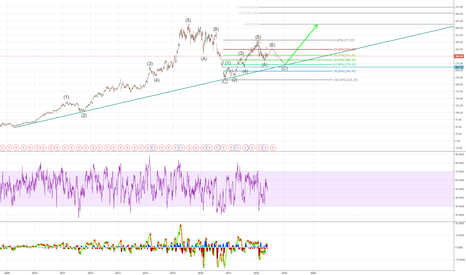

Airline - Upside in perspective of historical seasonality?Upside in perspective of historical seasonality in airline company SAS?

- Please, share your thoughts!

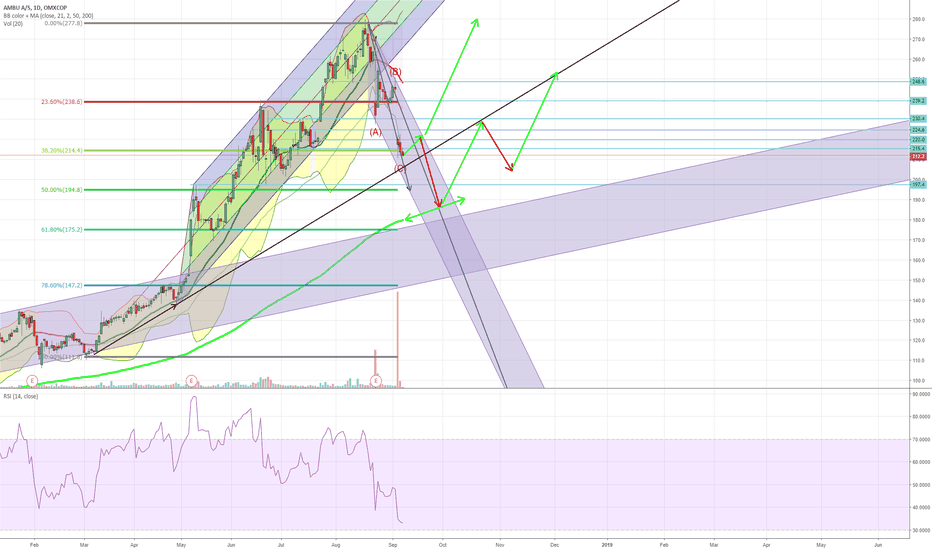

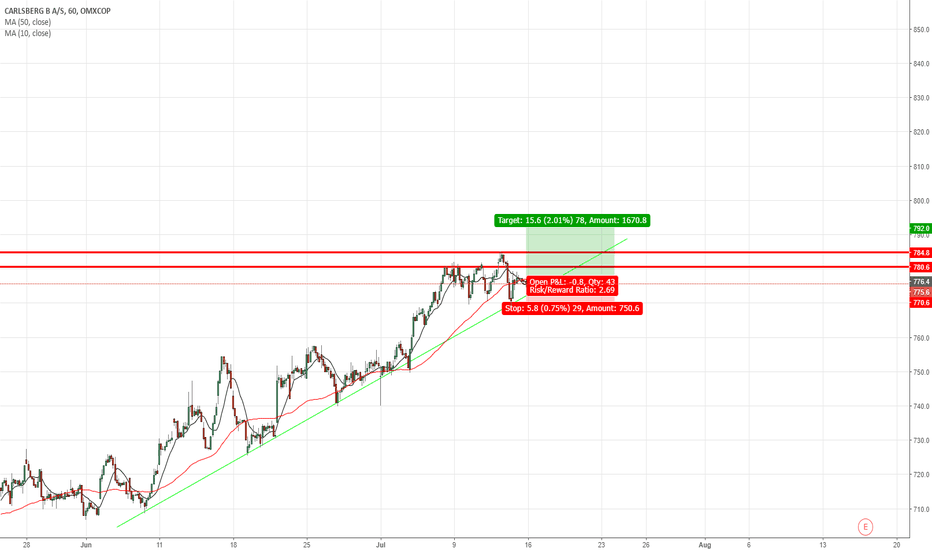

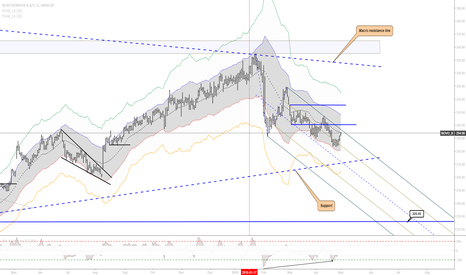

Mapping what I'm seeing - For self education in the futureI've tracked this stock for quite some time, as a friend of mine has it.

The correction was expected when the uptrend broke, but I'm unsure of the direction at this given point, so I'm trying myself out, so lets see if it's a hit or a miss.

There are two "ideas" .

I positive in the long run, but I do believe this has been going too fast, and the correction is due..

I like the trend being more near the previous trend seen in the bottom.

Happy trading

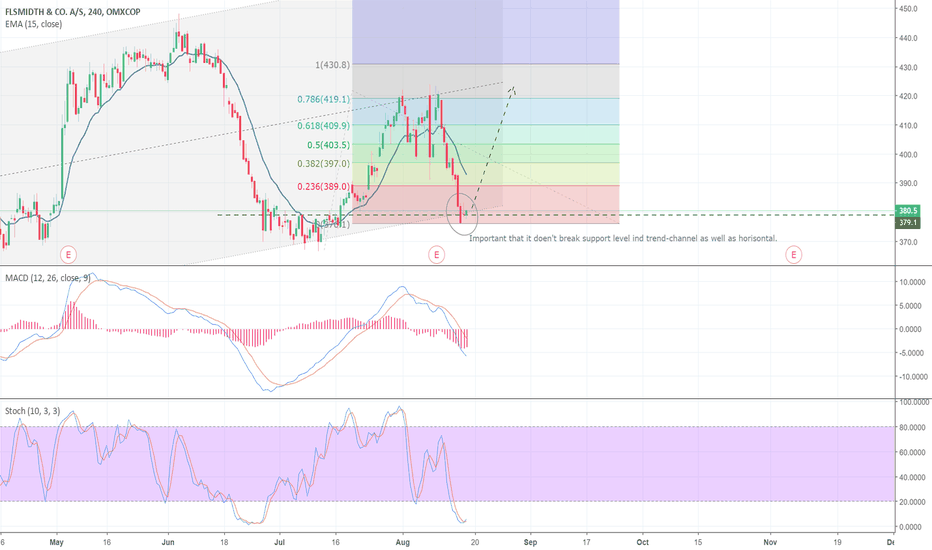

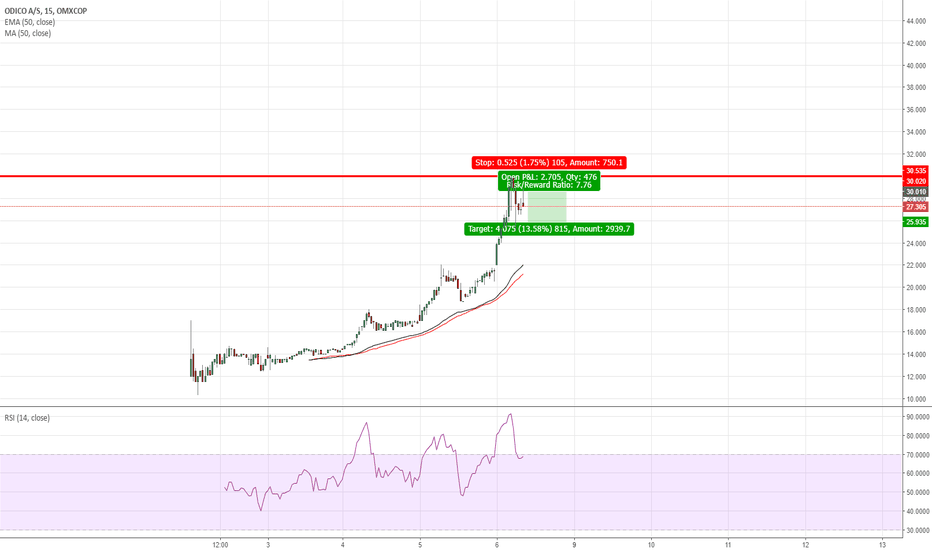

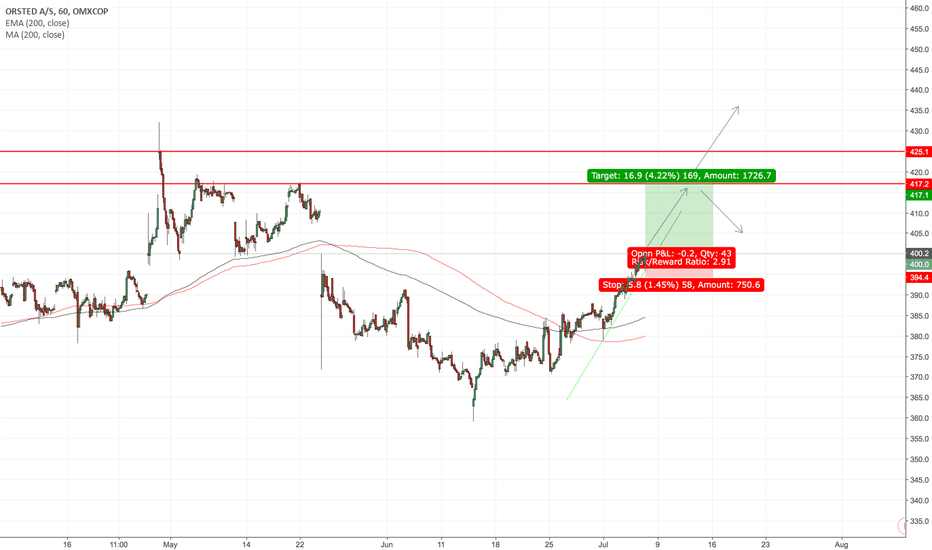

Hard resistance for ODICO30 is very likely to be a hard resistance for ODICO. Due to the psychological state. The stock has risen a lot since its IPO, and traders are wondering when the trend is ending.

Wait for the stock to approach the levels. If the stock meets resistance there might be an oppertunity. Aim for quite tight stops.

Invest safe.

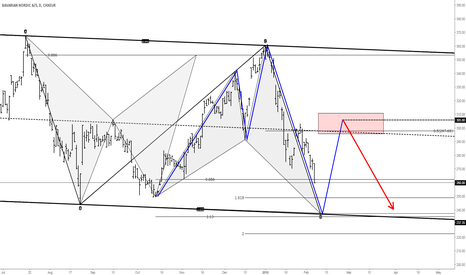

NOVO_B Bearish

Right before Q1 Novo_B is displaying, for medium term, further bearish trend. Take note of the bullish divergence that could bring the best scenario for the Q1 day- the level of 315 kr. The monthly and weekly charts are bearish and probably further downside action. As for the harmonic patterns I am looking for an ABC bearish pattern where the swing BC will end on around 224 kr level or so (notes on chart). The breaking of the macro support trend line is something to watch closely.

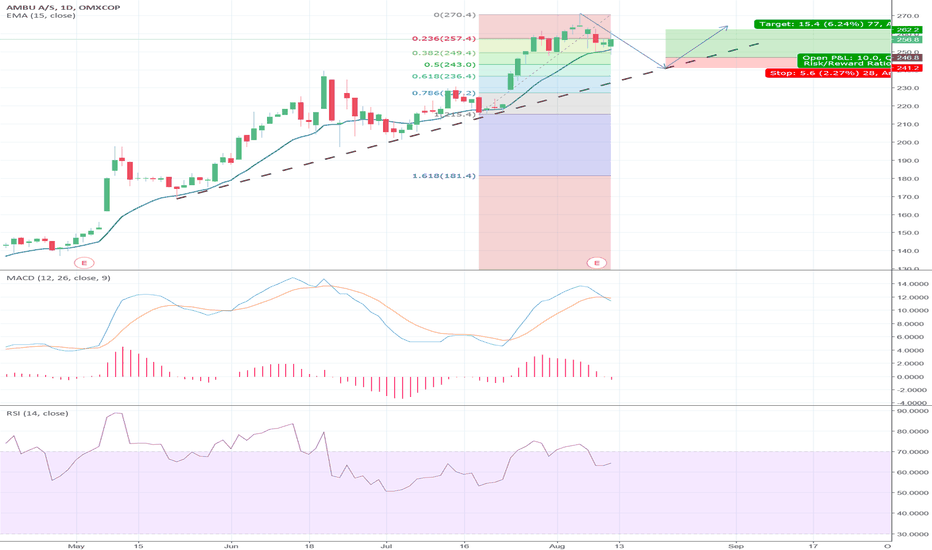

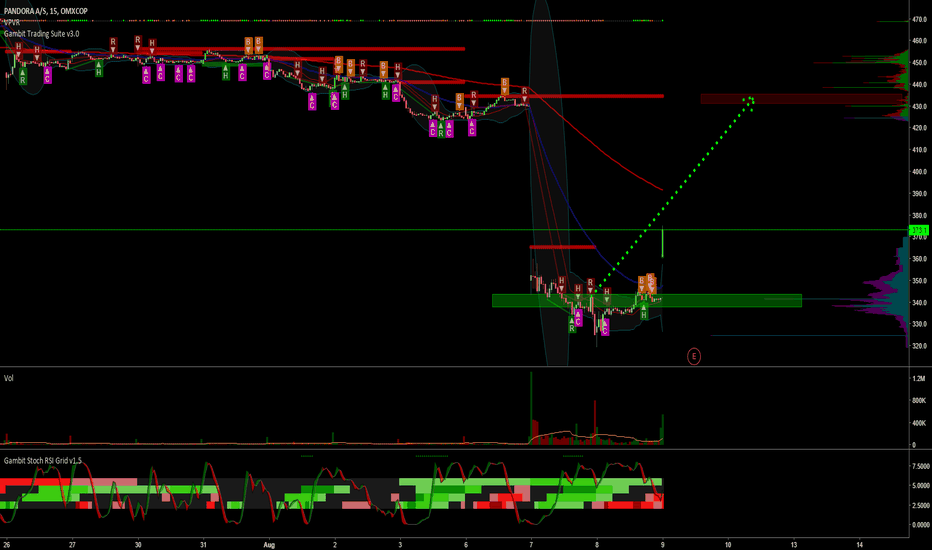

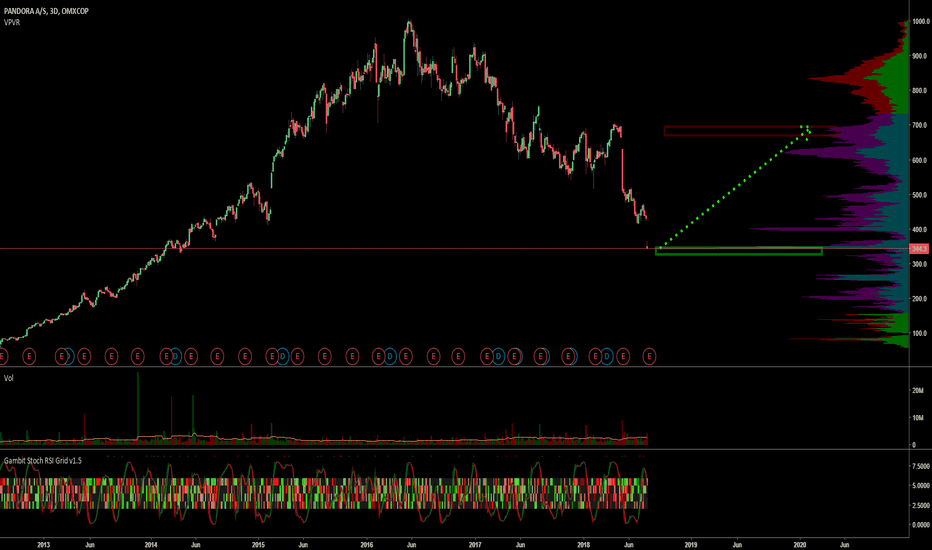

From bat to shark to 5-0Big ab=cd ending right at bullish Shark completion. If this pattern is succesful, I would be looking for a 50% upwards retracement right to a bearish 5-0 pattern around the middle of the channel.

Just something to watch for. It's tough terrain these days, who knows what'll happen!?

The old bear bat: