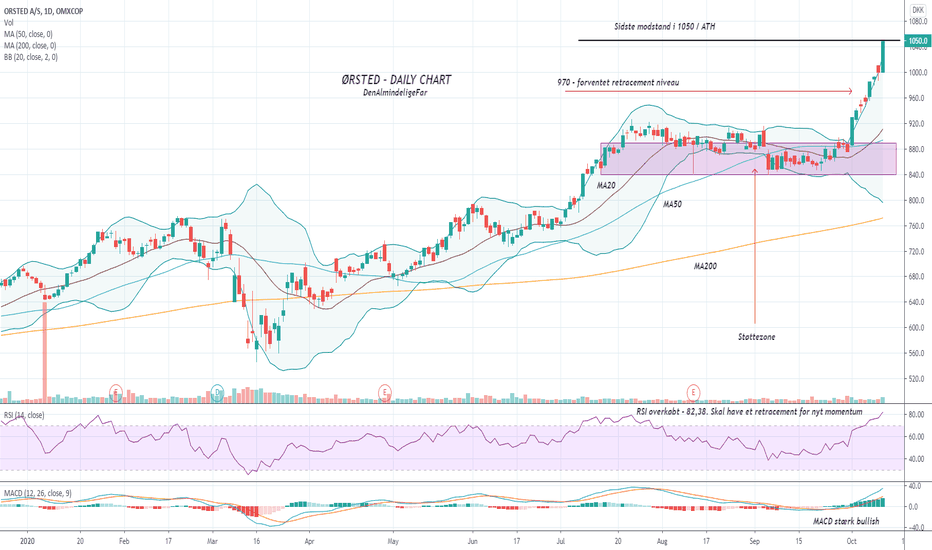

Novozymes - bullish longRSI looking strong

MACD bearish, but might turn soon

Moving averages positive.

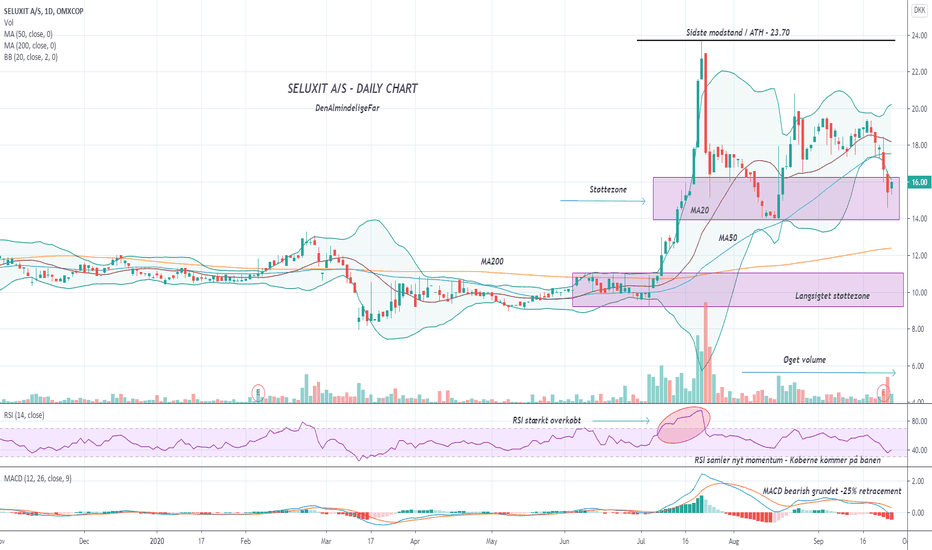

Seluxit waiting for reversal around 16RSI moving up.

MOving averages looking fine.

MACD bearish due to -25% retracement

Building up for another run

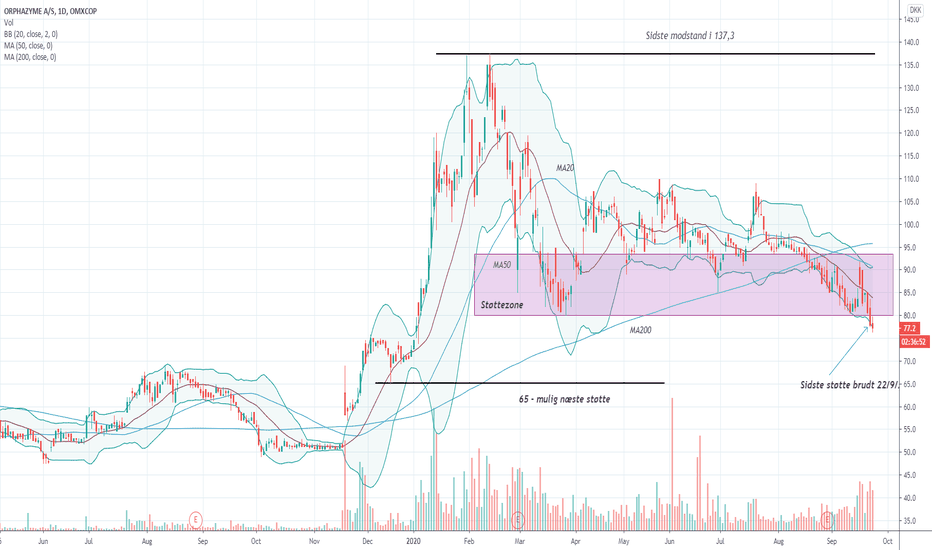

Orpha bearish - sellAll moving averages bearish.

RSI close to 30, but no buyers picking it up

MACD bearish

Broke last support on fibonacci.

Strong sell.

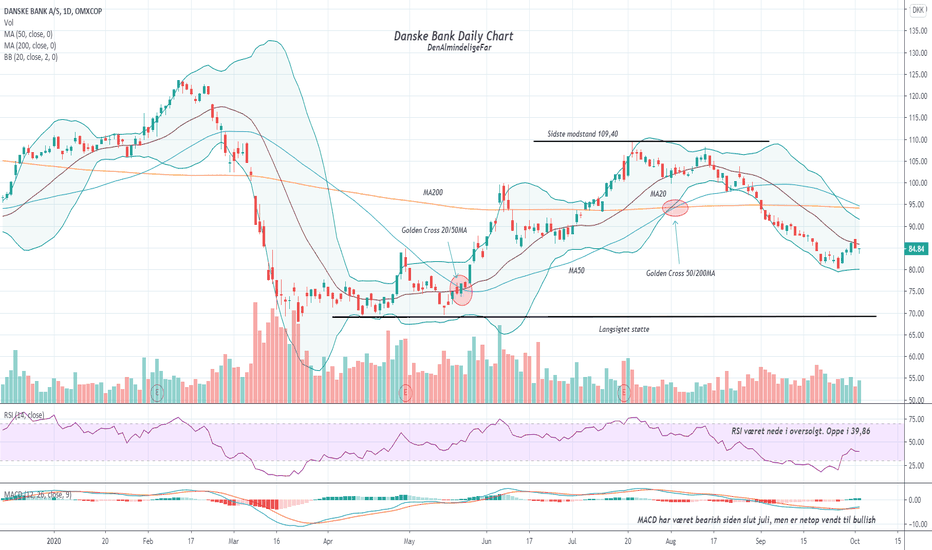

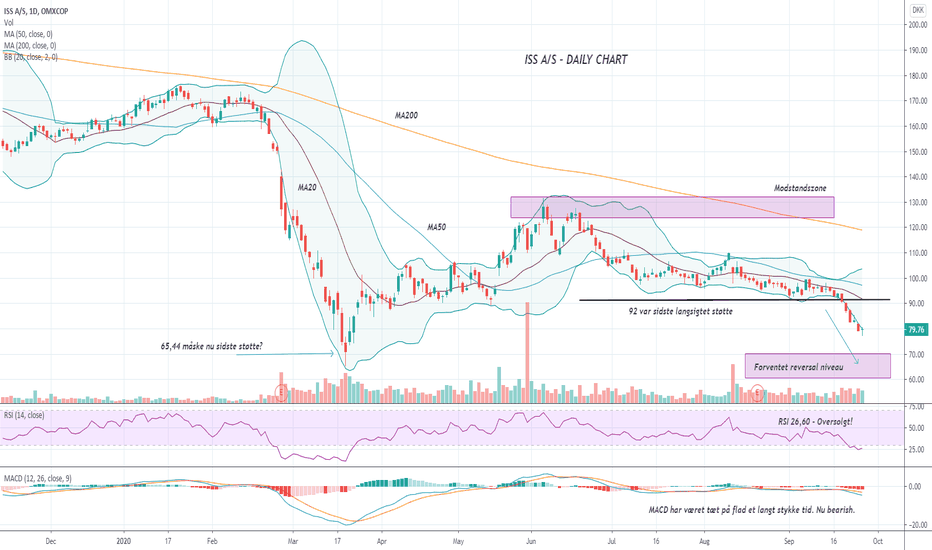

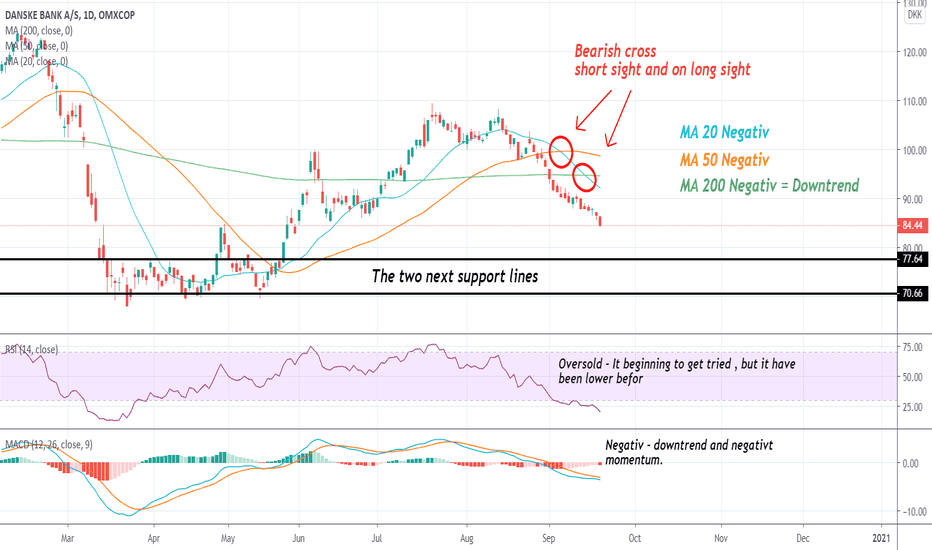

Down we go! but how fare ? Danish bank

Trick code: Danish

Danskebank is in decline and does not seem to stop 🧐

As you can see, all MA lines are negative and especially MA 200 and that means Danskebank is still in decline.

RSI - is oversold and is about to have some new energy, however, it may well continue yet.

MACD - is on a downtrend with negative momentum and has plenty of give of yet.

Friday's trading day ended with a red candlestick with good momentum and landed right on the support line (it is not drawn in, but that's where the price is right now) and I do not take that as a positive sign for Monday, but it can also jump up from here, but I do not think so - we'll see.

But where is it going?

where should it find its next support: candlesticks / news / support lines who knows but I have drawn the next support lines into the chart where I can see it has the opportunity to turn - If it should come under the last support line, is it well on its way to all time low in 2009 "course 31" - But let's take one week at a time :)

Hope you have a good Friday night 🍷

Trade with care 🙏

Bounce to the trendline beat with B&O!Ok, I’m moving in! From the trendline drawn from 2009 we see a possible bounce incoming. I’m fully aware that B&O barely avoided bankruptcy back in June and the share issue that saved them. But from a technical view this is looking far too juicy to just let go. A Long position is established here today. Might not happen just now, but potentially soon. Look at MACD and trendline for triggers.