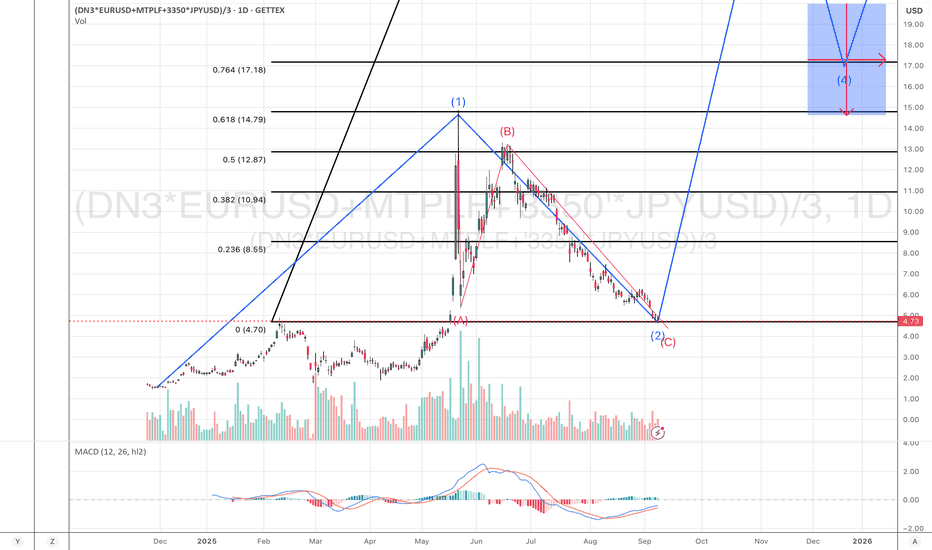

NVIDIA Testing Downtrend — Breakout Could Unlock UpsideNVIDIA has been trading in a corrective downtrend after its recent highs, with price compressing under the red trendline. If this downtrend breaks, a strong bullish move upward could follow, but key supports below remain critical if sellers extend pressure.

🔍 Technical Analysis

Current price: 143.04 EUR (XETR).

Price is consolidating under the downtrend line, keeping short-term bias cautious.

Immediate supports: 141.40 (short-term) and 139.44 (intraday).

A break of the red trendline would flip momentum bullish.

🛡️ Support Zones & Stop-Loss (White Lines):

🟢 141.40 – Last 15m Support (High Risk)

Weak intraday defense.

Stop-loss: Below 139.44

🟠 130.84 – 4H Support (Good Entry)

Major demand zone.

Stop-loss: Below 128.2

⚪ 128.34 – Macro Base

Strong final floor if deeper correction plays out.

🔼 Resistance Levels:

🟥 Downtrend Line (Red)

The key resistance. A break above → signals bullish reversal.

Psychological resistance: 145.00

🧭 Outlook

Bullish Case: Break above trendline → upside momentum resumes, targeting 145+.

Bearish Case: Rejection under trendline + loss of 141.40 → opens path to 139.44 and 130.84.

Bias: Neutral to bullish — watching for a confirmed trendline breakout.

🌍 Fundamental Insight

NVIDIA’s latest earnings disappointed the market, with slowing revenue growth and concerns about sustainability of its AI-driven boom. Profit margins remain high, but weaker guidance has triggered selling pressure and fueled the current downtrend.

Bearish pressure: Revenue slowdown + post-earnings profit-taking.

Bullish support: Long-term AI leadership and strong market position keep investors interested on dips.

✅ Conclusion

NVIDIA is testing a critical downtrend line after weak earnings triggered a pullback. A confirmed breakout could reignite the bullish trend, but failure and a break below 141.40/139.44 opens the way toward deeper supports at 130.84.

⚠️ Disclaimer

This analysis is for educational purposes only and does not constitute financial, investment, or trading advice.

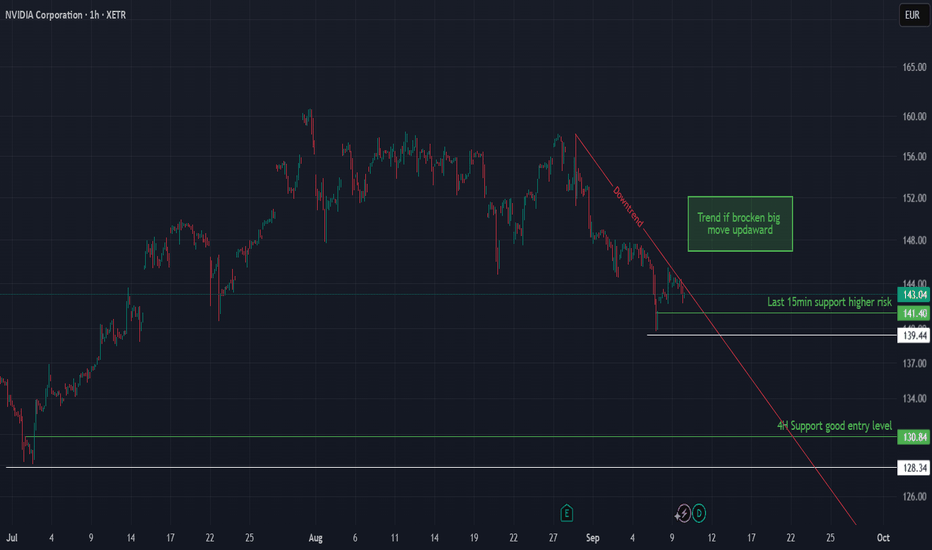

Cadeler’s Wind-Powered Surge - €2.5B Backlog to Fuel Growth Cadeler A/S (OB): Riding the Offshore Wind Wave

In a nutshell, what I see is a stock whose price declined by 33% from October 2024 to September 2025, despite the fact that the company is now in a much better position, with better ratios, much better revenue, and great value.

Company Overview

Cadeler A/S is a global leader in offshore wind farm installation and maintenance, primarily operating in European markets. Listed on Oslo Børs, the company operates a fleet of 4 jack-up vessels with 8 additional vessels in development, positioning itself to capitalize on Europe's aggressive renewable energy targets.

Market Opportunity

The offshore wind sector is experiencing a lot of growth. 2024 was a record year with 117 GW of new capacity installed globally. The Global Wind Energy Council forecasts 410 GW of new capacity by 2030, representing annual growth rates of 28% through 2029.

Europe's ambitious targets include 42.5% renewable energy by 2030 and 300 GW of offshore wind capacity by 2050, creating a massive addressable market for Cadeler's specialized services.

Financial Highlights

Strong Revenue Growth: Revenue doubled to €249M in 2024 from €109M in 2023, driven by successful project execution and the Eneti merger. Latest TTM revenue reached €465M (277.9% YoY growth). Q2 2025 revenue grew by 242%, but despite that, the stock price is trending down.

Record Backlog: Order backlog increased to €2.5B in 2024 from €1.7B in 2023, providing strong revenue visibility with key contracts including Baltica 2, Bałtyk 2/3 (Poland), US, and Taiwan 4.

Profitability Surge: EPS grew 409.5% YoY to €0.32 in Q2 2025, with a 3-year CAGR of 61.9%.

2025 Guidance: Management projects €485-525M revenue with €278-318M EBITDA.

Valuation Metrics

P/E Ratio: 6.7 (significantly compressed from the previous year)

P/B Ratio: 1.1 (37.1% decrease YoY)

Revenue CAGR (5-year): 87.6%

The combination of low valuation multiples and exceptional growth suggests potential undervaluation.

Key Risks

Project Execution: Permitting delays and cancellations (e.g., Hornsea 4 removal from backlog) can impact revenue visibility.

Cost Inflation: Rising turbine costs (+10% since 2021) and supply chain constraints could pressure margins.

Policy Dependency: Growth relies heavily on government subsidies and favorable renewable energy policies, creating regulatory risk.

My Investment Thesis

Cadeler is an opportunity in the rapidly expanding offshore wind installation market. They have a strong order backlog and prospective contracts, fleet expansion plans, and attractive valuation metrics; the company appears well-positioned to benefit from Europe's energy transition. I see it as a mix of value and growth investing.

I see Cadeler as a medium to long-term investment. I think the upside potential is anywhere between +50% and +100% from the current price.

I will allocate around 1% of my wealth into this stock.

Quick note: I'm just sharing my journey - not financial advice! 😊

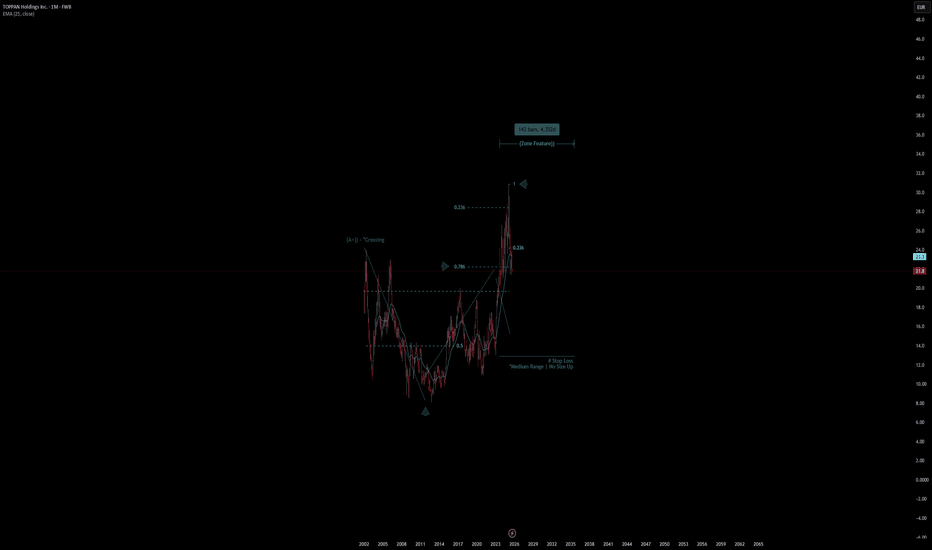

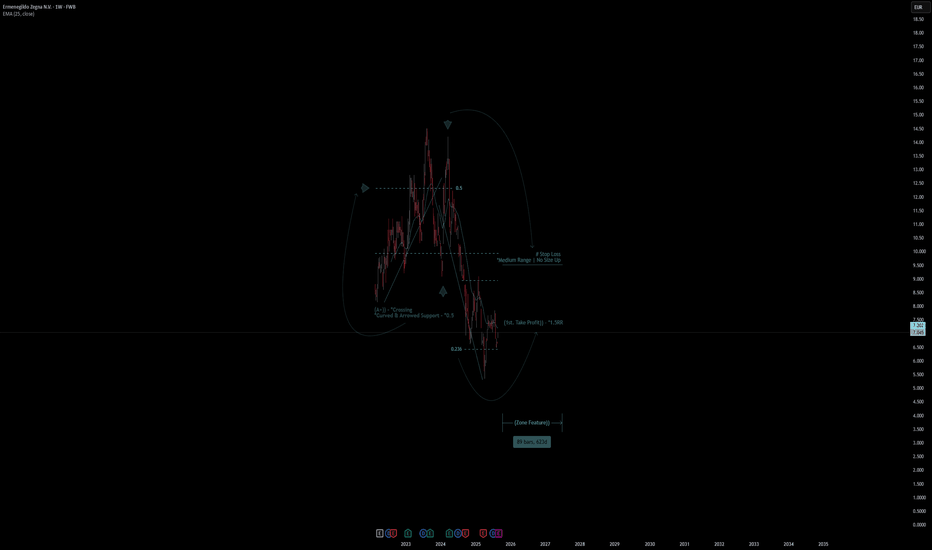

TOPPAN Holdings Inc. | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# TOPPAN Holdings Inc.

- Double Formation

* (A+)) - *Crossing - *25EMA - Short Entry | Subdivision 1

* Medium Range | No Size Up - *1.5RR | Completed Survey

* 143 bars, 4352d | Date Range Method - *Uptrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Monthly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Regular Settings

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 14.00 EUR

* Entry At 18.00 EUR

* Take Profit At 25.00 EUR

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

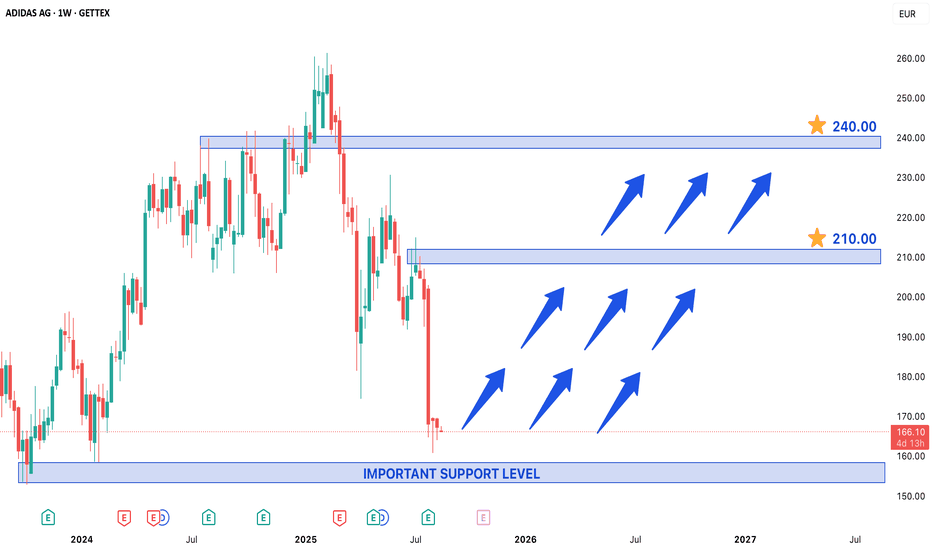

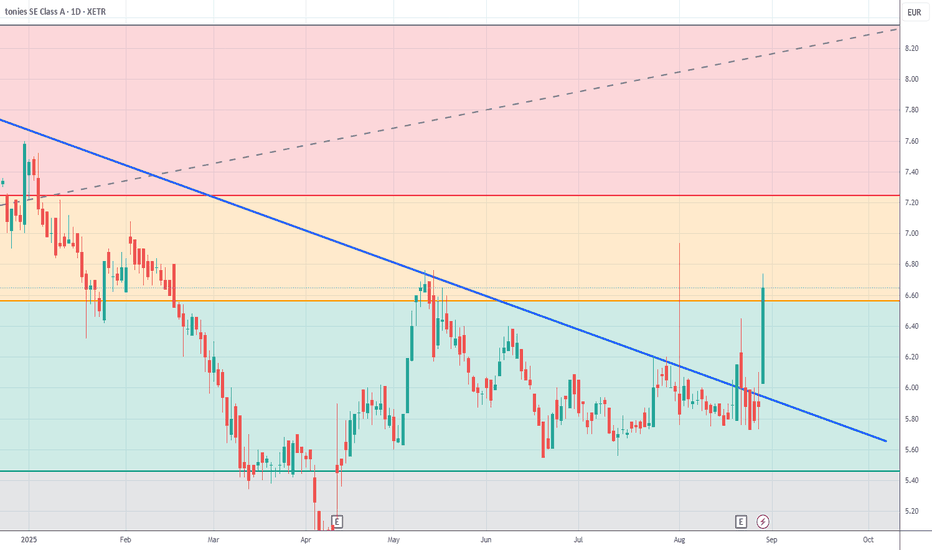

Adidas ADS Trading Near Important Support Level in Weekly ChartAdidas Stock Trading Near Important Support Level – A Potential Long-Term Entry Point

Adidas (ADS) stock is currently trading near a crucial support level, presenting a potential opportunity for long-term investors. Historically, this price level has acted as a strong base, with notable rejections observed in 2023 and 2024, indicating strong buying interest. Given the repeated bullish reactions from this zone, there is a high probability that the stock could resume its upward trajectory from here.

Price Outlook & Targets

If the support holds, Adidas stock could initiate a fresh bullish phase, with potential upside targets at 210.00 and 240.00. These levels represent key resistance zones where profit-taking or minor pullbacks may occur. Investors should monitor price action closely for confirmation of a sustained uptrend.

Risk Management Strategy

Before entering, a well-defined risk management plan is essential:

1. Stop-Loss Placement – Since the trade relies on the support level holding, a stop-loss should be placed below the recent swing low to limit downside risk.

2. Position Sizing – Allocate only a portion of the capital to avoid excessive exposure.

3. Trailing Stop for Profits – As the price moves toward 210.00, consider trailing the stop to lock in gains and protect against reversals.

4. Diversification – Avoid overconcentration in a single stock; balance the portfolio with other assets to mitigate sector-specific risks.

Conclusion

Adidas stock presents an attractive long-term opportunity near its historical support. However, disciplined risk management is crucial to navigate potential volatility. Investors should wait for confirmation of a bullish reversal before committing capital and adjust positions based on evolving market conditions.

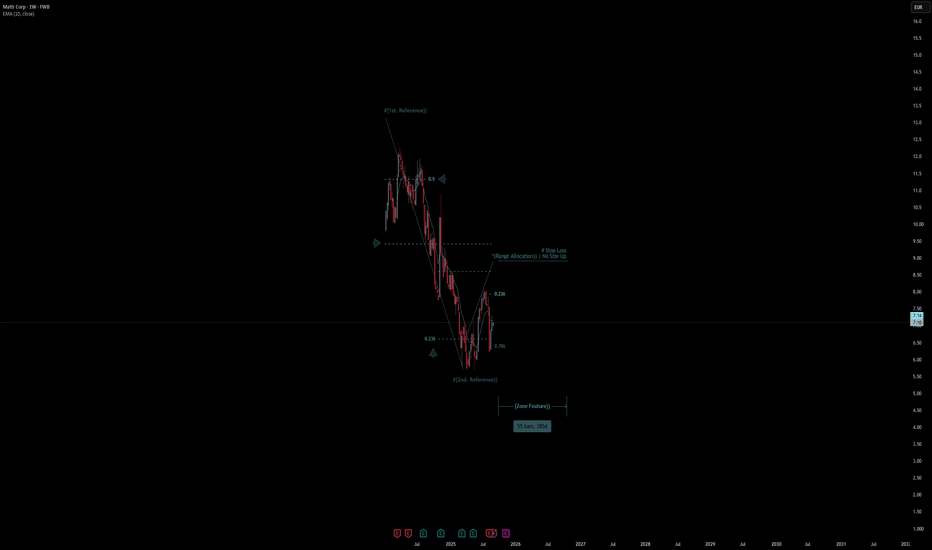

Mattr Corp Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# Mattr Corp

- Double Formation

* (1st. Reference)) - *10EMA - Short Entry | Subdivision 1

* (Range Allocation)) | No Size Up - *1.5RR | Completed Survey

* 55 bars, 385d | Date Range Method - *Downtrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Weekly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Regular Settings

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 9.00 USD

* Entry At 7.00 USD

* Take Profit At 4.00

* (Downtrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

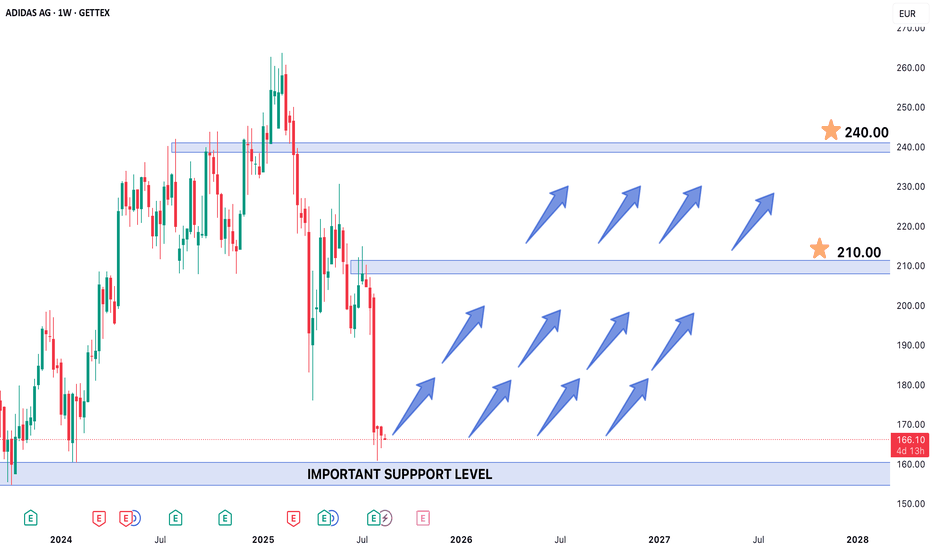

Adidas ADS Trading Near Important Support Level in Weekly ChartAdidas Stock Trading Near Important Support Level – A Potential Long-Term Entry Point

Adidas (ADS) stock is currently trading near a crucial support level, presenting a potential opportunity for long-term investors. Historically, this price level has acted as a strong base, with notable rejections observed in 2023 and 2024, indicating strong buying interest. Given the repeated bullish reactions from this zone, there is a high probability that the stock could resume its upward trajectory from here.

Price Outlook & Targets

If the support holds, Adidas stock could initiate a fresh bullish phase, with potential upside targets at 210.00 and 240.00. These levels represent key resistance zones where profit-taking or minor pullbacks may occur. Investors should monitor price action closely for confirmation of a sustained uptrend.

Risk Management Strategy

Before entering, a well-defined risk management plan is essential:

1. Stop-Loss Placement – Since the trade relies on the support level holding, a stop-loss should be placed below the recent swing low to limit downside risk.

2. Position Sizing – Allocate only a portion of the capital to avoid excessive exposure.

3. Trailing Stop for Profits – As the price moves toward 210.00, consider trailing the stop to lock in gains and protect against reversals.

4. Diversification – Avoid overconcentration in a single stock; balance the portfolio with other assets to mitigate sector-specific risks.

Conclusion

Adidas stock presents an attractive long-term opportunity near its historical support. However, disciplined risk management is crucial to navigate potential volatility. Investors should wait for confirmation of a bullish reversal before committing capital and adjust positions based on evolving market conditions.

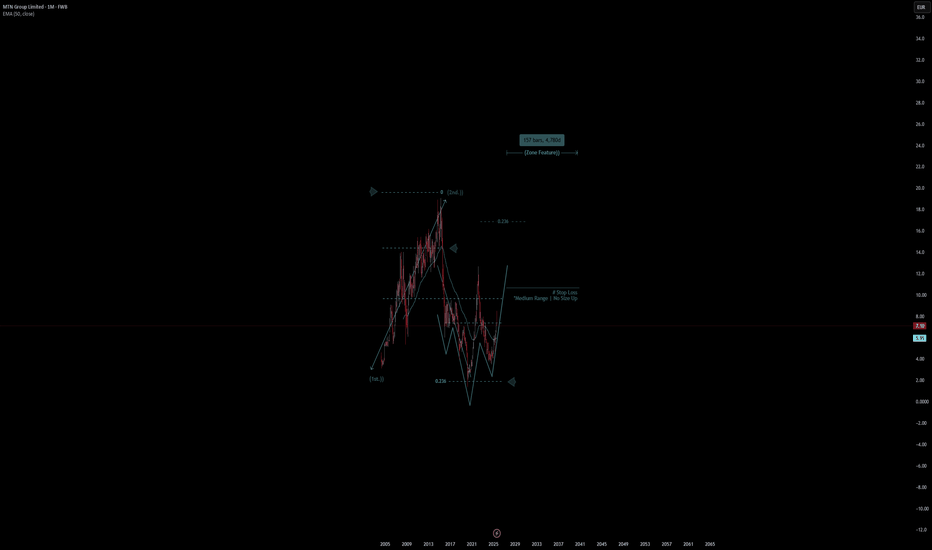

MTN Group Limited | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# MTN Group Limited

- Double Formation

* (Diagonal Shift)) - (1st.)) & (2nd.)) - *50EMA - Long Entry | Subdivision 1

* (Medium Range)) | No Size Up - *1.5RR | Completed Survey

* 157 bars, 4780d | Date Range Method - *Downtrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Monthly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Regular Settings

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 3.00 EUR

* Entry At 6.50 EUR

* Take Profit At 11.00 EUR

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Head & Shoulders

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

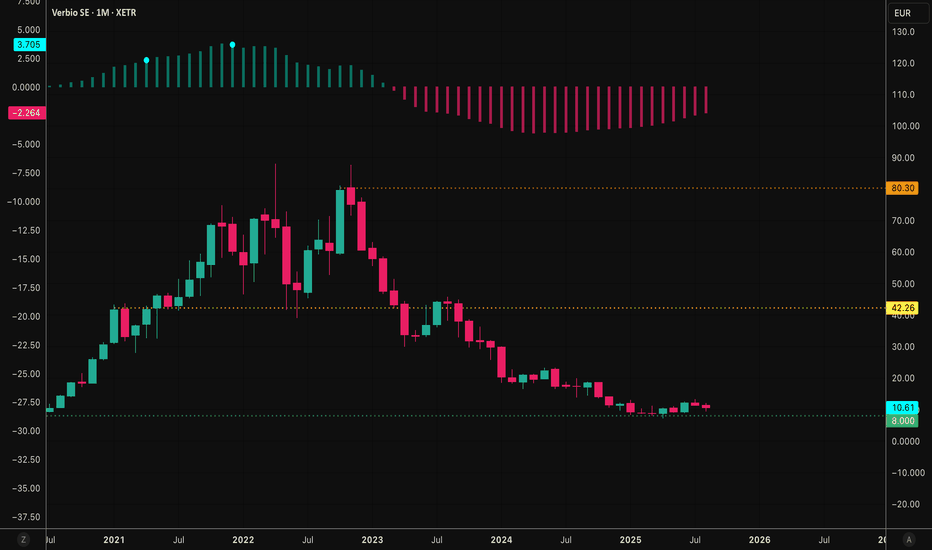

Ermenegildo Zegna N.V. | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# Ermenegildo Zegna N.V.

- Double Formation

* Curved & Arrowed Support - *0.5 - Short Entry - *25EMA | Subdivision 1

* (1st. Take Profit)) - *1.5RR - *Downtrend Area | Completed Survey

* 89 bars, 623d | Date Range Method - *Downtrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Weekly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Indexed To 100

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 105.00 EUR

* Entry At 92.00 EUR

* Take Profit At 71.00 EUR

* (Downtrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

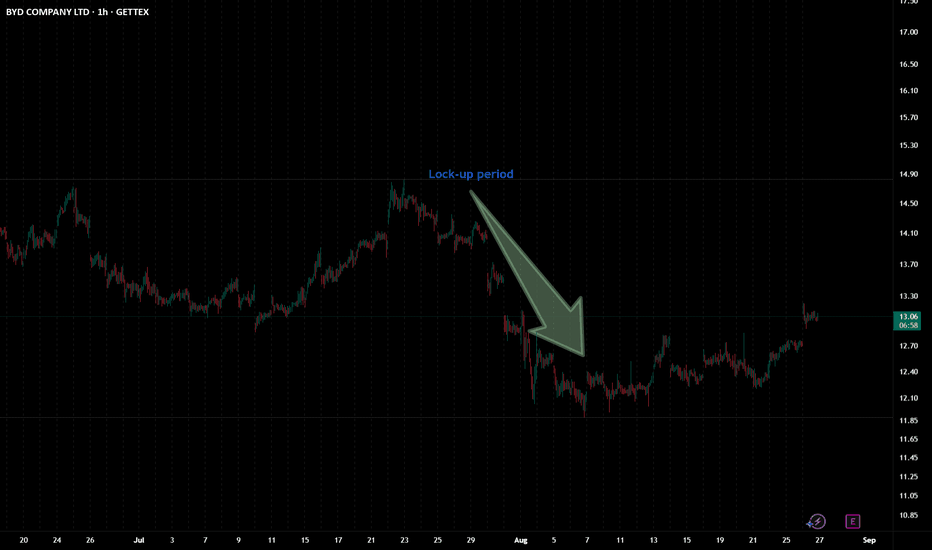

TESLA, pay attention to these numbers!!Despite the electric vehicle sector experiencing strong demand growth, with EV sales up 33.6% in July across the European market (source: Investing.com), Tesla appears to be struggling to keep up with the trend, posting a 40% drop in sales. In contrast, BYD continues to gain market share steadily.

Yet, Tesla is currently trading at a price that reflects an EPS multiple of 203.83x (with revenue growth expected to be -5.4% in 2025 and EPS falling by 12.1%) , an aggressive valuation that is difficult to justify given the company’s revenue has seen only modest growth over the past two years. This stagnation is largely due to weakening gross profit margins and broader macroeconomic headwinds that are weighing on performance. The current stock price still seems inflated by the momentum and hype generated by Tesla's strong performance up to 2022.

It is also worth noting that Elon Musk, during a key period, appeared to shift focus away from Tesla, impacting investor confidence and leadership credibility.

From a technical and statistical perspective, Tesla appears significantly overbought, with an estimated fair value that is 27.04% lower than the current price. On the chart, there’s a clear resistance zone between $346.04 and $351.22, and a support zone between $366.53 and $368.80.

(DISCLAIMER: The following is a personal opinion, not financial advice!!)

A potential short position in the coming days cannot be ruled out, with market reaction likely hinging on the earnings report due October 21. A stop-loss could be set around $368.80 (if the upward trend fails to confirm), with a take-profit range between $329.70 (200-day MA) and $302.00. An initial take-profit could be considered around $322.97, aligned with the 50-day moving average (MA50).

Let me know if you like the content and if you want give me a feedback!!

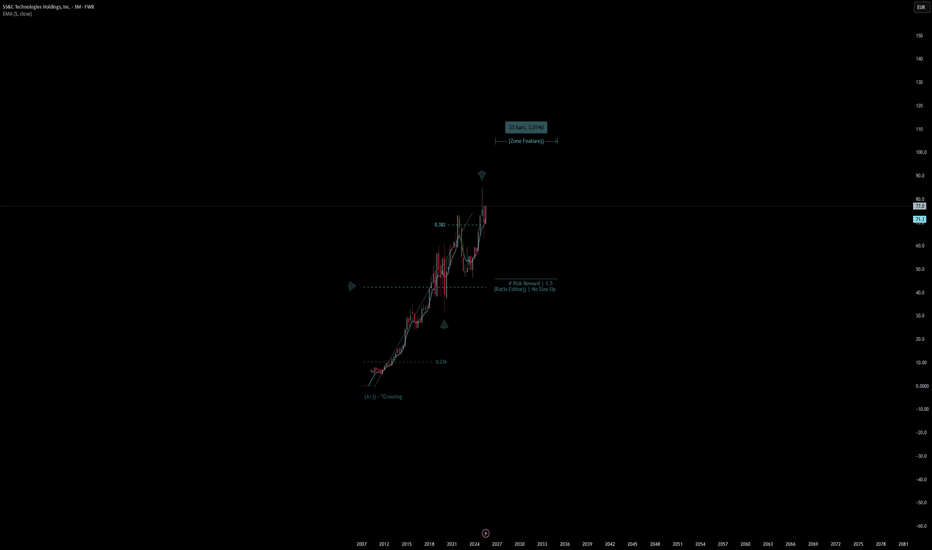

SS&C Technologies Holdings, Inc. | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# SS&C Technologies Holdings, Inc

- Double Formation

* (A+)) - *Crossing - Long Entry - *5EMA | Subdivision 1

* (Ratio Editor)) | No Size Up - *Uptrend Area | Completed Survey

* 33 bars, 3014d | Date Range Method - *(Uptrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* 3 Monthly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Regular Settings

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 48.00 EUR

* Entry At 66.00 EUR

* Take Profit At 91.00 EUR

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

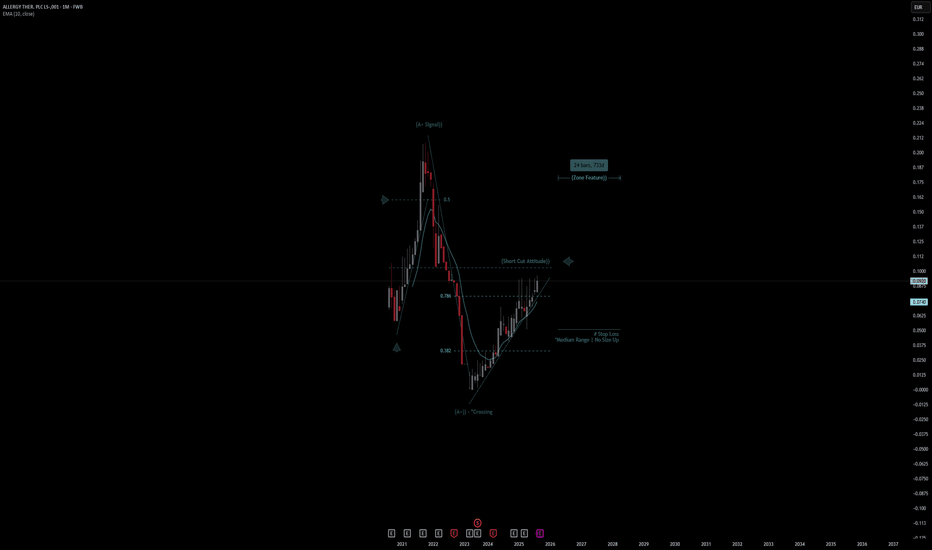

ALLERGY THER. PLC | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# ALLERGY THER. PLC

- Double Formation

* (A+)) - *Crossing - Long Entry - *10EMA | Subdivision 1

* (Short Cut Attitude)) | No Size Up - *Consolidation Area | Completed Survey

* 24bars, 733d | Date Range Method - *(Uptrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Monthly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Indexed To 100

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 43.00 EUR

* Entry At 103.00 EUR

* Take Profit At 193.00 EUR

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

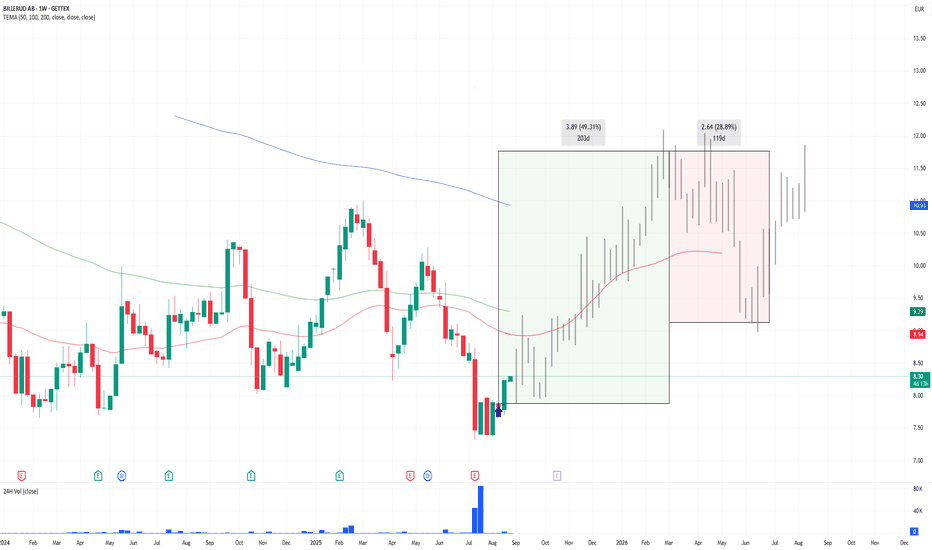

PERSONAL JOURNAL #2 | BILLERUD AB [BNF] | AUG 2025-2026Disclaimer

This is a personal journal of my exploits. This is not financial advice. Always do your own research.

Insight

Most companies are only now beginning to recovery post Covid-19, the localized correction in 2021 following Evergreen and Evergrande, as well as onset of new wars and high interest rates.

Outlook

Recovery.

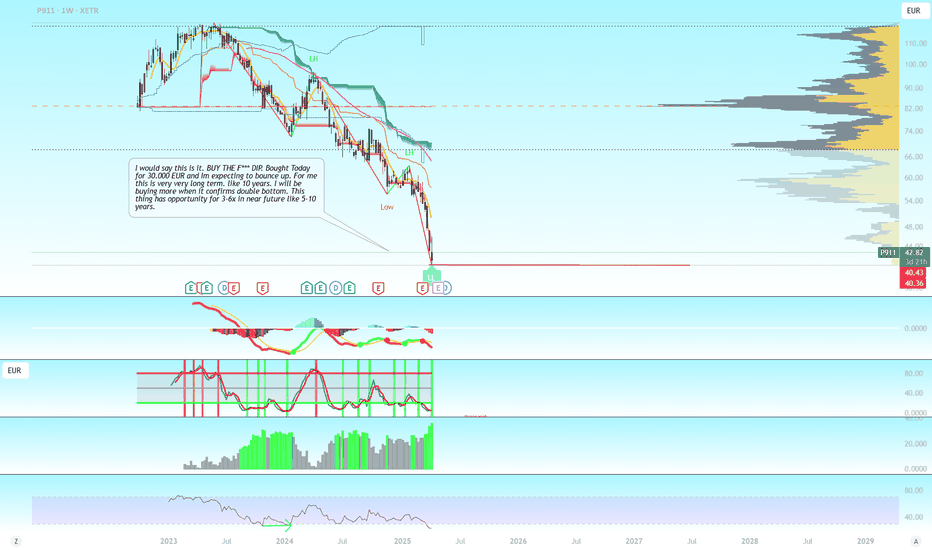

PERSONAL JOURNAL #1 | VOLKSWAGEN [VOW3] | AUG 2025-2026Disclaimer

This is a personal journal of my exploits. This is not financial advice. Always do your own research.

Insight

Most companies are only now beginning to recovery post Covid-19, the localized correction in 2021 following Evergreen and Evergrande, as well as onset of new wars and high interest rates.

Outlook

Recovery.

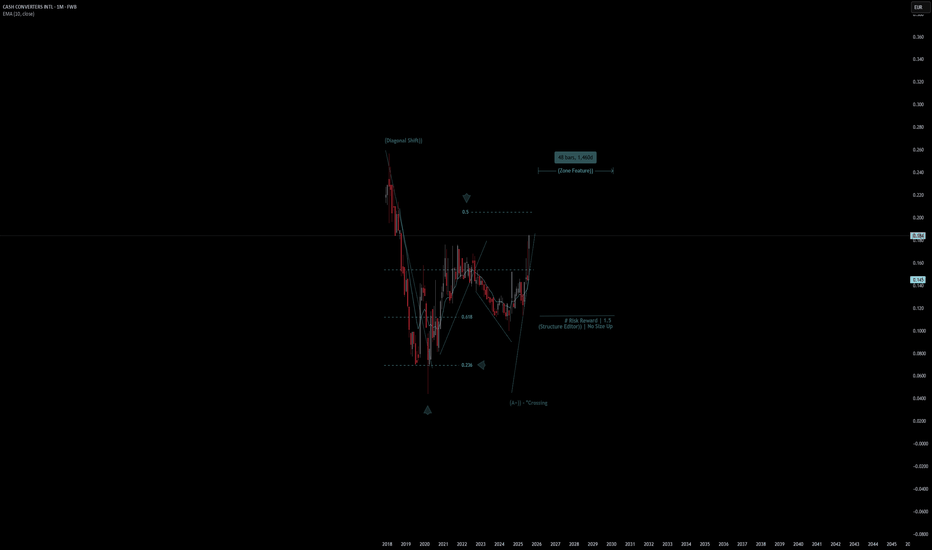

CASH CONVERTERS INTL | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# CASH CONVERTERS INTL

- Double Formation

* (Diagonal Shift)) - *Short Entry - *10EMA | Subdivision 1

* (A+)) - *Crossing - *Retest Area - 2nd Entry(Long Bias) | Completed Survey

* 48bars, 1460d | Date Range Method - *(Uptrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Monthly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Indexed To 100

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 50.00 EUR

* Entry At 68.00 EUR

* Take Profit At 100.00 EUR

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Valid - Double Bottom

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

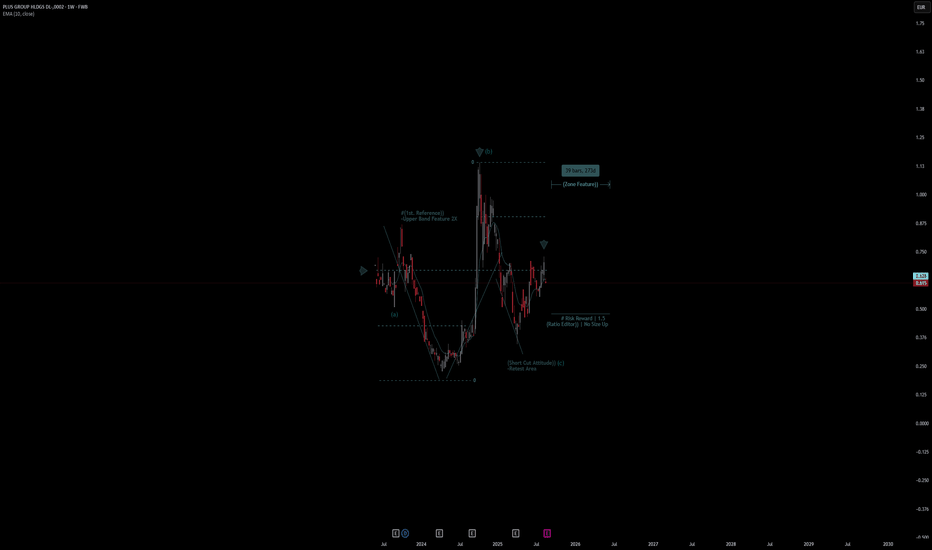

PLUS GROUP HLDGS | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# PLUS GROUP HLDGS

- Double Formation

* (1st. Reference)) - Upper Band Feature 2X - *Long Entry - *10EMA | Subdivision 1

* (Short Cut Attitude)) - *Retest Area | Completed Survey

* 39bars, 273d | Date Range Method - *(Uptrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Weekly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Regular Settings

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 0.380 EUR

* Entry At 0.550 EUR

* Take Profit At 0.770 EUR

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy