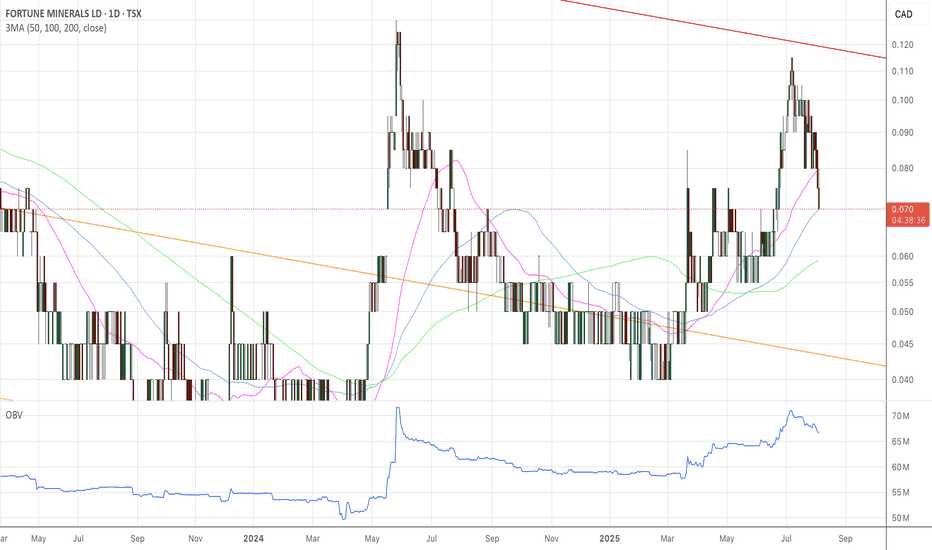

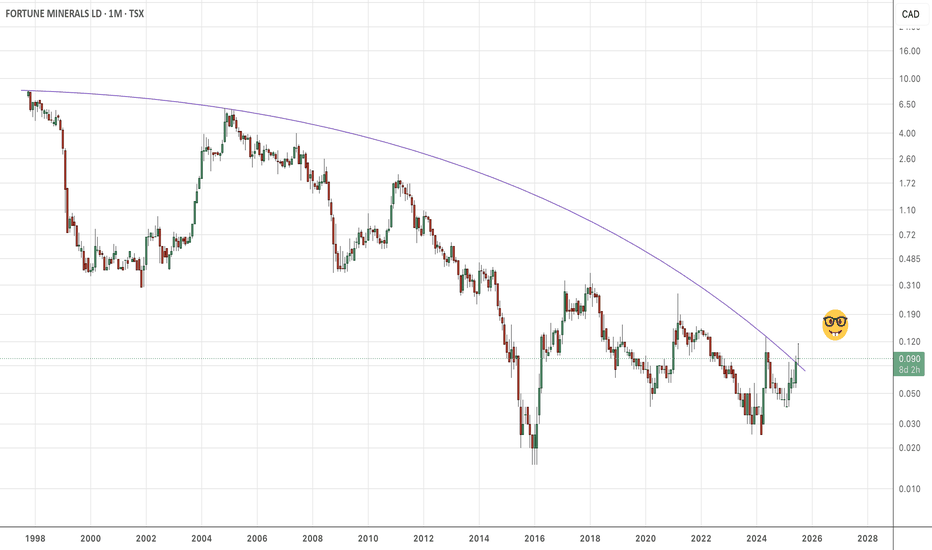

Fortune MineralsHey gang.

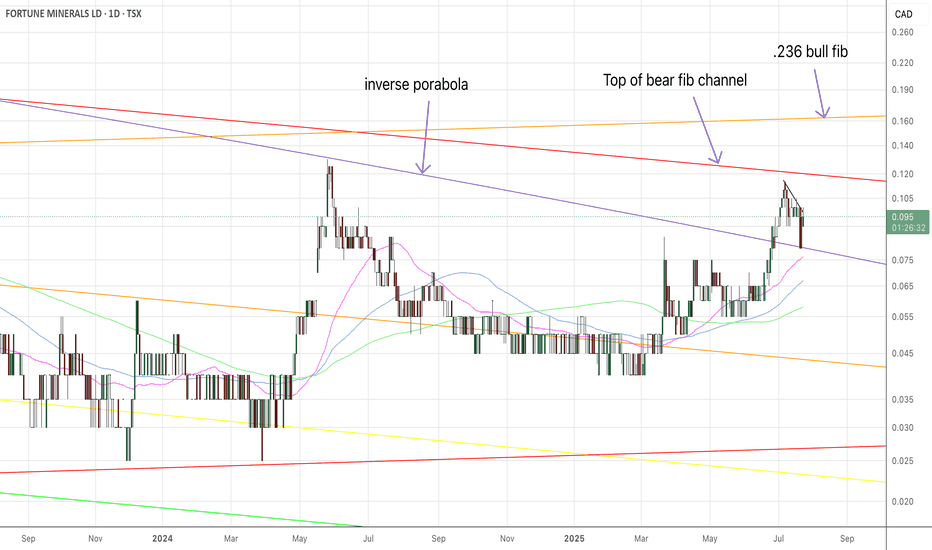

We're coming off of a 1-test, and now testing these ma's, which I'm saying will end up holding. This is one of the last real tests FT has to go through, before it spits out of this all-time bearish Fibonacci channel. The moving average need to continue to hold. Three times makes a trend, and this is the second time the price finds itself in the "meat" of the. ma's. It's sort of your last chance to buy before the price spikes and crazy volatility enters.

I'm here for the long haul sitting on around 5 million shares and looking for the log overhead at $2. We're going there.

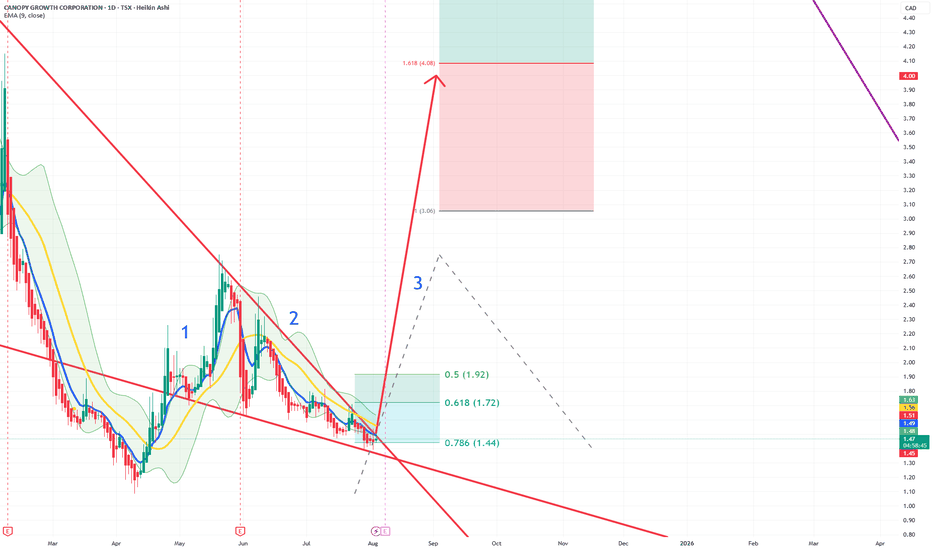

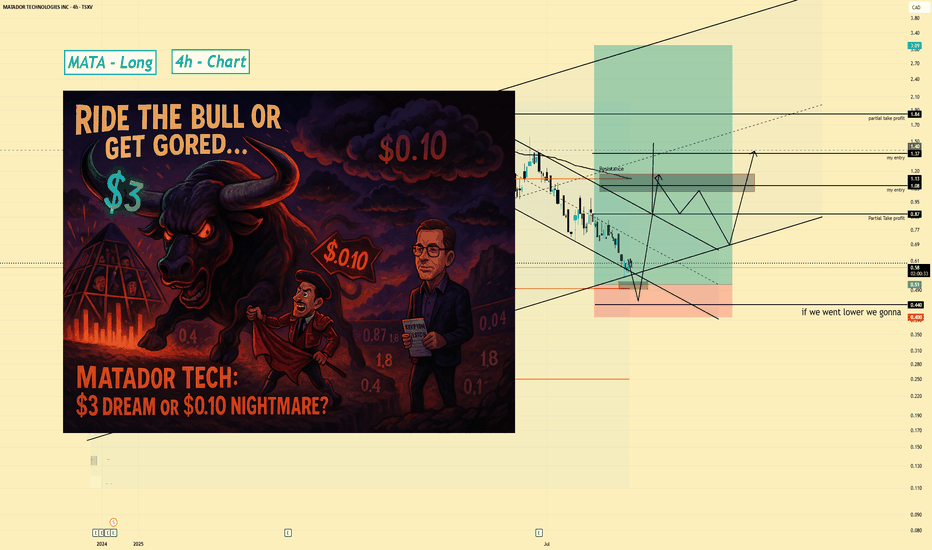

MATA | Long Swing Setup | Trapped Sellers (Aug 2025Matador Technology Inc. (Canada) | Long Swing Setup | Accumulation & Trapped Sellers (Aug 2025)

1️⃣ Short Insight Summary:

Matador Technology is an interesting small-cap play led by Mark Morris, who has a strong vision for tech innovation and market trends. Right now, price action shows signs of flushing out trapped traders, which could set up a big upside opportunity if we manage risk carefully.

2️⃣ Trade Parameters:

Bias: Long (Swing)

Entry: Watching accumulation zones between $0.50

Stop Loss: Below $0.40 (invalidates structure and opens downside risk)

TP1: $0.87 (initial target, partial exits recommended)

TP2: $1.80 (mid-term target)

Final TP: $3.00 (long-term aggressive target)

3️⃣ Key Notes:

Right now, the stock is extremely volatile. The goal is to buy where others are trapped and forced to sell. A clear break below $0.20 would be very dangerous and could push price as low as $0.10.

On the upside, we want to see the stock reclaim the $0.50 zone convincingly. This could build momentum towards $0.87 and beyond. Patience is key—this is a swing trade, not a quick scalp.

4️⃣ Follow-up:

I’ll monitor the price action around $0.40–$0.50 and update if we get a breakout from the current downtrend channel.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

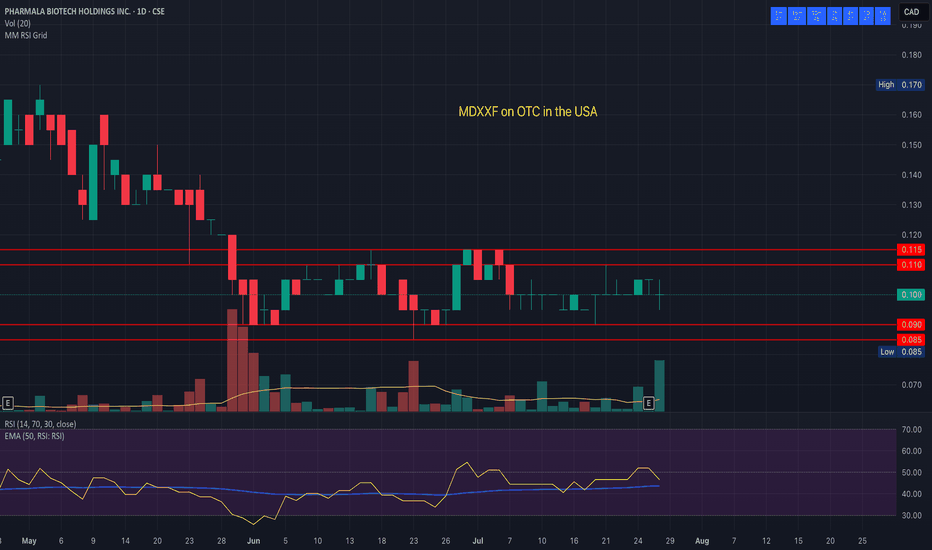

PharmAla Biotech Getting Very Tight, powerful break is imminentMDMA PharmAla Biotech Getting Very Tight, break is imminent. I have a bullish lean on this given the bullish tailwinds in the sector, the ramping up of bull volume on the weekly chart, and the lower wicks that look like accumulation to me on the monthly timeframe

I post regular analysis of the psychedelics sector, please like and follow to make sure you don't miss my next update!

Support: 0.090, 0.085

Resistance: 0.110, 0.115

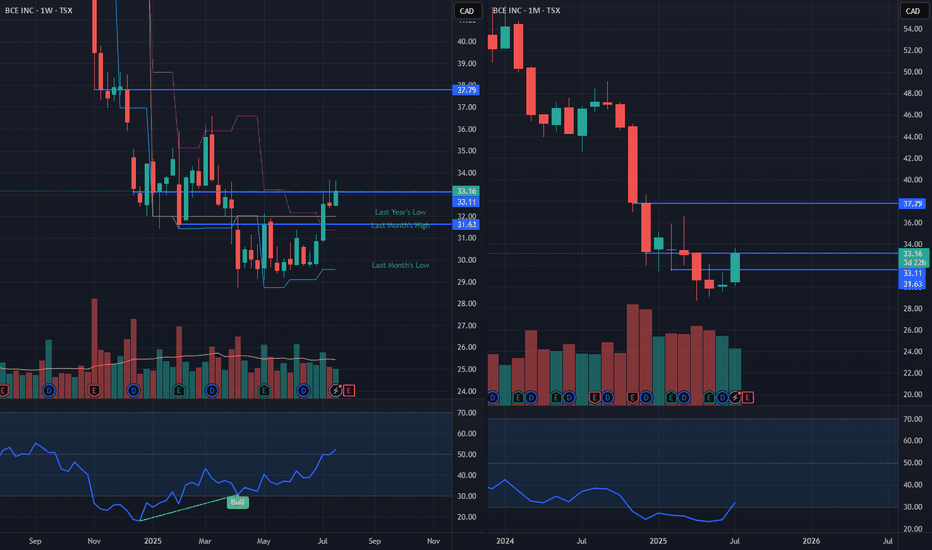

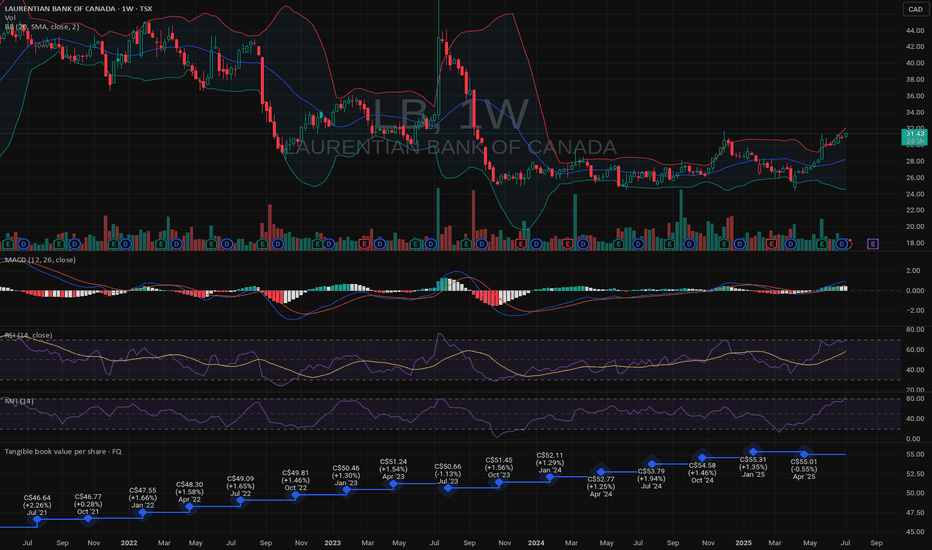

BCE monthly oversoldBCE monthly is oversold, a rare occasion to potentially load up and sell when the monthly RSI hits 70.

Monthly volume is not as big as the 2000-2010 period, however it does match the volume from 2021-2022 highs suggesting this may be the bottom.

Weak red monthly candles followed by June's reversal candle also suggest accumulation.

The weekly support around 29 and rectangle or box pattern suggest accumulation as well.

The red weekly candle was not followed by a red continuation weekly candle suggesting bulls are in control.

Fortune MineralsAfter banging off the top of the bear fib, the price came down and bounced off the top of the all-time inverse parabola. We got a pretty good bounce on low volume, but a landing on the moving averages is not in the rear-view mirror. A return to the 1-level bear fib, and you start to think about do you have enough Fortune? Maybe you need more for the run to $2 USD.

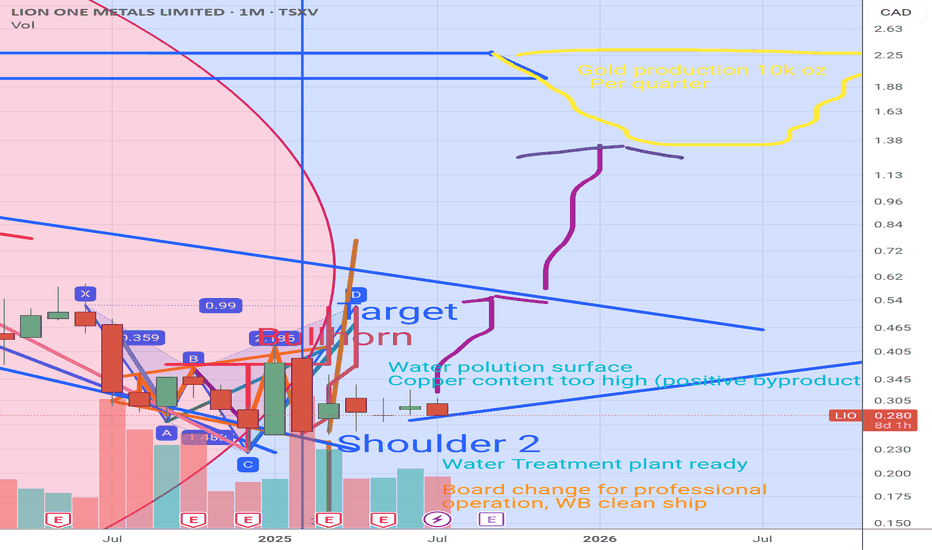

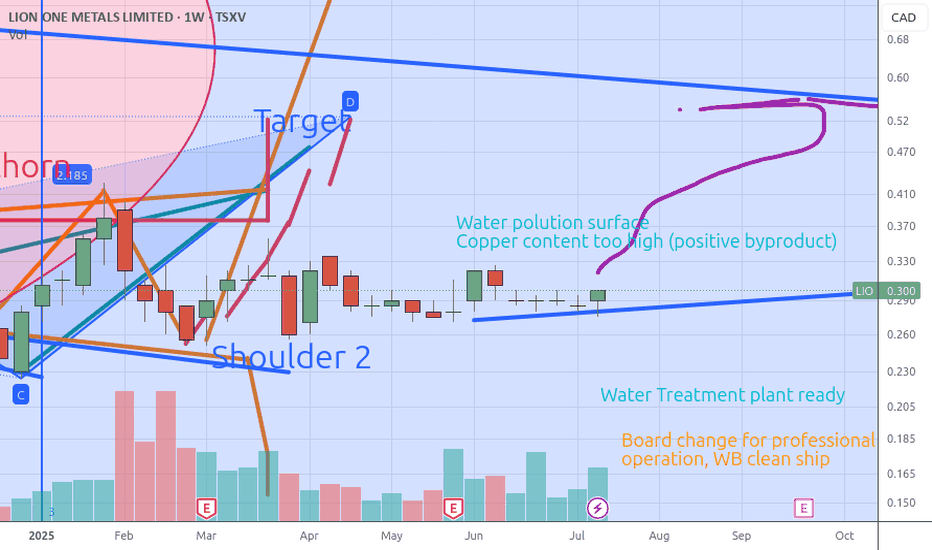

Water, Clean (board) Ship and 0.50 target. for 0.30 broken lio.vWater polution 30th of May gave a storm to the share. Like an oil spil, their copper spil was seen negative. There is considerable potential for Copper as by product with 200 eu a kg. Further we see WB is making a clean ship, firing the people who were not sustainable. Finding an Operation veteran who brough another mine to 2 billion marketcap. size. All positive now there Water Treatment plant is finished.

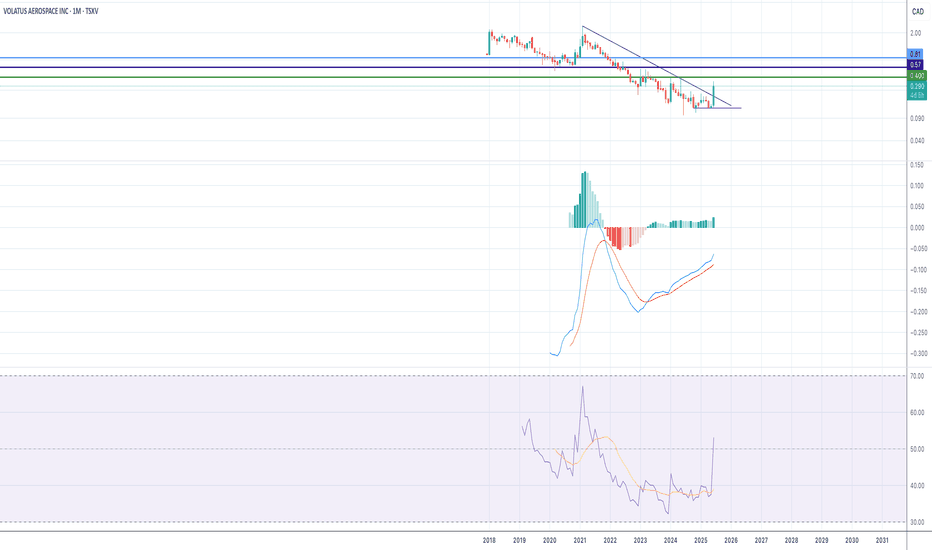

FLT - Long Term VisionOne of my favourite stocks. Looking at this, I am taking a 3-5 year outlook. It seems the company has been on a mission to grow and generate income. I wouldn't be surprised to see a Government contract get signed. (US or Canada) Would love to see them on the TSX. Eventual long term vision is a $10 stock while I attempt to accumulate shares at each of my targets. Would love to hear other opinions on this. This is my NVDA/Amazon over the next 20 years.

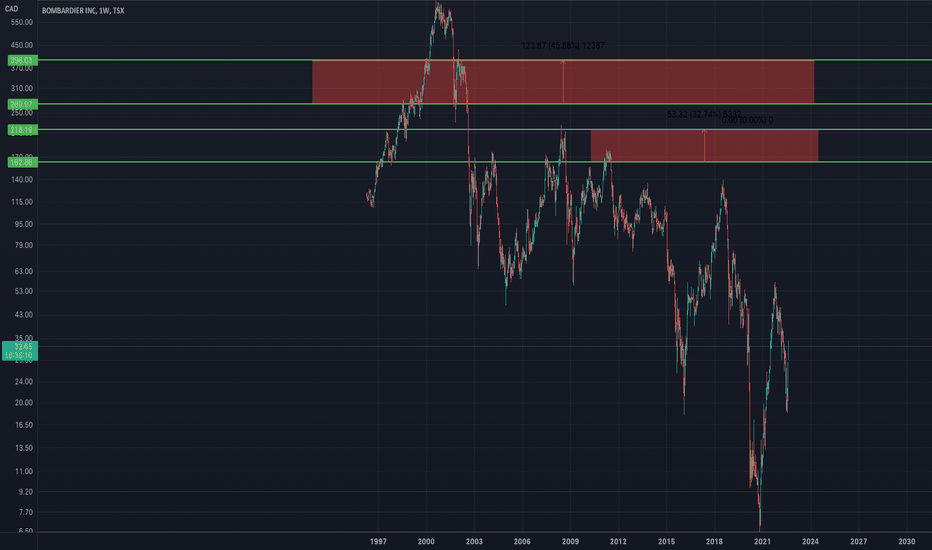

BBD.B Update idea after splitLONG LONG LONG ! Company have a very good future. The company sold the part that produced the trains. And she concentrated all her attention on the production of business jets. Technically, the company's shares look very cool. We tried to hide the technical specifications behind the split, but I have an old graph in my head.)))

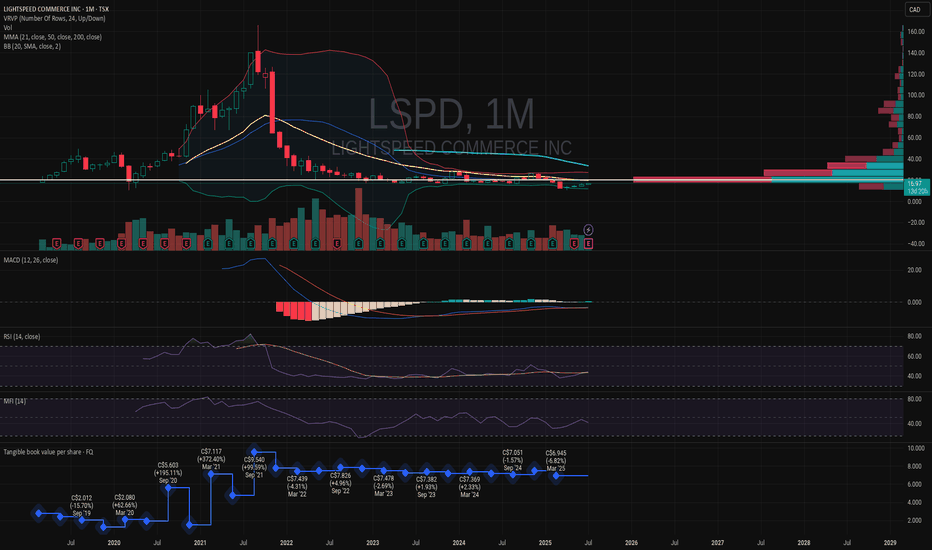

LSPD - Looks promising here. LONG. LSPD

If they can keep on keeping on, bring in cash, I think they have a good shot at carving out a market.

Of course I'm a newbie at all this and just giving my 0.00002 worth.

Same goes for all my charts. I don't profess to know a whole lot, but I'm trying.

If the last few years were tough for companies, expect more to come. IMO

So debt is a problem, staying cash positive is key, and creating a good management group is imperative. again, just thoughts.

cheers.

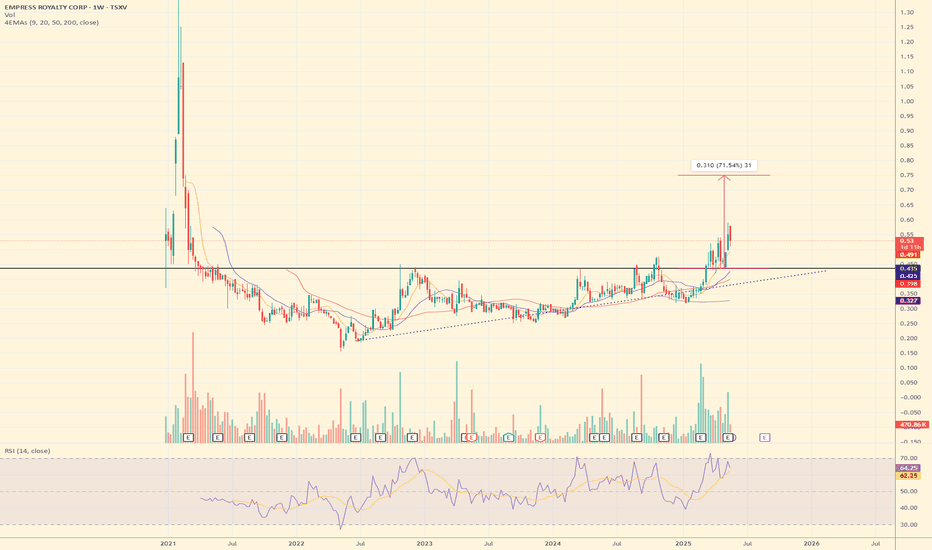

Empress Royalty – Undervalued Precious Metals Royalty🔹 Fundamental Outlook:

Empress Royalty offers exposure to gold and silver through a diversified portfolio of streaming and royalty agreements, with a focus on earlier-stage producers and developers. Backed by strategic partnerships with Endeavour Financial and Terra Capital, the company leverages deep deal flow and structuring expertise, while keeping overhead lean.

Cash flowing from several active royalties

EV/EBITDA (TTM): ~2.3 – indicating deep value

Free Cash Flow: ~$33M

Float: Only ~43M shares – tightly held

No major debt concerns (cash/debt ratio ~1.44)

The recent appointment of Mark Ashcroft as Business Development Advisor (North America) further boosts Empress’ ability to scale its portfolio with quality assets in the region.

✅ Undervalued vs peers on cash flow and earnings

✅ Royalty model limits operational risk

✅ Exposure to gold and silver (a rare mix)

✅ Insiders and partners with long-standing mining credentials

✅ Benefiting from a rising silver sentiment and the search for non-dilutive capital by small/mid-tier miners

🔹 Risks:

Operator dependency (as a royalty company)

Exposure to early-stage projects with potentially higher execution risk

Thin trading volume at times, which may increase volatility

📈 Conclusion:

Empress Royalty is a fundamentally solid, technically bullish small-cap royalty play. With silver sentiment turning and precious metals investors rotating into high-leverage names, EMPR offers both growth potential and asymmetric reward/risk.

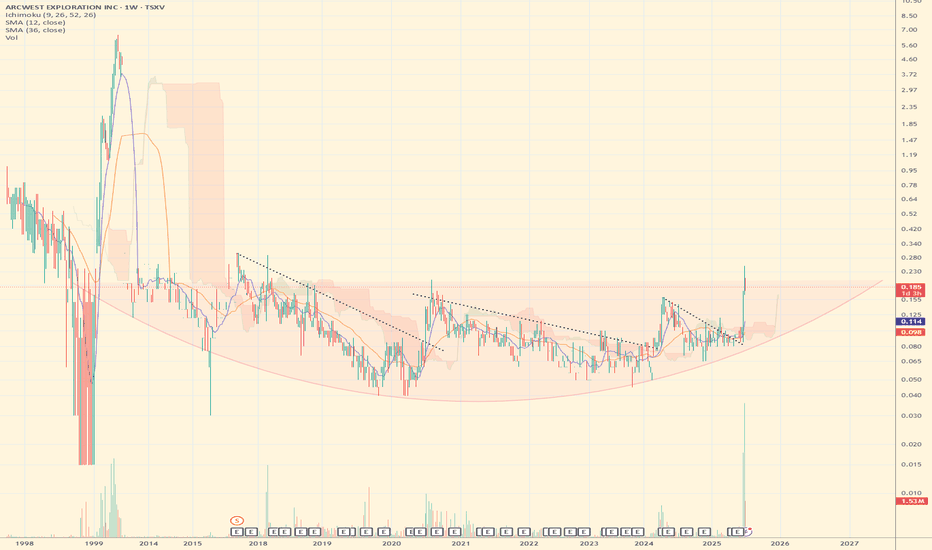

AWX - Breakout from Multi-Year Cup & Handle + JV Deal with FCXArcWest Exploration (TSXV: AWX) just broke out of a 7-year cup & handle formation, hitting C$0.21 with record weekly volume (1.53M).

📉 Long-term downtrend decisively broken

📊 12W SMA (0.114) > 36W SMA (0.098)

☁️ Weekly Ichimoku turns bullish

🔻 Pullback to C$0.185 (-7.5%) may offer entry

🔎 Next resistance zone: C$0.30+

Fundamental trigger:

ArcWest Exploration is a project generator focused on porphyry copper-gold systems in British Columbia, operating under a JV-based model. The company currently has eight 100%-owned projects, several of which are already partnered with major producers.

The recent breakout follows the announcement of a joint venture agreement with Freeport-McMoRan on the Eagle project, where Freeport can earn up to 80% interest by spending C$35M over 10 years, including staged cash payments and a commitment to fund exploration.

This deal marks ArcWest's second major JV partnership, alongside Teck Resources (on the Oxide Peak project), further validating the quality of its portfolio. Both Freeport and Teck are known for targeting large, long-life copper assets, which adds strong institutional backing and long-term exploration potential.

The alignment of technical breakout + institutional interest signals a possible structural re-rating as the market begins to price in multi-asset optionality and tier-1 partnerships.

The chart and fundamentals now align, suggesting multi-year upside potential.

📌 Do your own research before investing!

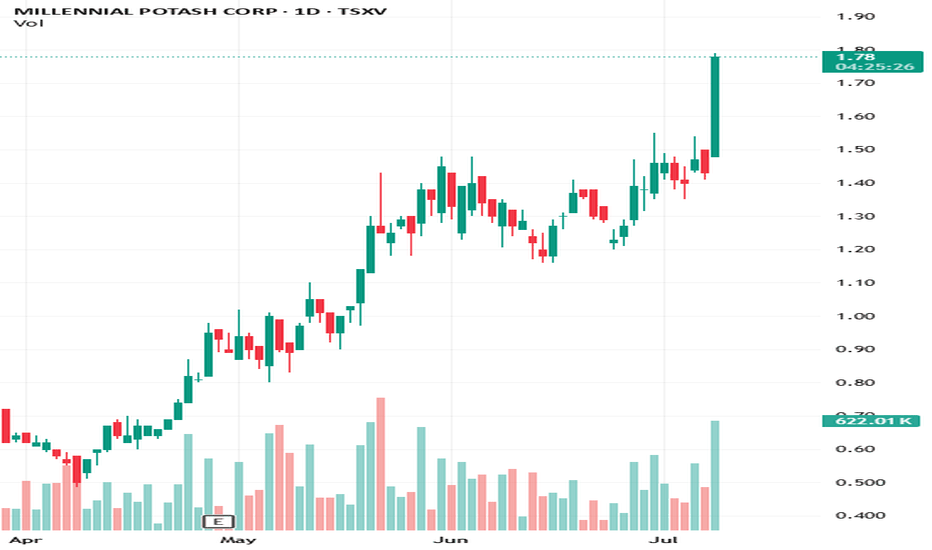

U.S. DFC Invests in $TSXV:MLP Banio Project Millennial Potash Corp. ( TSXV:MLP | OTC:MLPNF ) just announced a major development: the U.S. International Development Finance Corporation (DFC) has committed up to US$3M in project development funding for the Banio Potash Project in Gabon.

This strategic funding supports the upcoming Feasibility Study and was signed in Washington D.C. with the President of Gabon in attendance — a major signal of international and governmental backing.

Why this matters:

Potash = food security. Fertilizer is essential for crop yields, and potash demand in Africa is rising fast.

DFC backing helps derisk the Banio project and positions MLP for future development financing.

The investment arrives as Millennial moves from exploration to development — with second-stage drilling nearing completion.

Gabon's support + U.S. government endorsement puts MLP in a strong geopolitical position for long-term growth.

Follow for updates as the feasibility study unfolds and MLP potentially emerges as a cornerstone player in Africa’s potash supply chain.

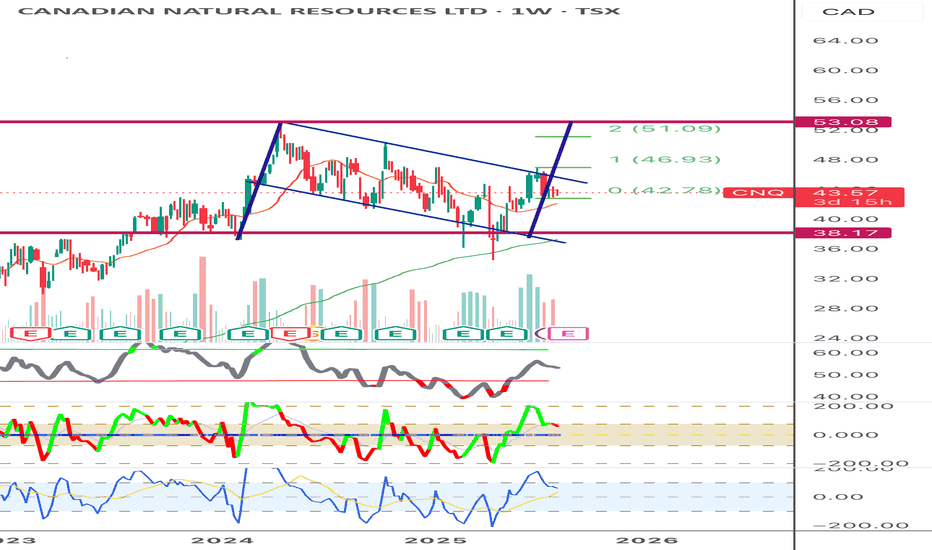

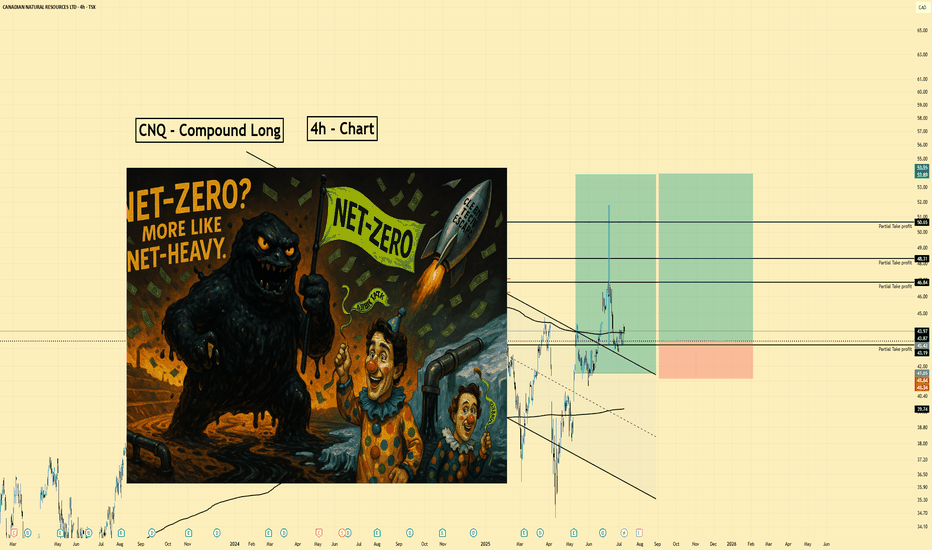

CNQ | Long | Oil & Gas Diversification Play | (July 9, 2025)CNQ | Long | Oil & Gas Diversification Play | (July 9, 2025)

1️⃣ Short Insight Summary:

Canadian Natural Resources (CNRL) is moving strong thanks to its diversified oil & gas operations, LNG expansion, and solid ESG positioning. We’re already up nicely on this move, and the setup still looks promising for higher targets.

2️⃣ Trade Parameters:

✅ Bias: Long

✅ Entry: Already in from lower (around $41)

✅ Stop Loss: Adjusted close to breakeven (~$41) to protect profits

✅ TP1: $46 — already partially hit (we took out 50% here)

✅ TP2: $50.65 — next profit-taking zone

✅ Final TP: $53.89 — extended target for the runners

✅ Partial Exits: Already 50% out, considering re-compounding at strong support zones

3️⃣ Key Notes:

We’re riding strong fundamental drivers: a major long-term LNG deal with Cheniere, increased pipeline capacity, and a robust oil sands base. The carbon capture (CCS) initiatives also support its ESG image, though they add capital costs. Oil price volatility and regulatory pressures remain risks, but the trend stays bullish as long as oil holds up and macro flows support energy stocks.

If entering fresh now, I'd watch closely and consider a tight stop around $41, as mentioned, to avoid getting caught in pullbacks.

4️⃣ Optional Follow-up Note:

I’ll continue to monitor and update this idea if major structure or price action changes.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not a financial advise. Always conduct your own research. This content may include enhancements made using AI.