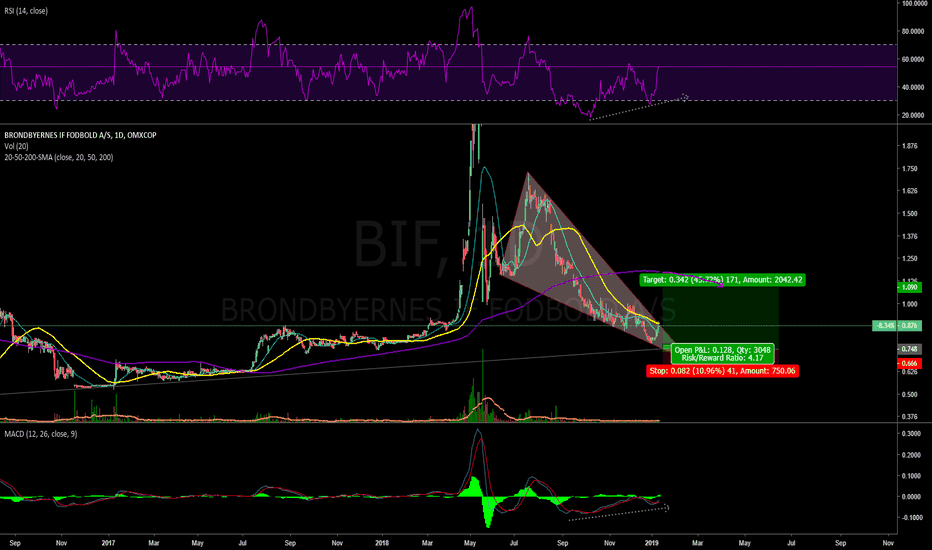

Buy zone for Brøndby with good setup. BIFBrøndby is soon ready to get in to Buy zone.

As you can see price made LL while RSI and MACD is making HL, which is bullish. I think one last leg down will happen to the buy zone and the RSI will be slightly above 30. Then we can expect a correcting rally. Maybe a new cyclus.

Buy zone is aroung 74-75 and stop is set to 0.66 which is below fib extension 1.0.

Target is set to expected SMA 200 zone.

Trade is active if the price touches buy zone.

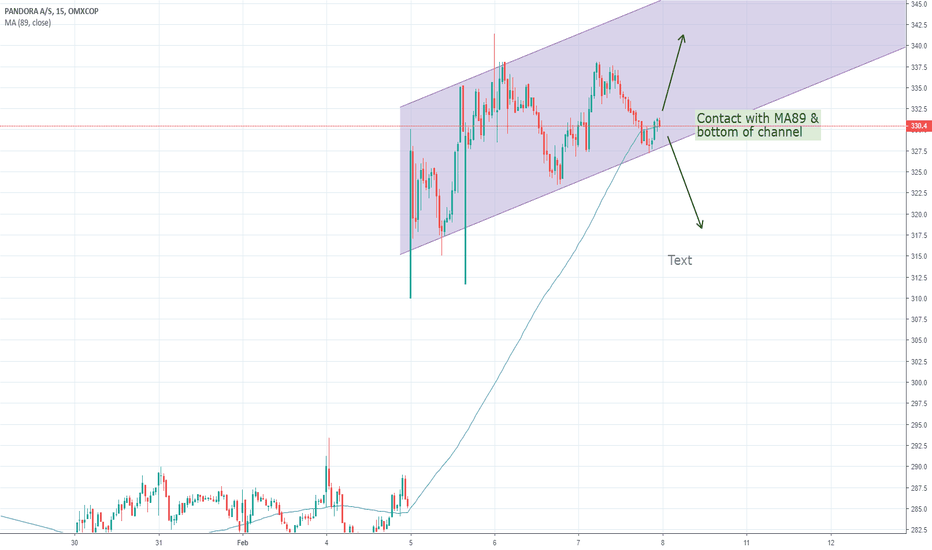

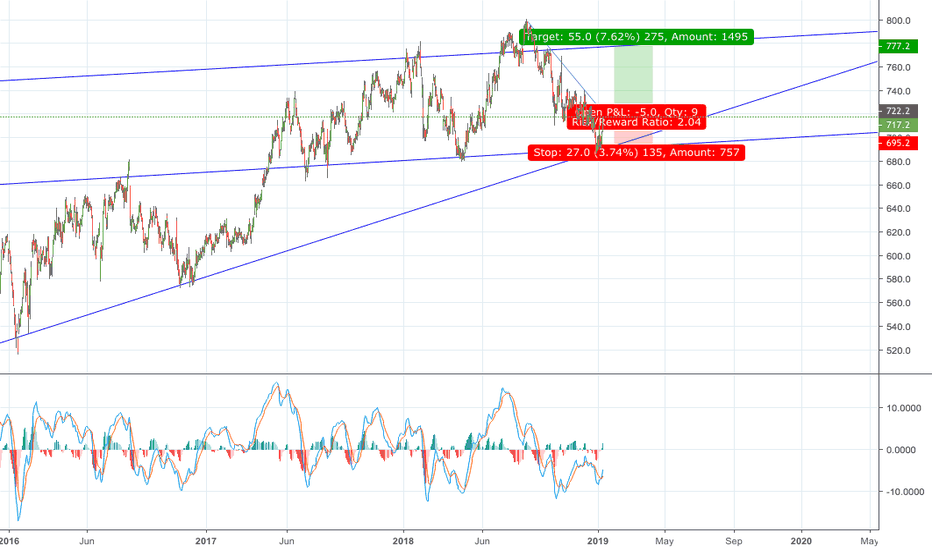

Will Pandora continue up the channel?Tuesday the annual earnings report was released and the stock jumped 17,6%.

Several finincial institutions have increased their price targets, e.g. Danske Bank from 310 to 365,

and a lot of large players are heavily invested. On the other hand, american hedgefond,

Coltrane Asset Management, increased their short position yesterday.

The stock is now at an interesting point as it's touching the MA89 and nearing the bottom of the

new channel that has formed since tuesday.

If it stays in the channel I think the following weeks can be very profitable, but it could also drop out

as it has been heavily shorted.

What do you think?

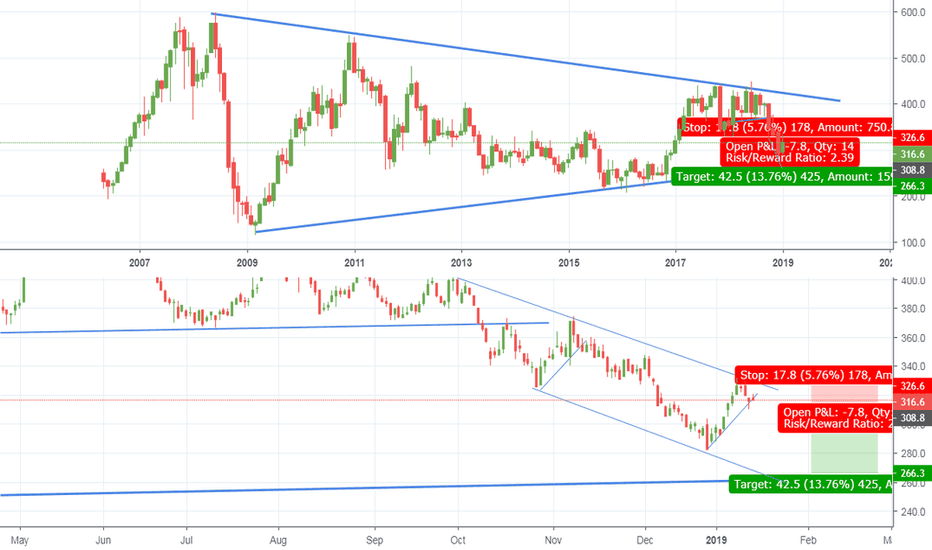

Rockwool correction over?As i see the large upgoing wave, we're in a wave 4 correction, and right now we are at 50% retracement which also was the turning point from wave 2, additionally we're close to the 200MA Weekly.

I expect atleast a short upward move, as I'm always quite skeptical with quick corrections.

This idea is based on this being the bottom, and I've remained konservative.

Reconsider if it breaks the black trendline top from before the big rise up.

Happy trading.

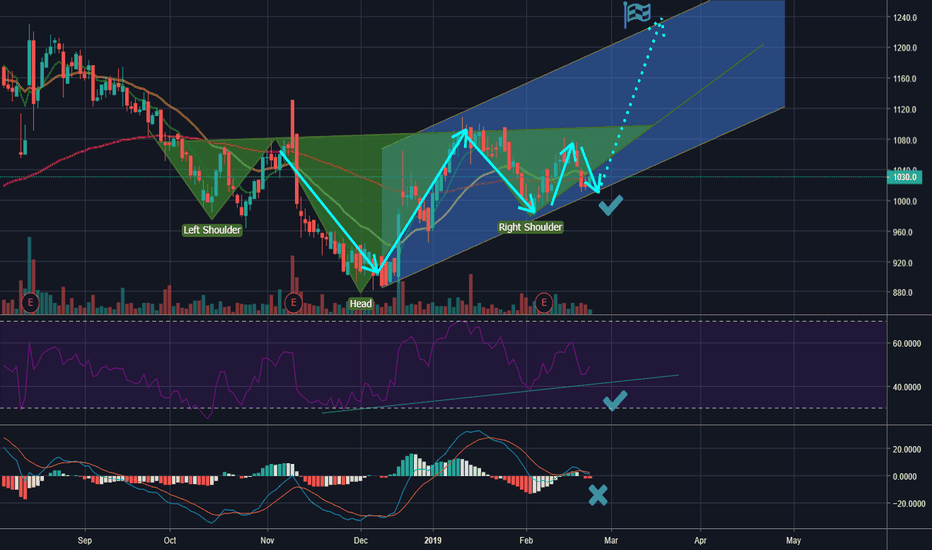

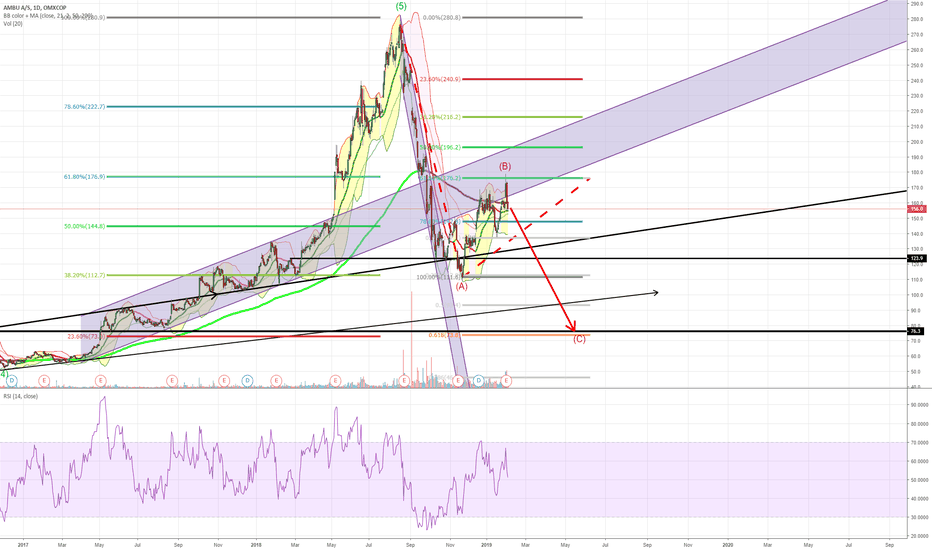

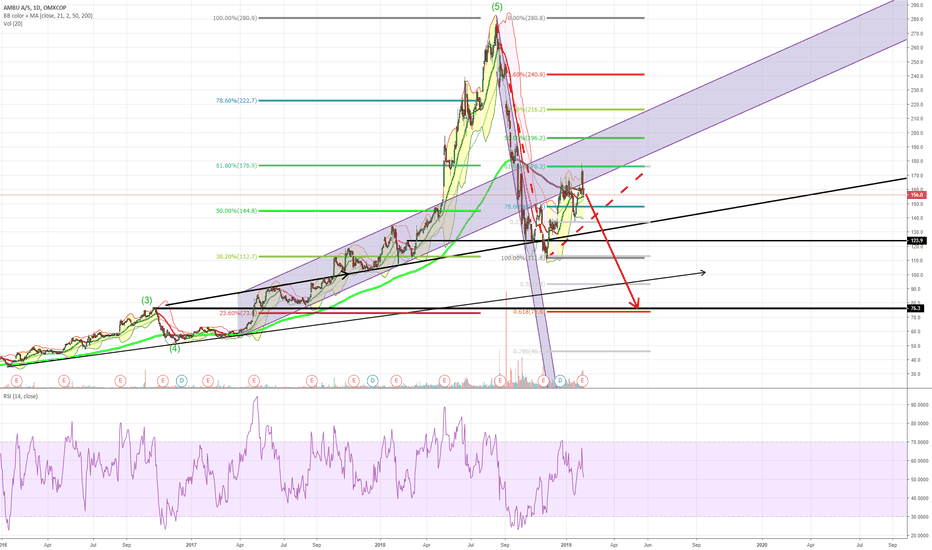

Ambu ready for the next slip?

My last guess on Ambu was incorrect, but i still believe we're are heading down even further.

The movement from the top was just too quick, suggesting extreme overbought, for the correction to be over in one quick move.

I believe we are seeing a big abc correction, and that we have now seen the top of the wave 2, I see it as "confirmed" as the quarter reporting made a major move to fib level, where it got hammered down from the next day.

Wave 2 have then moved between to fib levels seen overall on ambu lifespan.

I am not going to touch this with a ten foot pole before it is at least some degree below 100 dkk, preferably around 75.

Happy trading.

This is just my guess, see it as another perspective compared to your own.

Ambu ready for the next slip?My last guess on Ambu was incorrect, but i still believe we're are heading down even further.

The movement from the top was just too quick, suggesting extreme overbought, for the correction to be over in one quick move.

I believe we are seeing a big abc correction, and that we have now seen the top of the wave 2, I see it as "confirmed" as the quarter reporting made a major move to fib level, where it got hammered down from the next day.

Wave 2 have then moved between to fib levels seen overall on ambu lifespan.

I am not going to touch this with a ten foot pole before it is at least some degree below 100 dkk, preferably around 75.

Happy trading.

This is just my guess, see it as another perspective compared to your own.

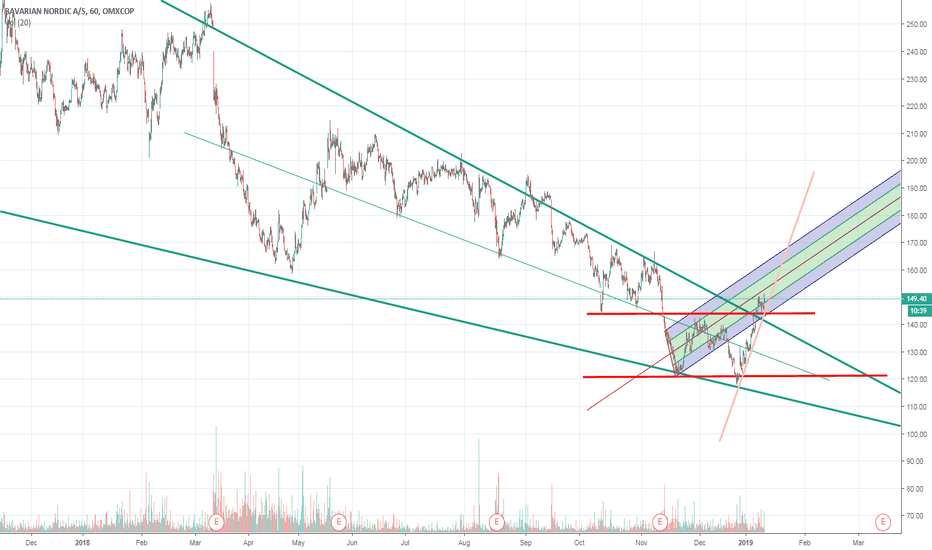

Bang & Olufsen analysisMany major investors believe that next year will be the 'year of stocks'. After recent major sell offs, many big companies lost at least 10% of stock value in December alone. So now is a great time to look for potential bottoms for long term positions at the start of the 2019. This is a luxury brand of Bang & Olufsen, approaching the massive trend line and support level, offering good RRR for a long position, break below the support would take us lower. The sell off was caused due to decrease in profit projections for next year. Watching such charts also gives indication for potential moves in US indices.

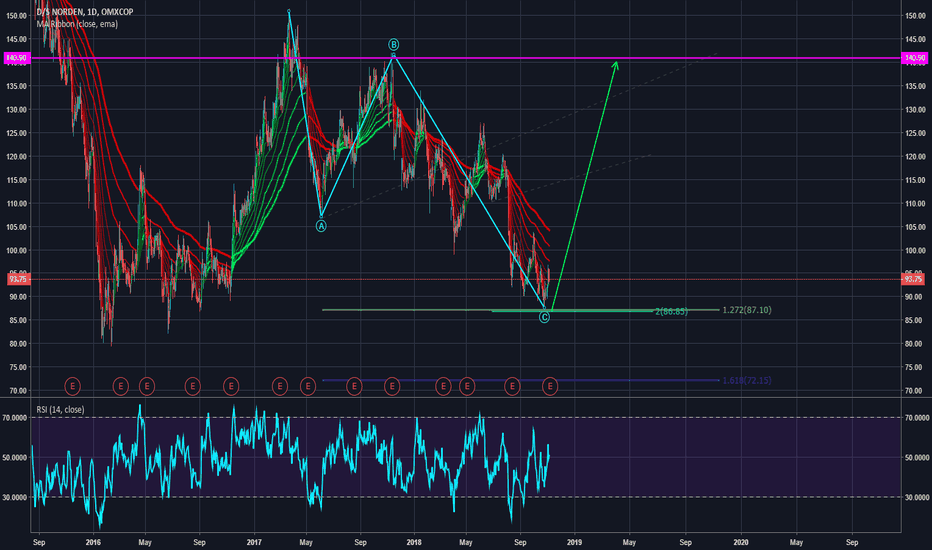

CATCHING THE BOTTOM ON NORDEN?The reasoning for believing that this is the bottom is due to the ABC, ending C at exactly 1.272 extended fibonacci.

Price bunched shortly after.

What also confirms this theory is drawing 1-5 waves, on it.

By drawing the extension of 1-2 waves i see that .2 fibonacci ends at the exact same price at the C at 87.10

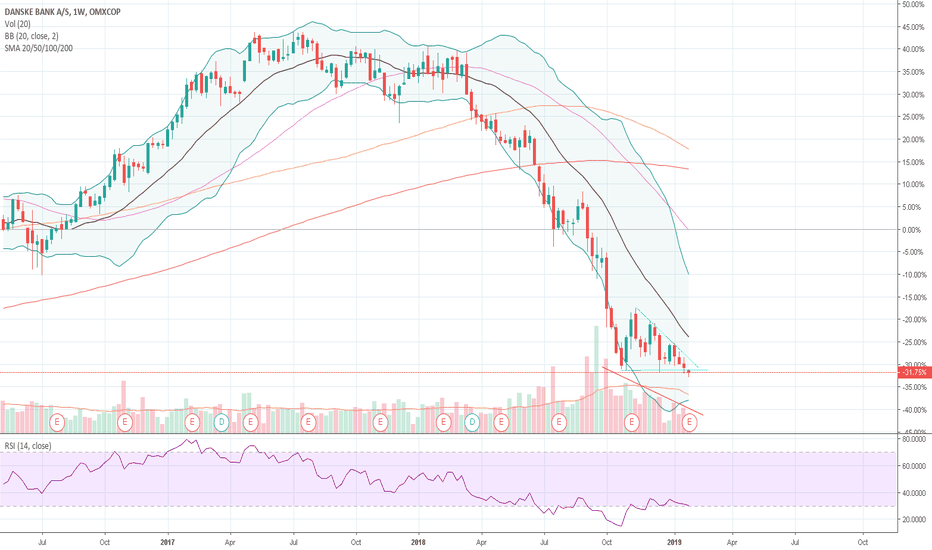

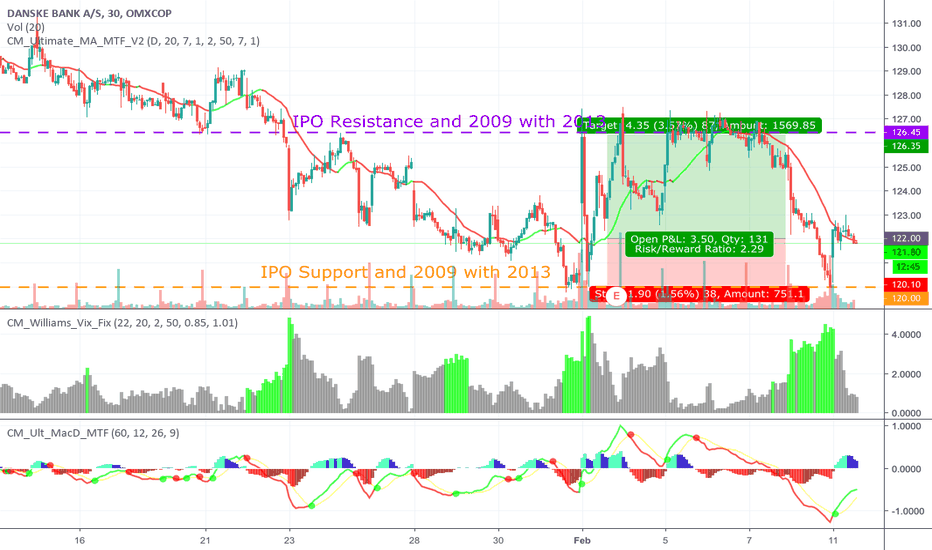

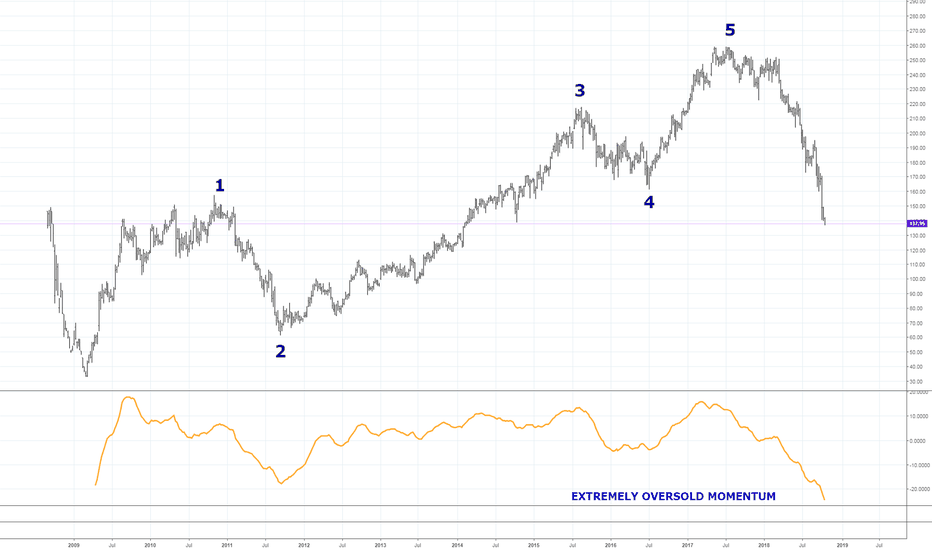

DANSKE BANK - Reaction and then one more dropOn the weekly chart, after a long uptrend in 5 Waves a correction phase started.

It is unfolding as a deep move down affected by the negative psychology of investors due to the news in Estonia.

Looking at the chart I expect a reaction soon and then a last drop in order to end this down period.

Long term Momentum has reached extremely oversold levels.

During that reaction more information will be available as to the stock's projections.

My opinion is that as soon as the reaction ends, the move down will probably test 120 and could even move towards 100.

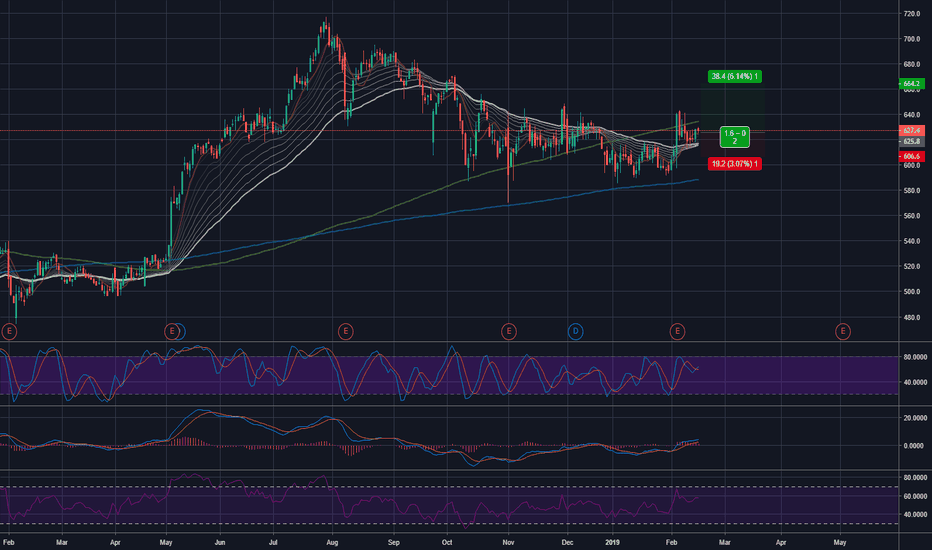

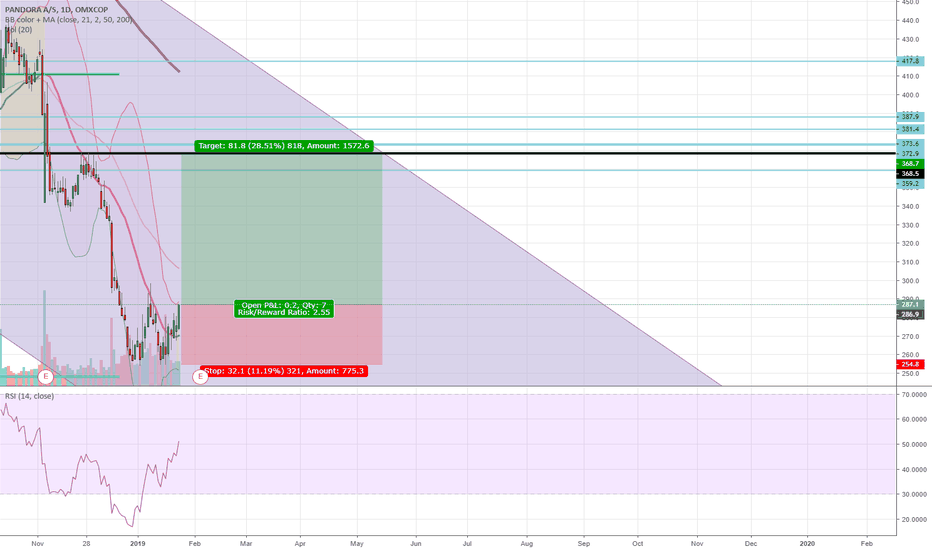

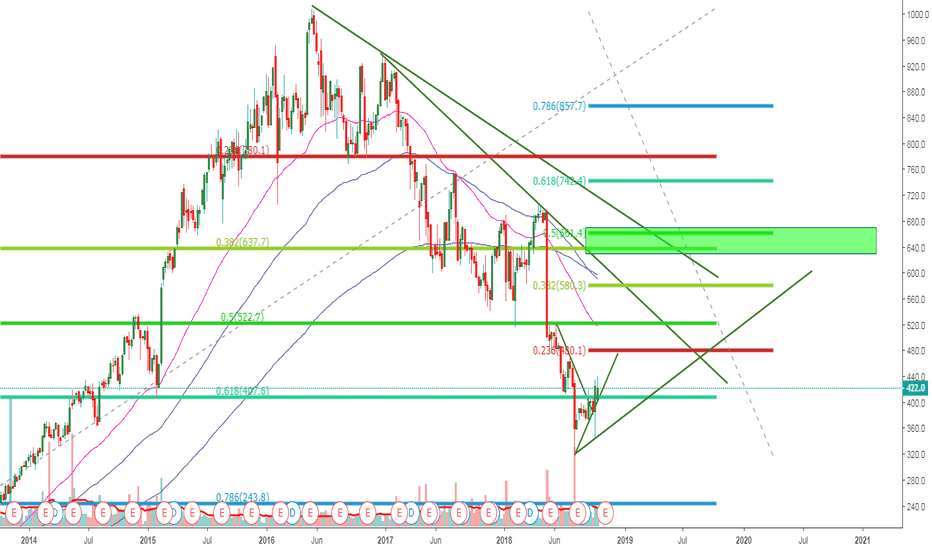

Is time for Pandora bearish positions over? Bullish perspectiveThe technical analysis matches with the fundamental perspectives, suggesting a new bullish time ahead after

two years of bearish trend. Immediately after rebounding from the 61.8 Fibo level (measurement taken from the big bullish move on a weekly trend) some news have suggested the interest of some Equity Funds of acquiring the danish company and, after that, other news have suggested the hiring of Rotschfield consultancy in order to help the company in case of a possible acquisition process. This has given the boost to the price, which is now showing in the 1W framework a clear bullish scenario under formation; important to mention that the short interest index shows now a value of just 5%, compared to the double digit value registered some until few weeks ago. The feeling is that the bearish strenght is becoming weaker and weaker.

Medium-Long Term Overview

In my analysis, the price is moving towards a next target of 516 DDK, which is the 50% retracement of the major uptrend move and at the same time is the 50 EMA in the Weekly.

After a short pullback, my long term view is the reaching of a target price in the range between 629 DDK and 671 DDK, corresponding to the area of both the 38.2% retracement of the big uptrend move and the 50% retracement of the big bearish move from 2016