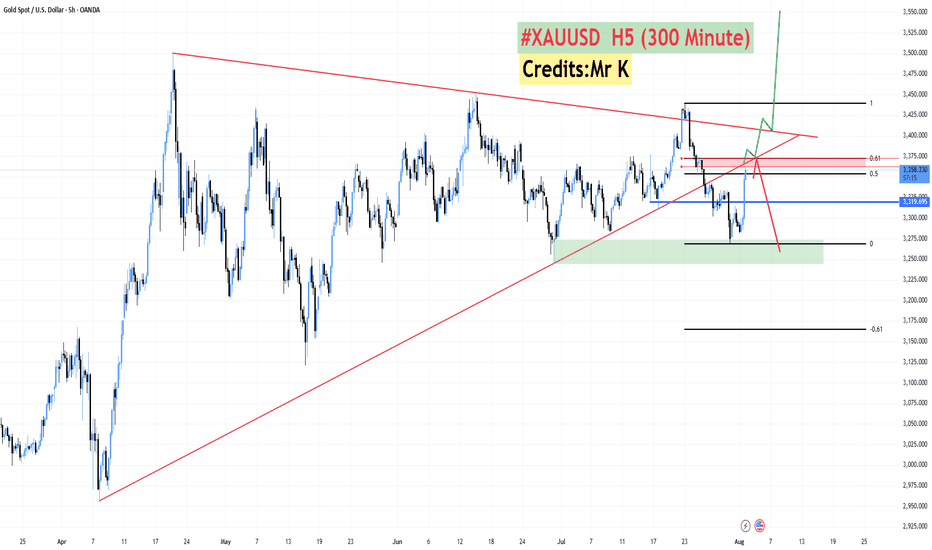

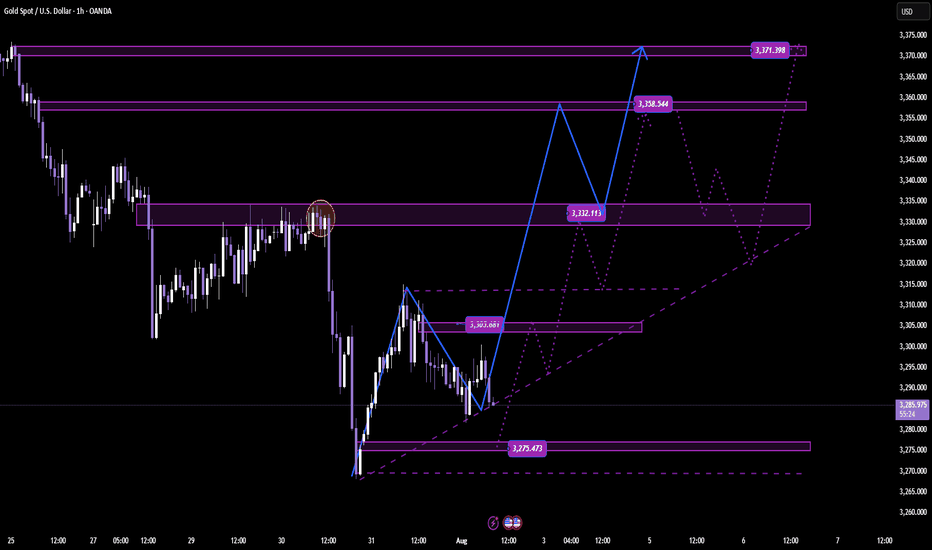

**#XAUUSD H5 Higher Timeframe Analysis**

📊 **#XAUUSD H5 Higher Timeframe Analysis**

What we witnessed today was a **tremendous recovery in Gold 🟡** after **3–4 consecutive bearish sessions 📉**.

📅 **Today’s candle** has **completely flipped the weekly structure**, turning a fully **bearish weekly candle into a bullish one 📈** — thanks to the **NFP data** that came in **favor of Gold and against the Dollar 💵❌**.

🔍 However, price is now approaching a **critical confluence zone**:

* 🧭 A **long-running trendline** (since April)

* 🔴 An **H4 Bearish Order Block**

* 📐 The **Fibonacci Golden Zone (0.50–0.618)** at **3362–3372**

📌 **From this level, we have two possible scenarios:**

1️⃣ **Sharp Rejection 🔻:**

Price may **reverse sharply** from the 3362–3372 zone and **resume the bearish trend**.

2️⃣ **Breakout & Trap Theory 🔺:**

If price **sustains above this zone**, it may signal that the recent **3–4 day drop was a fake breakdown**, designed to **trap sellers** and grab liquidity for a **further upside move**.

✅ **Confirmation will come if we get an H4–H6 bullish candle close above the trendline** and back inside the **buying zone of 3375–3390**.

🔓 **A breakout above the triangle pattern** will likely lead to a **strong bullish continuation 📈🚀**.

Futures market

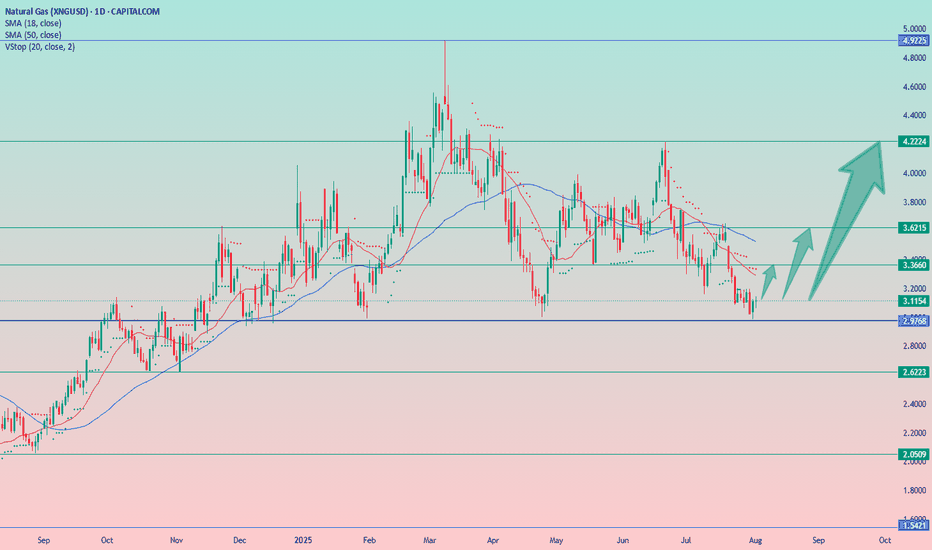

Natural Gas Rebounds from Key SupportNatural gas has bounced off its strong support level and is showing signs of upward movement, particularly evident on the hourly chart. Dips are being bought up, with the price quickly returning to previous levels.

Downsides: The downtrend is still in place (though it may potentially be broken), and there's a relatively long stop-loss below yesterday’s candle low at 2.98.

📝Trading Plan

Entry: buying gold at the current level

Stop Loss: 2.98

Target: 3.36, 3.62, and 4.20.

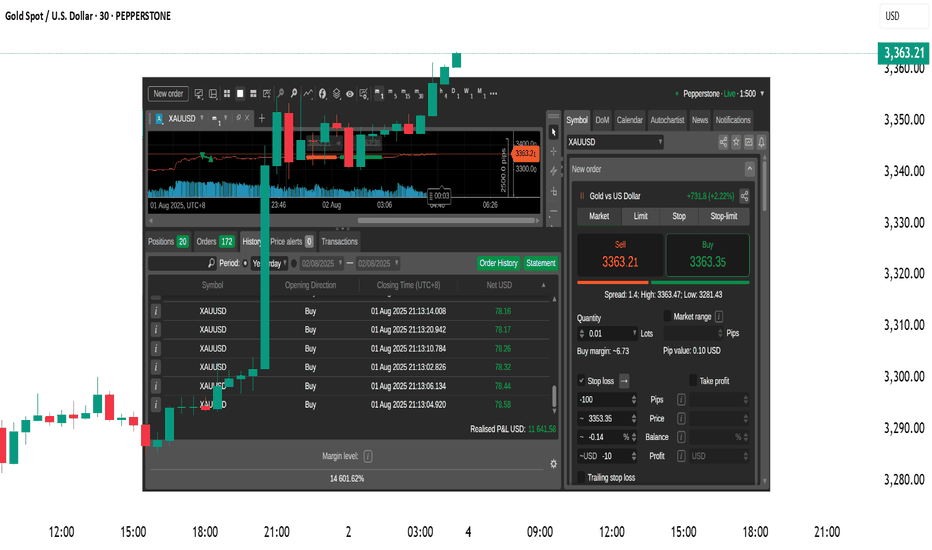

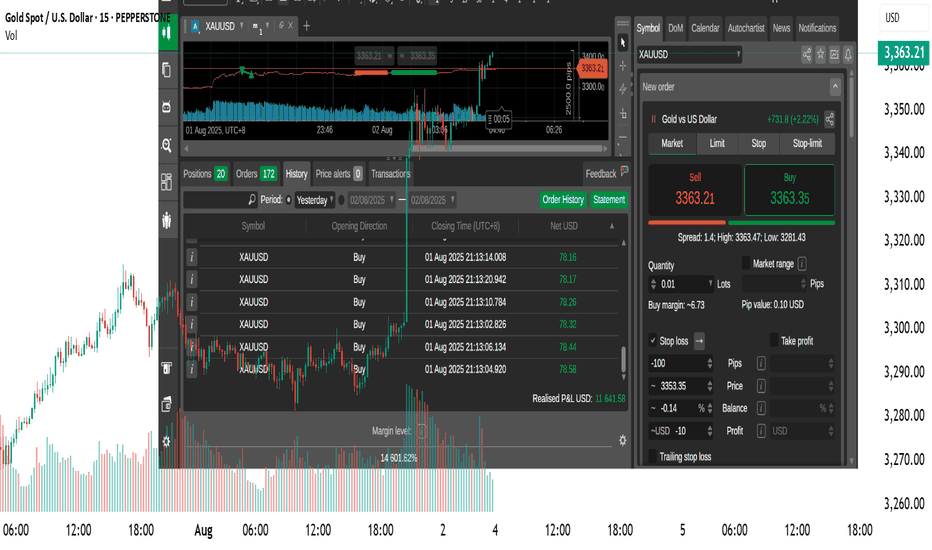

XAUUSD Live Trade with 11,641 USD ProfitsI managed to ride the momentum last night on XAUUSD and made over 11,641 usd profit on a live trading account. Gold usually create a range. It will create a top and a bottom then it will spend most of its time inside that range. That is pretty much how XAUUSD moves. If you can identify the top and the bottom then you can short it from the top and do a long trade on the bottom. The price will just travel from bottom to top and top to bottom. You can scalp your way to profits on this move if you can time it properly. Once in a while, a break from the top or the bottom happens. This is where you switch from trading the range to trading breakouts.

When you trade breakouts, you must trade it with the knowledge that less than 15 percent of breakouts are successful. Failed breakouts are very common. You need to have some form of stoploss below your breakout levels. You will know that the breakout fails once your stoploss is hit. If the breakout is successful then ride it. Do not put some TP (target price or take profit price) rather just trail your profits. Move your stops a few pips behind the price. Just enough distance to let the price breathe. If the price reverses then it will hit your stops. If the breakout is strong then you will ride it for a while until it reverses.

It will form another top and bottom again and move inside that range. Switch your approach again in trading long trades near the bottom and short trades near the top.

Just remember to always have some stoploss on every trade and never try to predict what the market will do or how the price will move. Let the market do its thing and just react to its movements.

Goodluck on your trades.

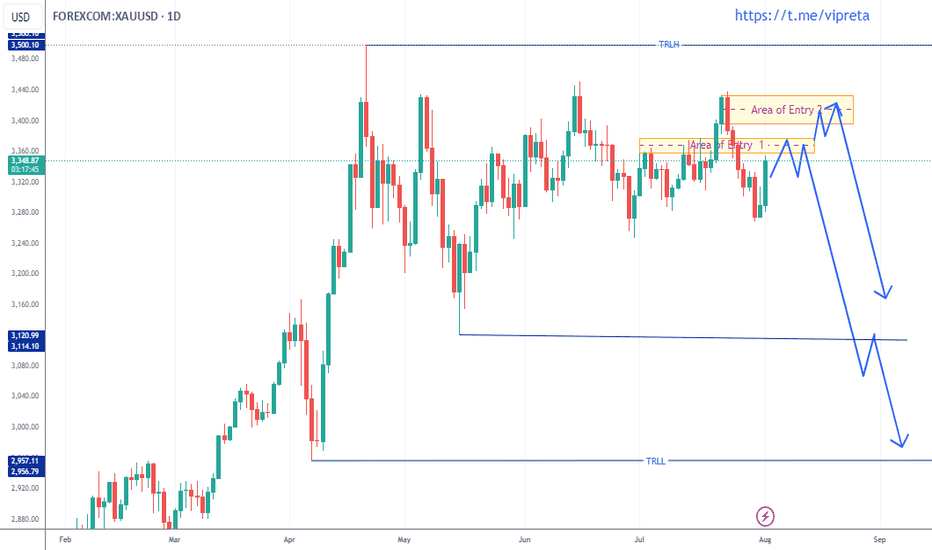

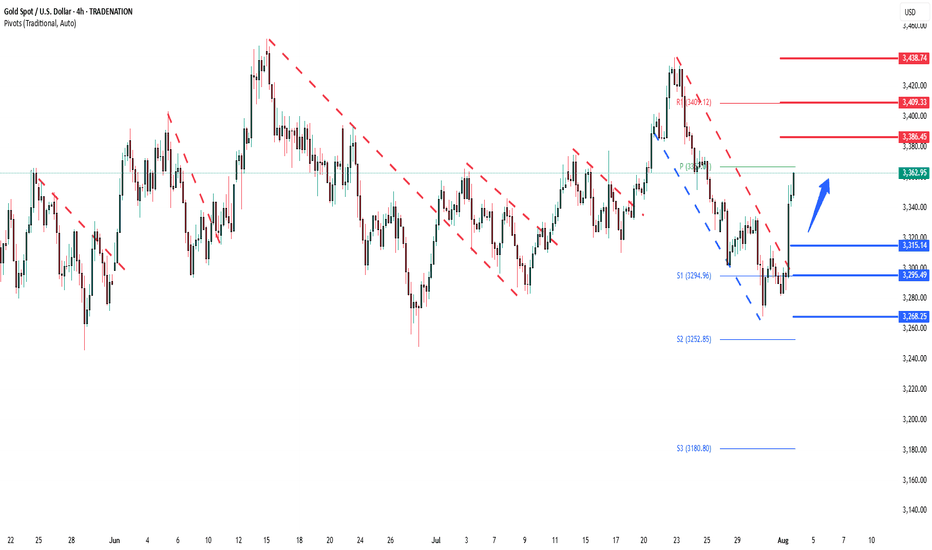

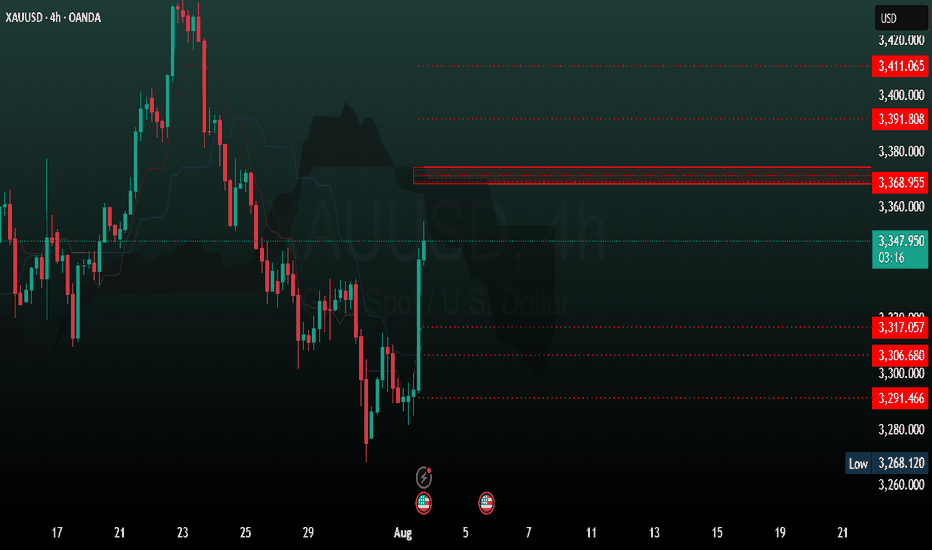

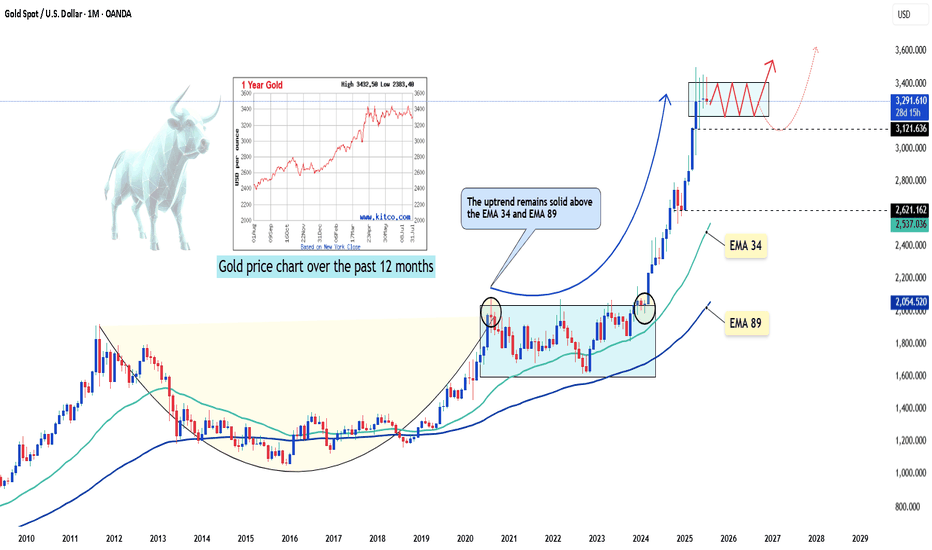

Gold The Week Ahead Key Support and Resistance Levels

Resistance Level 1: 3386

Resistance Level 2: 3410

Resistance Level 3: 3438

Support Level 1: 3315

Support Level 2: 3295

Support Level 3: 3268

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

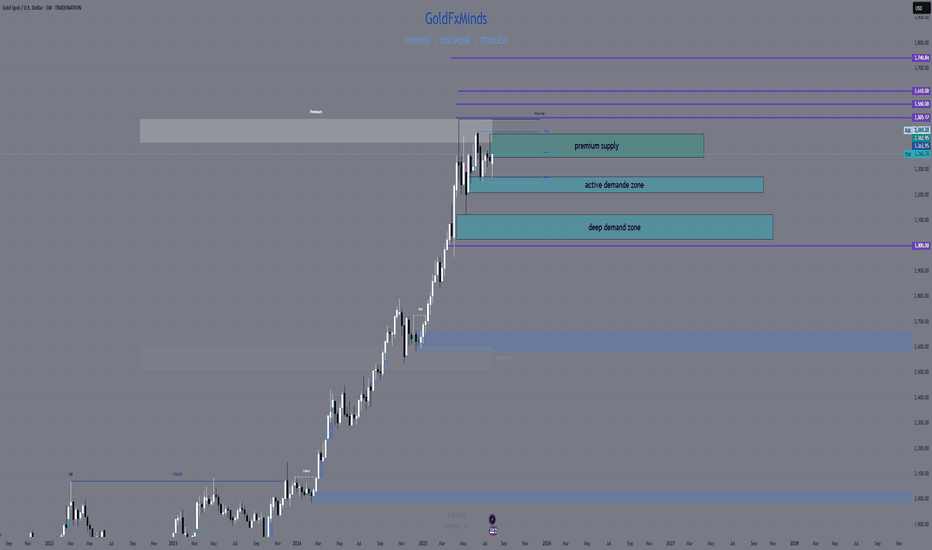

XAUUSD Weekly Outlook – August 4–8, 2025

The question isn’t whether gold is strong. The question is — will price expand, or rebalance?

🔸 Macro Overview

Gold begins the week consolidating just below its final HTF supply zone (3439), while USD weakens amid mixed macro data and growing speculation of future rate cuts. Markets await fresh catalysts, and gold’s recent impulsive rally is now facing the big test: break the wick, or pull back?

🔸 Weekly Structure & Bias

Element Observation

🔹 Trend Bullish continuation — clean structure

🔹 Last BOS March 2025 — impulsive, with imbalance below

🔹 Price Action Top wick rejection forming near 3439

🔹 Bias Still bullish, but entering exhaustion zone

🔹 RSI Above 70 — overheated

🔹 EMAs EMA5 > EMA21 > EMA50 > EMA100 — perfect trend

🔸 Key Weekly Levels (Zones + Confluences)

Zone Type Price Range Confluences

🔴 Supply 3350 – 3439 HTF wick supply + FVG + RSI 70+ + liquidity trap

🔵 Demand 3270 – 3215 Weekly OB + FVG + EMA21 support

🔵 Demand 3120 – 3070 Old BOS + deep FVG + psychological level

🟢 Support 3000 zone EMA50 + historical consolidation

🔸 Fibonacci Extensions (Above 3439)

Extension Level Price Target Confluences

1.0 (Swing Full) 3439 Supply wick high

1.272 3505 Next psychological milestone

1.414 3560 Mid-extension + liquidity

1.618 3610 Golden expansion target

2.0 3740 Full trend extension (max)

🔺 These levels serve as potential breakout targets ONLY if we get a confirmed weekly close above 3439 with clean BOS on LTF.

🔸 Weekly Scenarios

🟢 Scenario 1 – Break and Expand

If gold breaks 3439:

Expect clean continuation to 3505 → 3560 → 3610

Best entries come from new OBs on H4/D1 around 3350–3370

Follow momentum — but don’t chase without retrace confirmation

🔻 Scenario 2 – Rejection + Retracement

If price holds below:

Pullback toward 3270 – 3215 expected

EMA21 acts as dynamic support

If selloff gains strength, next demand = 3120 – 3070

🎯 This zone aligns with macro OB + re-entry for long-term bulls.

🔸 Conclusion & Gameplan

Gold is pressing against its final weekly ceiling.

Structure remains bullish, but every sniper knows — at the edge of premium, timing is everything.

✅ Above 3439 → expansion opens to 3505 → 3560 → 3610

🟦 Below 3439 → retracement into 3270 → 3215 → 3070

The best setups will be born from confirmation, not prediction. Let the market decide.

—

What would you do if 3439 rejects hard this week?

Comment your plan, tag your sniper level, and let’s stay ahead together 💬

—

With clarity, confidence, and perfect timing,

GoldFxMinds 💙

Disclosure: Analysis based on Trade Nation (TradingView) chart feed.

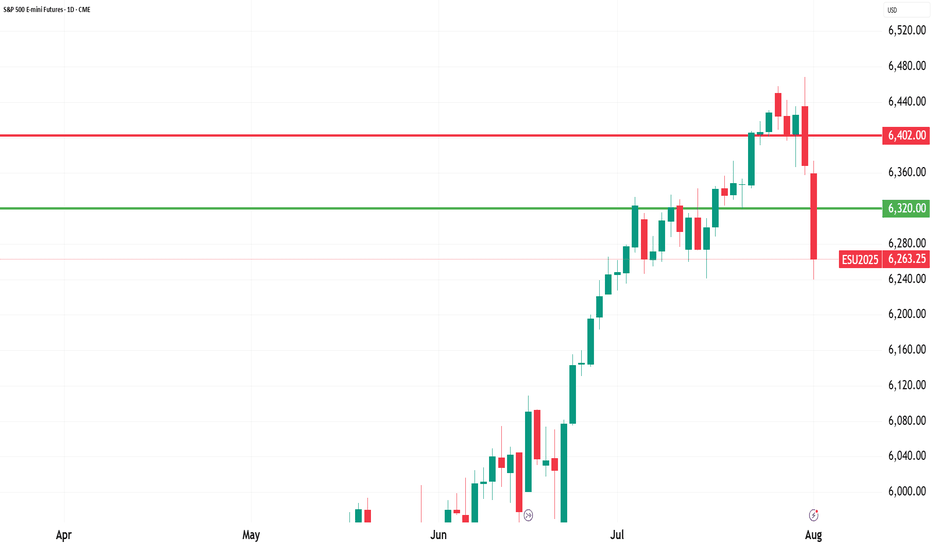

Time to catch its breathAfter the break to lower prices in the daily S&P 500 chart, the expectation for Monday is for the market to stop and catch its breath which means are not looking for a big day down on Monday but rather a sideways so only slightly lower move without new fundamental information to stimulate the market.

How to seize the key turning points in the gold market?The market is ever-changing, and following the trend is the best strategy. When the trend emerges, jump in; don't buy against it, or you'll suffer. Remember not to act on impulse when trading. The market is a haven for all kinds of resistance, so don't hold onto positions. I'm sure many people have experienced this: the more you hold onto positions, the more panic you become, leading to ever-increasing losses, poor sleep, and missed opportunities. If you share these concerns, why not try following Tian Haoyang's lead and see if it can open your eyes? I'm always here for you if you need help, but how can I help you if you don't even offer a hand?

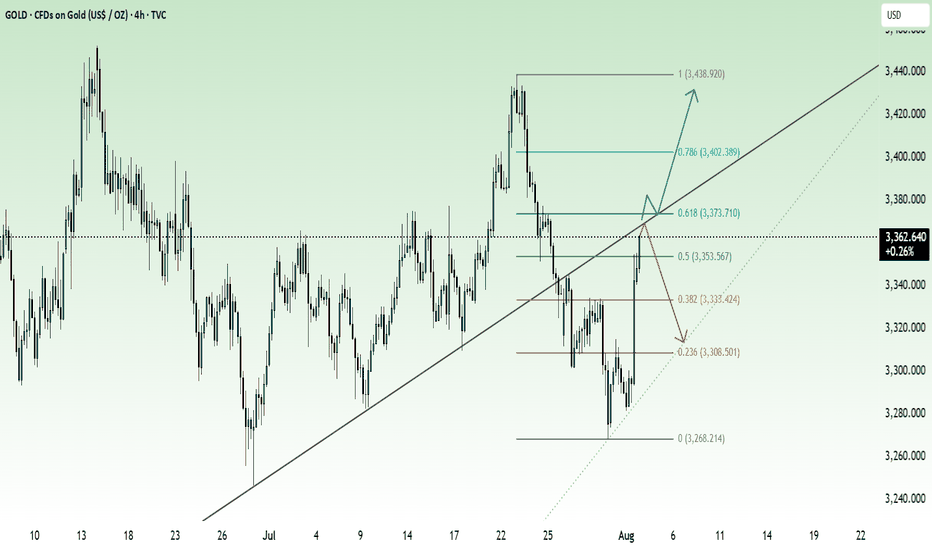

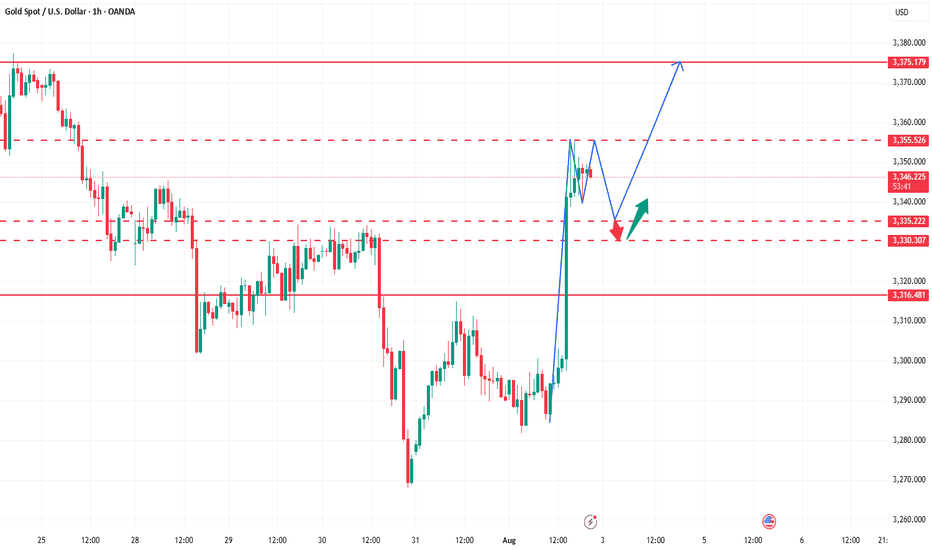

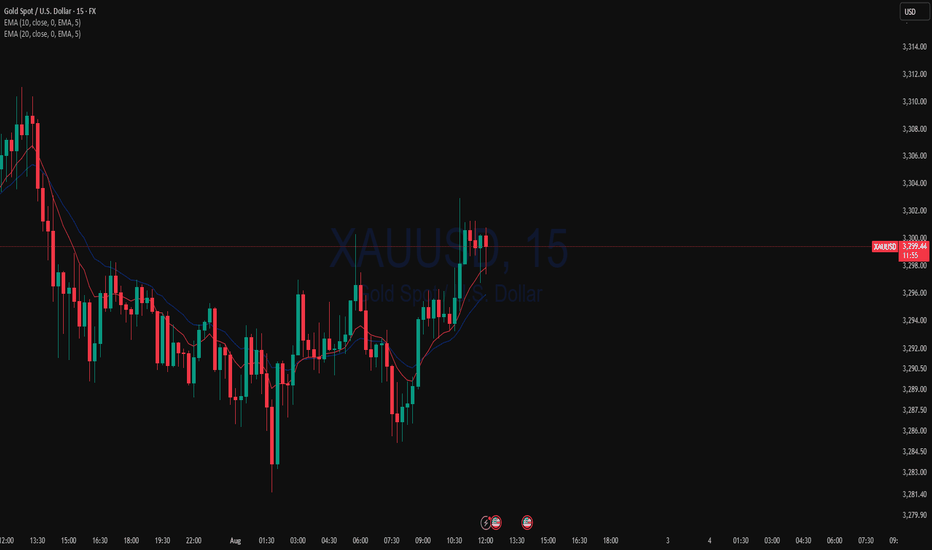

Gold did not fall below 3280 during the day on Friday and started to fluctuate in the range of 3280-3300. The non-farm payroll data was bullish, and it directly broke through the pressure of 3315, and then broke through the important pressure of 3335 again. As of now, it has reached a high near 3355. The non-farm payroll data market has almost been exhausted. Next, we will focus on the technical form adjustment. At present, you can consider light shorting in the area near 3355-3370. After all, chasing long is risky, and the technical side needs to be adjusted. If your current operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with me.

Based on the 4-hour chart, short-term resistance is near 3355-3365, with a focus on the key resistance level of 3370-3375. Short-term buy orders should be taken if a rebound continues. I'll provide detailed trading strategies at the bottom of the page, so stay tuned.

Gold operation strategy: Short gold in batches when gold rebounds to 3355-3370, with the target being the area around 3340-3335. Continue to hold if it breaks through.

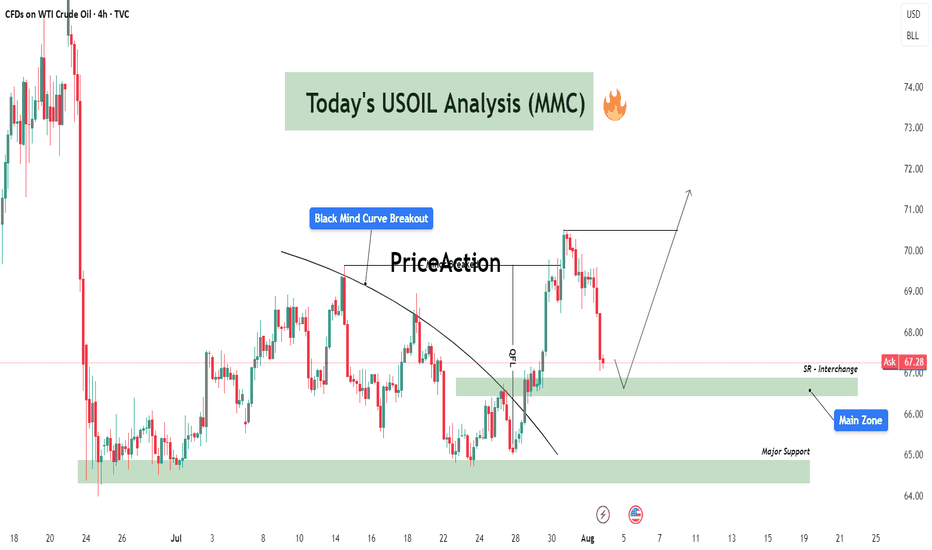

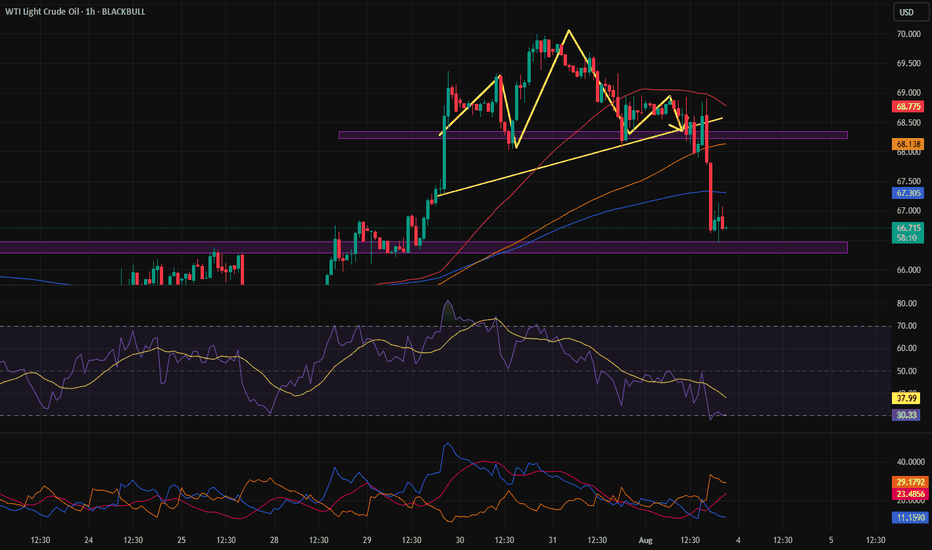

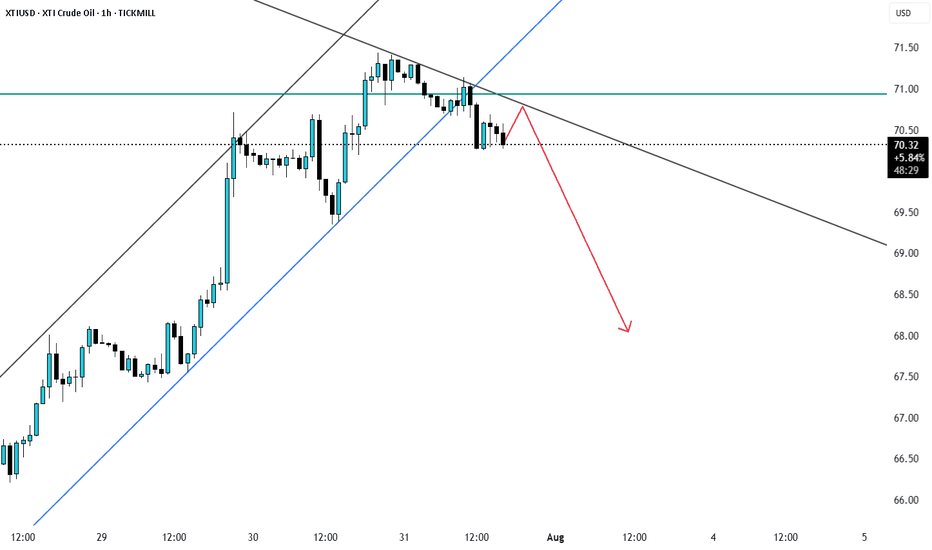

USOIL Technical Analysis – Black Mind Curve Breakout & Reversal🔍 Overall Market Context:

The current USOIL structure is a great example of market shift from compression to expansion, characterized by a breakout of the Black Mind Curve followed by a measured impulse move. This chart is not just reacting technically, but it reflects how institutional smart money manipulates curves, breaks minor structures, and then retests zones to refill orders before continuing directionally.

Let’s break the market psychology and price action phase by phase:

🔄 Phase 1: Black Mind Curve Breakout ✅

The Black Mind Curve represents long-standing supply pressure that had been capping price.

Its breakout marks a shift in market intention, often signaling the end of a distribution phase and beginning of a possible accumulation or re-accumulation.

Price broke above this curve cleanly with strong bullish candles, which also broke minor structure levels, confirming short-term bullish sentiment.

The breakout was also backed by momentum and volume as the market pushed 130+ pips upward—an aggressive impulse that trapped late sellers below.

📉 Phase 2: Retracement to Interchange Zones

Now, we’re in the retracement phase, where price is pulling back toward:

🔹 SR Interchange Zone ($66.80 - $67.30)

This zone was previous resistance, now flipping to support.

In MMC terms, this area is expected to serve as a refill zone where smart money will look to accumulate again after the breakout.

We are watching for confirmation candles or MMC-style reversal patterns here (e.g., inside bar breakouts, demand imbalances).

🔹 Main Zone ($65.80 - $66.50)

If the first zone fails, this is the next key demand base.

It holds historical value from previous accumulation phases (see July 10–25) and aligns with the origin of the last impulse.

Expect a sharper wick or deeper liquidity grab if price moves into this area.

📉 Phase 3: Final Defensive Zone – Major Support ($63.70 - $65.20)

This zone marks the last line of bullish defense.

A move here would mean the bullish structure is being reevaluated or absorbed by sellers.

However, if price hits this level, it could also attract significant institutional demand, setting up for a more powerful long-term leg up.

Reactions here are typically large and volatile, with a risk of fakeouts and fast reversals.

📈 Possible Scenarios (MMC Based Forecasting):

✅ Scenario 1 – Bullish Continuation (Primary Path)

Price finds support inside SR Interchange Zone.

Forms a base (MMC reversal structure) and pushes back to recent highs near $71.

Breakout above $71 opens room for next supply zones between $72.50 - $74.00.

⚠️ Scenario 2 – Deeper Liquidity Grab

Price breaks below SR Interchange and tests Main Zone for a deeper accumulation.

A wick or shakeout may happen before bullish continuation.

This trap zone could give the best R:R entry.

❌ Scenario 3 – Breakdown to Major Support

If both zones fail and bearish pressure sustains, price may revisit Major Support.

That would reset the bullish structure and require fresh MMC assessment.

🧠 MMC Logic at Work:

The curve break symbolizes the shift from supply dominance to a possible demand-led phase.

Minor structure breaks add fuel to trend shift and indicate participation from larger players.

Retracements are not weaknesses—they are refills for those who missed the move.

Smart money uses these zones and flips (SR interchanges) to hide in plain sight.

🎯 Key Takeaway for Traders:

This is a textbook MMC setup that combines:

Curve Breakout + Impulse

Zone Retest + Interchange Logic

Liquidity Engineering before Continuation

Traders should remain patient and observe reactions at each zone. Don’t chase—wait for the market to reveal its hand via MMC entry signals (break-of-structure, bullish engulfings, imbalance fills, etc.)

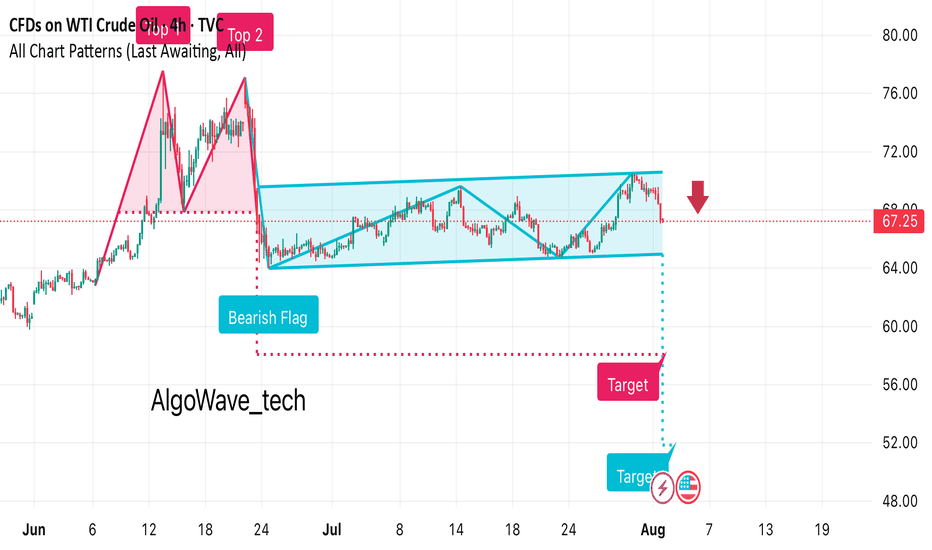

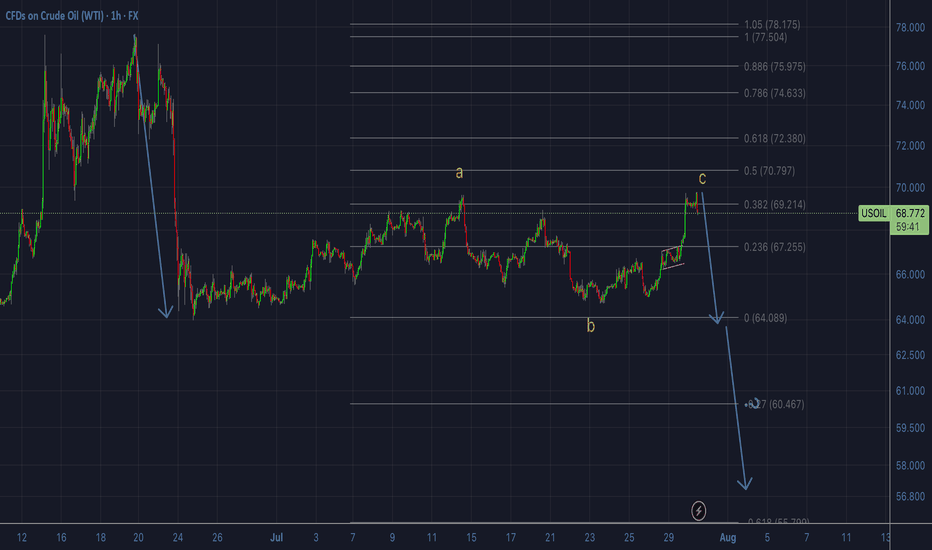

It looks like this chart for WTI Crude Oil is showing a bearish • Previous Move: There’s a strong downward leg before the flag formation, indicating bearish momentum.

• Flag Pattern: Price consolidates in an upward-sloping channel after the drop.

• Breakout: The chart suggests a bearish breakout below the channel, marked with a red arrow at around $67.25.

• Target Projection: The measured move target appears to be around the $53–54 range, based on the flagpole height.

Gold non-farm payrolls are bullish, long and short positions ana

Rather than envying the fish by the river, it's better to retreat and weave your net. We often envy the wealth others can earn by investing in the gold market. We often watch them enthusiastically investing, but we ourselves are afraid to enter the market. The two major factors that drive the market, technology and news, are a topic of constant debate among investors. To navigate the market, one must master the art of attack and defense to remain rock-solid while remaining at the forefront. As the saying goes, trust me, and I will reward you with profits!

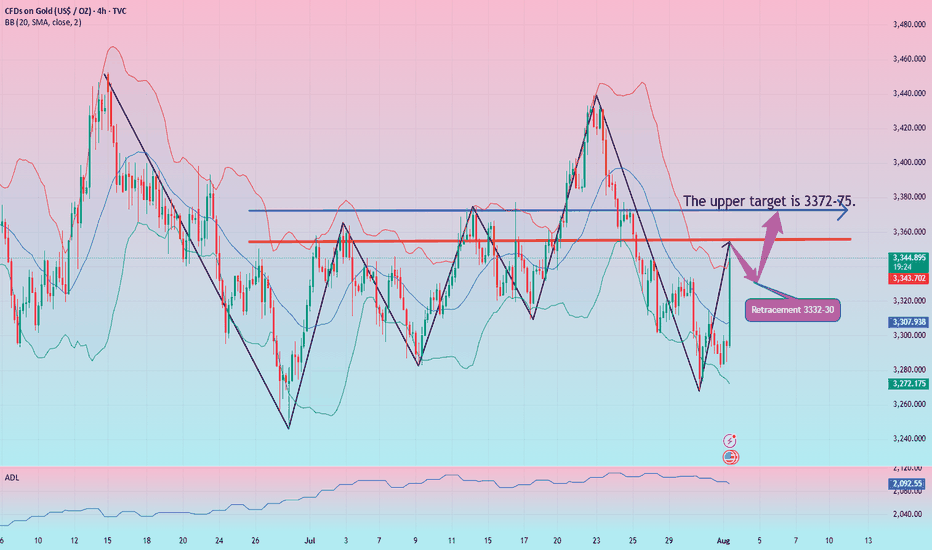

Gold Data is Bullish!

The positive non-farm payroll data sent gold soaring, with gains completely erasing all of the week's losses. Currently, gold's trend has reversed the stagnant bullish and bearish trend. After breaking through the 3300 mark and rising all the way to 3348, it shows no signs of stopping. A further test of the 3370 level is not out of the question!

Due to the strong bullish data, if you don't immediately chase longs or place a breakout long order during the first wave, you'll likely have little chance of a pullback. Therefore, you should remain aggressive in your trading strategies. We recommend a pullback to the 3332-30 level to continue the bullish trend. Upward pressure is expected at 3372-75! The market fluctuates violently, and more real-time entry and exit points are mainly based on Yulia's real-time guidance!

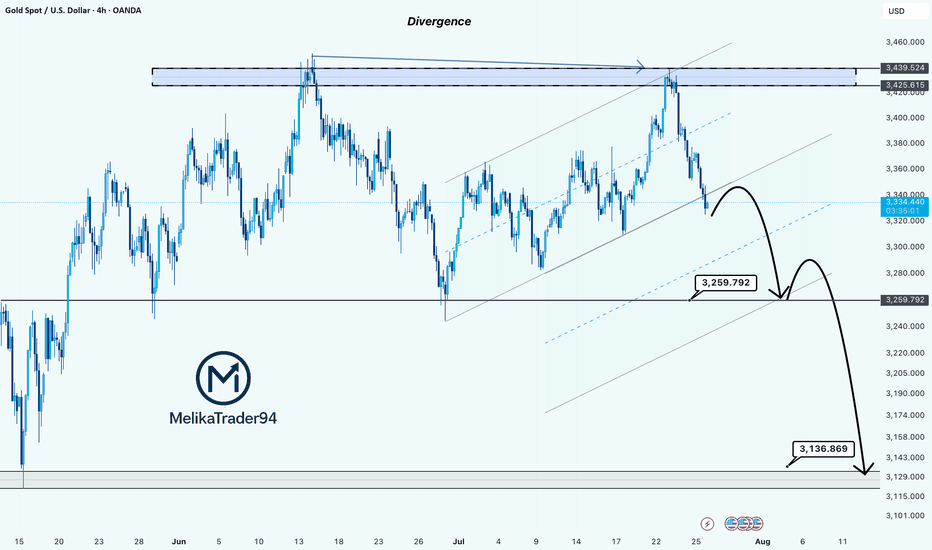

Gold Showing Signs of Reversal After Hitting Key ResistanceHello Guys.

Gold has reached a major resistance zone around 3439–3425, which has already acted as a strong ceiling in the past. The price tapped into this area again, forming a clear divergence, and failed to break higher.

Here’s what stands out:

Divergence signals a weakening bullish momentum at the top.

The price rejected the resistance and is now breaking structure to the downside.

A minor pullback may occur before continuation, as shown in the projected moves.

First target: 3259.792

Second target (if support breaks): 3136.869, a deeper zone for potential bounce or further drop.

This setup hints at a bearish trend building up. Stay cautious on longs unless the price structure changes again.

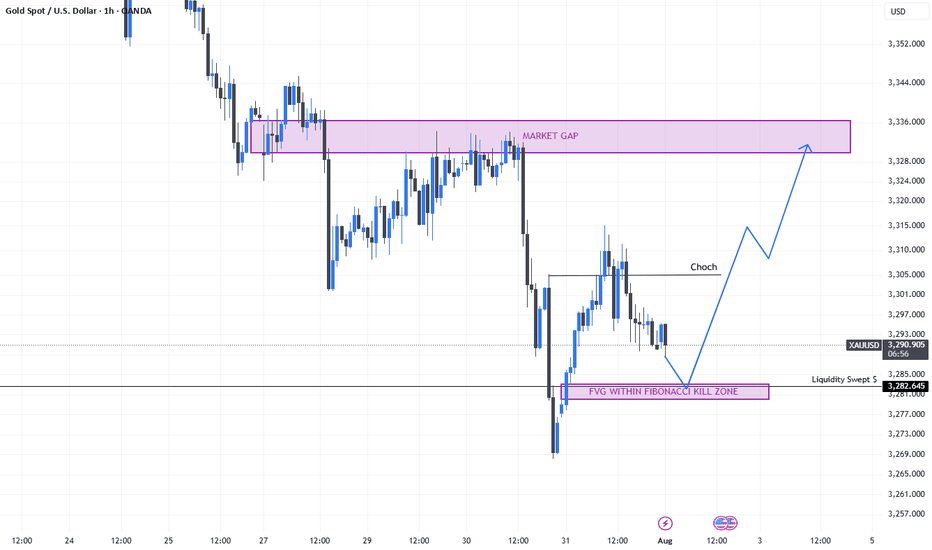

My first take on XAUUSDI see this last fall as a very clear sweep of liquidity (the recent lows. After that i see an impulsive push away from this zone giving me a change of character. Left behind is an FVG on hopurly chart that aligns within the kill zone on my Fibonacci tool. and that is where i would enter. I would expect price to mitigate this FVG. Another confluence is that we created many IFVG's on the way up showing balanced price action. Only one more confluence i would have liked is a HTF order block from the liquidity sweep but only have one on the 5 minute. i will monitor. First tp is that internal liquidity from the move, second tp is the external liquidity where we have had consolidation and a few failed attempts to break above this opening gap fvg. thanks for looking. any comments welcome,

DAILY SCALPING PLAN | CLINTON SMC STYLE✅ XAU/USD - DAILY SCALPING PLAN | CLINTON SMC STYLE

📆 Date: August 1st, 2025

📍 Strategy: Smart Money Concepts (SMC)

🔑 Focus: Liquidity Sweep | Order Block | BOS | Premium/Discount Model

🔍 Market Overview

Gold (XAU/USD) is currently in a manipulation phase after a strong move down from a premium supply zone. The market has swept key liquidity and is preparing for a high-probability move in both directions based on Smart Money footprints.

Current structure suggests:

Bullish intent forming from a discount demand zone.

Liquidity resting above recent highs – perfect for short-term scalps and intraday swings.

🟢 BUY SETUP – DISCOUNT DEMAND REACTION

🎯 Entry: 3275

🛡️ Stop Loss: 3268

🎯 Take Profits:

TP1: 3285

TP2: 3295

TP3: 3305

TP4: 3315

TP5: 3325

TP6: 3335

Reasoning:

This is a clean bullish OB resting beneath a CHoCH and BOS zone. Price may wick into this area as Smart Money reloads after sweeping early long positions. If held, expect sharp upside expansion toward previous liquidity highs.

🔴 SELL SETUP – PREMIUM SUPPLY REJECTION

🎯 Entry: 3356

🛡️ Stop Loss: 3362

🎯 Take Profits:

TP1: 3350

TP2: 3345

TP3: 3340

TP4: 3330

TP5: 3320

Reasoning:

This level is a key supply block where price previously distributed. If price expands into this zone, it’s likely to act as a liquidity magnet for Smart Money to offload longs and enter short-term shorts. Expect reaction.

🧠 SMC Insights

Internal BOS & CHoCH signal early signs of accumulation.

Price respects the premium vs. discount framework with clear liquidity targets.

SMC traders understand that price doesn’t move randomly – it targets liquidity, mitigates OBs, and respects structure.

🔔 Note:

Always wait for clear confirmation (rejection wick, engulfing pattern, or M15 structure shift) before execution. Entries without confirmation are riskier in current volatility.

📌 Follow @ClintonScalper for daily SMC scalping plans & deep institutional insight.

🔁 Like, comment & share if you find this helpful!

XAUUSD – the calm before the next breakout?Hello traders, what’s your take on the current trend in OANDA:XAUUSD ?

Looking back over the past 12 months, gold has delivered a truly impressive performance. From around $2,380 in August 2024, the precious metal surged to an all-time high of $3,432 by April this year — a gain of more than $1,000 in less than a year. But what’s more telling than the rise itself is how the market behaved afterward: instead of crashing, gold has maintained a high consolidation range, suggesting the uptrend is still very much alive.

This powerful rally didn’t happen in isolation. In a world marked by uncertainty, gold has once again asserted its role as a safe-haven asset. Inflation remains persistent across major economies, geopolitical tensions continue to stretch from Eastern Europe to the Middle East and Asia, and de-dollarization efforts by countries like China and Russia are reshaping global capital flows. None of these events alone could shake the markets, but together, they have laid the groundwork for gold’s sustained relevance.

From a technical standpoint, the long-term bullish structure remains intact. Following its peak at $3,432, gold has entered a modest correction phase — one that may well be a healthy consolidation before the next directional move.

Interestingly, while many investors remain cautious, the chart paints a different story: a market that isn’t afraid, but simply catching its breath. The real question is no longer “Can gold hold above $3,400?” but rather “Is the market gearing up for a fresh breakout — or a deeper correction?”

We may not be able to predict the future, but we can observe how price reacts at key levels. And sometimes, it’s in these seemingly quiet phases that the biggest turning points begin to form.

What do you think — is gold preparing for another leg up?

Drop your thoughts in the comments below! 👇

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Live Trade Last Night (Killed it with 11,641 USD Profits)I managed to ride the momentum last night on XAUUSD and made over 11,641 usd profit on a live trading account. Gold usually create a range. It will create a top and a bottom then it will spend most of its time inside that range. That is pretty much how XAUUSD moves. If you can identify the top and the bottom then you can short it from the top and do a long trade on the bottom. The price will just travel from bottom to top and top to bottom. You can scalp your way to profits on this move if you can time it properly. Once in a while, a break from the top or the bottom happens. This is where you switch from trading the range to trading breakouts.

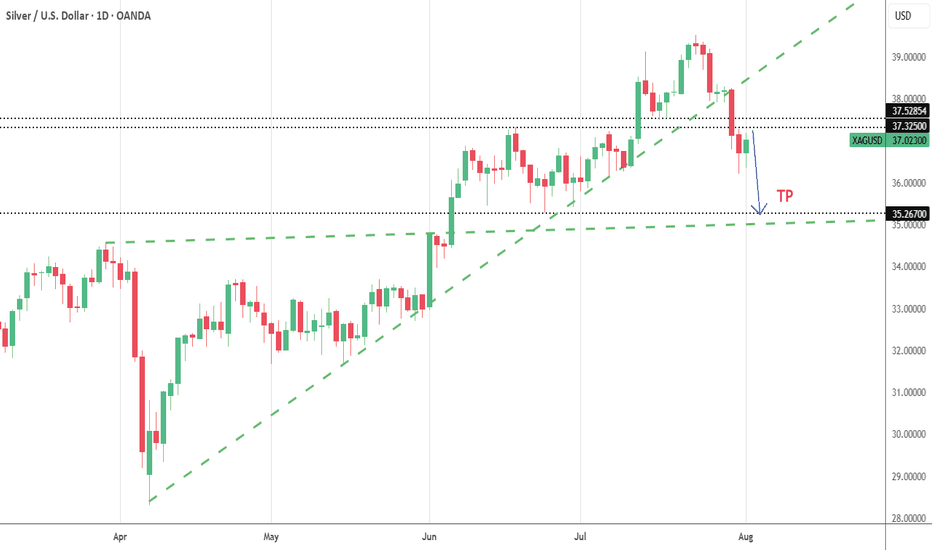

OIL - shortFollowing our previous forecasted up-move, from now on we will switch to looking for sell setups only. We would normally expect the C wave of the corrective pattern retrace all the way to the 0.618 fib of the downward impulse, as the A wave had already retraced to the 0.382. But that isn't necessarily always the case. As long as the C retracement has broken the top of the A retracement, the pattern formally speaking can be complete. We will not be looking for further buys, therefore, from now on. Even if it does continue to the 0.618, we will skip the eventual buy and focus on the sells. At the same time, because the eventuality of more up exists, we will wait for a proper sell setup before we enter any short position. Updates will follow.