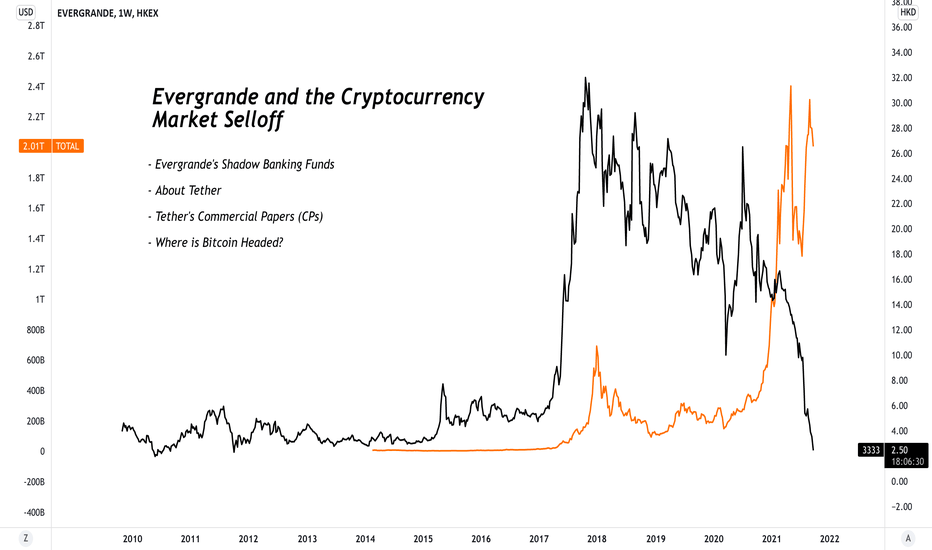

Evergrande and the Cryptocurrency Market Selloff ExplainedIn this post, I'll be providing an explanation on a theory regarding the potential connection between China's giant real estate developer, Evergrande, and Tether.

If you aren't familiar with Evergrande and the crisis it's currently going through, make sure to check out my previous post below:

Disclaimer: This is not investment advice. This is for educational and entertainment purposes only. I am not responsible for the profits or loss generated from your investments. Trade and invest at your own risk.

Evergrande's Shadow Banking Funds

- In my previous analysis, I mentioned the existence of Evergrande's $67B liability from shady sources.

- People, including renowned investors like Michael Burry, are posing doubts as to whether this liability has connections with Tether, a company that offers stablecoins in the cryptocurrency market.

About Tether

- Tether offers $USDT, a stablecoin that is convertable for 1 USD.

- Essentially, what it does is not so different from what banks used to do, and continue to do today.

- During the gold standard, when you took $500 to the bank, they'd give you an ounce of gold.

- Tether guarantees that they'll provide 1 USD per 1 USDT

- But, some say that Tether is faced with a bank-run like situation, looking at its reserves.

- According to their March 2021 Reserves update, commercial paper accounts for 65% of Tether's cash reserves.

- For those of you who don't know, commercial paper, or CP, is a way to finance extremely short term loans at a very cheap rate.

- Tether did not disclose whose CPs they were, in order to protect their partner's privacy.

Tether's Commercial Paper

- Back in July this year, Tether’s CTO and general counsel had an interview with CNBC, and made a few important points.

- They said that they have about $30B in AA rated International Commercial Paper, and these were rated AA by S&P and Fitch.

- The point that some people are making is that Tether’s commercial paper might actually be Evergrande’s commercial paper.

- This may seem like a conspiracy theory, but there are certain points that line up.

Reason #1

- First, Tether currently has $30B in commercial papers, and that’s an insane amount of money.

- Reuters reported that Shengjing Bank, the bank affiliated with Evergrande, is under investigation for providing illegal loans up to $20B.

- Considering that even a more renowned company like JP Morgan can’t write $20B loans, there is plausible reason to doubt that the capital may have come from Tether.

- So taking into consideration the size of the loan, some say that it’s highly likely that the capital flowed into Chinese real estate companies.

Reason #2

- Secondly, even after Bitcoin peaked in mid April, Tether continued to print more USDT. To be precise, they printed $15B between mid April and early June.

- In case you don’t know what bitcoin has to do with this, there have been claims that Tether has been arbitrarily printing USDT.

- This USDT would be used to manipulate the price of Bitcoin, and the overall cryptocurrency market in general.

- While Tether has been printing money like crazy, and as soon as Evergrande CPs defaulted on June 7, they stopped printing USDT.

- Now this is a chicken or egg question where we don’t know if Evergrande’s liquidity problem caused Tether’s collateral to impair, or whether Tether’s cutoff caused the liquidity issues at Evergrande, but something sure smells fishy.

How the Market Structure Would Break

- Tether claims that they don’t hold any Evergrande commercial papers, but we don’t know anything for sure yet.

- If it turns out that Tether was lying, and we see a domino effect take place, it would look something like this:

- Evergrande, along with other real estate developers in China, would go default.

- Tether, who lent them money in the form of commercial paper, could also go default.

- And with tether going default we would see the cryptocurrency market take a huge hit.

Where is Bitcoin Headed?

- So at this point, you may be wondering: where would Bitcoin be headed with this absolute mayhem of a situation?

- While Bitcoin and the overall crypto market crashed, we did manage to close above $40.7k on the daily.

- This would indicate that the overall uptrend remains intact, despite the awful news.

Conclusion

So many answers still remain unanswered. Where does Tether put its billions? Who issues $30B in AA International Commercial paper, willing to pay anything? Why did Tether stop printing money as soon as Evergrande’s liquidity died? As I've said in the previous post, the best thing we can do as investors is to prepare for all probable situations. In my personal opinion, the Chinese government seems willing to indirectly solve the issue by injecting capital via open market operations, so it's more likely that this situation will be settled at one point, as opposed to leading to the entire global financial market collapsing.

If you like this educational post, please make sure to like, and follow for more quality content!

If you have any questions or comments, feel free to comment below! :)

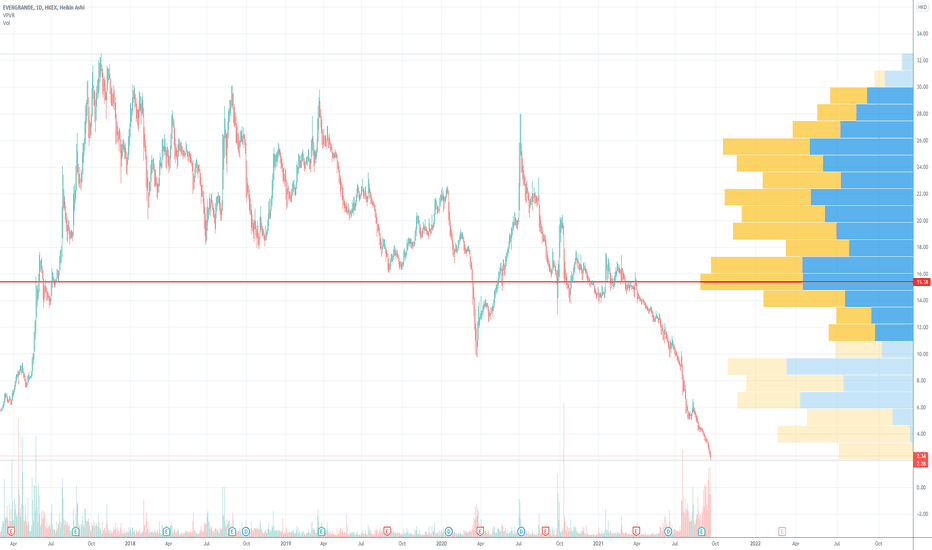

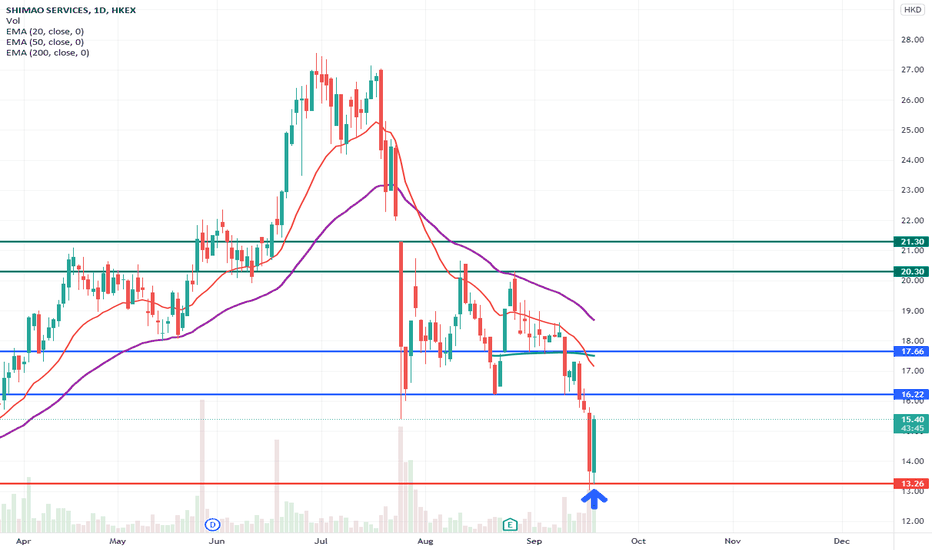

evergrande : Burn your money here... we are currently in a strong daily support and do you think we will recover from here??? maybe, Will the chinese government bail them out???

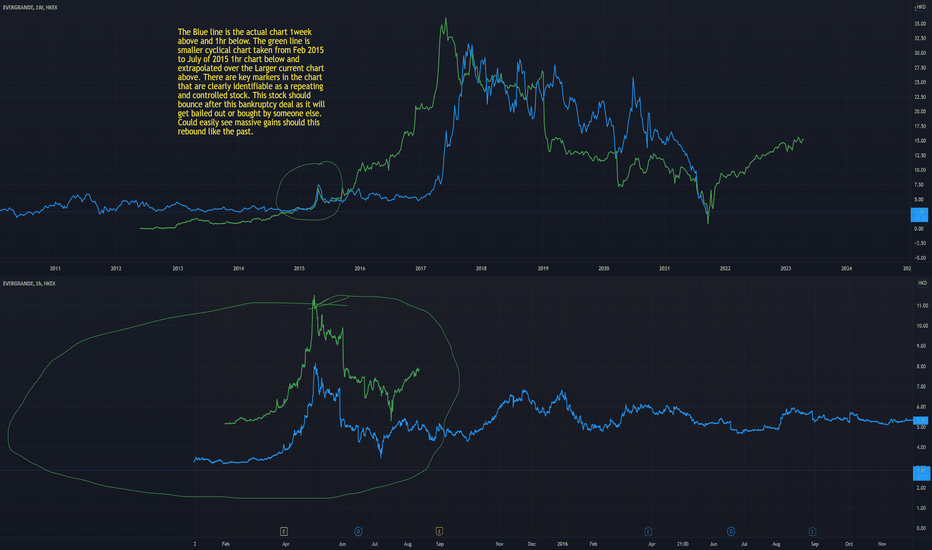

Evergrand potential tremendous upside should they get bailed outThe Blue line is the actual chart 1week above and 1hr below. The green line is smaller cyclical chart taken from Feb 2015 to July of 2015 1hr chart below and extrapolated over the Larger current chart above. There are key markers in the chart that are clearly identifiable as a repeating and controlled stock. This stock should bounce after this bankruptcy deal as it will get bailed out or bought by someone else. Could easily see massive gains should this rebound like the past.

Is Evergrande the next Lehman Brothers ??China`s economic model is based on real estate investment to drive growth. 20 Mil apartment buildings per year.

China`s residential property is 20% of GDP every year. Too much!

Real estate activities in China close to 30% of GDP every year. Huge!

Chinese Government is Bashing the private sector, look at GOTU and BABA for example.

Evergrande, second largest property developer in China has more than $300 billion in debt!

Evergrande has $83.5 million interest payment Sept. 23 and a $42.5 million payment on Sept. 29

Failure to to pay in 30 days can put Evergrande in default.

Today Evergrande has a Market Cap of 30.099B! At its peak, Evergrande was traded 13.5X higher!

Evergrande’s potential debt blowup can send shock waves through financial markets!

Today was just the beginning.

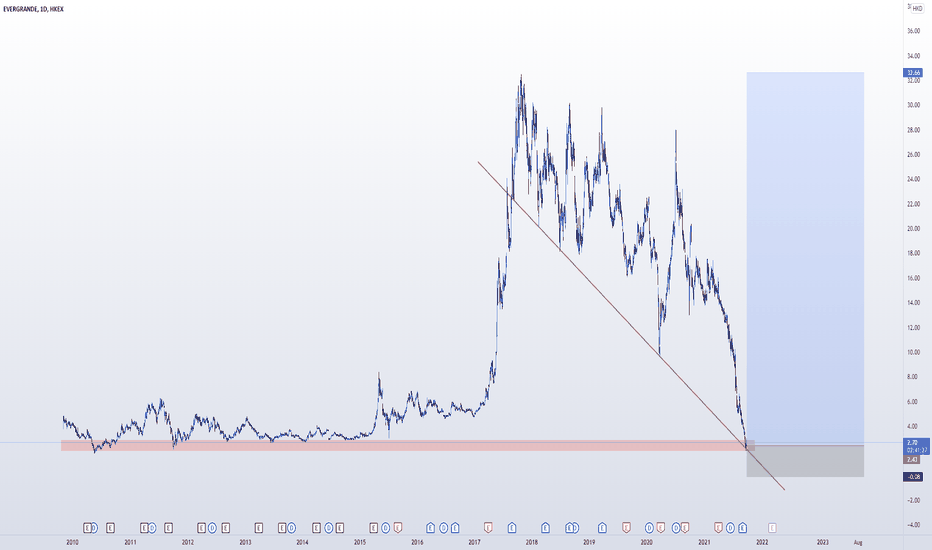

$2 Reject?As China's property giant Evergrande veers toward collapse, its unpaid debts spark protests.

EVERGRANDE - The mother of all dips?Evergrande is down over 93% over the past 24 months. Is it time to buy the dip?

I'm looking for a bottom in the low $2 range.

Will we see a bounce next week. I think so.

This trendline determines the final destiny of Evergrande. If breached, I will lose hope for any further upside in the future.

Big news (positive) is expected over the weekend before open which should give it a good bounce.

Trade wisely and free of emotions.

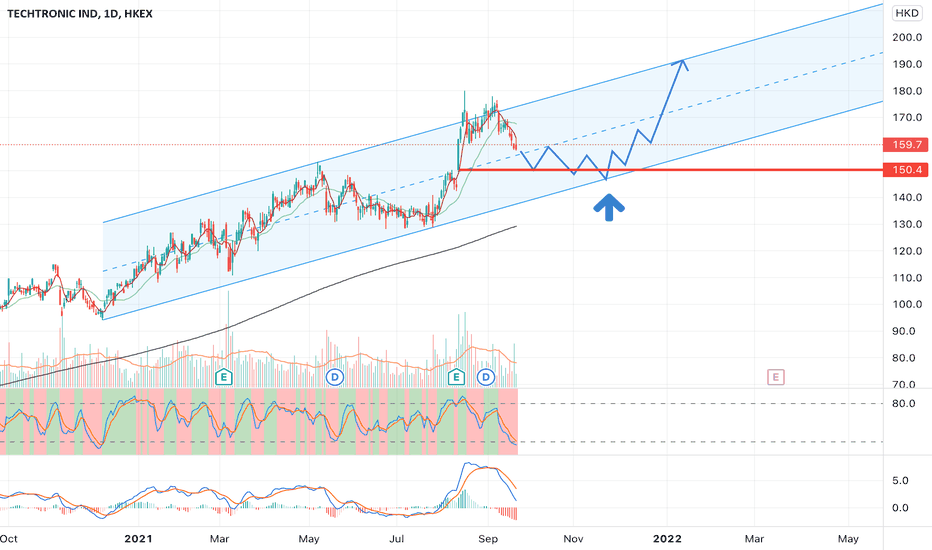

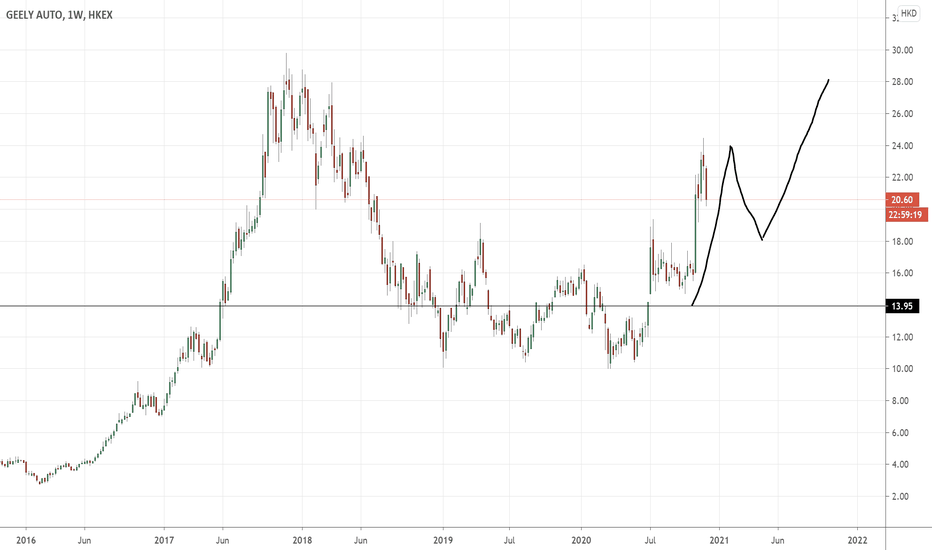

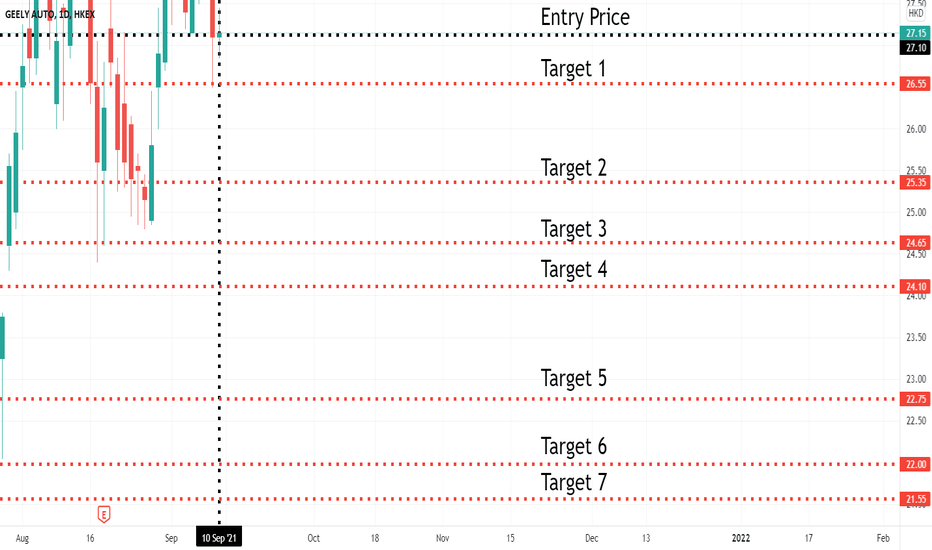

GEELY AUTO Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

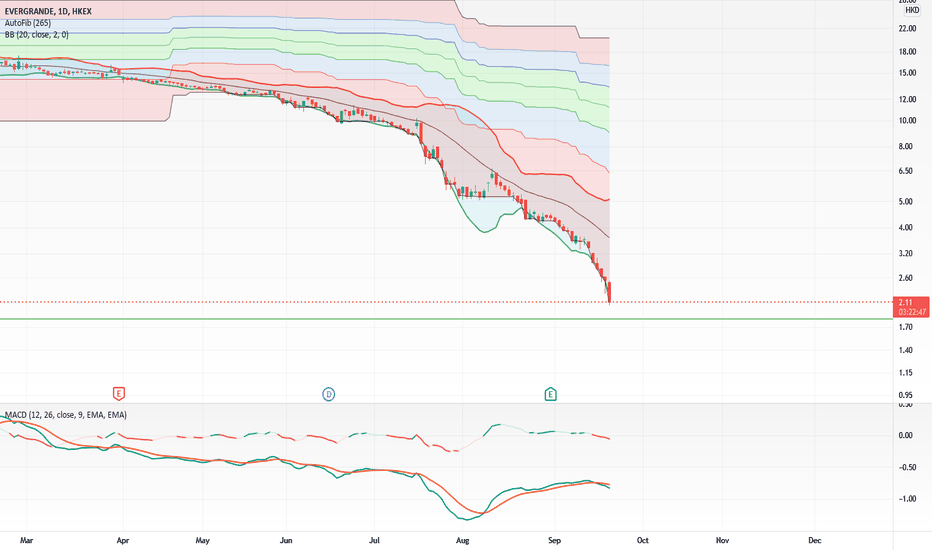

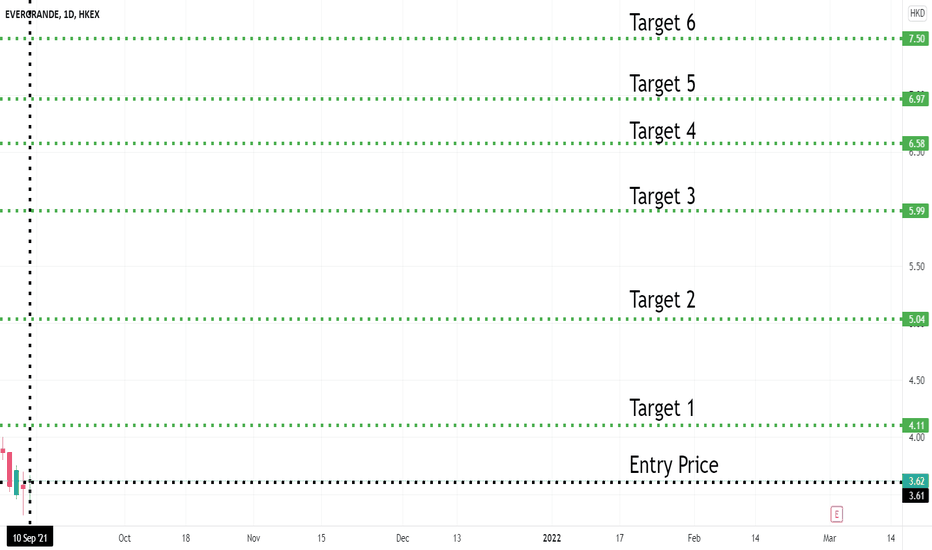

EVERGRANDE Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

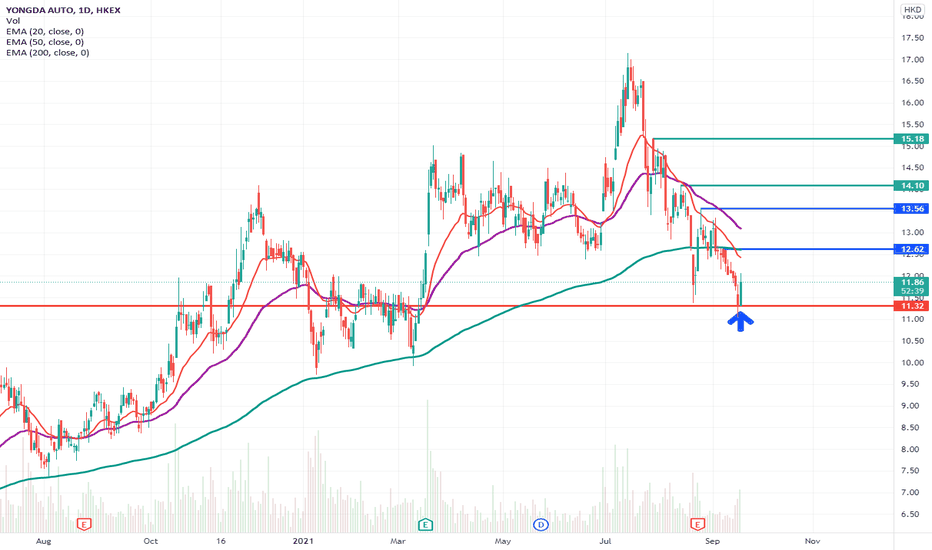

BYD COMPANY Daily TimefameSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

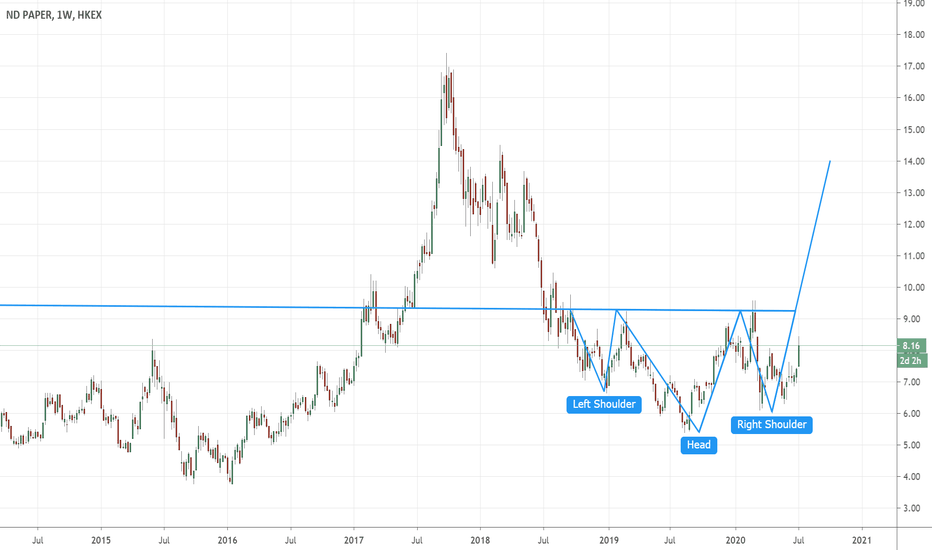

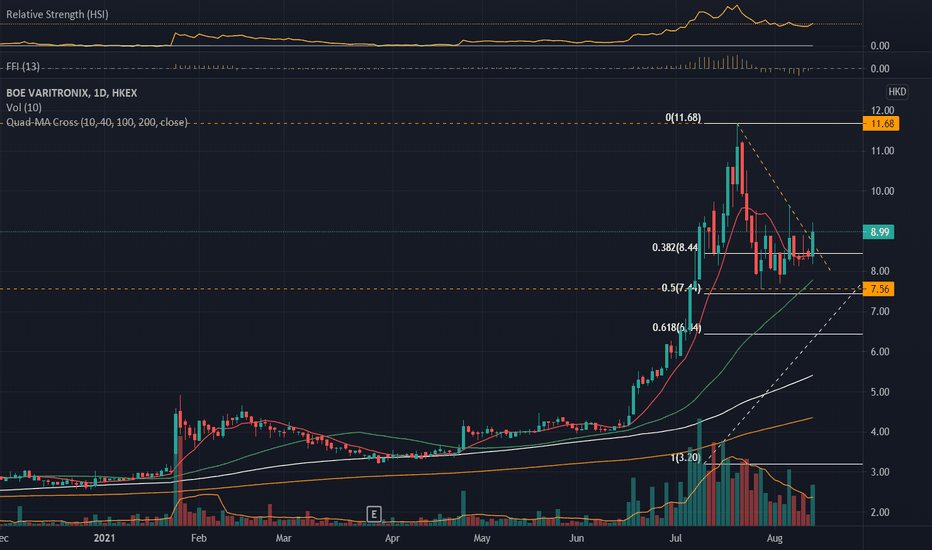

710.HKEX_Range Breakout and Retracement Trade_LongENTRY: 8.94

SL: 7.50

TP: 11.68

- ADX>20

- RSI<50,RSI<70

- Daily RS +ve

- Daily FFI +ve

- Daily MACD -ve

- Weekly RS +ve

- Weekly FFI +ve

- Weekly MACD +ve

- MAs are aligned.

- Breakout of range on 18 Jun 2021 with good volume.

- Moved to high of 11.68 on 21 Jul 2021 with increasing volume, and retraced on slightly lower volume to 50% Fib. level before signs of accumulation on 28 Jul 2021, 5 Aug 2021 and today. Between the accumulation dates, the retracement is under lower volume as well.

- Maintaining above 50% Fib. level and "P" Pivot Point will be important.

- Breakout of down trendline with volume today.

- Earnings announcement seems to be coming soon and it is in the electronic sector which is doing well globally during the pandemic. Hence, would expect a good earnings result to push the price higher.

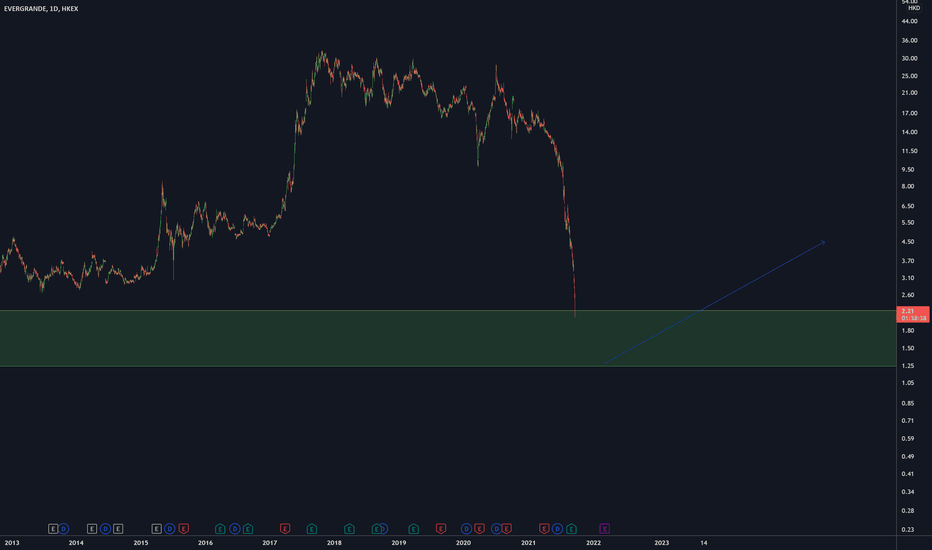

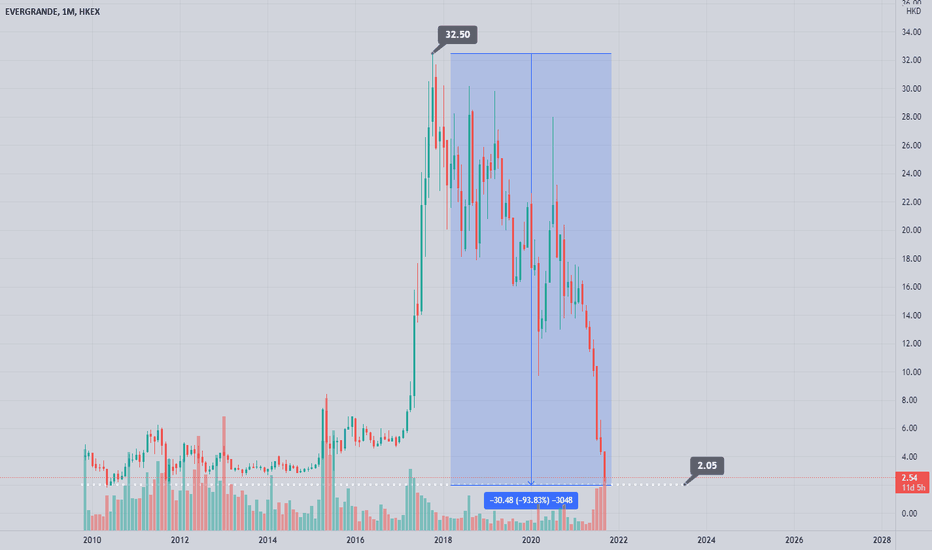

3333 JUST HIT 3.33. ARE WE AT THE BOTTOM?✅PREVIOUSLY ON EVERGRANDE

There's 5 waves from 0 to 32.5.

After 32.5, A is 18.18, B is 30.15, and we've been on bearish 5 waves since B(30.15) to make C.

✅ WHERE WE ARE

Drawing the TL from 32.5(5) to 30.15(B), and put Fib channel(2.0), we can see that the price is trying to bounce off.

If so, we'd have the bullish impulse.

💡The absolute principle for trading💡

BUY - as low as possible

SELL - as high as possible

PLEASE DO NOT FORGET TO SMASH LIKE👍🏻 AND FOLLOW ME❤ IT MOTIVATES ME TO THE NEXT IDEA! THANK YOU 🎉

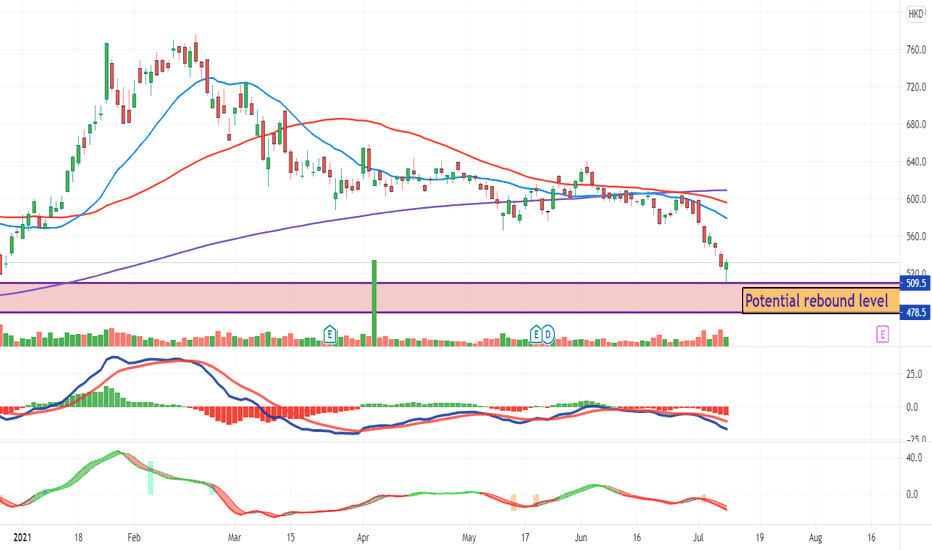

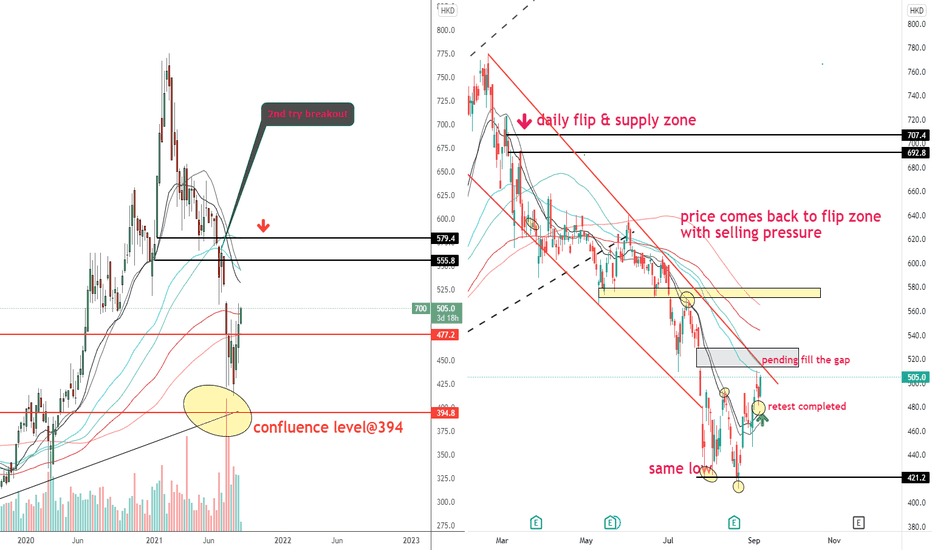

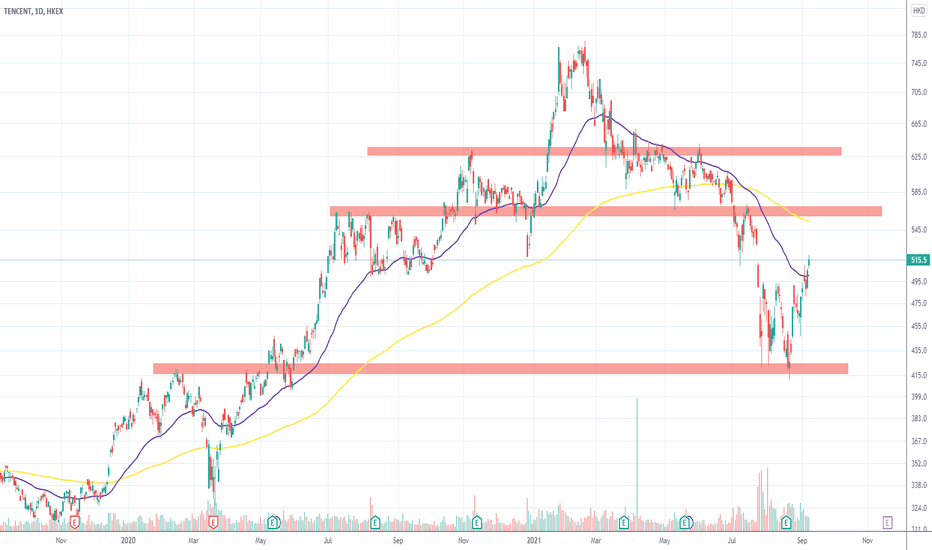

JICPT| Tencent completed retest, ready to challenge gap! Hello everyone. It's a good day for tech bullish buyers, especially Tencent fans.

On the daily chart, I found the retest has been completed with a bullish leg-out candle formed today. Looking above, the next challenge is the gap from HKD513 to HKD528. Also, there is a downtrend line which may weigh on it.

Looking forward, the valuation is attractive and I'm bullish on the stock. Though, it could have a second fall to the level of HKD479 before coming back again.

What's your opinion? Give me a like if you're with me.