Market indices

🇺🇸 Today's U.S. Data: Tariffs Starting to Bite?U.S. Data Journal – July 3, 2025

Today's U.S. economic releases showed a stronger-than-expected labor market, with Non-Farm Payrolls (NFP) surprising to the upside, alongside increases in factory orders and a solid ISM Services PMI print.

The combination of these indicators points to persistent demand strength across both goods and services. Moreover, the upward trend in factory orders and service sector activity suggests that tariffs are beginning to feed into cost structures, adding inflationary pressure from the supply side.

While the labor market remains resilient, the risk is that sticky input costs—partly tariff-driven—may complicate the disinflation narrative and potentially delay any dovish policy shift from the Fed.

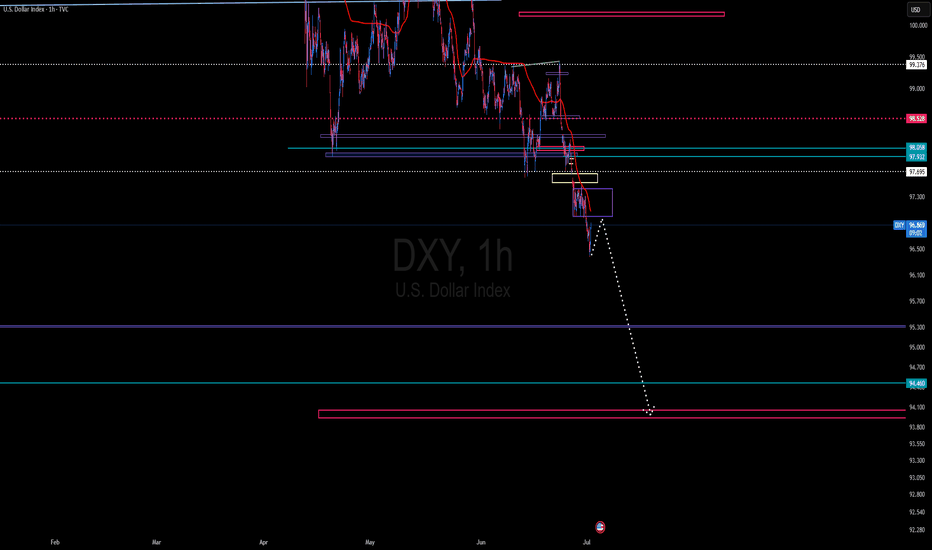

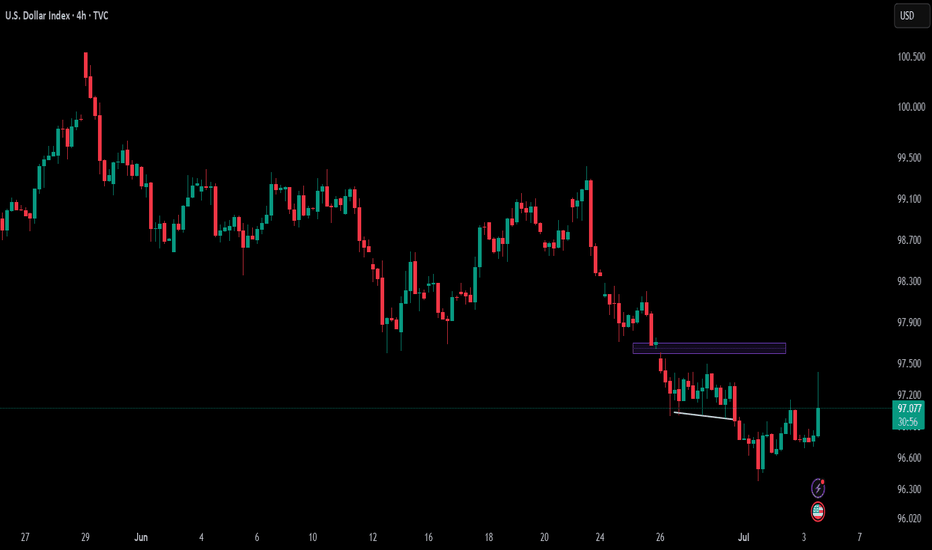

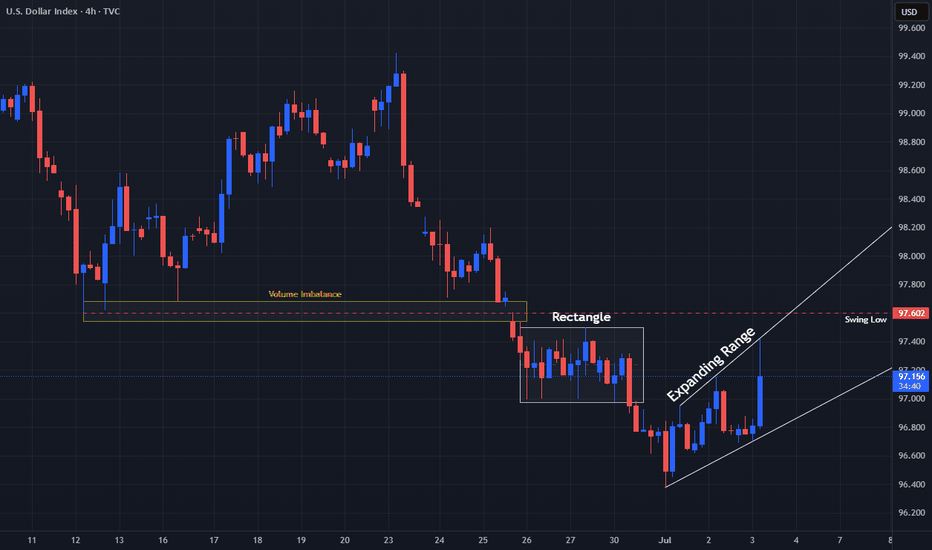

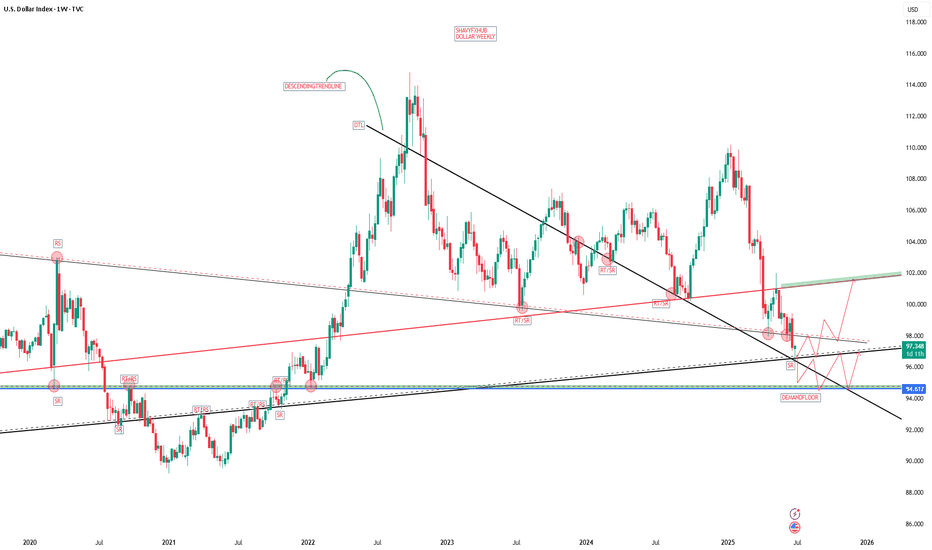

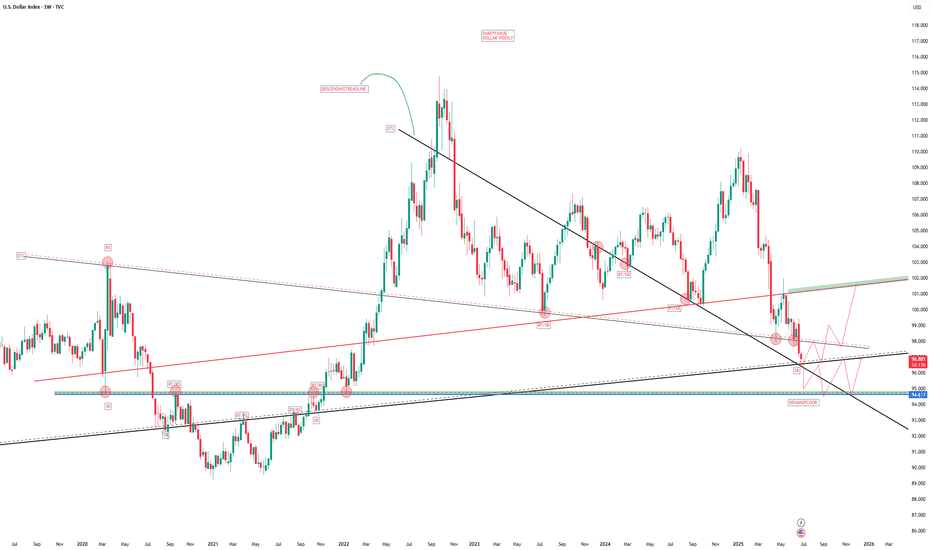

DXY Quite IndecisivePrice on TVC:DXY after having broken below the Swing Low on June 12th @ 97.602 has created a lot of Indecision!

Starting with a 5 Day Long Consolidation period as a Rectangle Pattern

Then after the Bearish Breakout on June 30th due to the Federal Reserve mentioning possibly leaning towards Interest Rate Cuts, we see the TVC:DXY form a Expanding Range

Now at the Swing Low and above all the Consolidation or Indecision, we see a Volume Imbalance in the 97.5 - 97.6 area.

Fundamentally, USD has been mostly beating expectations with:

- Manufacturing and Services PMI's showing Expansion

- Job Openings higher then expected

- Unemployment Claims Low

- Unemployment Rate dropping ( 4.1% )

- Factory Orders Rising

Non-Farm Employment however hurt USD with -33K instead of the 99K forecasted

With all the Tariff uncertainties and how they will affect Inflation continues to worry markets with only a few deals having been ironed out, like the 20% Tariff on Vietnam ( down from 46% ) before the July 9th Deadline.

tradingview.sweetlogin.com

Now with good Employment News out with numbers showing Strong Job Reports, this eases labor fears and could help remove some of the expectations of the amount of Interest Rate cuts this year.

tradingview.sweetlogin.com

tradingview.sweetlogin.com

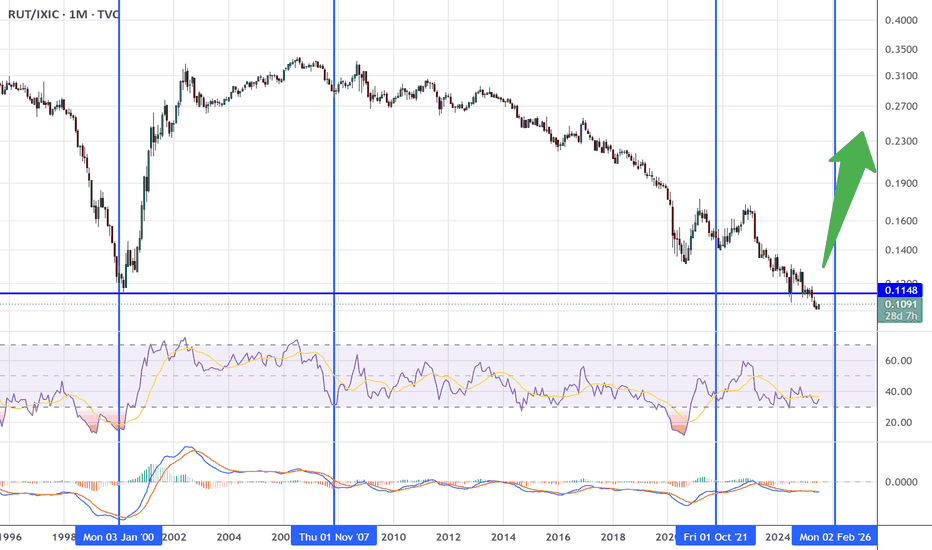

Russell 2000 will start outperforming NasdaqIMO the reversal is here for technology companies. Smaller companies will start outperforming Mega Caps. This will be because investors are looking for higher returns by taking more risk.

Smaller companies have a higher potential stock price appreciation but are more risky.

In 2000, this RUT/NASDAQ ratio reversal marked the top in the Nasdaq. I think we are close but might still have room to grow.

Oct-Nov 2025 Top?

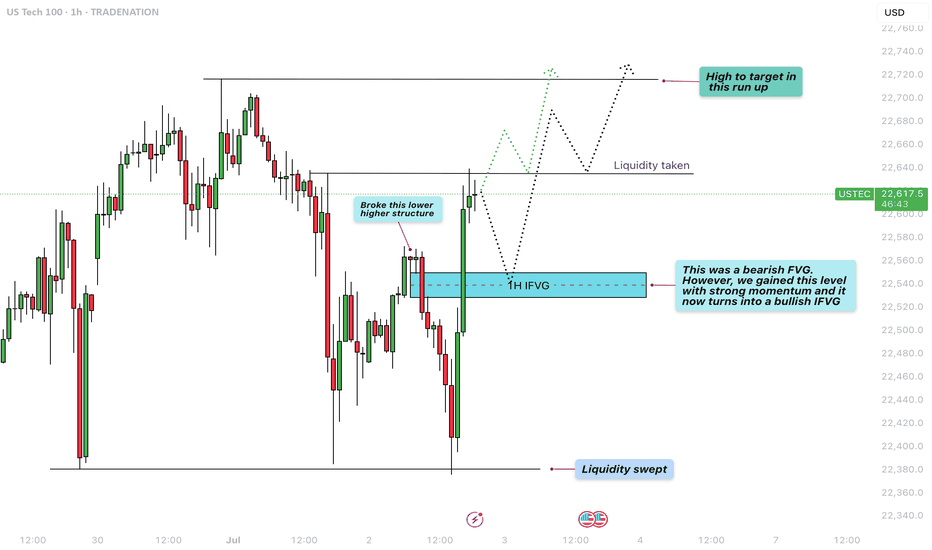

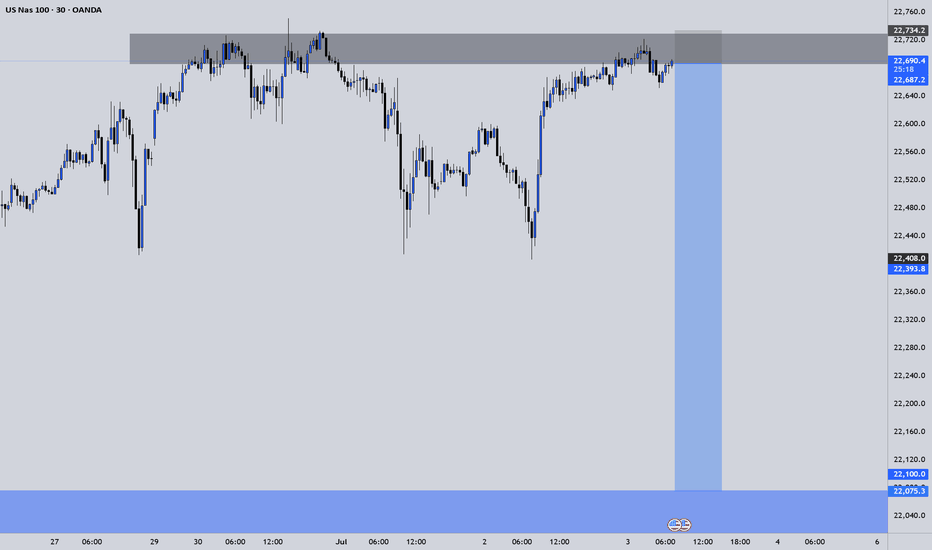

US100 - Reversal after liquidity sweep to target new highs?The chart presented shows a 1-hour analysis of the US100 (Nasdaq 100), illustrating a clean and structured price action narrative. Initially, we observe that the market swept liquidity at the lows, indicated by a sharp wick that pierced beneath the previous support levels. This type of liquidity sweep is common when smart money looks to grab stop-loss orders before reversing the trend.

Liquidity sweep to the downside

Following this liquidity sweep, price action aggressively moved upwards, breaking a lower high structure that had previously marked the bearish control of the market. This break of structure is a key bullish signal, suggesting a shift in momentum from bearish to bullish, and often signifies the beginning of a new upward leg.

1H FVG

An important element on this chart is the 1-hour Fair Value Gap (FVG), initially acting as a bearish imbalance. However, due to the strong bullish momentum, price not only reclaimed this level but did so decisively. As a result, this bearish FVG is now considered a bullish FVG, indicating that it may serve as a support zone on any short-term pullback.

Liquidity taken from the upside

After reclaiming the FVG and breaking structure, price surged further, taking out upside liquidity just above recent highs. This action typically leads to a short-term pullback, as profit-taking and new supply enter the market. The chart suggests that any retracement may find support at the 1H FVG, providing a potential entry point for bullish continuation.

Conclusion

In conclusion, the US100 demonstrated a textbook liquidity grab at the lows, followed by a break in bearish structure, a shift in momentum, and an inversion of a key FVG zone from bearish to bullish. The short-term upside liquidity has been cleared, and the next logical target is the high marked on the chart. Should the price respect the newly formed bullish FVG on any pullback, we can expect continuation toward that upper high, completing the bullish run.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

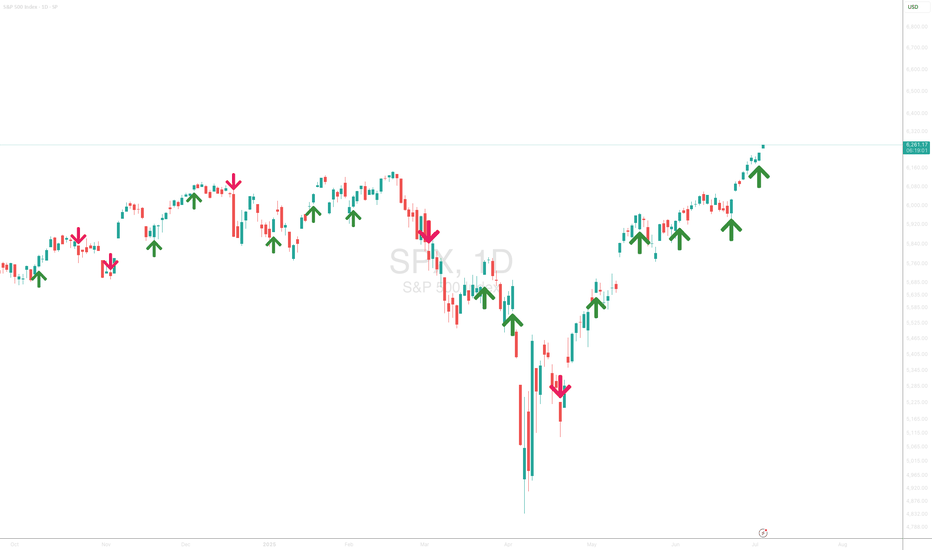

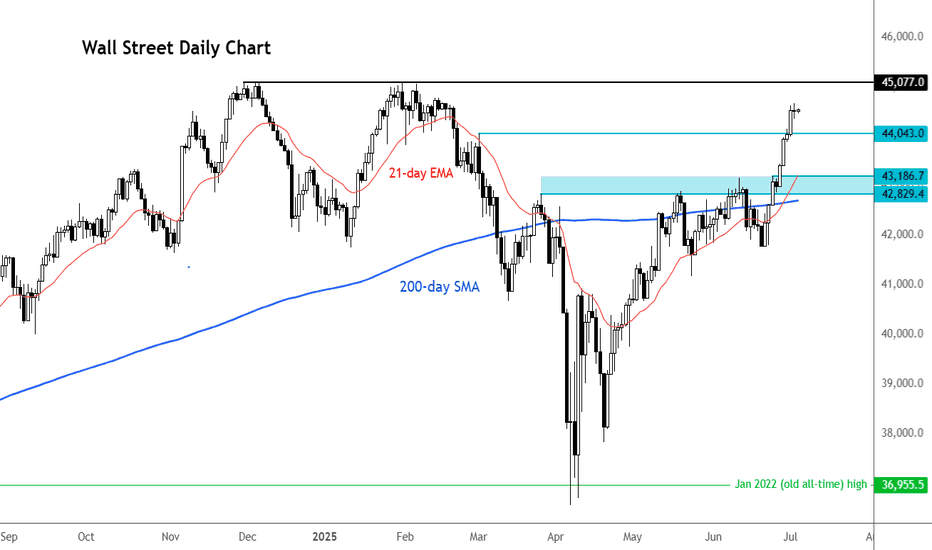

Nasdaq ready for pullback??Hi Guys,

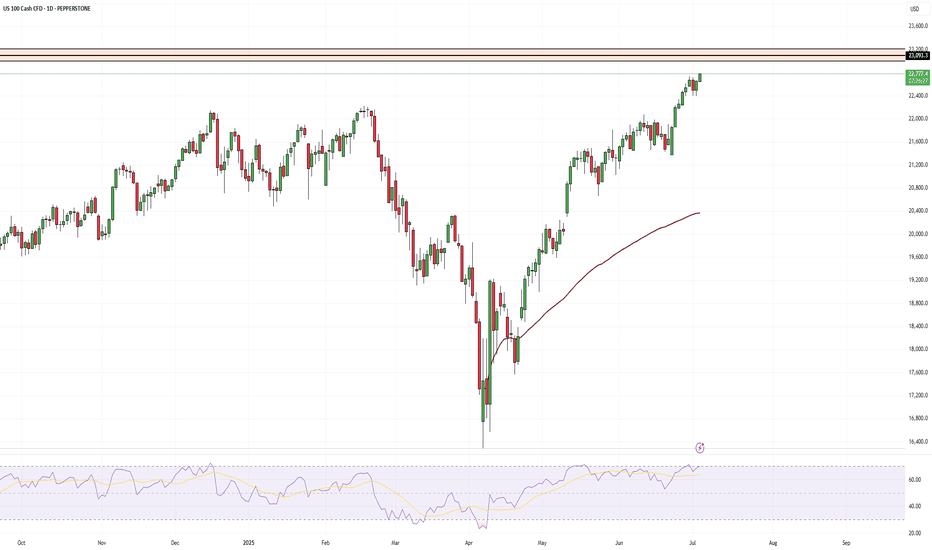

The US indices have been ripping back to all time highs without any meaningful pullbacks from the lows.

The Nasdaq is approaching a price level where we may see a pullback and some selling pressure.

The shaded box above the chart is that area and it contains two important fib levels. The bottom of the box is the 1.13 retracement of the recent high to the low after the tarrif news. The black line drawn through the box is the 2.0 retracement of the bear market high to low. This level is always important but it is more significant in this case because the SP 500 and Dow Jones both had the big drops from pretty much exactly this level. The Nasdaq failed to reach this level so if the other two indices are anything to go by we may see some selling here.

Daily RSI is showing divergence. Sell setups using break of structure chart pattern and candlestick patterns on lower time frame could result in nice risk to reward trades.

The red line coming from the bottom is the AVWAP and its no coincidence that it is in line with a n obvious support area should we get a deep enough pullback.

Safe Trading all

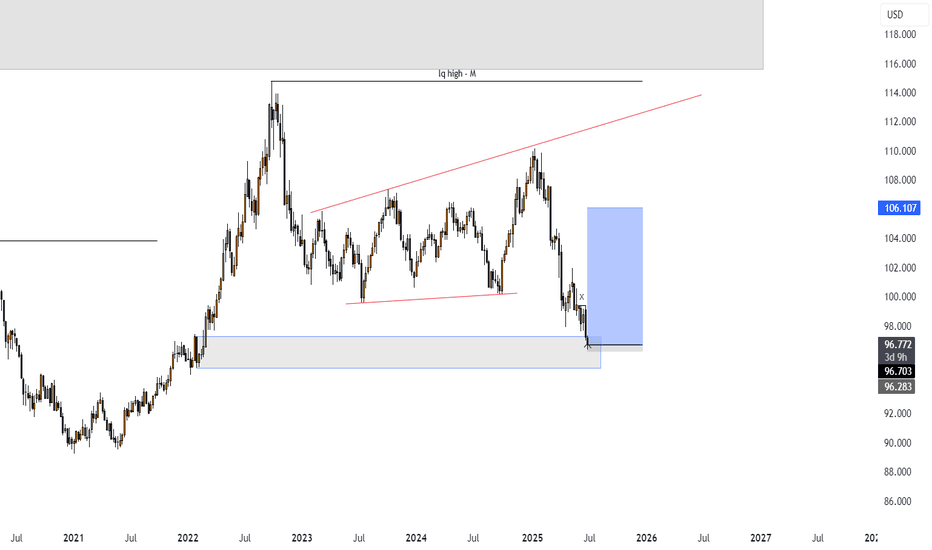

DOLLAREXACTLY AS FORECASTED FROM MY WEEKLY DOLLAR CHART,ON STRONG NON-FARM DATA DOLLAR RISE TO KEEP GOING HIGER,GOLD SELL,AUDUSD SELL ,EURUSD SELL GBPUSD SELL.

Average Hourly Earnings m/m

0.3% 0.4% —

Non-Farm Employment Change

147K 111K 139K

Unemployment Rate

4.1% 4.3% 4.2%

Unemployment Claims

233K 240K 236K

Interpretation and Implications

Average Hourly Earnings m/m:

Rose by 0.3%, slightly below the forecast of 0.4%. This suggests wage growth is steady but not accelerating, which may ease some inflation concerns.

Non-Farm Employment Change:

The US economy added 147,000 jobs, beating both the forecast (111K) and the previous month (139K). This indicates continued, though moderate, labor market expansion.

Unemployment Rate:

Fell to 4.1%, better than the expected 4.3% and down from 4.2% previously. This points to a modest improvement in labor market conditions.

Unemployment Claims:

Dropped to 233,000, lower than both the forecast (240K) and last month (236K). This signals fewer new layoffs and continued resilience in the job market.

Market Impact

Dollar (USD):

The combination of stronger-than-expected job growth and a lower unemployment rate is generally supportive for the US dollar, as it suggests the labor market remains robust. However, slightly softer wage growth may temper expectations for aggressive Fed tightening going forward.

Federal Reserve Outlook:

These figures reinforce the Fed’s “data-dependent” stance. Solid job creation and falling unemployment reduce urgency for immediate rate cuts, but the lack of wage acceleration may allow the Fed to maintain a cautious approach.

In summary:

The US labor market in July 2025 shows moderate strength, with job gains and a falling unemployment rate, while wage growth remains steady but not excessive. This mix supports a stable outlook for the dollar and gives the Fed flexibility in its upcoming policy decisions.

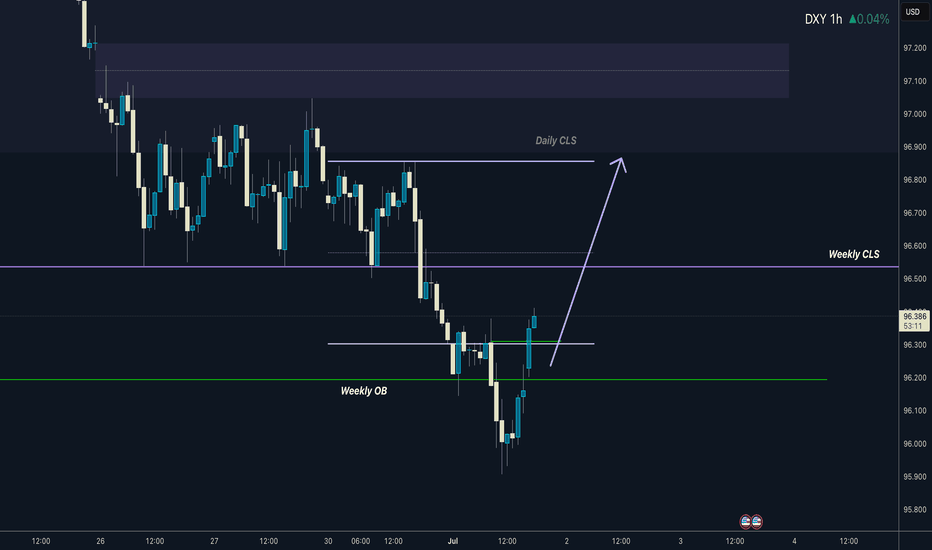

Dollar I Daily CLS I Model 1 I Time for pullbackHey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS Footprint, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behavior of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

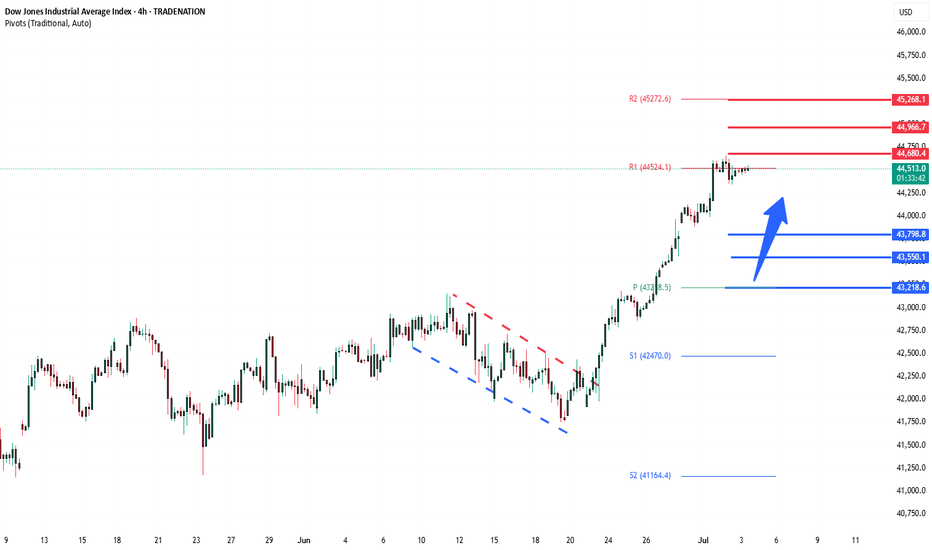

DowJones awaits us employment - NFP data Key Support and Resistance Levels

Resistance Level 1: 44680

Resistance Level 2: 44670

Resistance Level 3: 45270

Support Level 1: 43800

Support Level 2: 43550

Support Level 3: 43220

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

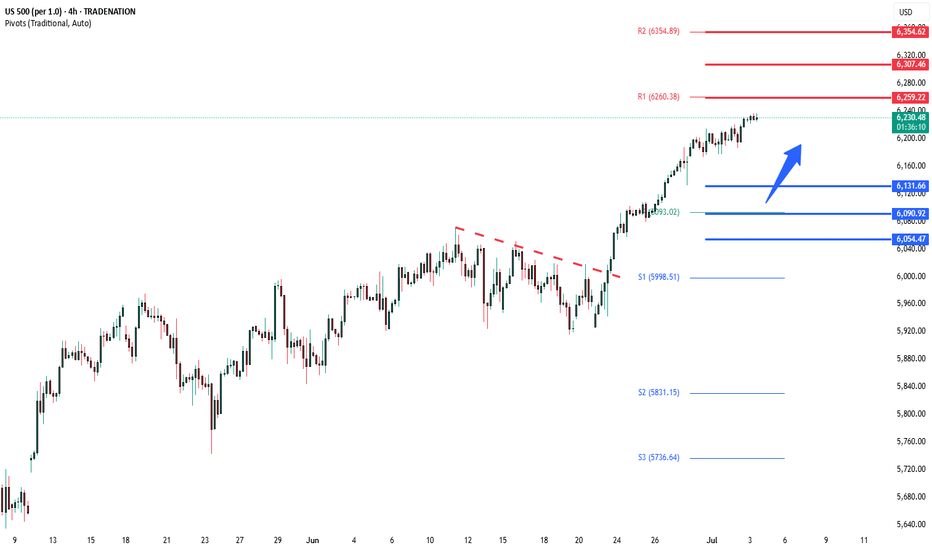

S&P500 bullish ahead of US employment- NFP numbersHouse Republicans moved Trump’s major tax and spending bill closer to a final vote, which could happen before his July 4 deadline. The package includes tax cuts, immigration funding, and the rollback of green energy incentives. Gamblers are raising concerns about a tax increase in the bill that could affect them.

In trade news, the US eased export rules on chip design software to China as part of an ongoing deal. China’s tone has shifted more positively, with a top official saying he’s hopeful about US-China relations and that conflict between the two is “unimaginable.”

At the Fed, Chair Jerome Powell hasn’t said if he’ll step down when his term ends in May, adding uncertainty. Trump, who wants a loyal replacement, has called for his resignation after a federal agency accused Powell of giving misleading testimony about expensive Fed building renovations.

On Wall Street, value investing made a comeback last quarter. Over 60% of active value fund managers beat their benchmarks by buying cheap industrial stocks and avoiding underperforming sectors like utilities and consumer staples.

Conclusion:

US equities are steady but cautious. Uncertainty around Fed leadership and Trump’s economic plans is keeping markets in check, while improving US-China trade relations and a shift toward value stocks are offering support.

Key Support and Resistance Levels

Resistance Level 1: 6260

Resistance Level 2: 6307

Resistance Level 3: 6355

Support Level 1: 6130

Support Level 2: 6090

Support Level 3: 6055

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DOLLAR INDEX BY 1;30 PM we are expecting the average hourly earnings m/m with a forecast 0.3% and previous 0.4% and Non-Farm Employment Change forecast 111K below past data of 139K

the rate of Unemployment is forecasted to be lower as monetary team is looking at 4.3% against previous data of 4.2%

but yesterday ADP -33k have given a clue that Non-farm data will come soft which will trigger sooner rate cut by feds.

dollar index and US10Y will be watched to see the direction of investment by investors.

if NON FARM EMEPLYMENT CHANGE AND UNEMPLOYMENT DATA REPORT COMES GREATER THAN FORECAST, DOLLAR AND US10Y WILL RISE AND WE SHORT GOLD ,AUDUSD SELL,GBPUSD SELL,EURUSD SELL ,USDJPY BUY.

THIS IS JUST FOR EDUCATIONAL PURPOSES ONLY.

Can Dow hit new highs?While the likes of the S&P 500 and Nasdaq 100 are already record highs, the Dow has not achieved that target yet. It continues to make higher highs and higher lows, and the momentum seems to be getting stronger. Soon, it may even flirt with fresh all-time highs, as investors ride the tailwinds of a robust rally that kicked off in early April. There have been a few catalysts behind this rally. First, it was Trump hitting pause on reciprocal tariffs; then, a wave of optimism washed over markets following a sudden de-escalation in the Middle East. The bulls took charge, and markets haven’t looked back since. But with 4 July celebrations on the doorstep and Wall Street due to close at 1pm NY time, today’s shortened session has a singular focus: the all-important US non-farm payrolls report. Will we have enough time to see the Dow march to new highs? The key levels are marked on the chart.

By Fawad Razaqzada, market analyst with FOREX.com

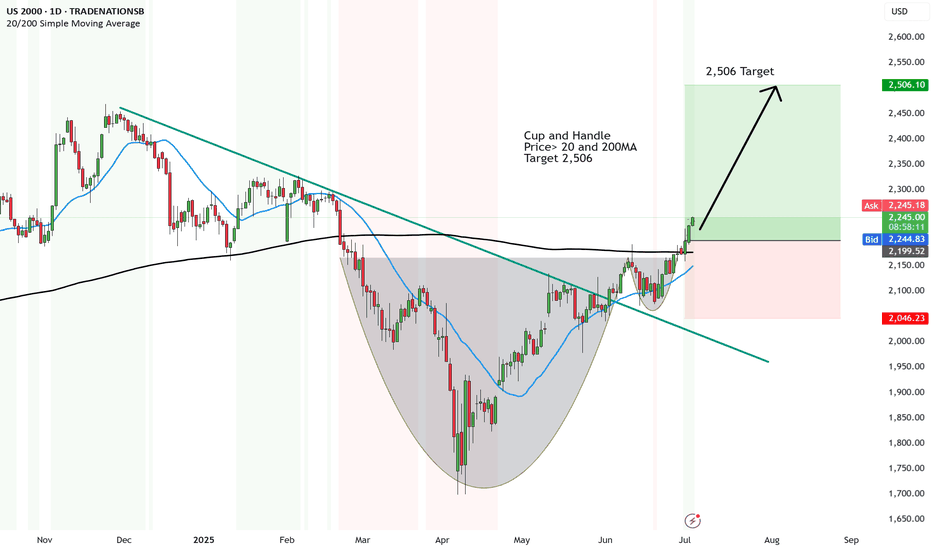

Go Russel - Strong upside for the small fry to 2,506First analysis ever done on the Russell 2000.

And the reason is because there is MAJOR upside to come for the first time in a LONG time.

So why now?

🧨 1. Rate Cuts = Small-Cap Lifeline

Small-cap stocks love lower interest rates — and the Fed's softening tone is a green light for upside.

💥 2. Breakout Setup After Long Chop

The US2000 has been stuck in a sideways range — now it's building energy for a potential breakout.

🏦 3. Regional Banks Bouncing

Regional financials (big weight in US2000) are showing signs of life — that’s a major boost to the index.

🧠 4. Under the Radar = Big Move Potential

While everyone’s chasing Nasdaq and S&P, smart money is quietly positioning in small caps before the crowd catches on.

📊 5. Economic Resilience Helps the Little Guys

US economy staying stronger than expected = tailwind for smaller domestic-focused businesses in the Russell 2000.

Cup and Handle

Price> 20 and 200MA

Target 2,506

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

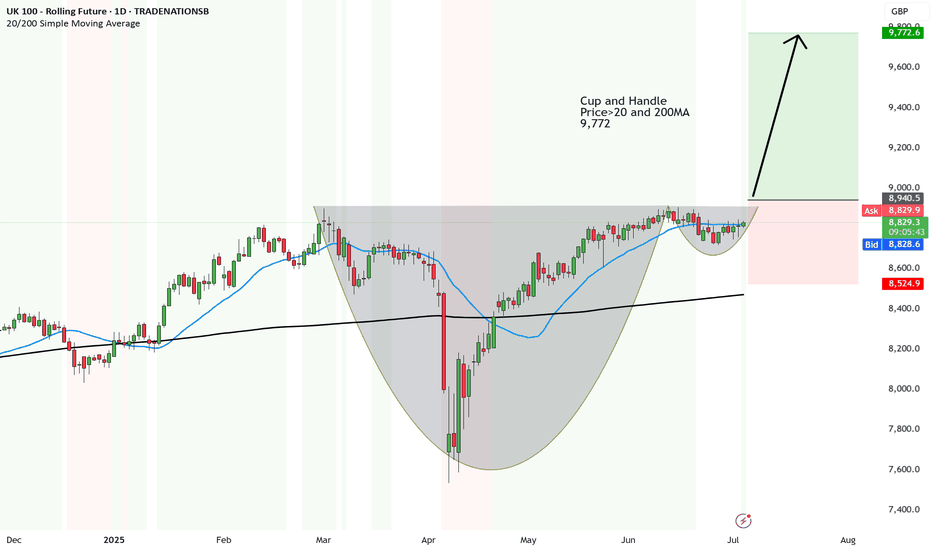

UK showing strong upside once breaks above C&H to 9,772

A very large Cup and Handle has formed on UK100.

There are many reasons for the upside to come but here are a few ones I can think of.

📉 2. Undervalued vs. Other Indices

FTSE 100 has lagged behind the US and EU — now global investors are eyeing it as a catch-up play.

💷 3. Weak Pound Helps Export Giants

A softer GBP = stronger revenue for big FTSE names like Shell, BP, Unilever, etc., which dominate global markets.

🏦 4. Rate Cut Hopes Are Back

With UK inflation cooling, the Bank of England might ease up — which is fuel for stocks, especially banks and housing.

📈 5. Rotational Flows Into Value

Traders are rotating out of overbought tech and into solid dividend/value plays — and the FTSE is packed with them.

And this is looking great for upside.

We can expect upside to come ONCE the price breaks above the brim level.

Price>20 and 200MA.

9,772

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

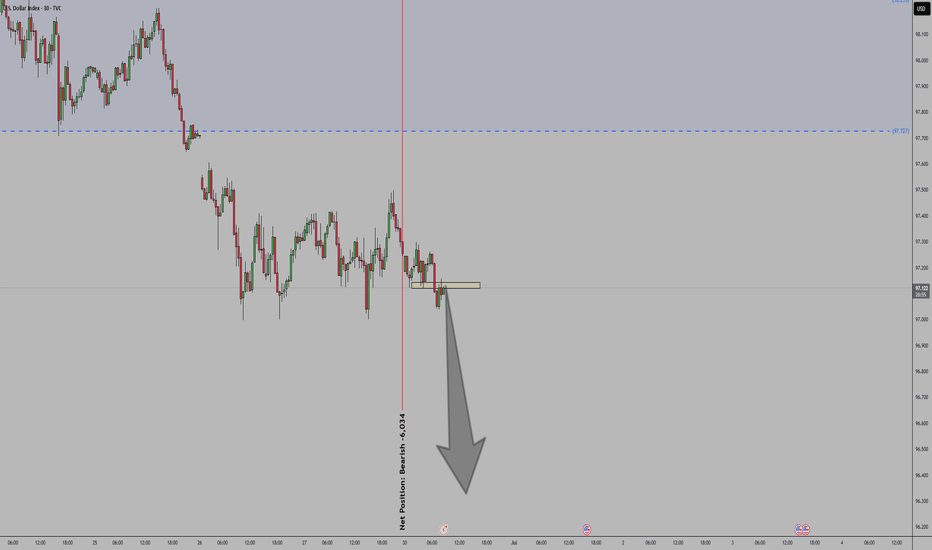

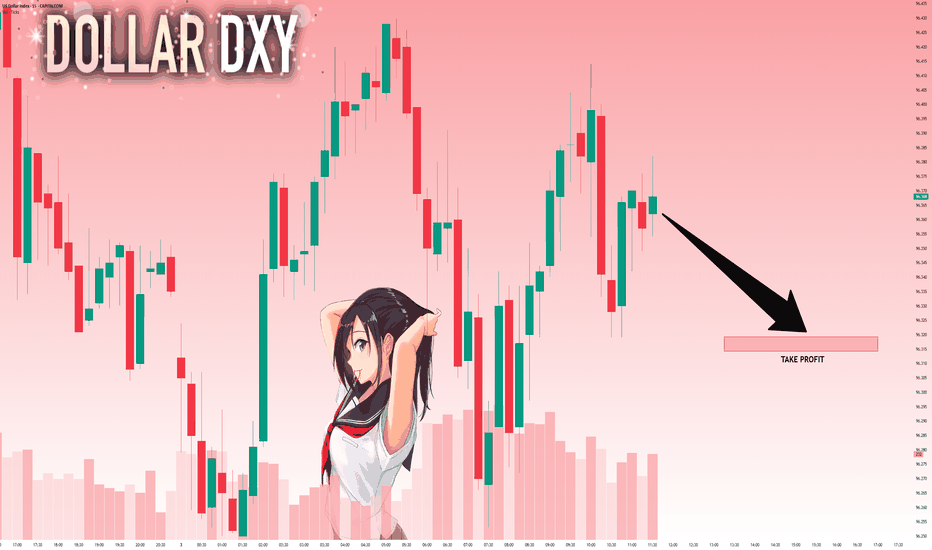

DXY: Next Move Is Down! Short!

My dear friends,

Today we will analyse DXY together☺️

The market is at an inflection zone and price has now reached an area around 96.362 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 96.319..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

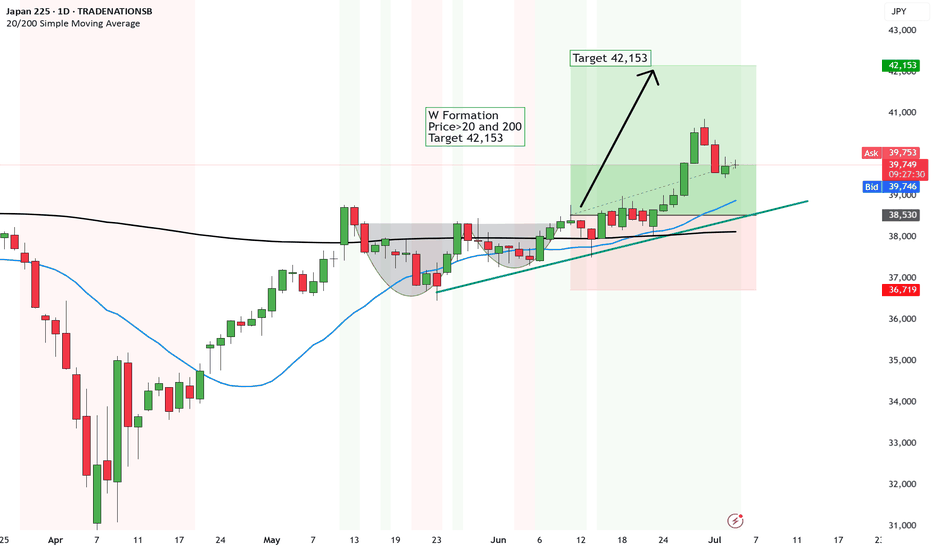

UPDATE Japan cruising to 42,153 thanks to the Tech War btw E & WIf you read my previous post about China you'll note, there are MAJOR developments in the East compared to the west.

It's always been a battle between the two. But this time it's based on research, developments and upgrades.

Loving the war on technology, because it is helping us normal folk with living quaility.l

Anyway, fundamentally Japan continues to expand.

🗳️ Political Stability = Market Confidence

Japan’s government is stable, and investors love certainty — it sets the tone for bullish momentum.

📉 Weak Yen = Export Party

A weaker yen boosts Japanese exports like cars and tech — big names like Toyota and Sony are crushing it.

💹 BOJ Staying Chill

The Bank of Japan isn’t rushing to hike rates — that’s fuel for equities and easy money flow.

📊 Value + Tech Combo

Japan’s got solid value plays AND hot AI growth stories — a killer combo right now.

🌍 Foreign Funds Are Piling In

Global investors are rotating into Japan — and that buying pressure alone can keep pushing prices higher.

And technically it's the same as last time, hence it's an update.

The price broke above the pattern and is slowing moving up a consistent uptrend to 42,153.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

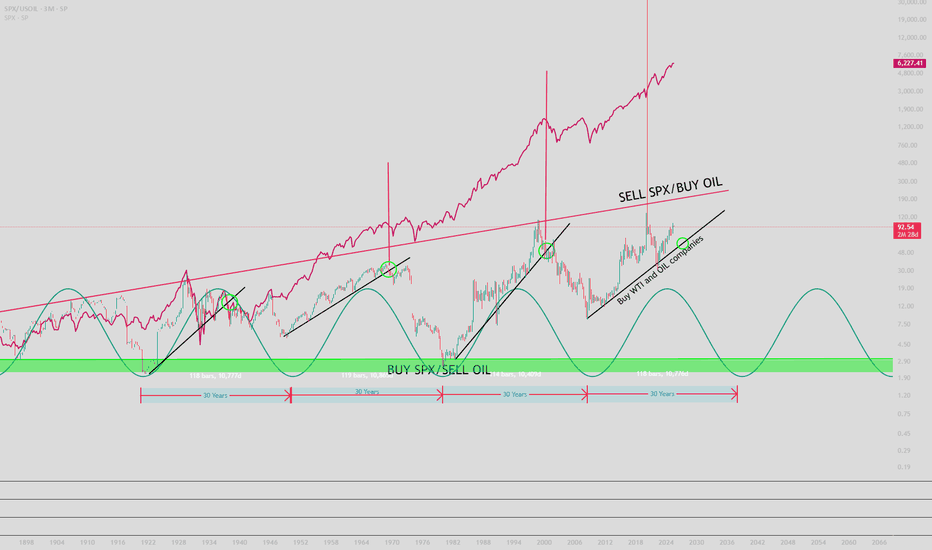

SPX VS OILHello there.

30 years low cycle is coming to end for OIL and energy.

Every 30 years, market of energy bottom against SPX.

When buy SPX AND NAS ? Each 30 years.

1920->1950->1980->2010->2040

When Sell SPX AND NAS ? Each 25-30 years

19401->970-2000->2025-30->2055-60

Sell SPX WHEN atm ? Well.. follow the last uptrend (blackline), sell when break

Recession always come when Energy > SPX

So.. keep an Eyes on Energy.

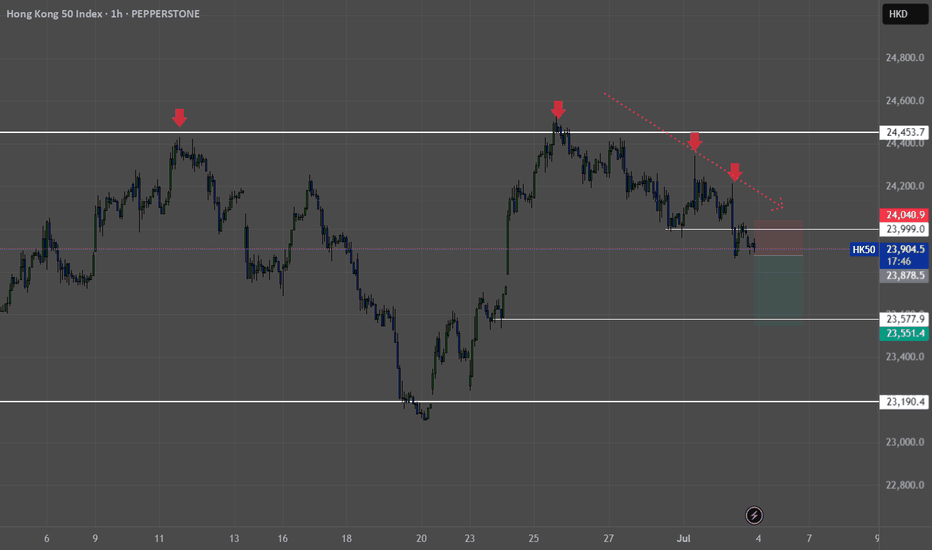

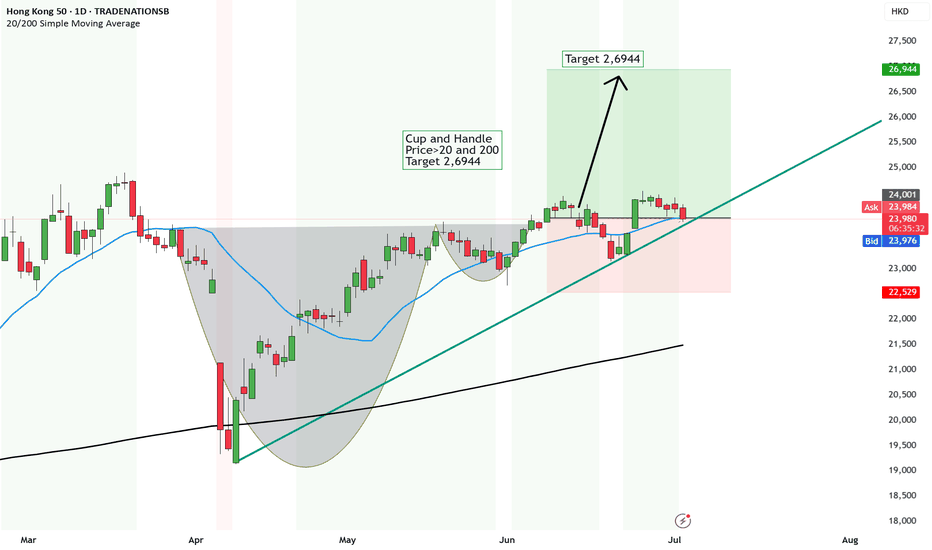

UPDATE The future of Hong Kong is here and ready to rally 26,944Have you noticed the developments in China lately?

TOp of the market buildings, technology, self driving train stations, delivery drones and flying cars.

Out of a futuristic movie - but in reality.

It seems like China is breaking away from the dependency to produce for America, and is showing the signs of growth, development and economic independence.

And fundamentally it is looking great too.

🧱 Mainland Money Surge

Mainland Chinese investors have poured a record $90 billion into Hong Kong stocks in H1 2025, boosting liquidity and narrowing the valuation gap with A‑shares

🚀 IPO Wave & Tech Strength

A booming IPO pipeline—including DeepSeek, Shein, CATL—has lifted market sentiment, while tech giants like Tencent, Alibaba, Xiaomi ride the AI growth wave

🤝 Trade Truce Optimism

Reduced U.S.–China trade tensions, including tariff de‑escalation and diplomatic overtures, are powering a broader rebound in risk assets across Hong Kong

🏦 Monetary Tailwinds

Expectations of U.S. rate cuts and continuing PBoC easing are lowering borrowing costs and lifting dividend‑yield plays in banking and property

📈 Market Leadership & Momentum

With a ~20 % YTD gain, the Hang Seng is outperforming mainland China, and analysts expect this victory lap to keep going as global investors re‑orient into Asia

As this is an update the setup remains the same and I guess is just waiting for that boost catalyst to take it up

The Cup and Handle pattern remains with the price needing to break above the brim level and for the price to continue above 20 and 200MA the target is still 26,944.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.