range trade of 620-640 for the month of august. historically Sept is very bearish and could see a drop back below 600 then.

Summer price action looks like so

Smaller price action (Tradeable technicals)

Bull flag early July has us squeezing up this last leg here..

If we gap up Sunday night then i like the short around 638ish

If we gap down and flush i like the dip buy around 634 gap close with the next target being 640+

Daily candle closed outside Bbands so I would not long this on any gap up... on a big earnings week like this, there will be a shake out day or a flush to try and stop out all of those who bought long last week for this weeks earnings.

TVC:NYA or NYSE

Has also reached the top of its weekly channel here. 21,000 will be tough. Price could grind up here but I'd be careful trading anything non tech.

As far as tech goes

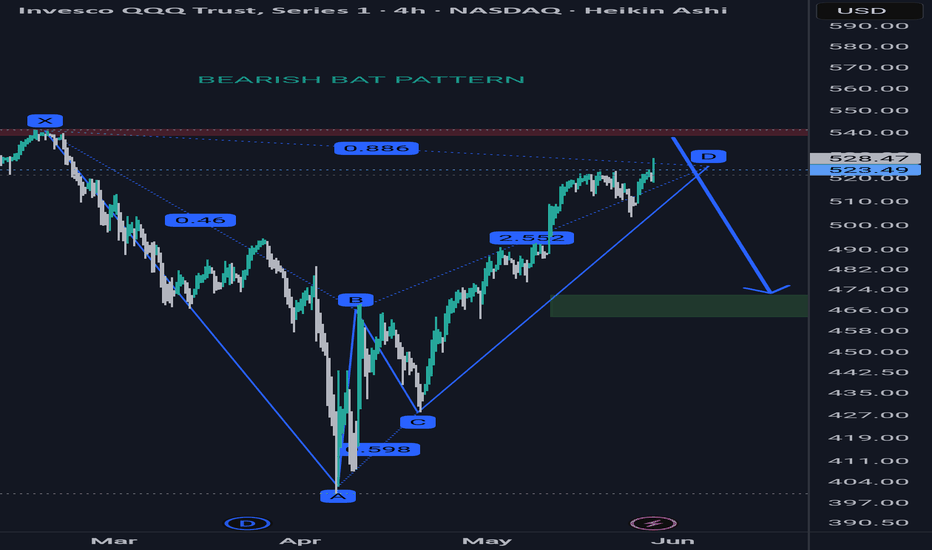

Here's NASDAQ:QQQ

monthly chart (Logarithmic)

We have room for 575-580

This should compliment Spy 550

Zoomed in on the daily chart and it's climbing back up to the resistance shown on the monthly

Hourly chart shows price action from early july... tight channel illustrates how frustrating the swings have been

562-563 is support heading into next week. If we have a major gap up Sunday night I would look to open short near 570 for a pullback before ER... if we gap down, I would buy the dip around 563 and average down if need be down to 561..

We should tag 575 this week

The sector that I think lags the most this week is the banking sector... AMEX:XLF

Banks outperform the entire market last week and are overheated at resistance I think they lag this week

I will update this more throughout the week if necessary..

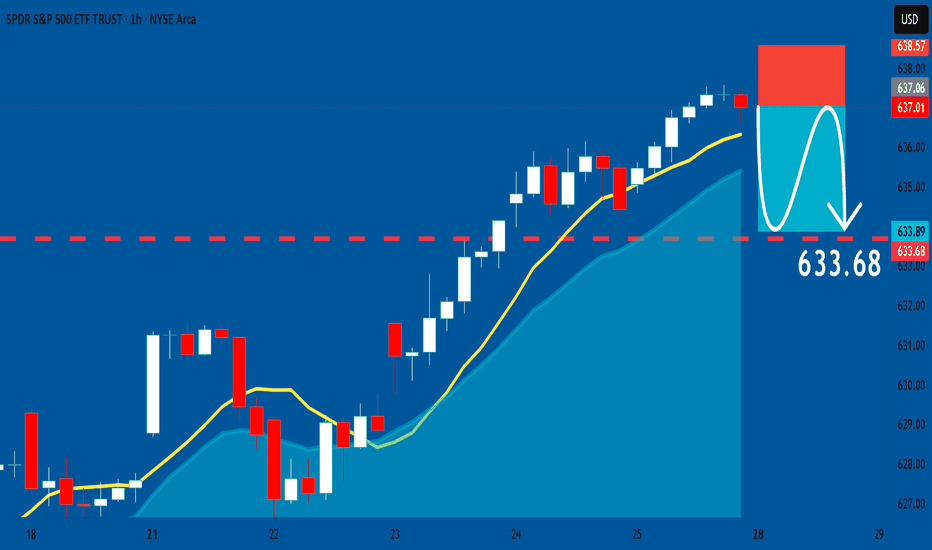

SPY: Bearish Continuation & Short Signal

SPY

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SPY

Entry Point - 637.01

Stop Loss - 638.57

Take Profit - 633.58

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

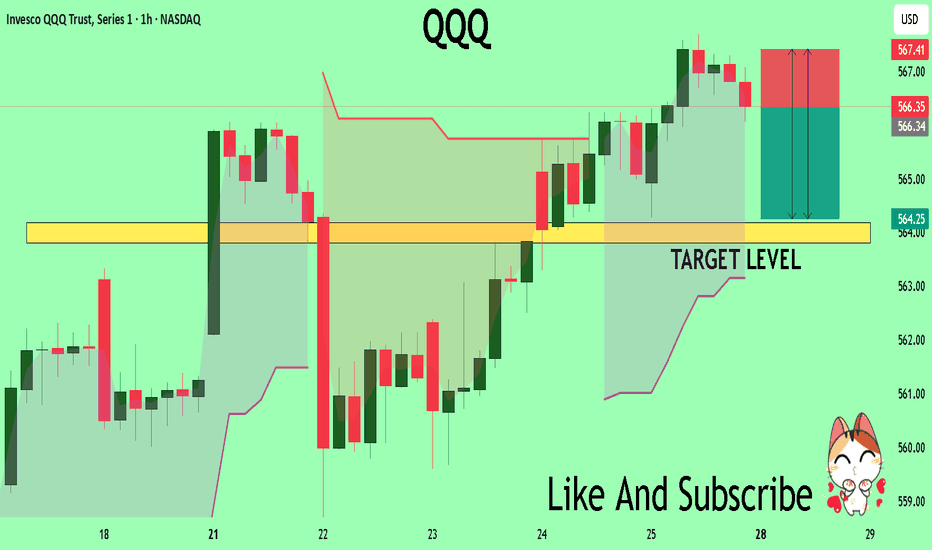

QQQ Massive Short! SELL!

My dear followers,

This is my opinion on the QQQ next move:

The asset is approaching an important pivot point 566.35

Bias - Bearish

Safe Stop Loss - 567.41

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 564.18

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

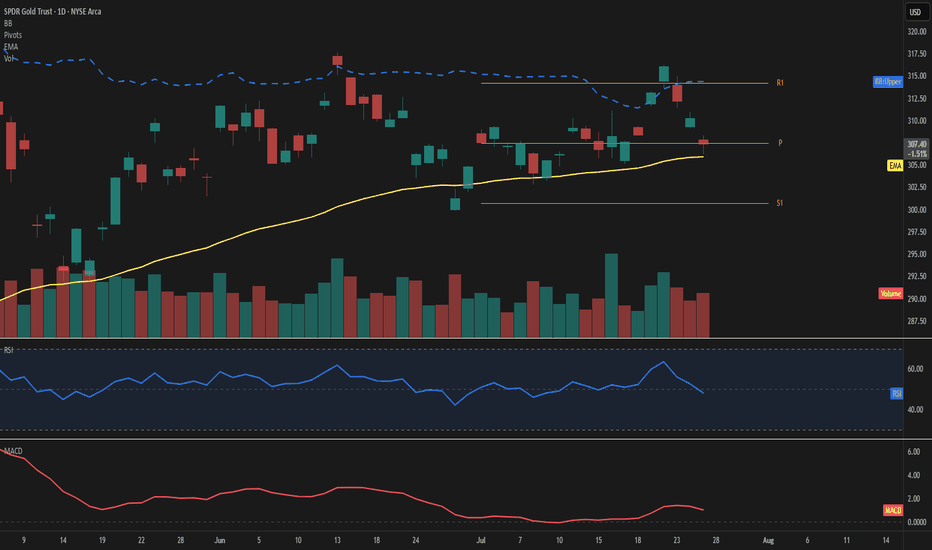

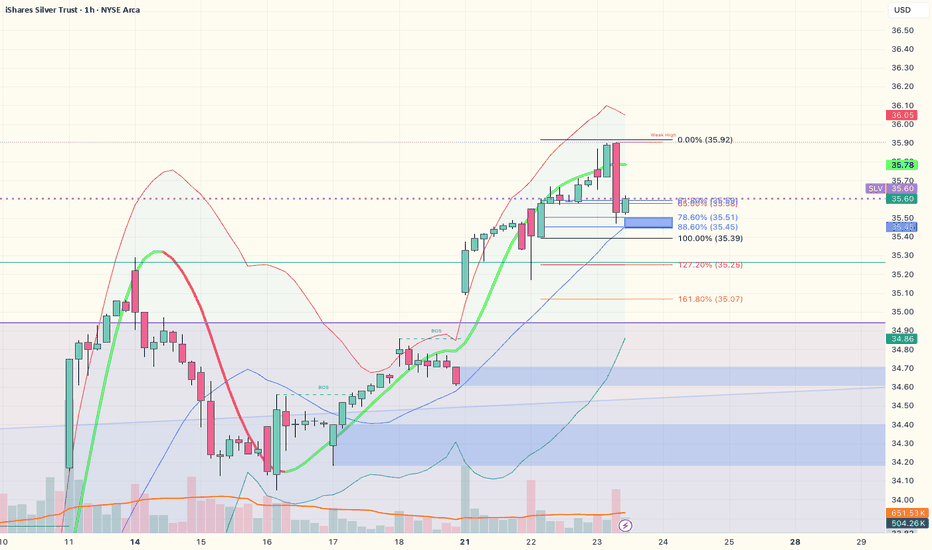

GLD – Price consolidates at highsPrice is hovering just above the 50-day EMA at 307, showing signs of short-term hesitation near the Fibonacci pivot. The upper Bollinger Band sits at 314, leaving moderate room for expansion if momentum picks up.

The RSI reads 48, reflecting a balanced setup without clear directional bias. MACD remains slightly positive, suggesting a still-constructive but soft momentum.

Key levels to watch include the pivot at 307 and the support at 301. On the upside, the 314 area aligns with both R1 and the upper band, acting as the next challenge.

Volume is up sharply (+22%) despite a mild -0.9% price pullback, indicating possible accumulation beneath the surface.

As long as price holds above the 50-day EMA, the structure remains intact.

A move away from the pivot zone will likely define the next directional wave.

SPY – Explosive strength above resistancePrice extends well above the 50-day EMA and pierces through the upper Bollinger Band, highlighting strong bullish momentum. RSI stands at 76, confirming overbought conditions, while MACD remains firmly positive.

The ongoing move leaves the EMA50 at 608 and the Fibonacci pivot at 607—both now acting as key support levels. With R1 at 620 already surpassed, the next potential resistance zone lies in uncharted territory beyond 636.

Volume has decreased by over 20%, which tempers the move slightly and should be monitored closely.

As long as price holds above 620, the bullish scenario remains valid.

Watch for any sudden spike in volume or a drop back below 636 as a possible shift signal.

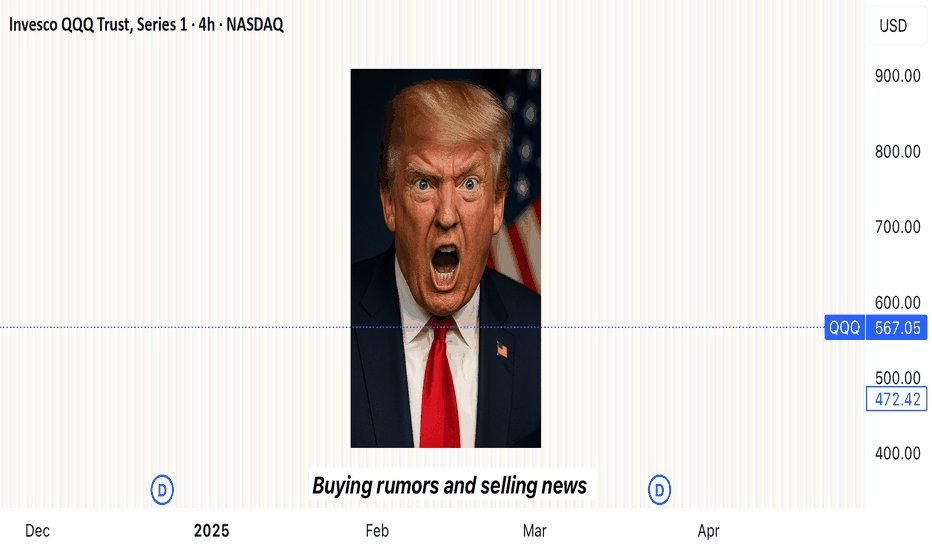

“Buy the rumor, sell the news”

---

### 🎯 **“Buy the Rumor, Sell the News” – A Trader’s Mind Game**

Imagine you’re not just following the market… you’re dancing ahead of it. This strategy flips traditional thinking on its head—and rewards those bold enough to act **before** the spotlight hits.

---

### 🕵️♂️ **Step One: Buy the Rumor**

- Traders catch whispers—like talk of a potential interest rate hike.

- The markets start to react *before* anything official is announced.

- Assets like gold might drop on the expectation alone… that’s your **entry point**.

You're not buying certainty. You're buying what the crowd *thinks* will happen.

---

### 🔊 **Step Two: Sell the News**

- Once the news breaks, it's already "old" to seasoned traders.

- That shocking headline? Already priced in.

- The market might reverse or surge unpredictably.

- This is when savvy traders exit, locking in profits from those who just arrived.

---

### 🧠 **Why It Works**

- Financial markets aren’t just driven by facts—they’re powered by **sentiment** and **anticipation**.

- By the time news goes public, smart money has already moved.

It’s like buying concert tickets before the band announces a tour—then selling them the moment fans go wild.

---

### 📉 **A Real Example**

- **Monday Rumor**: “The Fed will raise interest rates.”

- Gold begins to slide as traders prepare—this is your chance to act.

- **Thursday News**: The hike is confirmed.

- Instead of dropping further, gold might **rise** due to market overreaction or repositioning.

- You **sell** into that chaos—profit made.

---

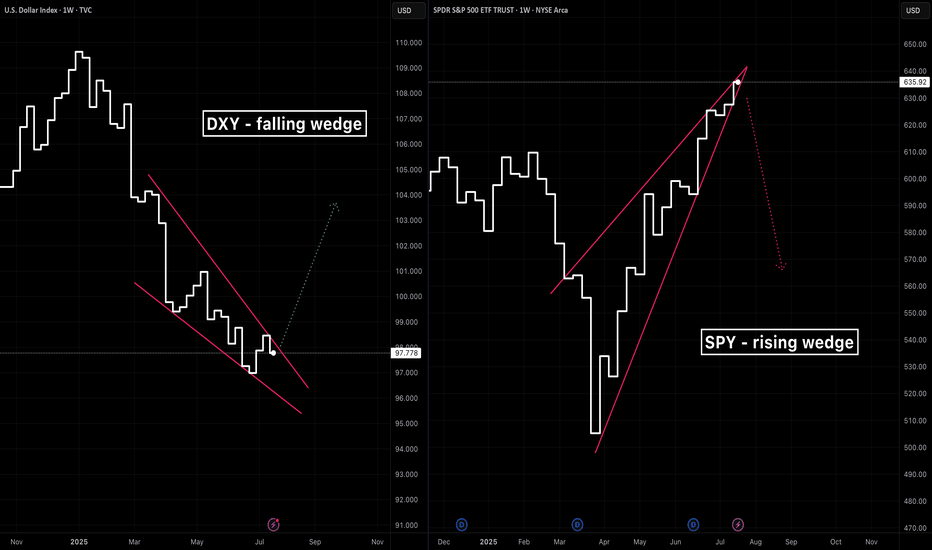

A tale of two wedgesIn early 2025 we’ve seen two classic wedge patterns on two of the market’s most watched charts: a falling wedge on the U.S. Dollar Index ( TVC:DXY ) and a rising wedge on the S&P 500 ETF ( AMEX:SPY ). Alone each tells its own tale—but together they sketch a tug‑of‑war between a fading dollar and resilient equities.

The Falling Wedge on DXY

A falling wedge in a downtrend signals waning bearish momentum and often precedes a bullish reversal once price breaks the upper trendline.

The Rising Wedge on SPY

A rising wedge in an uptrend is classically a bearish reversal pattern —a breakdown below the lower trendline confirms sellers are gaining control.

A Converging Reversal

Given the well‑known inverse correlation between the dollar and most assets, it’s noteworthy that both asset classes are flashing signs of a reversal. Taken together that makes a compelling argument.

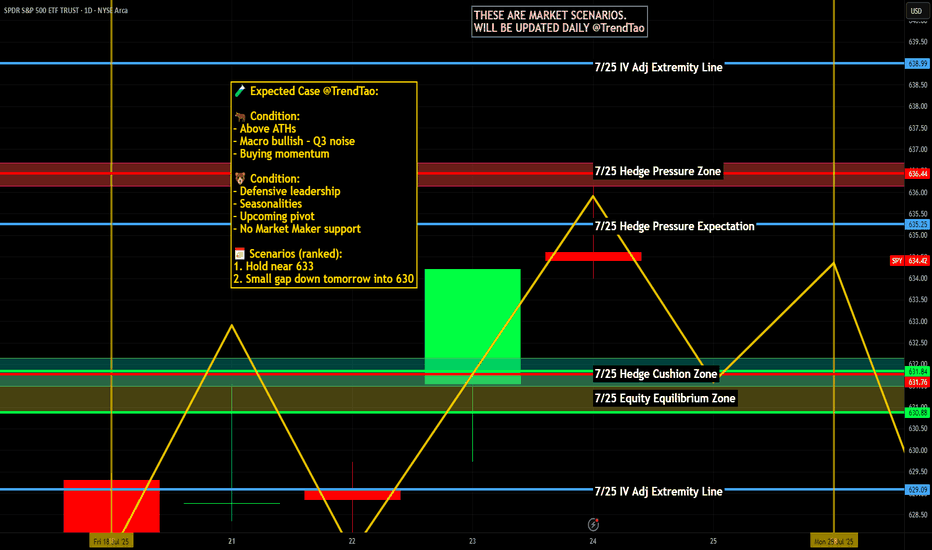

Nightly $SPY / $SPX Scenarios for July 25, 2025🔮 Nightly AMEX:SPY / CBOE:SPX Scenarios for July 25, 2025 🔮

🌍 Market‑Moving News 🌍

🏔️ Copper Market Flashpoint

Following President Trump’s announcement of steep copper tariffs (15–50% range), U.S. copper futures surged, then sharply reversed. Inventory arbitrage between CME and LME markets surged, distorting pricing dynamics and triggering concern over metal market stability.

🇪🇺 EU–China Summit Signals Trade Reset

EU leaders concluded their 25th summit with China, fostering deeper economic and strategic ties. Observers expect follow-up on mutual trade agreements, particularly regarding tech and sustainability sectors.

🌍 EM Equity Rally Consolidates Gains

Emerging markets continue to outperform global equities in 2025—with MSCI EM up ~18% vs. S&P 500. Analysts highlight strong opportunities in AI/fintech stocks in China and Latin America, suggesting further rotations out of U.S. markets.

📊 Key Data Releases & Events 📊

📅 Friday, July 25:

8:30 AM ET – Durable Goods Orders (June):

Forecast shows a sharp drop (~–10%), following a ~16% gain in May—signaling possible cooling in business-related equipment purchases.

10:00 AM ET – U.S. Imports of Steel Products (June):

Trade-data release monitoring steel flows amid evolving tariff frameworks.

All Day – Corporate Earnings Reports:

Companies such as First Financial Bancorp (FFBC), HCA, AON, Charter, and others report earnings. Outlooks may influence small- to mid-cap sentiment.

⚠️ Disclaimer:

This report is for educational and informational purposes only—not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #data #earnings #commodities #EM #technicalanalysis

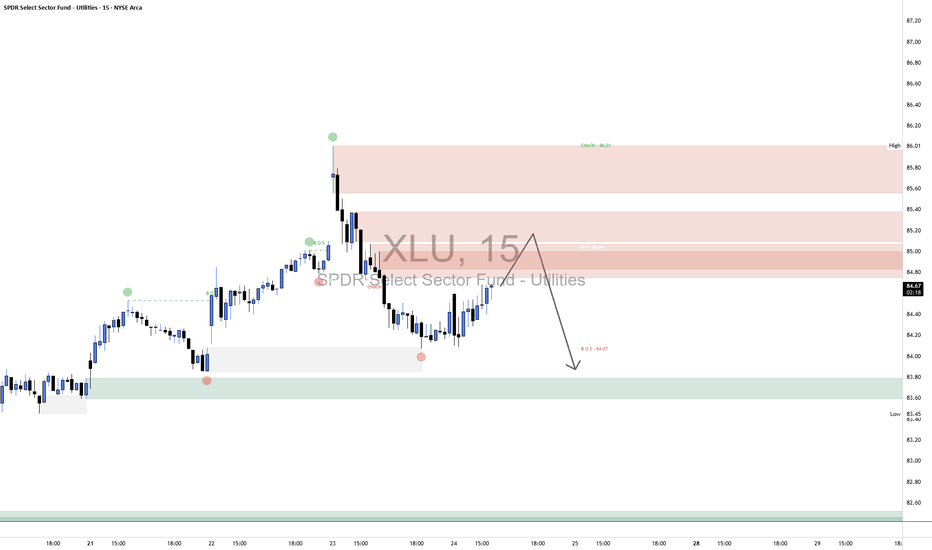

XLU Short1. Market Structure Overview

1.1 Change of Character (CHoCH) – 86.01

Marked a bearish shift after price broke below a significant higher low.

Suggests that the prior bullish trend has lost strength.

1.2 Break of Structure (BOS) – 84.07

Confirmed a bearish continuation, breaking below the previous support level.

Validates the downtrend structure following the CHoCH.

2. Supply & Demand Zones

2.1 Supply Zones (Resistance)

Zone A: 85.40–86.01

Major Supply zone created by distribution before the sharp sell-off.

Acts as strong resistance; sellers aggressively entered at this level.

Zone B: 84.80–85.20 (0.5 Level)

Intermediate Supply—likely a reaction zone for institutional sell limits.

Price could stall or reverse from this level before testing Zone A.

2.2 Demand Zones (Support)

Zone C: 83.45–83.80

First Major Demand—price reacted here previously with a strong bounce.

A break below could expose lower demand.

Zone D: 82.50–82.90

Deeper Demand—represents a high-probability buying area if Zone C fails.

3. Price Action in Bordered Region

Current Price (~84.69): Price is climbing toward supply after a local low.

Expected Move: Price is likely to:

Reach into Zone B (84.80–85.20).

Potentially reject from supply and continue downward.

If rejection occurs, price is expected to revisit Zone C (~83.50–83.80).

Bullish Scenario: If price breaks above 85.20 and sustains above 86.01, bullish continuation becomes likely.

Bearish Scenario: Rejection from current supply areas confirms continuation of the downtrend.

4. Structure & Momentum Outlook

Bias: Bearish, unless 86.01 is broken and flipped into support.

Momentum: Price is currently retracing with moderate strength. If supply absorbs buyers in Zone B, momentum will likely reverse to the downside.

Key Level to Watch: 85.00–85.20 area for reversal confirmation.

5. Supporting Financial Context

Sector Rotation: The Utilities sector (XLU) has seen recent inflows and outflows tied to market volatility and interest rate speculation.

Rate Sensitivity: Utilities are interest-rate sensitive, and the market is pricing in uncertainty around Fed cuts, adding pressure to the sector.

Recent Sentiment: Some analysts view defensive sectors like utilities as range-bound or underperforming during growth-driven rotations (CNBC, Bloomberg).

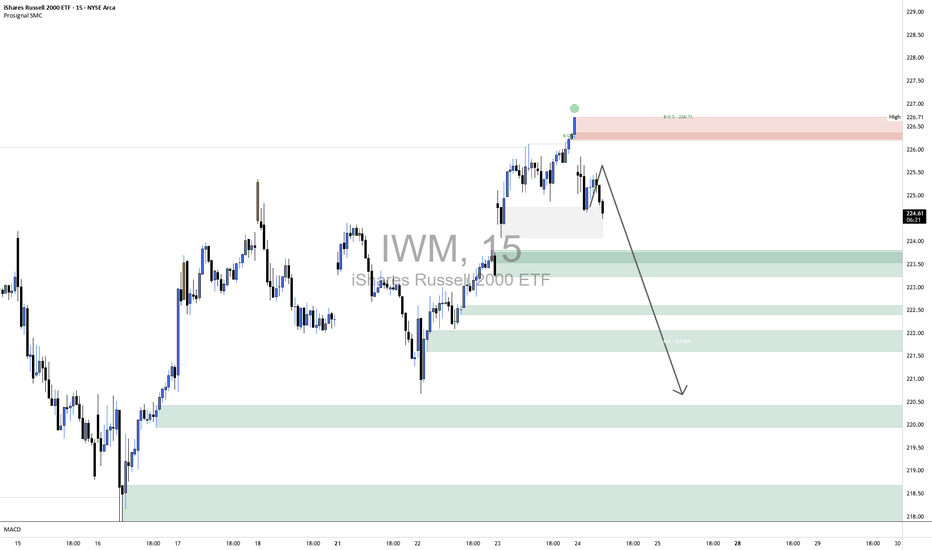

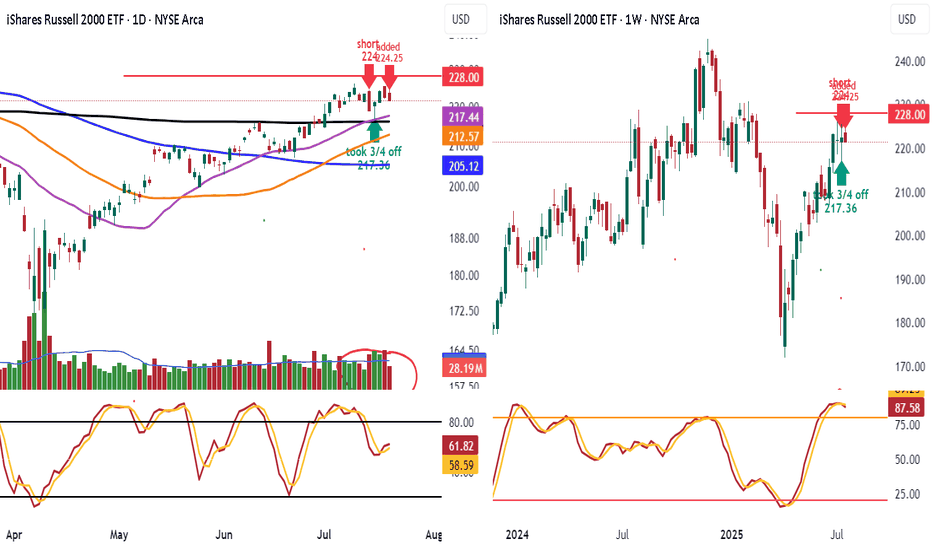

IWM Short1. Broader Market Structure 📉

1.1 Change of Character (CHoCH)

Occurred near the top (~226.70), breaking the prior higher low—signaling a shift from bullish to bearish momentum.

1.2 Break of Structure (BOS)

Confirmed by a move below that level, validating the bearish change and underlining a downtrend in progress.

2. Supply & Demand Zones

2.1 Demand Zones (Support)

Price zones where buyers have previously stepped in, marking potential reversal points:

Zone A (~223.00–223.50) – First layer of support; price tested this zone after the BOS.

Zone B (~221.80–222.20) – Mid-range demand area with historical buyer activity.

Zone C (~220.00–220.50) – Deeper support zone; last line before structural lows.

Key Takeaway: These zones represent probable stops for a short-term pullback and are ideal for long-entry decisions.

2.2 Supply Zone (Resistance)

~226.70–226.75 – Located at the level where BOS occurred; acts as near-term resistance where sellers may reassert control.

3. Price Action Inside the Bordered Area

Current Price (~224.55): Hovering between the supply and first demand zone.

Expected Movement:

A pullback into Zone A (~223.00–223.50).

If demand holds, look for a bullish reaction—forming a higher low, potentially pushing price back toward 226.70+.

Bearish Risk: A break below Zone A increases downside risk into Zone B or C, reinforcing the bearish structure.

4. Momentum & Structure Outlook

Bullish Scenario: A bounce from demand with structure preserved (~higher low) could lead to short-term upside into resistance.

Bearish Scenario: A drop below the bordered demand zone would confirm continuation of the downtrend.

Watch: Price structure around the 224–223 area and reversal cues (e.g., rejection candles, volume spikes).

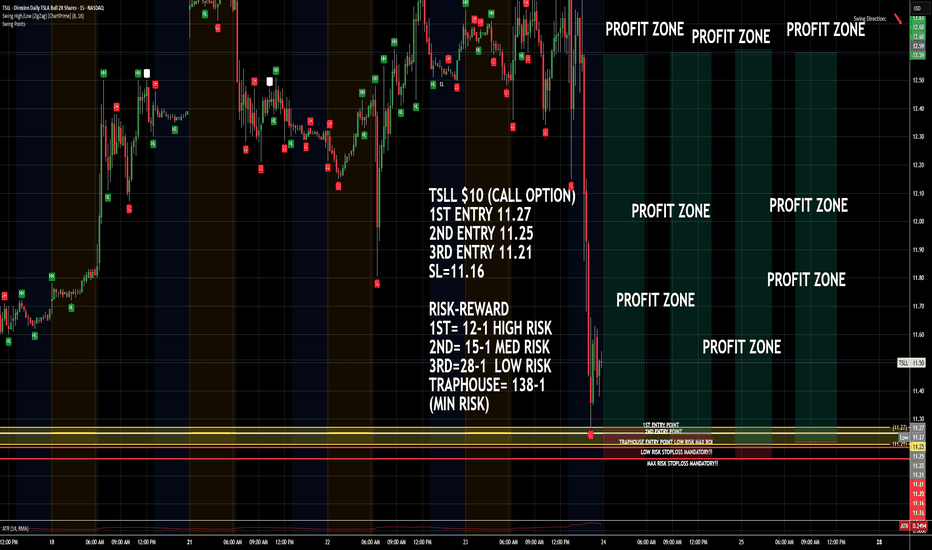

TSLL $10 CALL OPTIONIf price drops done into entry zone which is detailed on the chart, Enter the trade with a Call Option $10 or below!! Remember to set your stop loss!! Trap has potential!

P.S. If when market opens and share price doesnt drop but continue to rise from that point, then just enter in on a call and cross your fingers lol!!! But price should go up because of that dramatic drop !!!

CYMPLE

Nightly $SPY / $SPX Scenarios for July 24, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 24, 2025 🔮

🌍 Market-Moving News 🌍

🤝 U.S.–EU & U.S.–Japan Trade Optimism Lifts Sentiment

The S&P 500 and Nasdaq hit record-high closes on July 23, fueled by optimism over a potential U.S.–EU trade deal mirroring the U.S.–Japan framework, with the EU-set tariff on autos potentially halved to 15%

💵 Dollar Retreats, Yields Climb

As markets shifted toward risk assets, U.S. Treasury yields increased and gold softened, while the dollar eased—highlighting growing confidence in trade-driven growth news

🏦 Fed Independence Under Pressure—But No July Cut Expected

A Reuters poll shows economists see heightened political pressure on the Fed jeopardizing its independence, though the consensus remains that rates will stay unchanged this month

📊 Key Data Releases & Events 📊

📅 Thursday, July 24:

8:30 AM ET – Initial Jobless Claims

Weekly tally of new unemployment benefit applications—key indicator of labor-market conditions.

10:00 AM ET – New Residential Sales (June)

Tracks signed contracts for new homes, offering insight into housing demand under tightening mortgage rates.

All Day – Trade Headlines & Fed Watch

Continued focus on U.S.–EU trade developments and any follow-up to Fed independence concerns from policy circles.

⚠️ Disclaimer:

This information is for educational and informational purposes only—not financial advice. Please consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #trade #economy #Fed #housing #jobs #technicalanalysis

IWM short 224 and 224.25Shorted IWM going into resistance

on daily. Target is 216 I will take 3/4 off re add when breaks

the 50 day 212.57 and 100 day 205.12 watch daily stoch see they roll over

Look weekly rolling over but needs break 68%. Look weekly making lower highs

See we can get a follow thru selling today with more selling vol

Have trailing stop in place