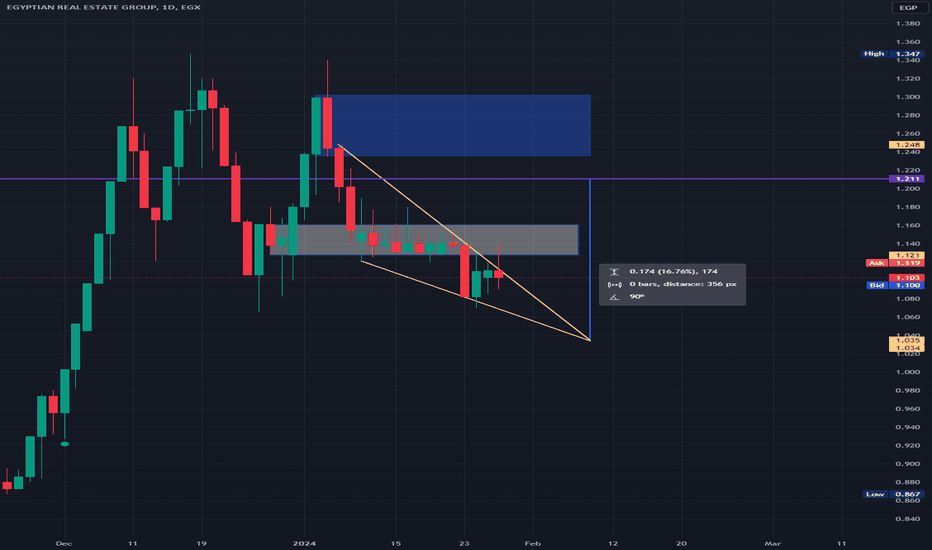

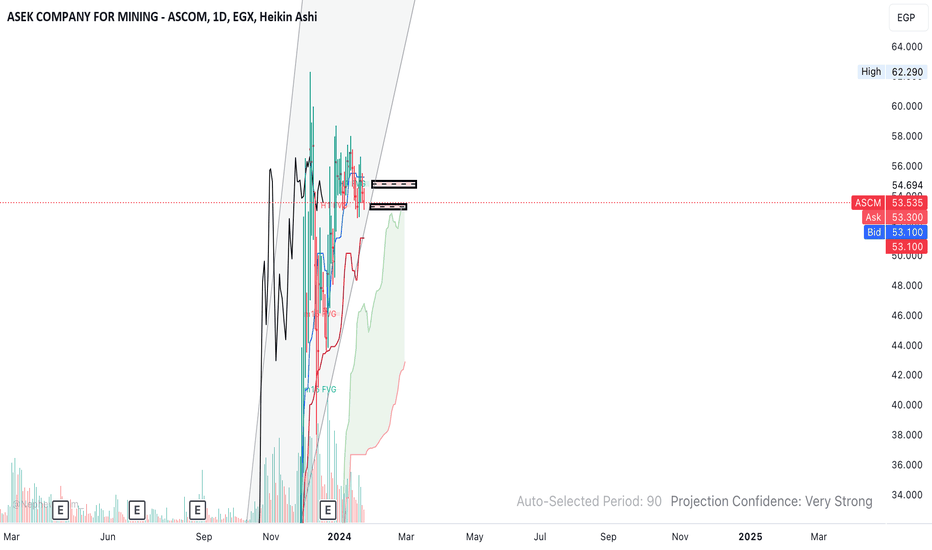

ATLAS (AIFI) should target 0.875 after stabilizing above 0.545Weekly chart, the stock is trading in the rising channel, and should cross the Pennant pattern Resistance at around 0.543

Stabilizing above 0.545 for one week with high volume, will push the price to target 0.875

Stop loss (SL) line should be considered for the rising stop loss level.

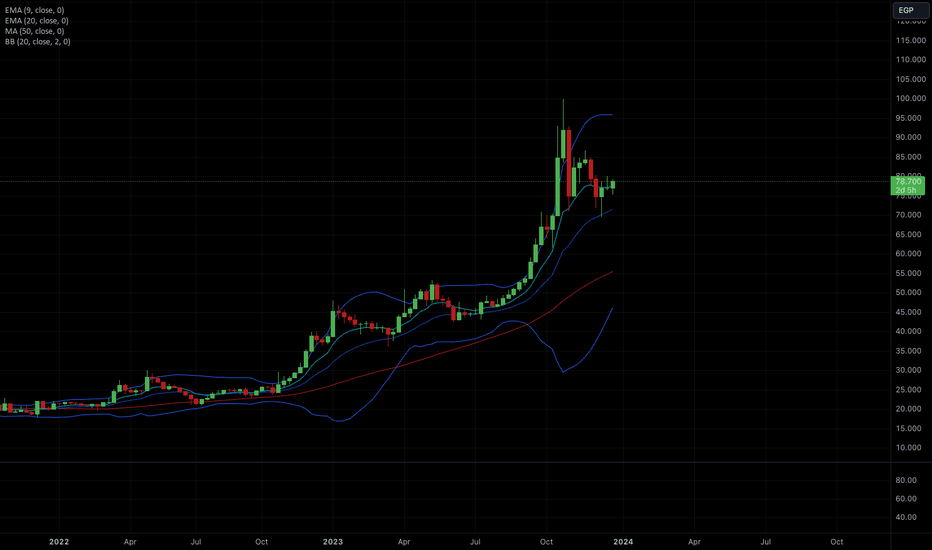

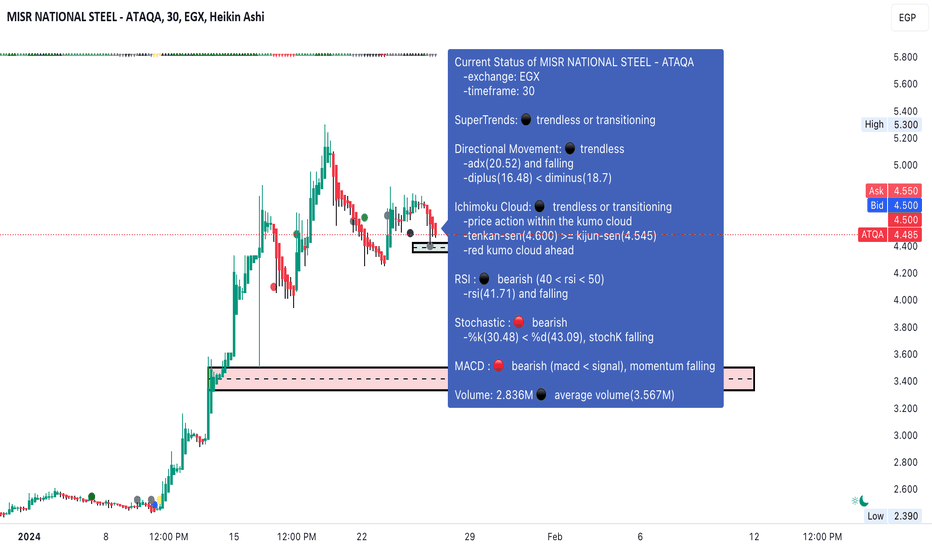

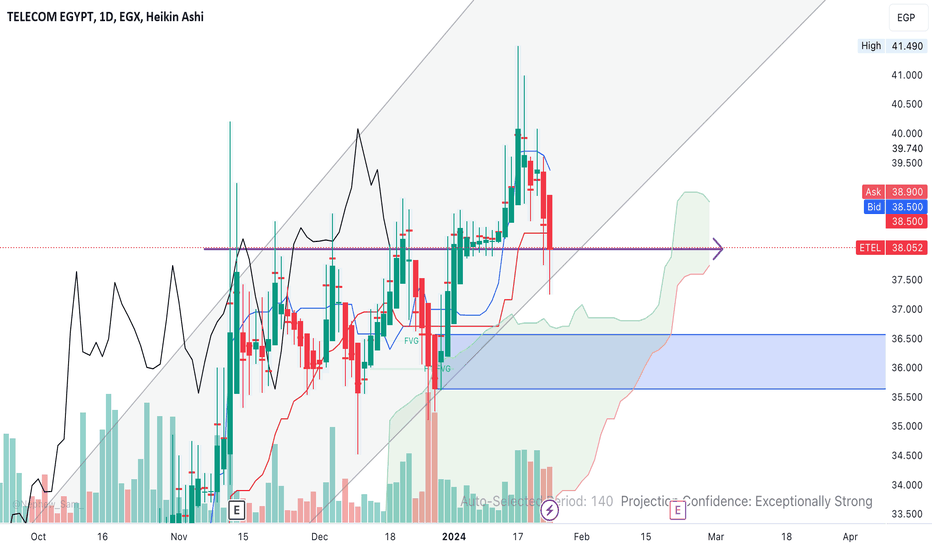

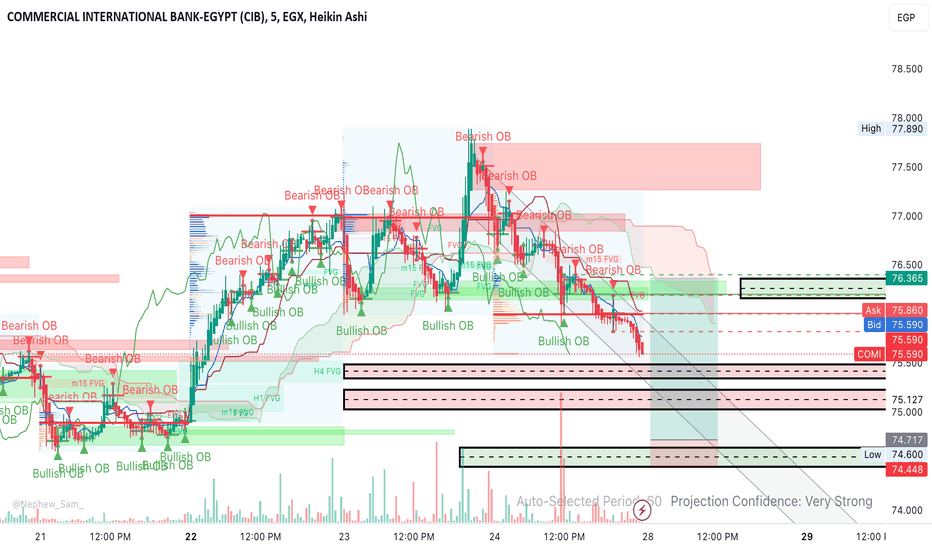

there is an opportunity for trading next week, let's pass ....The demonstrated concept is based on FVG, Order Block, and Ichimoku Kinko Hyo. The narrative is in Arabic, and channeled toward Arabic speaking trader in CASE.

Disclaimer: this is not an investment proposal; if you want to invest consult your investment/wealth manager.

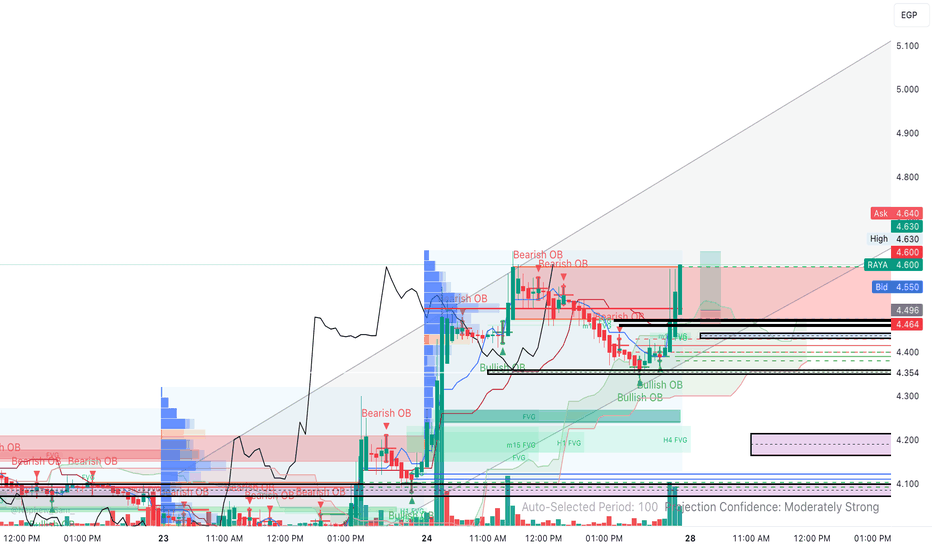

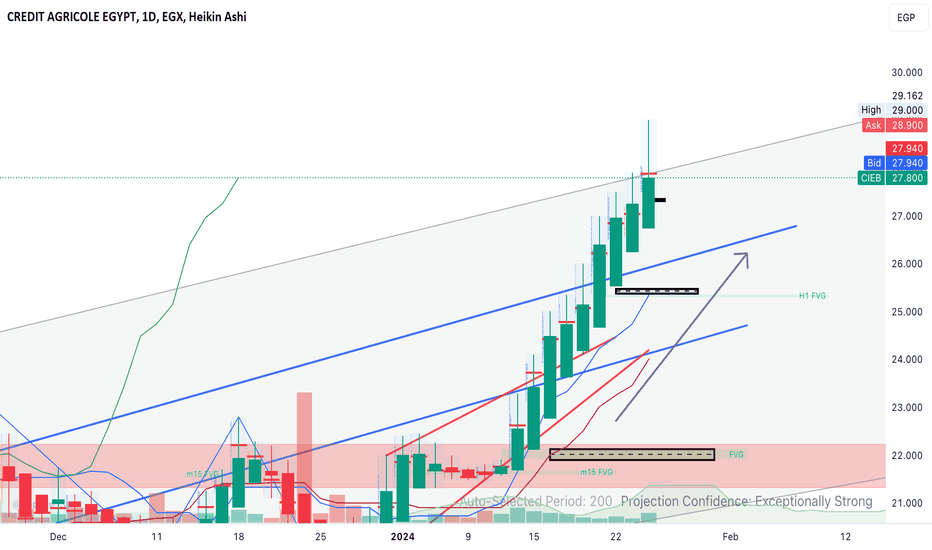

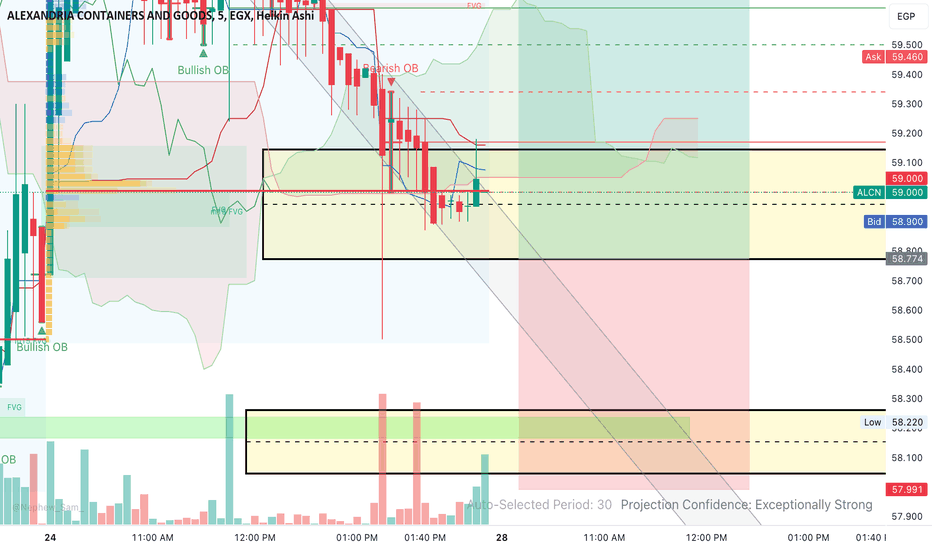

Great Opportunity ---- Sunday 28th Jan 24The demonstrated concept is based on FVG, Order Block, and Ichimoku Kinko Hyo. The narrative is in Arabic, and channeled toward Arabic speaking trader in CASE.

Disclaimer: this is not an investment proposal; if you want to invest consult your investment/wealth manager.

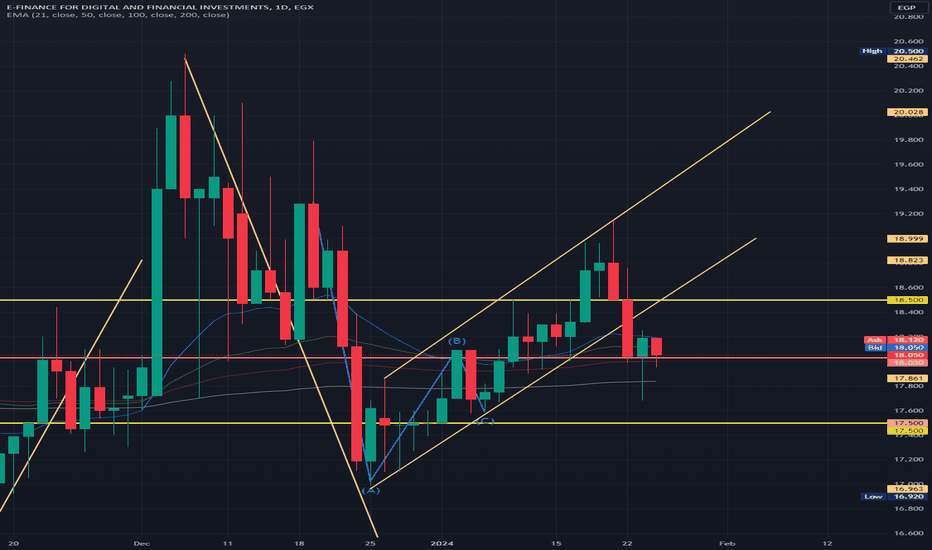

Let's wait & confirm our decision on Sunday 1-28-24 he demonstrated concept is based on FVG, Order Block, and Ichimoku Kinko Hyo. The narrative is in Arabic, and channeled toward Arabic speaking trader in CASE.

Disclaimer: this is not an investment proposal; if you want to invest consult your investment/wealth manager.

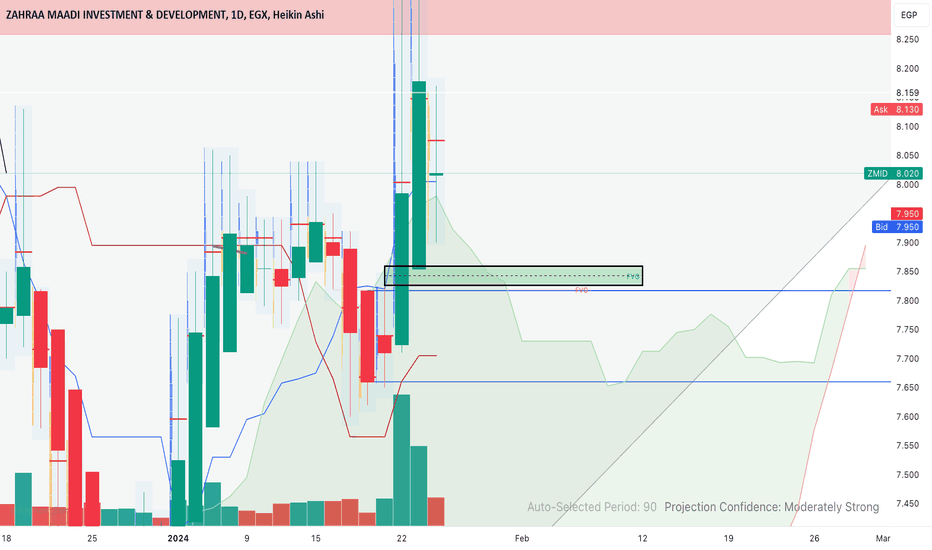

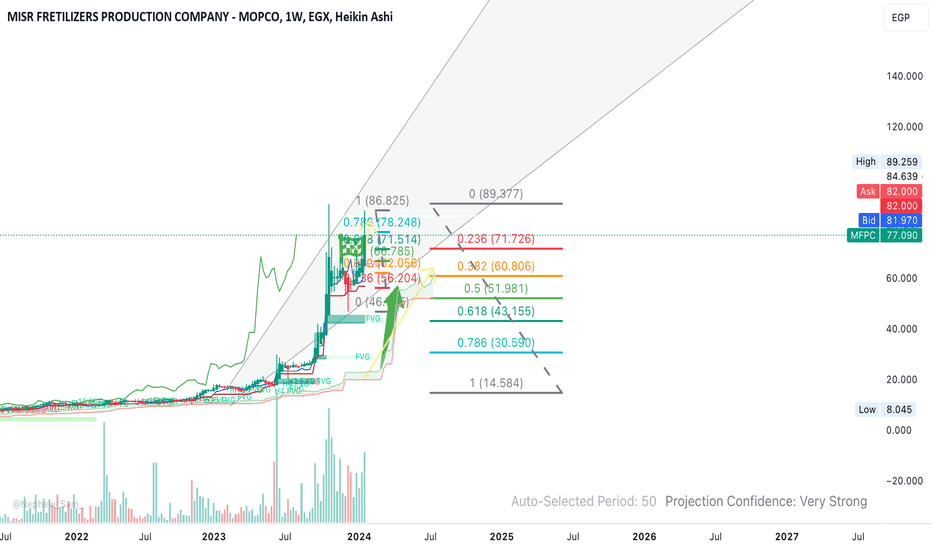

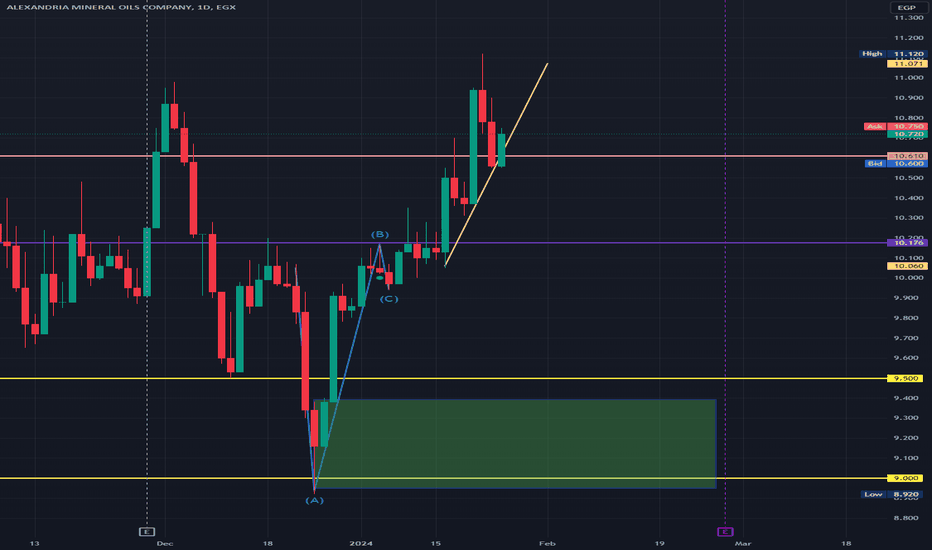

Sunday 28th of January - Smart Money outlookThe demonstrated concept is based on FVG, Order Block, and Ichimoku Kinko Hyo. The narrative is in Arabic, and channeled toward Arabic speaking trader in CASE.

Disclaimer: this is not an investment proposal; if you want to invest consult your investment/wealth manager.

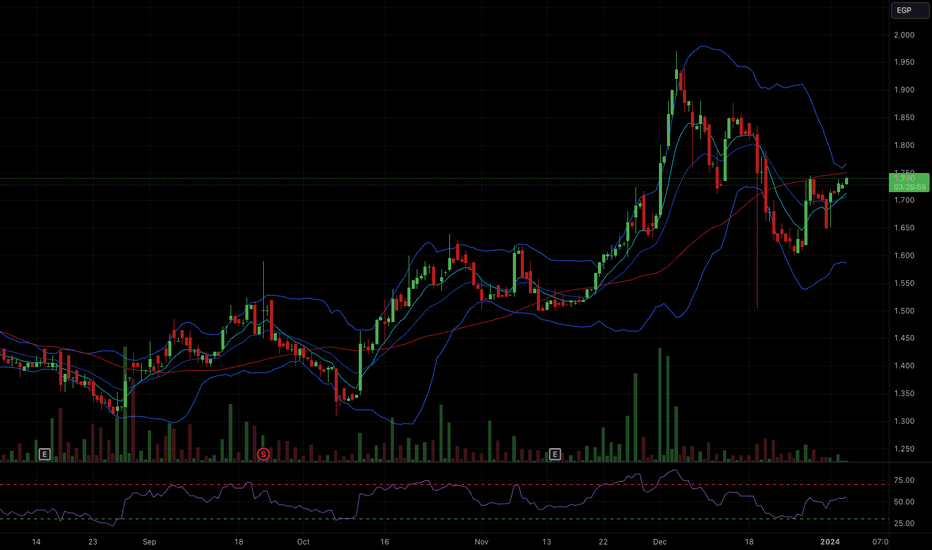

Intraday trading opportunity ALCN is listed on CASE. ALCN is currently consolidating even though it is forward trending. Combining SMART MONEY CONCEPT, FVG, and Ichimoku Kinko Hyo outlined a potential intraday trading opportunity as well as medium term.

The video narrative is in Arabic language channeled toward Arabic speakers CASE traders.

Disclaimer: this is not an investing proposal but a forward thinking analysis that might be right based on the market dynamics.

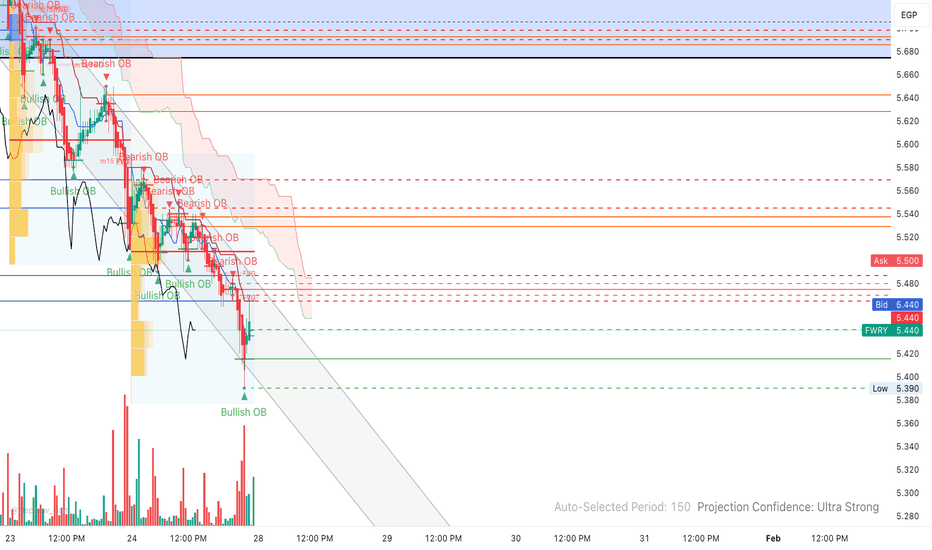

Commercial International Bank (COMI) opportunity Seizing intraday opportunity based on Smart Money Integrated with Ichimoku Kinko Hyo + FVG.

The narrative is channeled toward Arabic speakers trading in CASE.

Disclaimer: My analysis is not an investment proposal; Please consult your Investment Advisor and/or your Wealth Manager for your investment decisions.

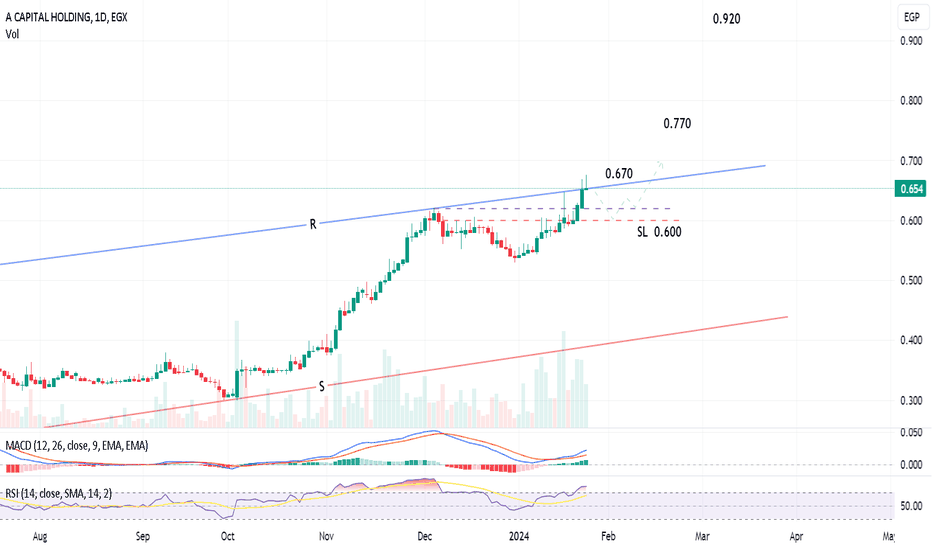

ACAP is preparing to cross the Resistance line RDaily chart, the stock is trying to beat the Resistance line R.

Some correction may happen between 0.618 - 0.600 and rebound afterwards to test the Resistance line R.

Above Resistance line R (crossing at around 0.670), the target will be 0.770 then 0.920

Stop loss below 0.600 should be considered.