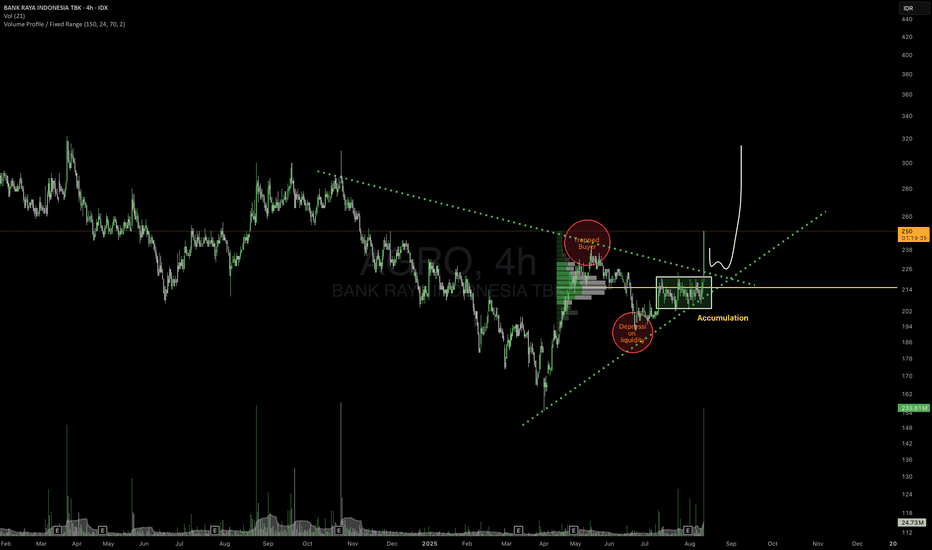

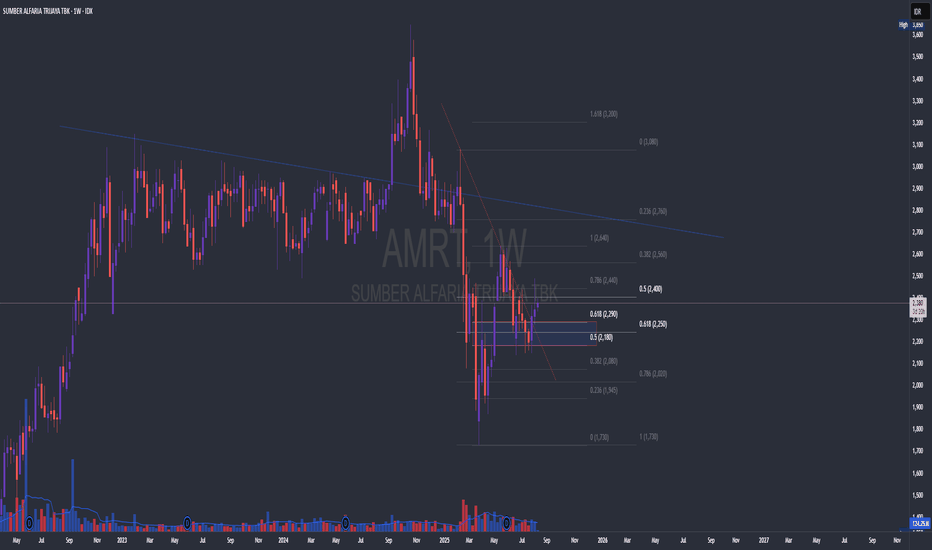

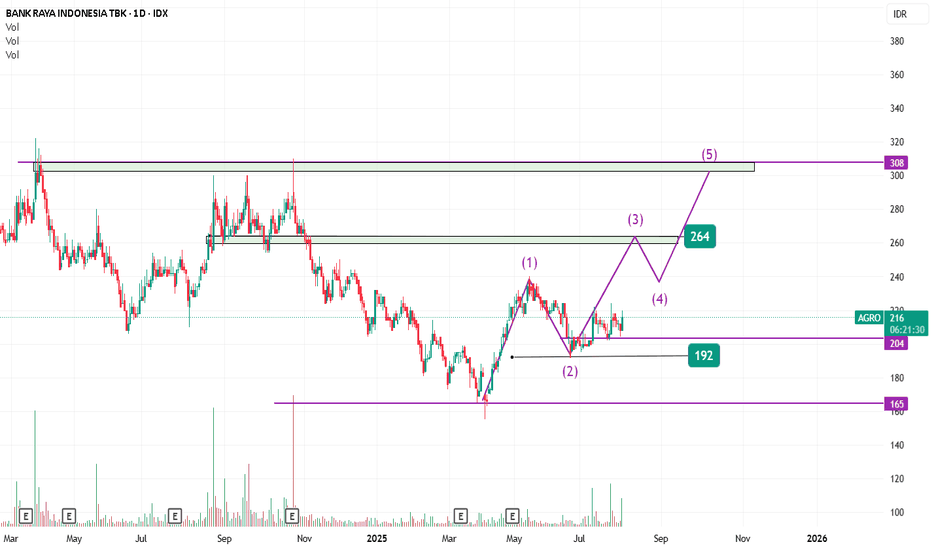

Do Not FOMOPrice is in a decisive position. On the thin line of dynamic resistance. If price successfully pass, it will have a great opportunity to continue again. If not, it is likely to retest support.

Structurally, the potential is quite high.

Action:

1. Don't be fomo, waiting for confirmation of the breakout is better.

2. If you want to go long, it is safer to wait in the support area, around 210-182

DYOR

Trade with your own decision

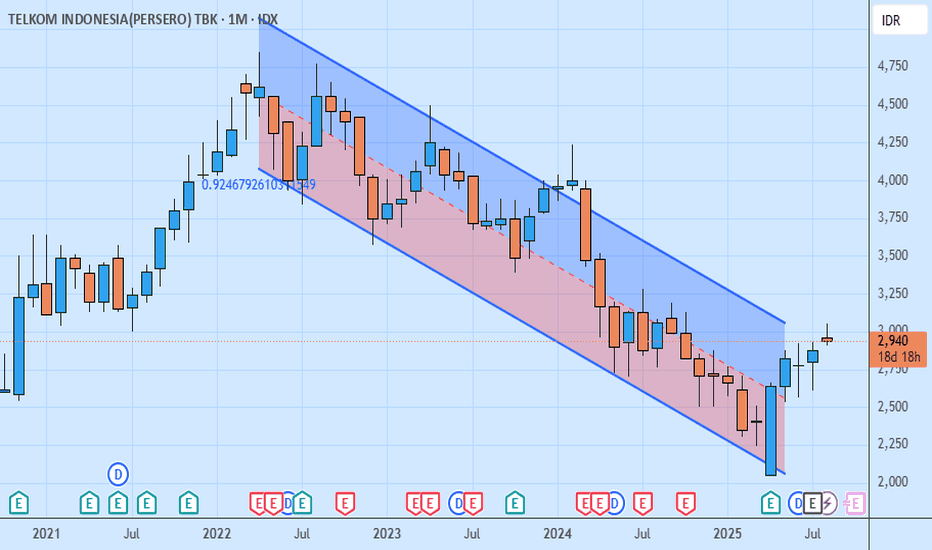

TLKM On the Rise? Probably NotI was tempted to buy into TLKM again last month, because it rose so fast and sounds awesome. So, I looked at the books and... did nothing.

TLKM buyback plans between 28 Mei 2025 - 27 Mei 2026 may provide supports, but nothing on its book tells me to buy it now. The company's first quarter performance was disappointing with reduced revenue and profits, probably due to increased competition in the industry. And I don't think they will launch new breakthrough projects anytime soon.

In my most optimistic eyes, TLKM will probably rise up to 3250 and that's that. But I strongly suspect it may fail to rise far beyond 3000-ish where it currently is. After all, it has touched the upper band of its multi-year downtrend channel.

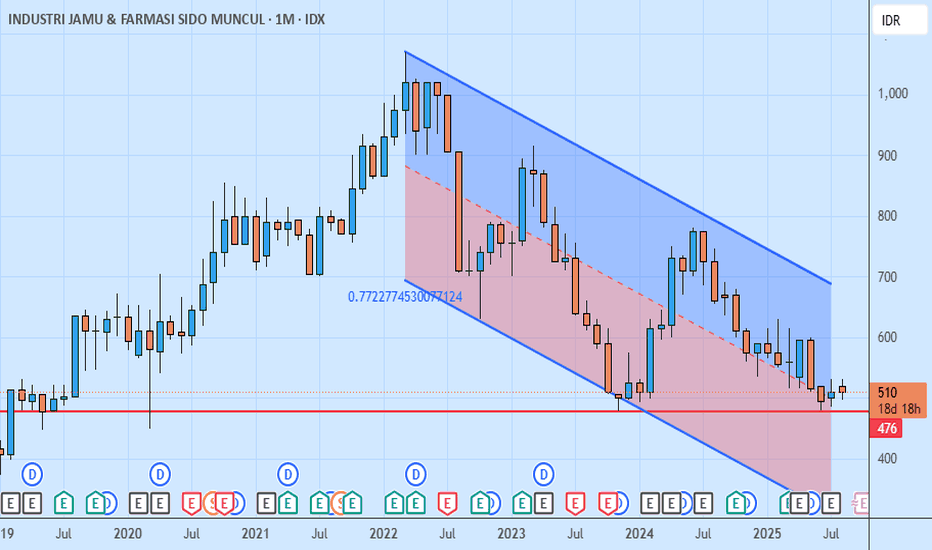

SIDO On the Crossroads?SIDO was a VERY reliable asset on my portfolio since the pandemic. It fell in the aftermath, but we can always hope for a meaningful recovery as the company is pretty much perfect on the books. But it fell so hard since mid-2024.

I stopped buying SIDO since then, though I still keep it on my portfolio for the sake of dividends. Now, I am thinking of buying it again.

On June, SIDO has touched multi-year lows under 500. Then it slowly woke up to just slightly above 500 now. Sufficient reasons to think it may temporarily go sideways or rise till the next stopover at 600-ish.

BJTM May Stay SidewaysBJTM stays on long-term downtrend. It probably will move sideways around 450-580 (February highs and lows) in the foreseeable future as it strives to create new supports.

Nothing particularly unfavorable can be seen on the books. BJTM grew moderately in the first quarter, and that's that. However, several corporate news have increased pressures on BJTM since 2024.

First, the controversial BEKS acquisition plan. Though it was probably arranged by the government, investors did not think it would be favorable for BJTM.

Second, suspected loan fraud. Earlier this year, Jakarta prosecutors detained three suspects on loan manipulation case in its Jakarta office. There are no reports of BJTM direct involvement, but the news soured our mood.

Third, Indonesian central bank most likely will cut rates again. Rate cut itself should not significantly impact BJTM as local government-affiliated bank, but slower growth is on the horizon.

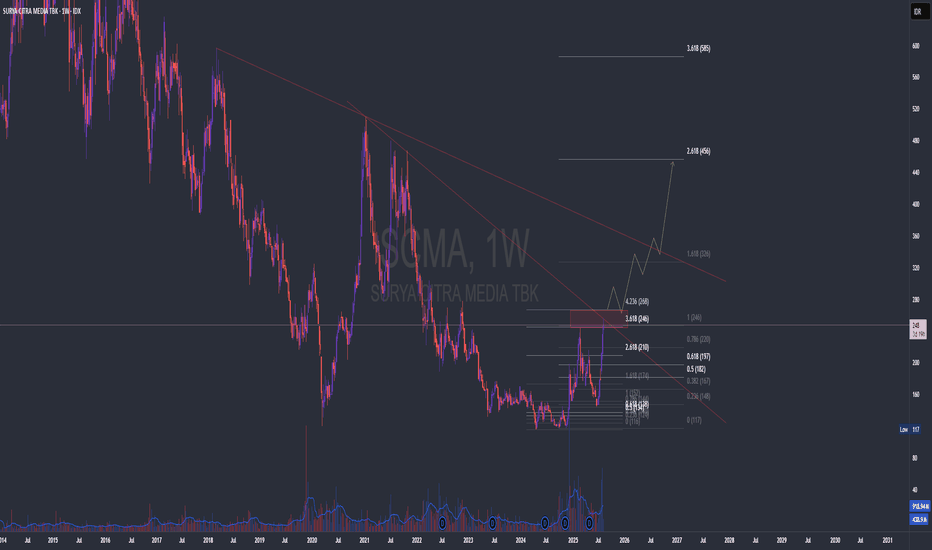

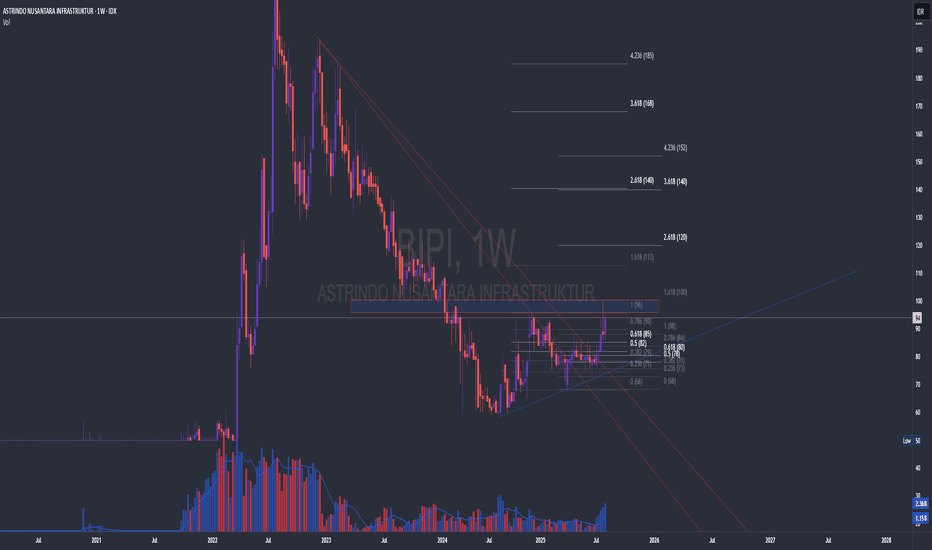

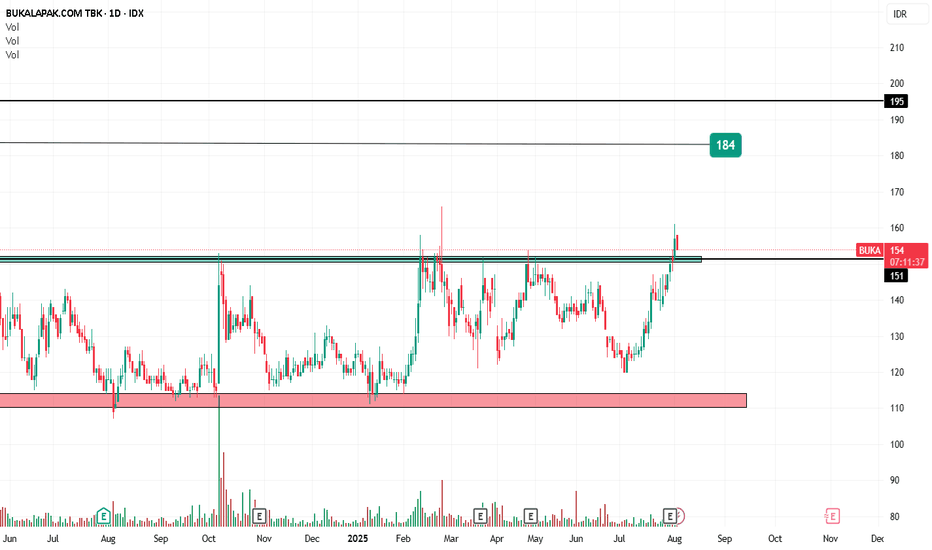

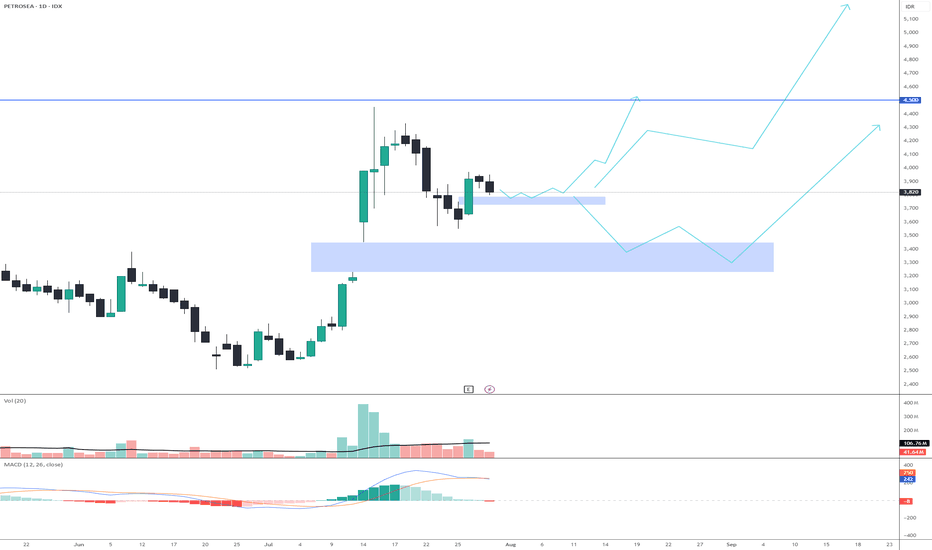

Will This Wait End Soon?In April 2025 the price appears to be breaking away from dynamic resistance and there will be consolidation in the following weeks.

In the week of July 21, the price broke the consolidation area and tried again to break through the 96-100 resistance area.

Structurally, it is enough to give hope to those affected by harapan

But will those hopes be fulfilled?

It should be noted that the closing candle in the last week of July looked bad. However, there is a but, that the structure has not yet become invalid..

So there are several options:

1. The safest thing is to wait for confirmation of the price breakout from the 96-100 resistance area.

Only if this scenario occurs can you take buy action

2. Install a buy net in the 76-82 consolidation area to get a better RR ratio.

3. Buy speculation range area until 76. As usual, good averaging determines the results.

based : S/R, fibo, candles

DYOR

Trade with your own decision

PGEO Technical Analysis:Long-Term Trend: From the chart, PGEO has been in a fairly strong uptrend since around May 2024. This is marked by the price consistently forming 'higher highs' and 'higher lows'.

Support and Resistance:

Strong Support: The main support area appears to be around the 1,480 - 1,500 price level. The price briefly corrected to this area and bounced back up. Another minor support is around 1,300.

Strong Resistance: The nearest resistance is around the 1,800 price area. This is the highest price level previously reached. The next stronger resistance appears to be around 1,950 - 2,000.

Volume: There was a significant increase in volume as the price started moving up since May 2024. This indicates strong buying interest from the market. However, in the last few days, trading volume has slightly decreased as the price corrected, which could be an indication of profit-taking or temporary consolidation.

Current Condition: Currently, the price of PGEO is in a consolidation phase after peaking around 1,800. The price is moving sideways between the 1,800 resistance and the 1,500 - 1,600 support.

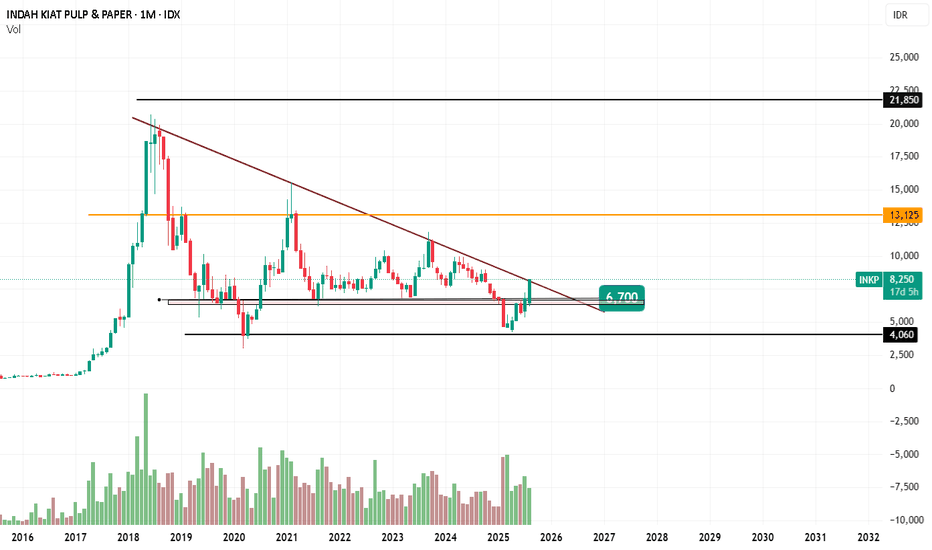

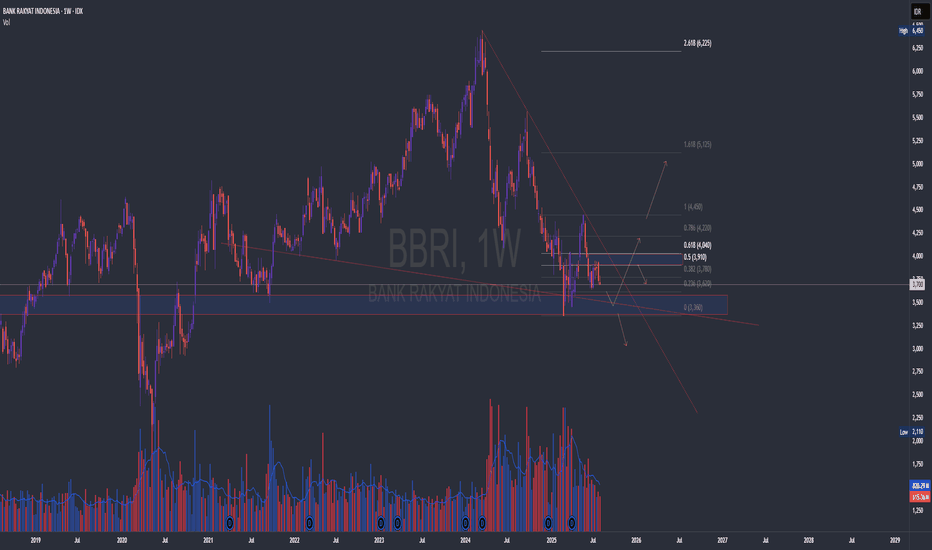

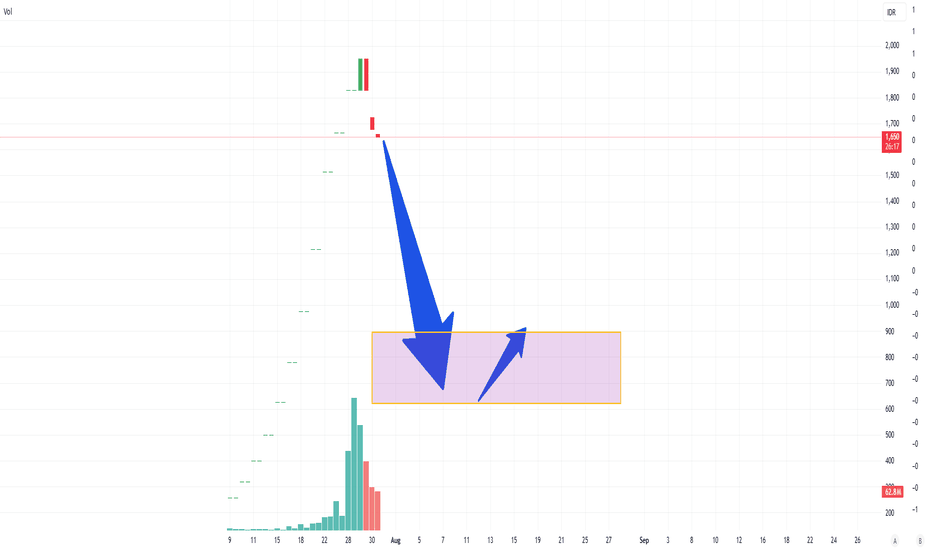

Needs ConfirmationJust to the point... The structure still looks bad but there is no invalid confirmation that it will continue to fall.

Weekly closed nya juga jelek

The action?

1. Speculation, buy now with averaging strategy There was demand in the previous candles. Invalid if the price drops below support

2. Waiting in the support area, in order to achieve a better RR ratio if the price drops until there.

3. Wait for the price to escape from dynamic resistance

DYOR

Trade with your own decision

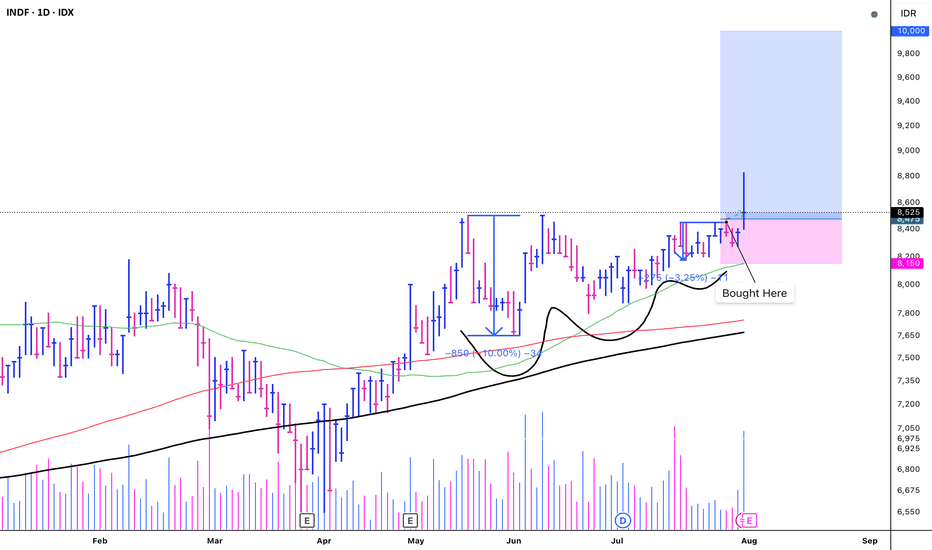

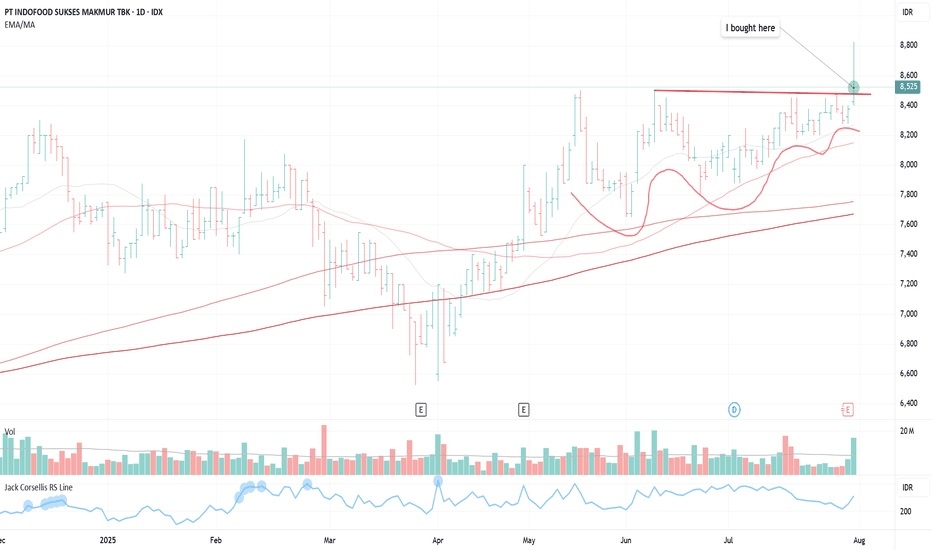

INDF - VCP (13W 10/3 3T)IDX:INDF - VCP

+)

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 > 150 > 200

4. Price is within 25% of its 52-week high.

5. Price is over 25% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (71).

EPS Growth:

a. Quarterly QoQ: -

b. Quarterly YoY: +11.20%.

c. TTM YoY: +32.14%.

d. Annual YoY: +6.07%.

(-)

1. There is no significant breakout with substantial volume.

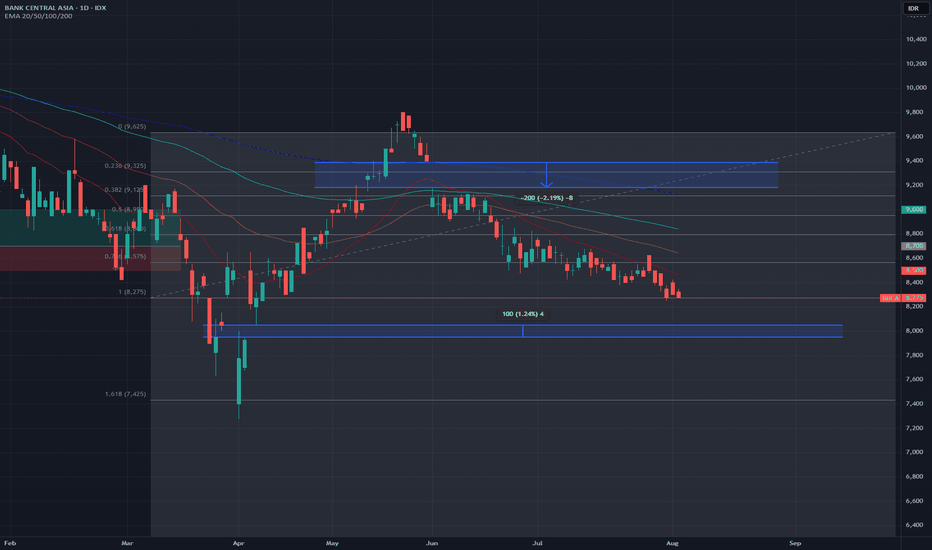

$INDF (VCP - 10W 10/3 4T)Position update: July 31, 2025.

Key factors:

1. Confirmed stage 2 uptrend.

2. A textbook Volatility Contraction Pattern (VCP) with a clearly defined, low-risk entry point.

3. Price action moves in the opposite direction of the declining general market.

4. The stock moves on its own drummer, rallying 30% to a new 52-week high, while the broader market declined 14%.

5. Volume has dried up, indicating less supply coming to the market.

6. Significant volume expansion on the breakout.

Considerations:

1. The percentage of stocks trading above their 200-day moving average stands at 51%—a positive sign and a strong indication of a potential bull market campaign.

2.Despite the technical strength, the stock squatted into the close, signaling potential weakness in the breakout. Risk should be managed carefully with appropriate stop-loss placement.

This represents a quintessential VCP breakout, offering a clean pivot entry with minimal risk. I’m seeing improved traction in my personal trades and have accordingly increased my position sizing at this stage.

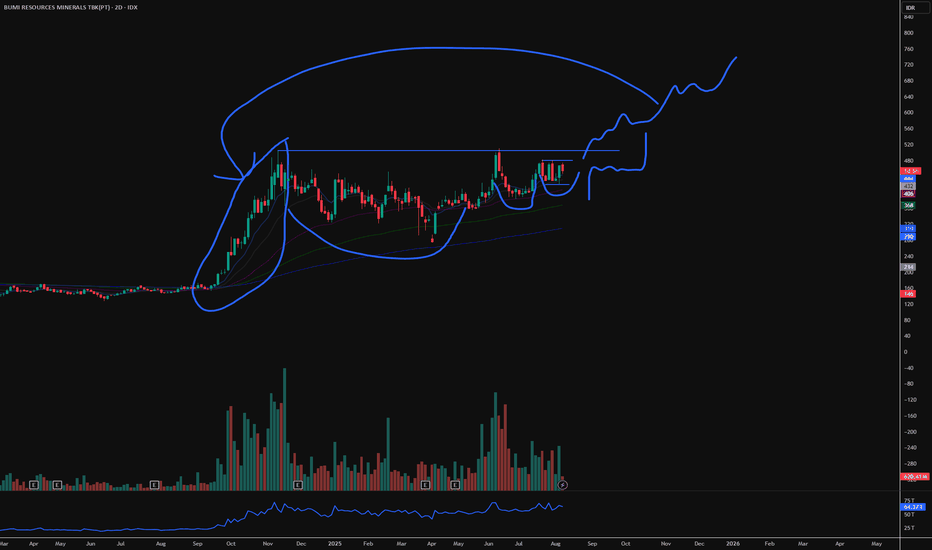

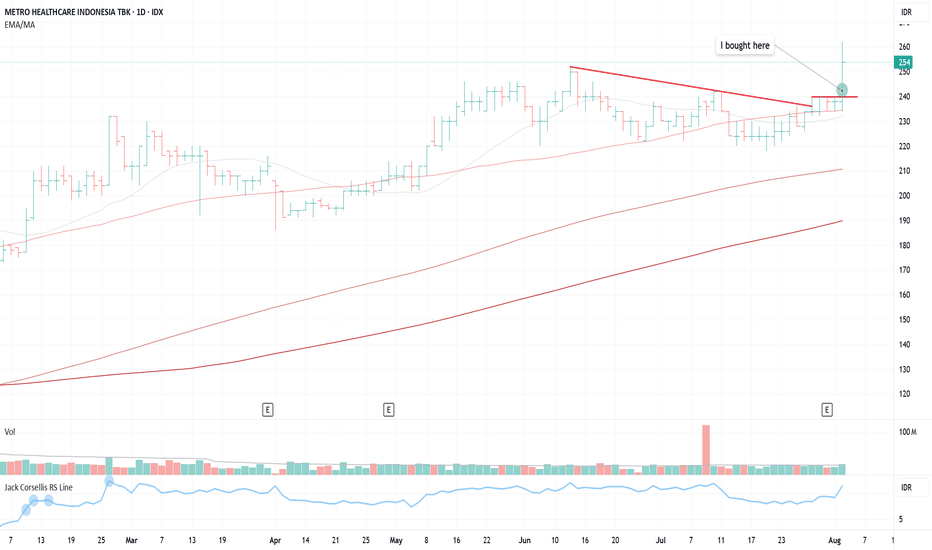

$CARE - CHEAT AREAIDX:CARE

Position Update: August 4, 2025

Key factors:

1. Low-risk entry point.

2. A rebase following a failed cup-and-handle formation, creating a potential cheat setup.

3. A confirmed Stage 2 uptrend, indicating upward continuation.

4. The stock is outperforming, rising even as the broader market trends lower.

5. Displays strong relative strength against the market and peers.

6. Volume dries up suggests less supply coming to the market.

7. Many stocks start showing traction based on my own stock continuum.

Considerations:

While the breakout was not accompanied by a significant volume surge, it is occurring in the early stages of what appears to be a new bull market cycle. This macro environment may support continued strength and follow-through.

I’ll be watching closely to see if it can hold up and follow through from here.

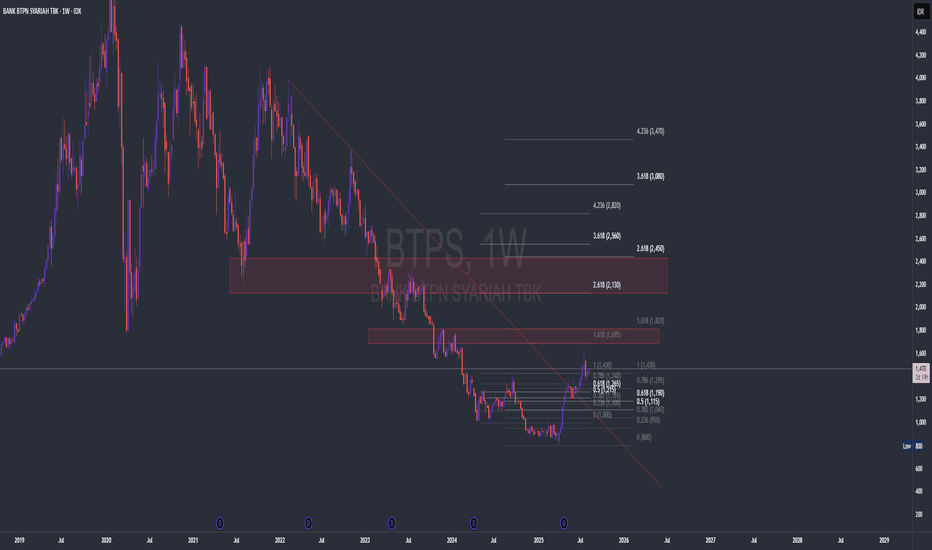

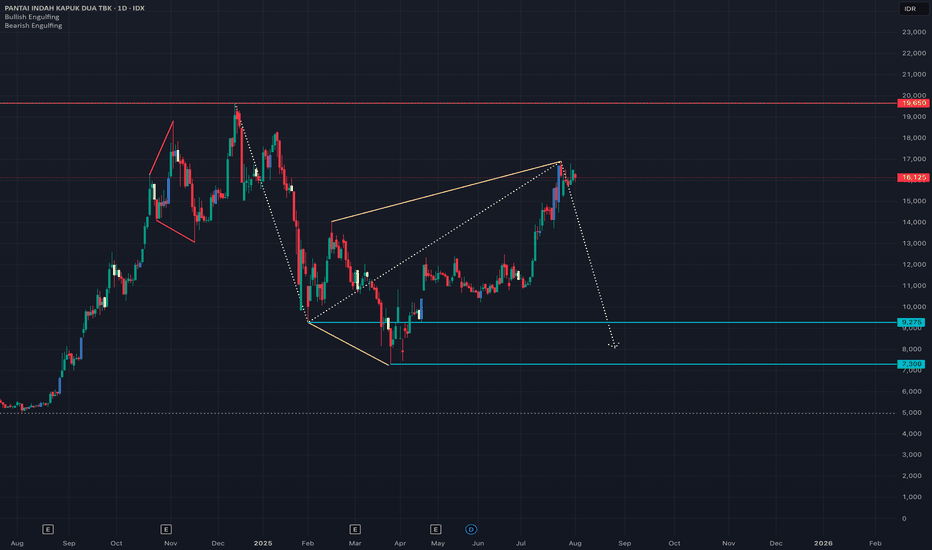

PANI Potentially Downside Min To 9,275 Or 7,300PANI (Pantai Indah Kapuk Dua) Potentially Downside Either From Current Market Level Or Higher with the note as long as it doesn’t break above 19,650.

The potential downside if it happens, it would test below 9,275 or the best case 7,300.

Below these 2 levels look for buy set up for investment.

All the best.