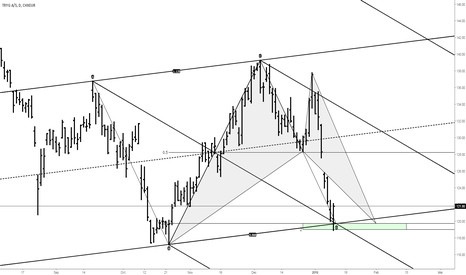

Tryg: severe price action stops at bullish batThere's not a lot of interest in insurance companies these days, but you gotta love how price action turns around instantly from this PRZ :) Let's see if it can keep it up.

Nice bullish bat

Reciprocal ab=cd one bar from 1:1 in time

Good matching channel

Median line target hit

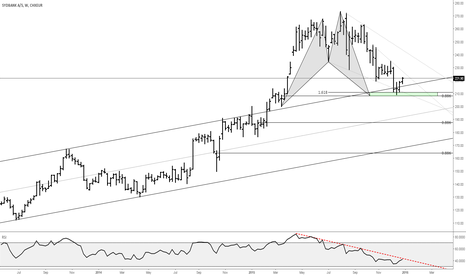

Chr. Hansen bear batBearish bat almost completed with overbought RSI. Might be time for a pull back.

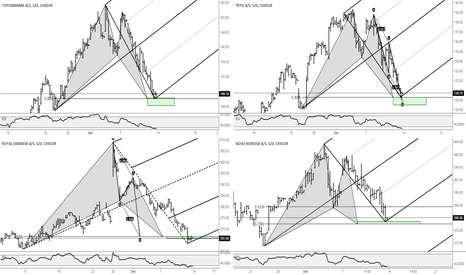

Danish stocks harmonic correctionsSeveral danish stocks closed at or near the completion of some rather nice harmonic patterns last friday. This is just some of them. The danish OMX C20 index did fail a very precise bullish Gartley, so the first target for this possible bounce could be a test of that area from below: invst.ly The reaction from that test should be a good indication on the strength of this market.

FLSMIDTH bearish 5-0FLS completed the daily bearish 5-0 with a minor instant reaction. We've just had another test which resulted in a succesful bearish bat on the hourly time frame. See private chart below.

Targets if 250 is taken out would be the potential bullish bat/leonardo close to the last bottom. In case of total break down I have marked som older lower targets. For now I will properly remain bearish as long as the box/channel isn't broken.

Q3 on thursday the 12th and already more than 4% down from the PRZ makes it way too risky to enter now but I thought I'd share it anyways.

Bearish bat on 2h private chart: