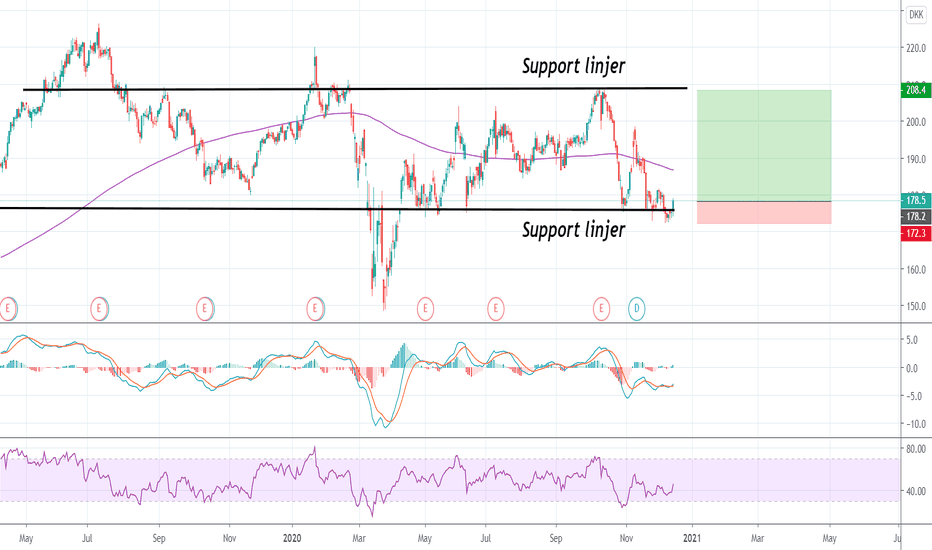

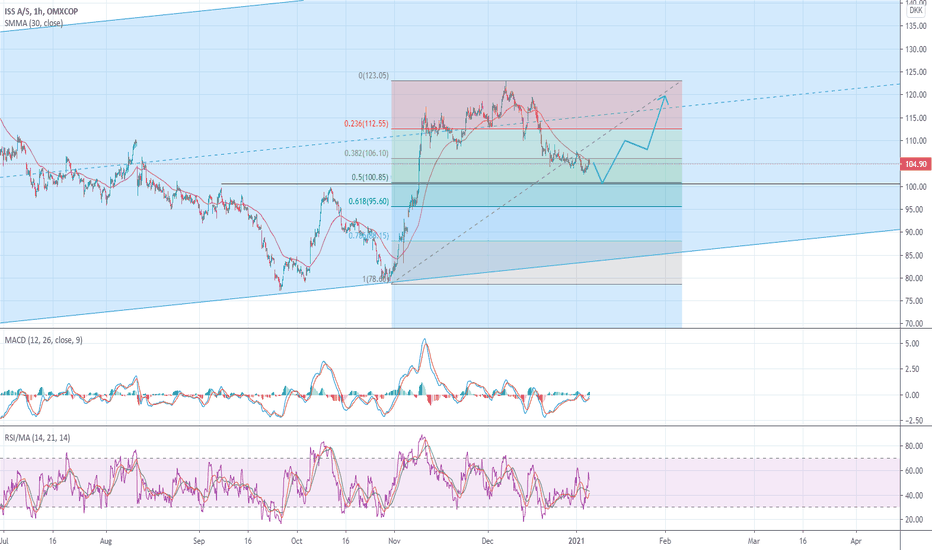

Time for an upswingTRYG A/S

Trickerkode: Tryg

er ved at blive spændende, både FA og teknisk, dog kunne den tekniske del godt bruge lidt flere positive tegn.

Men mon ikke den holde sig til din range kanal!?

Synes i hvertfald det er er god risk/reward i forhold til dette swing som er vist på chartet.

Open trade til kurs 177-179

Take profit til kurs 205-208 ( max gain 17 % )

Stop loss til kurs 171-172 ( max loss 3,30 % )

Risk / reward Ratio: 5,12

Tryg A/S er en god stabil dansk aktie, der hele tiden har fingeren på pulsen og det er de også godt igang med lige nu :

finanswatch.dk

og ( dog skal man være medlem for at læse denne 👇 )

finans.dk

Tryg A/S er bestemt en god defensiv aktie at have i sin portefølje som også giver en god udbytte ( når de udbetaler )

Hvis du ikke vil swinge den, er det stadig et okay tidspunkt at købe den på pga ( FA og den er nede ved stærk support linje og bryd op igen i fredags.

Hvis den skulle falde yderligere og du er lang i denne, kunne løbende opkøb være en mulighed, dog husk at time det ud fra din risk management, men jeg ser tryg i højere vande i 2021.

Dette er blot min vurdering i denne lille analyse.

Disclaimer: holder den ikke - Men overvejer at købe til mig selv og til gruppen i næste uge hvis den bliver over supporten, dette er en langsigtet investering for mig/os hvis vi går ind i den.

God weekend 🙏

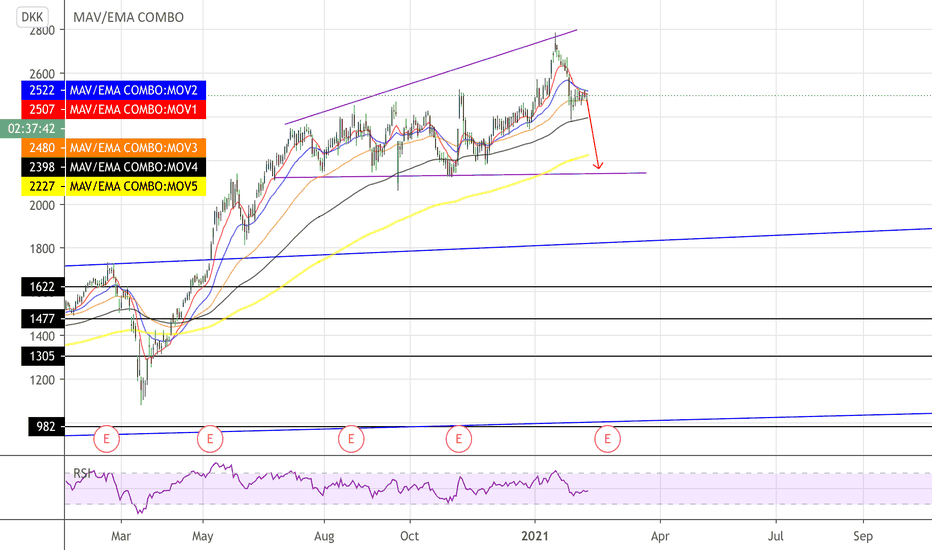

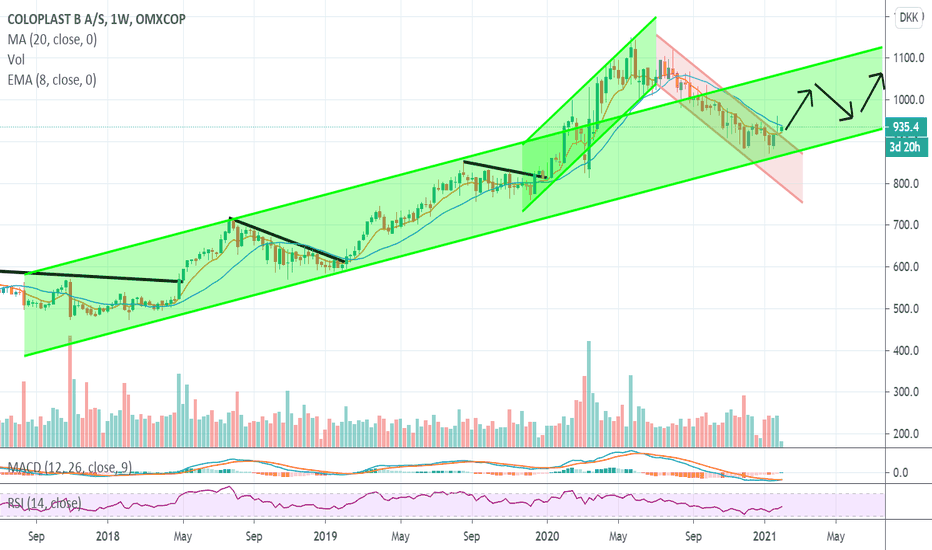

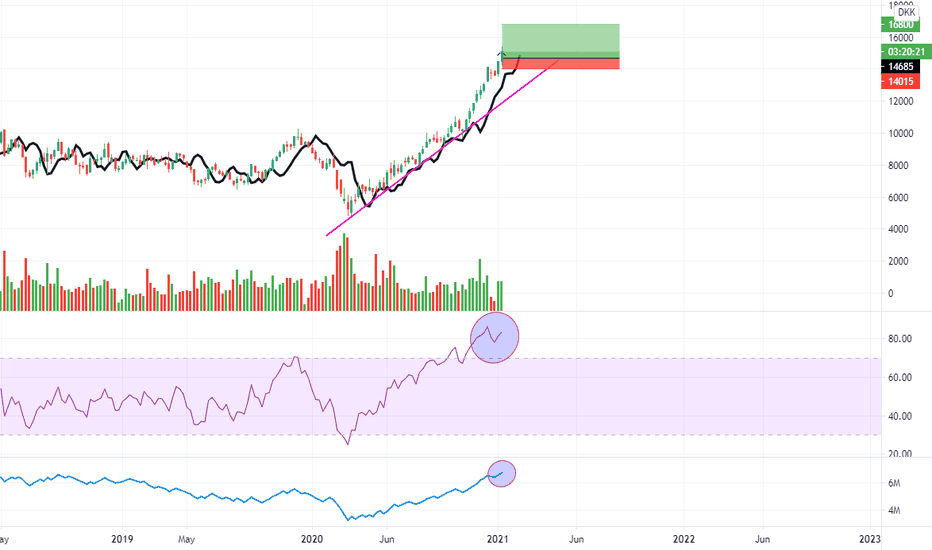

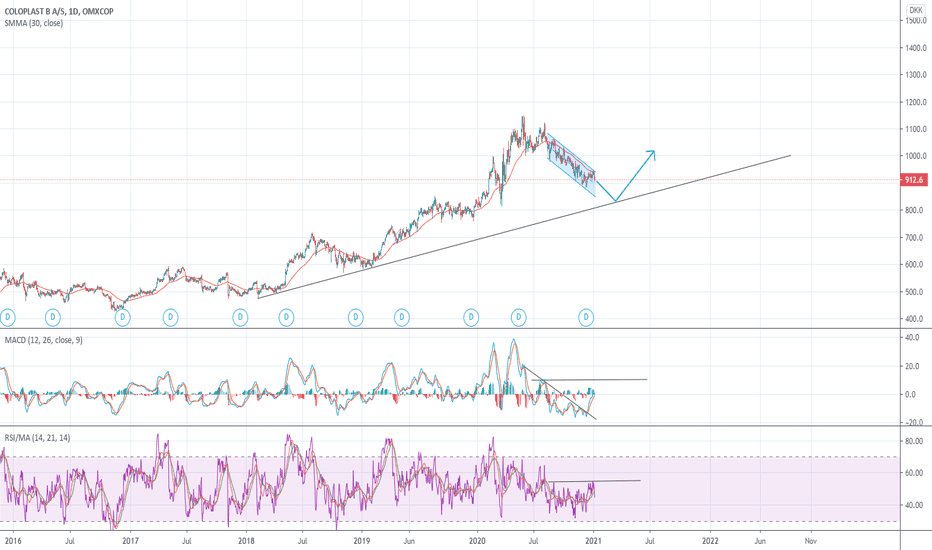

Coloplast - ready for new uptrend?After an accelerated trend channel during the first 6 months of 2020, the stock has made a bullish retracement flag marked by the red channel. Last week and today it has shown the strength to break out of the bullish flag formation, and looks technically ready for a new bullish rally.

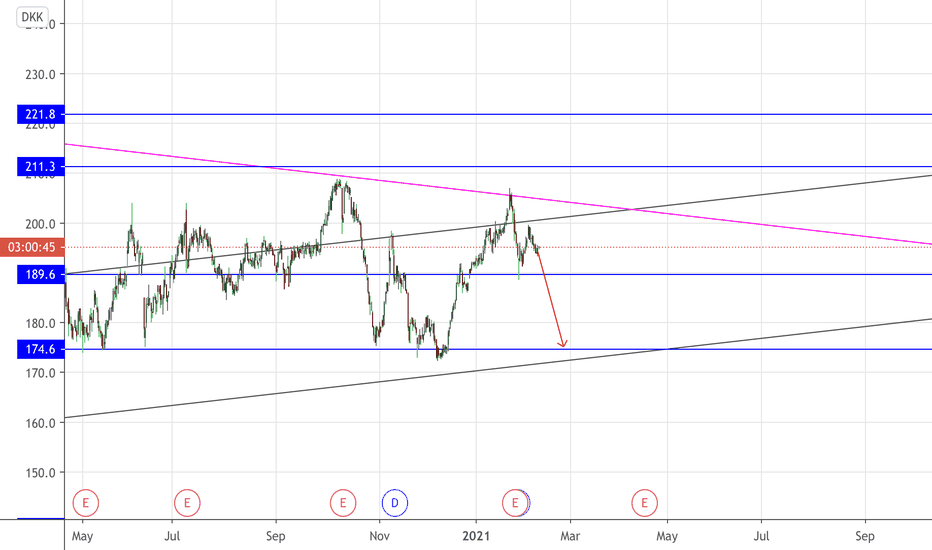

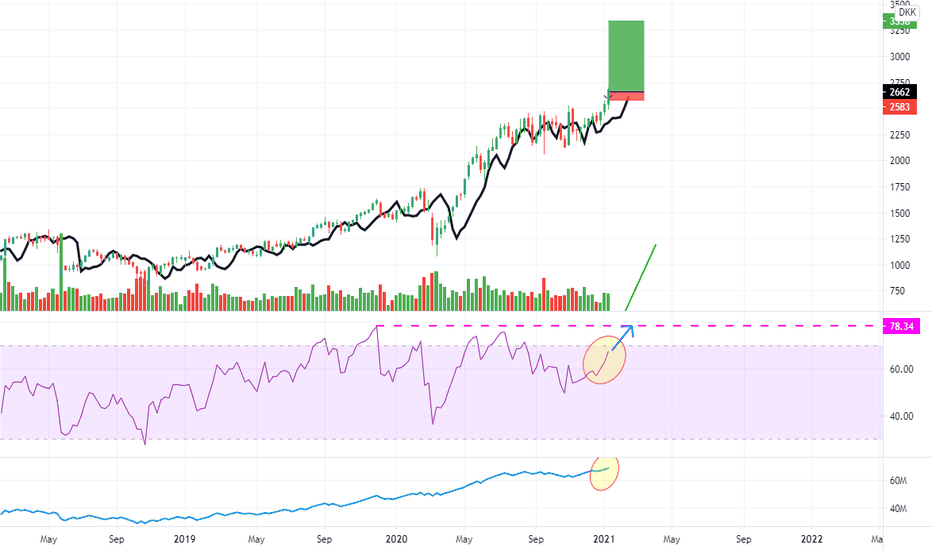

GMAB - Potential Long Term Growth ProspectSome basic chart analysis on Genmab.

This is more to bring your attention to the stocks long term growth prospects.

With a TTM P/E ratio of 29 and a FWD of 3, combined with solid revenue growth TTM and FWD leads me to suggest that Genmab will thrive in the coming months and climb to all time highs.

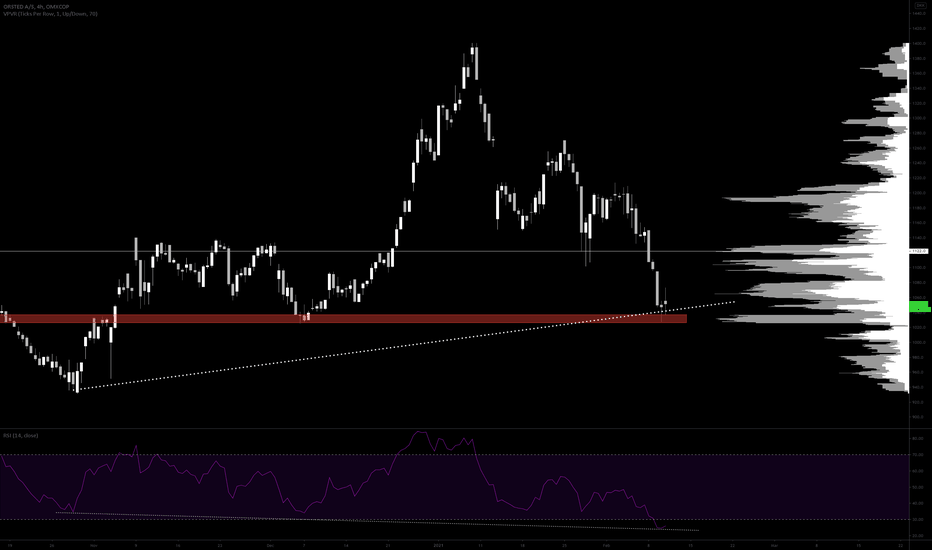

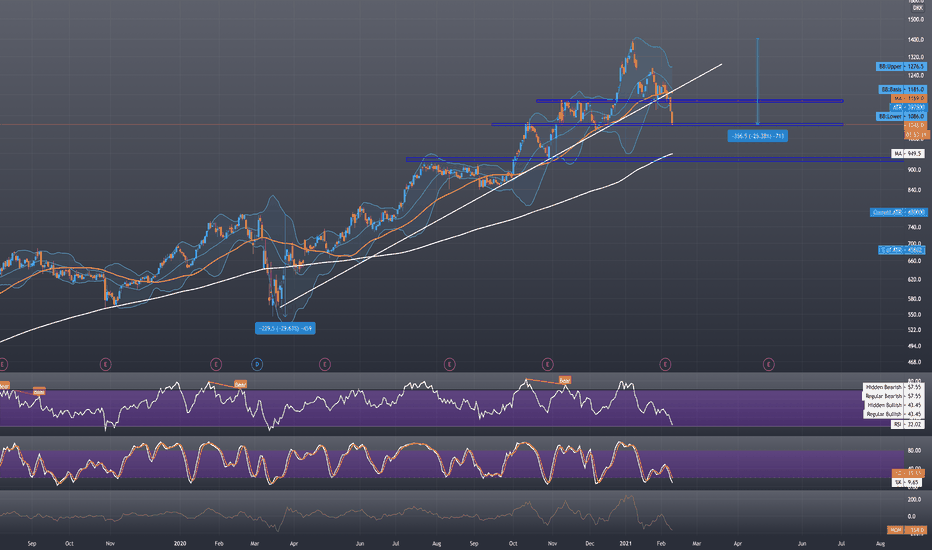

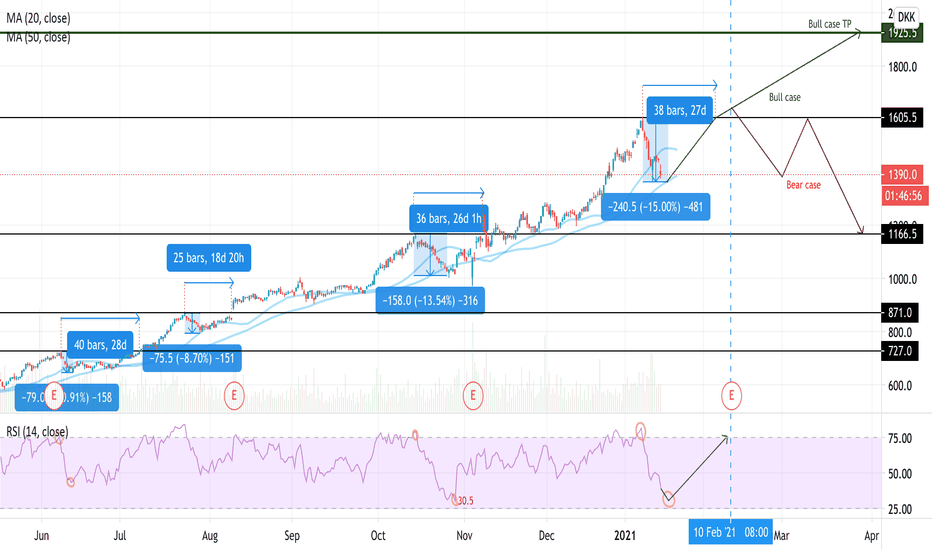

VWS | A true warrior on cyclical dips, will it repeat?Vestas Wind Systems (VWS) has been a top performer in my long-term portfolio. I have noticed that the stock trades sharply negative when it reaches overbought levels (RSI basis), dropping for a few days thereafter until the RSI recharges / normalizes for the next leg up.

In the previous instances this has occurred, the stock took about 20 - 30 days to recover the losses. Not terrible when we consider it then usually goes on to gain ~30% to set new ATHs.

If this repeats, Trend-based Fib Extension gives us a 1925 DKK price target

I'm no expert in Elliot Waves but looking at smaller time frames puts us at C on the ABC correction pattern, suggesting the beginning of the new wave to come.

The company has its ER on the 10th of Feb. This could prove extremely important for validating the Bull case, as outlined above (and with the green pattern), or potentially setting the stock on course for a Head & Shoulders top (Bear case, red pattern).

Looking forward to hear from their management, Green energy is on a tear and should continue through 2021 and VWS will most definitely be a beneficiary if so.

Any thoughts?

Thanks and Good luck to all

(*This is not financial advice, for sake of discussion and illustrative purposes only*)

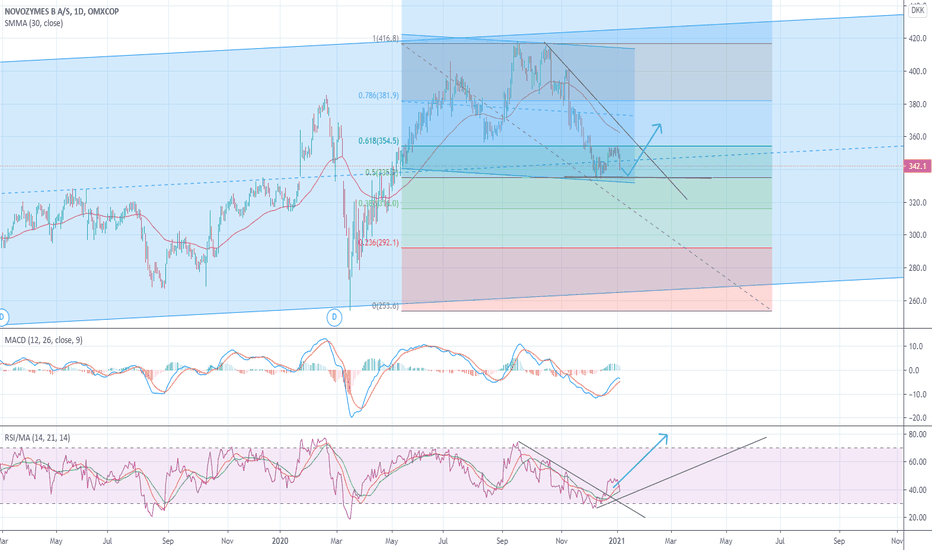

Soon BullI think that it still will go a little lower to the major support before it starts its bullish trend. RSI seem stable and have not yet had sign of higher spikes. Maybe they come soon?? and The fact that id have dropped to 50% on Fibonnaci i think this is one to watch for a bull position soon.

End of Bear?More and more indicate to me that its near the end of the bear for this one. It have reached 50% down from the high top and low bottom, RSI seem to turn upward trend. and if the support from last bottom holds, then that for sure a good potential Bull. but will it go thru the resistance?

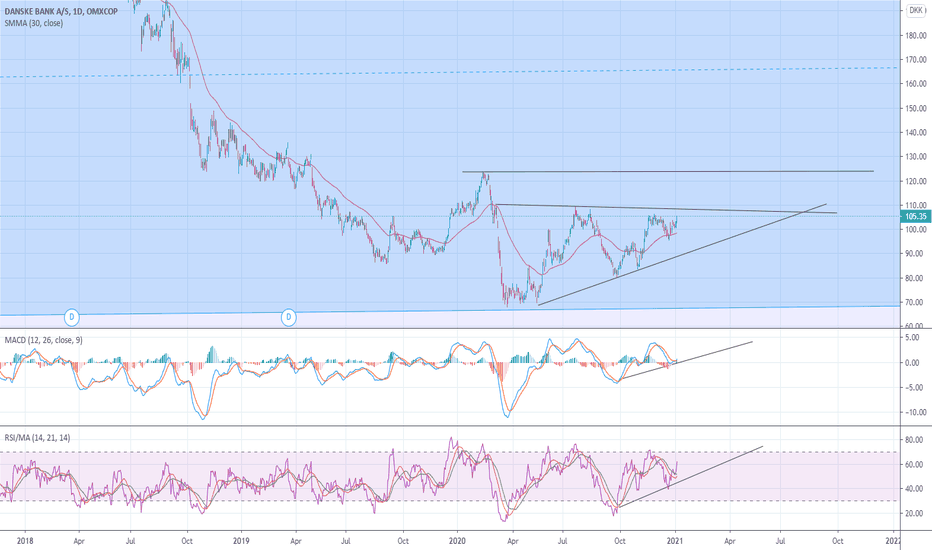

Short term BullishAll around I feel that its a positive bullish form, where a possible first target around 122dkk could be reached in near future. Danske Bank got some kicks from the scandals that keep coming but latest seem be ignored as the stock is detronized already. higher bottoms at RSI and MACD indicate still positive reactions to the stock.

Investing with all the odds in your favor - an overviewThis is a video with an overview over how to get all the odds in your favor while investing and most importantly an insight into how. At the end of the video I'm showing the "why" with two concrete examples from OMXCOP:CBRAIN and GRWG.

I make these videos for my little brother in our common language english (we have different maternal languages).

A lot of the ideas our counter-intuitive but when you see them they become almost self evident. The ideas builds upon knowledge from one trader who is considered by many of today's top traders to be "the greatest trader who ever lived"; Livermore who traded from 1891 at 14 years of age until 1940, as well as great investors building on top of and adding to his ideas, from books by the like of Minervini and O'Neil who are great explainers.

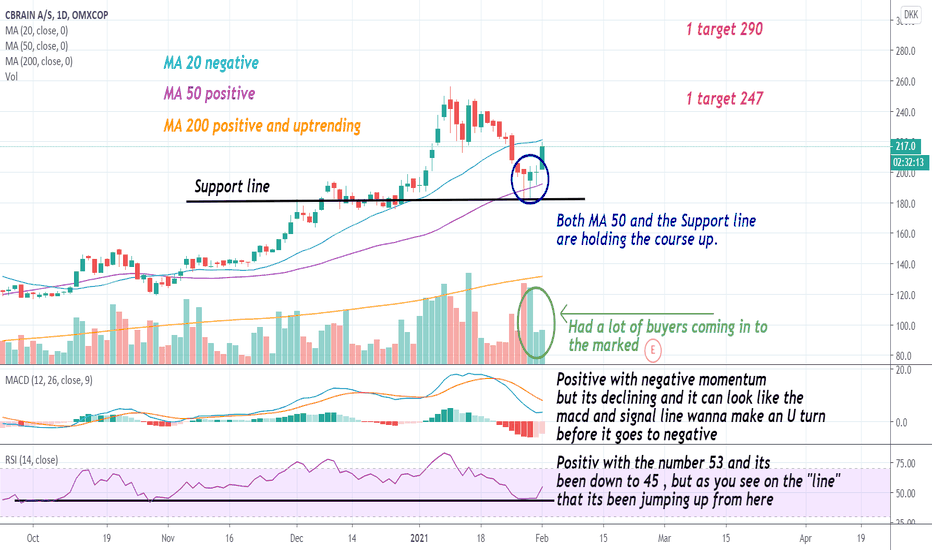

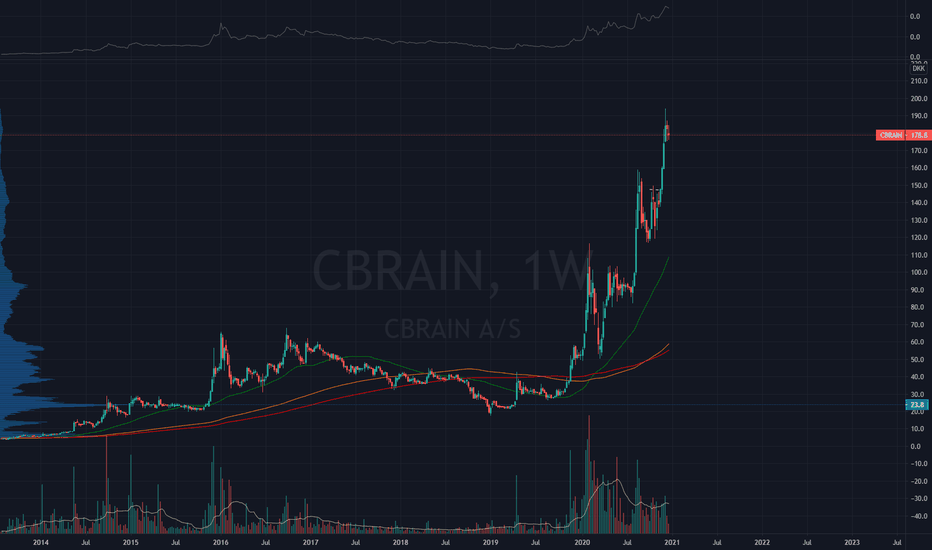

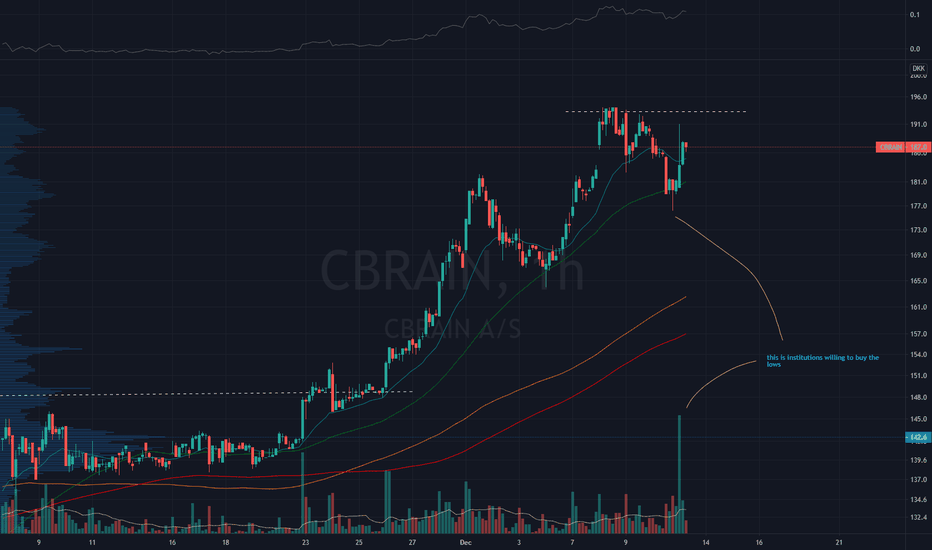

CbrainCbrain is an astounding IT company, that keeps progressing and growing everyday with new orders comming in.

I see this as a very attractive company to invest in, and im currently awaiting a fall back.

The current Stock price is over SMA 20, 50 & 200 and RSI says oversold.

I personally see to fall ( Towards ) 150-160.

The best price to get it i personally see around 152, however if you want to be sure you get on board, ~160 should not be a problem either

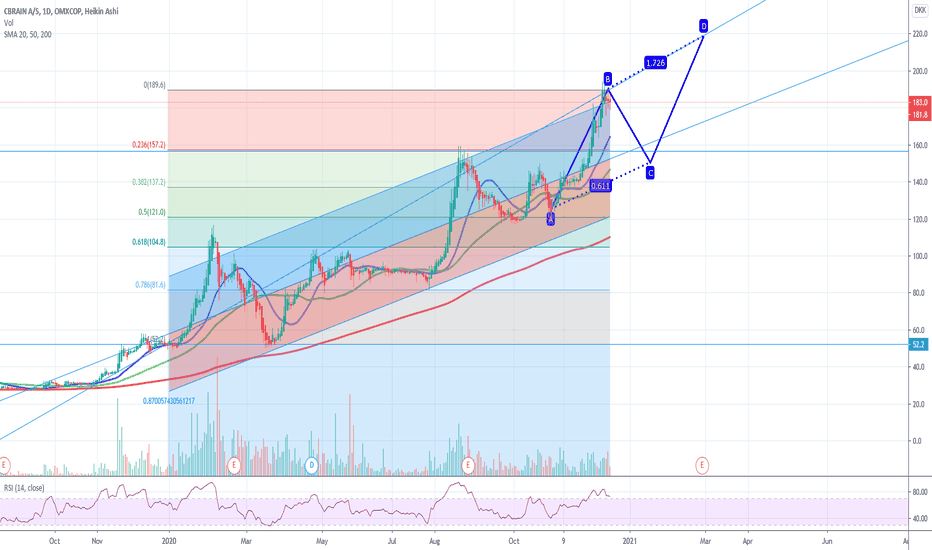

Cbrain trend and fundamentals aligning for a great setupFundamentals check, disruptive company: check, Story: check (important for institutions).

Institutional buying is quite obvious.

Price action looking very good

Myself I'm waiting for an even better setup, but I could see a fundamentals persons buying here for sure