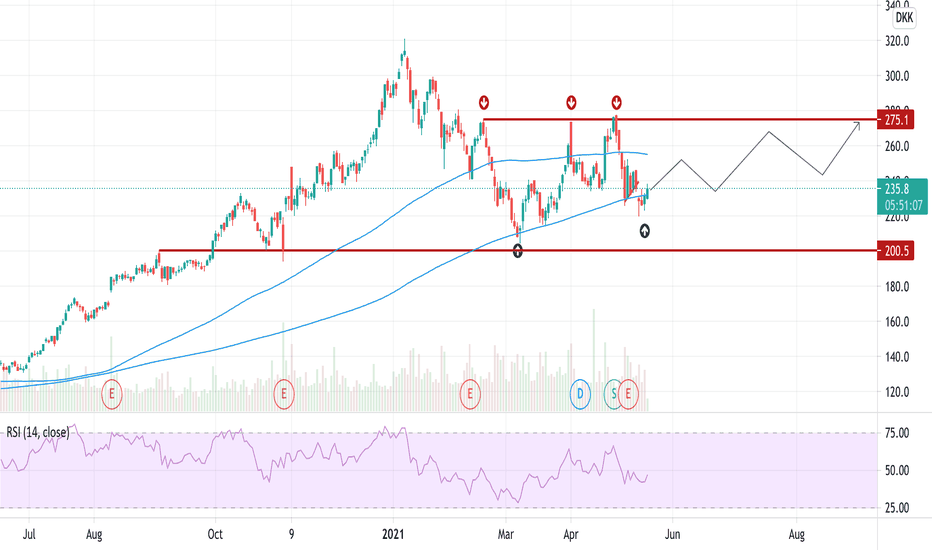

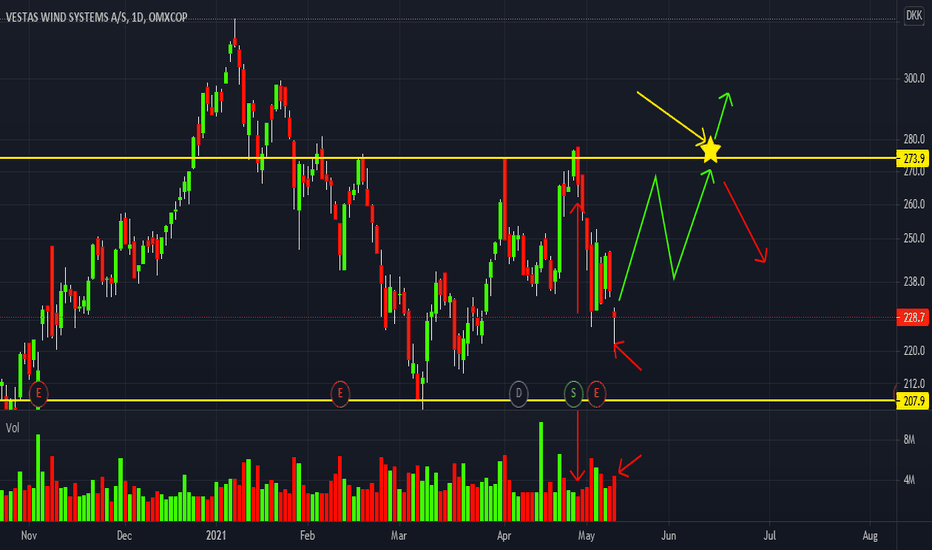

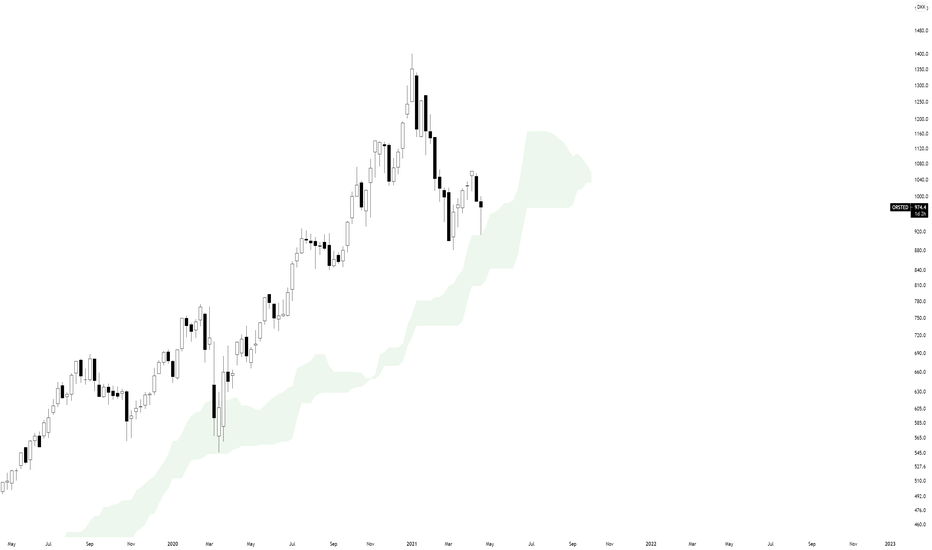

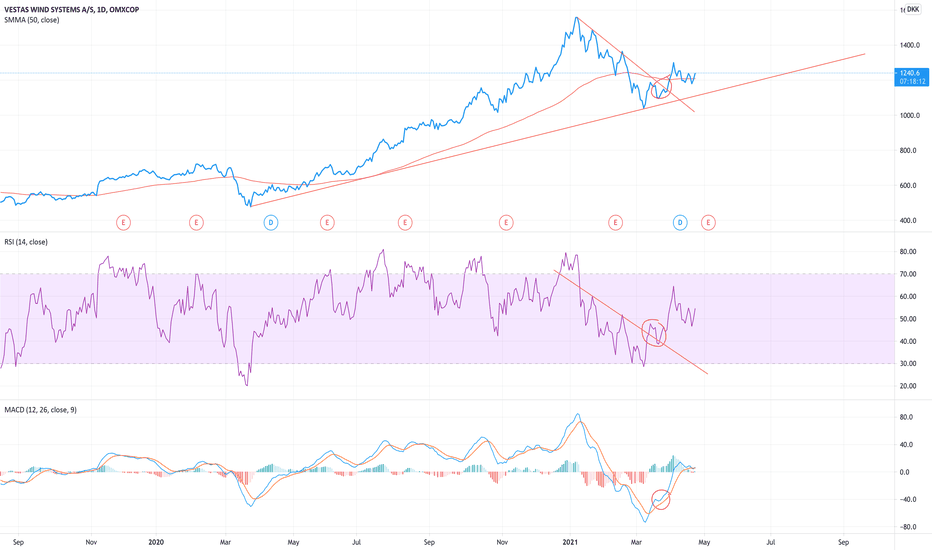

VWS| Moving Average "trap zone"Hey all,

Since recovering from it's multi-month sell off, Vestas found strong support in early March at the 200-day MA, and has since been consolidating within a moving average "trap zone".

I have observed this pattern previously and on daily time frames, this sort of "coiling" will bring to a strong move up or down once the trap narrows, RSI seems to be developing a wedge pattern also, needing to chose a direction for the months to come.

VWS is currently trading below the 20, 50 and 100-day moving average, but has found support again at the 200-day MA recently.

I like this set up, although I would preferably be watching for a breakout above 275DKK for confirmation.

Downside risk is probably around the 200DKK mark.

Any thoughts?

Good luck!

(*This is not financial advice, for sake of discussion and illustrative purposes only*)

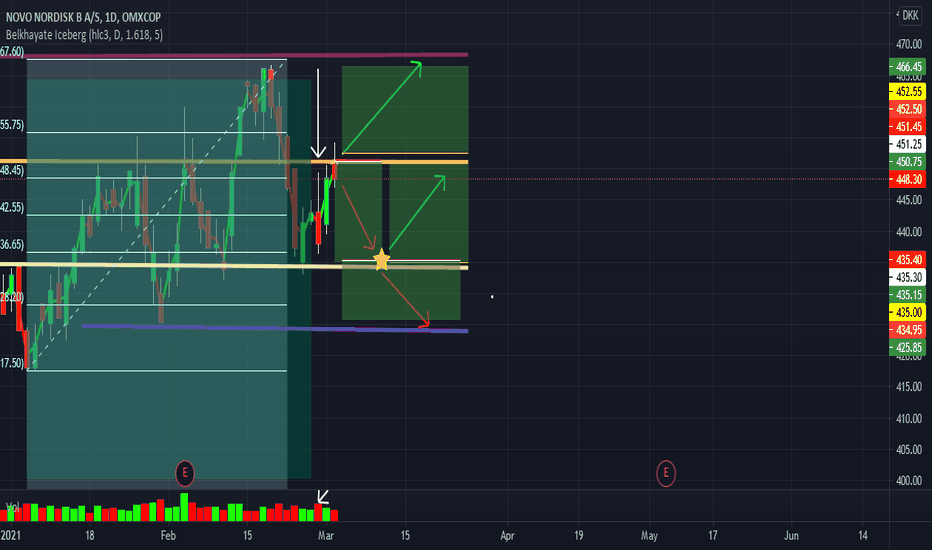

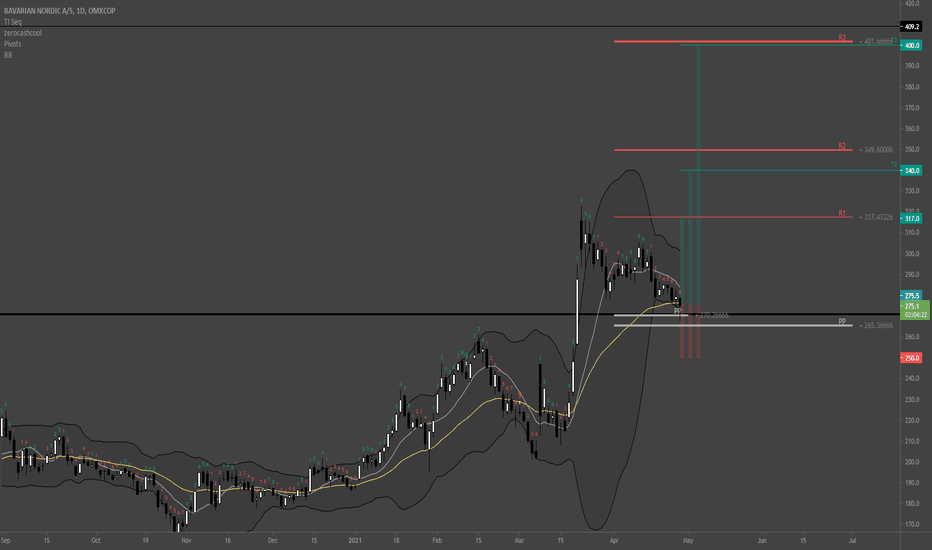

Adding Danske Bank to my investment portfolio 🏦Danske Bank's reputation has been under a lot of pressure because of accusations of money laundry.

But as we all know; banks don't have to serve justice and this will most likely not have any real consequenses for DB.

The combination of a selloff because of bad reputation and huge growth opportunities in growth stocks, I find Danske Bank to be undervalued.

I am adding this to my long term investment portfolio by dollar cost averaging in a position, throughout the range I've marked on the chart as a buy zone.

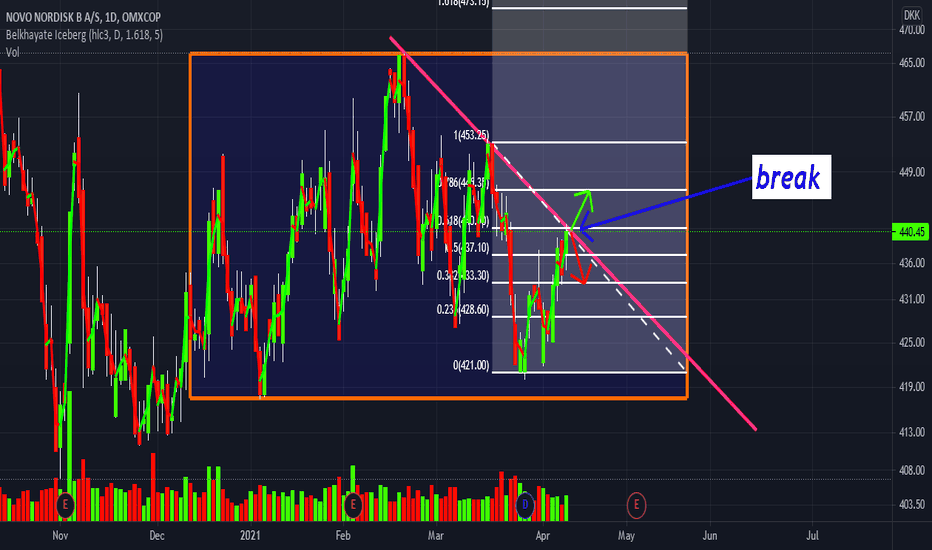

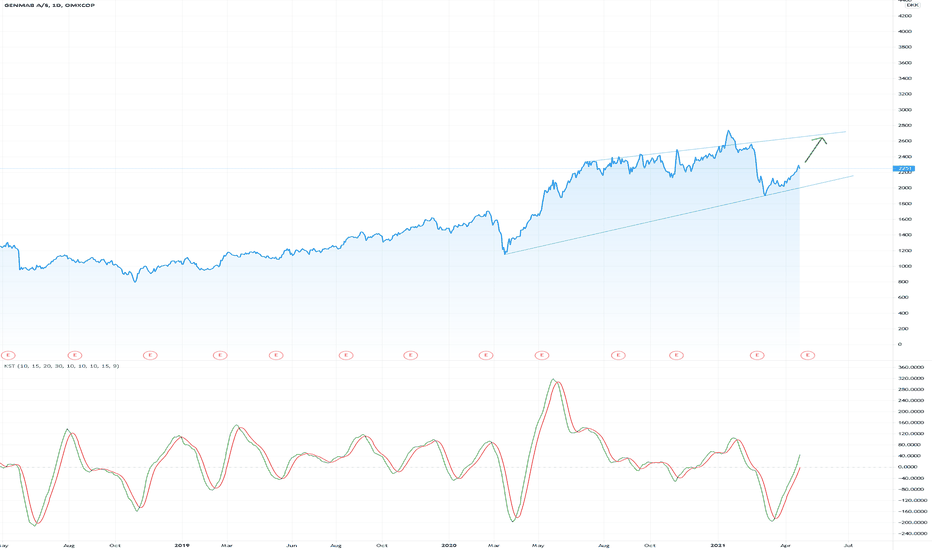

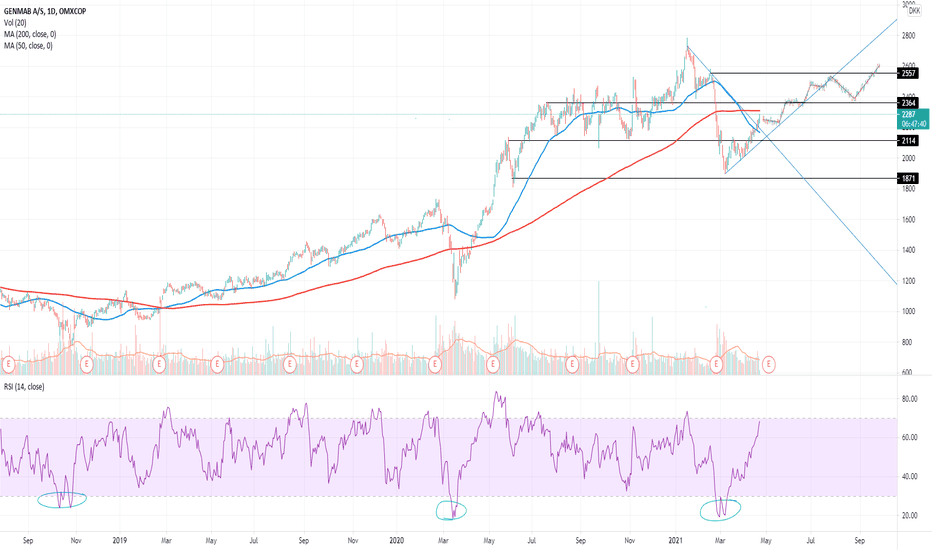

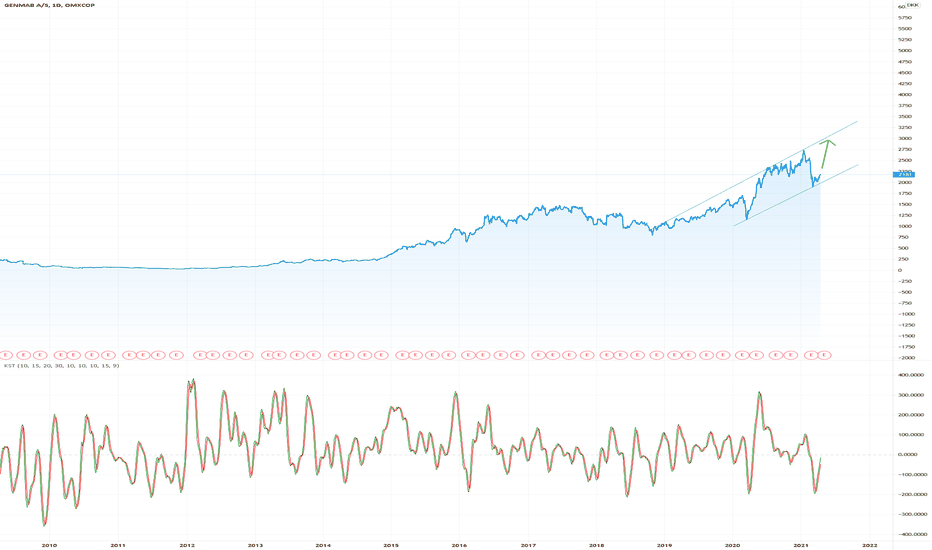

Genmab opportunitysteamloss in the Genmab stock will likely fuel a new rush.

1) the 2 previous times times RSI has been below 30, it has resulted in strong returns. Will it happen a 3rd time?

2) The current strongly rising RSI will like make sure that the price will move and stay above the short term downward trend.

3) Opportunity for the price to move towards 2557 DKK. Yet be aware of potential strong resistance around 2364 DKK.

4) If this small up trend can offset the short term setback, 50/200 will likely trigger a new golden cross.

Entered long in 2168 DKK

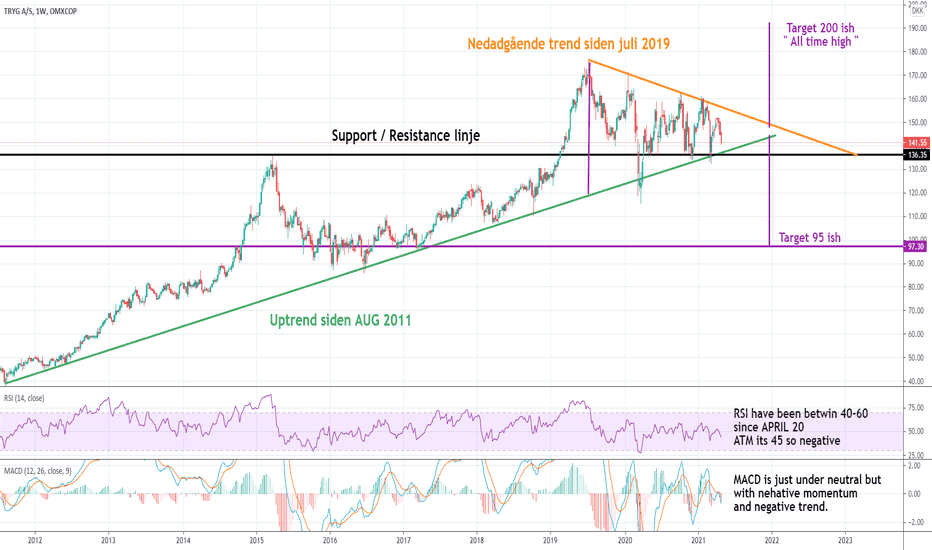

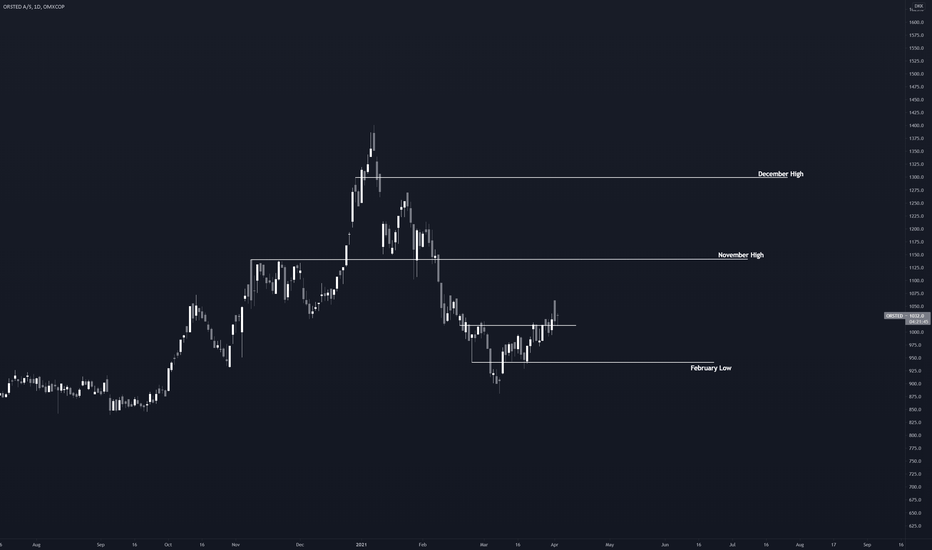

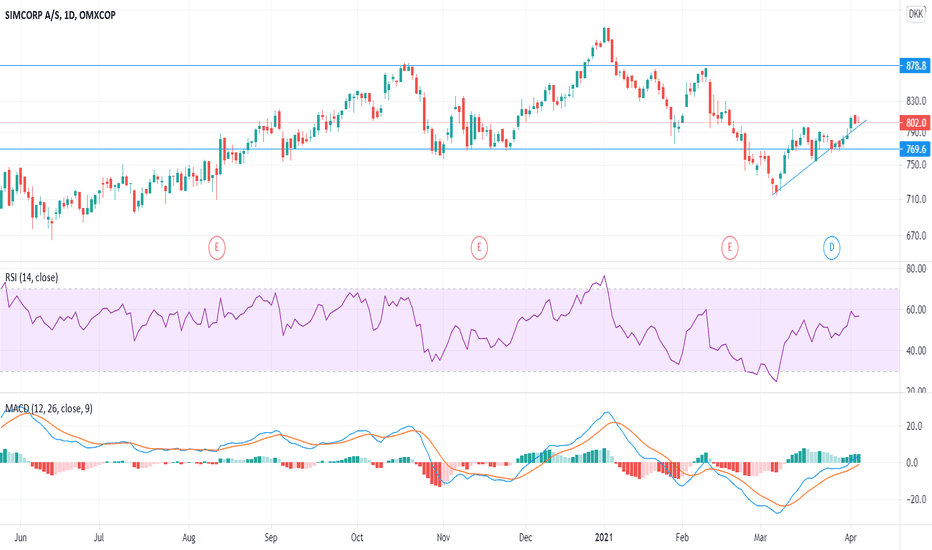

VestasIt has broken a long lasting negative trend indicated by the trendlines and RSI and MacD. Though there seems to be a rotation from growth to value-stocks combined with the fact that all sustainable stocks seems to be old news. It may therefore take som time for the stock to recover, but it will most likely happen.