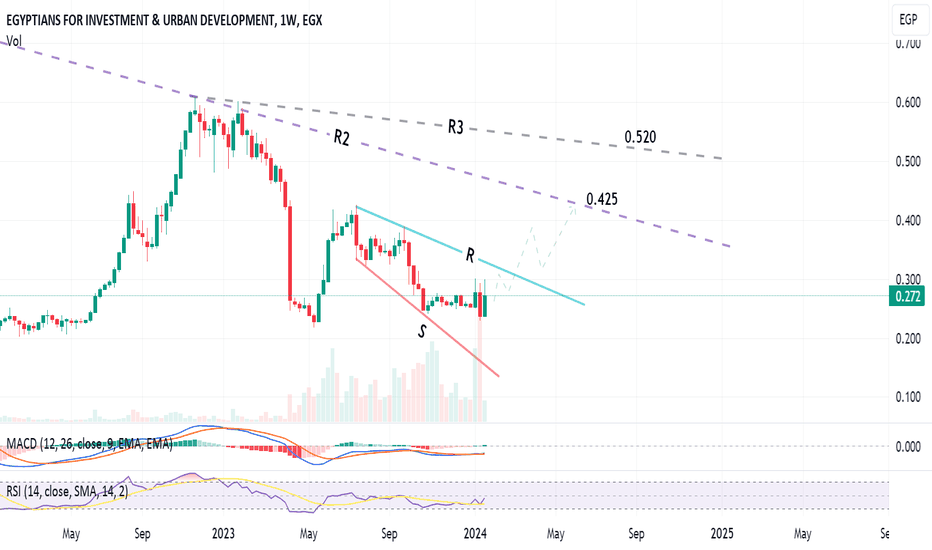

EIUD should target 0.425 after beating Resistance (R)Weekly chart, trading in a falling expanding wedge, high probability to target the Resistance line (R), then cross upwards.

Above Resistance (around 0.308), the target will be 0.425

Above R2 targets R3 (around 0.520)

Raise the profit protection level as the price goes up.. Below 0.230 stop loss

** Be careful with this stock - as it has up and down sudden sprints!

AIFI should target 0.585 after crossing Resistance30-min chart, the stock is trading in a falling wedge.

After crossing up, the target is hitting the resistance line (R) upwards.

After crossing at around 0.520, the target will be 0.585 passing through some resistance levels as shown.

Below 0.503 (support line S) stop loss

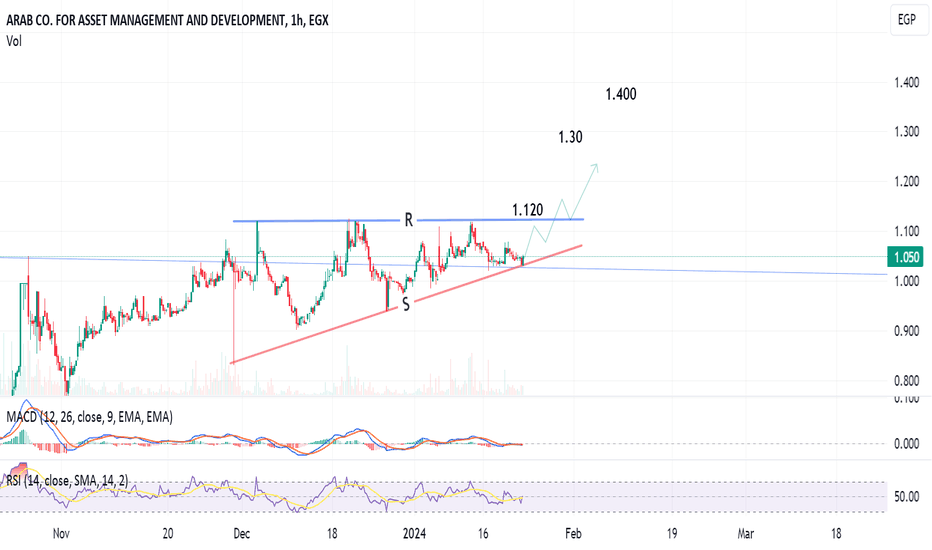

AMIA should target 2.99 then 3.52Daily chart, the stock made a nice breakout to the rising channel, the target is 2.99, then 3.52

However, as the technical indicator RSI is in the over-bought zone, there may be a correction before continuing upwards.

Profit protection level should be dynamically considered as the stock price goes up.

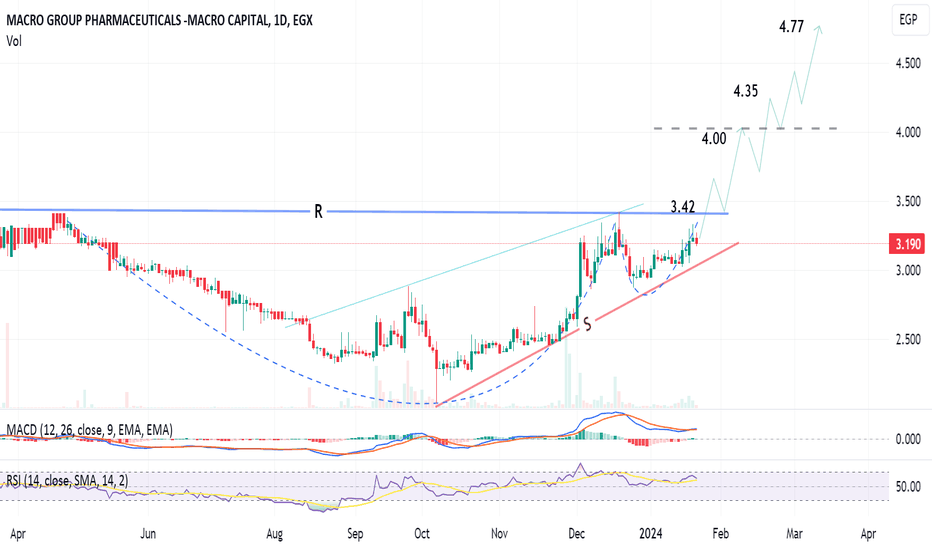

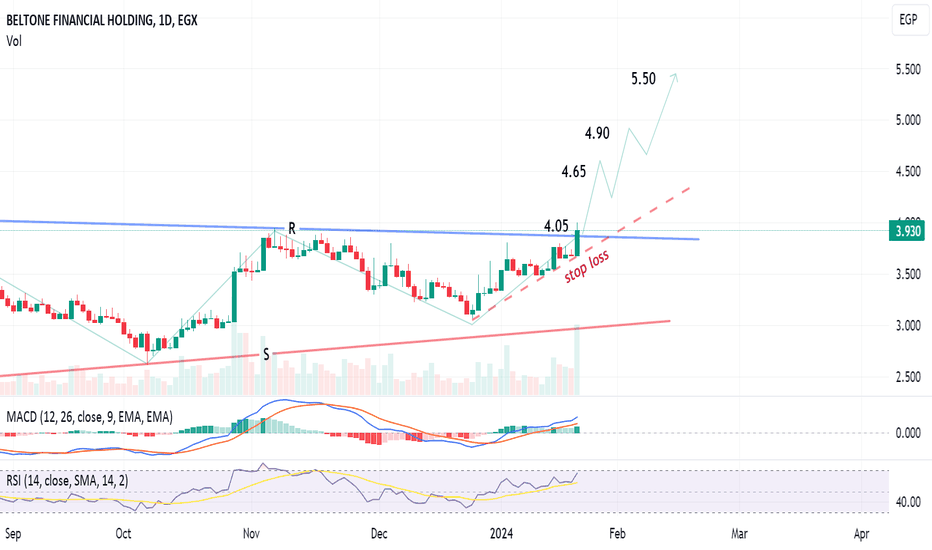

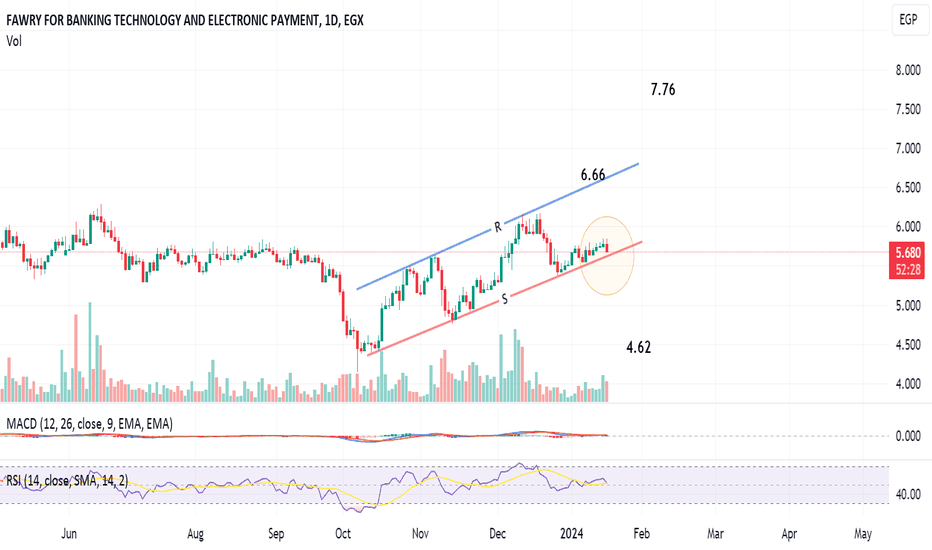

Beltone (BTFH) should target 5.5 after confirming breakoutDaily chart, the pattern triangle was formed. Closing above 4.05 will confirm the target 5.50

Technical indicator MACD is positive. RSI is getting near over-bought; pushing for correction!

So, be careful and ready with a dynamic (quick) stop loss

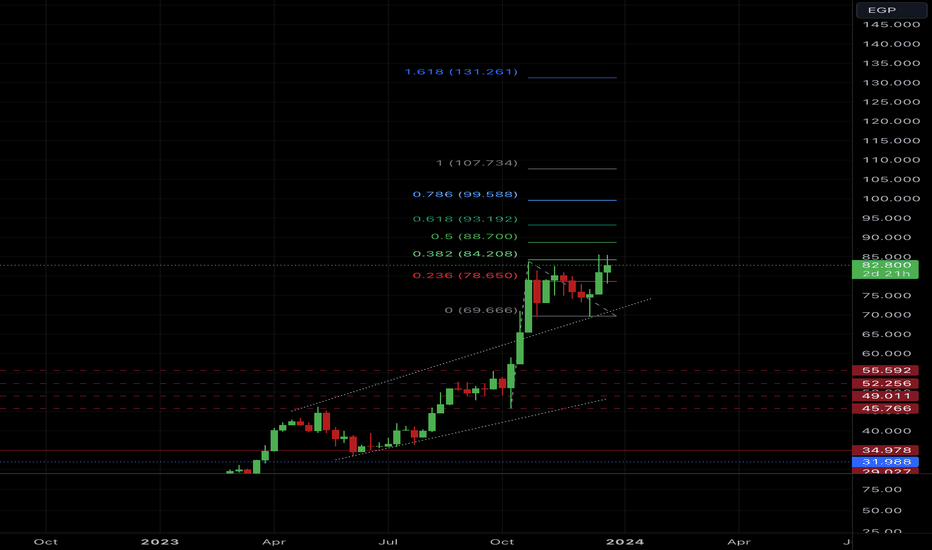

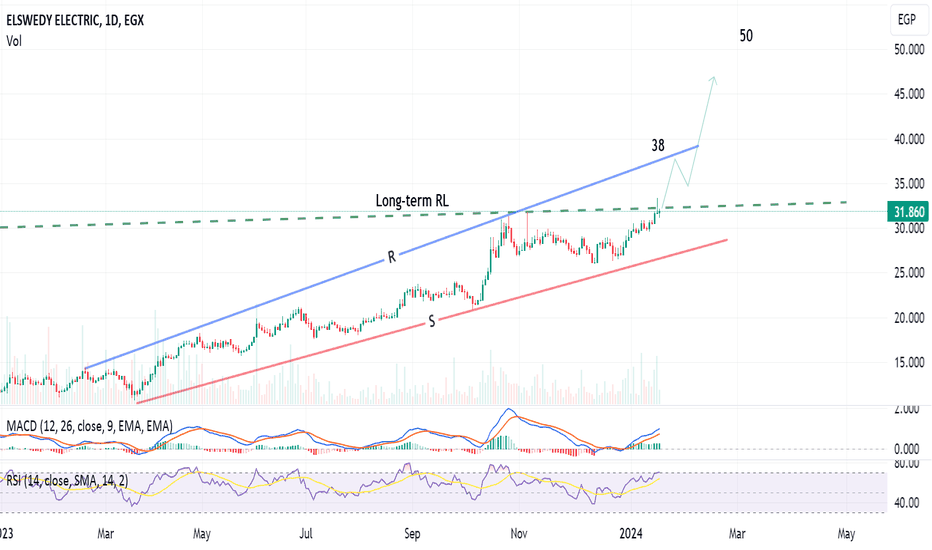

ElSwedy Electric (SWDY) should target 38 then 50 and 55Daily chart, the stock is trading in a rising widening wedge, and has a tendency to cross the long term Resistance line (RL) at around 32.7, then the target will be 38.

Above the resistance line R1, the target will be 50 - (then 55 on the weekly time-frame)

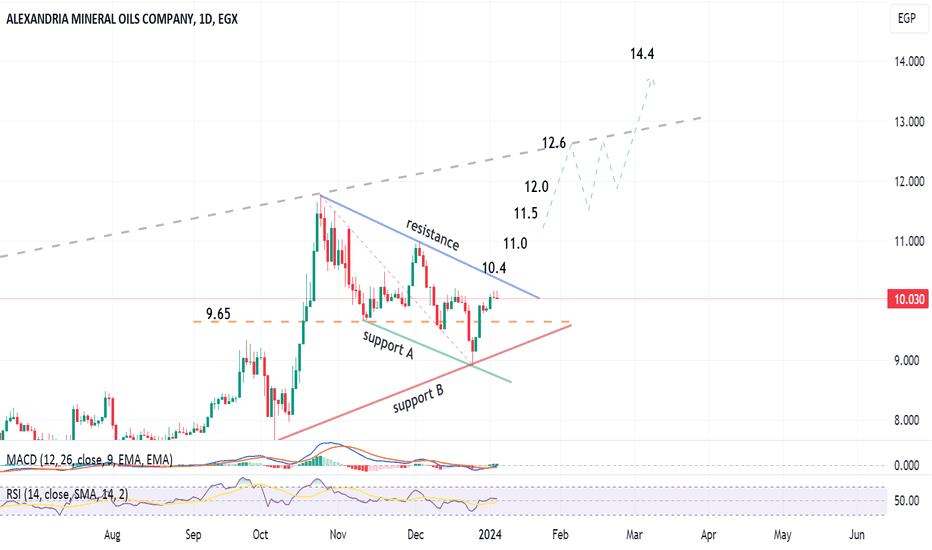

AMOC to target 14.4 after crossing resistanceDaily chart, AMOC is trading in a descending channel, and it seems a chart pattern will be formed - a flag / inside a triangle.

After crossing the resistance (at 10.35 - 10.4), the target will be 12 and 12.6 , then some correction may happen at 12.6 before reaching the target 14.4

Stop loss below 9.6 to be considered.

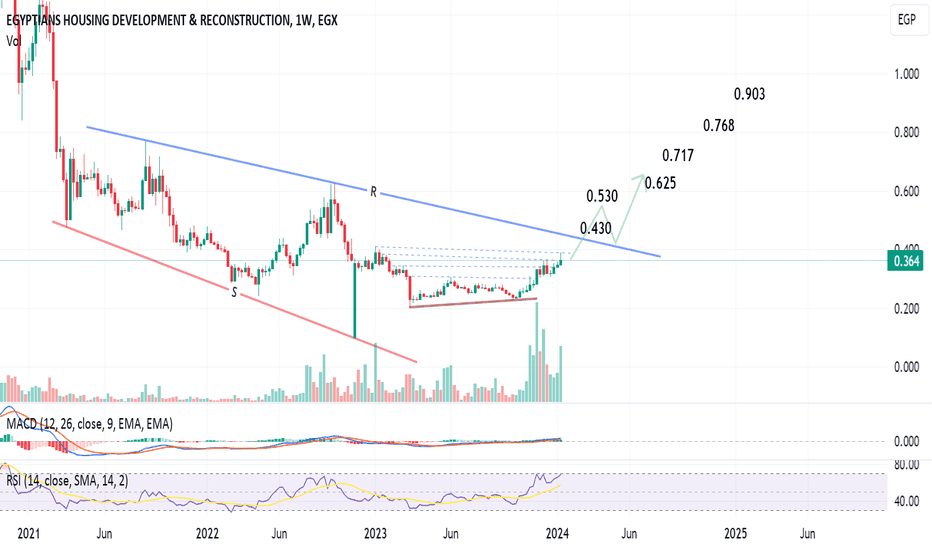

EHDR should target 0.450, then 0.625Weekly chart, the stock is trading in a falling expanding triangle, with a tendency to cross the resistance line.

After crossing at around 0.430, the target will be 0.530, then zigzag upwards up to 0.903 passing through the shown resistance levels.

Technical indicators RSI and MACD are positive.

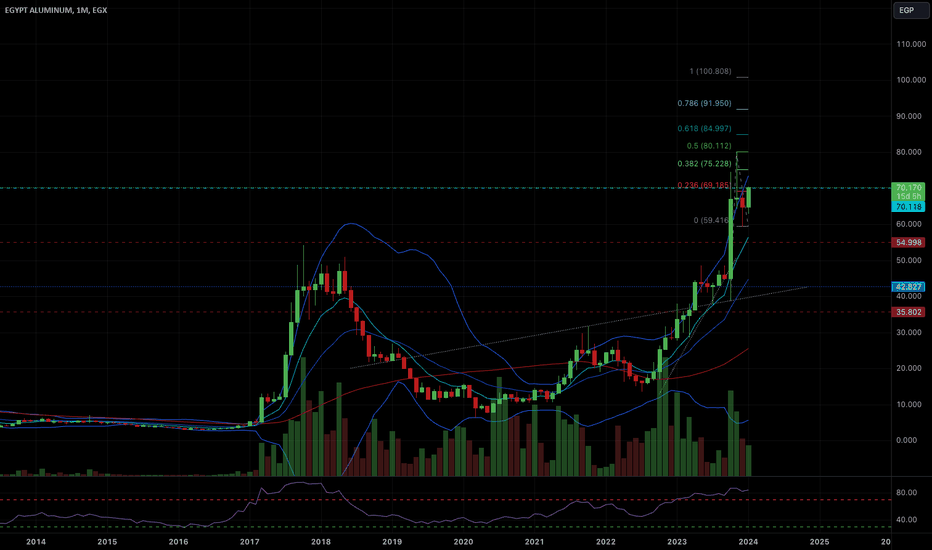

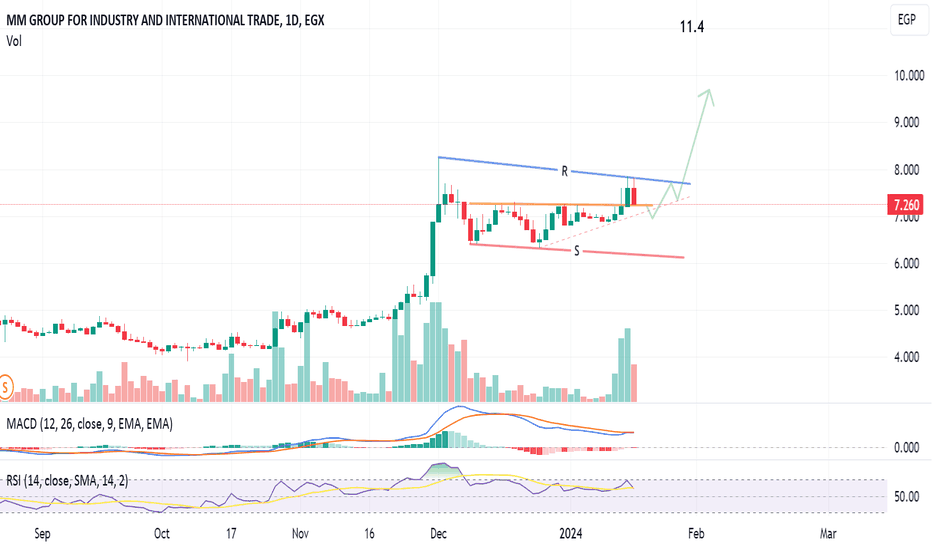

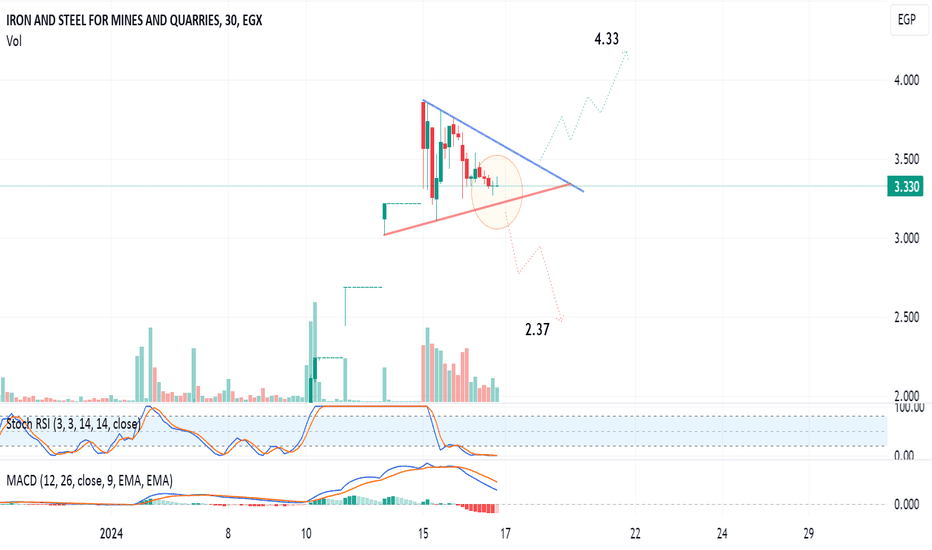

ISMQ, Egypt, is on a critical price level !30-min chart,

I chose this "little" time-frame to see intra-day sentiments. This is not for opening new positions. Be careful!

Higher probability for testing the support (red) line, then rebound upwards; as the technical indicator Stochastic RSI is 0, and the volume is decreasing with price decrease.

After crossing the resistance (blue) line, the target will be 4.33

But below support, it is 2.37

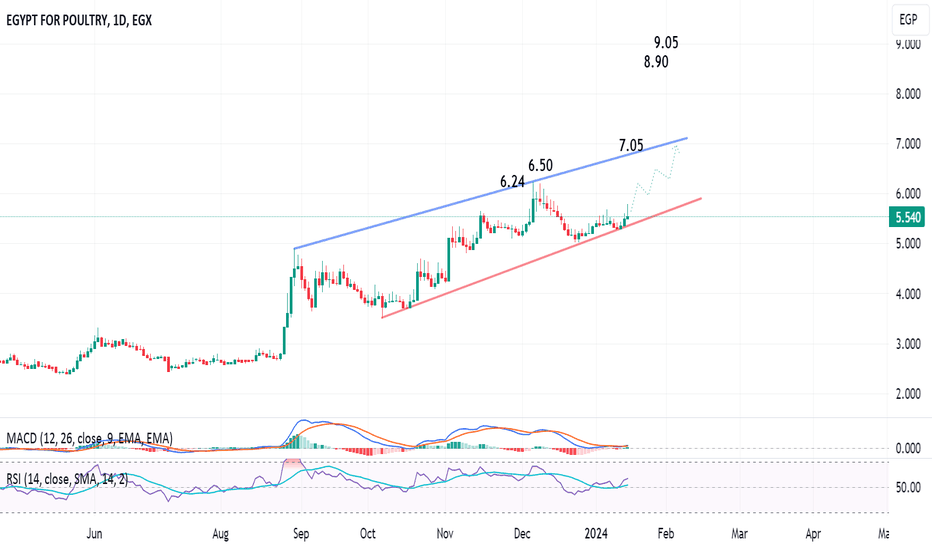

Egyptian Poultry should target 7.05, (then 8.90 after crossing)Daily chart, the stock (EPCO) is trading in a rising wedge, and the technical indicators RSI and MACD are reflecting a tendency to complete upwards to the resistance line (blue) - around 7.05

After crossing the resistance line up, the target will be 8.90 extending to 9.05

SPMD should rebound and target 0.655 after beating resistance1-hour chart, the stock (Speed Medical, Egypt) is trading in a falling expanding wedge pattern, and is getting into technical indicator RSI buy area.

The Ichimoku chart signals a change to up-movement.

So, the higher probability is a rebound to the resistance line. After crossing up, the target will be 0.655