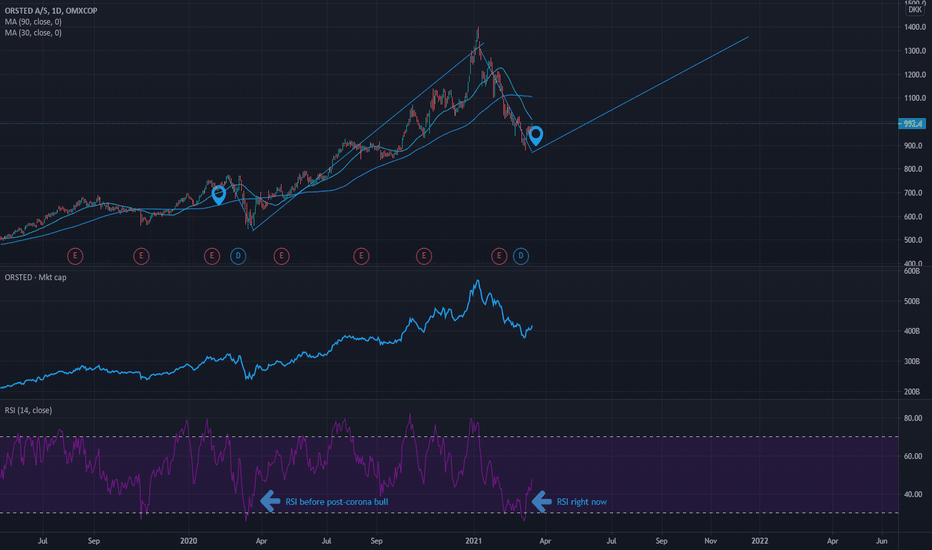

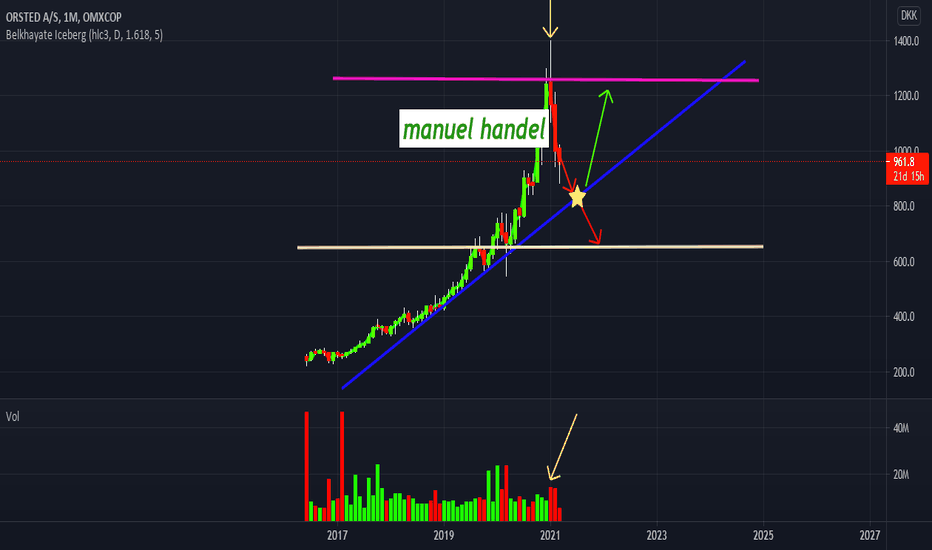

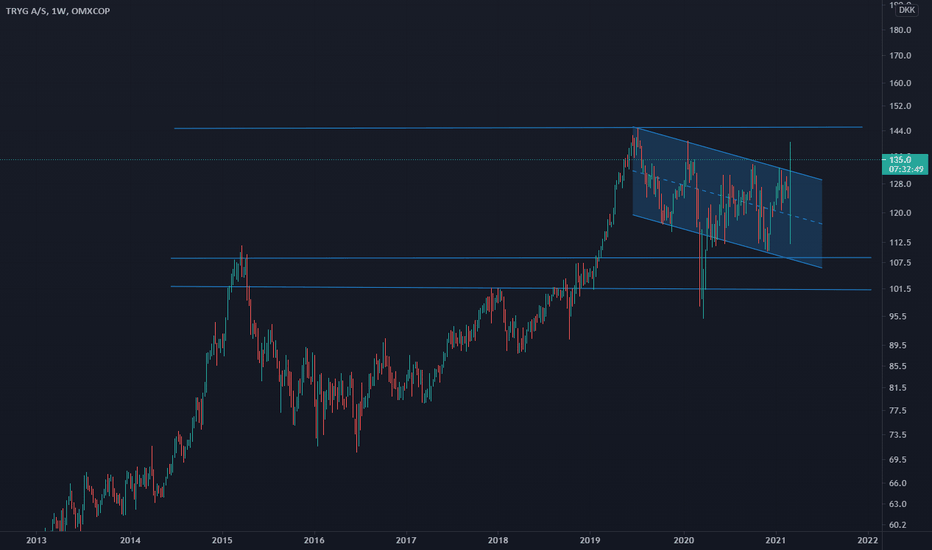

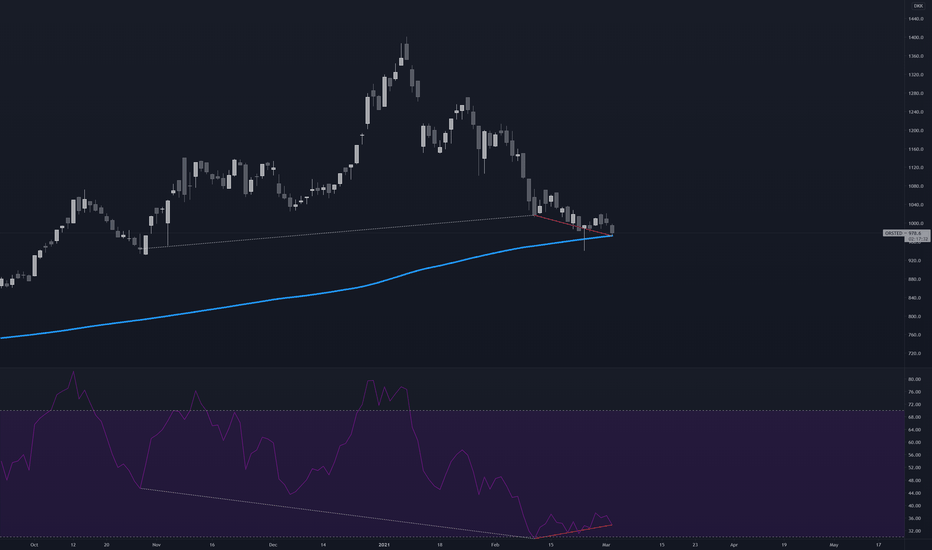

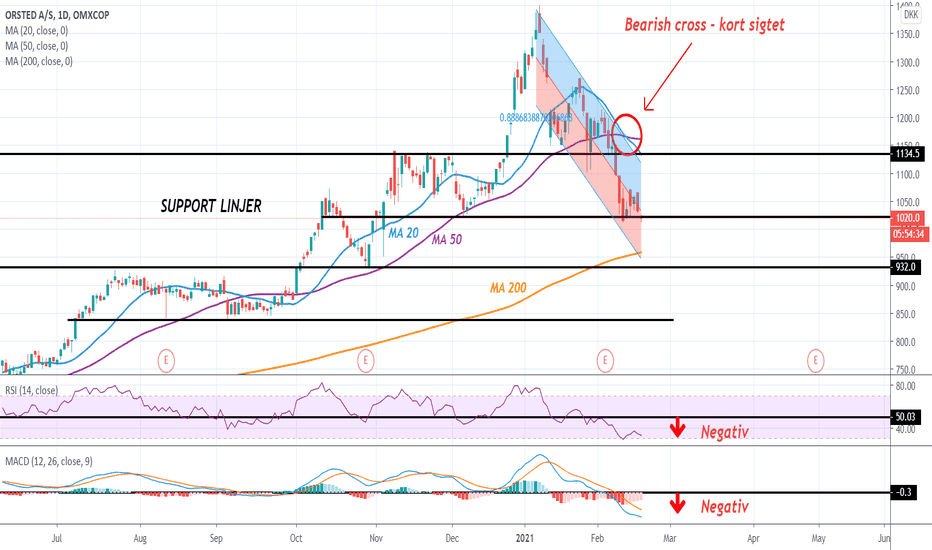

RSI showing a potential start for a bull runØrsted, is a safe bet when it comes to the long run, but it even has huge potential of a potential upcoming 50 to 80 percent of increase in the stock price till the end of the year.

The RSI is showing the same pattern as it did before the post-corona bull run it had, while having fallen a little more than the last year correction/crash.

But moving averages are still pretty neutral, though as seen on the chart; moving averages mostly showed positive signs a bit after the start of the bull run.

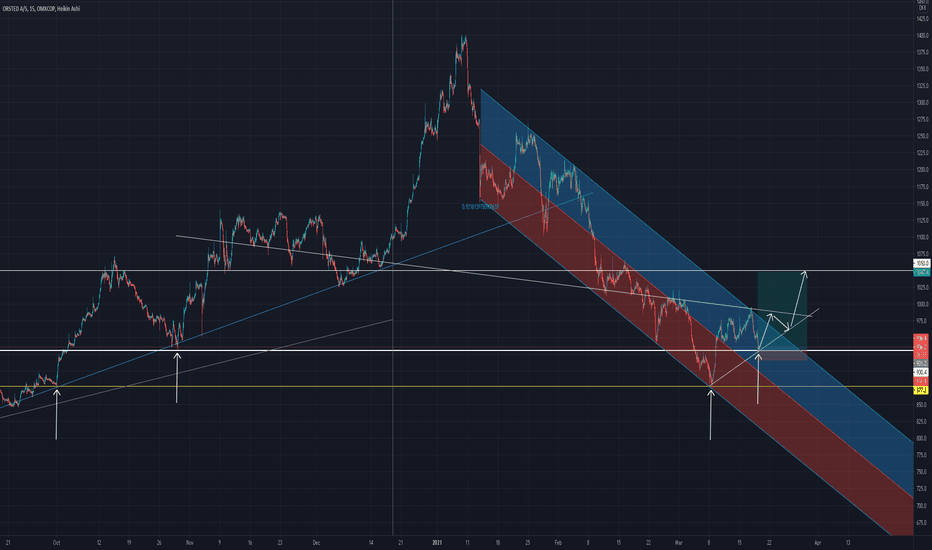

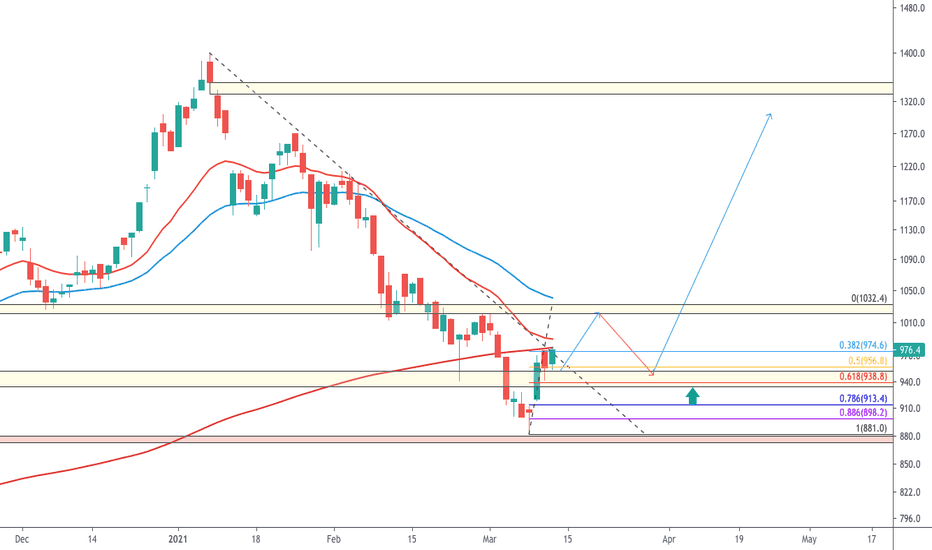

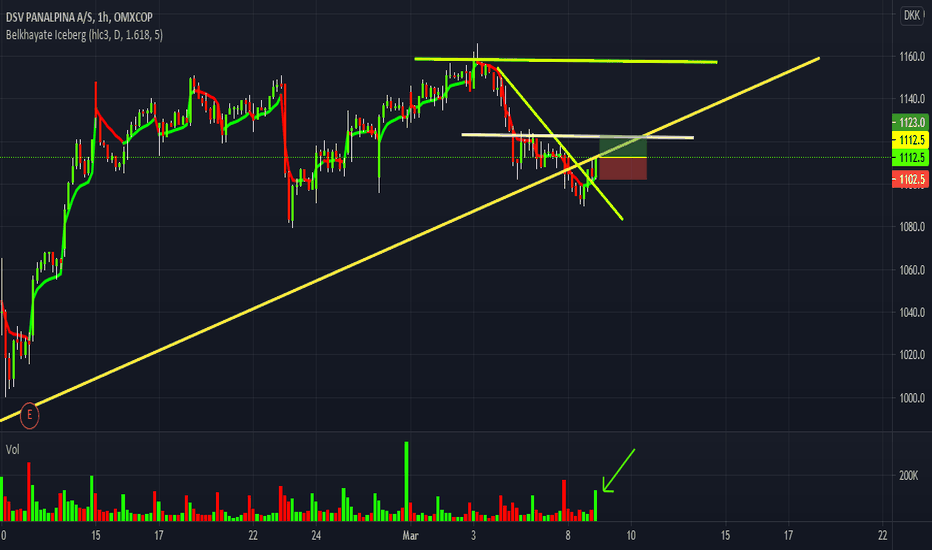

Orsted double divergence + 200 MA supportPretty simple stuff

Seems like a hidden bullish (continuation) divergence have played out, though it failed so far.

However, a regular divergence is also playing out atm, and could be supported by strong support on the Daily 200 SMA

Dividend registration day is today the 2nd of march, and will be paid out the 4th of march.

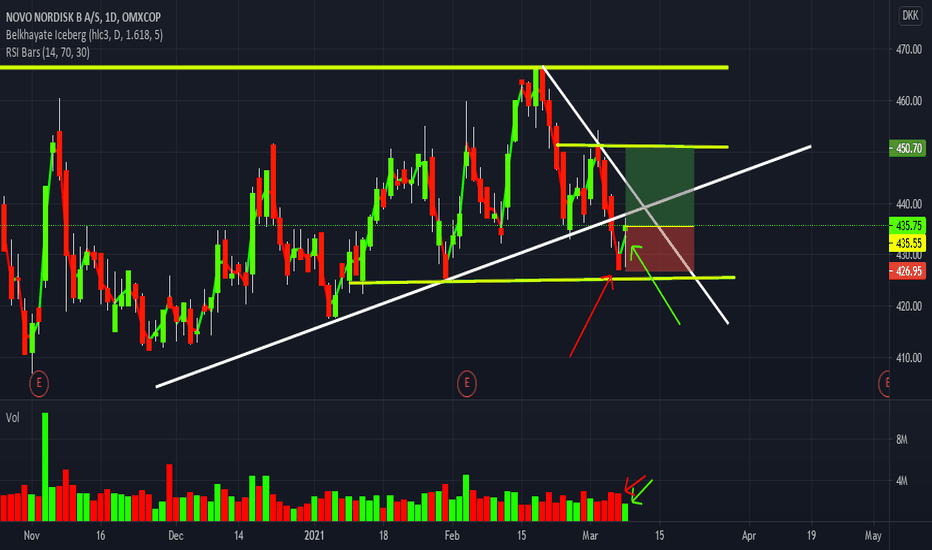

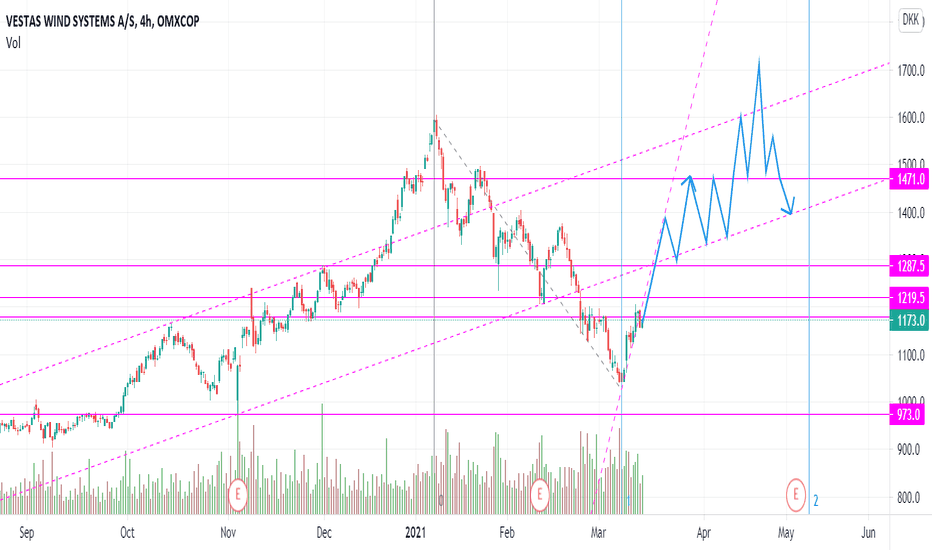

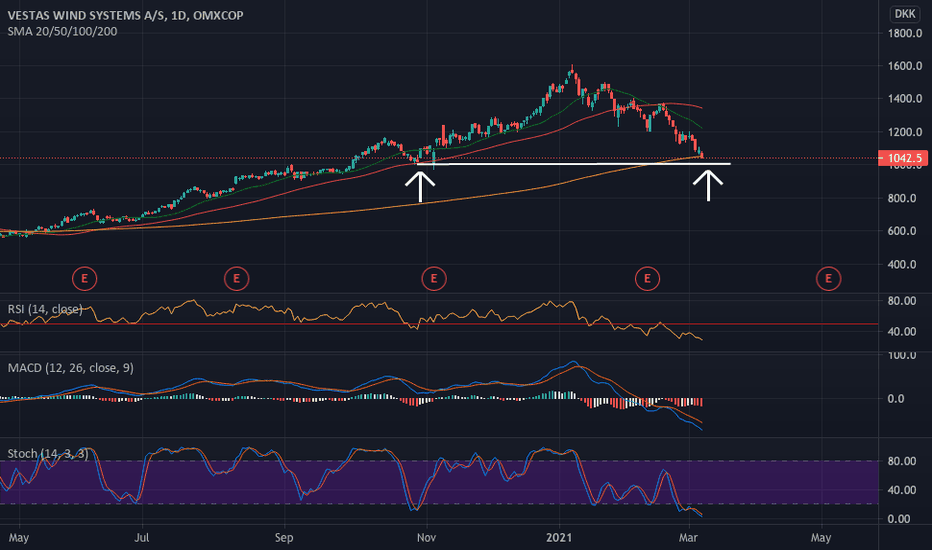

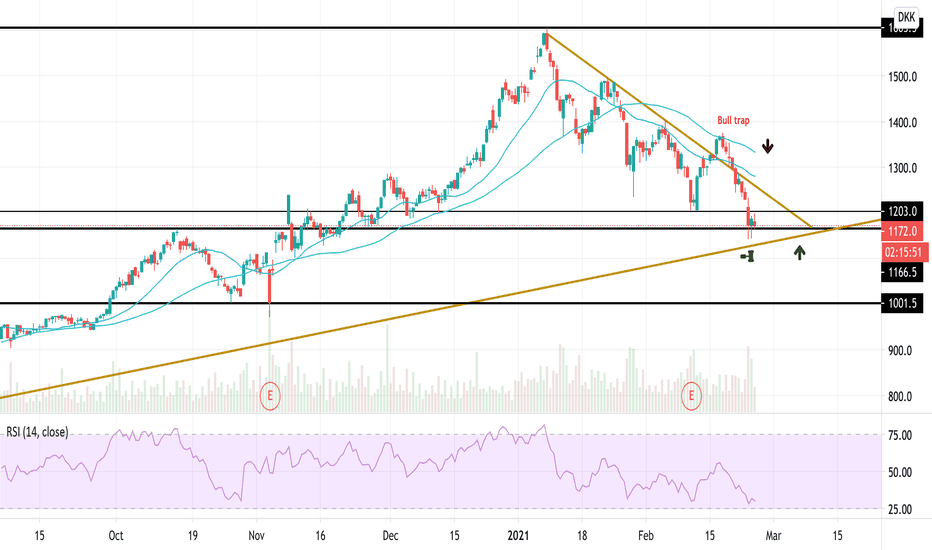

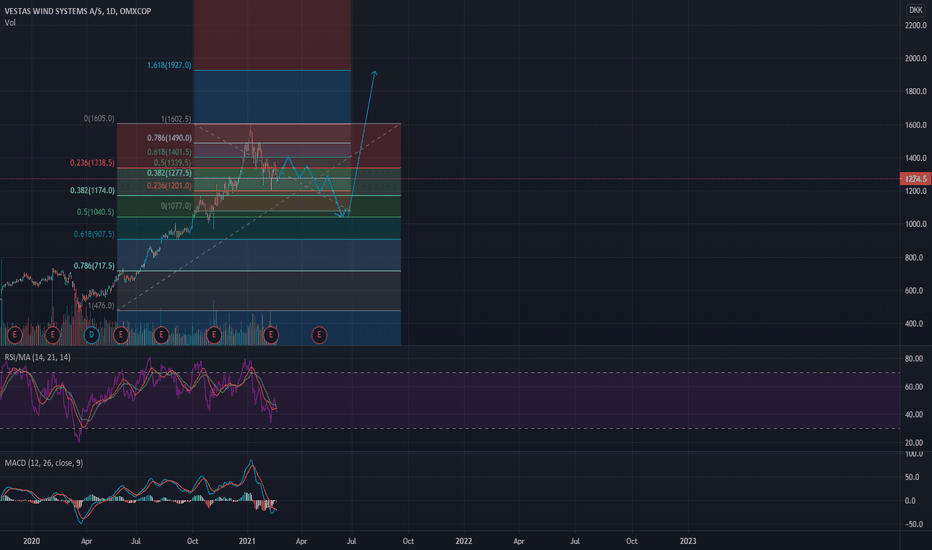

VWS | Correction complete?Hi all,

my previous chart on Vestas Wind Systems didn't quite go to plan. The stock price has just been ladderring down since it's 8th of January ATHs @1605 DKK, and I've gladly been picking up more shares on the cyclical troughs.

Now VWS is really looking for a turnaround. Some positives:

- We are finally sitting at a very strong support range @~1160 DKK, which is our first real support after this crashed through 1286 DKK;

- Price is approaching our long-term uptrend support, which hasn't failed since beginning in March 2020. If this support holds this could be a strong pop to the upside out of the multi-month Wedge formation;

- We can see what appears to be a Hammer candlestick in yesterday's close.

Some potential counterarguments to keep in mind:

- Moving Average positioning is significantly Bearish, and previous "breakout" proved to be a Bull trap, finding strong resistance on the 50-day Moving Average;

- There is a small gap which VWS might look to fill @~1100 DKK;

- RSI really need to improve, as it is currently at it's lowest in months but hasn't reached oversold territory, despite a ~27% drop from ATHs.

I already have a significant position in this name, would love to see this rally ~40% back to ATHs over the coming months - VWS sure is capable of it, and the company's push in offshore wind (which in my opinion will be a massive growth industry in the coming years) really gives me confidence in the Long Term.

Would love to hear your thoughts! OMXCOP:VWS

(*This is not financial advice, for sake of discussion and illustrative purposes only*)

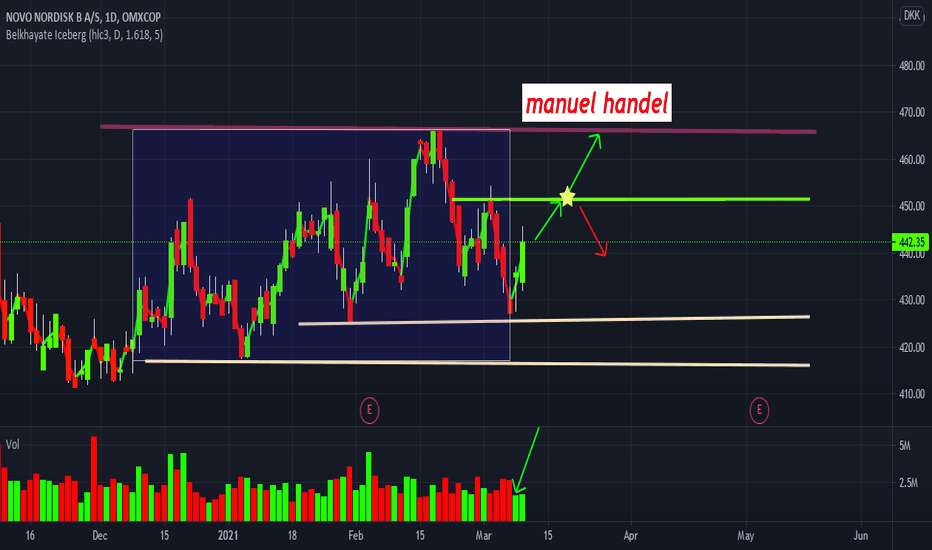

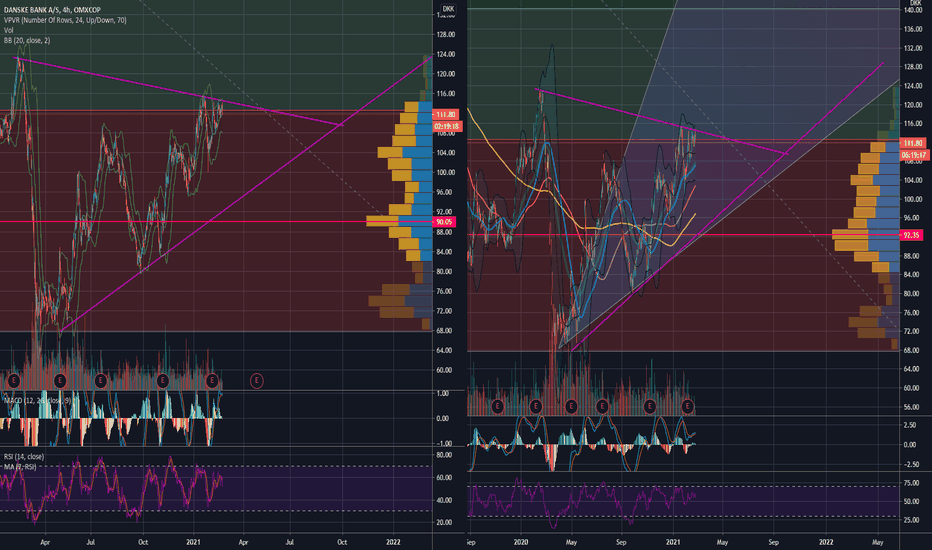

Symmetrical triangle DBA uptrend is ongoing and could result in a significant increase. The prime reason for our investment into DB is for the underlying value at 187,5 DKK.

The bank is trading at a low P/E for any C25 companies and as a bank it is as well trading beyond it's closest peers.

With a P/E at under 0,6 the company trades under bookvalue.

DISCLAIMER:

NB Holdings owns and trades this stock

This cannot be seen as financial advice.

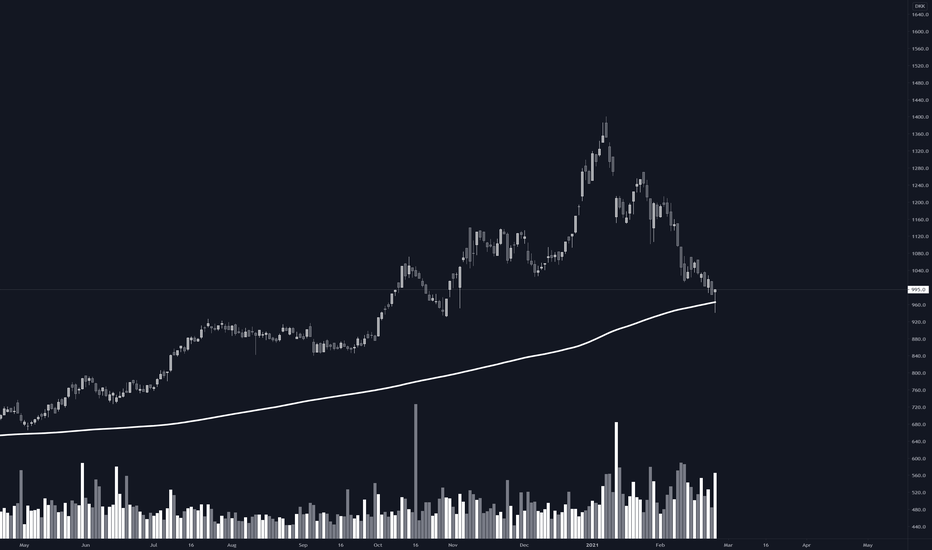

A wild guess. Its hard to to realize whats the future will bring for Vestas. For sure it will eventually hit 2000DKK but the question is when. Its not impossible to see it fall to 1000DKK due to high correction. before moving higher up. This setup is based on the Elliot waves that im not so into. and it have started correction up. This prediction is a mix of optimitic and pessimistic.

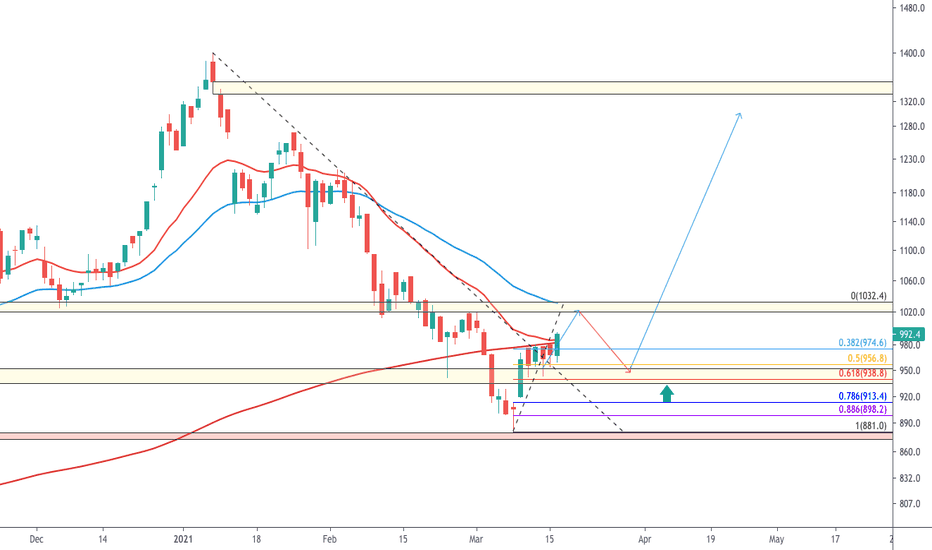

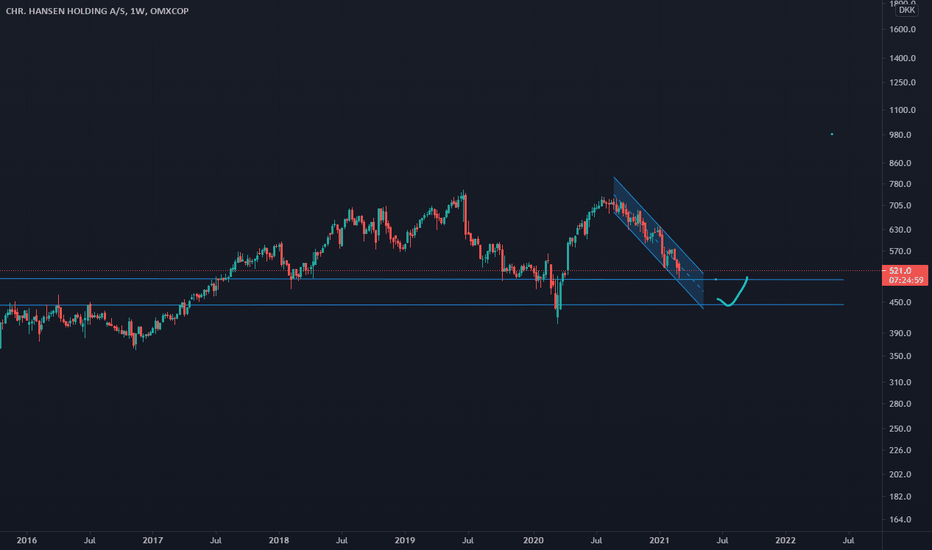

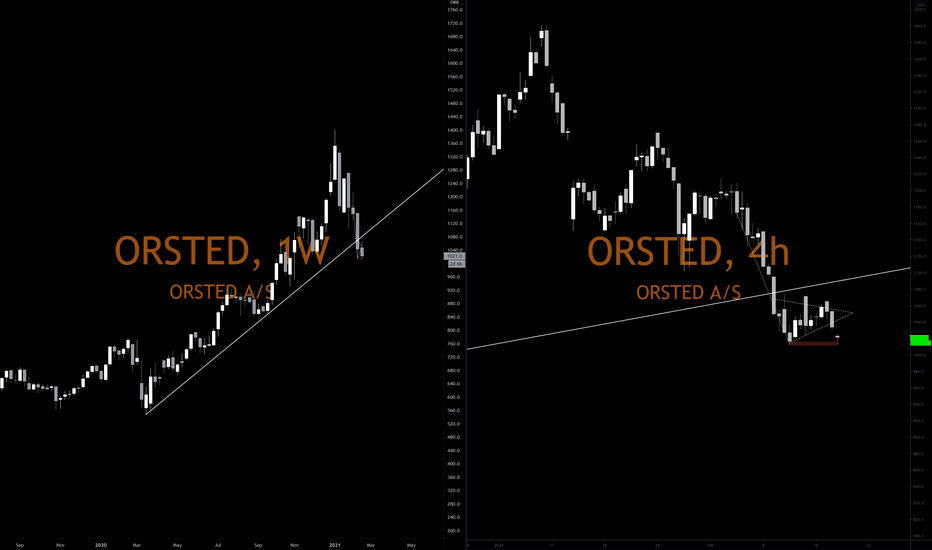

Orsted possible V-bottomSince my last update, Orsted has been sitting just under the Support at the High Volume Node, and also been shaping what seems to be a double bottom on the 4-hour chart. On a bit longer term it also shaped a bearflag/bearpennant, which should be rejected due to higher time frame trend such a's long term EMA's & RSI.

Currently a hammer-candle is present on the 4-hour chart, with its lower wick touching the excact bottom in the double bottom. Due to the extra consolidation time since last update, I'll remain long in Orsted untill just sub-1400 DKK, as long as this double bottom holds.