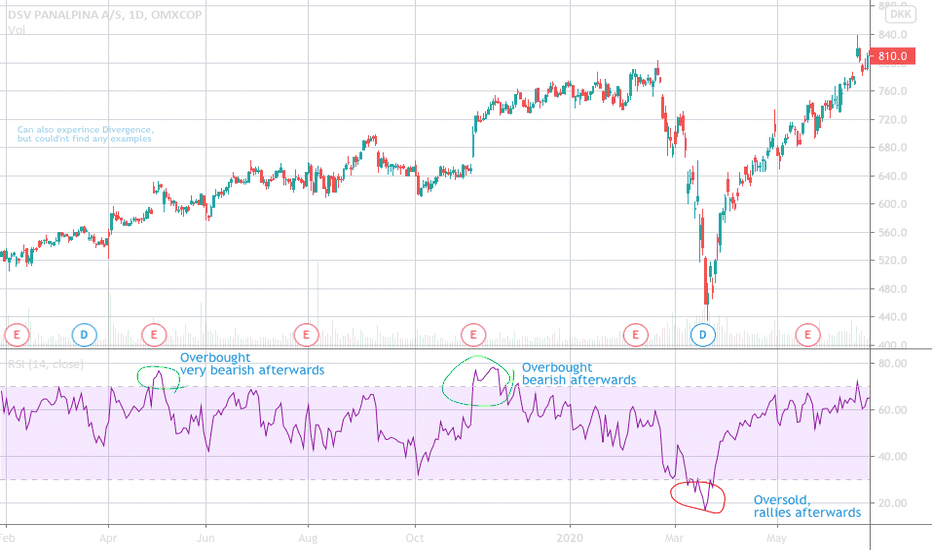

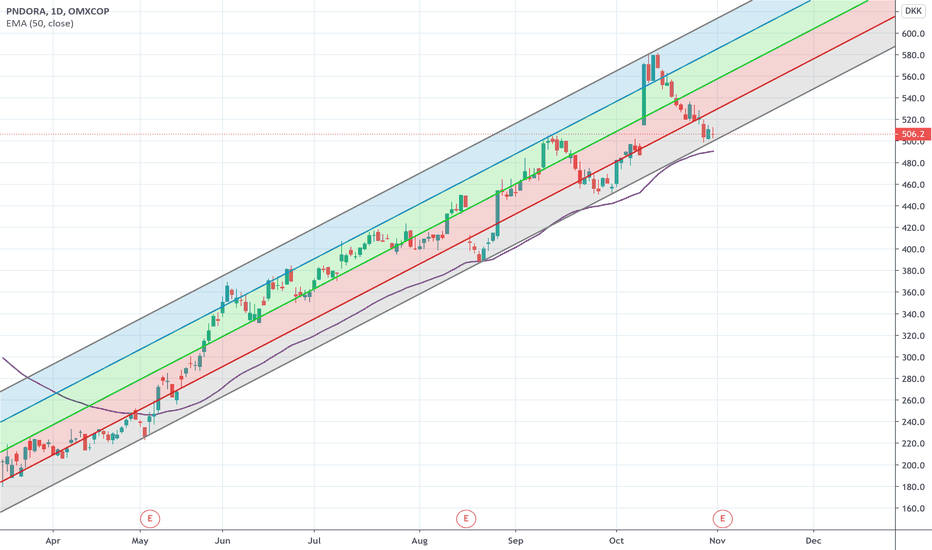

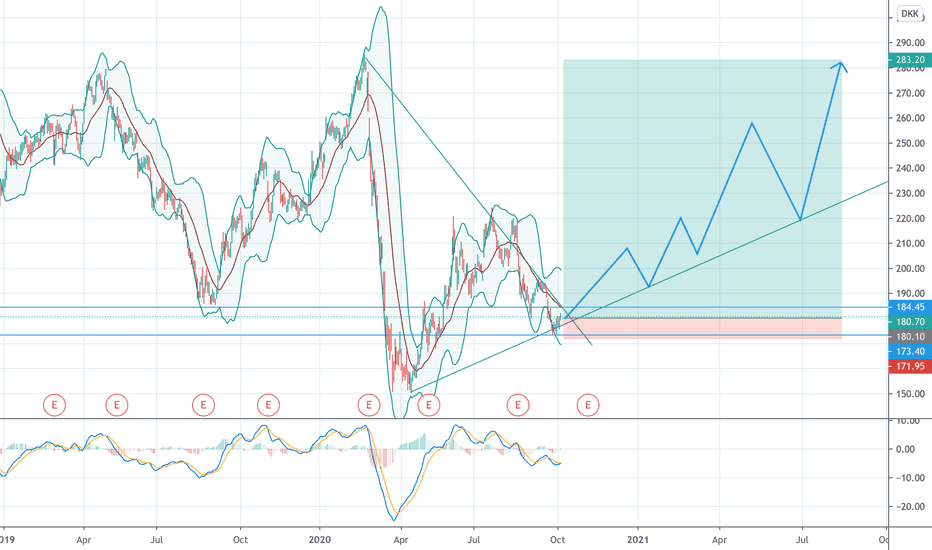

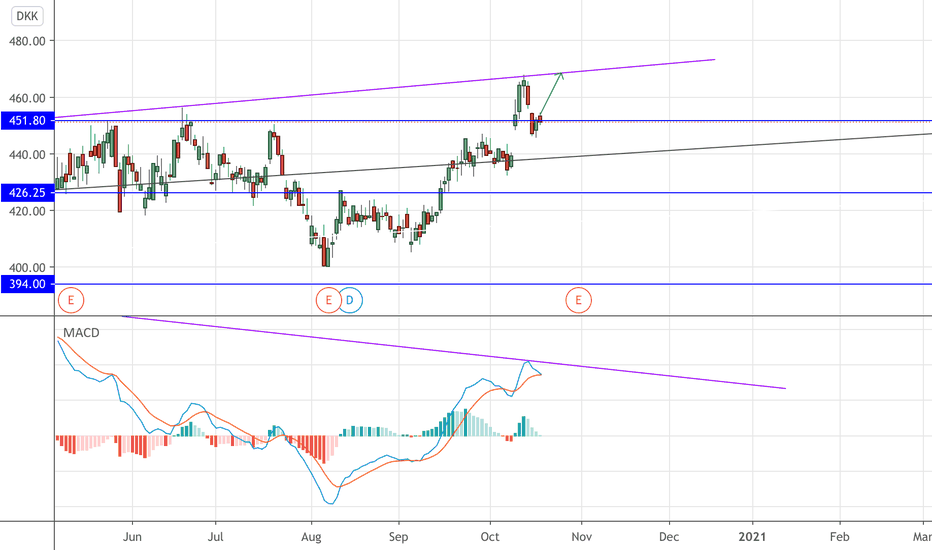

DSVDSV har siden april været i en konstant optrend, men har den seneste måned antaget en neutral trend som særligt kommer til udtryk i en RSI som har indfundet sit minimum i de lavere niveauer under 50. I det niveau har jeg integnet en linje som symbol for en nyt lav niveau for RSI. Noget tyder på at den sidste måned har været drevet af et lavere momentum, hvilket skyldes nyheder om Corona-vaccine som har fået folk til at overveje sektorrotation til value-aktier. Dog tyder noget på at DSV denne gang har momentum til at bryde den neutral trend, hvilket ses i MacD indikatoren som ligger an til et brud op gennem gennemsnitlinjen i kombination med en RSI værdi som søger op i niveauet over 50.

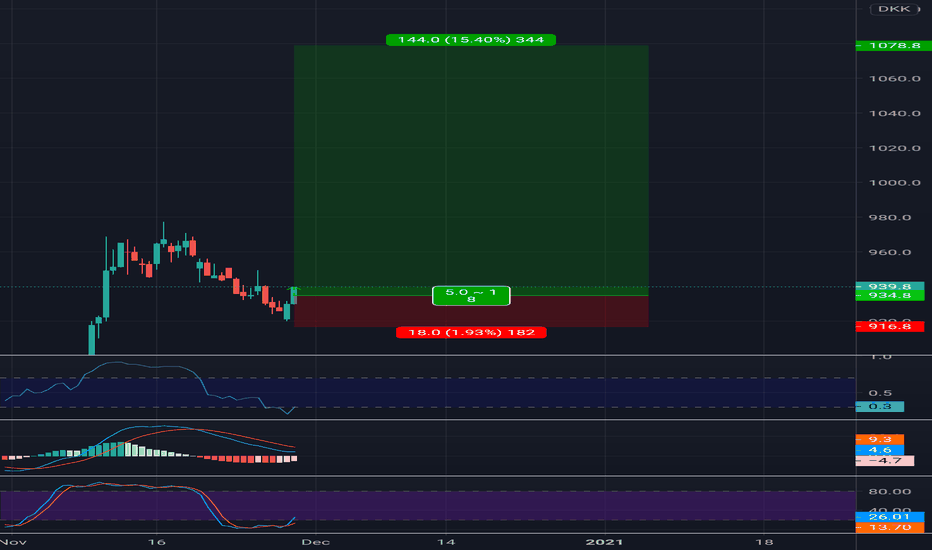

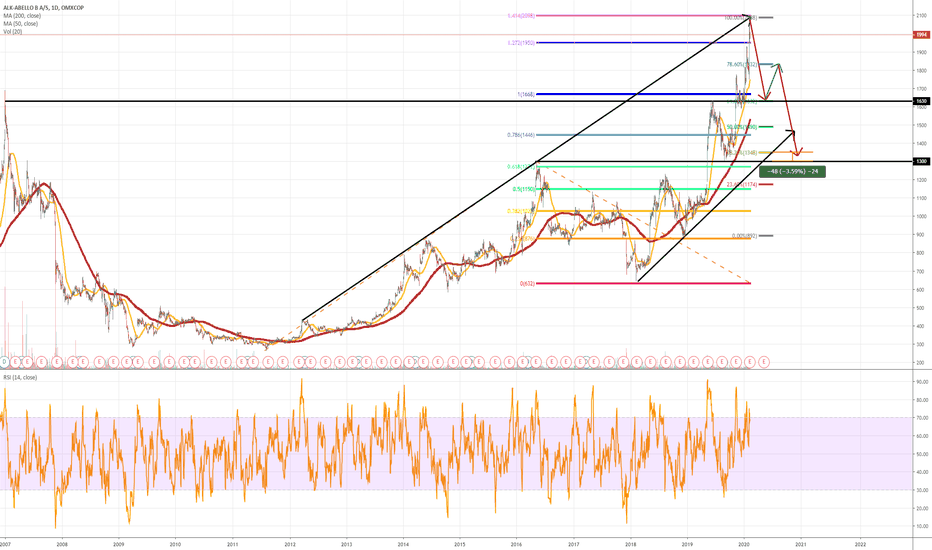

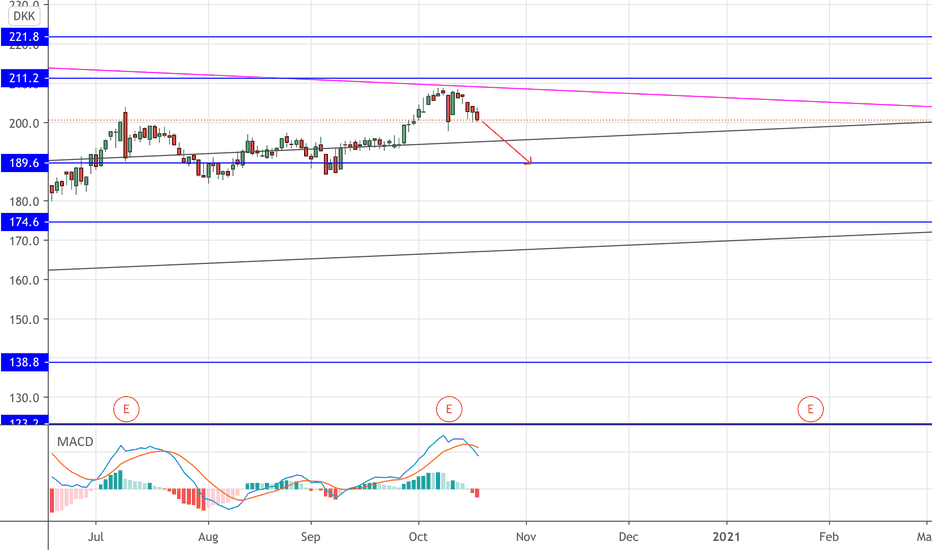

I Think we've reached a top in 2020 in this stockI've taken time to create this view on Alk-Abello, and I see a good overlap between fib levels and topping on trend line from previous tops the previous years.

this to me indicates that this wave 3 of a major wave 3 could be over now, which should result in a retracement, which I've given my guess on, on the chart.

After this retracement I of course believe we will again reach new highs in the wave 5 of the major wave 3, 2020 will just probably be a red year for Alk, depending on the speed of which this happens.

This is my view, and solely my view, always do your own due diligence.

Happy investing and trading.

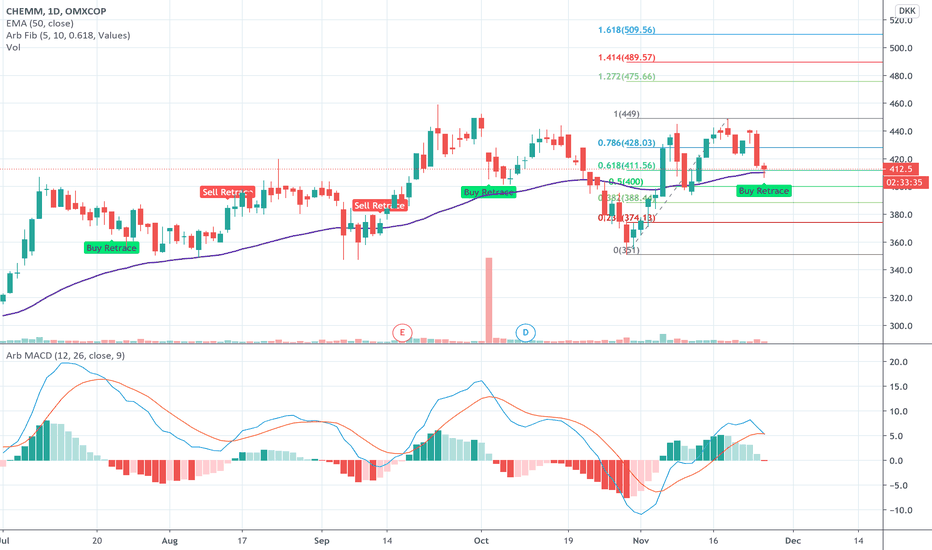

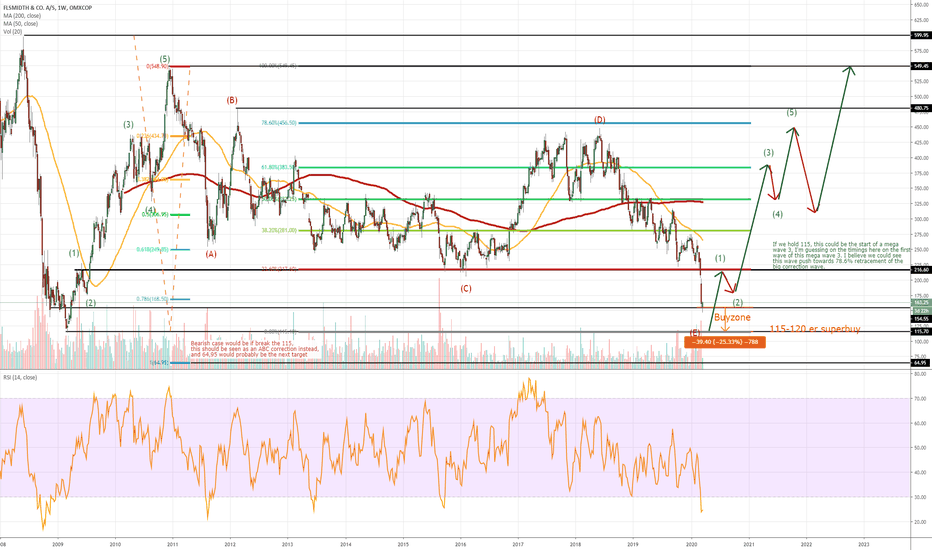

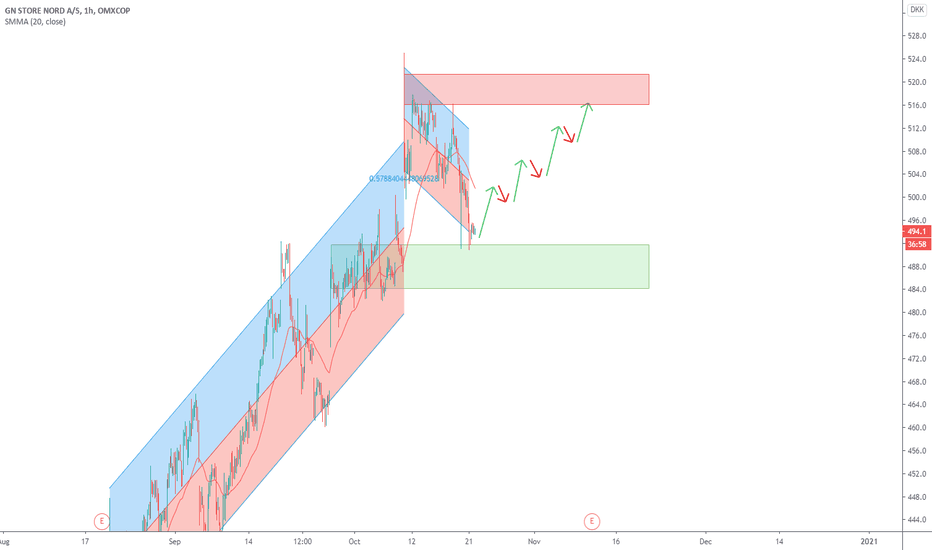

Continuing bearish case, or bullish turn?I see a good buying opportunity at these levels, especially for long investors.

We're not quite in the buy range, but were momentarily today.

The oversold RSI on the weekly and major double bottom is what I'm counting on for this bullish reversal.

115 is a critical level, and must hold for this bullish case to have any meaning according to Elliot wave.

I currently have not stake in this, but could be if we get closer to the double bottom, which would be very interesting.

Happy trading.

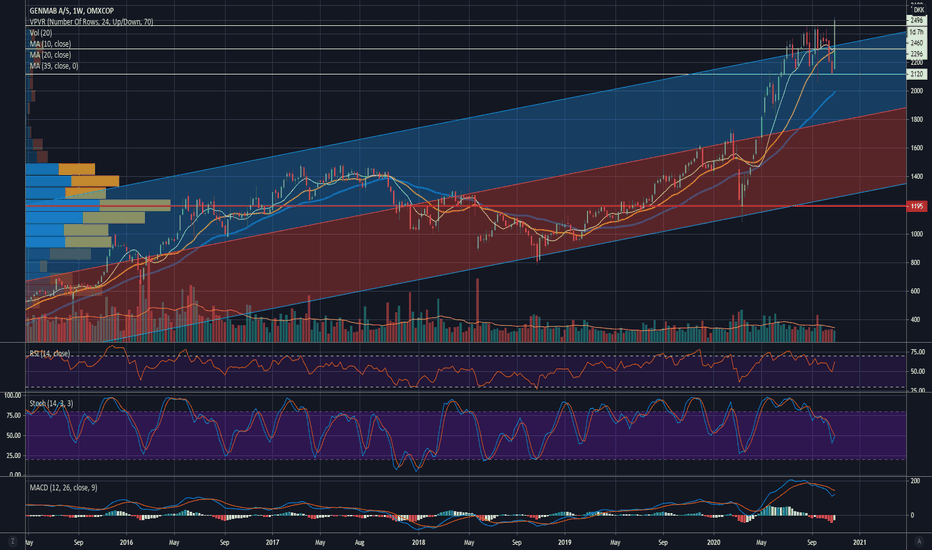

Genmab $GMAB all time high after Q3 earnings beat #biotechNovember 4, 2020; Copenhagen, Denmark;

Interim Report for the First Nine Months Ended September 30, 2020

Highlights

Novartis granted U.S. FDA approval for Kesimpta® (ofatumumab) in relapsing multiple sclerosis

Janssen and European Myeloma Network achieved positive topline results from Phase 3 APOLLO study of daratumumab in relapsed or refractory multiple myeloma

Janssen was granted U.S. FDA approval for DARZALEX® (daratumumab) in combination with carfilzomib and dexamethasone in relapsed or refractory multiple myeloma based on Phase 3 CANDOR study

DARZALEX net sales increased 35% compared to the first nine months of 2019 to USD 2,937 million, resulting in royalty income of DKK 2,898 million for the first nine months of 2020

Genmab (GNMSF) commenced binding arbitration of two matters under daratumumab license agreement with Janssen

Announcement of plan to transition Arzerra® (ofatumumab) to an oncology access program for chronic lymphocytic leukemia patients in the U.S.

“Genmab continued to deliver on the promise of improving the lives of patients, with multiple regulatory milestones for Genmab-created products under development by our partners, including the exciting U.S. FDA’s approval of Kesimpta and the 8th U.S. FDA approval for DARZALEX,” said Jan van de Winkel, Ph.D., Chief Executive Officer of Genmab. “During the first nine months of 2020, with our solid financial footing Genmab has continued its focused investment in advancing its proprietary antibody product pipeline and building its capabilities as we evolve into a fully integrated biotech.”

Financial Performance First Nine Months of 2020

Revenue was DKK 8,067 million in the first nine months of 2020 compared to DKK 2,405 million in the first nine months of 2019. The increase of DKK 5,662 million, or 235%, was primarily driven by the upfront payment from AbbVie pursuant to our new collaboration announced in June and higher DARZALEX royalties.

Net sales of DARZALEX by Janssen Biotech Inc. (Janssen) were USD 2,937 million in the first nine months of 2020 compared to USD 2,168 million in the first nine months of 2019, an increase of USD 769 million, or 35%.

Operating expenses were DKK 2,641 million in the first nine months of 2020 compared to DKK 1,943 million in the first nine months of 2019. The increase of DKK 698 million, or 36%, was driven by the advancement of epcoritamab (DuoBody®-CD3xCD20) and DuoBody-PD-L1x4-1BB, additional investments in our product pipeline, and the increase in new employees to support the expansion of our product pipeline.

Operating income was DKK 5,426 million in the first nine months of 2020 compared to DKK 462 million in the first nine months of 2019. The increase of DKK 4,964 million was driven by higher revenue, which was partly offset by increased operating expenses.

Outlook

Genmab is maintaining its 2020 financial guidance published on August 20, 2020.

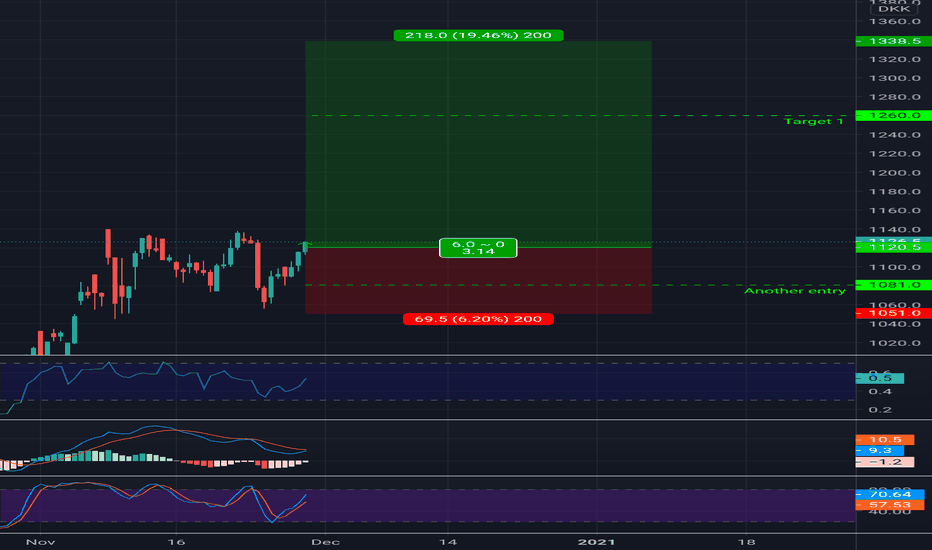

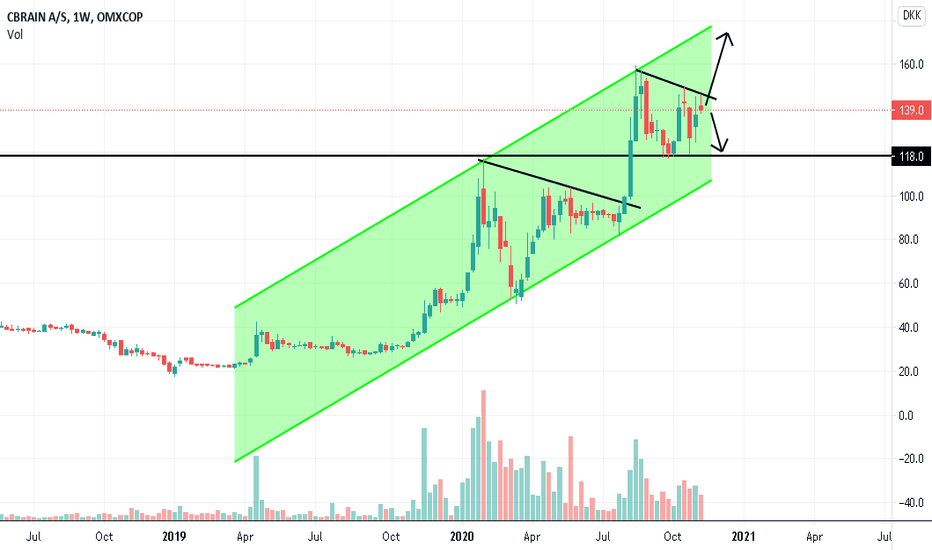

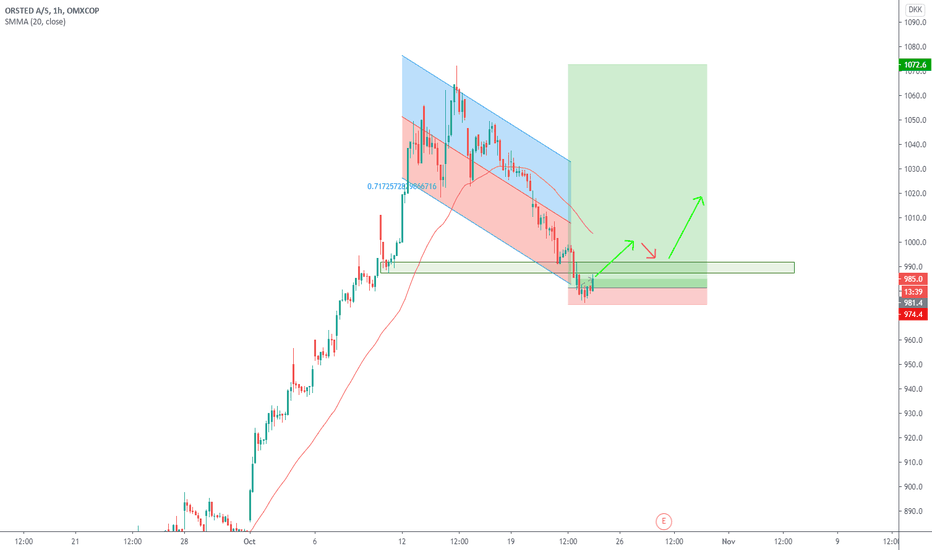

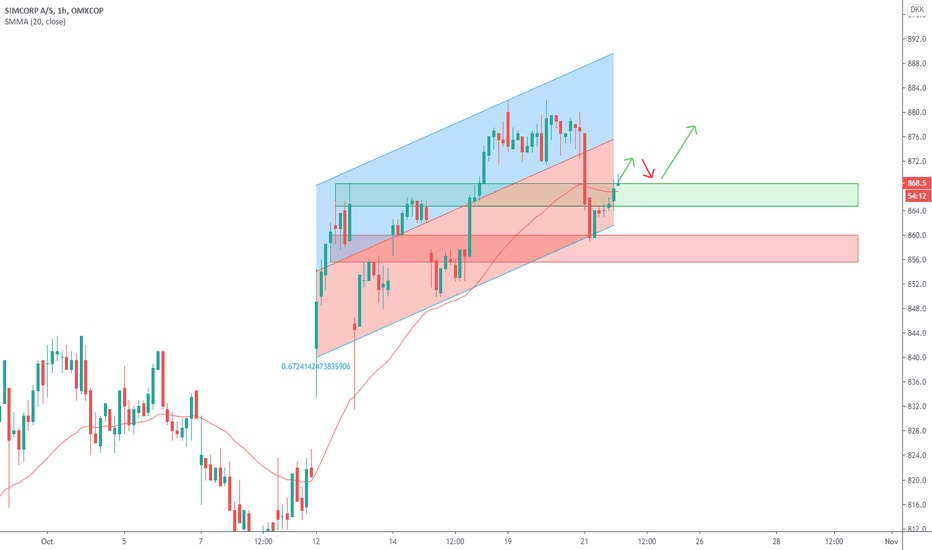

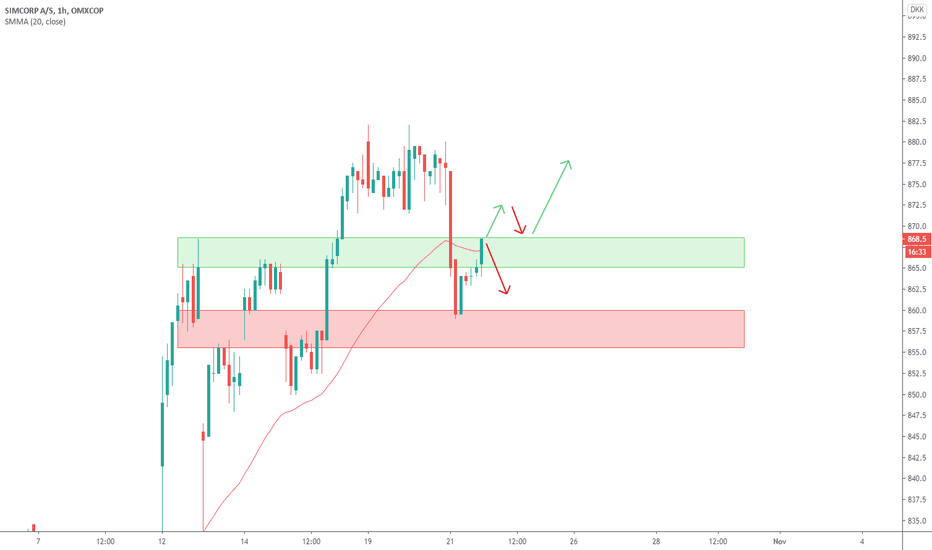

Update Analyse on SimcorpAs you can see we got the breakthrough at the green supportline. Now we can be sure that the stock is starting a new trend.

Simcorp Analyse Hello this is my analyse of Simcorp. As you can see i have both maked a long- and short opportunity. Before we can see a new trend coming we need to see it brake through the green support line.

We could maybe see a shoulder head shoulder formation coming.