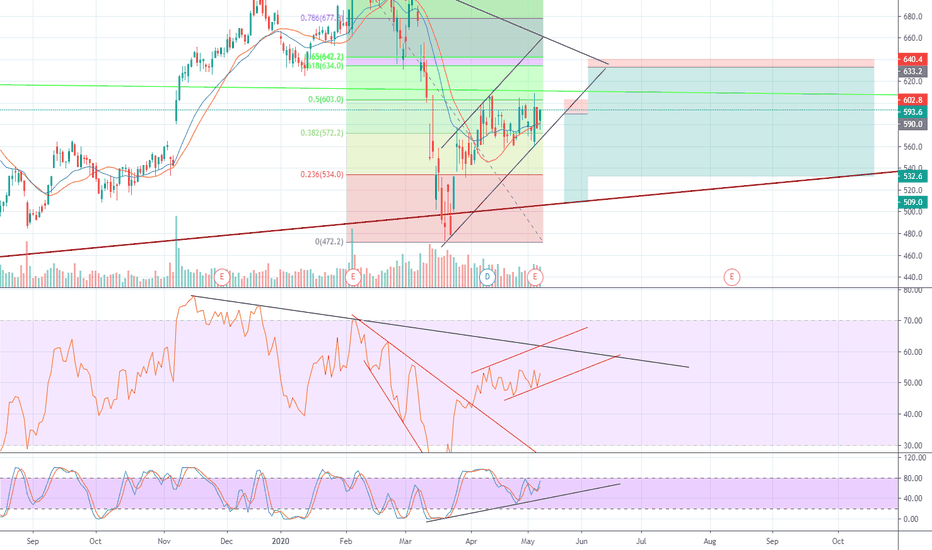

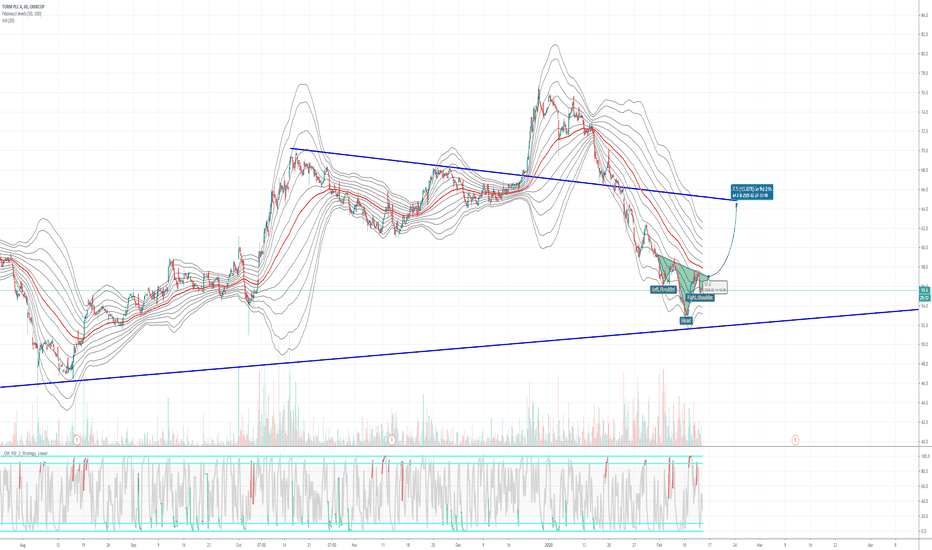

ORSTED Long Idea OMXCOP:ORSTED

DISCLAIMER.

This analysis is made to help and give you an idea of what opportunities could be in Orsted. I don't take any responsibility's for your loss of money based on my Analysis!

__________________________________________________________________________________________________________________________________________________________________________________________________________

Orsted before Covid-19 - About 720-750

Orsted after Covid-19 -About 575 on it's lowest.

Orsted now - 690

I'm sure Orsted will fall back but I see that as an opportunity to buy. That is because Orsted before Covid-19 was stable at about 720-750. Therefor i'm very sure Orsted after covid-19 will come very strong back.

I know the arrows is not placed perfect! It is going to take longer to get to 765, but the arrows will hopefully give you some understanding of were the stock can be in the furture.

This is my first time making this, and I would like to get advise, constructive criticism.

Thank you very much

- Bertram

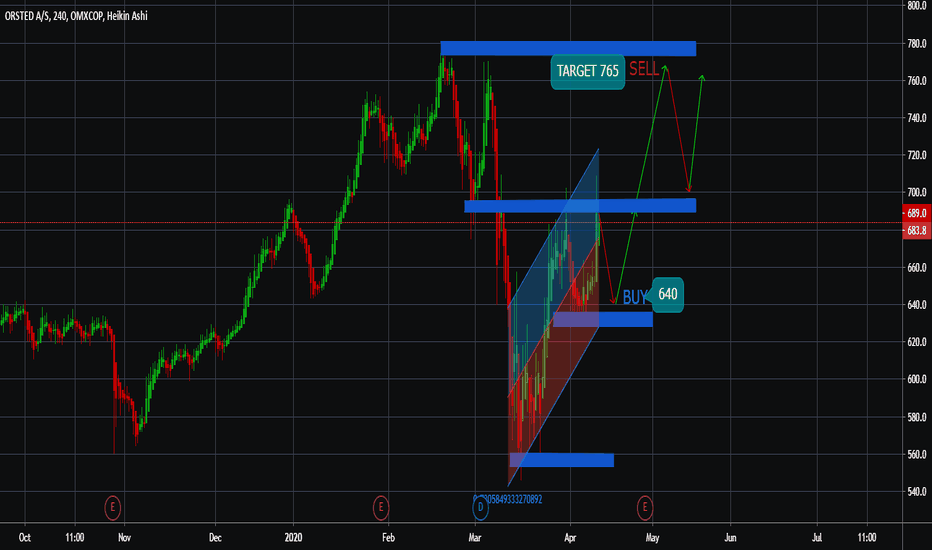

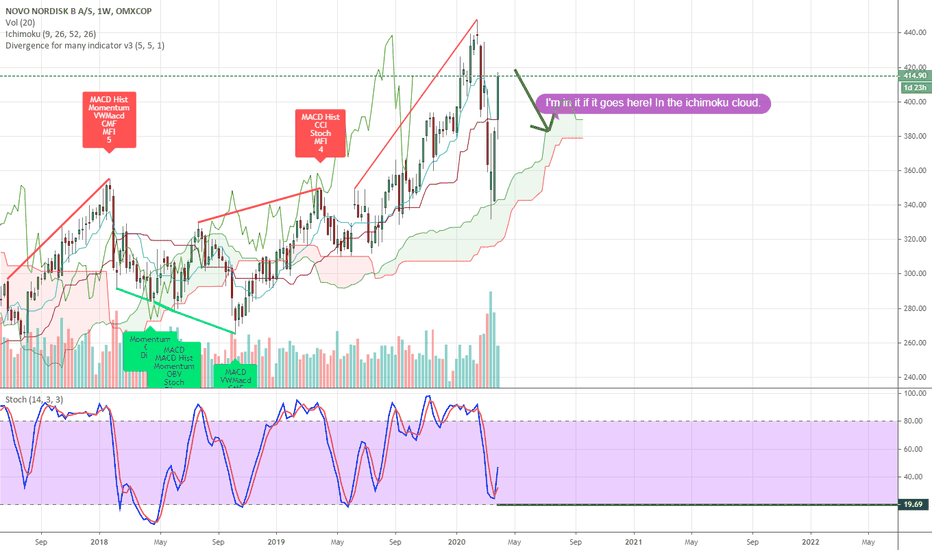

Long Term: looking for an entry point on this beautiful stockNovo Nordisk is one of the world leaders in the medical treatment of diabetes.

It also researches, develops and markets treatments for obesity. It is a fast-growing sector with the rise of fast food and the development of emerging countries.

However, the field is becoming more and more competitive, especially in the US, which has meant slower growth for the future of Novo Nordisk. Until now, she was considered a "cash cow".

Let's see if I can drink her milk :-)

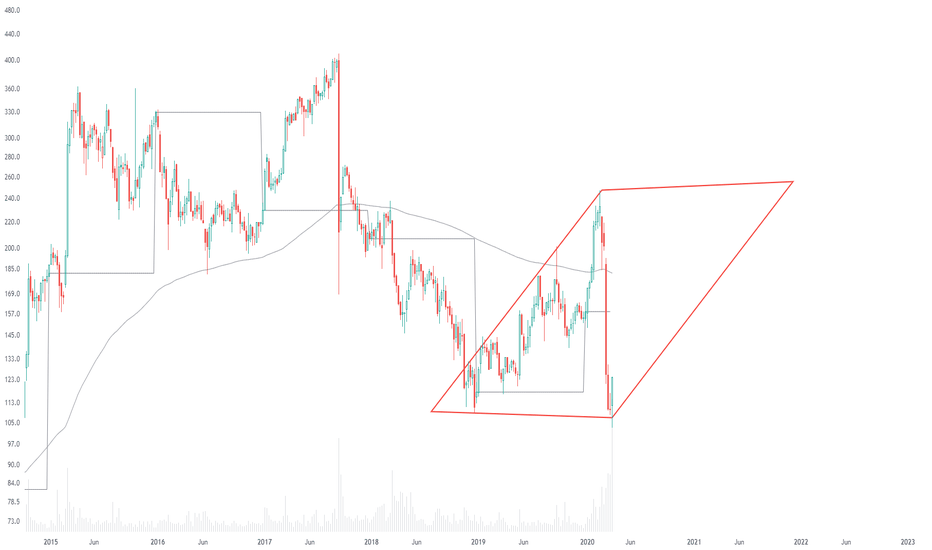

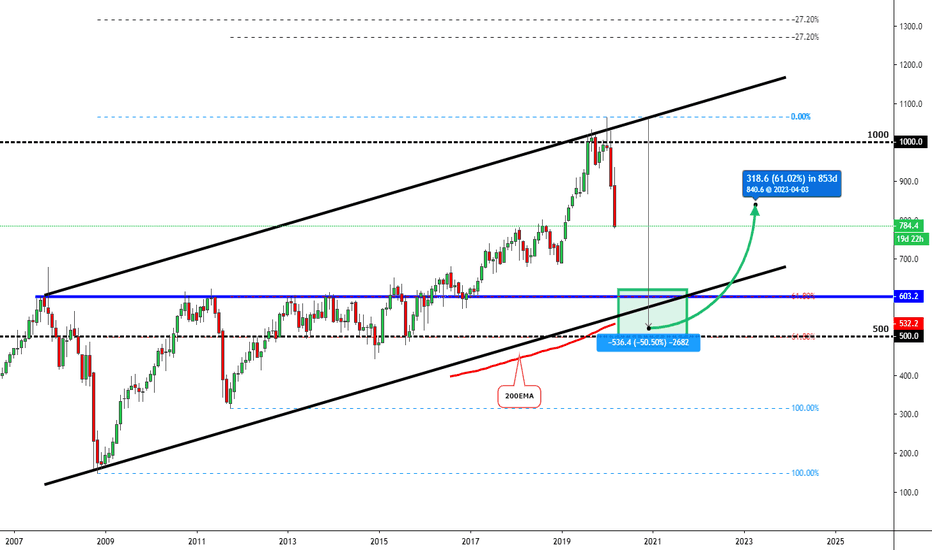

CARLSBERG (CARL_B) | Beer Lovers, This Might Be Your Chance! :)Hi,

Carlsberg A/S produces and sells beer and other beverage products in Western Europe, Eastern Europe, and Asia. The company provides craft and specialty, and non-alcoholic beers; and soft drinks. It offers its products primarily under the Carlsberg, Baltika, Tuborg, Birell, Ringnes, and other local brand names. Carlsberg A/S also exports its products to approximately 100 countries worldwide.

Carlsberg has started aggressively to approach technically a great support area. Those kinds of market situations are the perfect chance to buy stocks that have been in your watch-list for years. Now, the market offers really great buying opportunities to buy those stocks from technically great and strong price zones.

Carlsberg's buying prize zone stays between 500-600. Technically it would be a perfect area to buy it or even grow your shares on Carlsberg.

For those who like beer, this is a great opportunity to justify their few evening beers with "support purchases", you just buy a beer and trying to push the price up, hopefully, it would be a good excuse! :D

Okay, technical criteria are:

1) The blue horizontal line marks 4-5 years highs and lows, it has been a really powerful resistance level which now should act as a really powerful support level.

2) Different Fibonacci retracement levels adding strength to the marked buying area, acting as support levels.

3) If the price falls as low as 500 then the round number should act as a support level.

4) 50% drop from the all-time high. It lands perfectly into our buying zone.

5) Monthly EMA200, the most powerful Moving Average combination should work as a support level.

6) Parallel channel projection (pulled from candle bodies), the projected lower trendline should add just a bit of strength into the marked area. Not the best criterion but good to know that the possible channel projection "runs" through the buying area.

Do your OWN fundamental research and if this matching with my technical analysis viewpoints then you are ready to go! If it doesn't match then...SKIP IT!!

Good luck,

Vaido

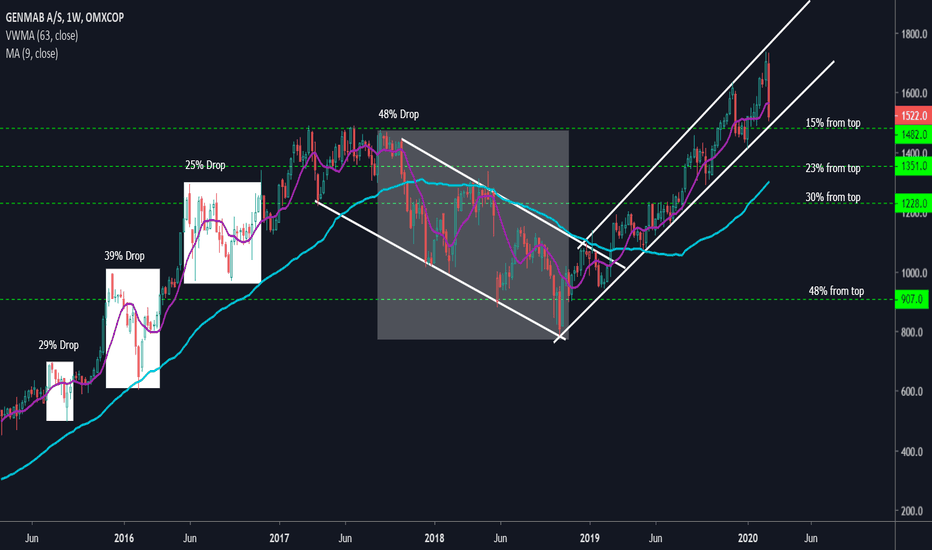

Will the trend hold?Back in late 2014 Genmab broke out and haven't looked back since, though it have seen many downturns on the way, as we can see it has been through 4 big downturns of 25%+ drops. Another one could be in motion, a weekly bearish engulfing candle has formed and we have seen it drop 15% and is now back testing the former resistance and is about to test the bottom support trendline . If it doesn't hold we could likely see another 15% drop back to 1228 kr .

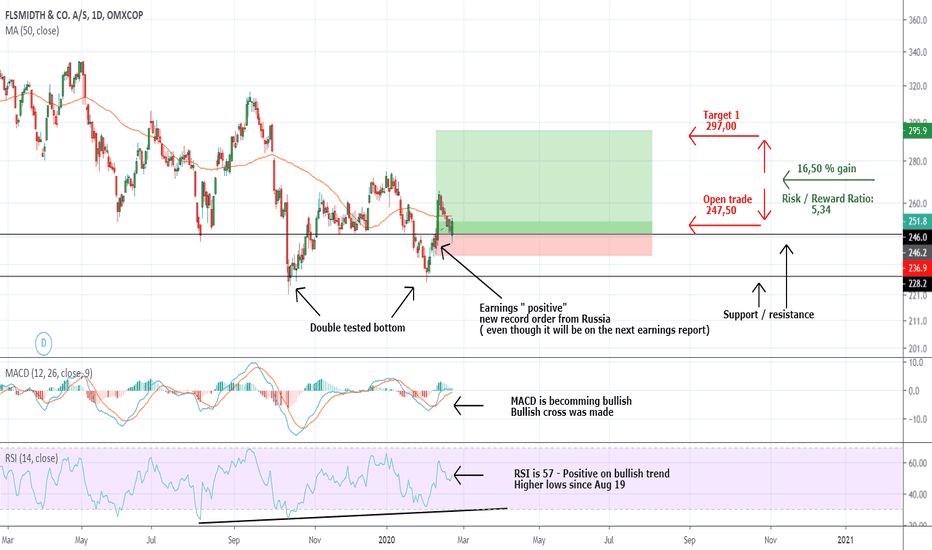

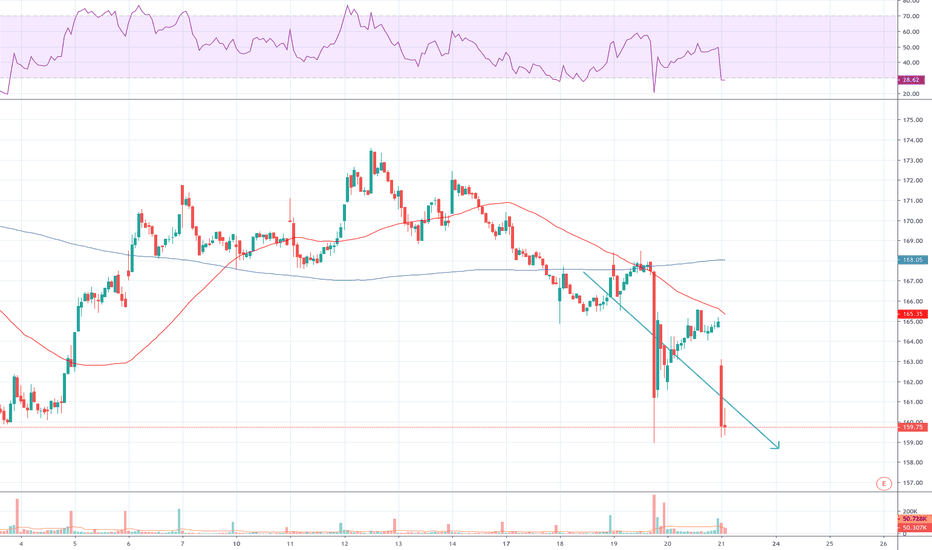

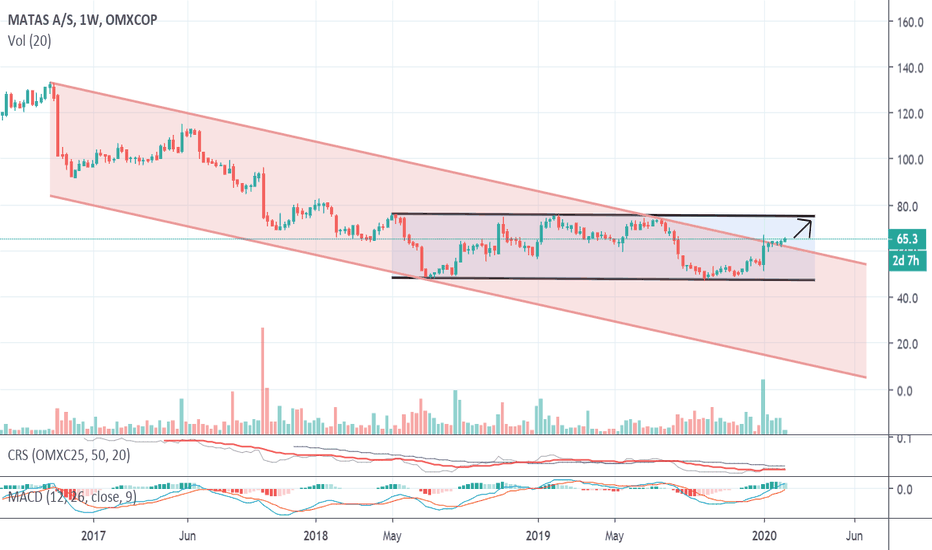

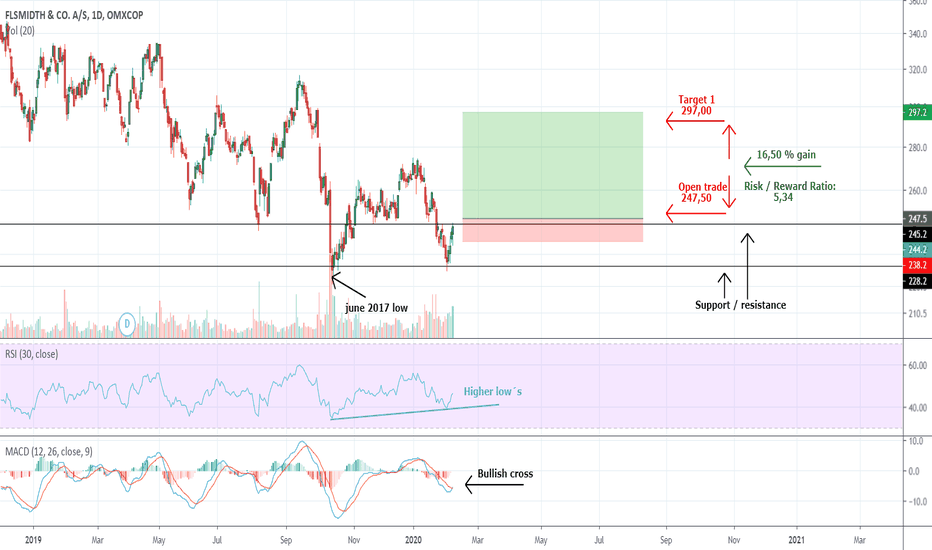

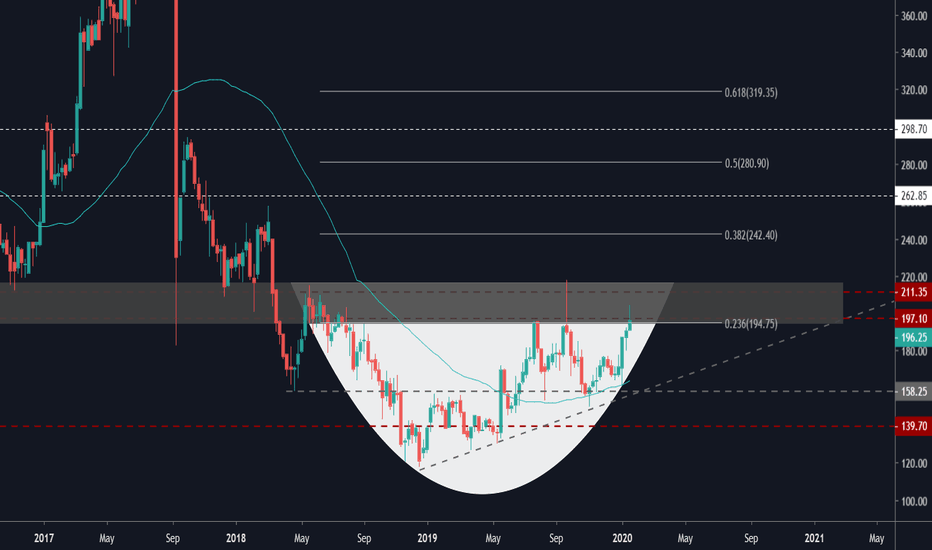

Swing in to earnings Trying to make the next swing.

MACD is making a bullish cross

RSI is making higher low´s ( close to 0,50 )

Earnings comming in tomorrow.

Open trade : 246,00

Set TP : 297,00

Set SL : 238,00

Risk / Reward ratio: 5,44

This is NOT an investment advice - remember always to do your own reseach - happy hunting

Maersk seems ready to rise to 11000 DKK againA. P. Moller Maersk B has broken out of its downward trend and seems like an interesting buy here at 8300 DKK for a swing trade to 11000 DKK by April or for the long run. However, I would like to see further increase in stock price the next days. Next financial report is out the 20th of February.

On the watch for potential breakoutBavarian Nordic

is a fully integrated biotechnology company focused on the development, manufacturing and commercialization of cancer immunotherapies and vaccines for infectious diseases.

Is yet again testing the resistance at 200. The grey area is a 5 year previous Support/resistance zone, been tested multiple times.

Break out could lead to a significant rally

it goes on the watch list for now.

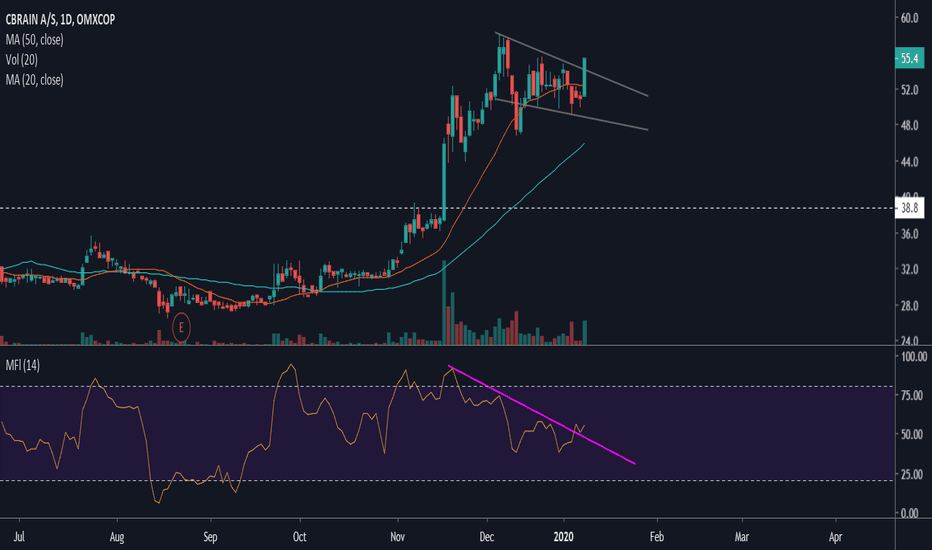

Breaking out strong growthcBrain is a software company listed on NASDAQ OMX Nordic .

cBrain F2, a revolutionary and highly effective tool for digital transformation of knowledge work

cBrain offers the integrated F2 software suite: a highly effective tool and a fast track to digitize all workflows, knowledge processing, records management and communication, including social media, while supporting PCs as well as mobile/tablets.

The Danish State Administration reduced service costs for citizens by over 50%.

It's what citizens have come to expect in Denmark, a country ranked 1st for the last 5 years in the European Digital Economy and Society Index (DESI).

Ministries in Denmark have reduced case processing time by 30%.

96% of users say transparency has improved.

- CBrain is well underway into the German market, where it has succeeded in becoming supplier to a large board of the central administration and has so far won 6 orders.

- The University of Bristol has signed an agreement with cBrain to provide F2 case and document management in the cloud as their new digital platform > May 2018.

- 13 out of 19 Danish Ministries are now using F2 Platform.

- On April 16 2019 cBrain informed that it had concluded its first agreement in the United Arabic Emirates (UAE) The agreement concerns delivery of a F2 based solution for a federal ministry, which supports a national task guide manager.

ready for new highs

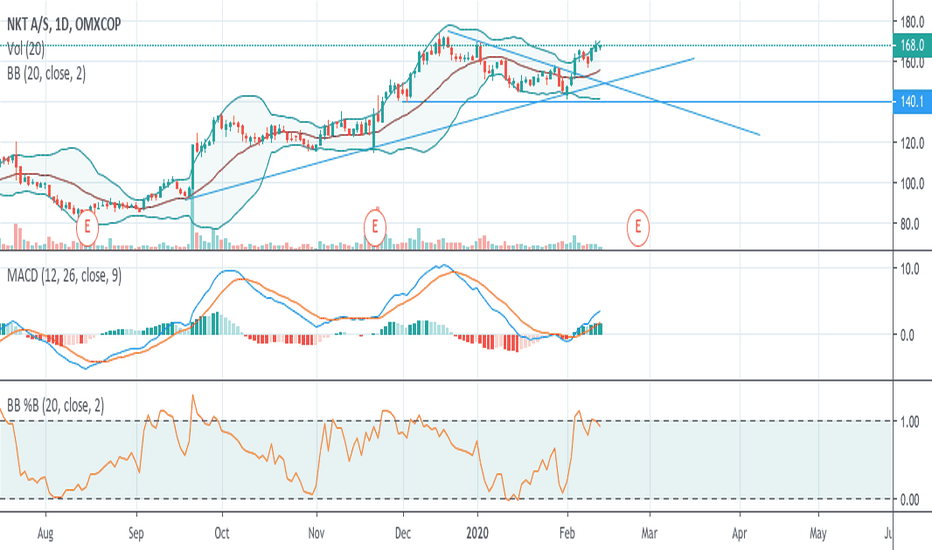

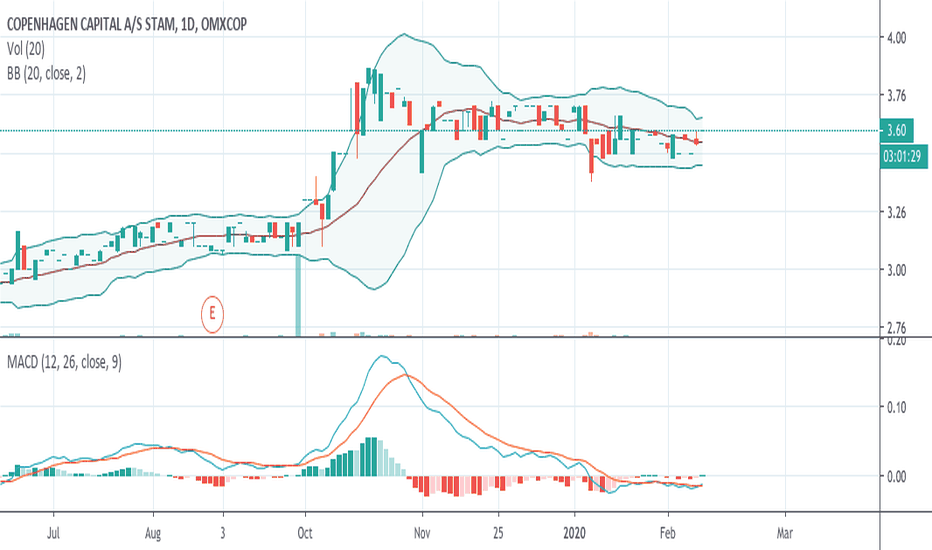

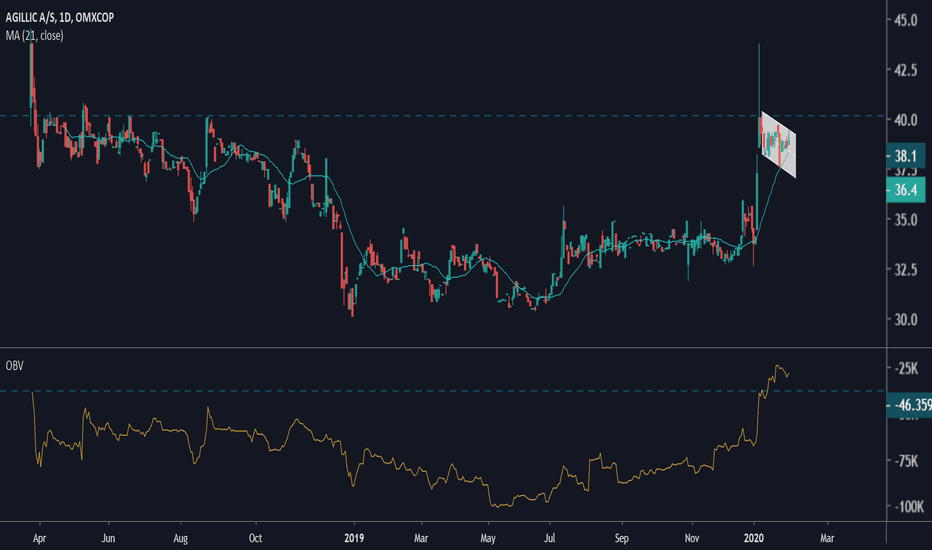

Agillic a Danish-founded software company with a proprietary marketing automation solution that serves as a platform for loyalty clubs and customer communication across all channels. Together with a network of partners and agencies, we help companies such as Matas, Sydbank, Mofibo and Egmont engage and communicate seamlessly with their customers.

After a wild ride up, agillic have made a shallow pullback to the 21 MA and holding which indicates a strong breakout, and also made a bull flag which it could break out of anytime.

OBV - shows new highs and price will likely follow - new highs coming