Global battery management market is expected to reach USD 5.4 B$GEMS.C – Great opportunity to capture the expanding Global battery management market.

Although COVID-19 negatively impacted the global battery management market in 2020, it is expected to reach USD 5.4 billion in 2022. It is projected to register a CAGR of over 4.85% during the forecast period (2022-2027). Now the market has reached the pre-pandemic level. The battery management system is meant to track the aspects of the battery system and its cells and use the information gathered to reduce safety hazards and improve battery performance. High demand for battery management systems will accelerate the market growth of battery management systems. This is the perfect opportunity to occupy a significant market share of any lithium mining and supplying company.

prnewswire.com/news-releases/global-battery-management-system-market-expected-to-reach-5-4-billion-in-2022--301658228.ht ml

$GEMS.C is the leading single sources supplier of critical energy minerals used for clean and green energy evolution. As lithium is a crucial element for the battery management system, Infinity stone venture corporation continuously focuses on a smooth supply of critical energy minerals.

* Investors in the Infinity stone venture get exposure to lithium, graphite, copper, cobalt, nickel, manganese, and possibly some PGMs & REEs.

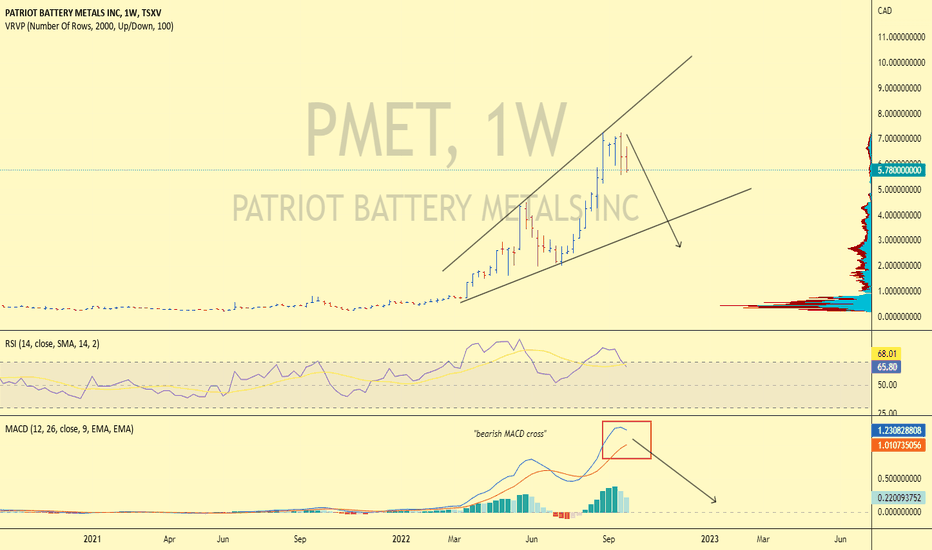

* Infinity's lithium mining portfolio is impressive; four projects, 11k+ hectares, 65+ pegmatites, tens of km of a prospective strike — very near or bordering Patriot Battery Metals

* infinity stone venture successfully confirmed historically mapped pegmatites and identified new showings. Eighty-seven samples were collected over 3,850 hectares of claims adjacent to the Patriot discovery.

$GEMS.C has a bright future in the global battery management market and is constantly fulfilling the demand for critical energy minerals through its eco-friendly mining program. It has government tax incentives and grants, including Canada's 30% Critical Mineral Flow-Through Tax Credit.

(CSE: GEMS) (OTC: GEMSF)

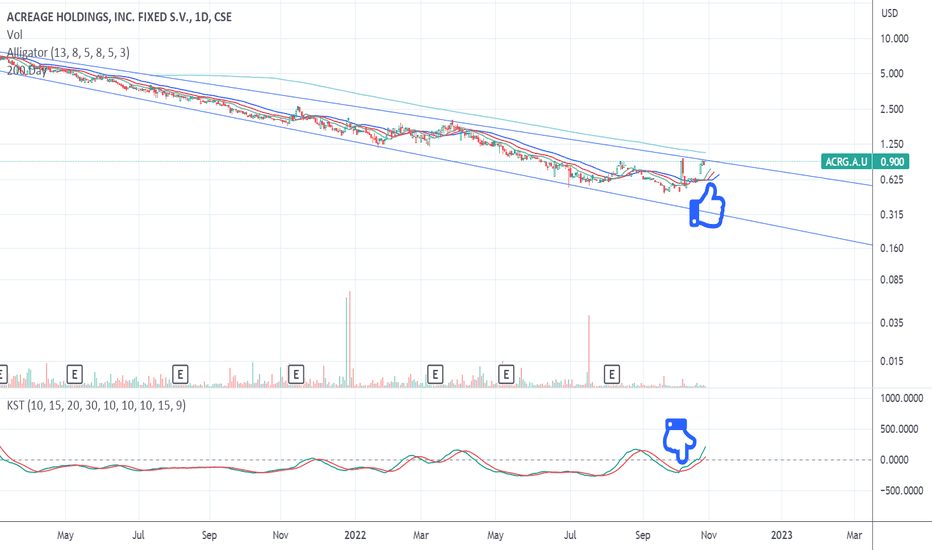

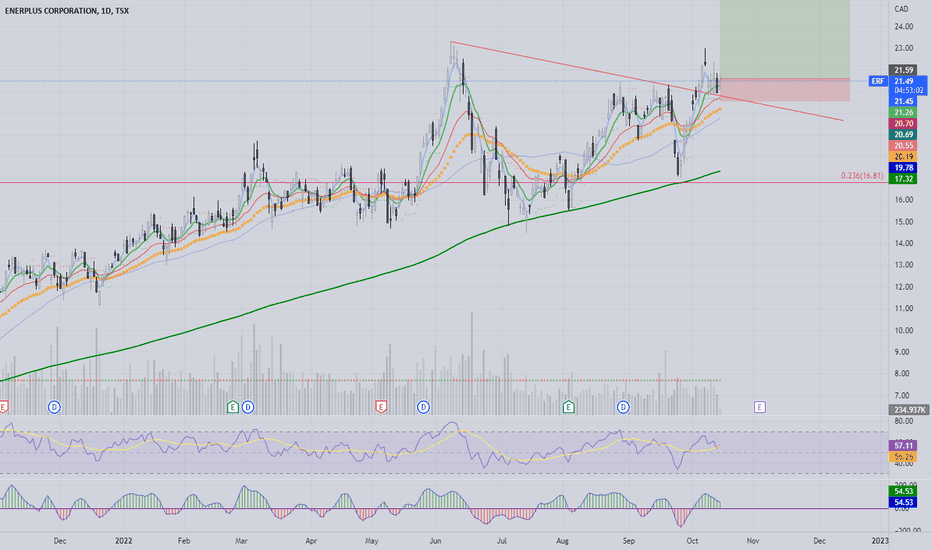

Acreage is flirting with the resistance of a descending channel Bullish cross on the KST & Williams alligator.

The stock is getting very close to the 200DMA.

ERF LongERF looking to run up to 382, tricky getting an entry this year. Lets see how this one goes.

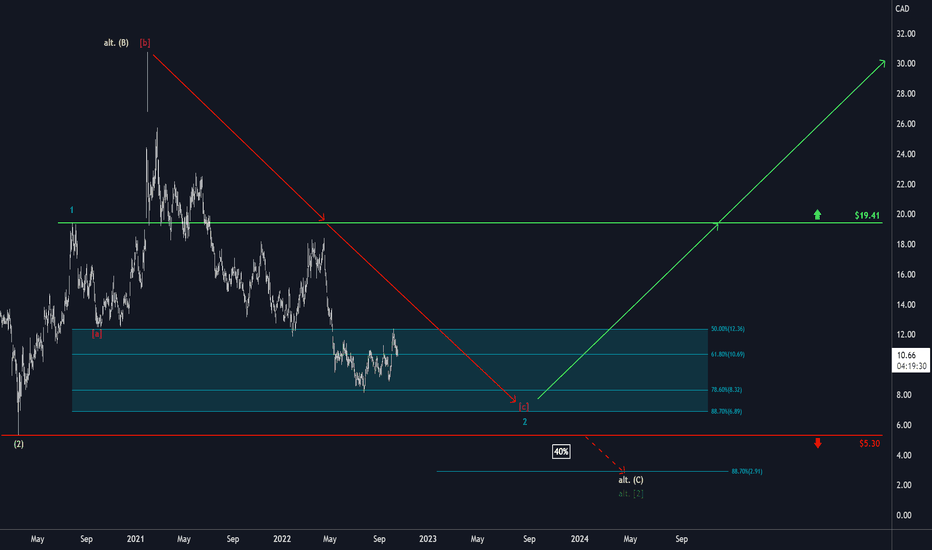

First Majestic: Shy…While First Majestic had actually already made it to the upper edge of the turquoise zone between $6.89 and $12.36, it has shied away and drawn back again until the retracement at 61.80%. Thus, we still give it some time to finish wave 2 in turquoise – although it could also continue the ascent from here. As soon as wave 2 in turquoise is completed, First Majestic should indeed move upwards, heading for the resistance at $19.41. However, there is also a 40% chance that First Majestic could slip through the turquoise zone and drop below the support at $5.30. In that case, it should extend the downwards movement until $2.91.

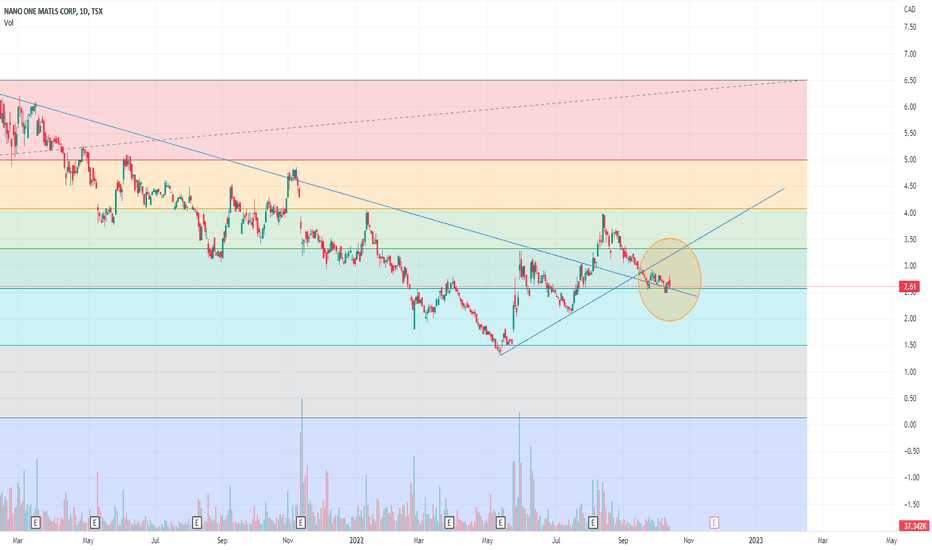

#NNOMF_NANO $NANO will the share price go up?#NanoOneMaterials has signed some great deals this year:

#RioTinto

#EuroManganese

#JohnsonMatthey

I'm curious if the share price will take some positive action in this years last quater?

After touching a 2 years low in May it did a good run till August. Since than the share price was cooling down and tries the next run to the resistance at about CAD 3,3x

If the price can sustainably brake through that resistance again, it could become a nice run. Specially if more positive news will arrive! But first it has to defeat the support at about CAD 2,57

No financial advice - just my opinion.

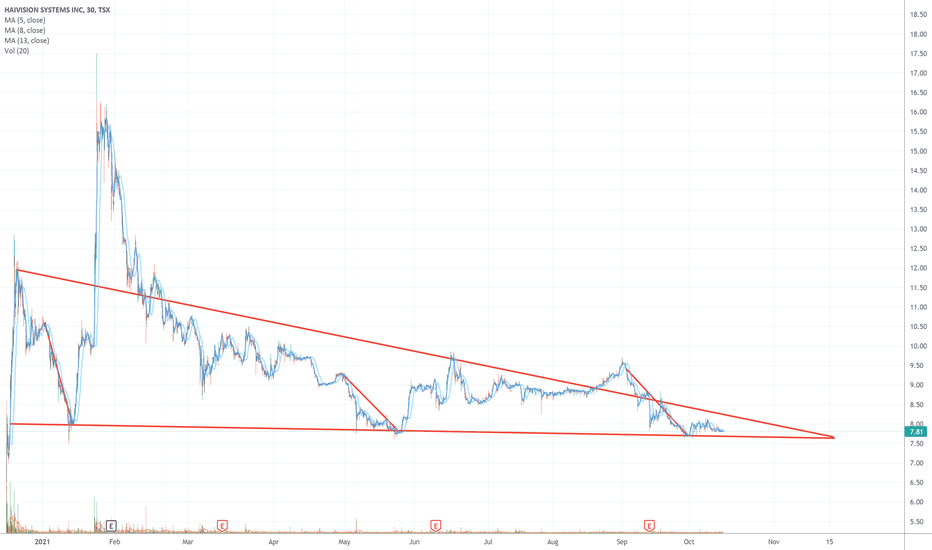

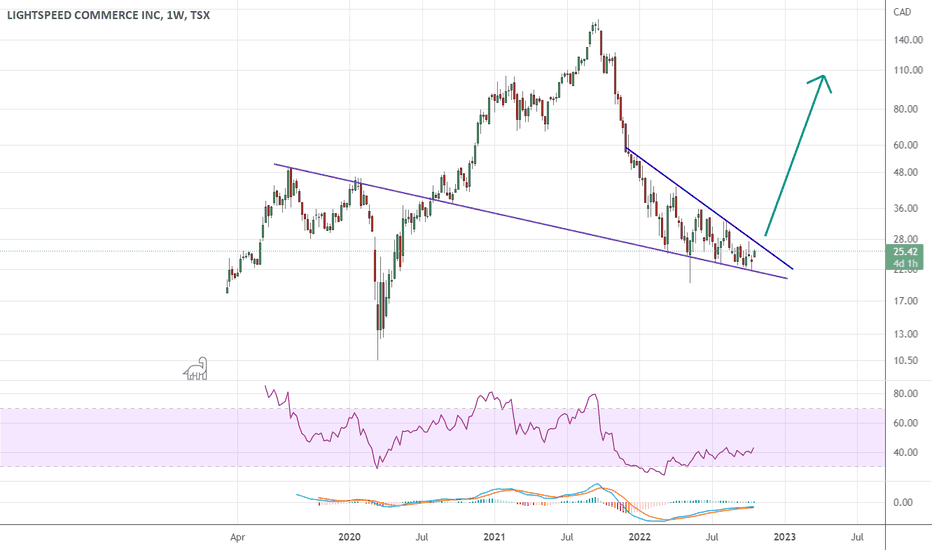

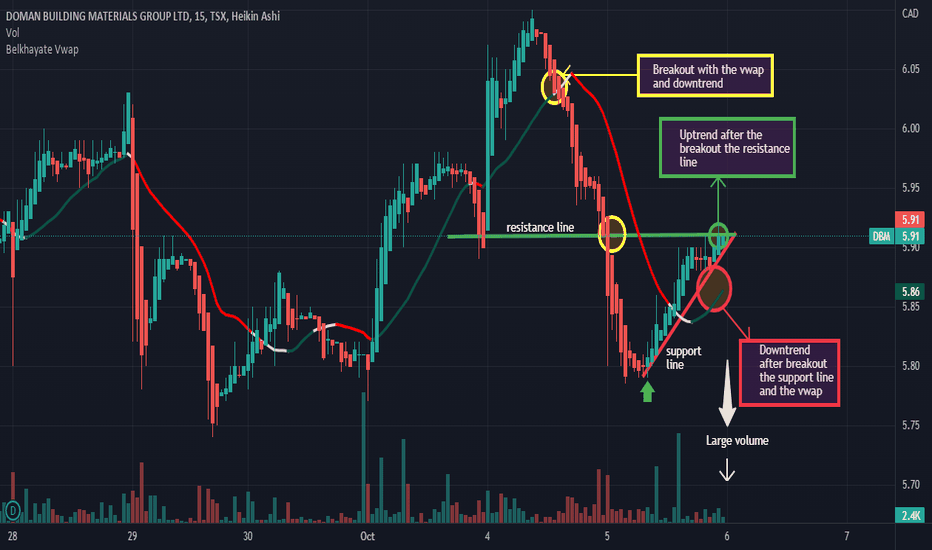

AnalysisHere we will have a big probability of an uptrend after the breakout with force the resistance line by a big green candle with a large green volume. So, in other hand we can have a downtrend if the support line and also the vwap indicator are broken with force by a big red candle with a large red volume.Thanks.

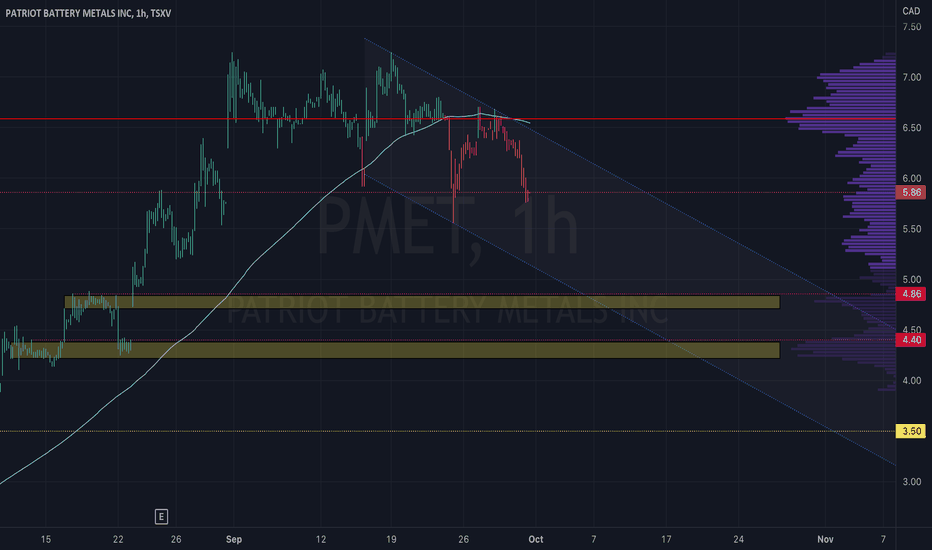

PMET 1H downtrendPatriot Battery Metals Inc. PMET.V

Below magic line

Channel down

Volume support levels

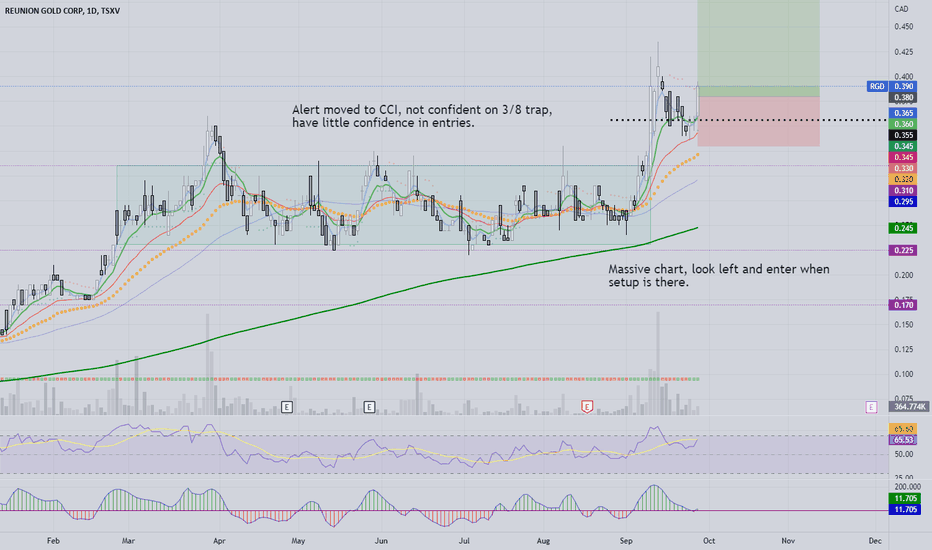

RGD longThis one has been a trial of patience. Watching for a long time, finally broke up. Pretty volatile so stop is a good distance away.

GMG IDEAGraphene idea GMG, edges of circles and spirals usually are a signal of a trend change or impulse. Look for intersecting lines for volatility as well. All for my own record keeping. Hope TV keeps this one updated and gives me future dates to plan my financial future. my DXY chart stopped in August and shit was just getting good.

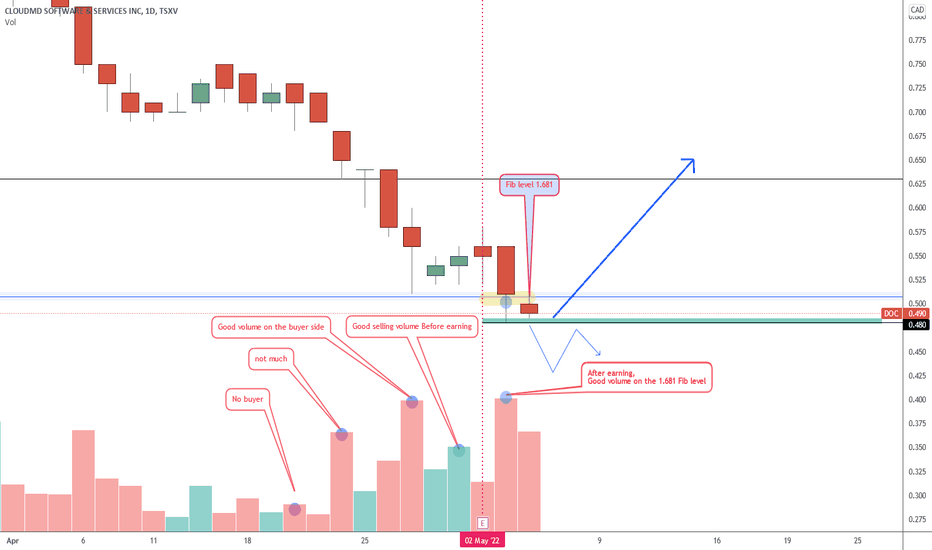

Earning reversal play LONG DOC1 We are in a monthly support zone (We are long)

2 On the weelky we reverse to the upside but we did not rebounce from the actual low and the stock fall lower.

3 Divergence on the weekly Low low

4 We are testing the 1.618 FIB level of the previous weekly rally (Reversal on daily)

5 + Logic volume to suggest a rebounce from the 1.681 FIB level.

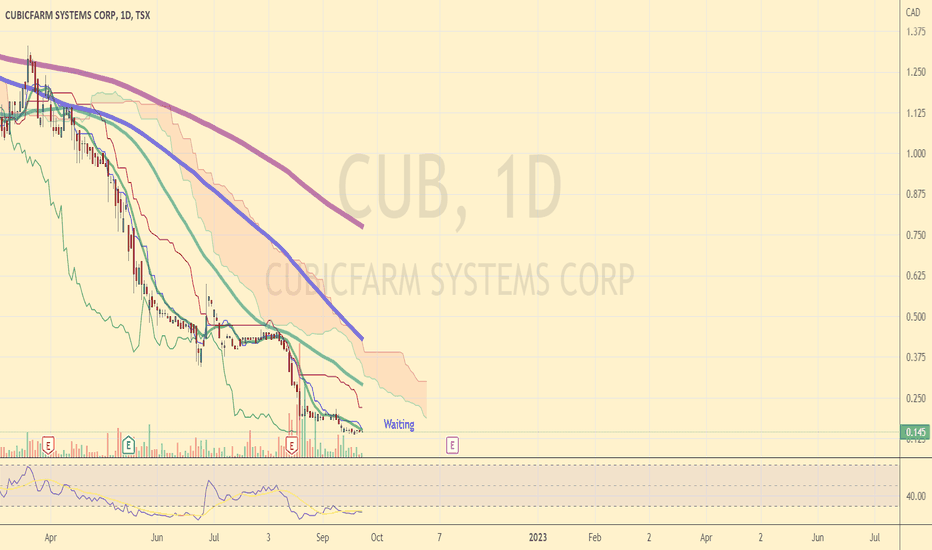

All I want is Food on the TableA possible tech solution to help with the continued and growing Food Crisis and unpredictable weather

Upside: Not vulnerable to weather, increasing Food Prices could make AgTech more profitable over time

Downside: AgTech utilizes alot of Electricity Cost