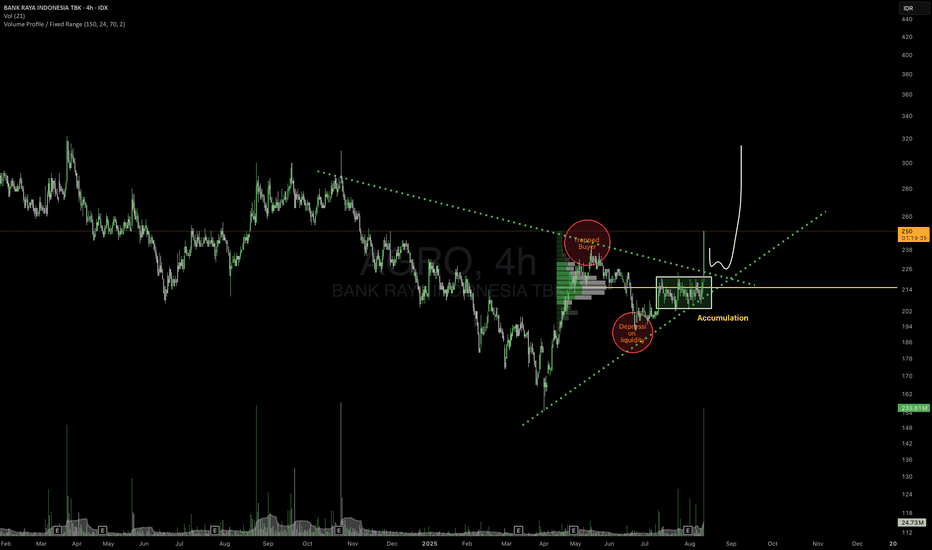

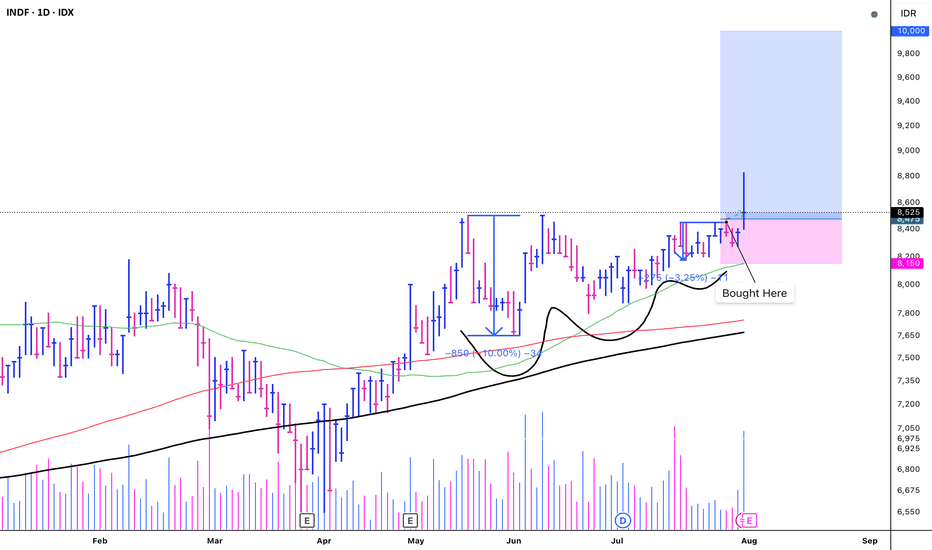

Do Not FOMOPrice is in a decisive position. On the thin line of dynamic resistance. If price successfully pass, it will have a great opportunity to continue again. If not, it is likely to retest support.

Structurally, the potential is quite high.

Action:

1. Don't be fomo, waiting for confirmation of the break

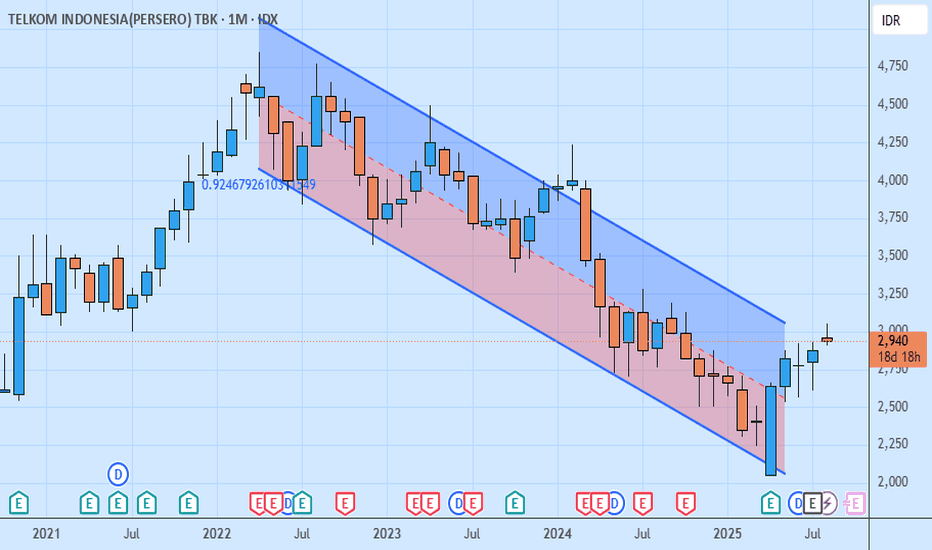

TLKM On the Rise? Probably NotI was tempted to buy into TLKM again last month, because it rose so fast and sounds awesome. So, I looked at the books and... did nothing.

TLKM buyback plans between 28 Mei 2025 - 27 Mei 2026 may provide supports, but nothing on its book tells me to buy it now. The company's first quarter performan

PGEO Technical Analysis:Long-Term Trend: From the chart, PGEO has been in a fairly strong uptrend since around May 2024. This is marked by the price consistently forming 'higher highs' and 'higher lows'.

Support and Resistance:

Strong Support: The main support area appears to be around the 1,480 - 1,500 price level. The

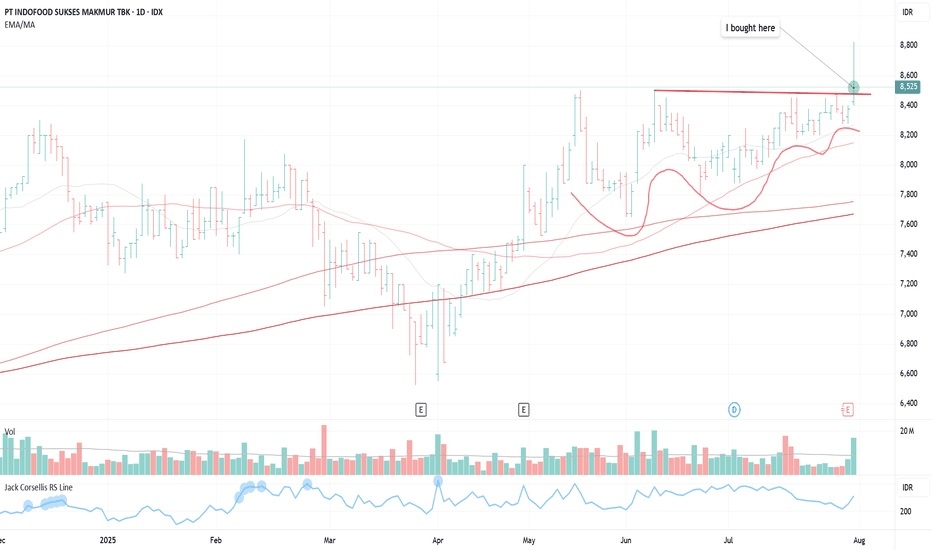

INDF - VCP (13W 10/3 3T)IDX:INDF - VCP

+)

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 > 150 > 200

4. Price is within 25% of its 52-week high.

5. Price is over 25% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above

$INDF (VCP - 10W 10/3 4T)Position update: July 31, 2025.

Key factors:

1. Confirmed stage 2 uptrend.

2. A textbook Volatility Contraction Pattern (VCP) with a clearly defined, low-risk entry point.

3. Price action moves in the opposite direction of the declining general market.

4. The stock moves on its own drummer, rall

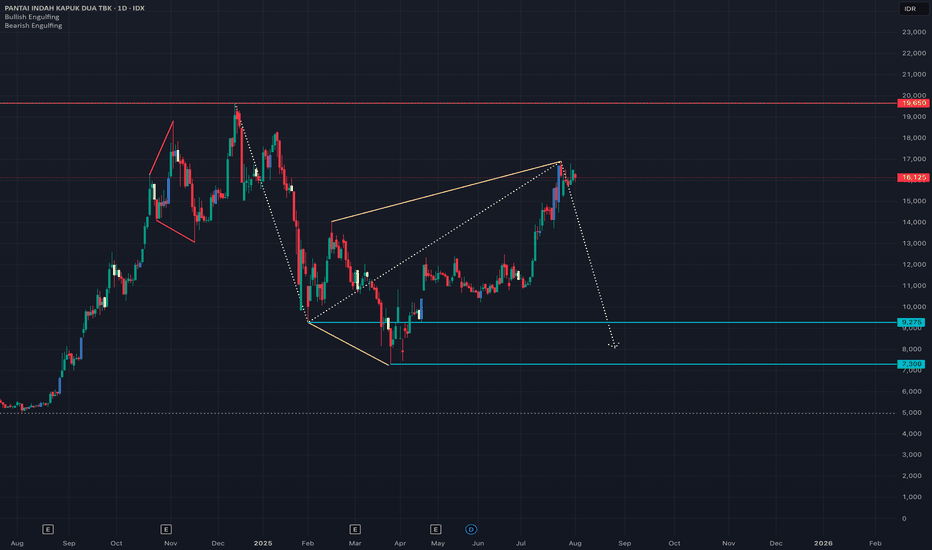

PANI Potentially Downside Min To 9,275 Or 7,300PANI (Pantai Indah Kapuk Dua) Potentially Downside Either From Current Market Level Or Higher with the note as long as it doesn’t break above 19,650.

The potential downside if it happens, it would test below 9,275 or the best case 7,300.

Below these 2 levels look for buy set up for investment.

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Today

SMRASUMMARECON AGUNG

Actual

—

Estimate

—

Today

GIAAGARUDA INDONESIA (PERSERO) TBK

Actual

—

Estimate

—

Today

BBTNBANK TABUNGAN NEGARA PERSERO

Actual

—

Estimate

—

Today

BMRIBANK MANDIRI (PERSERO) TBK

Actual

—

Estimate

140.89

IDR

Today

NSSSNUSANTARA SAWIT SEJAHTERA TBK

Actual

—

Estimate

—

Today

LPKRLIPPO KARAWACI

Actual

—

Estimate

—

Today

PTPPPEMBANGUNAN PERUMAHAN TBK

Actual

—

Estimate

—

Aug 20

MDKAMERDEKA COPPER GOLD TBK. PT

Actual

—

Estimate

−9.84

IDR

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Finance | ||||||||

| Energy Minerals | ||||||||

| Utilities | ||||||||

| Non-Energy Minerals | ||||||||

| Process Industries | ||||||||

| Technology Services | ||||||||

| Consumer Non-Durables | ||||||||

| Communications | ||||||||

| Retail Trade | ||||||||

| Consumer Services |