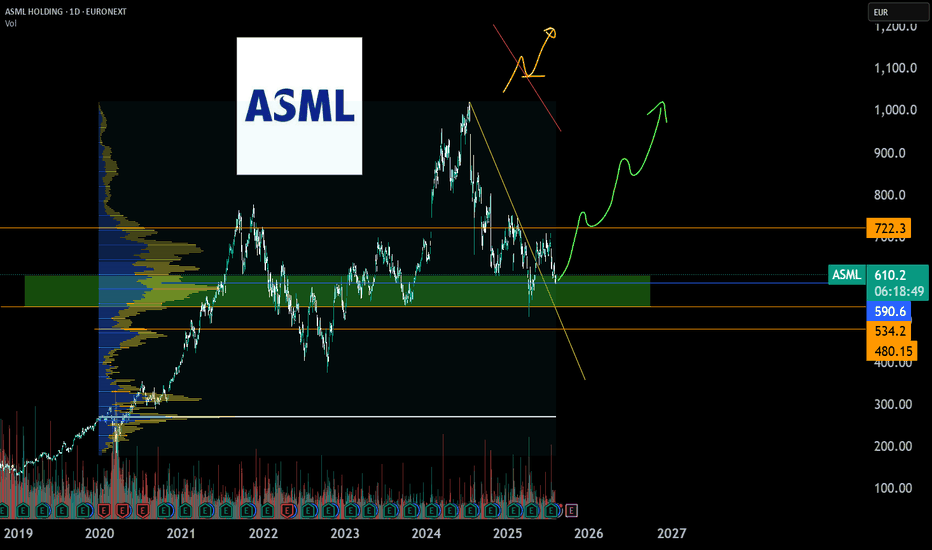

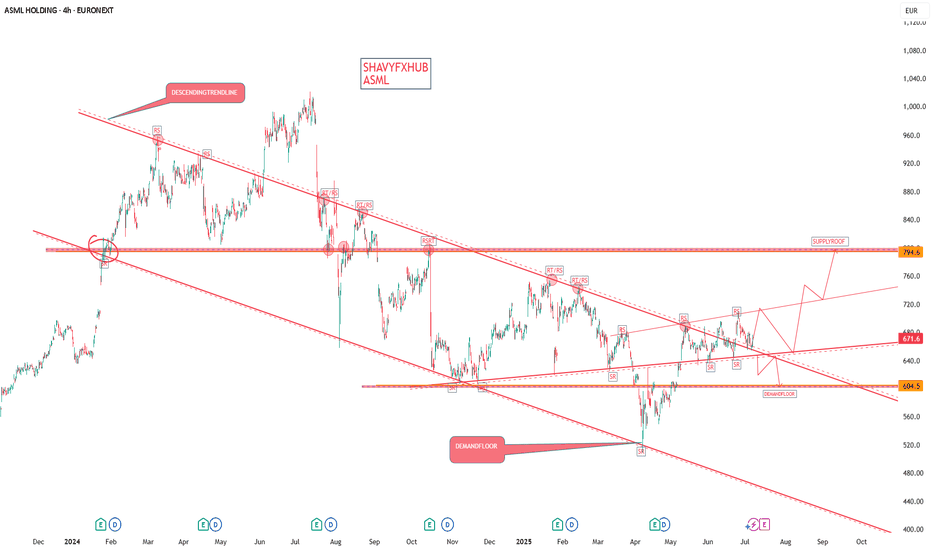

ASML enters buy zone and will posibly rotate to uptrend again.ASML is lagging behind after stagnated growth and a weak order intake due to china chip machine restrictions and uncertaincy about chip machine import tarrifs. It looks like tarrifs on chip machinery is settled and companies will likely place orders again after internal investment approvals.

Earni

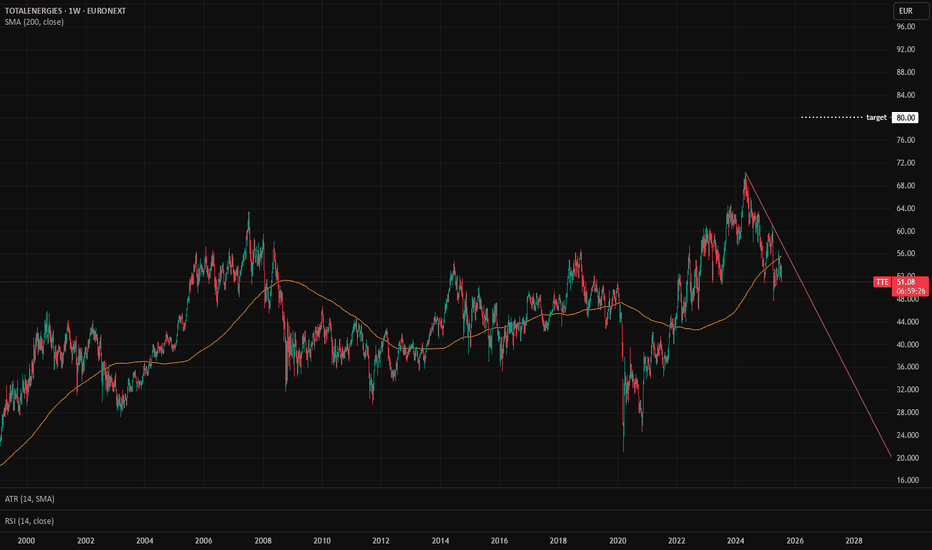

TTE: Fundamental Analysis +56 %With 2024 revenue of 195,6 billions €, Total Energies ranks among the top 10 largest energy companies in the world. EverStock identifies a fundamental revaluation potential of + 56 %.

Valuation at 7.3x net earnings

Currently valued at 115,7 billions € in market capitalization, Total Energies post

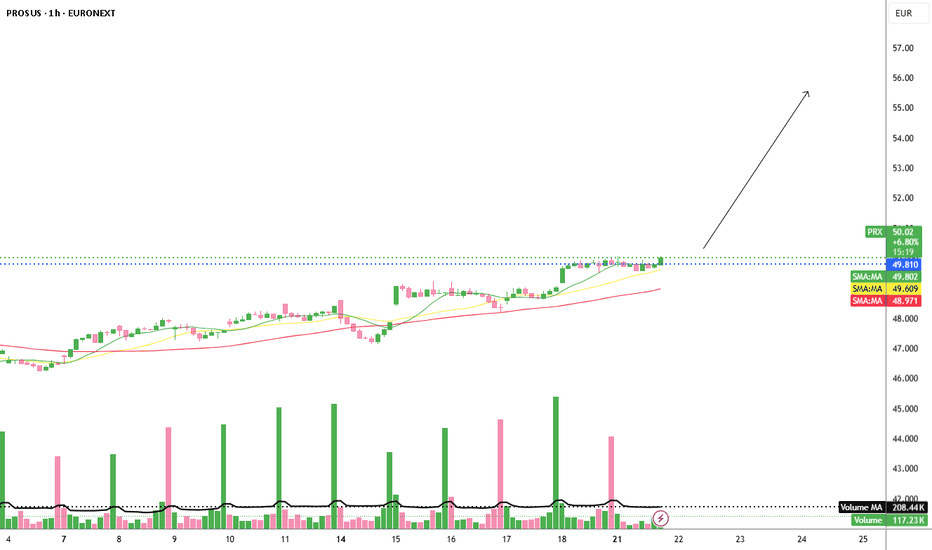

Prosus N.V. – Hidden Giant with Breakout PotentiaFollowing a strong bullish trend in July, Prosus N.V. is already up 8% month-to-date, and things are heating up. The company is reportedly in talks to acquire Just Eat Takeaway.

However, since Prosus already holds a 24% stake in Delivery Hero, the EU antitrust body has pushed back. Prosus has resp

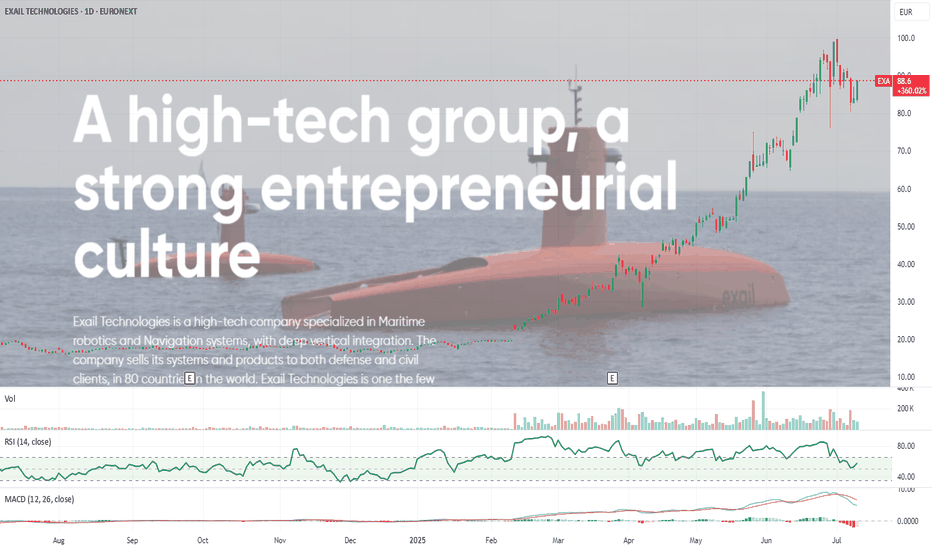

Exail Technologies European Drone Warfare and Robotics. Exail Technologies (previously Groupe Gorge S.A.) is a French tech company specializing in drones, robotics, and maritime autonomous systems, with growing exposure to defense and industrial markets.

It’s on a clear uptrend, sitting well above its 50 and 200-day EMAs with momentum firmly in play.

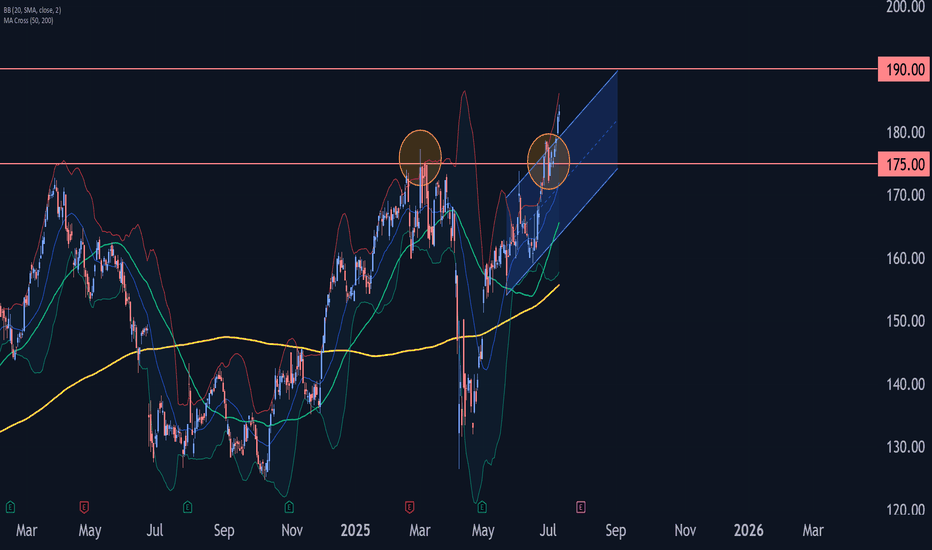

Airbus Wave Analysis – 10 July 2025- Airbus broke resistance zone

- Likely to rise to resistance level 190.00

Airbus recently broke the resistance zone lying between the resistance level 175.00 (which started the earlier sharp downward correction in March, as can be seen from the Airbus chart below) and the resistance trendline of t

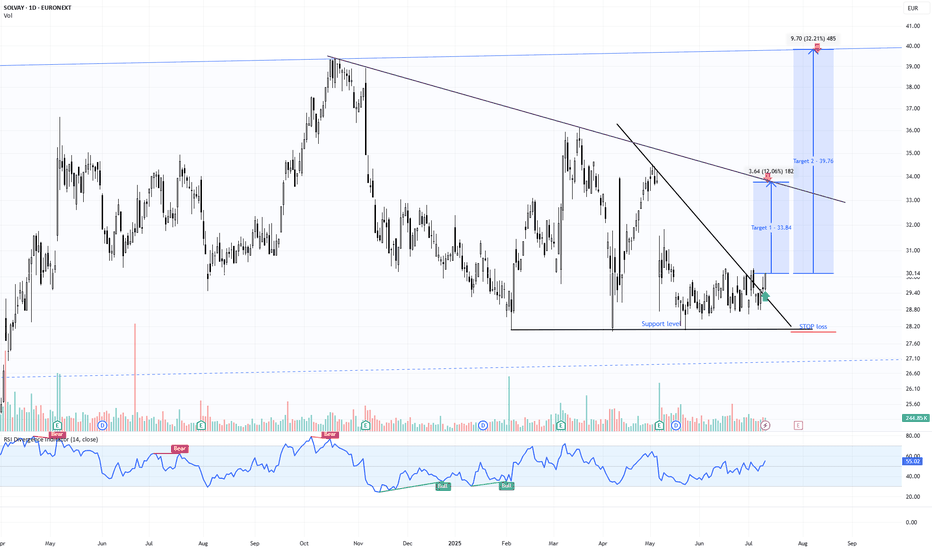

SOLB | Confirmed Descending Triangle Breakout – 32% Target📍 Ticker:

SOLB (Solvay SA – Euronext Brussels)

📆 Timeframe: 1D (Daily)

📉 Price: €30.14

📈 Pattern: Descending triangle breakout confirmed on daily close

📊 Breakout Probability estimation: ~73% (short-term triangle breakout upward)

🔍 Technical Setup (Updated on Daily Chart):

Solvay has now confirmed

ASMLASML Holding

ASML closed at $671.6 on July 7, 2025.

Market Capitalization:

ASML's market cap is approximately $302–$314 billion as of early July 2025, making it one of the world’s 30 most valuable companies.

Key Financials and Outlook

Next Earnings Release:

Scheduled for July 16, 2025. The consens

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Tomorrow

SHURSHURGARD

Actual

—

Estimate

0.81

EUR

Tomorrow

SIPSIPEF

Actual

—

Estimate

—

Tomorrow

MONTMONTEA NV

Actual

—

Estimate

—

Aug 15

ROUROULARTA

Actual

—

Estimate

—

Aug 18

NYXHNYXOAH SA

Actual

—

Estimate

−0.57

EUR

Aug 19

EVSEVS BROADC.EQUIPM.

Actual

—

Estimate

—

Aug 21

VGPVGP

Actual

—

Estimate

2.10

EUR

Aug 21

TESBTESSENDERLO GROUP

Actual

—

Estimate

—

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Consumer Non-Durables | ||||||||

| Finance | ||||||||

| Health Technology | ||||||||

| Process Industries | ||||||||

| Utilities | ||||||||

| Consumer Services | ||||||||

| Industrial Services | ||||||||

| Non-Energy Minerals | ||||||||

| Producer Manufacturing | ||||||||

| Distribution Services |