Futures market

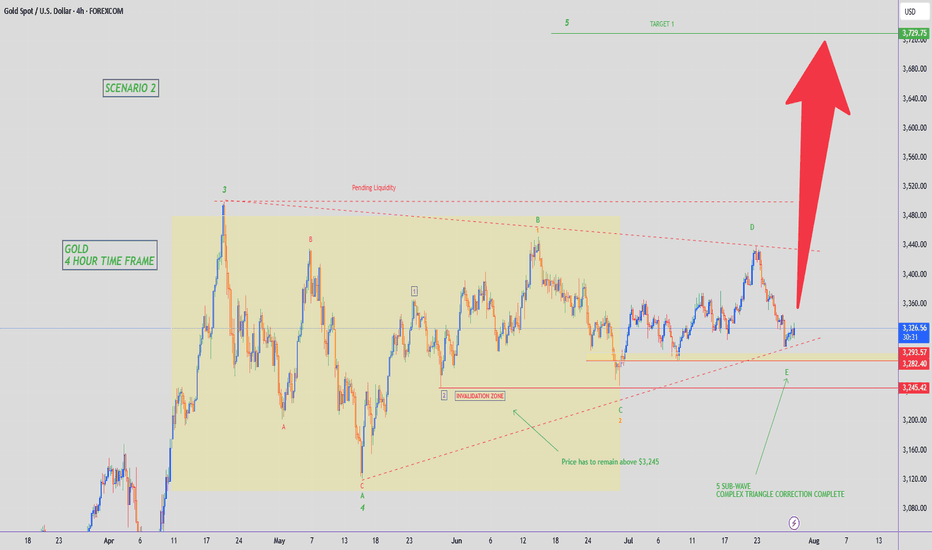

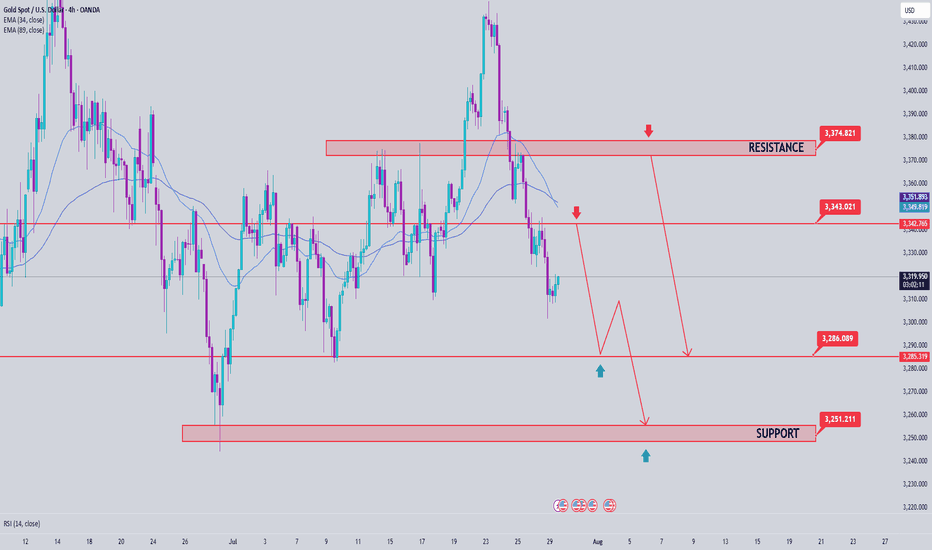

gold 4hour say: put sellstop in lowpersonaly i predict mini crash on gold and waiting for it , now we have powerfull 3angel pattern we must put sellstop in last low , buystop on last high

sellstop stoploss = last high

if sellstop open like new traders , dont close it soon , wait minimum 2 week ,understand?

ALERT= if gold can break last high , it can start new up trend, wave , so if you have old sells ,you must put SL or hedge buystop in last low

if sell

wishhhhhhhhhhhhhh youuuuuuuuuuuuuuuu win

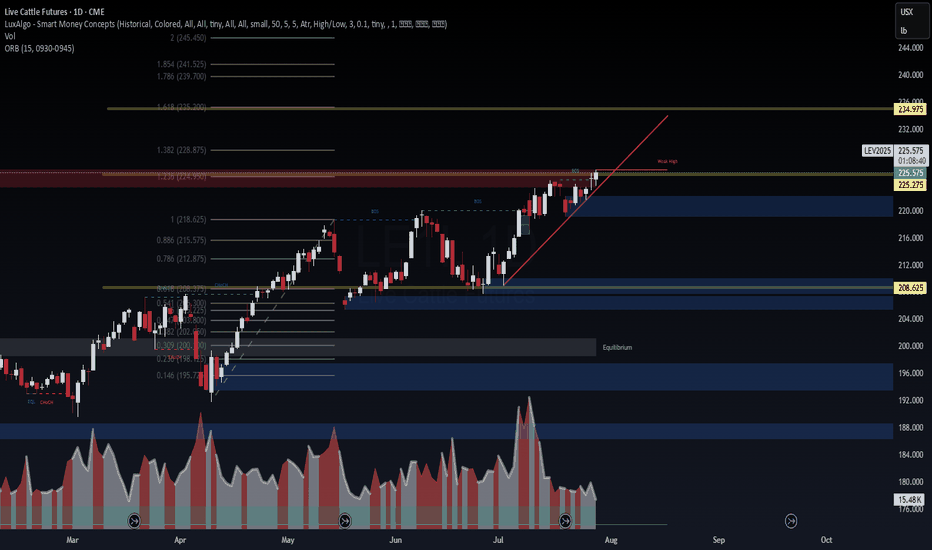

Live Cattle Futures (LEV2025) – Approaching Breakout Zone🐄 Live Cattle Futures (LEV2025) – Approaching Breakout Zone

WaverVanir DSS models show LEV2025 pushing into a key resistance band near 225.65–228.87 — the "weak high" zone where institutional sellers previously stepped in. Price remains in a clear bullish structure with clean BOS and rising demand.

🔍 Chart Structure Highlights:

📈 Trendline support holding since early June

🟨 Price sitting just below 1.382 Fib (228.87) – strong resistance

🟩 If broken, next fib extensions align at:

TP1: 234.97

TP2: 239.70

TP3: 245.45

🟦 Key downside structure support = 208.62 (CHoCH zone)

🧠 Options Flow (Aug–Dec 2025)

🟢 Call Buying: 224C, 225C, 226C, 242C – strong bullish pressure

🔴 Put Selling: 224P, 222P, 210P – income strategies defending downside

💡 Flow favors continuation higher, but many traders capping profits → suggests grind higher, not a parabolic run yet

📈 Strategy Insight

VolanX DSS bias: Bullish with caution

Break above 228.87 confirms squeeze toward 234–240 range

Failure to break = short-term fade back to 218–212 support band

🎯 Watch Levels

Breakout Confirm: Close above 229.00

Invalidation: Daily close below 218.62

Next Target Zone: 234.97 – 239.70 (1.618–1.786 extension)

#LEV2025 #LiveCattle #SMC #VolanXProtocol #CommodityFutures #OptionsFlow #FibStrategy #WaverVanir #DSS #Agriculture #MacroTrading #CMEFutures

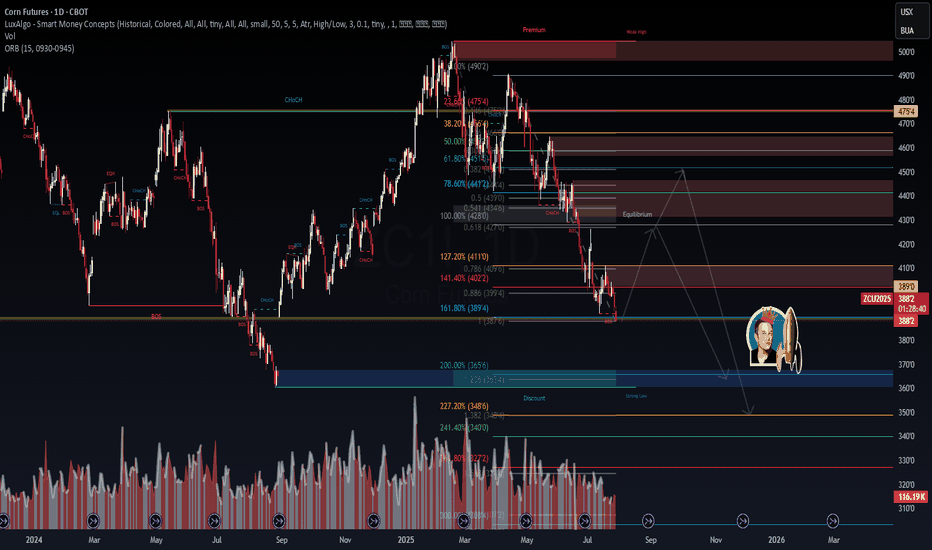

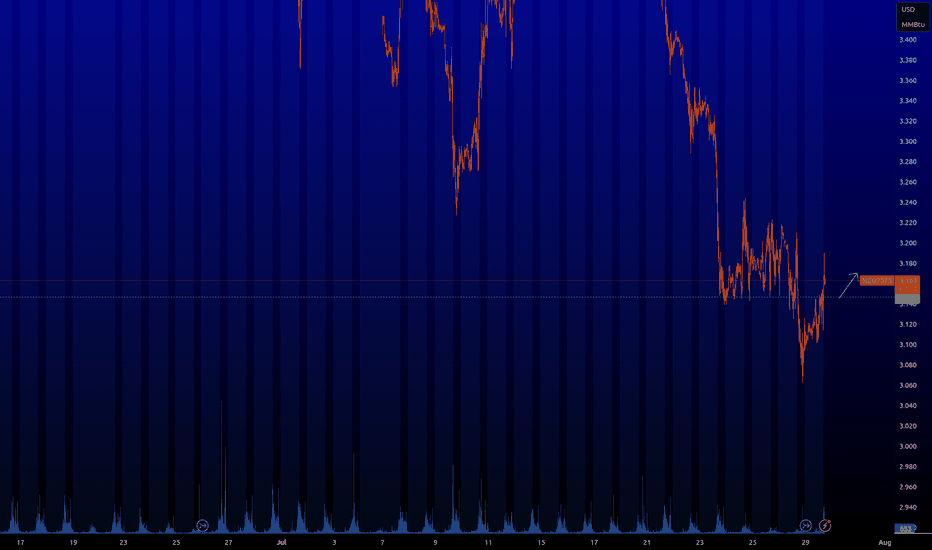

Corn Futures (ZCU2025) – Heavy Structure, Heavy Pressure📉 Corn Futures (ZCU2025) – Heavy Structure, Heavy Pressure

WaverVanir DSS shows continued downside probability in Corn as price compresses below the 0.786–1.272 fib zone and forms a supply rejection cluster near 4.10–4.27.

🧠 Macro Snapshot:

🌽 USDA WASDE (Aug 12) may revise yield upward amid favorable Midwest weather → bearish catalyst

🇧🇷 Brazil exports peaking + weak BRL = added global pressure

💵 Strong USD + elevated carry costs reduce long-side incentive

🏦 Fed tone remains hawkish → commodity bearish bias holding

🔍 Technical Breakdown:

✅ Confirmed BOS → CHoCH → Lower High confirms bearish control

📐 Fibonacci clusters align at:

🔻 TP1: 3750–3640 (1.236–200% ext)

🔻 TP2: 3480–3400 (2.27–2.41 ext + strong low confluence)

🛑 Invalidation above 4110–4140 (structural break + 1.272 retrace buffer)

🎯 Trade Setup (Short Bias)

Criteria Details

Entry Zone 3890–3880 (confirmed rejection candle)

TP1 3640 (volume/imbalance cluster)

TP2 3480 (fib confluence)

TP3 3270 (final extension)

Stop-Loss Close above 4110

Risk/Reward Targeting 3.2R at TP2

⚠️ What to Watch

📆 WASDE Aug 12

💬 CFTC Net Positioning (Fri)

🌡️ Weather swings (Corn Belt)

🧮 ZCU25 calendar spreads (ZCU25-ZCZ25)

🚀 The rocket is reserved for when fundamentals flip (e.g., yield shock, China buying). Until then, structure says one thing:

Smart money is hunting liquidity below 3640.

#ZCU2025 #CornFutures #FibStrategy #WaverVanir #VolanXProtocol #SmartMoneyConcepts #DSS #CommodityTrading #MacroAnalysis #ProbabilisticSignals #HawkishFed #SupplyChainPressure

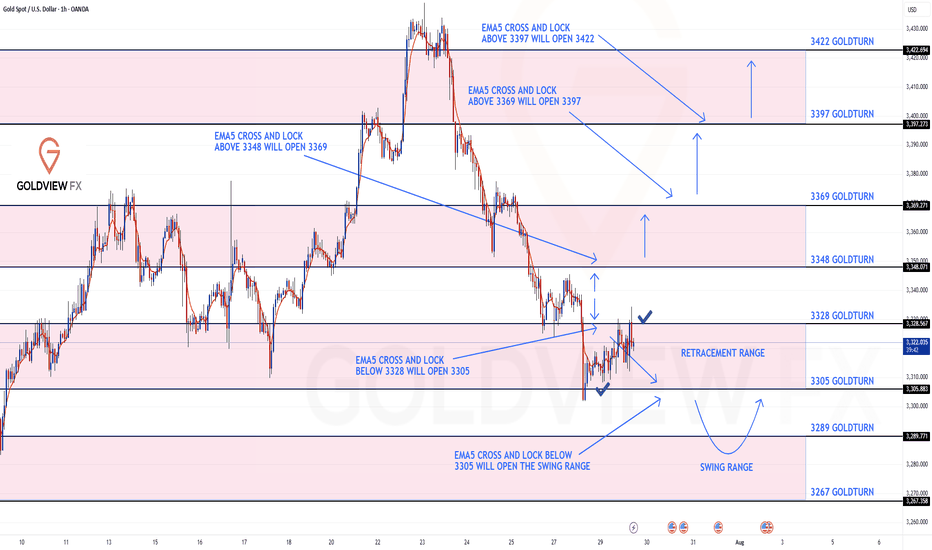

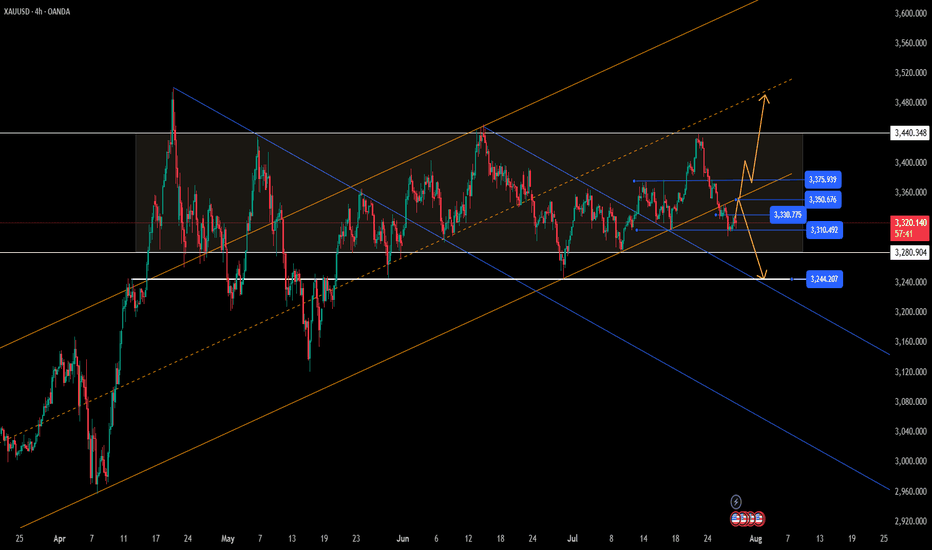

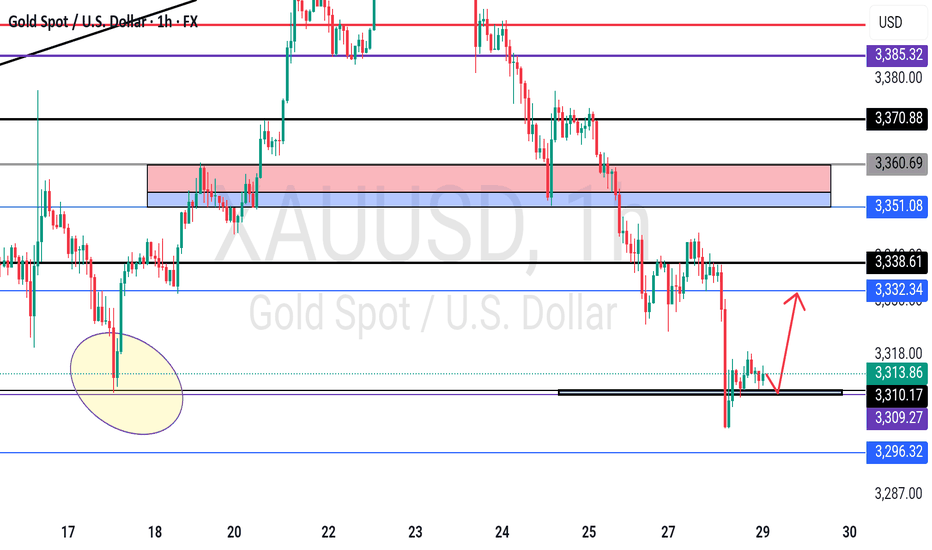

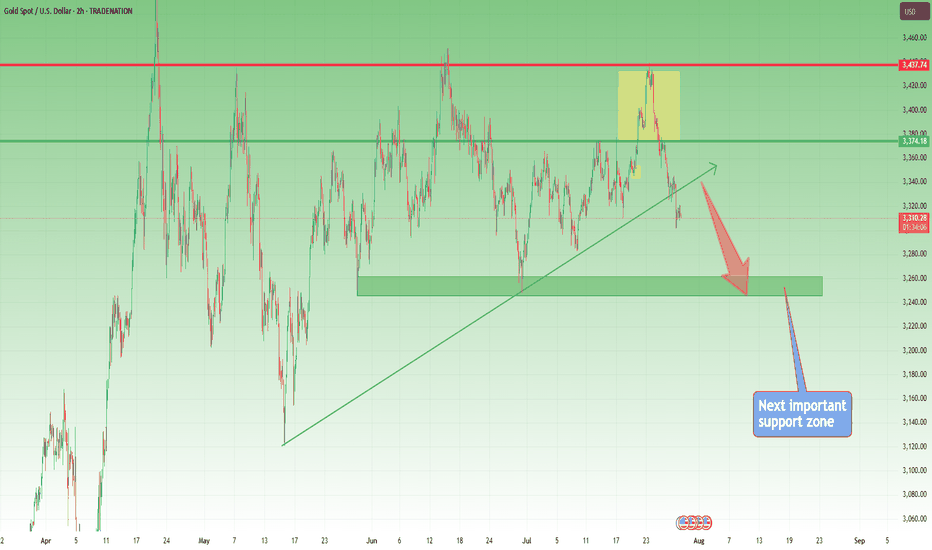

GOLD ROUTE MAP UPDATEHey Everyone,

Following yesterday’s move into the 3305 retracement range, we got the expected reaction without an EMA5 lock, which further confirmed the rejection from that level and led to a clean bounce into 3228 just like we analysed.

From here, we anticipate price to range between 3328 and 3305. EMA5 cross and lock above 3328 or below 3305 will be key to confirming the next directional move.

We’ll continue to monitor for that confirmation and adjust accordingly.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3348

EMA5 CROSS AND LOCK ABOVE 3348 WILL OPEN THE FOLLOWING BULLISH TARGETS

3369

EMA5 CROSS AND LOCK ABOVE 3369 WILL OPEN THE FOLLOWING BULLISH TARGET

3397

EMA5 CROSS AND LOCK ABOVE 3397 WILL OPEN THE FOLLOWING BULLISH TARGET

3422

BEARISH TARGETS

3328 - DONE

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305 - DONE

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289

3267

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

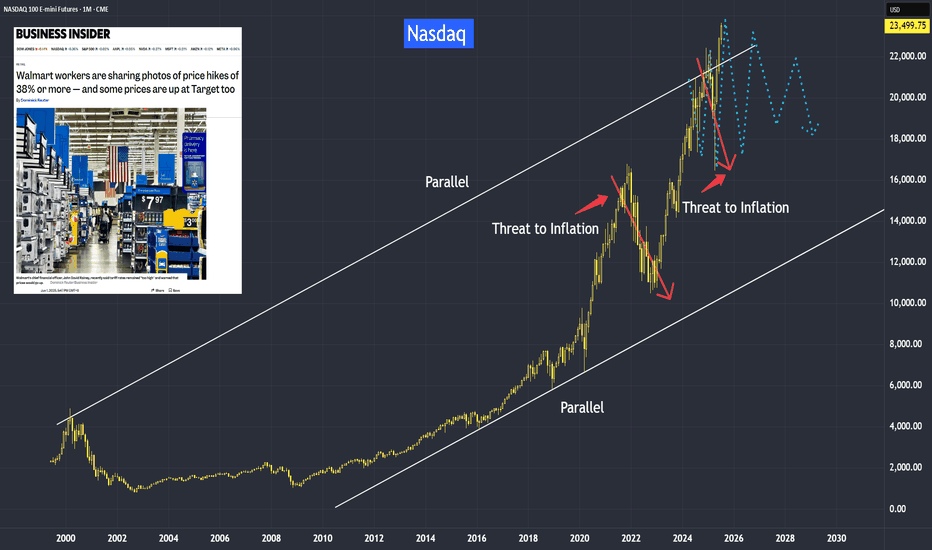

Why Are Markets Rising Despite the Tariffs?Because of the

1) Set timeline on finalizing the tariff rates and

2) The ongoing negotiations,

They aimed at striking a balanced deal between the U.S. and its trading partners.

The Liberation Day tariffs were announced on 2nd April, and markets initially crashed in response. However, just seven days later, on 9th April, the U.S. postponed the higher tariff increases for most countries by 90 days. Since then, markets have rebounded and even broken above their all-time highs set in December last year.

Now that the dust is settling with the expiration of timeline and ongoing negotiations, the big question is:

Where will the markets head next?

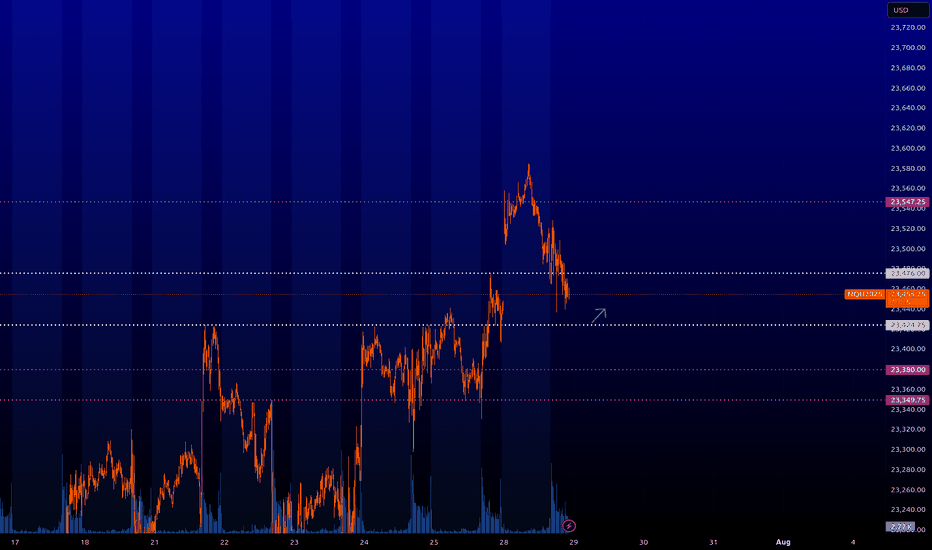

Mirco Nasdaq Futures and Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.sweetlogin.com

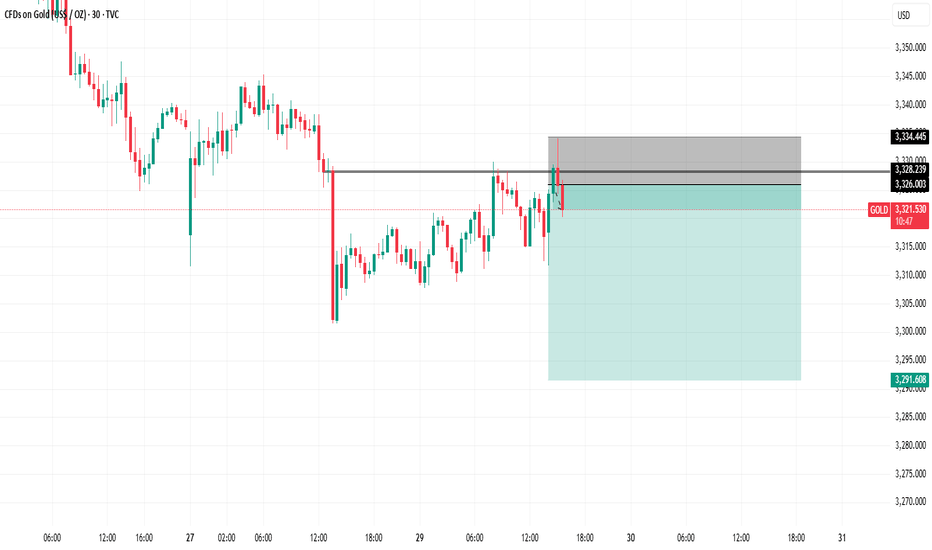

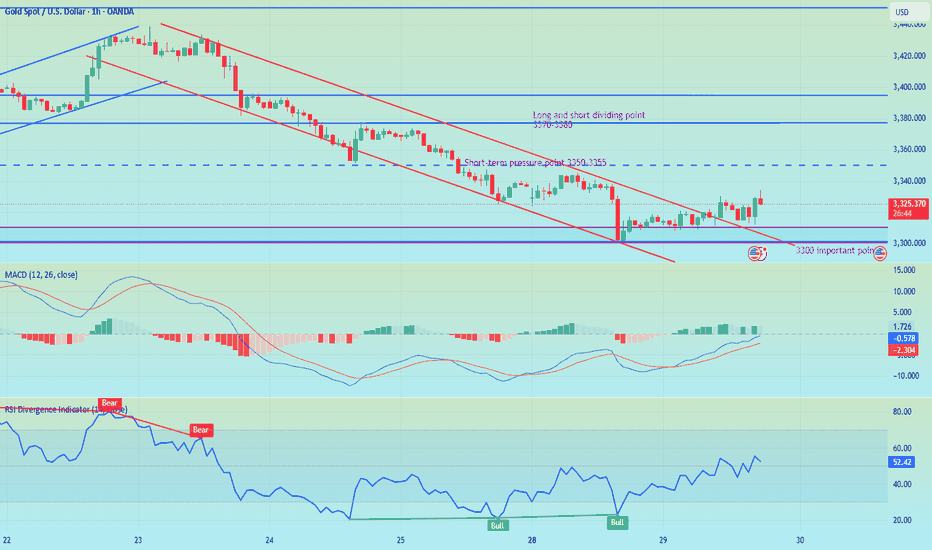

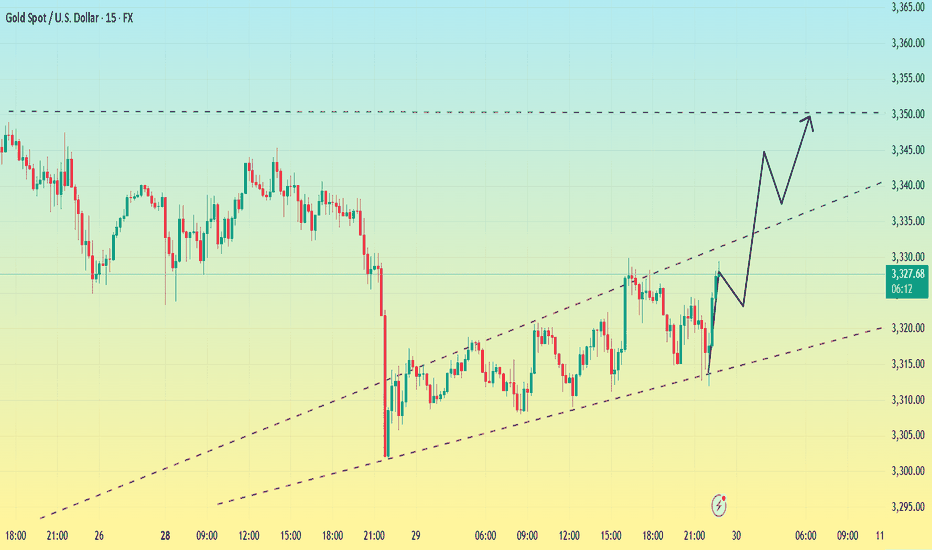

Gold prices under pressure: $3,330-3,350Gold prices under pressure: $3,330-3,350

Upward momentum: Gold could break through $3,330 if the Federal Reserve hints at a September rate cut or the EU economy deteriorates.

Downside risks: Gold could fall below $3,300 if strong US economic data (such as GDP and PCE figures) are released.

Optimistic scenario: If the Fed cuts rates in September and global stagflation risks increase, gold could reach $3,400.

Pessimistic scenario: If the US economy experiences a soft landing, rising real interest rates could push gold prices down to $3,200.

Key Technical Levels:

Support: $3,300

Resistance: $3,330/$3,350

Aggressive Strategy:

Sell Price: $3,325-$3,330

Stop Loss: $3,335

Target Price: $3,310

Conservative Strategy:

Sell Price: $3,340-$3,350

Stop Loss: $3,355

Target Price: $3,330-$3,310

Bottom Picking Strategy:

Buy Price: $3,300-$3,310

Stop Loss: $3,290

Target Price: Above $3,350/$3,400

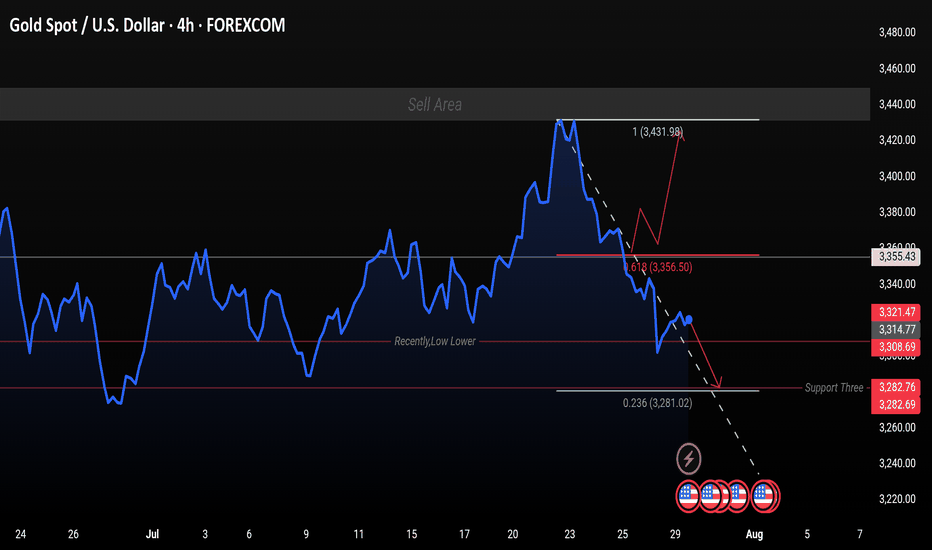

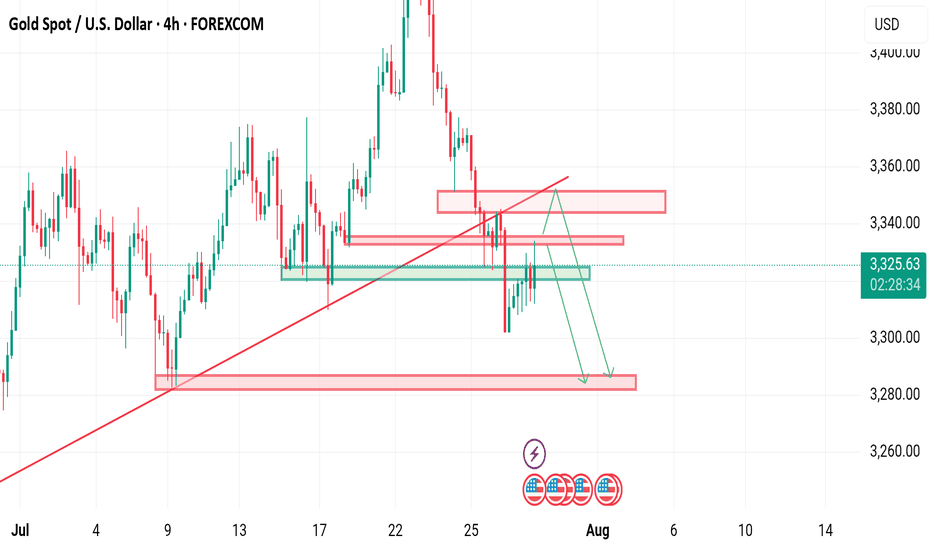

H4 Analysis. It's sell or buy let's see?

Gold is currently trading near 3323 after a recent sharp drop from the 3431 high. The price is respecting the downtrend line and has tested the 0.236 Fibonacci retracement at 3281 as support.

📉 Bearish Outlook:

If the price fails to break above 3314–3325, we could see a continuation toward the 3282 and possibly 3281 support zone.

📈 Bullish Scenario:

A break and close above 3355 (Fib 0.618) could push the market toward the 3431 resistance zone (Sell Area).

Key Levels to Watch:

Resistance: 3355 / 3431

Support: 3314 / 3308 / 3282

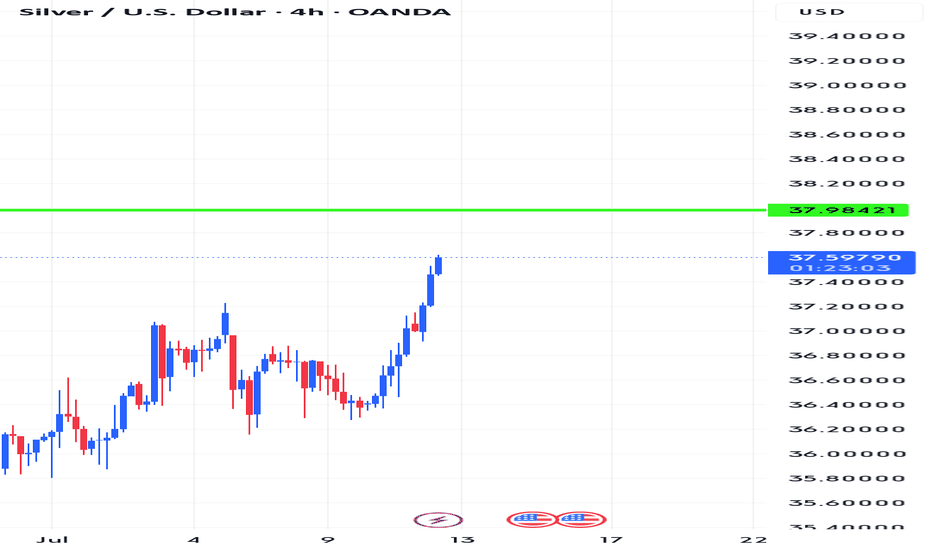

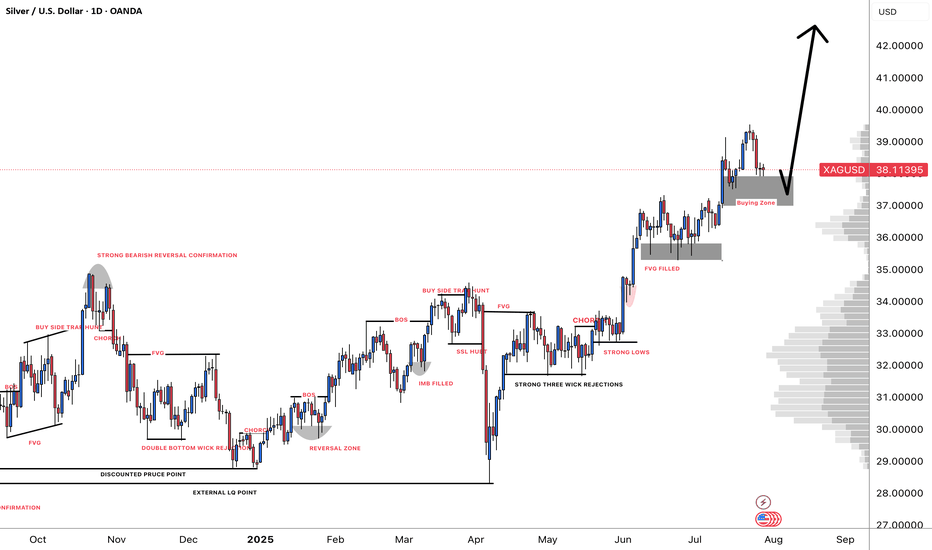

#XAGUSD: A Strong Bullish Move, Possible Target at $45?Silver is currently experiencing a correction, but the overall price remains bullish. Analysing the data, we can see a potential price reversal in our area of interest. Following the recent higher high, price is poised to create another record high. We should closely monitor volume and price behaviour. A strong volume signal would indicate a potential bullish move in the future.

Good luck and trade safely.

Like and comment for more!

Team Setupsfx_

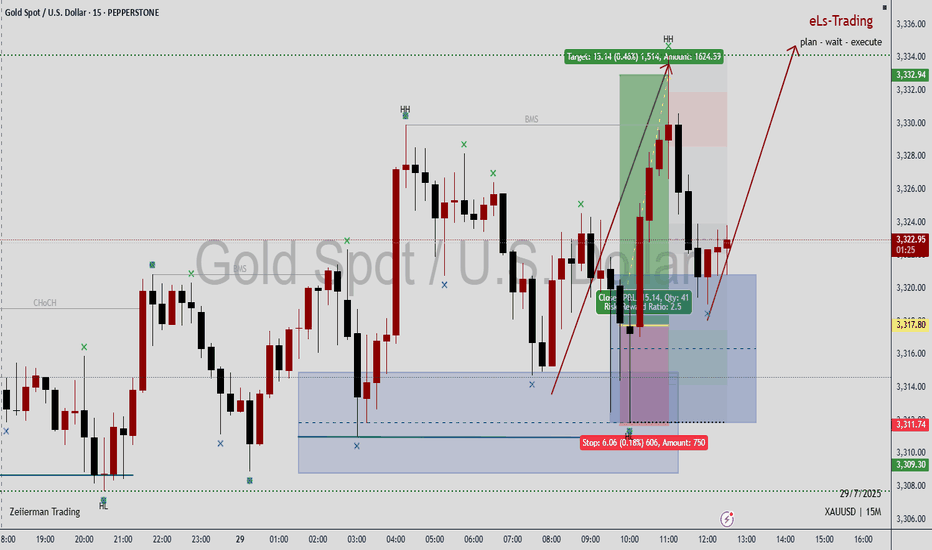

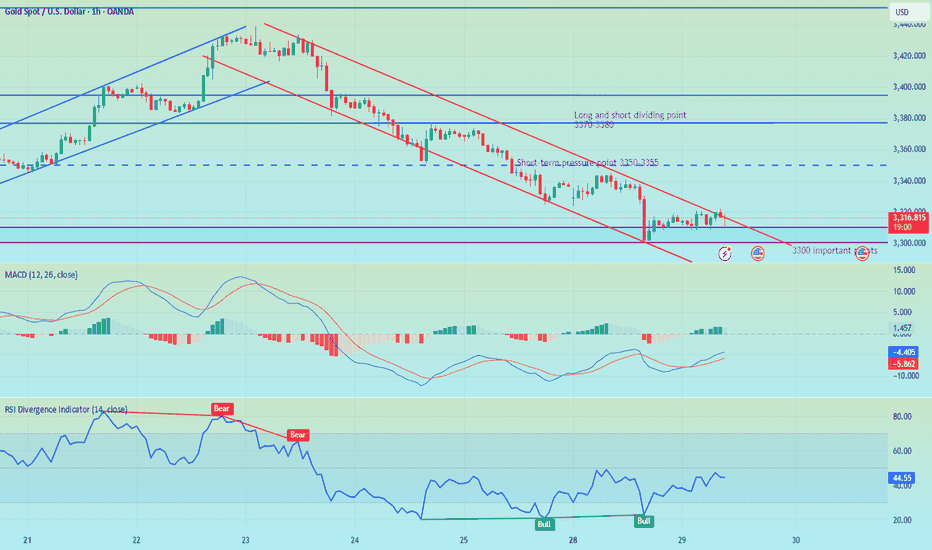

Gold Price Analysis July 29📉 XAUUSD ANALYSIS – IS THE CORRECTION OFFICIALLY STARTING?

Gold has officially broken out of the bullish wave structure and left the rising price channel – an important technical signal that the bearish correction trend has been activated. This development opens up the possibility of retests of the broken trendline, and if that happens in today's session, this could be a good opportunity to look for SELL entry points in the new trend.

📌 Short-term trading strategy:

Potential selling zone: 3343 – 3345

Downside target: 3283 first, followed by the strong liquidity zone around 3250

Confirmation of bearish force: Price continues to maintain below the 3375 area – which will act as an important resistance level. Only when the daily candle closes back above this zone will the uptrend be re-established.

✅ Reverse buying strategy if there is a strong support signal:

Buy trigger zone: Observe the price reaction around the 3285 area - there needs to be a clear bearish rejection signal (pin bar/bullish engulfing candle...)

Deeper buying zone: 3251 - where liquidity is concentrated and there is a possibility of bottom-fishing demand appearing.

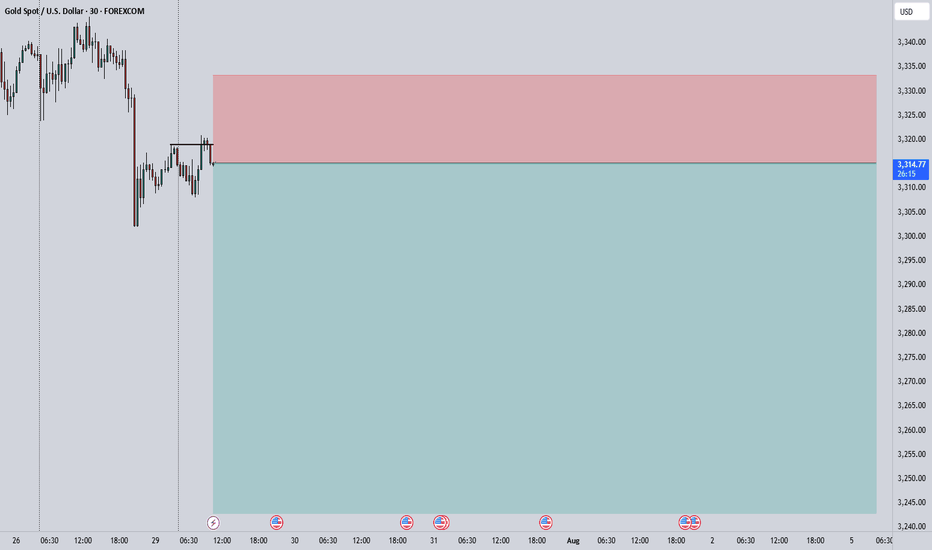

GOLD - One n Single Area, what's next??#GOLD... market just reached at his ultimate area as we discussed in our last week analysis and in Friday analysis as well.

The area is 3309-10

Keep close and don't be lazy here.

NOTE: we will go for cut n reverse below 3309 in confirmation.

Good luck

Trade wisley

Please check how to trade later.Since the release of the trading strategy, I have been able to accurately predict market trends. I am also grateful to so many brothers for following me. My premium privileges are about to expire. I will put the subsequent trading content in the group. If any brothers are interested, they can find me through 🌐. As for how to deal with the future market, I have stated the extraordinary situation and will patiently wait for the rebound of gold. At the same time, I will pay attention to the impact of the Sino-US trade talks.

XAUUSD is still bearish Gold is currently below rising channel and holding the Range of 3320-3335,although yesterday implusive drop is incompleted without testing 3290-3280

What's possible scanarios we have?

▪️I'm still on bearish side till 3345 is invalidated and candle flips above. I open sell trades at 3332 again and holds it .

if H4 & H1 candle close above 3345 I will not hold or renter sell.

▪️Secondly if H4 candle closing above 3345 this down move will be invalid and Price-action will reached 3370.

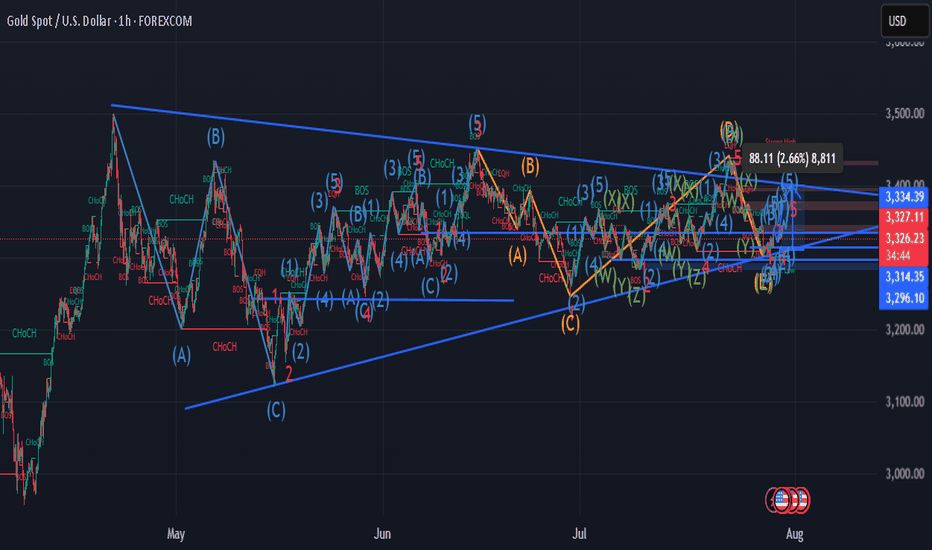

technical analysis- (xau-usd) (H1)This chart highlights a large symmetrical triangle formation, with an internal WXYXZ corrective structure blended with impulsive Elliott Waves (1)-(5). The price action is marked by key structural shifts: CHoCH, BOS, and EOH, signaling trend reversals and liquidity grabs.

📌 Price recently bounced off the ascending trendline, forming a potential wave (2) low, suggesting a bullish move into a wave (3) impulse.

🔼 Short-term target points to a revisit of the strong resistance zone around 3,400–3,410.

📊 Key Setup:

• Pattern: Symmetrical Triangle

• Wave Count: Corrective WXYXZ + impulsive structure in progress

• Signals: Bullish CHoCH + BOS confirmation

🎯 Trade Idea:

• ✅ Direction: BUY

• 🎯 Take Profit (TP): 3,400 – 3,410

• 🔻 Stop Loss (SL): 3,296

🔁 Sideways range compression sets up ideal conditions for short-term swing or breakout scalps.

Bottoming out? Be wary of the market.After a sharp drop to around 3300 on Monday, gold rebounded, reaching a high of around 3330 so far.

From the 1-hour chart,Gold has now broken out and stabilized within the hourly chart's downward trend channel. The key upward level is currently around 3330. If it breaks above 3330 again, caution is advised; it may test 3345-3350. Conversely, if it fails to break above 3330, gold may consolidate between 3300-3330 before the non-farm payrolls release.

From a short-term 15-minute perspective, the current 15-minute range has been broken out and stabilized. The current situation is unfavorable for bears. Based on the trend, a breakout above the 15-minute range would indicate a rebound. However, until 3330 holds, the 3320-3330 range is the only option. However, the current trend favors a bullish pullback, so I'm not too keen on shorting. Therefore, focus on support at 3320.

If it fails to break below 3320, enter a long position near 3320. The upper target is the top of the 3345-3350 range.

European session under pressure 3321 continue to shortI reminded everyone last night that if gold holds the 3300 mark, it will consolidate in the 3300-3345 range in the short term. The current gold price basically fluctuates narrowly between 3320-3310. Judging from the daily chart, the short-term upper pressure is at 3330. Only if the daily line stands firmly above 3330, there is a possibility of a rebound upward in the short term. Judging from the hourly chart, gold is still in a downward trend, and the hourly line is blocked near 3321. In the short term, if it cannot break through 3320-3330, gold will continue to fall. You can consider shorting, with the target at 3310-3300. If the European session is still volatile, maintain high shorts and low longs to participate in the cycle.

My premium privileges are about to expire, and subsequent trading strategies and analysis will be published in the group.

XAUUSD – Bears in Control, but Watch for a Rebound FirstYesterday, after a small bounce from the ascending trendline, Gold broke down and printed an intraday low around $3300.

Right now, the market appears bear-dominated, and further downside continuation is likely in the coming days.

________________________________________

📉 But there’s a catch:

From last week's top, Gold has dropped over 1400 pips without any meaningful correction.

That opens the door for a possible short-term rebound, which could be just a setup for new short entries.

________________________________________

📌 Key levels to watch:

• First resistance: $3350

• Major resistance: $3375 – Only a daily close above this level would shift control back to the bulls

🎯 Until then, any bounce is an opportunity to sell into strength.

A break below $3300 opens the path to $3280, with a likely extension toward $3250.

________________________________________

Conclusion:

The trend is bearish, but don’t chase.

Wait for a corrective rally, then look to sell the rip—unless bulls reclaim $3375, it’s still a bear market.

Let’s see if Gold gives us the setup. 🎯

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.