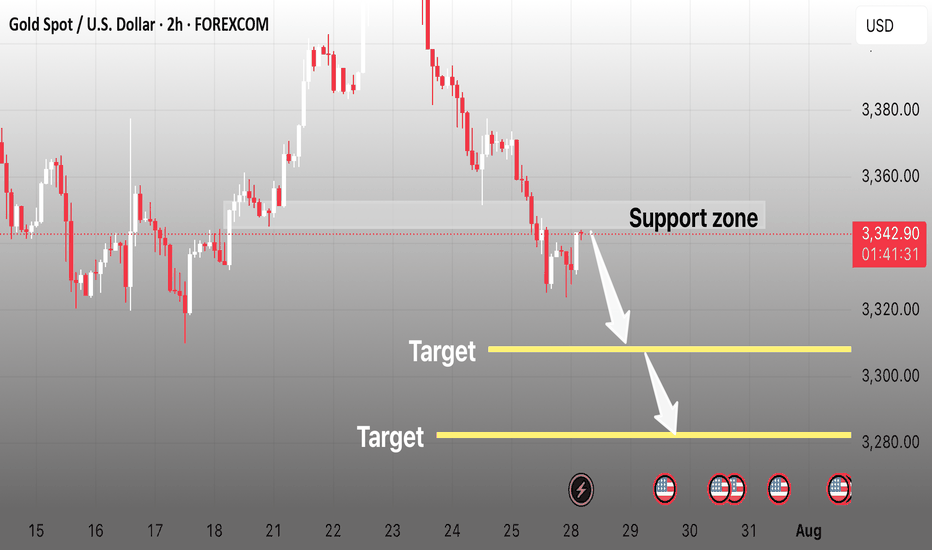

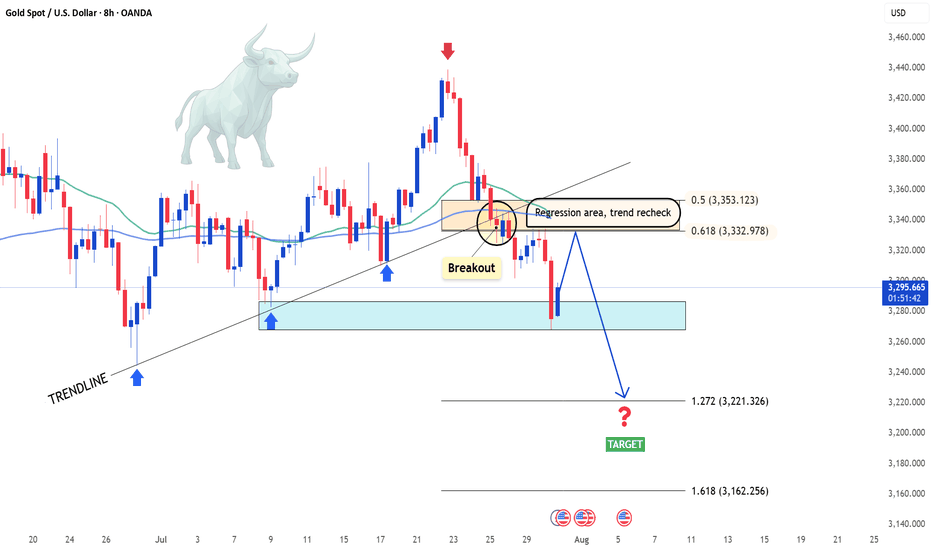

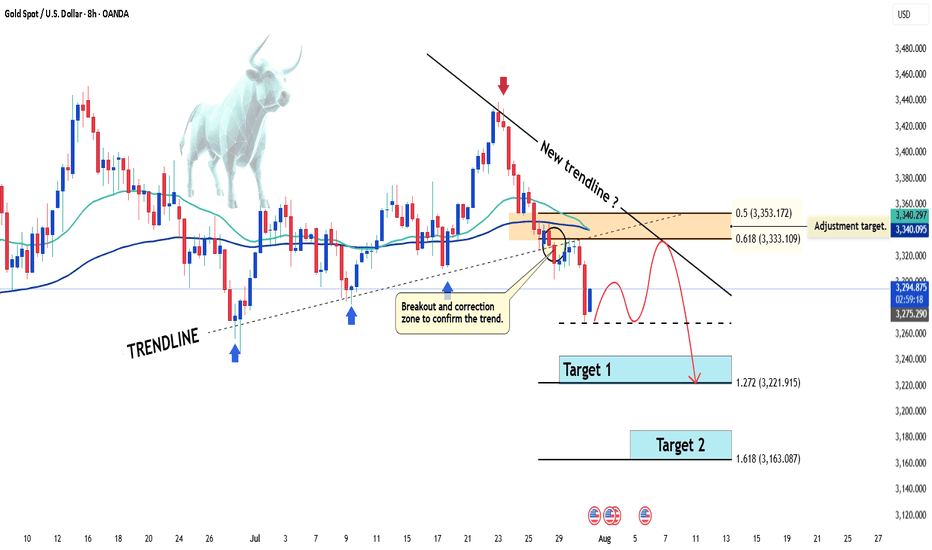

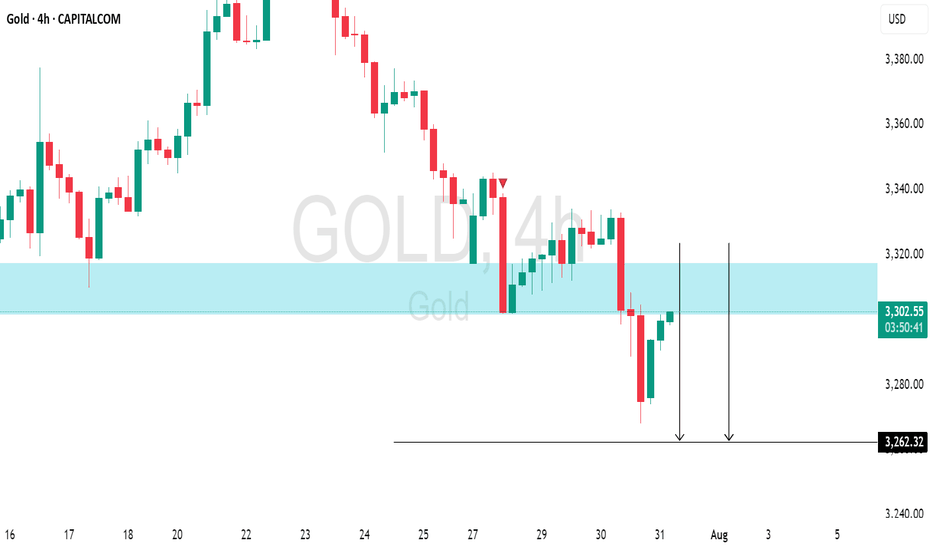

GOLD Breakdown Setup | Clean Sell Targets Ahead!XAU/USD (Gold) Analysis – 2H Timeframe

After a clear rejection from higher levels, Gold has pulled back to retest the broken support zone around 3340–3350, which now acts as a resistance.

If the price sustains below this zone, we can expect a smooth move down toward clean liquidity areas below.

This is a textbook bearish continuation setup. 💥

🔻 Trade Idea – Short Setup:

• Sell Below: 3,340

• Target 1: 3,300

• Target 2: 3,280

• Stop Loss: 3,355 (above resistance zone)

🧠 Confluences:

• Bearish market structure

• Support zone retest

• Trend continuation

• High-impact USD news ahead (watch for volatility)

📅 Key Dates: July 30 – Aug 1

⚡ NY session could trigger the move!

Futures market

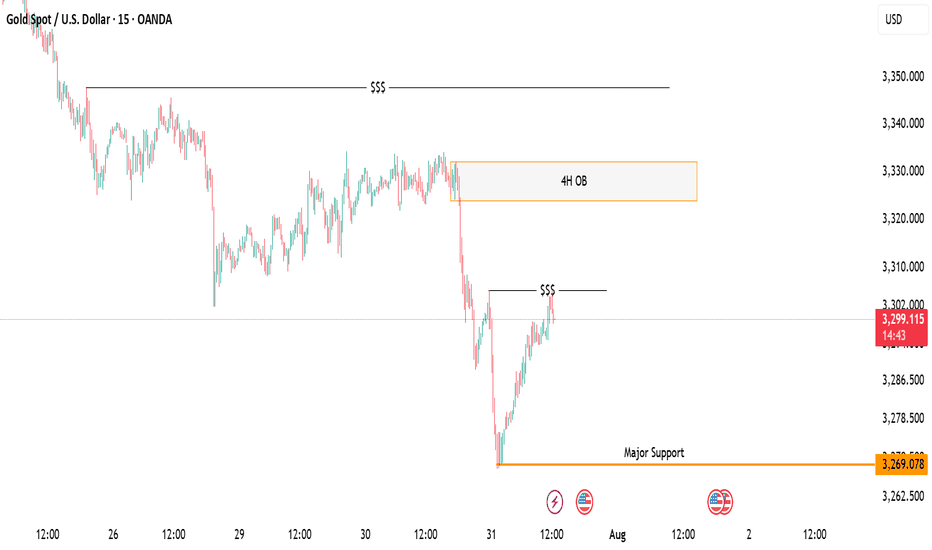

Gold Market Update: Major Support at and Supply atGold is recovering after a strong drop from the previous range high. Price is approaching a 4H Order Block near the 3300–3310 zone, which may act as a supply area. A minor liquidity zone has just been tapped, suggesting a potential short-term rejection.

The major support lies at 3269, which sparked the recent bullish move. If price rejects from the OB zone, a pullback toward this support is likely. However, a clean break and hold above the OB may signal further upside.

📌 Key Levels:

Supply Zone: 3300–3310

Support: 3269

🧠 Wait for clear confirmation before executing trades.

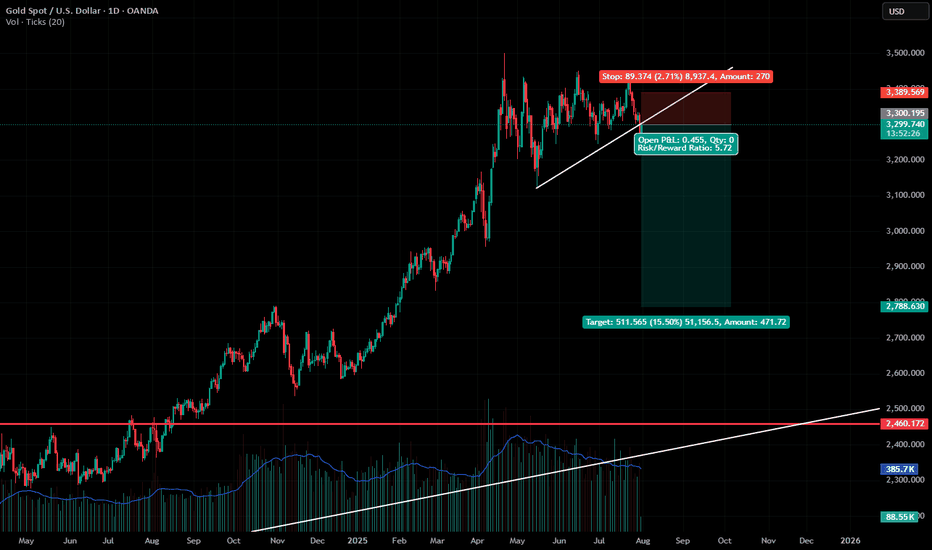

Will Upcoming Data Determine the Next Gold's Direction?Macro approach:

- Gold retreated this week, reversing early gains to trade near four-week lows amid renewed US dollar strength and caution ahead of the Fed's policy decision.

- The retreat was mainly pressured by stronger-than-expected US economic data and a tentative revival in risk appetite, offsetting pockets of safe-haven demand.

- Key drivers included robust US GDP growth for 2Q, a bounce in consumer confidence, and the Fed's steady rates with a more hawkish tone, suggesting cuts may be further out.

- Meanwhile, recent US-EU and US-China trade deals eased some global uncertainty, damping gold's appeal as a hedge.

- Market participants also eyed the labor market's continued cooling, but resilient consumer spending further buoyed the dollar.

- Gold may remain volatile, with potential upside if upcoming US PCE inflation and NFP reports disappoint expectations. Any escalation in trade tensions or signals of Fed policy easing could renew support for gold prices.

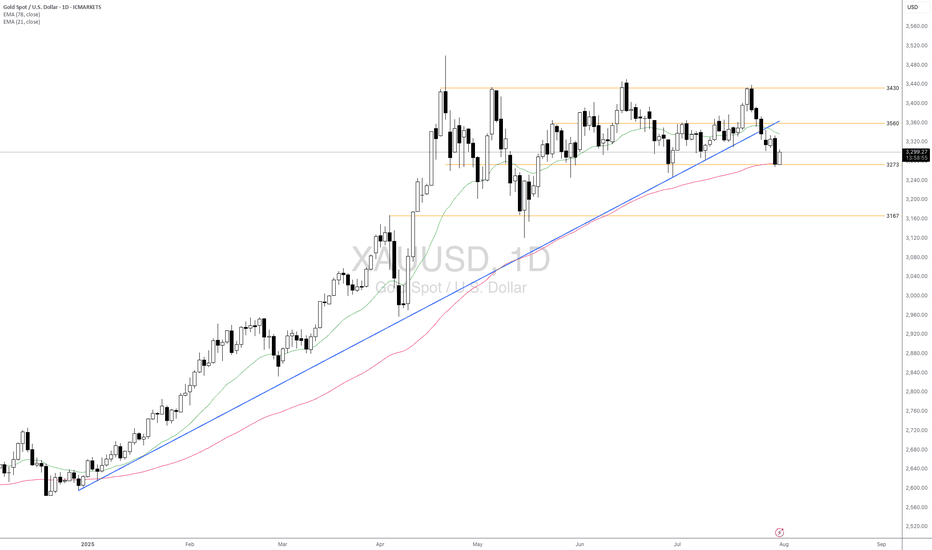

Technical approach:

- XAUUSD fluctuated within the range of 3285-3560, which is below the broken ascending trendline. The price between the two EMAs awaits an apparent breakout to determine the next trend.

- If XAUUSD breaks below the support at 3273, confluence with EMA78, the price may plunge to retest the following support at 3167.

- On the contrary, remaining above the support at 3273 may lead XAUUSD to retest the resistance at around 3560.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

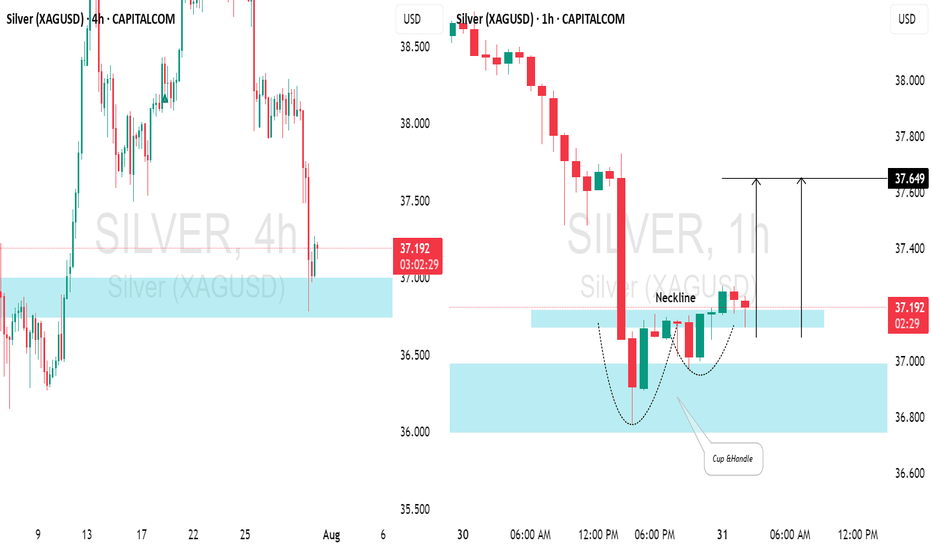

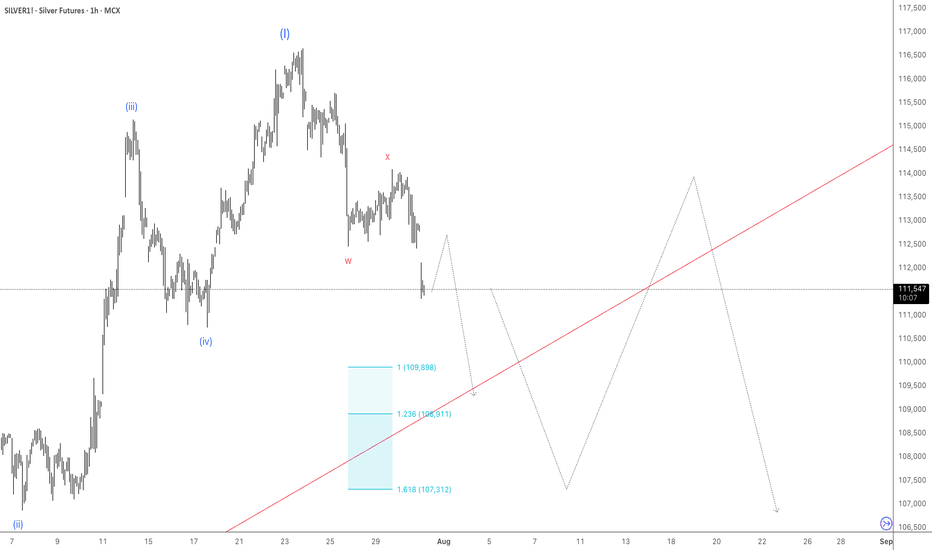

SILVER (XAGUSD): Time for Pullback📈SILVER appears to be oversold following yesterday's decline.

After testing a significant daily / intraday support level, there's a noticeable bullish reversal.

The price formed a cup & handle pattern on the hourly chart and has broken above its neckline. We can expect a pullback to at least 37.64.

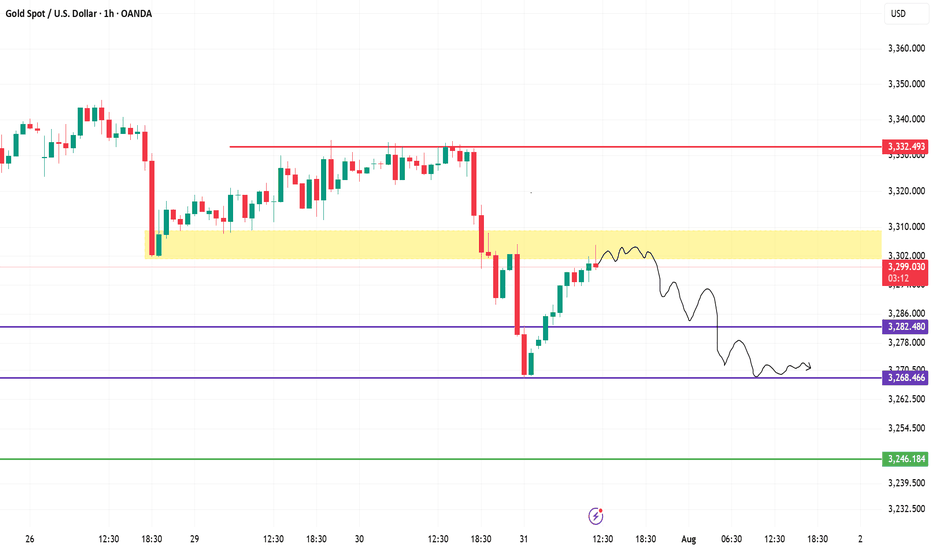

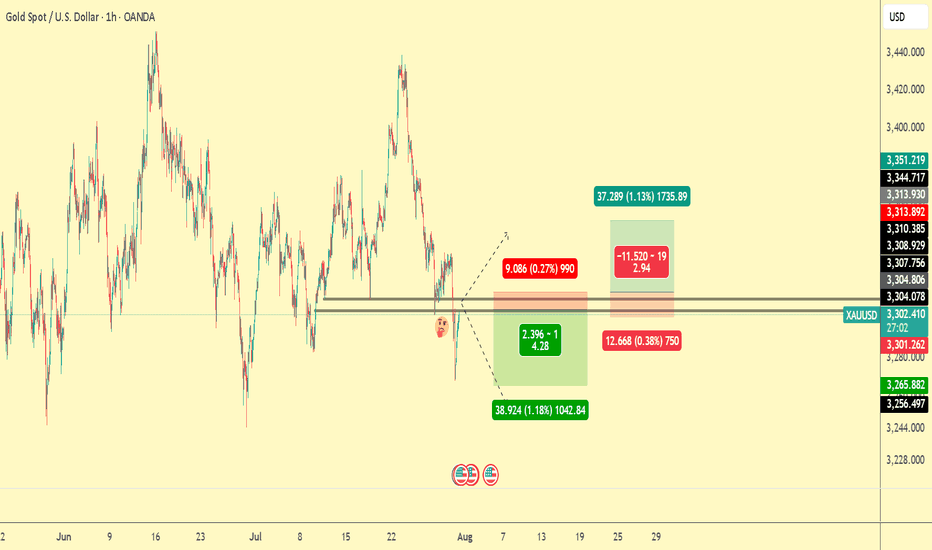

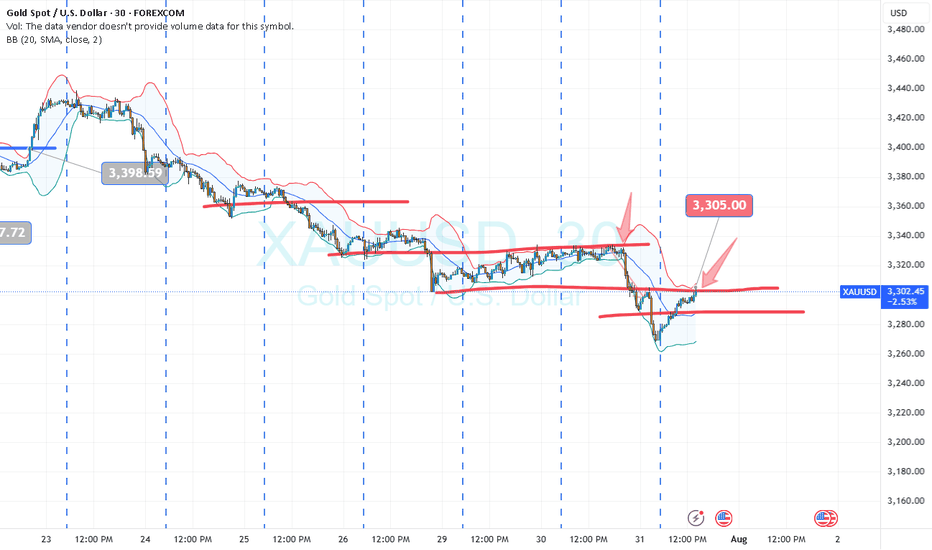

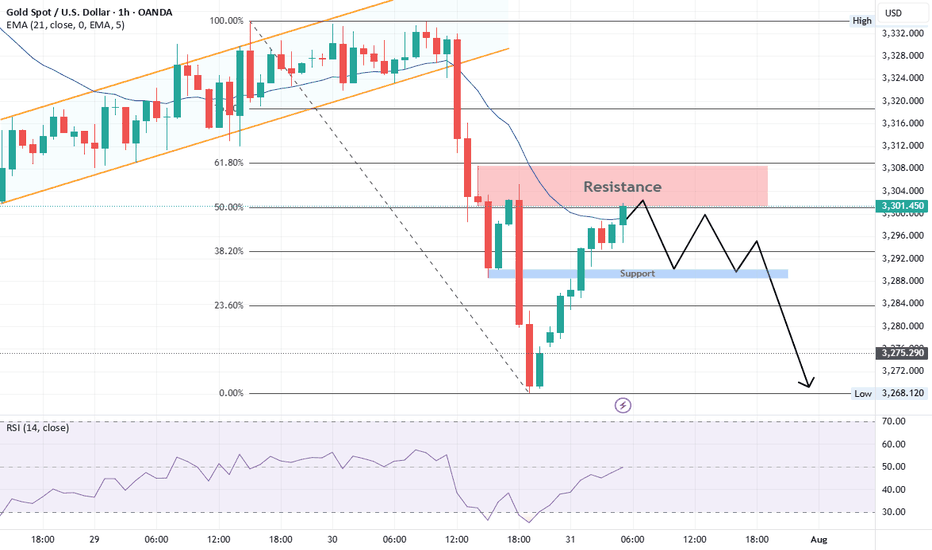

XAUUSD (Gold) Analysis – 1H Chart | July 31, 20251. Fakeout & Rejection from Supply

Price faced sharp rejection near the 3,332 resistance. The strong red candle indicates aggressive selling and liquidity grab.

2. Retest of Broken Demand Zone

Gold is now retesting the **3,298–3,305** yellow zone, which previously acted as demand but may now flip to resistance (supply).

3. Bearish Market Structure

The price formed a **lower high and lower low** pattern — a clear sign of downtrend resumption. Current bounce looks corrective.

4. Projection: Potential Drop Ahead

As per the drawn path, if price fails to reclaim above 3,305, a likely drop toward 3,282, then 3,268 is expected.

5. Key Levels to Watch

Resistance: 3,305 → 3,332

Support: 3,282 → 3,268 → 3,246

Bearish bias remains valid below 3,305.

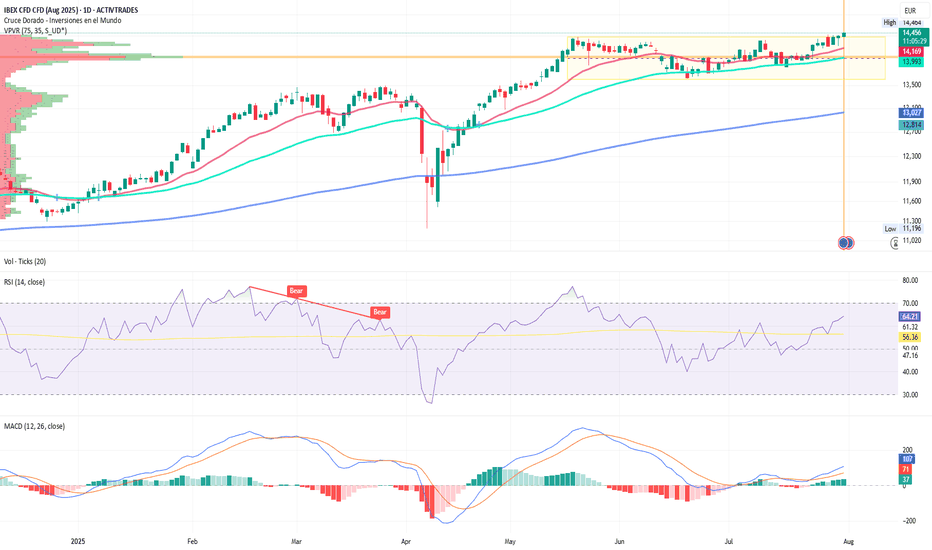

Trump Tightens the Grip, the IBEX Holds FirmWill the IBEX 35 End July at New Highs? Futures Point Up Despite Tariff Threat

By Ion Jauregui – Analyst at ActivTrades

The IBEX 35 could end July near record highs following a strong opening across European markets. At 08:10 CET, futures on the Spanish benchmark were up 0.54% to 14,445 points, showing more strength than their peers: Euro Stoxx 50 futures rose 0.22%, the German DAX 0.28%, and the UK FTSE 100 0.07%.

This upward momentum comes despite a growing international risk: U.S. President Donald Trump has announced a 15% tariff on all imports from Europe, including industrial, agricultural, pharmaceutical, and luxury goods. Fortunately, Europe has chosen not to escalate the conflict by imposing additional tariffs beyond those already in place. A tit-for-tat scenario could have pushed European inflation higher — something the ECB governance is keen to avoid.

Potential Impact on the IBEX 35

The tariff decision introduces uncertainty for key sectors within the IBEX 35, especially those with strong international exposure such as Inditex, Grifols, IAG, Acerinox, and Gestamp, which could face margin pressure and weaker exports. In the short term, the outcome will depend on the European Commission’s response, which is already considering coordinated countermeasures.

Still, investors appeared optimistic in early trading, focusing on a solid round of earnings from Spanish companies. Meliá, Viscofan, PharmaMar, Sanjosé, and Inmobiliaria del Sur posted strong first-half results, lending support to the index. On the downside, BBVA reported a 2% drop in quarterly net profit, and the Bank of Spain has reduced its systemic buffer requirement for the bank.

Technical Analysis

The IBEX 35 is trading near its key resistance level at 14,500 points. A monthly close above that level would confirm a breakout from annual highs, potentially opening the path to 14,800 points. However, the tariff threat could bring short-term volatility.

Since late May, the index has been moving within a price consolidation range, but in the past two sessions it has shown signs of a bullish breakout above the previous high at 14,358 points. The Point of Control (POC) currently lies at 14,000 points, providing immediate support. Momentum indicators and moving average crossovers suggest the current push is backed by the 50-period moving average and an ongoing price expansion.

• Supports: POC at 14,000; key support at 13,599 (consolidation zone)

• Resistances: At current highs

• MACD and RSI: Indicate a growing overbought trend and increasing bullish volume

Despite Trump Tariff Storm

Despite the new tariff front opened by Donald Trump, the IBEX 35 displays a resilience worth noting. Backed by solid corporate earnings and favorable technicals, bulls remain at the helm — for now. The risk of a full-scale trade war still looms, but Europe’s decision not to retaliate has eased inflation concerns.

And like that brave brigantine that sailed stormy seas, the IBEX remains steady and defiant, unshaken by winds or tempest. “Asia to one side, Europe to the other...” Today, the Spanish index sails toward new highs, hoping to close July with all sails unfurled.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

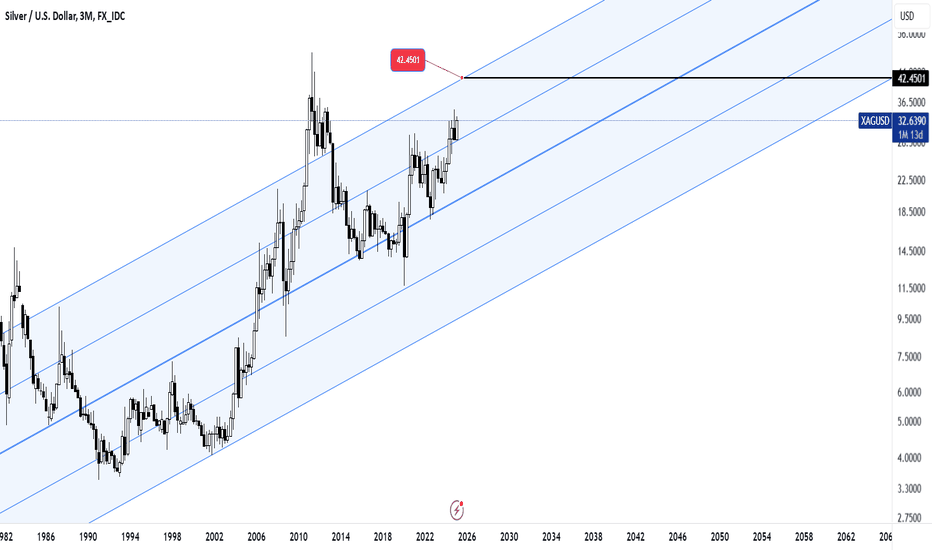

Silver on the path of growth and developmentAs I mentioned in the previous article, silver is moving towards the desired target, which is around $40 per ounce of silver. As you can see, this three-month chart and the uptrend drawn and reproduced shows the desired price target near the top of the channel.

If there is a change and an update is needed, I will definitely check and publish it again.

Good luck.

MJ .REZAEI

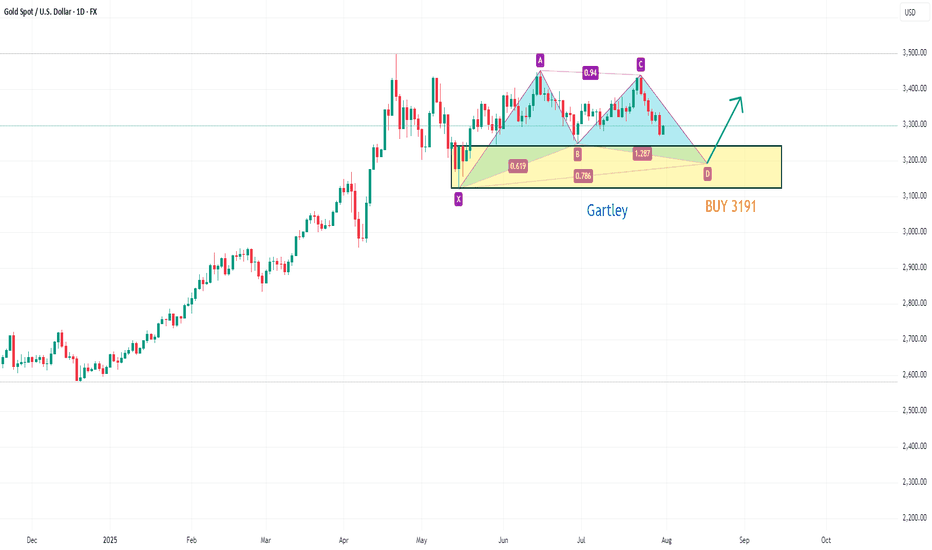

Gold is Falling Sharply – Will It Keep Falling?Hello dear traders, what’s your view on XAUUSD?

Yesterday, XAUUSD continued its strong downtrend and is now trading around 3,296 USD.

The recent drop in gold is largely due to the strengthening U.S. dollar, following the Federal Reserve’s decision to hold interest rates steady as expected — despite sharp criticism from President Donald Trump.

Technically speaking, after breaking below the rising trendline, gold failed to retest successfully and plunged further, confirming that the bearish trend is now in control. Price is currently moving below key moving averages, and the structure has clearly formed a sequence of lower highs and lower lows — reinforcing the likelihood of continued downside.

If a pullback occurs before the next leg down, the Fibonacci 0.5 and 0.618 retracement zone — which aligns with the EMA 34 and 89 and a major resistance level — will be a key area to watch. This could present a prime opportunity for breakout and trend-following traders.

Looking ahead, the next key support sits near 3,220 USD. If this level breaks, gold may head toward the 3,162 USD zone.

What do you think? Will gold keep falling, or will buyers step in? Drop a comment and hit follow to catch the next big move!

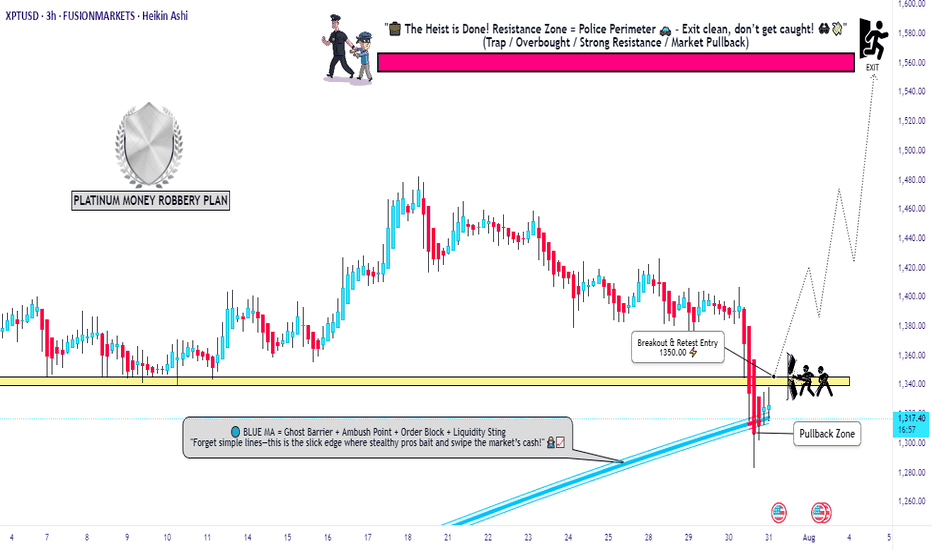

Platinum Breakout Stalk: Thief Entry Only After Confirmed🧠 Thief's Heist Plan Activated!

Asset: XTI/USD (PLATINUM) 💎

Strategy: Bullish Pullback + Breakout Play 💥

🔍 We stalking platinum's neutral zone… waiting for that clean breakout!

No early entries, no premature SLs. Discipline = Profits. 🎯

🎯 Entry: After breakout confirmed. Use multiple DCA limit orders to layer in like a ghost.

🔐 Stop Loss: ONLY after breakout – Place at 1280.00 🛡️

💎 Target: 1560.00 – Vault unlock point! 💰

📵 DO NOT place SL or orders before breakout – patience is the thief’s edge. 🧘♂️

This isn’t gambling... this is precision trading. Breakout = green light 🚦

Get ready to raid the platinum vault!

#ThiefTrader #BreakoutStrategy #PlatinumHeist #XTIUSD #BullishSetup #SmartMoneyMoves

XAU/USD at Make-or-Break: $3,304 Holds the Key!"XAU/USD is testing a key resistance at $3,304. A breakout could trigger a rally to $3,315, while rejection may lead to a drop to $3,292."

Price Action & Key Levels

Support: 3,298 → 3,292 (critical demand zone).

Resistance: 3,304 → 3,310 (supply zone).

Breakout Level: 3,304 (confirmation needed).

Indicator-Based Evidence

RSI: "RSI at 62 (not overbought), suggesting room for upside."

MACD: "MACD histogram is rising, supporting bullish momentum."

Moving Averages: *"Price above 9 & 21 EMA, short-term trend bullish."

Fundamental Context

"Gold is supported by Fed rate cut expectations, but a strong USD could limit gains."

"Geopolitical risks (e.g., Middle East tensions) may boost safe-haven demand."

Scenario 1: Bullish Breakout

Entry: Buy above $3,304 (confirmed close).

Target: $3,310 → $3,315.

Stop-Loss: Below $3,298 (risk management).

Scenario 2: Bearish Rejection

Entry: Sell below $3,298.

Target: $3,292 → $3,288.

Stop-Loss: Above $3,306.

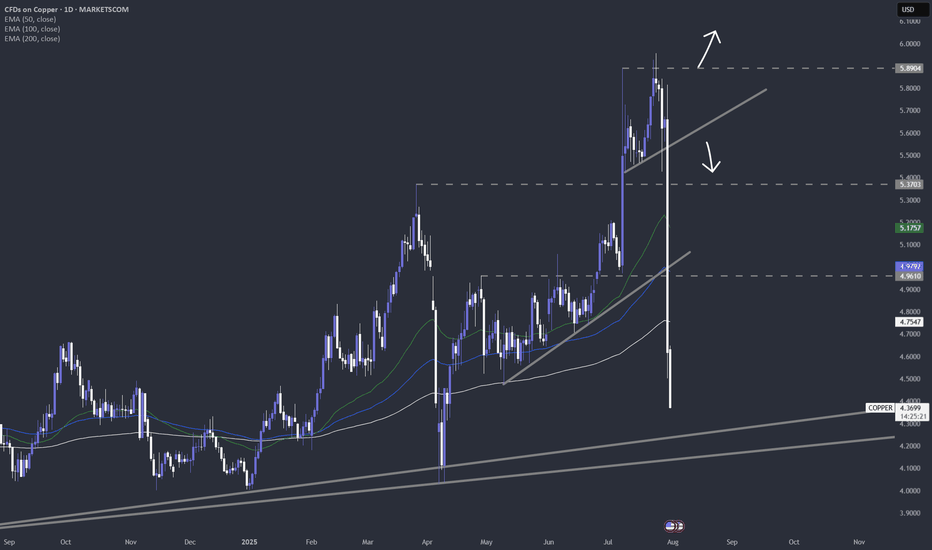

What a turnaround on copper futuresManipulation? Smells like it, but of course, this is just the market we are currently living in.

Let's dig in.

MARKETSCOM:COPPER

COMEX:HG1!

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Gold price continues sharp declineHello everyone! Do you think gold will rise or fall? Let’s dive into the latest movements of this precious metal.

Just as we anticipated in yesterday’s strategy , gold has extended its downward move, with the bears firmly in control. The precious metal is currently trading around 3,290 USD, clearly signaling a short-term downtrend after breaking the ascending trendline that started in early July. Although there was a slight bounce, price remains capped below the key resistance zone of 3,333 – 3,350 USD, which coincides with the confluence of the 0.618 – 0.5 Fibonacci retracement and the EMA 34/89 — adding even more downside pressure.

The main reason behind this recent drop lies in the easing of trade tensions following the US-EU tariff agreement, which has significantly weakened gold’s safe-haven appeal. At the same time, the FOMC meeting yesterday failed to provide any bullish catalyst for gold. Even though the Fed is expected to keep rates unchanged, a single hawkish remark from Chair Powell was enough to intensify short-term selling pressure.

From a technical perspective, gold attempted to retest the broken trendline but failed, confirming the bearish structure. A new wave of correction could emerge soon, but the overall outlook remains tilted toward further downside.

My personal view:

Target 1 is at the 1.272 Fibonacci extension.

Target 2 lies at the 1.618 Fibonacci level — which could be the next destination.

And you — what do you think about this trendline break? Let’s discuss in the comments!

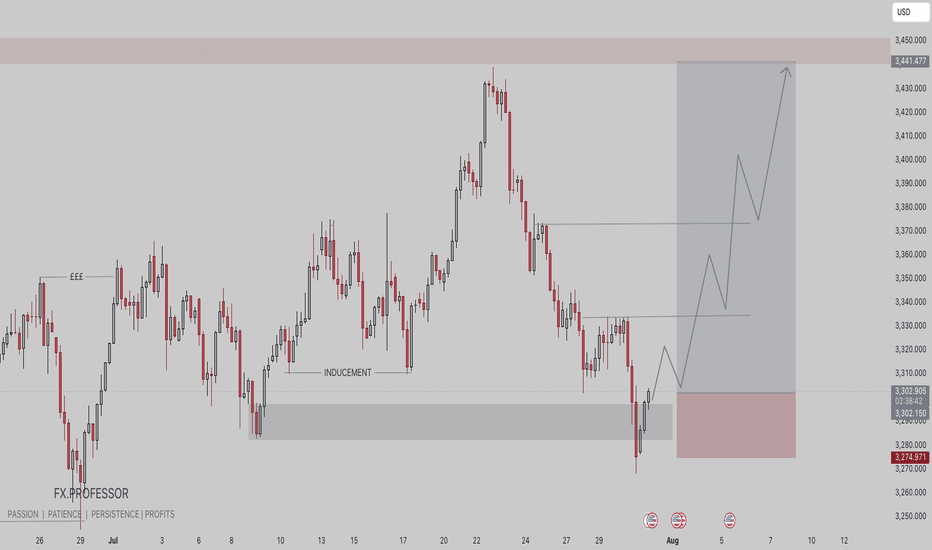

GOLD BUY TRADE IDEA🟡 XAU/USD Smart Money Setup – July 31, 2025

🔍 Key Technical Highlights:

• Demand Zone Entry:

• Price has tapped into a clear demand zone (gray box) around 3,274 – 3,290, signaling potential institutional accumulation.

• The previous inducement low has been swept, aligning with Smart Money Concepts (SMC).

• Liquidity Engineering:

• Equal highs (liquidity pool) visible from late June remain uncollected — a prime upside target.

• Price structure shows internal BOS, suggesting a shift in market sentiment.

• Expected Path:

• A potential multi-leg bullish move is mapped out, targeting the 3,440+ premium zone, completing imbalance fill and stop-run above highs.

• Risk-Reward:

• Stop loss sits just below the demand zone (~3,274), maintaining a favorable risk-to-reward ratio.

⸻

🧠 Smart Money Flow Narrative:

1. Sweep of inducement lows triggers institutional entries.

2. Demand zone holds with bullish reaction — confirmation of intent.

3. Expect higher highs and a rally toward uncollected liquidity above 3,440.

4. Low-risk buy opportunity for both swing and intraday traders.

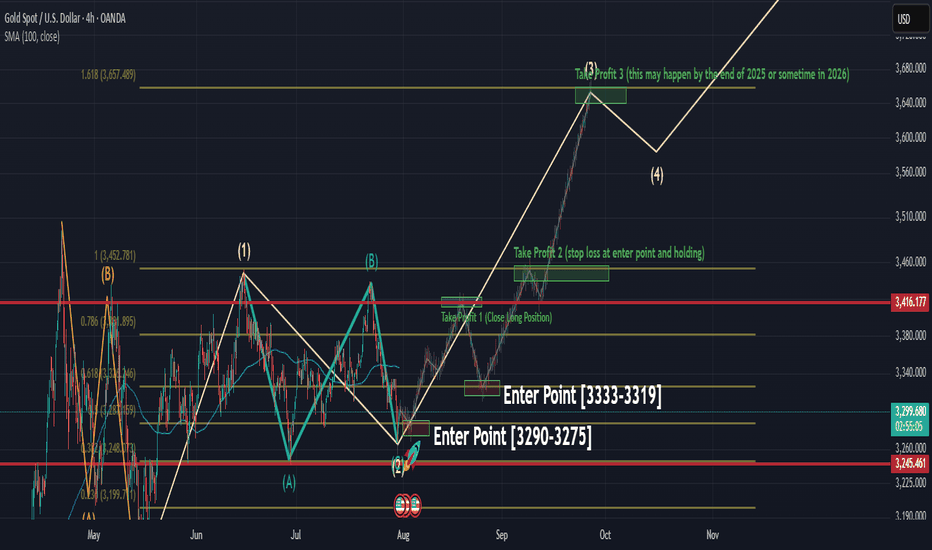

Roadmap to 3982: Key Long Entries and Profit ZonesThe initial long entry zone is between 3290 and 3275 .

From this range, an uptrend is expected to begin, targeting 3416 , which is our first exit point to close the initial long position.

After that, we wait for the next long entry , ideally around 3333 to 3319 . A new upward movement from this range is expected to reach 3455 . At this level, we continue to hold the position while placing the stop loss at the entry level to protect profits.

The next take profit target is 3650 , which may be reached by the end of 2025 or in 2026.

The final target is 3982 , which is likely to be hit in 2026, as the market may not have enough strength to reach it in 2025.

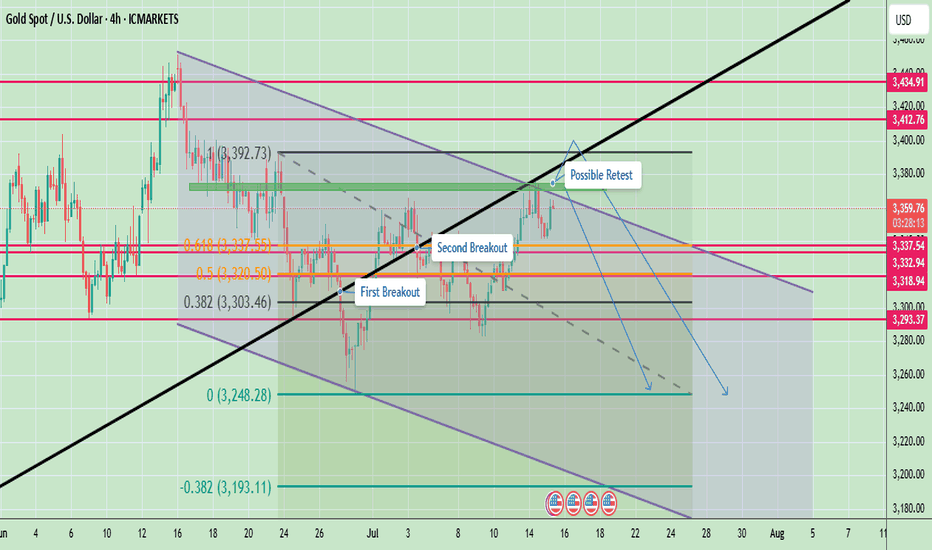

Gold Faces Strong Rejection Below $3,365 – Bearish Wave Ahead?Gold is currently trading around $3,359, showing signs of exhaustion after climbing from the $3,248 low. The chart illustrates a textbook scenario of channel rejection after testing the upper boundary of the descending wedge and failing to break above the $3,365–$3,392 resistance zone. Price is now hovering just below the diagonal black trendline, indicating a potential lower high formation and setting up for another bearish wave.

📌 Key Technical Highlights

Resistance Zone: $3,365–$3,392

This area marks the confluence of the black long-term trendline, the top of the descending purple channel, and the previous high at $3,392.

Price attempted a "Possible Retest" as annotated on the chart and is now starting to pull back—showing signs of bearish rejection.

Bearish Scenario (Blue Arrows):

Multiple downward arrows show likely bearish paths if the current resistance holds.

Key short-term targets:

$3,337, $3,320, $3,303, Strong support at $3,293–$3,248

Further downside may test extension levels toward $3,220–$3,200 by early August if momentum builds.

⚠️ Bearish Confirmation Criteria

Failure to close above $3,365 (black trendline)

Breakdown below $3,337 followed by $3,320

Strong selling pressure supported by fundamentals (e.g. USD strength, Fed hawkish stance)

✅ Invalidation / Bullish Outlook

A decisive breakout and close above $3,392.73 would invalidate the bearish structure.

In that case, targets would shift toward:

$3,412, $3,434, $3,490 (long-term trendline intersection)

However, today's U.S. CPI (Consumer Price Index) release adds a layer of volatility and potential trend disruption, making this a high-risk trading day.

📊 CPI News Impact – What to Watch

High CPI (Stronger than forecast):

- Increases expectations of further Fed tightening → strengthens USD → bearish for gold

- Likely scenario: sharp drop toward $3,337 → $3,320 → $3,293

Low CPI (Weaker than forecast):

- Signals disinflation → weakens USD → bullish for gold

- Possible breakout above $3,365 → retest of $3,392 → if broken, target $3,412 and $3,434

Neutral or as expected CPI:

- Likely leads to whipsaw — fakeout on both sides

- Caution advised — wait for candle close confirmations post-news

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!