Breakout, pullback, repeat A.P. Moller - Maersk

is an integrated container logistics company. Connecting and simplifying trade to help our customers grow and thrive. With a dedicated team of over 76,000, operating in 130 countries.

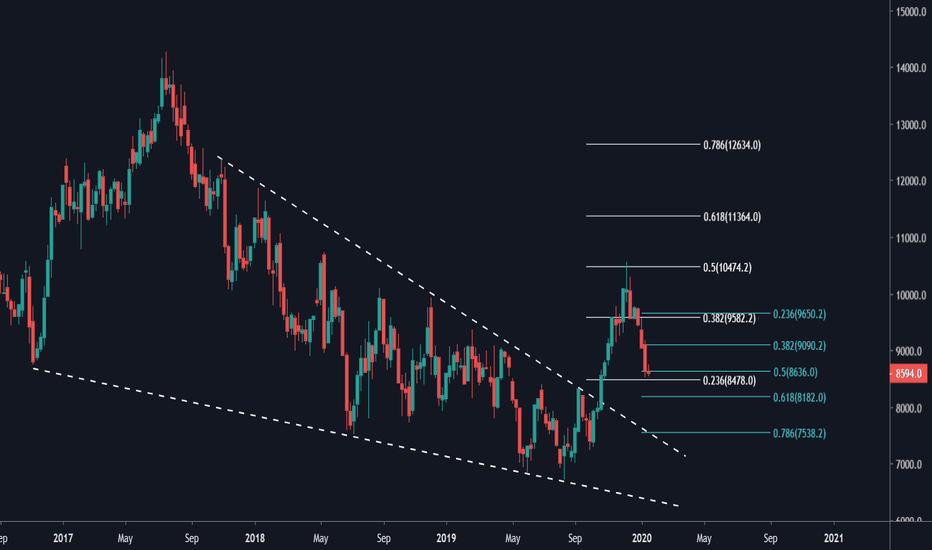

Weekly broke out of the falling wedge, retraced to the 0.5 Fib and now seeking to retest the wedge and currently pullbacked to the other fib 0.5.

Strong support at 8200, Daily 200 MA is at 8220, Fib 0.618 is a 8182, so multiple things points to 8200 being potential support.

Wait for a pullback and a bounce a 8200, or a bottom formation at current levels

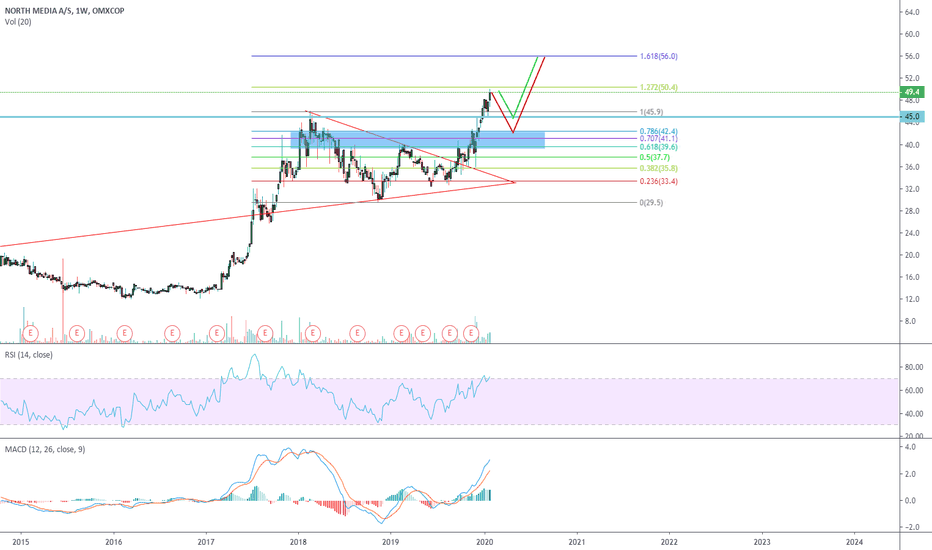

Össur still holds its upward trend channel - nice buying spotÖssur is just in the bottom of its upward channel so if the 48 DKK level holds it would indicate a continued rising trend. Would be a good buy in my opinion if we see this stock in plus Monday, January 20.

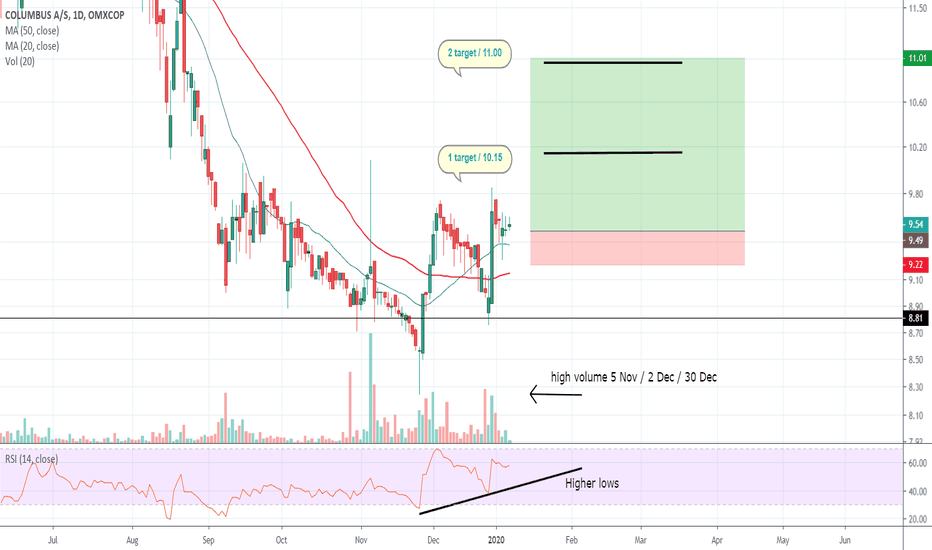

New up trend started ?Golden cross was made mid Dec.

RSI have higher lows, started in Dec / The RSI is on a bullish uptrend / its not OB ( a good thing )

Bullish engulfing caddelstick was made on the 20 Nov and again in the end of Dec.

Fundemental :

Q3 of 2019 is positive compare to Q3 of 2018

The first three quarters of 2019 Columbus delivered an organic revenue growth of 3% and an increase

in EBITDA of 48%.

EBITDA

YTD 2018 : 111,627

YTD 2019 : 164.854

Profit before tax

2019 : 94,115

2018 : 66,226

Link : ir.columbusglobal.com

Disclaimer :

I have this stock myself and opened that trade below.

Open trade : 9.50

1 target : 10.15

2 target : 11.00

Set SL : 9.22 ( there is alittel room for a spike down )

Risk/Reward Ratio :

1 target : 2.44

2 target : 5.63

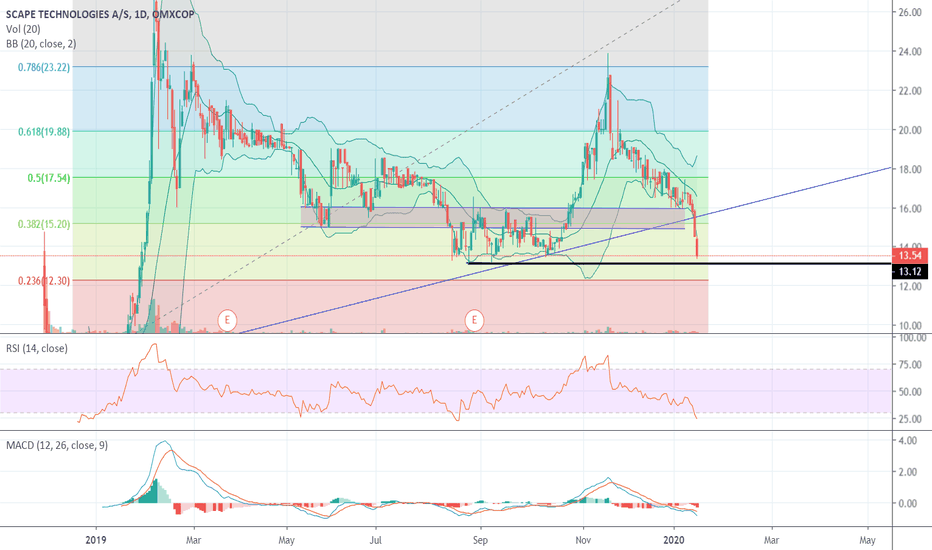

Potential buying opportunityIt looks to me as if Scape Technologies might be bouncing back up in the next couple of weeks. There is a strong support line (black line). If the price bounce at this line, I will be buying a portion. MACD looks close to giving a buying signal and RSI shows oversold. Bollinger bands seems to tell, we have to experience a small drop in price (first at least). It would be a tripple or quatripple bottom.

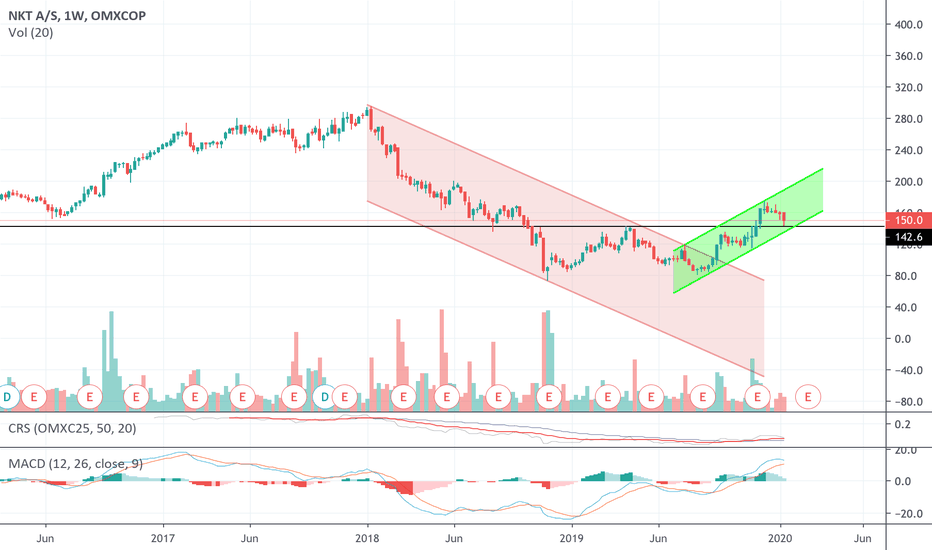

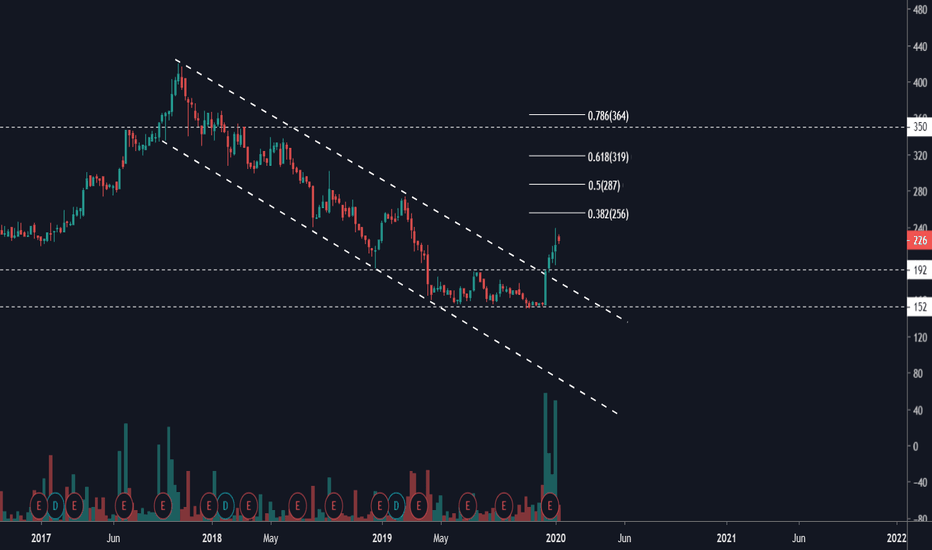

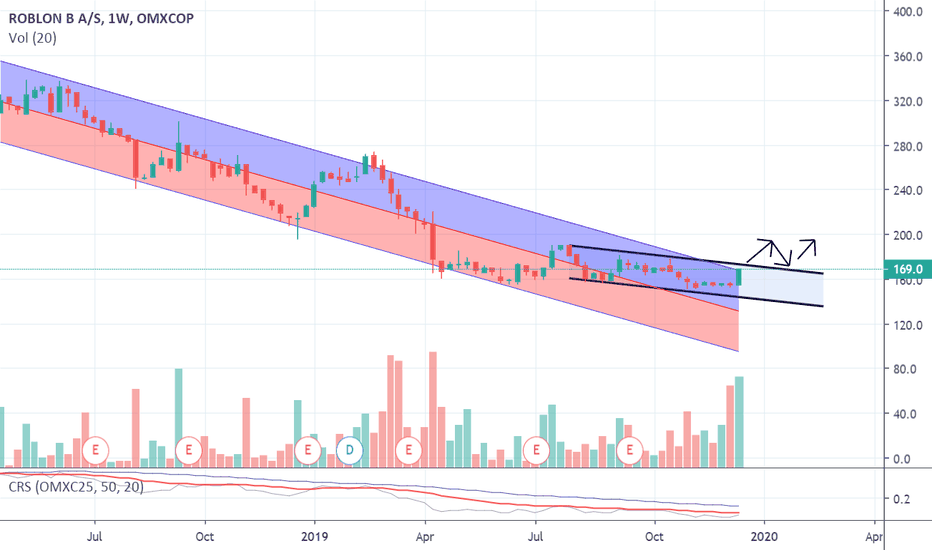

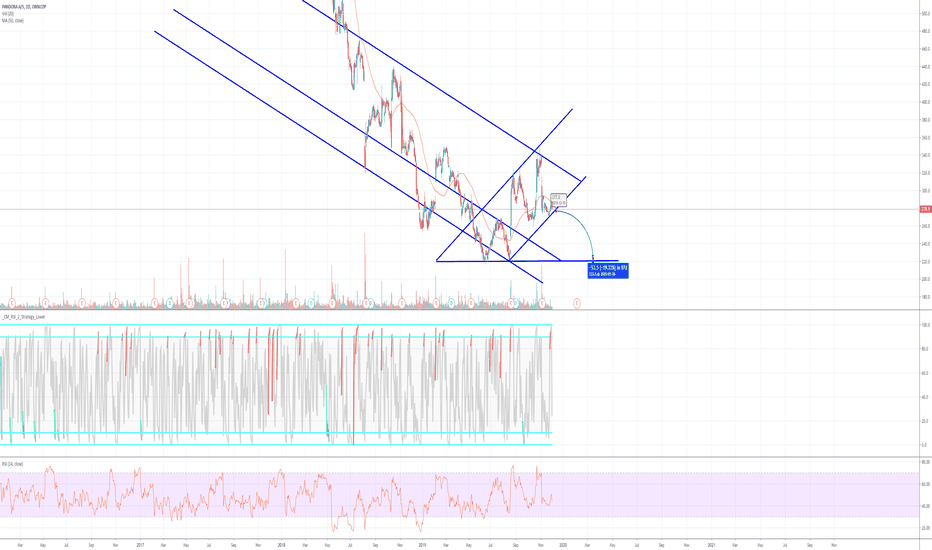

Point of reversalRoblon has broken out of downtrend with large volume, It has since retested the support at 192-200, but with not enough follow through to the upside, we will likely see some consolidation before continuation towards 350

About the company

Roblon is a global, innovative company developing and supplying competitive high-performance fibre solutions and technologies to strategic customers who demand the highest quality, durability and safety standards.

Roblon aims to be the preferred supplier of high-performance fibre solutions and technologies for strategic customers.

Possible turn around for Columbus - Long PositionDanish Midcap IT firm Columbus normally avoids public radar, which might allow some upside here.

Considering the past 6 months' development, I don't believe the major price fall is completely justified and I believe a turn around is possible.

The recent development in the stock price shows strong support in 8.70 DKK, whereby this might be a long term bottom and hereafter support for positive development. During December increasing volumes have shown, while weekly RSI is still low despite increases.

When comparing P/S Ratio and P/E ratio to local (larger) danish peers (Columbus=green), Columbus is strongly underpriced considering their Q3 YTD.

I will go long when the price is 9.50-9.60

Stoploss 9.25

Target A 10.54 (1st possible strong resistance level )

Target B 11.60 (2nd possible strong resistance level )

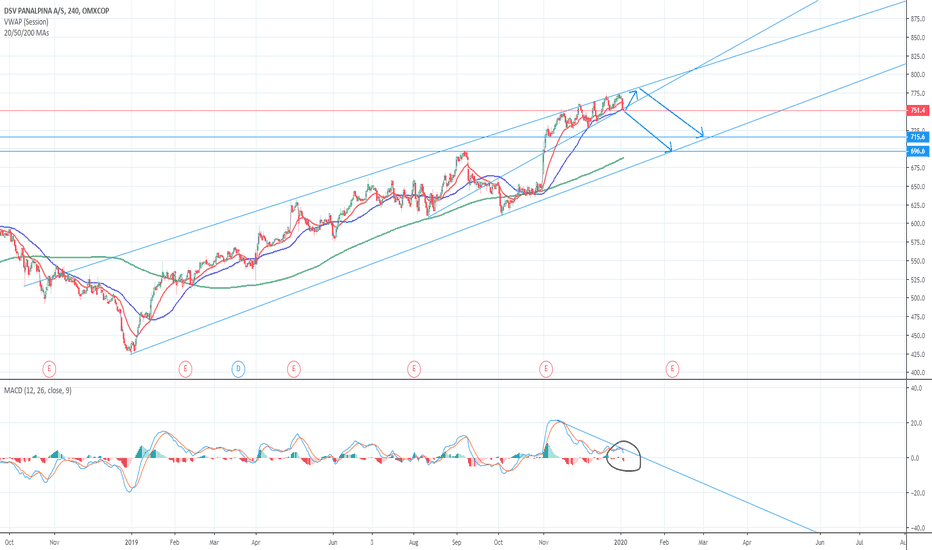

DVS Bear divergenceAccording to the 4h chart, DVS is showing massive bearish divergence on the MACD. A clear uptrend has been established, however in the short term (2 weeks or so), DVS looks like it is heading towards the lower trend line, presenting good sell opportunities. This is supported by trader sentiment, as the US closed the session with a large bear push on Friday, causing price to break below a smaller up-biased structure. This, paired with the divergence readings would indicate a drop in price over the next couple of weeks.

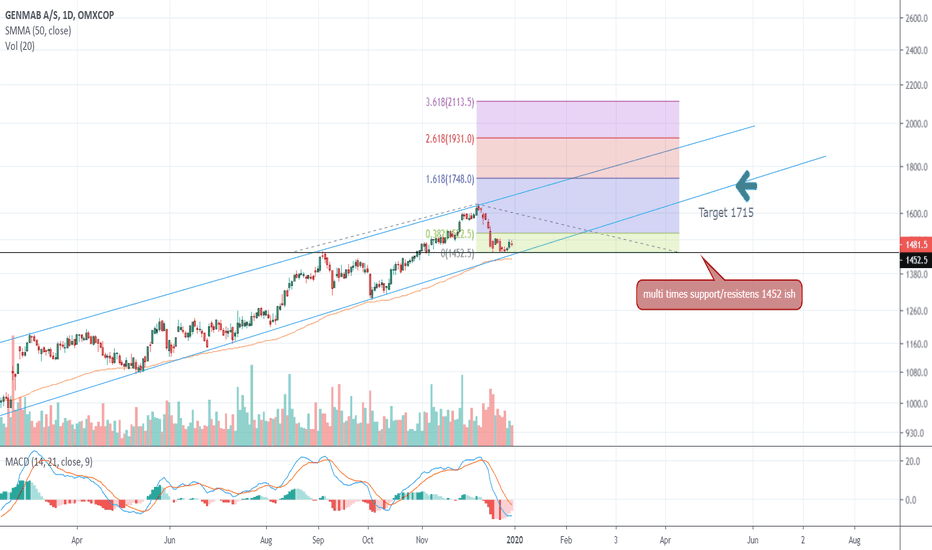

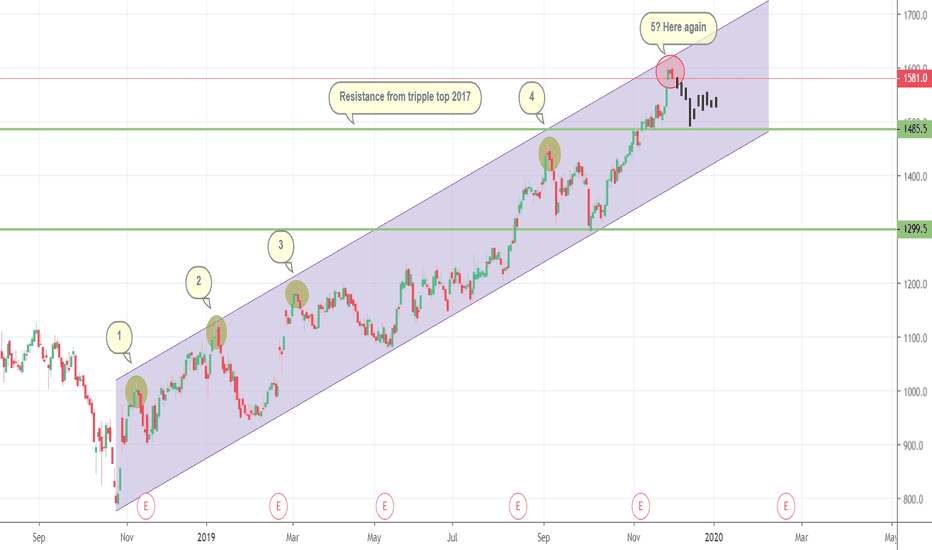

Will it follow the trend channel.Trend channel started in Nov 2018 and have been holding the channel for over 1 year

Will it keep going?

Still a up trend

holding the channel

50 ma holding more then nicely

support/resistens at 1453 ish

just hit the low of the channel

my signals say buy, so here is my idea.

Open trade at :1475

Set my TP at :1715

Set my SL at :1445 (if there should come a down spike at the resistens at the last caddelstick)

( this is just my point of view and should not be taken as a buy or sell indicator for you - remember always to do your own analyse )

Possible breakout of downtrend in Danish cable company RoblonThis stock has shown strength the last weeks and seems to be ready to break out of the downtrend. If we see the price go trough the black resistance line and have a continuation as shown with the arrows (retracement and then further up), I would be a buyer in 187 DKK.

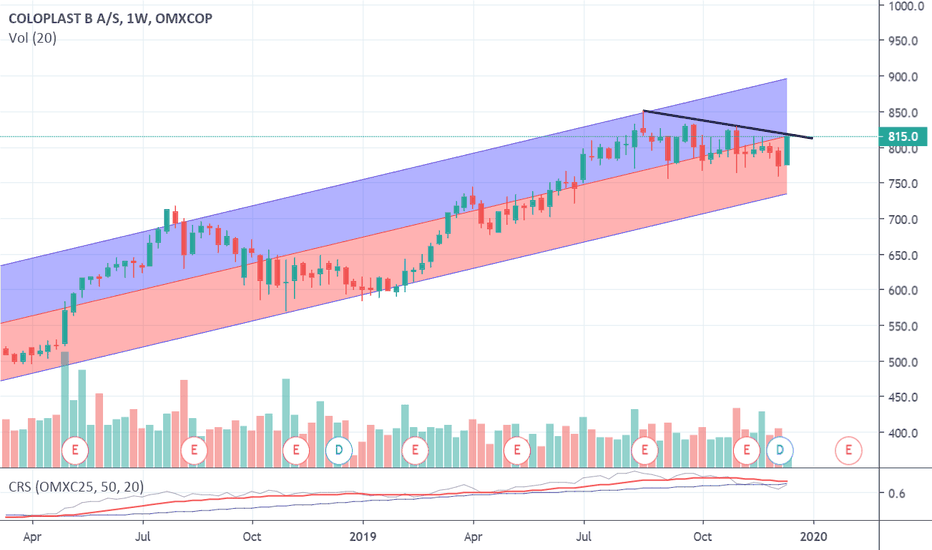

Coloplast: Watch for break of black resistance line at 818 DKKColoplast is in a solid uptrend that goes years back. However, this resistance needs to be crossed in order for it to go higher. One could then wait for a small retracement to the black line that then needs to hold as support for it to bounce further up to 900 DKK

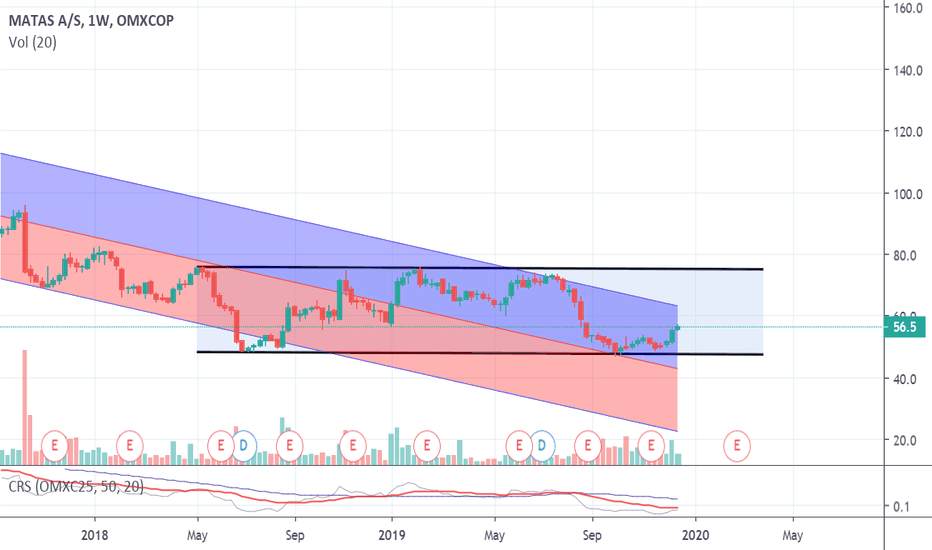

Likely continued upside in Matas during next weeks (and years)Matas might be about to break its down trend if it can move up through the top of the down trend channel at 63 DKK during the next few weeks. If it can, the next price target would be the top of the trading range 76 DKK. A further break through 76 DKK would indicate a new strong up trend.

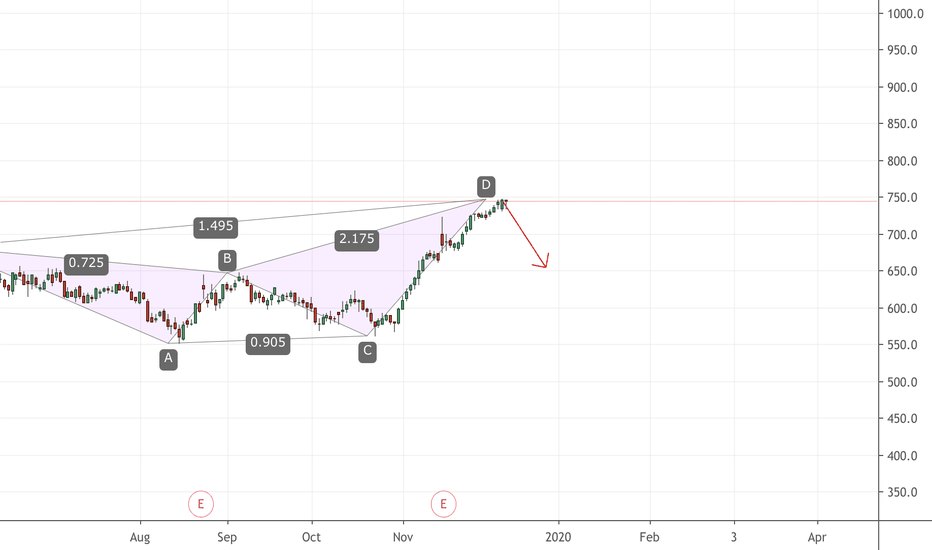

100 point drop ahead?GMAB

We are here again, fifth time we hit the upper band of the paralell ascending trend channel, the prior 4 times it made a spinning top and bearish engulfing before heading down. That's pretty much what we can see again, spinning top followed by bearish engulfing.

GMAB, recently broke out of the big overhead resistance from the former triple top, which was formed in 2017. It would be likely that GMAB takes a breather after 8 weeks of green and a bit overextended. It could take a small dive and revisit 1485 and enjoy the view from the former top and bounce back from there.

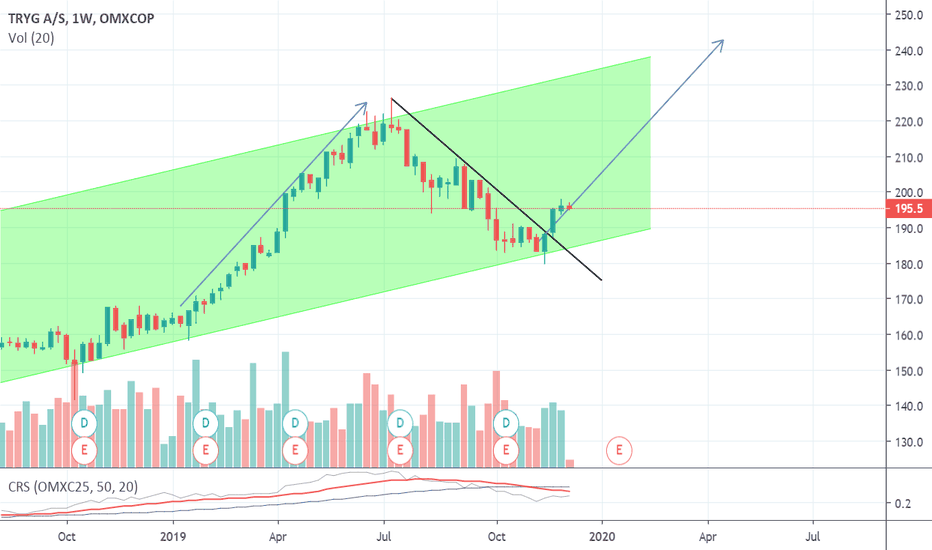

Interesting buying spot for insurance company "Tryg" Good weather and no snow in Denmark so far, thus the insurance stocks should have good financial reporting next year. This stock is a part of the Danish leading C20 index and seems to be able to go for the top of the drawn trend channel now that the black resistance line has been overcome. It should hold 184 DKK so a stop loss can be put there.