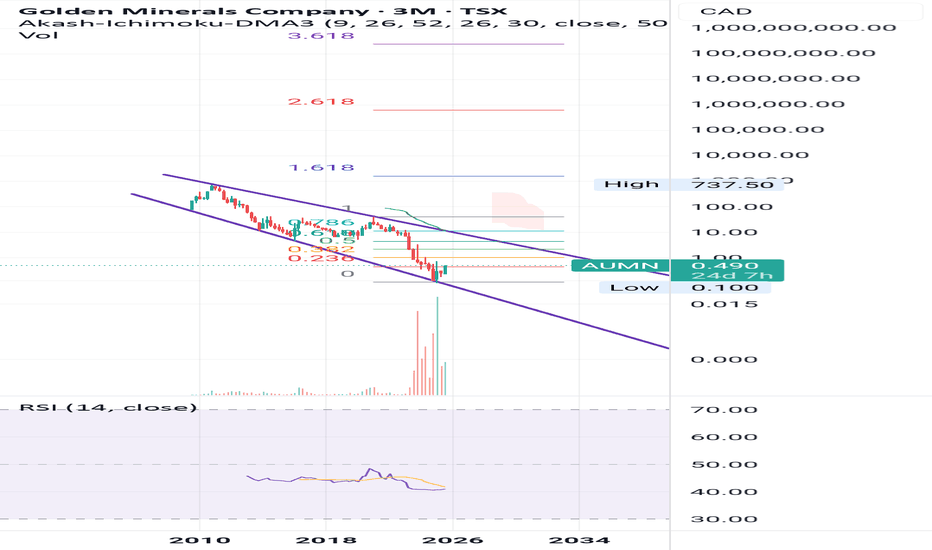

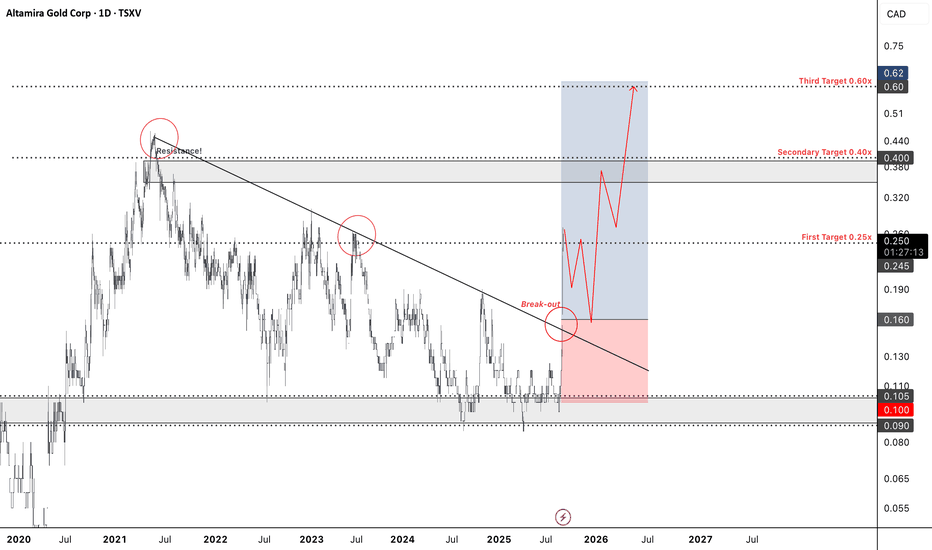

GOLD HITS $3,546 ATH - Time to "Swing the Bat" on Juniors Again!With Gold absolutely ripping to fresh all-time highs at $3,546, I couldn't help but dust off one of the old playbooks and revisit TSXV:ALTA .

Got back in at 10c because sometimes the best opportunities are hiding in plain sight while everyone's chasing the shiny new toys.

For those who've been

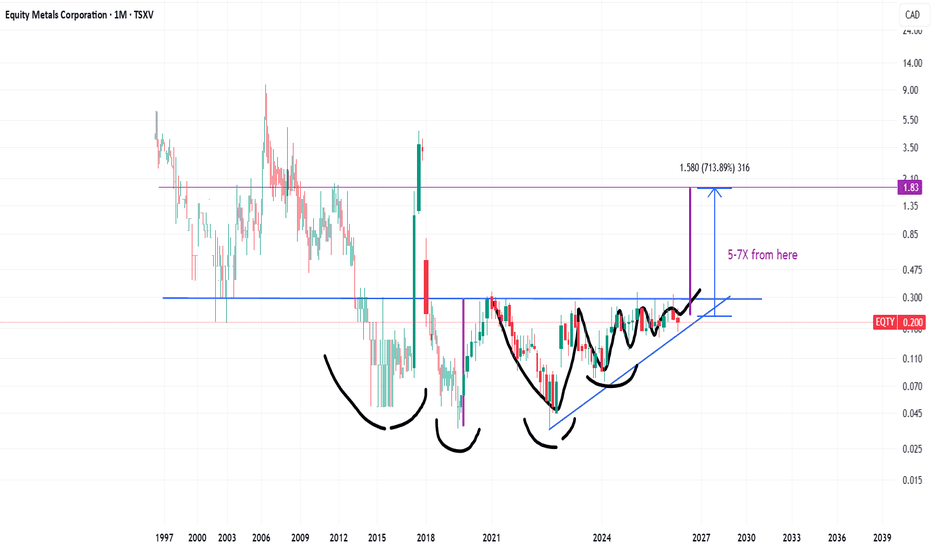

IH&S and Asc Triangle gives 5-7 x in time for EQTY Silver stockBullish set up for silver stock

Silver charts long term indicate break out, this small silver miner could 5 to 7 x according to

the inverse Head and Shoulders pattern its making atm

On the right hand side of the shoulder its made an ascending triangle

Bulkowski suggests 60 % chance of breakout

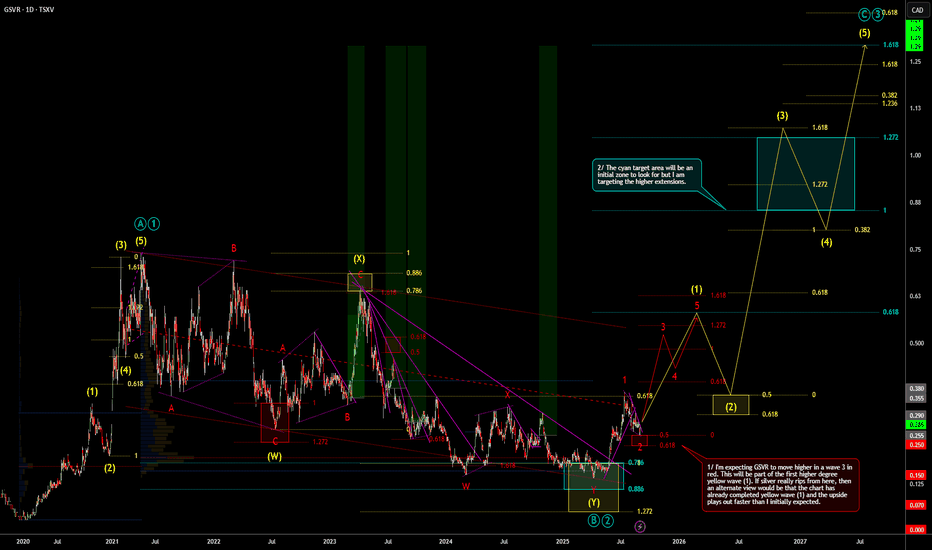

Daily Outlook on GSVR Guanajuato Silver CompanyThis is my Daily chart outlook for TSXV:GSVR I have added in tranches during the decline looking for the up move which I believe is unfolding now. The chart could unfold in ABC or 12345. Price currently looks like it is ready to breakout of the wave 2 consolidation.

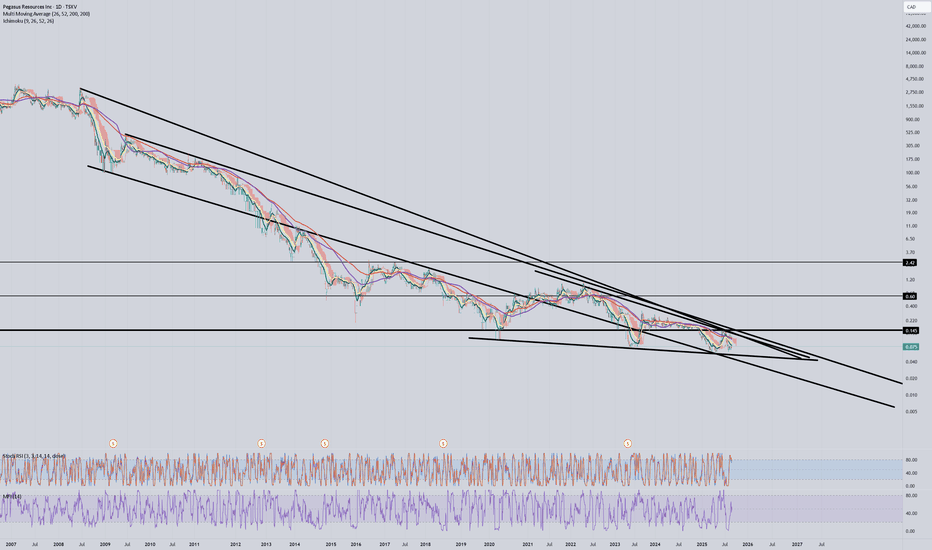

Trading Idea: Brixton Metals (BBB.V / BBBXF)There is the bear market in precious metals from 2011 in a stock. There couldn't be worst timing for listing the Brixton Metals than the 2011 top in gold. Nevertheless - there we are. The gold bull market is here and thus my trade idea. I guess we all see the technicals pretty well so I will post on

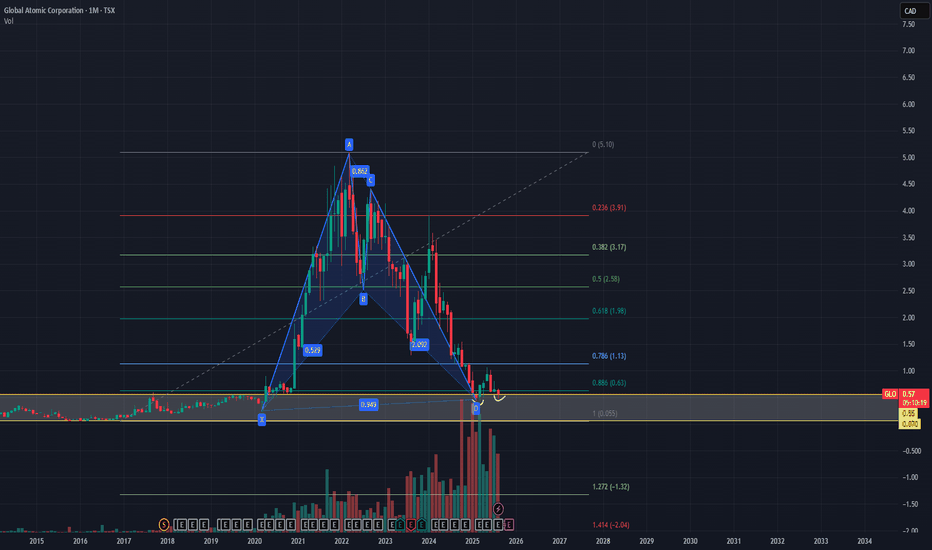

Play on Uranium at key levels.Looking more into nuclear energy, uranium miners/contractors seem to be fitting the scenario where more demand will come.

Knowing that above the previous breakout levels the price simply runs up higher it make it very easy to strategize stop losses.

The company also has communicated with the publi

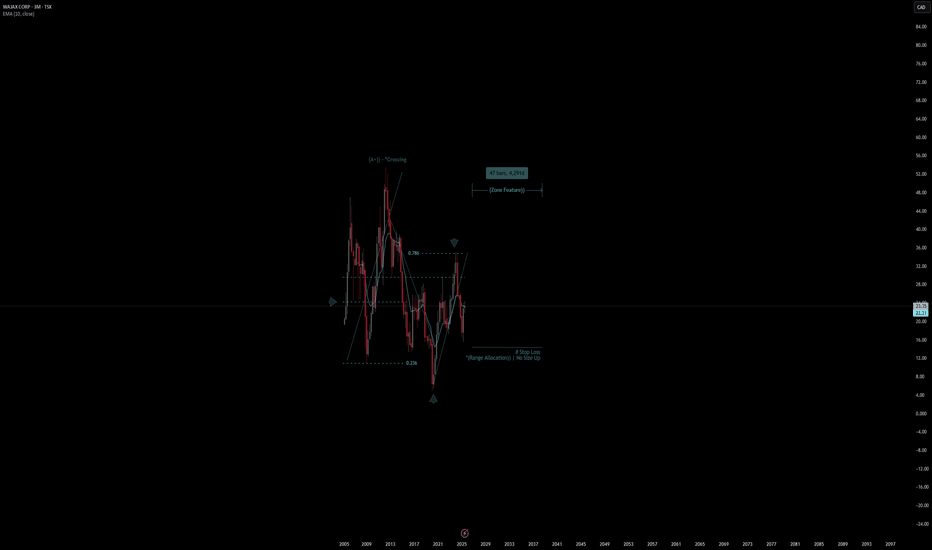

WAJAX CORP | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# WAJAX CORP

- Double Formation

* (A+)) - *Crossing - *Reversal Entry - *10EMA | Subdivision 1

* (Range Allocation)) | No Size Up - *Retest Area | Completed Survey

* 53bars, 4839d | Da

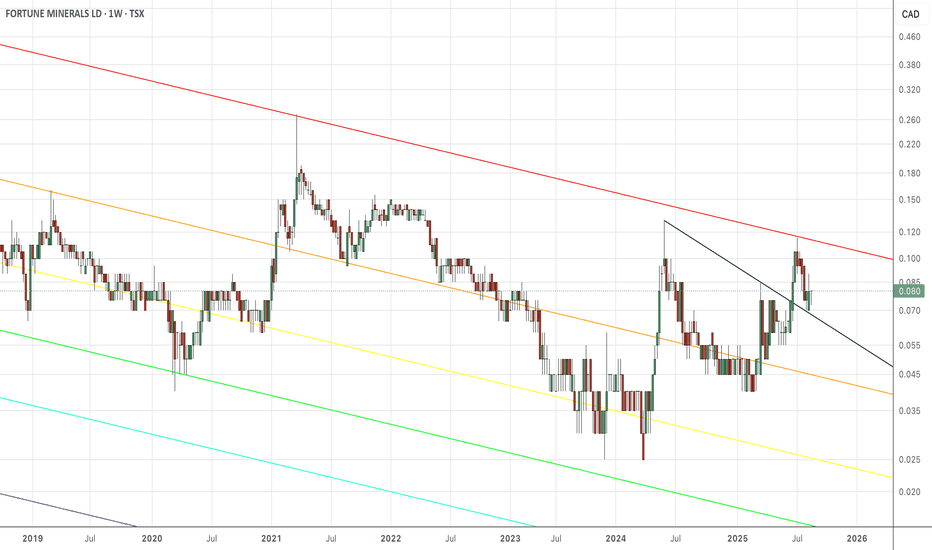

Fortune MineralsFT price landing on support with what almost look like spinning tops. If you squint your eye, they look like spinning tops. You know what that means? Reversal. Reversal to where? The 1-level. If the price reverses and slams back into the 1-level, guess what? Yes, a breakout. Breakout an

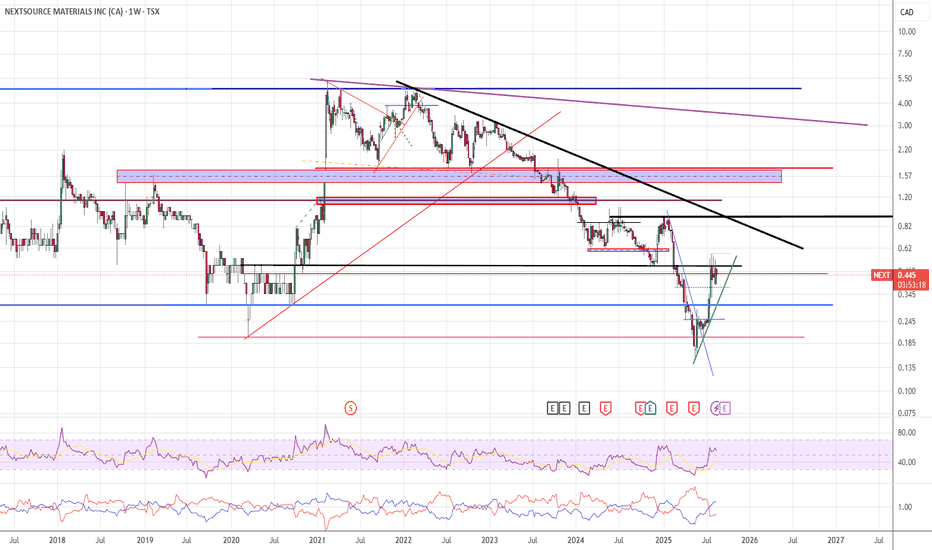

NEXT: big move in the makingNEXT: recent trend change from down ward to up in combination with increased volumes and positive corporate developments - closest target at $0.93C.

*** Graphite - as every mining corporation/ governments are chasing new graphite projects and and industrial corporations are trying to secure enough

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Tomorrow

BNXABanxa Holdings, Inc.

Actual

—

Estimate

0.01

CAD

Tomorrow

VZLAVizsla Silver Corp.

Actual

—

Estimate

−0.01

CAD

Tomorrow

GBTBMTC Group Inc. Class A

Actual

—

Estimate

—

Tomorrow

NWCNorth West Company Inc.

Actual

—

Estimate

0.77

CAD

Tomorrow

MDIMajor Drilling Group International Inc.

Actual

—

Estimate

0.20

CAD

Sep 10

ROOTRoots Corp.

Actual

—

Estimate

−0.10

CAD

Sep 10

URCUranium Royalty Corp

Actual

—

Estimate

−0.01

CAD

Sep 10

ETEvertz Technologies Limited

Actual

—

Estimate

0.14

CAD

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Technology Services | ||||||||

| Electronic Technology | ||||||||

| Retail Trade | ||||||||

| Finance | ||||||||

| Consumer Durables | ||||||||

| Non-Energy Minerals | ||||||||

| Industrial Services | ||||||||

| Energy Minerals | ||||||||

| Commercial Services | ||||||||

| Transportation |